Global Admission Management Software Market Size, Share and Analysis Report By Component (Software/Platform, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Institutions, Small and Medium-sized Institutions), By Application (Application & Enrollment Management, Document & Fee Management, Student Communication & CRM, Reporting & Analytics), By End-User (Higher Education (Universities, Colleges), K-12 Schools, Corporate Training & Certification Bodies), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 171826

- Number of Pages: 349

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Quick Market Facts

- Role of Generative AI

- U.S. Market Size

- Component Analysis

- Deployment Mode Analysis

- Organization Size Analysis

- Application Analysis

- End-User Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

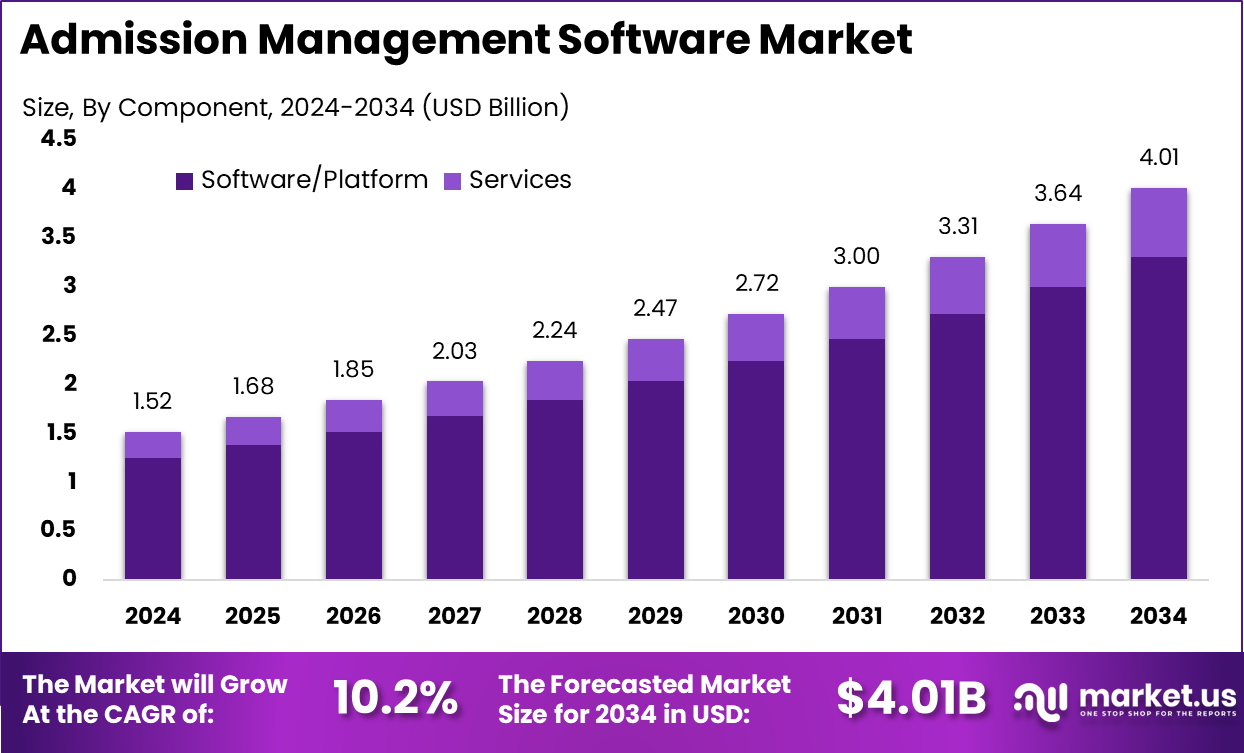

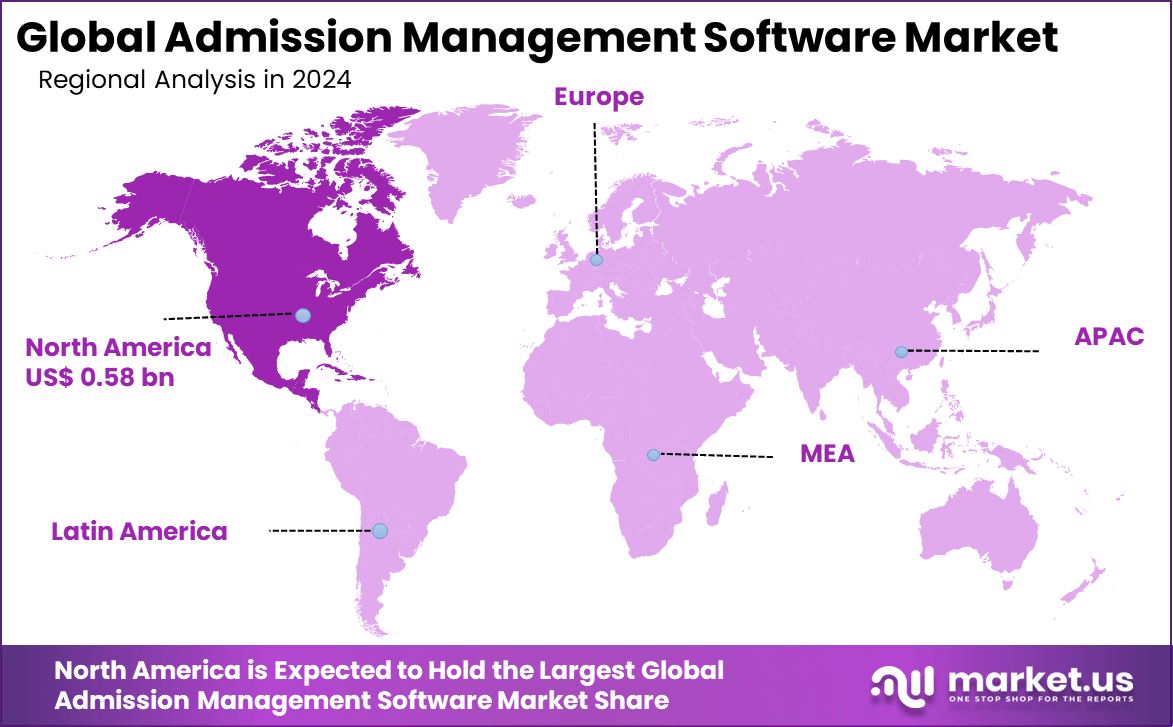

The Global Admission Management Software Market size is expected to be worth around USD 4.01 billion by 2034, from USD 1.52 billion in 2024, growing at a CAGR of 10.2% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 38.5% share, holding USD 0.58 billion in revenue.

The admission management software market includes digital platforms used to manage student enrollment and admission processes. These systems support application collection, document verification, communication, and decision tracking. Educational institutions use the software to improve accuracy and reduce manual effort. The market plays an important role in modern education administration.

Admission management software is used by schools, colleges, universities, and training institutes. It supports both online and offline admission processes. Institutions rely on these systems to handle large volumes of applications efficiently. As education becomes more competitive, software adoption continues to increase.

One major driving factor is the growing number of student applications. Manual admission processes are time-consuming and error-prone. Institutions require automated systems to manage applications effectively. Software solutions help reduce administrative workload. Another driving factor is the shift toward digital education services.

Students expect online application and communication options. Admission software supports digital forms, automated notifications, and real-time updates. This improves the applicant experience. Demand for admission management software is rising across public and private institutions. Universities with large applicant pools seek scalable solutions. Demand is also strong among private schools aiming to improve efficiency. This supports steady market growth.

For instance, in July 2025, Technolutions, Inc. hosted Slate Summit with AI tools stealing the show. New features build branded emails and chatbots right in Slate, no extra apps needed. Calendar sync and HTML fixes cut setup time for admissions teams. Platform hit 41 million apps processed last year, up big from before. Institutions praise the student-first speed.

