Global Advanced Therapy Medicinal Products Market Analysis By Therapy Type (Cell Therapy, Gene Therapy, Tissue-Engineered Products, Combination/Joined ATMPs (e.g., cell + gene + scaffold), Others), By Product Type (Somatic Cell Therapy Products, Tissue-Engineered Medicinal Products, Gene Therapy Medicinal Products, Combined ATMPs / Multi-Modal Products, Others), By Application (Oncology, Genetic Disorders (e.g., inherited metabolic, haematologic), Neurology, Cardiovascular Diseases, Musculoskeletal / Orthopaedic (e.g., tissue repair), Ophthalmology, Dermatology, Others), By End-User (Hospitals and Clinics, Contract Development & Manufacturing Organizations (CDMOs), Biotechnology & Biopharma Companies, Research & Academic Institutes, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 166507

- Number of Pages: 291

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

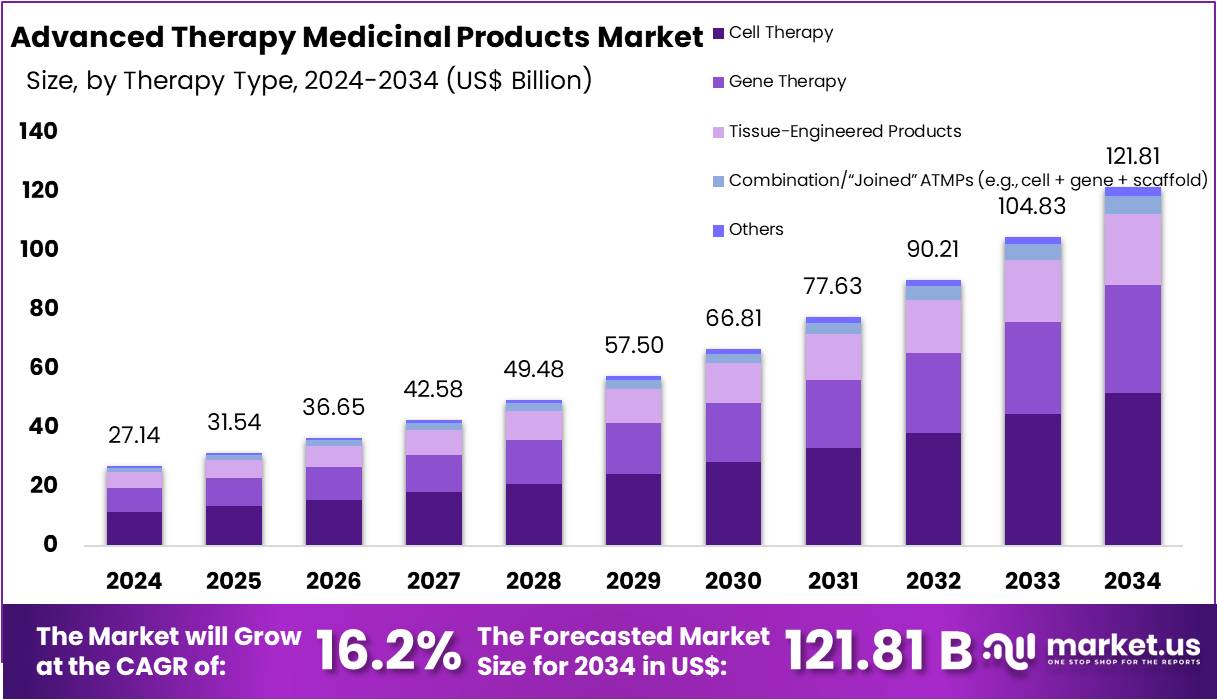

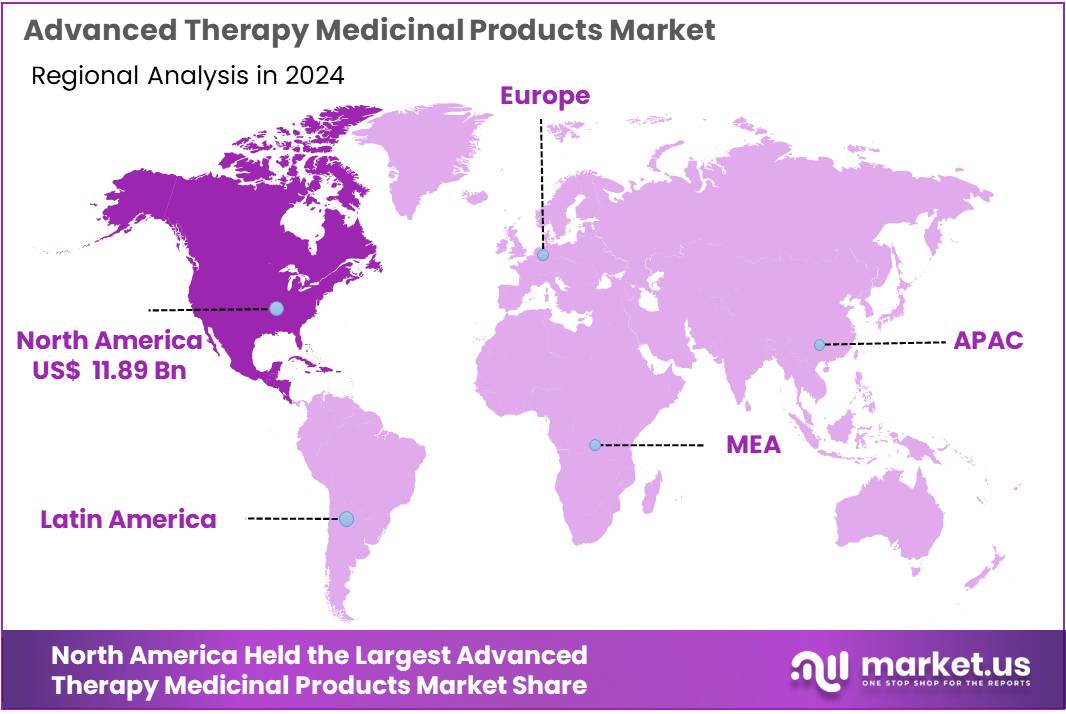

The Global Advanced Therapy Medicinal Products Market size is expected to be worth around US$ 121.81 Billion by 2034, from US$ 27.14 Billion in 2024, growing at a CAGR of 16.2% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 43.8% share and holds US$ 11.88 billion market value for the year.

Advanced Therapy Medicinal Products (ATMPs) represent a regulated class of innovative therapies developed from genes, tissues, or cells. These therapies are designed to repair or replace damaged biological functions. Their development has been supported by progress in molecular biology and regenerative medicine. According to PubMed Central, around 32 gene therapies had been approved globally by June 2024, reflecting rapid clinical advancement.

