Global AdTech Market By Solution (Demand-side Platforms (DSPs), Supply-side Platforms (SSPs), Ad Networks, Data Management Platforms (DMPs), Others), By Advertising Type (Programmatic Advertising, Search Advertising, Display Advertising, Mobile Advertising, Email Marketing, Native Advertising, Others), By Organization Size (Large Enterprises, SMEs), By Platform (Mobile devices, Web, Others), By Industry Verticals (BFSI, Retail & Consumer Goods, Media & Entertainment, Education, IT & Telecom, Healthcare, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Jan. 2024

- Report ID: 112188

- Number of Pages: 213

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

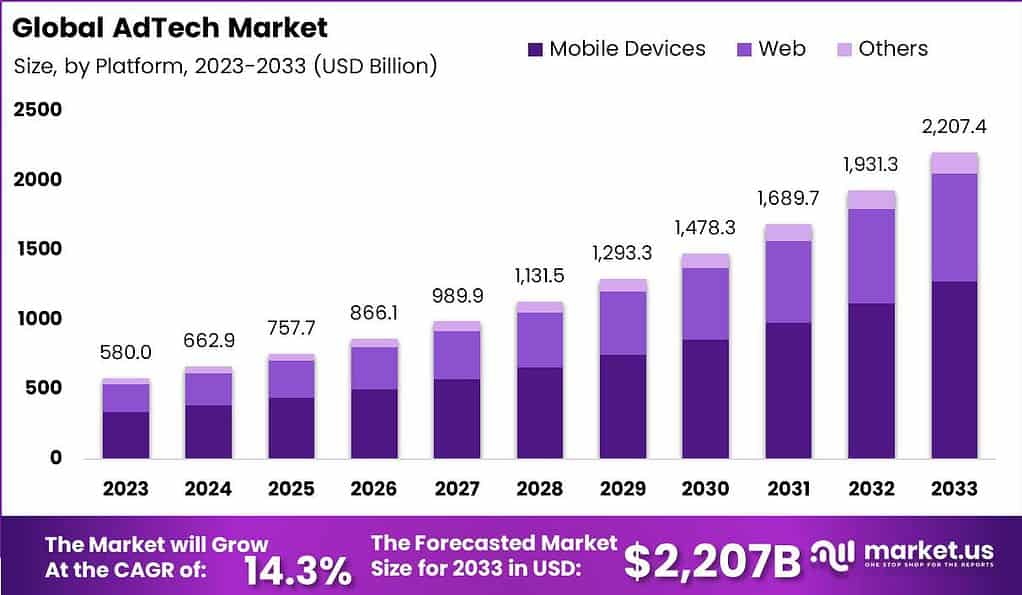

The Global AdTech Market size is poised to cross USD 662.9 Billion in 2024 and is likely to attain a valuation of USD 2,207.4 Billion by 2033. The adtech industry share is projected to develop at a CAGR of 14.3% from 2024 to 2033.

Advertising Technology, commonly known as AdTech, refers to the application of advanced technology and tools to automate and optimize advertising processes and campaigns. This broad category includes a spectrum of software, platforms, and technologies that empower businesses to precisely target, deliver, and assess the performance of their advertising efforts.

In recent years, the AdTech market has seen significant growth and innovation, spurred by the widespread digitalization of advertising and a rising preference for data-driven marketing strategies. With businesses redirecting their advertising budgets towards digital channels, the importance of efficient and scalable AdTech solutions has become more pronounced. AdTech platforms encompass a broad range of capabilities, including ad targeting, ad serving, ad exchanges, programmatic advertising, and analytics, providing businesses with the tools to optimize the impact and return on investment (ROI) of their advertising initiatives.

Note: Actual Numbers Might Vary In The Final Report

One of the key factors contributing to the growth of the AdTech market is the exponential increase in digital advertising spending. With the proliferation of online platforms, social media, mobile devices, and streaming services, advertisers are investing heavily in digital channels to reach their target audiences. AdTech solutions provide the tools and infrastructure needed to manage and optimize these complex and dynamic digital advertising ecosystems.

