Global Advanced Wound Care Market By Product Type (Alginate Dressings, Collagen Dressings, Film Dressings, Foam Dressings, Hydrocolloid Dressings, Hydrofiber, Hydrogels Dressings, Superabsorbent Dressings, Wound Contact Layers and Other Advanced Dressings) By Application (Chronic Wounds, Diabetic Foot Ulcers, Pressure Ulcers, Venous Leg Ulcers, Other Chronic Wounds, Acute Wounds, Surgical & Traumatic Wounds and Burns) By End-use (Hospitals, Specialty Clinics, Home Healthcare and Other End-Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 16470

- Number of Pages: 320

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

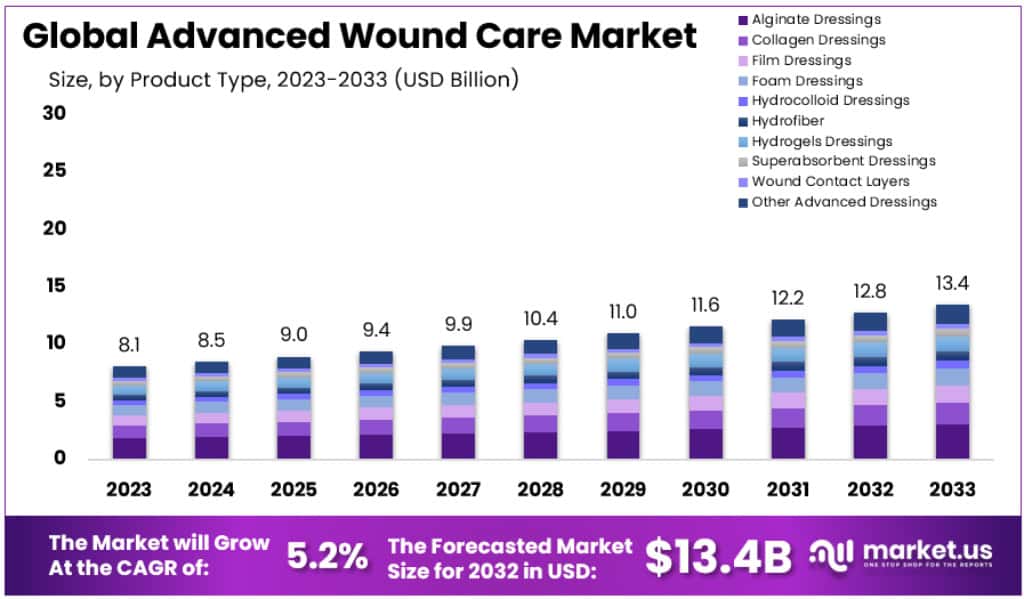

The Global Advanced Wound Care Market size is expected to be worth around USD 13.4 Billion by 2033, from USD 8.1 Billion in 2023, growing at a CAGR of 5.2% during the forecast period from 2023 to 2033.

Due to the rising incidence of chronic diseases around the world, the demand for advanced wound care products has increased. Market growth will also be driven by the growing geriatric population. This is because the elderly have slow healing abilities.

According to WHO, the WHO estimates that the percentage of people 60 years and older was 9.8% in 2017. This number is projected to rise to 14.1% and 21.2% respectively by 2030 and 2050. The fastest-growing segment of the U.S. population is the elderly (>=65). According to the U.S. Census Bureau 2017 National Population Projections, nearly four out of four Americans will be older adults by 2060. This is expected to drive market growth.

Key Takeaways

- Market Value: The market was worth USD 8.1 billion in 2023.

- Projected Market Value: Expected to grow to around USD 13.4 billion by 2033.

- Growth Rate: Predicted to grow at a Compound Annual Growth Rate (CAGR) of 5.2% from 2023 to 2033.

- Elderly Population: The percentage of people aged 60 years and older was 9.8% in 2017, projected to rise to 14.1% by 2030 and 21.2% by 2050.

- Foam Dressings Market Share (2023): Held a dominant position with more than a 22.9% share.