Market expansion has been reinforced by rising unmet medical needs and growing investment in advanced therapeutics. Many conditions treated by ATMPs have limited or no effective alternatives. Study by global researchers found that about 68.5% of gene therapy trials in 2023 targeted cancer, showing a strong focus on oncology. For instance, cell therapy activity in China expanded significantly, with 206 trials conducted between 2014 and 2024, indicating strong national engagement.

Supportive regulation has played a major role in shaping sector growth. In the European Union, Regulation (EC) No 1394/2007 introduced a centralised framework that enabled structured oversight of ATMPs. According to EMA reports, only seven ATMPs were authorised between 2009 and 2016, but approvals accelerated in 2024 and 2025. New EU rules for joint health technology assessment from 2025 are expected to streamline access decisions across Member States.

Global regulatory alignment has further strengthened the development environment. The World Health Organization has emphasised the need for improved quality and safety systems for cell and gene therapies. WHO updated its GMP guidance for biological products to support consistent production standards. In 2025, WHO also introduced new INN schemes for cell-based therapies. Mutual recognition agreements on GMP inspections between EMA and FDA now cover ATMPs, facilitating efficient cross-border supply.

Investment Trends, and Infrastructure Expansion

Scientific progress in cell engineering continues to expand the therapeutic scope of ATMPs. Recent reviews have highlighted improvements in viral vectors, CRISPR-based editing, nanocarriers, CAR-T cells, and oncolytic viruses. These tools are improving safety and efficacy. For example, developers are more confident in advancing programmes into trials as manufacturing and quality standards become clearer, which increases the likelihood of future approvals.