Key Takeaways

- Market Size and Growth: The AdTech market is expected to reach a valuation of USD 2,207.4 billion by 2033, with a projected CAGR of 14.3% from 2024 to 2033.

- What is AdTech: AdTech, short for Advertising Technology, involves advanced technology and tools to automate and optimize advertising processes, including ad targeting, serving, exchanges, programmatic advertising, and analytics.

- Factors Driving Growth: The exponential increase in digital advertising spending, with 73% of individuals aged 10 and above having access to smartphones by 2022, has significantly contributed to the AdTech market’s growth.

- Innovations: Tech giants like Meta and Google are leveraging AI and generative AI features to enhance advertising capabilities, including ad content generation and personalization.

- Segment Analysis: In 2023, Demand-side Platforms (DSPs) dominated the market with a 33% share, followed by Supply-side Platforms (SSPs), Ad Networks, and Data Management Platforms (DMPs), each serving specific advertising needs.

- Advertising Types: Search Advertising held a dominant market position in 2023, capturing over 23% of the market share, followed by Programmatic Advertising, Display Advertising, Mobile Advertising, Email Marketing, and Native Advertising.

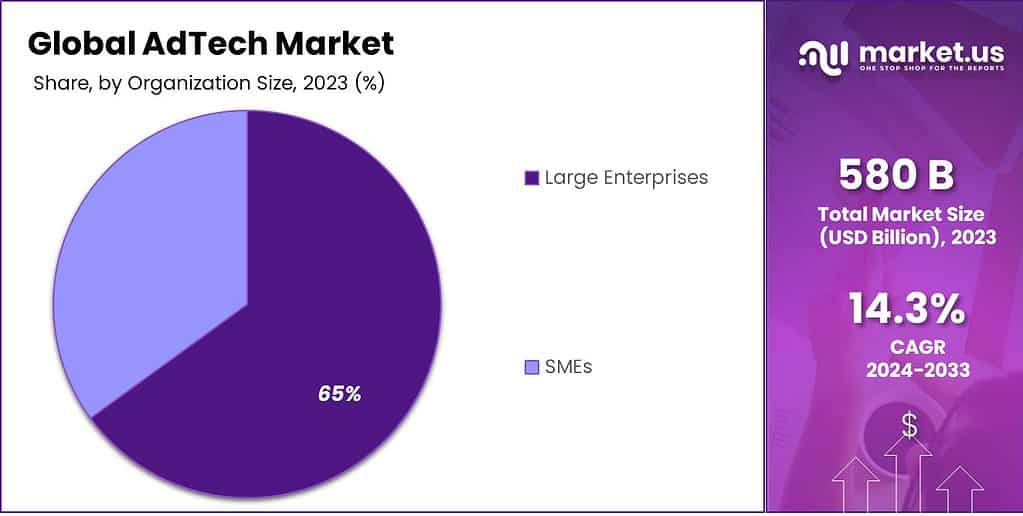

- Organization Size: Large Enterprises led the AdTech market in 2023 with a 65% share due to their extensive resources and the need for comprehensive advertising strategies. However, SMEs are rapidly gaining influence with user-friendly AdTech platforms.

- Platform Analysis: Mobile devices were the dominant platform in 2023, capturing over 58% of the market share, followed by Web. Emerging platforms like connected TVs and wearable devices are also gaining traction.

- Industry Verticals: Retail & Consumer Goods held the largest market share in 2023 (28%), driven by digital transformation and e-commerce growth. Other sectors such as BFSI, Media & Entertainment, Education, IT & Telecom, Healthcare, and more also contribute to the market diversity.

