Global Aerosol Market By Material (Aluminum and Steel), By Type (Standard and Bag-In-Valve), By Application (Personal Care, Household, Automotive and Industrial, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 63125

- Number of Pages: 220

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

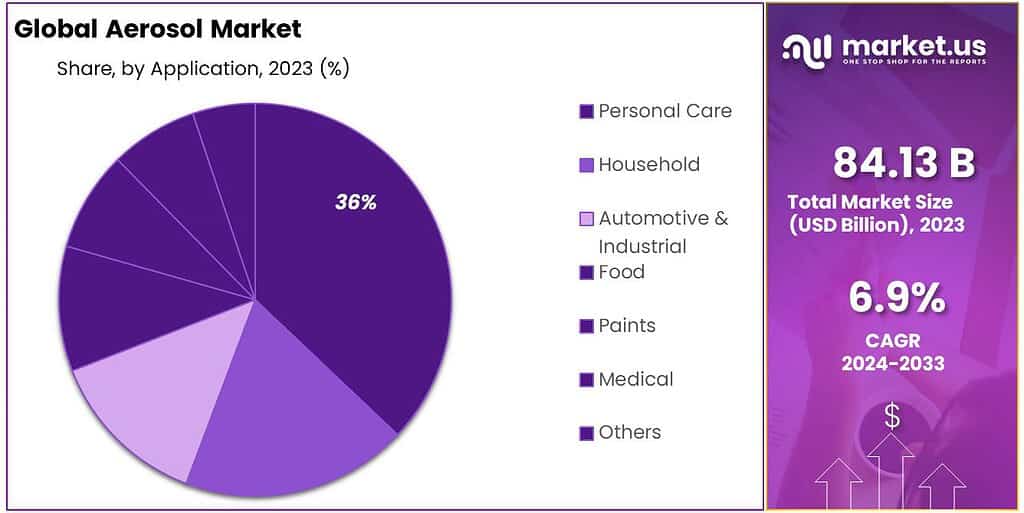

The global aerosol market size is expected to be worth around USD 163.9 billion by 2033, from USD 84.13 billion in 2023, growing at a CAGR of 6.9% during the forecast period from 2023 to 2033.

The increased usage of personal care items including shaving cream, hairspray, deodorant, and body sprays is mostly to blame. Colloidal systems called aerosols are made up of liquid or solid particles suspended in a gas. The personal, medical, industrial, automotive, food, and paint industries all utilize these aerosols extensively.

Due to its simplicity of use and appealing design, aerosol-based packaging has drawn interest from several end-use sectors. Due to the fast urbanization and infrastructure development in emerging nations in the Asia Pacific, the demand for aerosol paints and home goods will continue to rise.

Note: Actual Numbers Might Vary In the Final Report

Key Takeaways

- Market Growth: The aerosol market is set to soar, reaching an estimated worth of USD 163.9 billion by 2033 from USD 84.13 billion in 2023. That’s a robust CAGR of 6.9%.

- Material Dynamics: Aluminum dominates, constituting 60.2% of the revenue in 2023. Its eco-friendly nature and recyclability drive its growth, but rising prices might steer manufacturers towards alternative materials.

- Types in Demand: Standard aerosols hold the highest revenue share (83.1%) in 2023, driven by continuous and metered valves. Bag-in-valve technology, offering superior product dispersion and purity, is poised for significant growth.

- Applications Galore: Personal care leads the market, accounting for over 36% in 2023. Demand for deodorants and hair care products fuels this segment. Household, automotive, industrial,and medical sectors follow suit, indicating diverse usage.

- Market Drivers: The automotive industry’s increasing use of aerosols in developing nations, along with the rising demand in personal care and pharmaceuticals, propels market growth.

- Challenges Ahead: Escalating aluminum prices might prompt a shift to cheaper alternatives, impacting aerosol production. Additionally, Europe’s crackdown on plastic packaging poses a challenge to the plastic aerosol segment.

- Opportunities Abound: Emerging economies show a growing interest in personal care items. Improved living standards and a focus on cleanliness in households drive demand for aerosol-based products, fostering opportunities.