- Alginate Dressings: Known for their biocompatibility, typically made from seaweed.

- Collagen Dressings: Used for natural wound healing, especially effective for diabetic foot ulcers.

- Film Dressings: Transparent and waterproof, used for protecting against bacteria.

- Hydrocolloid Dressings: Form a gel when in contact with wound exudate, aiding in wound healing.

- Hydrofiber Dressings: Convert into a gel on contact with exudate, providing a moist environment for healing.

- Hydrogel Dressings: Beneficial for dry or minimally exuding wounds, burns, and radiation-damaged skin.

- Superabsorbent Dressings: Suitable for highly exuding wounds, they lock in moisture and reduce maceration risk.

- Wound Contact Layers: Act as a protective interface between the wound and secondary dressings.

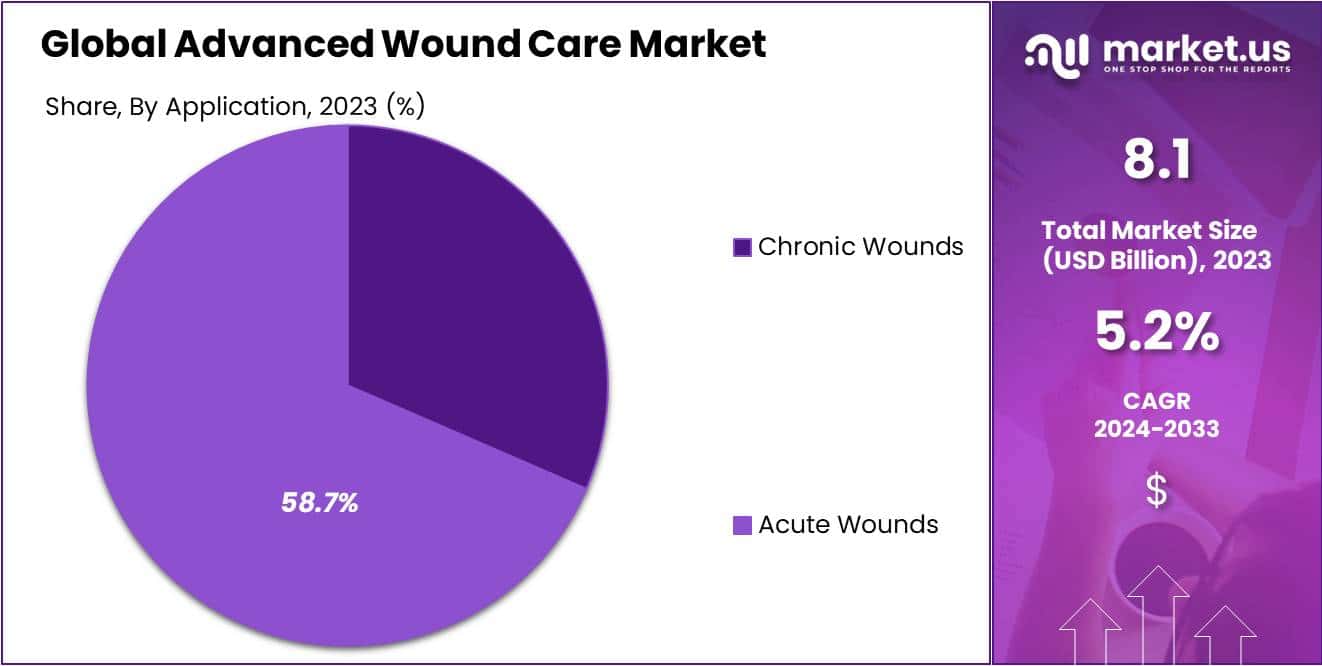

- Acute Wounds Market Share (2023): Captured more than a 58.7% share.

- Hospitals Market Share (2023): Dominated the end-use segment with more than a 46.3% share.