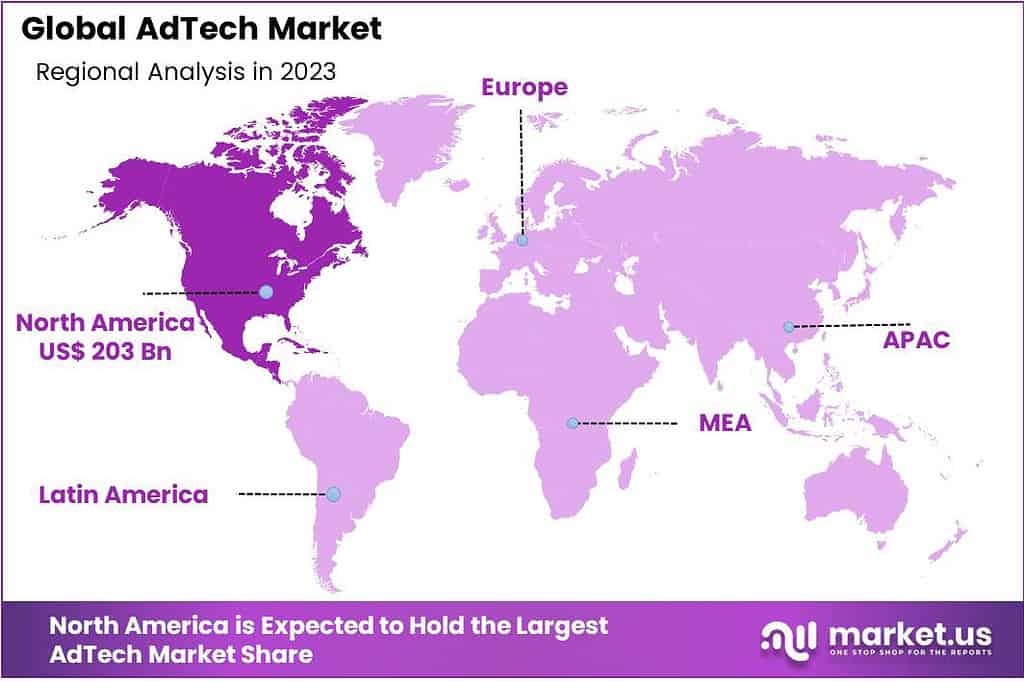

- Regional Analysis: North America led the AdTech market in 2023 with a 35% share, followed by Europe, APAC, Latin America, and MEA. Each region has its unique growth drivers, such as digital infrastructure and data protection regulations in Europe.

- Key Players: Major players in the AdTech market include Google, Meta Platforms, Twitter, Amazon, Alibaba, Microsoft, and Adobe, with strategic moves like acquisitions and partnerships to expand their offerings.

By Solution Analysis

In 2023, the Demand-side Platforms (DSPs) segment held a dominant market position in the AdTech market, capturing more than a 33% share. DSPs revolutionized digital advertising by allowing buyers of digital advertising inventory to manage multiple ad exchange and data exchange accounts through a single interface. This efficiency not only streamlined the advertisement buying process but also enabled better targeting and optimization, leading to its significant market share.

On the other hand, Supply-side Platforms (SSPs) complemented DSPs by allowing sellers to manage their advertising space inventory, fill it with ads, and receive revenue. Though smaller in comparison to DSPs, SSPs are crucial for maximizing the profits of publishers.

Ad Networks, another pivotal segment, continued to play a vital role by aggregating, categorizing, and making available ad inventory to marketers, thereby simplifying the buying process. Meanwhile, Data Management Platforms (DMPs) have been the backbone for data-driven marketing, offering insightful strategies based on the analysis of big data. These platforms are instrumental in collecting, organizing, and activating large sets of data from disparate sources, enabling advertisers and marketers to make informed decisions.

Lastly, the ‘Others’ segment, which includes emerging technologies and platforms, has been steadily gaining traction. This segment encapsulates the innovative and adaptive nature of the AdTech market, constantly evolving with new tools and technologies designed to enhance advertising efficiency and effectiveness.

By Advertising Type Analysis

In 2023, the Search Advertising segment held a dominant market position, capturing more than a 23% share of the AdTech market. This segment benefits significantly from its ability to target consumers actively seeking specific products or services, thus delivering highly relevant advertisements. Search Advertising is highly valued for its effectiveness in driving direct response and sales, leading to a substantial return on investment for advertisers. Additionally, the continuous refinement of search algorithms and the increasing sophistication of keyword targeting have further enhanced its appeal, contributing to steady growth.