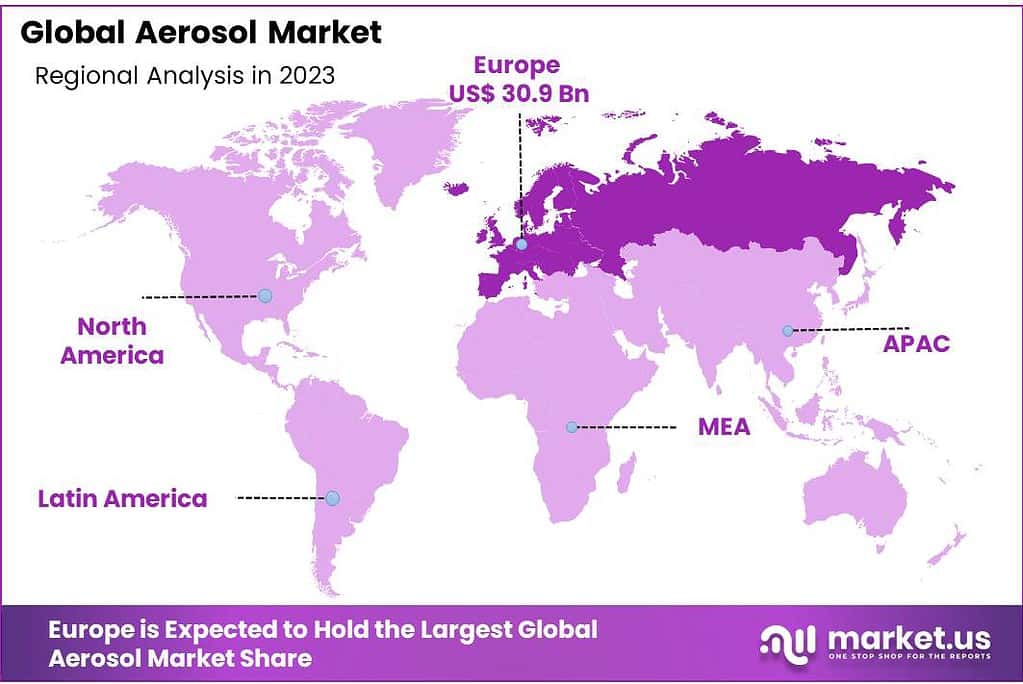

- Regional Insights: Europe, holding a significant market share, faces growth obstacles due to regulatory emissions standards. Asia Pacific emerges as a rapid-growth region, led by China and India’s consumer spending and investment-friendly policies.

- Key Players and Developments: Major companies are expanding capacities and innovating. Examples include Honeywell doubling production capacity for eco-friendly solutions and Ball Corporation introducing sustainable aluminum aerosol cans.

Material analysis

The global market can be divided into steel and aluminum. Aluminum material, which represented 60.2% of the total revenue in 2023, is expected to grow at a significant rate during the forecast period.

Aluminum is an eco-friendly material that can be recycled multiple times. It also provides strong packaging that enhances the product’s aesthetic appeal. These factors have contributed significantly to the segment’s growth. Aluminum prices have been on the rise globally over the last few years.

The final cost of aerosols is rising due to an increase in aluminum prices. Aerosol manufacturers will likely choose a lower-priced option due to this fact. This could hinder the growth of the aluminum segment over the next few years.

Due to its low weight, low cost, and high recyclability, the plastic material segment has seen significant demand over the last few years. The growth of this market will be impeded by a ban on plastic packaging in Europe.

Type analysis

In 2023, the standard segment was responsible for the highest revenue share at 83.1% and will continue to dominate the forecast period. The segment comprises both continuous and metering valves. Continuous valves are used for applications that require continuous spray. This segment is expected to grow due to the increasing use of these valves in technical products and food products.

For efficient dispensing of metered doses, metered valves are preferred. They can be used in pharmaceutical applications as well as air fresheners. Bag-in-valve refers to a packaging technique in which the bag containing the product is welded onto the valve.