By Product Type

In 2023, Foam Dressings held a dominant market position, capturing more than a 22.9% share. This segment’s prominence is attributed to the product’s versatility in managing exuding wounds, thereby meeting a broad range of wound care needs. Foam dressings, known for their absorptive capacity and thermal insulation, are increasingly favored for chronic wounds, such as venous leg ulcers and pressure ulcers, which propel their demand.

Alginate Dressings, which are typically derived from seaweed, are lauded for their biocompatibility and optimal moisture maintenance, making them ideal for moderate to heavily exuding wounds. Their utility in promoting autolytic debridement has further cemented their position in the market.

Collagen Dressings stand out for their role in facilitating natural wound healing. They are particularly effective in wound bed preparation, encouraging new tissue growth. This segment benefits from the increasing incidence of diabetic foot ulcers where collagen’s restorative properties are essential.

Film Dressings present a unique offering with their transparent, waterproof design. They are widely used for their protective barrier against bacteria and foreign particles, making them suitable for minor burns and superficial wounds.

Hydrocolloid Dressings are distinct in their ability to form a gel when in contact with wound exudate. This feature aids in creating a moist environment, which is conducive to wound healing, especially for burns and light to moderately exuding wounds.

Hydrofiber Dressings are gaining traction for their impressive fluid-handling capabilities. These dressings convert into a gel on contact with exudate, providing a moist environment that supports healing and facilitates the removal of the dressing without damaging newly formed tissue.

Hydrogel Dressings, known for their cooling and soothing effect, are particularly beneficial for dry or minimally exuding wounds, burns, and radiation-damaged skin. Their moisture-donating characteristic is a key factor driving their adoption.

Superabsorbent Dressings, as the name implies, have exceptional absorption abilities, making them suitable for highly exuding wounds. Their capacity to lock in moisture and reduce the risk of maceration is critical in managing complex wounds.

Wound Contact Layers serve a niche but vital market segment. These dressings act as a protective interface between the wound and secondary dressings, preventing adherence to the granulating tissue, which can be critical in the treatment of fragile skin or painful wounds.

Other Advanced Dressings encompass a variety of specialized products, including those embedded with antimicrobials or growth factors, addressing specific needs within wound care management and offering tailored solutions for complex wound scenarios. This segment’s growth is fueled by continuous innovation and customized care requirements.

Each segment within the Advanced Wound Care Market is driven by specific clinical needs and patient outcomes, underscoring the importance of innovation and patient-centered care in driving market dynamics. The market is expected to expand, supported by an aging population, rising prevalence of chronic wounds, and technological advancements in wound care products.

According to Life Span Organization in 2018, approximately 500,000 open-heart surgeries were performed in the United States. According to AHA Journals, about 500,000 open-heart surgeries were performed in the U.S. in 2018.

By Application

Acute Wounds held a dominant market position, capturing more than a 58.7% share in 2023. This segment’s strength is largely due to the high volume of surgical procedures and trauma cases that require immediate wound care solutions. Products in this category are designed to minimize infection risk and promote rapid healing.

Chronic Wounds, which include diabetic foot ulcers, pressure ulcers, and venous leg ulcers, represent a significant portion of the market. The increasing prevalence of diabetes and obesity has led to a rise in diabetic foot ulcers, necessitating advanced dressings that cater to these complex wounds.

Pressure Ulcers are another key application segment, spurred by the growing elderly population and the incidence of hospital-acquired pressure injuries. Advanced wound care products aimed at this segment focus on pressure redistribution and moisture management to prevent wound deterioration.

Venous Leg Ulcers, often associated with chronic venous insufficiency, require dressings that can manage heavy exudate and support compression therapy. This segment benefits from a demographic trend towards an aging population and the associated circulatory conditions.

Other Chronic Wounds encompass a diverse group of wound types, each requiring specialized care. This segment includes arterial ulcers and mixed etiology wounds, where advanced dressings play a critical role in addressing the underlying causes and supporting healing.

Surgical & Traumatic Wounds, as a subcategory of acute wounds, are a primary focus due to their immediate and extensive care requirements. The need for effective infection control and quick healing drives the demand for innovative wound care products in this segment.