Public funding has become an essential force supporting long-term growth. In the United States, the NIH has launched several targeted programmes. According to federal updates, the Ultra-Rare Gene-based Therapy Network supports rare neurological conditions, while the Cure Sickle Cell Initiative addresses a global burden of over 20 million people. The Bespoke Gene Therapy Consortium will mobilise about US$104 million over five years, including US$39.5 million from NIH, to advance shared platforms.

Economic expectations are reinforcing investment momentum. A peer-reviewed study estimated that annual gene therapy spending in the United States could reach US$20.4 billion under conservative assumptions. Health payers are testing new reimbursement tools. For instance, outcomes-based agreements in US Medicaid programmes aim to manage budget impact for high-cost therapies such as those for sickle cell disease, supporting wider adoption while encouraging real-world performance.

Manufacturing and distribution models continue to evolve. European analyses indicate that hospital-based production under exemption pathways can complement industrial manufacturing. New EU rules on joint HTA and mutual GMP inspection recognition with the United States improve supply efficiency. WHO’s updated GMP guidance supports investment in compliant facilities across more regions. Study by global health bodies noted ongoing challenges, but these concerns are driving stronger safety systems and clearer regulatory pathways, reinforcing long-term market stability.

Key Takeaways

- The global ATMPs market was described as advancing toward US$121.81 billion by 2034, rising from US$ 27.14 billion in 2024 with a 16.2% CAGR.

- A third-party observer noted Cell Therapy leading the therapy landscape in 2024, securing over 42.6% share due to strong clinical adoption and expanding indications.

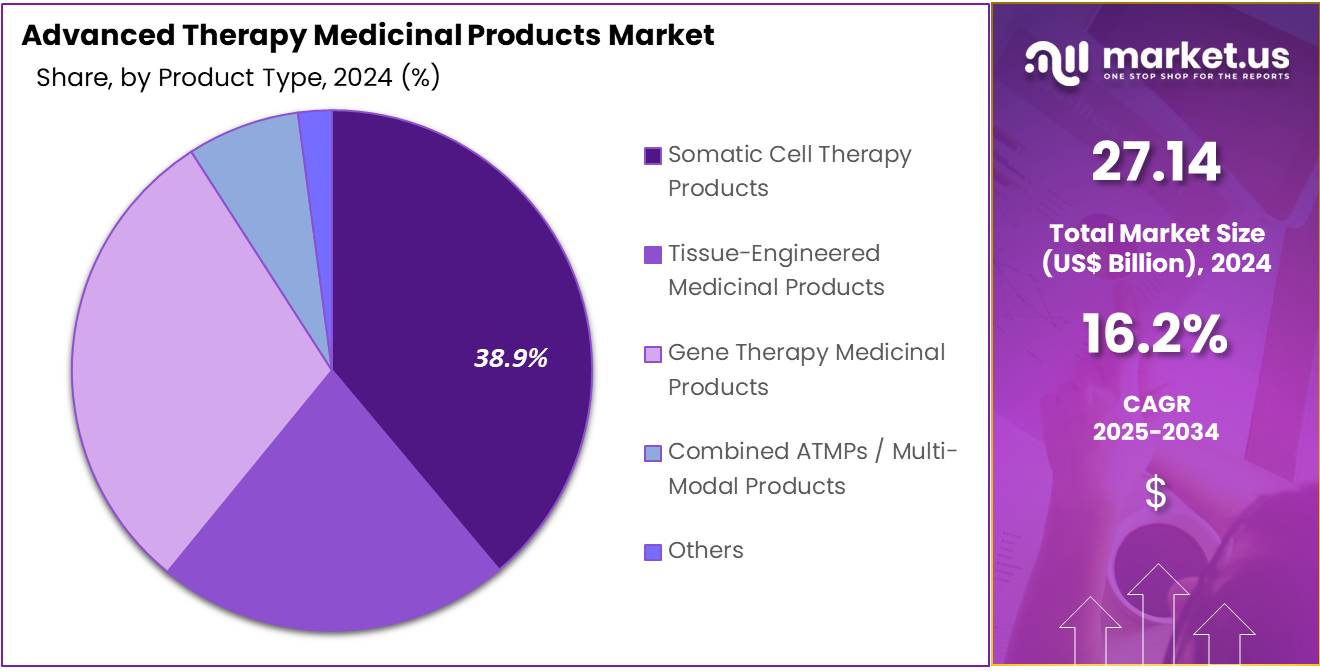

- Industry commentary highlighted Somatic Cell Therapy Products as the top product category in 2024, accounting for more than 38.9% share across the ATMPs portfolio.