Programmatic Advertising follows closely, revolutionizing the AdTech space with its automated, real-time bidding on advertising inventory. This segment has been growing rapidly, attributed to its efficiency and precision in reaching target audiences. By leveraging data analytics and machine learning, Programmatic Advertising offers dynamic ad placements, optimizing ad spend and improving campaign performance.

Display Advertising remains a significant segment, known for its visual appeal and broad reach. Despite facing challenges from ad blockers and banner blindness, innovative formats like interactive and video ads are rejuvenating this space. In 2023, it accounted for a substantial market share, driven by its versatility and the growing consumption of digital content.

Mobile Advertising has surged, fueled by the global increase in smartphone penetration and mobile internet usage. It’s not just about reaching users; it’s about engaging them where they spend most of their time. With advanced targeting capabilities and the ability to personalize messages, Mobile Advertising is becoming increasingly effective and accounted for a considerable portion of the market in 2023.

Email Marketing continues to be an essential tool for direct communication and customer retention. Its ability to deliver personalized content directly to users’ inboxes contributes to its enduring value. In 2023, it maintained a stable market share, supported by advancements in segmentation and automation technologies.

Native Advertising is gaining traction by offering a seamless user experience. Blending with the content environment, these ads provide value, thus reducing the intrusion factor common in traditional ads. The segment is witnessing growth as both publishers and advertisers recognize the benefits of such integrated advertising experiences.

By Organization Size Analysis

In 2023, the Large Enterprises segment held a dominant market position in the AdTech market, capturing more than a 65% share. This segment benefits from substantial budgets and resources, allowing for more extensive and sophisticated advertising campaigns.

Large Enterprises often lead in adopting innovative advertising technologies, leveraging their scale to negotiate better rates and access premium ad inventories. Their dominance is also underpinned by the need for comprehensive, multi-channel strategies that cover global markets, necessitating robust AdTech solutions capable of delivering at scale. Additionally, these organizations have the capacity to harness and analyze vast amounts of data to refine and optimize their advertising efforts, further enhancing their market position.

On the other hand, Small and Medium-sized Enterprises (SMEs) are rapidly becoming a significant force in the AdTech market. While they held a smaller share of the market in 2023, their influence is growing due to the democratization of AdTech tools.

Affordable and user-friendly platforms are enabling SMEs to execute sophisticated advertising campaigns previously reserved for larger corporations. This shift is driven by the increasing availability of self-service AdTech platforms, which allow SMEs to manage campaigns with more agility and reduced costs. Furthermore, targeted and local advertising is particularly effective for SMEs, allowing them to reach their niche markets efficiently.

Note: Actual Numbers Might Vary In The Final Report

By Platform Analysis

In 2023, the Mobile devices segment held a dominant market position in the AdTech market, capturing more than a 58% share. This substantial portion can be attributed to the pervasive use of smartphones and tablets, which has significantly shifted consumer media consumption and browsing habits towards mobile platforms.

The continuous innovation in mobile technology and the growing number of mobile applications have further fueled the adoption of mobile advertising technologies, making it an integral part of digital marketing strategies. Additionally, the increased precision of location-based services and personalized advertising through mobile devices has enabled advertisers to target audiences more effectively, contributing to the segment’s growth.

On the other hand, the Web segment, although facing stiff competition from mobile, continues to maintain a significant share in the AdTech market. The segment benefits from the extensive reach of the internet and the ongoing relevance of desktop and laptop computers in professional environments. Moreover, advancements in programmatic advertising and real-time bidding have refined the effectiveness of web-based advertisements, ensuring its continued appeal to marketers.

Other emerging platforms in the AdTech market are also gaining traction, driven by the advent of new technologies such as connected TVs, wearable devices, and augmented reality platforms. These platforms offer innovative ways to engage with consumers, opening new avenues for targeted and immersive advertising experiences. However, as of 2023, their market share remains relatively small compared to mobile and web but is expected to grow as technology advances and adoption increases.