The can and the bag contain the propellant. The propellant is placed between the bag and the can. This allows for the propellant to be completely separated from the product, which increases the integrity of the package. The propellant is used to disperse the aerosol in a bag-in valve aerosol. This can be done by simply squeezing the bag and pressing the spray button.

To preserve the purity of the product, cosmetic, medical, and food products are often packaged in aerosols with a bag-in valve. The valve bag offers almost 99.6% product dispersion. It is typically made from four-layer laminates which reduce the risk of oxidation.

The bag is also hermetically sealed with the product. These benefits are drawing many product manufacturers to the bag in the valve aerosol segment. This will drive the segment’s growth over the next few years.

Note: Actual Numbers Might Vary In the Final Report

Application analysis

In 2023, the personal care segment accounted for more than 36% of the market in volume. This segment is driven by growing demand for deodorants and hair care products. Due to changing lifestyles, increased consumer spending, and a greater emphasis on gender-specific products, the demand for personal care products in emerging economies is growing.

The rise in living standards and the emphasis on hygiene in developing countries are responsible for the rapid growth in the household segment. This has resulted in a rise in household products such as cleaners, disinfectants, and air fresheners. These products last longer if they are dispersed in smaller quantities.

Their use is further accelerated by this property. These products are also used in the industrial and automotive sectors. Spray paints and automotive cleaners are in high demand due to increased consumer awareness about vehicle appearance and maintenance.

Additionally, increased vehicle sales are positively impacting the demand for other products such as adhesives, sealants, and anti-fog agents. The growing demand for dry powder inhalers and metered-dose inhalers in North America is responsible for the growth of the medical market. This is expected to drive the demand for these inhalers in the future due to rising pollution.

Кеу Маrkеt Ѕеgmеntѕ

By Material

- Aluminum

- Steel

- Other Materials

By Type

- Standard

- Bag-In-Valve

By Application

- Household

- Plant Protection

- Insecticides

- Air Fresheners

- Disinfectants

- Other Households

- Personal Care

- Hair Spray

- Suncare

- Shaving Mousse/Foam

- Deodorants

- Other Personal Cares

- Automotive & Industrial

- Lubricants

- Greases

- Spray Oils

- Cleaners

- Food

- Whipped Cream

- Oils

- Edible Mousse

- Sprayable Flavours

- Paints

- Consumer

- Industrial

- Medical

- Topical Application

- Inhaler

- Other Medicals

Drivers

Increasing Usage in the Automotive Applications in Developing Nations to Boost Market Growth

In the car world, aerosol isn’t just for spray paint. It’s used in lots of stuff like wipes, oil cans, and sealers. You’ll find it cleaning up battery terminals, motors, carburetors, brakes, and more. It’s even handy for lubing up tires and sprucing up engines. And those cans? They’re not just for show—they store oils, polishes, and all sorts of car care goodies.

Growing Demand in Personal Care Packaging and Pharmaceutical Industries Drives Market Growth

Packaging is a big deal for us shoppers—it sways what we buy every day. And now, more and more brands are using aerosol packaging that you can recycle or reuse.

These cans keep stuff sealed up tight, cutting down on accidents and leaks, which is a win for everyone. Businesses love these aerosol cans too—they’re cost-effective and eco-friendly. Plus, in the medical world, aerosols are helping treat breathing problems like asthma and COPD.

Restraints

Aluminum prices are going up, and that’s making aerosols pricier too. So, manufacturers might start looking for cheaper options, which could slow down the use of aluminum.

Meanwhile, plastic has been popular ’cause it’s light, cheap, and easy to recycle. But, with Europe cracking down on plastic packaging, that segment might hit a speed bump soon.

Opportunity

More folks in growing economies are really into personal care stuff ’cause lifestyles are changing, people are spending more, and there’s a big focus on products for specific genders.

Homes are stepping up too, with better living standards and a real emphasis on cleanliness, especially in places that are still developing. So, things like air fresheners, cleaners, and disinfectants are flying off the shelves. Using less of these products but making them last longer? That’s a win-win for everyone.

Trends

People love them ’cause they’re light, eco-friendly, and easy on the environment. That’s why more of these aerosols are gonna hit the shelves.