- The Oncology segment was identified as the foremost application area in 2024, capturing over 34.8% share owing to rising cancer-focused advanced therapies.

- Market insights indicated Hospitals and Clinics dominating end-user utilization in 2024, representing more than 45.5% share driven by increased treatment accessibility and specialized infrastructure.

- Independent assessment emphasized North America as the leading regional market in 2024, holding over 43.8% share and generating US$11.88 billion in ATMP revenues.

Therapy Type Analysis

In 2024, the ‘Cell Therapy’ held a dominant market position in the Therapy Type Segment of the Advanced Therapy Medicinal Products (ATMPs) Market, and captured more than a 42.6% share. This segment grew due to rising clinical success in oncology and immune-related disorders. Approvals increased its acceptance. Demand rose as scalable platforms improved production. Broader use in degenerative diseases supported expansion. Allogeneic therapies also advanced access. The segment continued to strengthen its position across major healthcare systems.

Gene therapy held a strong position due to its ability to target rare genetic disorders. Approvals expanded its reach. Stable investment in viral vectors improved production. Durable treatment outcomes increased clinical confidence. Tissue-engineered products also grew at a steady pace. Their adoption rose in wound care and orthopedic repair. Advances in biomaterials improved healing. Supportive regulations encouraged new scaffold-based solutions. These trends strengthened the entire regenerative segment.

Combination ATMPs advanced as multimodal solutions gained traction. Their integration of cell, gene, and scaffold technologies improved complex disease management. Growth was driven by innovation in engineered constructs. Investment increased as superior therapeutic outcomes were observed. Other emerging modalities such as exosome therapies also showed promise. Their targeted actions supported early demand. Steady research momentum improved safety and performance. Together, these evolving segments contributed to the broader expansion of the ATMP landscape.

Product Type Analysis

In 2024, the Somatic Cell Therapy Products held a dominant market position in the Product Type segment of the Advanced Therapy Medicinal Products (ATMPs) Market, and captured more than a 38.9% share. This leadership was driven by strong clinical results. Demand increased in oncology and immune disorders. Regulatory support improved access. Personalized therapies gained attention. Manufacturing capacity expanded. These factors supported stable growth. Adoption rose in major regions. The segment maintained clear momentum.

Tissue-Engineered Medicinal Products showed steady progress. Growth was supported by advances in biomaterials. Regenerative medicine applications expanded. Demand rose in wound care. Orthopedic reconstruction benefited from innovation. Clinical pipelines widened. Research investments increased. Market adoption broadened in specialized centers. These developments strengthened the segment. Continuous improvement in scaffold design improved outcomes. Collaboration between research groups advanced product feasibility. The segment showed cautious but positive traction during the year. Overall, growth remained stable.

Gene Therapy Medicinal Products recorded strong expansion. The growth was driven by rising approvals. Vector manufacturing improved. Rare disease programs expanded. Clinical evidence increased confidence. Funding supported large pipelines. Adoption grew in targeted therapies. Combined ATMPs saw moderate uptake. Multi-modal approaches improved outcomes. Innovation supported new trials. The Others category included early technologies. These products remained in evaluation. Future growth potential appeared significant. Advancements in regenerative methods strengthened long-term prospects. Market momentum remained positive overall.

Application Analysis

In 2024, the ‘Oncology’ segment held a dominant market position in the Application Segment of the Advanced Therapy Medicinal Products Market and captured more than a 34.8% share. Strong adoption of cell and gene therapies supported this lead. Growth was driven by a rising cancer burden and rapid progress in targeted treatments. Genetic disorders formed the next major area. Demand increased due to the need for curative therapies for inherited metabolic and haematologic conditions. Improved diagnostics also supported expansion.

Neurology registered steady gains. Growth was supported by the rising burden of chronic neurological conditions. Therapies for spinal muscular atrophy, Parkinson’s disease, and multiple sclerosis advanced the segment. Cardiovascular applications also showed progress. Research in cardiac repair and regenerative gene therapies increased activity in this space. Musculoskeletal and orthopaedic applications expanded due to demand for tissue repair. Stem-cell-based solutions for cartilage damage and injury management strengthened development across this group.