By Industry Verticals Analysis

In 2023, the Retail & Consumer Goods segment held a dominant market position in the AdTech market, capturing more than a 28% share. This prominence is largely due to the digital transformation of the retail industry, where e-commerce platforms and online marketplaces have become central to consumer purchasing habits.

Retailers are increasingly leveraging advanced advertising technologies to personalize shopping experiences, target potential customers, and measure the effectiveness of their campaigns, driving substantial growth in this segment.

The BFSI (Banking, Financial Services, and Insurance) sector also makes a notable contribution to the AdTech market. With the rise of online banking and fintech services, these institutions are turning to sophisticated advertising tools to attract, engage, and retain customers. This sector relies heavily on data-driven advertising strategies to reach specific demographics and promote various financial products and services.

In the realm of Media & Entertainment, AdTech plays a critical role in monetizing content across platforms ranging from online streaming services to traditional broadcasting. This industry vertical leverages advertising technologies to deliver targeted content and advertisements to viewers, enhancing user experience and maximizing revenue.

The Education sector, particularly e-learning platforms, has embraced AdTech to reach potential students and promote educational services and products. As online education continues to grow, targeted advertising has become an essential tool for educational institutions and service providers.

Similarly, IT & Telecom industries utilize AdTech to promote new technologies, services, and innovations. As these sectors are often at the forefront of technological advancements, advertising technology is crucial for communicating complex information in an accessible manner and reaching a global audience.

Healthcare, another vital segment, uses AdTech to educate the public about health services, new treatments, and wellness products. However, this sector must navigate stringent regulations regarding consumer data and privacy, which can influence advertising strategies and technologies used.

Other sectors such as travel, real estate, and automotive also contribute to the diversity of the AdTech market, each employing unique strategies to reach their target audiences and achieve their marketing goals.

For Instance

- in November 2022, as per the International Telecommunication Union, a department of the United Nations based in Switzerland overseeing various issues, including technology and communication, projections indicate that by 2022, ~73% of individuals aged 10 and above will have access to a smartphone. This marks a ~7% increase over the current proportion of the population using the Internet. Consequently, the growing proliferation of mobile devices is a significant factor propelling the ad-tech market forward.

- In October 2023, Meta unveiled its first set of generative AI features designed specifically for advertisers. These features provide advertisers with the capability to leverage AI for various purposes, including the creation of backgrounds, expansion of images, and generation of multiple versions of ad text derived from the original copy.

- In July 2023, Omnicom and Google joined forces in a strategic partnership, integrating Google’s generative AI models into Omnicom’s Adtech platform. This collaboration is geared towards bolstering the capabilities of Omnicom’s Adtech platform, offering advertisers personalized and impactful advertising opportunities. The integration seeks to leverage generative AI to optimize the customization and performance of advertising content within Omnicom’s Adtech ecosystem.

- in February 2023, as reported by Simplilearn Solutions Pvt. Ltd., a US-based online edu-tech company, global digital advertising expenditures witnessed a modest growth of ~2.4% in 2022. Projections indicate a further increase, with expectations to reach $645 billion by 2024, up from $389 billion in 2022. This surge in digital advertising demand is a key driver fueling the growth of the ad tech market.

Key Market segments

By Solution

- Demand-side Platforms (DSPs)

- Supply-side Platforms (SSPs)

- Ad Networks

- Data Management Platforms (DMPs)

- Others

By Advertising Type

- Programmatic Advertising

- Search Advertising

- Display Advertising

- Mobile Advertising

- Email Marketing

- Native Advertising

- Others

By Organization Size

- Large Enterprises

- SMEs

By Platform

- Mobile devices

- Web

- Others

By Industry Verticals

- BFSI

- Retail & Consumer Goods

- Media & Entertainment

- Education

- IT & Telecom

- Healthcare

- Others

Drivers

- Proliferation of smartphones for greater mobile optimization and in-app advertising: Smartphones are driving rapid growth in mobile advertising as users spend more time in apps and on mobile sites. AdTech platforms are optimizing for mobile to serve ads on this key channel.