Burns, although a smaller segment, are critical due to the severity and complexity of care required. Advanced wound care products for burns are specialized to address the unique challenges of burn healing, including the prevention of infection and the reduction of scarring.

The Advanced Wound Care Market is characterized by the diversity of applications, each with distinct needs and treatment approaches. The market is anticipated to grow, propelled by factors such as the rising incidence of conditions leading to chronic and acute wounds, advancements in wound care technology, and an increasing focus on reducing hospital stays and healthcare-associated infections.

- According to data from CDC, the 2015 incidence of nonfatal injury was 517,249. This increased to 540 in 2017. According to Brady United Organization, approximately 317 people are killed in gun violence every day in the U.S., and 212 of them survive. The segment will likely expand due to an increase in acute wounds.

- According to Agency for Healthcare Research and Quality in the United States, pressure ulcers affect more than 2.5 million people each year.

- According to NCBI, pressure ulcers can be seen in clinical settings anywhere from 4% to 38%.

- According to the American Diabetes Association, an estimated 34.2 million people had diabetes in 2018, which is 10.5% of all Americans. Market growth will be boosted by the expected rise in diabetic foot ulcer cases.

By End-use

In 2023, Hospitals held a dominant market position, capturing more than a 46.3% share. This sector’s leadership is driven by the comprehensive care they provide, coupled with advanced technologies and specialized staff. Hospitals are often the first point of care for acute and severe chronic wounds, necessitating a wide array of advanced wound care products.

In Australia, for example, 11.1 million people were admitted to hospital in 2019-2020. The market is expected to grow due to an increase in hospitalization rates and hospitals. The market is also being pushed by an increase in the number and quality of surgeries. According to Business Insider, South Korea is home to nearly one million plastic surgery procedures.

According to a similar source, nearly one-third of all women aged 19-29 have had plastic surgery. Consequently, an increase in surgeries could lead to greater use of advanced products for wound care. This may help propel advanced wound care market growth.

Specialty Clinics are also a pivotal part of the market, focusing on targeted treatments for complex wound conditions. These clinics often provide specialized care, such as for diabetic foot ulcers or pressure ulcers, and their market share is growing as they become more prevalent and accessible.

The home health segment will see the fastest CAGR at 6.1% over the forecast period, Reflecting the trend towards patient preference for at-home treatment. Advances in wound care products that support self-management, such as dressings with extended wear time and telehealth services for wound monitoring, are driving this segment’s expansion.

Other End-Uses, which include long-term care facilities, community healthcare services, and outpatient settings, cater to a smaller but essential part of the market. These settings emphasize cost-effective and efficient wound care solutions that align with the varying levels of care required.

Кеу Маrkеt Ѕеgmеntѕ

By Product Type

- Alginate Dressings

- Collagen Dressings

- Film Dressings

- Foam Dressings

- Hydrocolloid Dressings

- Hydrofiber

- Hydrogels Dressings

- Superabsorbent Dressings

- Wound Contact Layers

- Other Advanced Dressings

By Application

- Chronic Wounds

- Diabetic Foot Ulcers

- Pressure Ulcers

- Venous Leg Ulcers

- Other Chronic Wounds

- Acute Wounds

- Surgical & Traumatic Wounds

- Burns

By End-use

- Hospitals

- Specialty Clinics

- Home Healthcare

- Other End-Uses

Driver

Surge in Surgical Procedures Worldwide

More people around the world are having surgeries thanks to improved access and affordability. This rise in operations leads to more wound-related complications, like infections. As a result, there’s a growing demand for advanced wound care products to manage and heal these surgical wounds effectively.

Restraint

High Costs of Advanced Wound Care

The significant expense of advanced wound care products can limit their use, particularly in regions with lower incomes. Although these products are essential for effective treatment, their high cost can be a barrier, making them less accessible for some patients and healthcare systems.