Ophthalmology contributed meaningful growth. Gene therapies for inherited retinal disorders improved clinical outcomes and supported adoption. Dermatology advanced at a gradual pace. Interest increased in skin regeneration and genetic treatments for rare dermatological conditions. The “Others” segment covered emerging indications. These included autoimmune disorders, metabolic diseases, and regenerative organ repair applications. Broad clinical pipelines supported future expansion. Continued investment strengthened development across these areas and ensured a positive outlook for advanced therapy applications.

End-User Analysis

In 2024, the ‘Hospitals and Clinics’ held a dominant market position in the End-User Segment of the Advanced Therapy Medicinal Products (ATMPs) Market, and captured more than a 45.5% share. This lead was driven by rising adoption of cell and gene therapies. Demand increased in oncology and rare diseases. Hospitals used advanced infrastructure to support complex treatments. Skilled teams improved therapy delivery. Growing patient inflow also supported wider use. These factors kept hospitals and clinics ahead.

CDMOs showed steady growth as developers relied on outsourced manufacturing. Their specialized facilities supported complex production needs. They improved scalability and compliance. Biotechnology and biopharma companies also played a major role. Their R&D pipelines expanded. Clinical trial activity increased. Investments in gene and cell therapies rose. Collaboration between industry groups strengthened innovation. These factors supported higher adoption of advanced therapy technologies across commercial settings. Market participation continued to rise steadily.

Research and academic institutes maintained stable involvement. They supported early scientific studies. Their work enabled preclinical evaluations and proof-of-concept trials. Partnerships with industry groups improved knowledge creation. The ‘Others’ segment included specialty centers and private laboratories. Adoption increased as access to regenerative care expanded. These facilities offered testing and small-scale therapeutic services. Awareness of personalized treatment approaches improved uptake. Combined contributions strengthened the overall end-user landscape for advanced therapies.

Key Market Segments

By Therapy Type

- Cell Therapy

- Gene Therapy

- Tissue-Engineered Products

- Combination/Joined ATMPs (e.g., cell + gene + scaffold)

- Others

By Product Type

- Somatic Cell Therapy Products

- Tissue-Engineered Medicinal Products

- Gene Therapy Medicinal Products

- Combined ATMPs / Multi-Modal Products

- Others

By Application

- Oncology

- Genetic Disorders (e.g., inherited metabolic, haematologic)

- Neurology

- Cardiovascular Diseases

- Musculoskeletal / Orthopaedic (e.g., tissue repair)

- Ophthalmology

- Dermatology

- Others

By End-User

- Hospitals and Clinics

- Contract Development & Manufacturing Organizations (CDMOs)

- Biotechnology & Biopharma Companies

- Research & Academic Institutes

- Others

Drivers

Rapid Expansion Of The Clinical Development Pipeline

The rapid expansion of the clinical development pipeline has been recognized as a major driver for Advanced Therapy Medicinal Products. The rising number of investigational gene, cell, and RNA therapies signals a strong momentum in research activities. This expansion reflects sustained interest from developers and investors.

The growth of candidate therapies entering clinical stages has been linked to intensified innovation, which is expected to strengthen future commercialization prospects in the ATMP landscape. These trends indicate a sustained shift toward advanced modalities with high therapeutic potential.

A broader and more dynamic pipeline also supports stronger investment flows. Increased trial activity has created a continuous inflow of new therapeutic candidates positioned for regulatory review and future market entry. Study by several industry groups has shown that companies tend to increase spending when a higher volume of assets advances through development. This pattern reinforces overall market expansion. Companies respond by allocating resources to manufacturing, regulatory preparation, and long-term commercialization strategies.

According to the American Society of Gene & Cell Therapy (ASGCT), 71 gene-therapy trials were initiated in Q4 2024. This figure represented six fewer than the previous quarter but still demonstrated robust activity within the space. The organization also reported that the global pipeline for gene, cell, and RNA therapies surpassed 3,200 active trials by Q3 2025. This increase reflects sustained demand for clinical progress. The broad scale of these programs highlights the sector’s movement toward diversified therapeutic innovation.