- Shift to digital media and marketing over traditional formats: Brands are shifting budgets from traditional advertising like print and TV to digital channels like social, search, and display. This fuels demand for data-driven AdTech platforms.

- Rising importance of data-driven and programmatic advertising: Data and programmatic advertising allows for automated media buying and more targeted ad serving based on audience data and demographics. This increases relevance and ROI.

- Need for automation and AI-powered ad platforms: AdTech companies are utilizing automation, machine learning and AI to optimize and streamline digital advertising. This improves campaign performance.

Restraints

- Stringent privacy regulations and security concerns: Regulations like GDPR limit how user data can be collected and used for ads. This restricts targeting capabilities. Security risks also challenge AdTech.

- Ad fraud, bots, and click theft: Fraudulent activities like fake clicks and impressions subtract value and undermine campaign results. AdTech platforms try to detect and reduce these.

- Brand safety and suitability challenges: Brands want safe, suitable ad placements that align with their values. Objectionable content remains a concern and challenge.

- Consumer mistrust and ad fatigue: Intrusive or overly targeted ads cause frustration. Consumers increasingly use ad blockers and distrust how their data is used.

Opportunities

- Widespread adoption of AR and VR technologies for more interactive and immersive ad experiences: Emerging formats like AR and VR allow for more engaging and memorable ads tailored to new devices and platforms.

- Growth of connected TV and digital out-of-home ads: Connected TVs and DOOH formats present new environments for data-driven and targeted advertising.

- Leveraging blockchain and crypto for transparency and security: Blockchain solutions are being explored to increase transparency, security, and prevent fraud in the AdTech supply chain.

Challenges

- Presence of Ad-Blocking Bypass Solutions: Ad blockers reduce ad visibility and revenue. Solutions that bypass blockers raise concerns about consumer choice and control.

- Measurement and attribution across channels: Consistently measuring ROI and attributing value across different ad platforms and formats remains difficult.

- Maintaining relevance amid shifting consumer demographics and behaviors: AdTech needs to continuously adapt to new technologies, devices, and audience preferences to stay relevant.

- Rising competitiveness in the ad space: The ad market is intensely competitive, with new entrants and consolidation across AdTech vendors. Differentiation is a key challenge.

Regional Analysis

In 2023, North America held a dominant market position in the AdTech market, capturing more than a 35% share. This substantial market share can be attributed to the robust digital infrastructure, high internet penetration, and the presence of key industry players in the region. Notably, the United States has been a pioneering market, driving innovation and adoption in AdTech solutions. As businesses increasingly shift towards digital advertising, the North American market is expected to maintain its leadership, with projections indicating continued growth.

Moving to Europe, the region has shown significant growth in AdTech, driven by advanced technologies and stringent data protection regulations like GDPR which have reshaped advertising strategies. Europe’s market is characterized by high digital literacy rates and a strong preference for personalized advertising, fueling the demand for sophisticated AdTech solutions.

In the Asia-Pacific (APAC) region, there is a rapid digital transformation with countries like China and India at the forefront. The expanding internet user base and mobile penetration have catapulted the region into a fast-growing AdTech market. The APAC region is anticipated to witness the highest growth rate due to its large population, increasing urbanization, and growing digitalization in both personal and commercial realms.

Latin America is also embracing digital advancements, with countries like Brazil and Mexico leading in the regional AdTech market. Although at an earlier stage compared to North America and Europe, Latin America shows promising growth potential due to its improving internet infrastructure and growing digital advertising space.

Lastly, the Middle East and Africa (MEA) are experiencing a digital revolution, with a surge in mobile usage and internet penetration. The region presents a unique market with diverse opportunities, particularly in the Gulf Cooperation Council (GCC) countries, where there’s a high demand for innovative advertising technologies.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Thailand

- Singapore

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The AdTech market features a dynamic and competitive landscape with several key players contributing to its growth and innovation. In the market, key players are opting for strategic moves such as partnerships and acquisitions to amplify their product offerings and establish a sustainable competitive advantage. These companies range from established giants to emerging startups, each bringing unique solutions and strategies to the table.