Opportunity

Untapped Potential in Emerging Markets

Emerging economies present untapped opportunities for the wound care market. Countries like India, Brazil, and South Africa have growing healthcare systems, rising populations, and increasing healthcare spending. This makes them fertile ground for the expansion of advanced wound care services.

Challenge

Insurance Coverage and Affordability Issues

Insurance coverage that doesn’t fully pay for advanced wound care treatments can restrict access to these vital services. Without comprehensive coverage, patients might struggle to afford the care they need, which can affect their healing process and overall health outcomes. Better insurance policies could improve this situation.

Trend

Innovation and New Product Development

There’s a trend toward creating more advanced wound care products, like dressings that not only cover wounds but also provide medicinal benefits to promote healing. The drive to improve and innovate in this space is strong, with ongoing research and development aimed at enhancing patient outcomes.

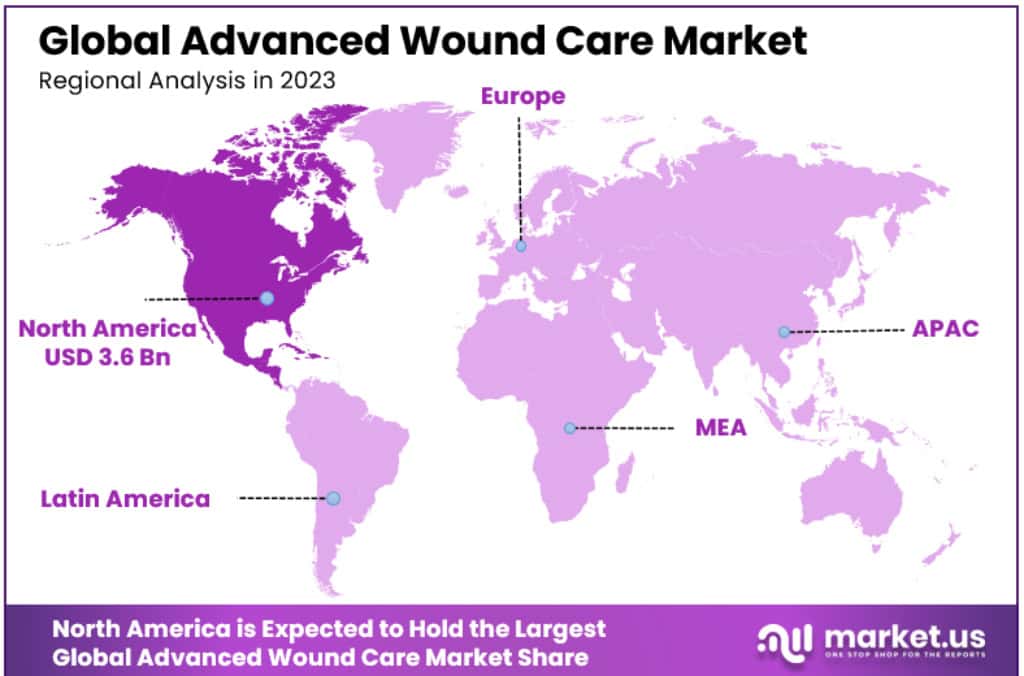

Regional Analysis

North America leads the Advanced Wound Care Market, holding a 44% share with a market value of USD 3.6 billion in 2023. This dominance can also be attributed to the well-developed healthcare system and increased number of surgical procedures. According to Zapido, in 2019, approximately 18.1 million surgical and minimally invasive cosmetic procedures were performed in the U.S.

Advanced wound care products are being increasingly used to prevent surgical site infection. The market is expected to grow due to an increase in accidents like road accidents, burns, or trauma events around the world. WHO (2018) predicts that each year in India, over 1,000,000 individuals suffer from moderate or severe burns. These factors will likely drive market growth over the forecast period.

The Asia Pacific market for advanced wound care will experience the highest CAGR at 6.0% during the forecast period. This is due to a rise in chronic diseases and an increase in the elderly population. According to the European Parliament Japan’s population over 65 is rapidly aging and Japan has 28.7%. In addition, the country’s elderly population will make up one-third of its population by 2036.