For instance, the continued rise in active studies shows that advanced therapies are moving more consistently along the development pathway. For example, the large number of ongoing trials indicates readiness among developers to transition from research toward commercial planning. According to multiple market assessments, such intensifying clinical efforts often signal long-term revenue opportunities. The pipeline strength therefore acts as a foundational driver. It supports manufacturing expansion, regulatory engagement, and investment acceleration across the entire ATMP value chain.

Restraints

Regulatory And Post-Authorisation Burden Remains High

The regulatory environment for Advanced Therapy Medicinal Products (ATMPs) is characterised by extensive oversight, which has resulted in a sustained administrative burden. The need for continuous evaluation, structured evidence generation, and extended monitoring has created delays in product progression and commercial scalability. The growth of the ATMP market has therefore been constrained by the requirement to comply with stringent post-authorisation obligations, which increases both time and resource commitments for developers. This complexity has slowed broad adoption across healthcare systems.

The post-approval phase has been identified as a major pressure point for manufacturers, as long-term safety and efficacy tracking remains mandatory. A study analysing the EU ATMP landscape indicated that 118 post-authorisation measures were applied to 25 authorised therapies between 2013 and 2024. The study further noted that 41.5% of these measures required real-world data. Such extensive information requests have increased operational workloads. The requirement for large-scale data collection has raised compliance costs and extended timelines for market consolidation.

According to Frontiers research piece, additional regulatory designations have influenced the path to market. For instance, of 27 approved ATMPs assessed, 52% received PRIME designation while 74% held orphan status. These designations were associated with shorter time to marketing authorisation, with PRIME reducing timelines by about 42.7% and orphan designation by around 32.8%. Despite these accelerations, developers still face rigorous post-approval monitoring demands, indicating that early approval does not mitigate long-term regulatory expectations.

The combined impact of accelerated approval pathways and ongoing evidence obligations has highlighted a major structural restraint. Study by various regulatory research groups has shown that even with supportive frameworks, long-term follow-up requirements continue to hinder rapid market penetration. For example, the mandatory submission of real-world outcomes extends resource use well beyond the approval phase. These cumulative obligations have resulted in slower commercial uptake and limited scalability of ATMPs across the European market.

Opportunities

Shifting Indication Focus Into Non-Oncology And Rare Diseases

The opportunity for Advanced Therapy Medicinal Products (ATMPs) has expanded as development activity moves beyond oncology into broader therapeutic categories. This transition supports wider patient access and strengthens long-term commercial potential. The growth of programmes in non-oncology areas indicates that demand is diversifying. As treatment needs rise across chronic and genetic disorders, the shift positions ATMP developers to address unmet clinical requirements. This broadening landscape enhances portfolio resilience and encourages strategic investments across multiple disease segments.

The repositioning of ATMP pipelines toward rare diseases further reinforces this opportunity. According to recent development trends, rare conditions outside oncology are gaining priority because they offer high unmet need and supportive regulatory pathways. This environment strengthens the value of cell and gene therapies that deliver targeted, durable outcomes. The increasing number of rare-disease initiatives demonstrates that ATMPs are becoming central to next-generation therapeutic strategies. This shift supports sustained growth and improves the viability of long-term innovation.

A study by ASGCT reported that during Q4 2024, gene-therapy trial initiations reached near balance, with 49% focused on oncology and 51% targeting non-oncology conditions. This movement signals that developers are actively exploring broader clinical categories. For instance, musculoskeletal, metabolic, and neurological disorders have shown rising clinical interest. The distribution of trial activity reflects an industry-wide recognition that ATMPs can generate therapeutic value across multiple disease areas, not only in cancer.

Further evidence of this expansion was observed within the non-genetically modified cell-therapy pipeline. For example, 61% of rare-disease programmes in Q4 2024 targeted non-oncology indications, indicating deliberate diversification. This trend suggests a growing confidence in applying ATMP technologies to complex, non-cancer disorders. The shift broadens treatment applicability and enhances commercial pathways. As developers expand their focus, a significant opportunity emerges for ATMPs to achieve wider clinical adoption and stronger market penetration across global healthcare systems.