Top Key Players

- InMobi Technology Services Private Limited

- Twitter Inc.

- Meta Platforms Inc.

- Oracle Corporation

- Amazon.com Inc.

- Alibaba Group Holding Limited

- Microsoft Corporation

- Adobe Inc.

- Google LLC

- Verizon Communications Inc.

- Other key players

Recent Developments

- In August 2023, Meta completed the acquisition of Kustomer, a customer relationship management (CRM) platform, for a total of USD 1 billion. This strategic move is perceived as Meta’s initiative to broaden its advertising business by incorporating additional customer data through the integration of Kustomer’s CRM capabilities.

- In August 2023, Zeta unveiled its latest innovation, the Customer Growth Intelligence (CGI) Snowflake Native App, on the Snowflake Marketplace. This new application strengthens and extends the already deep integration between Zeta and Snowflake. Both companies share a common vision to revolutionize the way enterprises manage consumer data – streamlining the process of ingesting, storing, synthesizing, surfacing, and activating data. The ultimate goal is to simplify complex solutions for marketers within the evolving landscape of data utilization.

Report Scope

Report Features Description Market Value (2023) USD 580.0 Bn Forecast Revenue (2033) USD 2,207.4 Bn CAGR (2024-2033) 14.3% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Solution (Demand-side Platforms (DSPs), Supply-side Platforms (SSPs), Ad Networks, Data Management Platforms (DMPs), Others), By Advertising Type (Programmatic Advertising, Search Advertising, Display Advertising, Mobile Advertising, Email Marketing, Native Advertising, Others), By Organization Size (Large Enterprises, SMEs), By Platform (Mobile devices, Web, Others), By Industry Verticals (BFSI, Retail & Consumer Goods, Media & Entertainment, Education, IT & Telecom, Healthcare, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Google, InMobi Technology Services Private Limited, Twitter, Inc., Meta Platforms, Inc., Oracle Corporation, Amazon.com, Inc., Alibaba Group Holding Limited, Microsoft Corporation, Adobe Inc., Google LLC, Verizon Communications Inc., Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is AdTech market?AdTech, short for Advertising Technology, refers to the use of advanced technology and tools to automate and optimize advertising processes and campaigns. It encompasses a range of solutions, including ad servers, demand-side platforms (DSPs), supply-side platforms (SSPs), data management platforms (DMPs), and various analytics tools, aiming to enhance the efficiency and effectiveness of digital advertising.

How big is the AdTech market?The Global AdTech Market size is poised to cross USD 662.9 Billion in 2024 and is likely to attain a valuation of USD 2,207.4 Billion by 2033. The adtech industry share is projected to develop at a CAGR of 14.3% from 2024 to 2033.

Who are the key players in AdTech market?Some key players operating in the AdTech market include Google, InMobi Technology Services Private Limited, Twitter, Inc., Meta Platforms, Inc., Oracle Corporation, Amazon.com, Inc., Alibaba Group Holding Limited, Microsoft Corporation, Adobe Inc., Google LLC, Verizon Communications Inc., Other key players

Which region has the biggest share in Ad Tech Market?In 2023, North America held a dominant market position in the AdTech market, capturing more than a 35% share.

How does AdTech contribute to personalized advertising?AdTech utilizes data analytics and user profiling to deliver personalized ads to specific target audiences. This enables advertisers to tailor their messages based on individual preferences, behaviors, and demographics.

Is AdTech a growing industry?Yes, AdTech is a growing industry. With the increasing digitalization of advertising and the demand for more targeted and personalized campaigns, the AdTech market continues to expand. Emerging technologies, such as programmatic advertising, artificial intelligence, and data-driven insights, contribute to the industry's growth.

-

-

- InMobi Technology Services Private Limited

- Twitter Inc.

- Meta Platforms Inc.

- Oracle Corporation

- Amazon.com Inc.

- Alibaba Group Holding Limited

- Microsoft Corporation

- Adobe Inc.

- Google LLC

- Verizon Communications Inc.

- Other key players