Geriatrics are at higher risk for various diseases and disabilities. This could increase the demand for wound care products. The market will also be helped by an increase in Medical Tourism. The Asia Pacific is expected to experience the fastest growth due to the factors mentioned above.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

The advanced wound care market is fragmented due to the presence of many small and large players. Due to the many players in this market, competition in the market will increase in the future. To strengthen their product portfolios, top players often collaborate, launch new products, merge with other companies, or make acquisitions.

Positive clinical outcomes for Integra Bilayer Wound Matrix were also reported by Integra LifeSciences in May 2020. Collagen and amniotic materials are included in the company’s portfolio of regenerative technologies. The corporation owns some of these items. The advanced wound care market is anticipated to expand over the course of the projected period thanks to different methods employed by top competitors.

Маrkеt Кеу Рlауеrѕ

- Smith & Nephew

- Mölnlycke Health Care AB,

- ConvaTec Group PLC,

- Baxter International,

- URGO Medical,

- Coloplast Corp.,

- Medtronic,

- 3M,

- Derma Sciences Inc. (Integra LifeSciences),

- Medline Industries,

- Other Key Players

Recent Development

- May 2023: Research in Wound Repair and Regeneration reveals a breakthrough in chronic wound treatment with the development of nanofiber-based wound dressings. These new dressings have shown superior efficacy in healing chronic wounds compared to traditional methods.

- April 2023: The FDA endorses a novel hydrogel wound dressing, aimed at enhancing healing and alleviating pain for burn patients. This new dressing type represents a significant advancement in burn care.

- March 2023: Findings from a study in PLoS One highlight the effectiveness of stem cell-infused wound dressings in treating diabetic foot ulcers. This innovative approach marks a critical step forward in diabetic wound management.

- February 2023: The FDA gives approval to a new alginate-based wound dressing. Designed for trauma wounds, this dressing is tailored to halt bleeding and foster healing, presenting a significant improvement in trauma care.

- January 2023: A study in Nature Communications introduces a groundbreaking wound dressing made from biocompatible materials. Proven to rapidly heal wounds in animal models, this development holds promise for future human medical applications.

Report Scope

Report Features Description Market Value (2023) USD 8.1 Billion Forecast Revenue (2033) USD 13.4 Billion CAGR (2023-2032) 5.2% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Alginate Dressings, Collagen Dressings, Film Dressings, Foam Dressings, Hydrocolloid Dressings, Hydrofiber, Hydrogels Dressings, Superabsorbent Dressings, Wound Contact Layers and Other Advanced Dressings) By Application (Chronic Wounds, Diabetic Foot Ulcers, Pressure Ulcers, Venous Leg Ulcers, Other Chronic Wounds, Acute Wounds, Surgical & Traumatic Wounds and Burns) By End-use (Hospitals, Specialty Clinics, Home Healthcare and Other End-Uses) By Product Type (Alginate Dressings, Collagen Dressings, Film Dressings, Foam Dressings, Hydrocolloid Dressings, Hydrofiber, Hydrogels Dressings, Superabsorbent Dressings, Wound Contact Layers and Other Advanced Dressings) By Application (Chronic Wounds, Diabetic Foot Ulcers, Pressure Ulcers, Venous Leg Ulcers, Other Chronic Wounds, Acute Wounds, Surgical & Traumatic Wounds and Burns) By End-use (Hospitals, Specialty Clinics, Home Healthcare and Other End-Uses) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Smith & Nephew, Mölnlycke Health Care AB, ConvaTec Group PLC, Baxter International, URGO Medical, Coloplast Corp., Medtronic, 3M, Derma Sciences Inc. (Integra LifeSciences), and Medline Industries Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Smith & Nephew

- Mölnlycke Health Care AB,

- ConvaTec Group PLC,

- Baxter International,

- URGO Medical,

- Coloplast Corp.,

- Medtronic,

- 3M,

- Derma Sciences Inc. (Integra LifeSciences),

- Medline Industries,

- Other Key Players