And get this, VMR also sees pharmaceutical sprays staying popular. These tiny drug particles in pressurized bottles are handy for treating breathing problems like asthma and even managing conditions like HIV. Pharma folks really dig these aerosols to help with airway issues.

Regional Analysis

Europe held 36.1% of the world’s largest market share in volume terms in 2023. It is also the largest producer of aerosols. The large market share can be attributed mainly to the personal care sector. The region’s market growth is being driven by factors such as high cosmetics consumption and rapid growth of the fragrance sector.

Consumer spending is also increasing. Despite increasing personal care demand, Europe’s market growth is hampered by regulations regarding Volatile Organic compound emissions (VOCs), set by the European Commission (EC) and the Environmental Protection Agency (EPA). The region will overcome this problem with innovation in the near future.

Asia Pacific is one of the fastest-growing regions in terms of revenue and is expected to grow at a 9.1% CAGR over the forecast period. China and India have focused on encouraging favorable investments which will create lucrative growth opportunities over the forecast period.

The demand for aerosol products in the paints, personal care, and automotive sectors is increasing due to rising consumer spending in emerging Asian countries. Due to the high consumption of hair care products in countries like Saudi Arabia and UAE, Africa and the Middle East are expected to see significant growth during this forecast period.

Additionally, hypermarkets such as Carrefour and Lulu Hypermarket in Kuwait, Saudi Arabia, and the UAE have allowed for the retail distribution and sale of consumer products.

Note: Actual Numbers Might Vary In the Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Major companies in this market employ a variety of strategies, including mergers and acquisitions as well as new capacity expansions. Spray Products Corp., for example, purchased a new Ohio facility in May 2018. Lindal Group also opened its new, state-of-the-art facility in Columbus (Indiana).

Маrkеt Кеу Рlауеrѕ

- Henkel AG & Co., KGaA

- S. C. Johnson & Son, Inc.

- Procter & Gamble

- Unilever

- Honeywell International Inc.

- Akzo Nobel N.V.

- Beiersdorf AG

- Estée Lauder Inc.

- Oriflame Cosmetics Global SA

Recent Development

December 2022: Honeywell announced its Baton Rouge, LA., facility has doubled the production capacity of Honeywell Solstice ze (HFO-1234ze), an ultra-low-global-warming-potential (GWP) and energy-efficient solution compared to other current technologies. Solstice ze is used in foam insulation, as an aerosol propellant, and in refrigeration and air conditioning applications.

June 2022: Ball Corporation launched its most sustainable aluminum aerosol can globally, with only half the carbon footprint of a standard can. This will help support Ball’s ambition to achieve its 2030 science-based targets and net-zero emissions prior to 2050.

Report Scope

Report Features Description Market Value (2023) USD 84.13 Billion Forecast Revenue (2033) USD 163.3 Billion CAGR (2023-2032) 6.9% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Aluminum and Steel), By Type (Standard and Bag-In-Valve), By Application (Personal Care, Household, Automotive and industrial, and Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Henkel AG & Co., KGaA, S. C. Johnson & Son, Inc., Procter & Gamble, Unilever, Honeywell International Inc., Akzo Nobel N.V., Beiersdorf AG, Estée Lauder Inc., Oriflame Cosmetics Global SA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are aerosols in the market?Aerosols are utilized in various industries for a range of purposes including personal care products, household cleaners, air fresheners, pharmaceuticals, automotive products, and more.

Why is there a rising demand for aluminum and plastic-based aerosols?Aluminum and plastic aerosols are gaining traction due to their lightweight nature, biodegradability, and lower environmental impact, driving their increased use and production.

What impact do aluminum and plastic aerosols have on the market expansion?The growing preference for lightweight and environmentally friendly packaging options is projected to fuel the expansion of the aerosol market, driving manufacturers to increase production of these types of aerosols.

-

-

- Henkel AG & Co., KGaA

- S. C. Johnson & Son, Inc.

- Procter & Gamble

- Unilever

- Honeywell International Inc.

- Akzo Nobel N.V.

- Beiersdorf AG

- Estée Lauder Inc.

- Oriflame Cosmetics Global SA