Trends

Growing authorisation of ATMPs in Europe with changing regulatory dynamics

The authorisation landscape for Advanced Therapy Medicinal Products has shown clear signs of expansion. The trend is defined by a steady rise in approved therapies, broader technology categories, and more structured regulatory processes. Growth has been supported by increasing maturity in development pipelines and rising confidence among regulators. The market is moving toward a more predictable environment as more products demonstrate clinical value. This pattern reflects sustained progress in advanced therapies, supported by scientific innovation and improved regulatory clarity across Europe.

A study by European researchers in 2025 indicated that 27 Advanced Therapy Medicinal Products received marketing approval across the region. According to the findings, gene-therapy medicinal products accounted for close to 70% of these authorisations, showing the dominance of genetic approaches. For instance, four cell-therapy medicinal products and three tissue-engineered products were cleared, reflecting diversification across platforms. One combined-type product was also approved, which signalled gradual broadening of the therapy mix. These data highlighted balanced growth across multiple ATMP categories.

According to a Q1–April 2024 report, the regulatory pathway mix for these therapies continued to evolve. The data showed that nearly half of the evaluated ATMPs proceeded through the standard marketing authorisation route. For example, 38% secured conditional authorisation, which demonstrated reliance on adaptive mechanisms for promising therapies. Around 12% were approved under exceptional circumstances. This pattern suggested that regulators were using flexible tools to support innovative products while maintaining structured assessment frameworks.

The combined insights from both datasets indicate a maturing regulatory ecosystem that supports advanced therapies while ensuring safety and evidence standards. Study by the European Medicines Agency demonstrated that multiple approval pathways were being used to match clinical readiness. For instance, the diversity of gene- and cell-based approvals aligned with increasing scientific robustness. The overall trend suggested that Europe is moving toward a more supportive environment for ATMP innovation. This direction is expected to strengthen the market and enable wider therapeutic adoption.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 43.8% share and holds US$ 11.88 billion market value for the year. The region advanced due to strong clinical activity and rapid growth in cell and gene therapy programs. Research institutions expanded trials at a steady pace. Hospitals adopted advanced treatment options faster. Supportive regulations enabled quicker approvals. High healthcare spending strengthened access to complex therapies. This created a consistent rise in ATMP utilization across major therapeutic areas.

The regional growth can be attributed to strong investment in biotechnology and a well-established innovation ecosystem. Academic centers partnered with industry groups to accelerate testing and development. Skilled professionals supported continuous research progress. Clear regulatory guidance reduced development barriers. Reimbursement support encouraged wider adoption in specialized facilities. A rising burden of chronic and rare diseases increased demand for targeted therapies. These factors reinforced regional leadership and sustained a high level of commercial activity across the ATMP landscape.

North America is expected to maintain its lead due to ongoing advancements in regenerative medicine and precision-based therapeutics. Improvements in genome editing tools are driving faster innovation. Collaboration among therapy developers, CDMOs, and research institutes remains strong. Manufacturing capacity continues to expand. Funding access supports early-stage and late-stage projects. Healthcare providers show rising interest in personalized treatments. These combined strengths ensure long-term competitiveness and a stable outlook for advanced therapies across the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Advanced Therapy Medicinal Products market is shaped by innovators, developers, and large biopharma companies. Their combined strengths influence research progress, regulatory acceptance, and commercial adoption. Novartis AG and Gilead Sciences Inc., through Kite Pharma, have established strong positions with approved CAR-T therapies. Their experience in global distribution, treatment center networks, and quality systems supports wider patient access. Their continued investments indicate stable growth prospects. These companies set performance benchmarks and accelerate competition across the cell and gene therapy landscape.

Innovation in gene editing strengthens the market’s scientific foundation. CRISPR Therapeutics AG leads in CRISPR-based therapies, supported by advanced collaborations and late-stage clinical programs. Its work in sickle cell disease and beta-thalassemia demonstrates strong therapeutic potential. Oxford Biomedica plc supports this progress through specialized viral vector technologies. Its lentiviral platforms improve manufacturing efficiency and development timelines. Both organizations contribute essential capabilities. Their combined efforts enhance pipeline diversity and reinforce confidence in next-generation treatment modalities.

Manufacturing remains a decisive factor in ATMP scalability. AGC Biologics Inc. has expanded capabilities through strategic acquisitions in Europe and the United States. Its facilities support commercial-scale cell and gene therapy production. This strengthens reliability for clinical and commercial customers. Other major CDMOs, including Samsung Biologics, FUJIFILM Diosynth Biotechnologies, and Lonza Group AG, offer robust development platforms. Their infrastructure ensures higher production quality and regulatory compliance. These companies improve supply resilience and support global ATMP commercialization.

A broad group of additional players provides specialized support. Thermo Fisher Scientific Inc., Catalent Inc., Celltrion Inc., Yposkesi, Centre for Breakthrough Medicines, and SCTbio a.s. deliver focused services in vectors, analytics, and cell processing. Their roles extend across early development, scale-up, and GMP manufacturing. This diversified ecosystem strengthens innovation efficiency. It also reduces operational risk for therapy developers. These participants ensure sustained progress and form the wider backbone of the ATMP value chain, enabling long-term market expansion.

Market Key Players

- Novartis AG

- Gilead Sciences Inc. (via its subsidiary Kite Pharma Inc.)

- CRISPR Therapeutics AG

- Oxford Biomedica plc

- AGC Biologics Inc.

- Samsung Biologics Co. Ltd.

- FUJIFILM Diosynth Biotechnologies

- Lonza Group AG

- Celltrion Inc.

- Thermo Fisher Scientific Inc.

- Yposkesi (Erytech Pharma SA)

- Centre for Breakthrough Medicines LLC

- SCTbio a.s.

- Catalent Inc.

- Other key players

Recent Developments

- In May 2023: Novartis acquired a gene-therapy programme for the rare disease cystinosis from Avrobio Inc.: The deal involved a purchase price of approximately US $90 million. Through acquiring this asset, Novartis expanded its ATMP pipeline into a rare genetic disorder indication, reinforcing its commitment to one-time gene therapies.

- In March 2023: CRISPR Therapeutics entered into a non-exclusive licence agreement with Vertex, in which Vertex paid CRISPR Therapeutics an up-front payment of US $100 million for non-exclusive rights to CRISPR’s gene-editing technology to support hypoimmune gene-edited cell therapies. This deal strengthens CRISPR Therapeutics’ platform reach into cell-therapy space and aligns with the company’s focus on advancing advanced therapy medicinal products (ATMPs).

Report Scope

Report Features Description Market Value (2024) US$ 27.14 Billion Forecast Revenue (2034) US$ 121.81 Billion CAGR (2025-2034) 16.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Therapy Type (Cell Therapy, Gene Therapy, Tissue-Engineered Products, Combination/Joined ATMPs (e.g., cell + gene + scaffold), Others), By Product Type (Somatic Cell Therapy Products, Tissue-Engineered Medicinal Products, Gene Therapy Medicinal Products, Combined ATMPs / Multi-Modal Products, Others), By Application (Oncology, Genetic Disorders (e.g., inherited metabolic, haematologic), Neurology, Cardiovascular Diseases, Musculoskeletal / Orthopaedic (e.g., tissue repair), Ophthalmology, Dermatology, Others), By End-User (Hospitals and Clinics, Contract Development & Manufacturing Organizations (CDMOs), Biotechnology & Biopharma Companies, Research & Academic Institutes, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Novartis AG, Gilead Sciences Inc. (via its subsidiary Kite Pharma Inc.), CRISPR Therapeutics AG, Oxford Biomedica plc, AGC Biologics Inc., Samsung Biologics Co. Ltd., FUJIFILM Diosynth Biotechnologies, Lonza Group AG, Celltrion Inc., Thermo Fisher Scientific Inc., Yposkesi (Erytech Pharma SA), Centre for Breakthrough Medicines LLC, SCTbio a.s., Catalent Inc., Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Advanced Therapy Medicinal Products MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Advanced Therapy Medicinal Products MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Novartis AG

- Gilead Sciences Inc. (via its subsidiary Kite Pharma Inc.)

- CRISPR Therapeutics AG

- Oxford Biomedica plc

- AGC Biologics Inc.

- Samsung Biologics Co. Ltd.

- FUJIFILM Diosynth Biotechnologies

- Lonza Group AG

- Celltrion Inc.

- Thermo Fisher Scientific Inc.

- Yposkesi (Erytech Pharma SA)

- Centre for Breakthrough Medicines LLC

- SCTbio a.s.

- Catalent Inc.

- Other key players