Key Takeaway

- In 2024, software and platforms dominated the admission management software market with an 82.4% share, reflecting strong reliance on integrated digital systems to manage admissions workflows.

- Cloud-based deployment led with a 91.7% share, driven by demand for scalability, remote access, and simplified system maintenance.

- Large institutions accounted for 58.6% of adoption, supported by high application volumes and complex admission processes.

- Application and enrollment management held 47.3%, highlighting the importance of end-to-end handling of applications, reviews, and student onboarding.

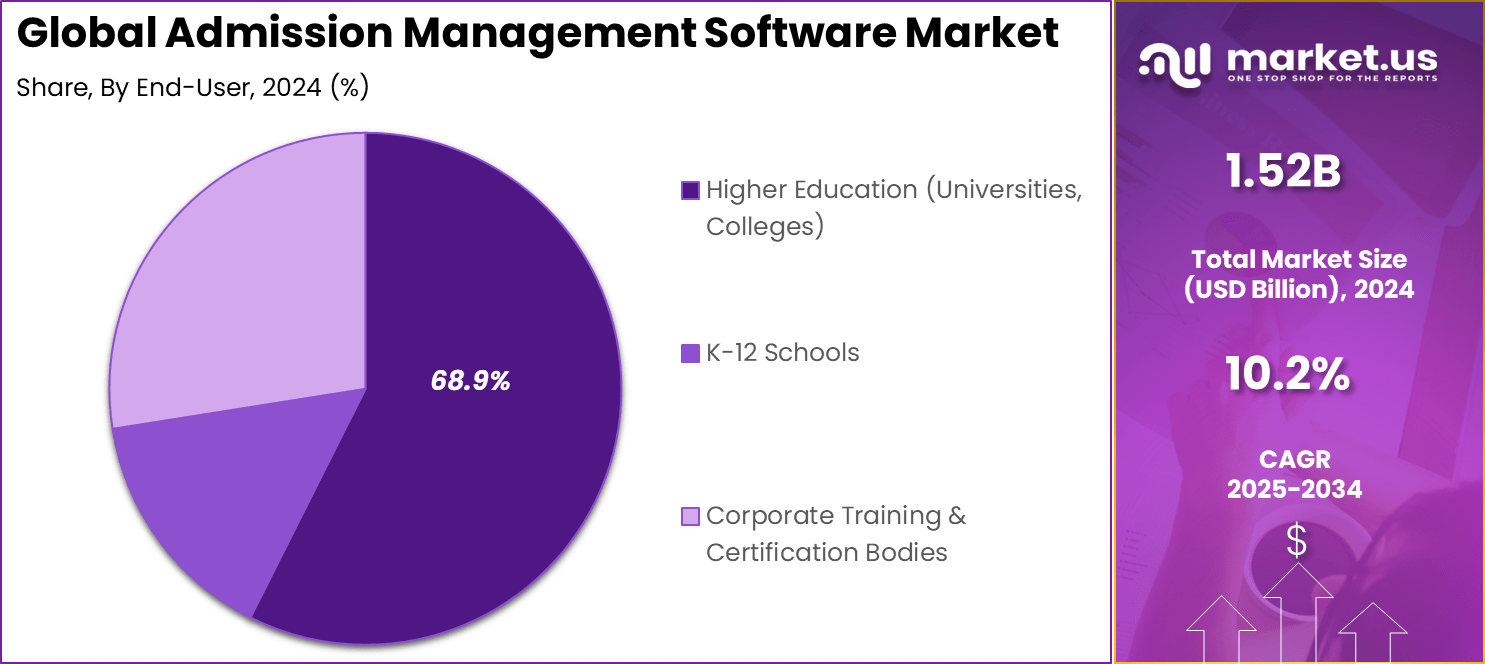

- Higher education represented 68.9%, reflecting widespread use across universities and colleges to streamline student intake and engagement.

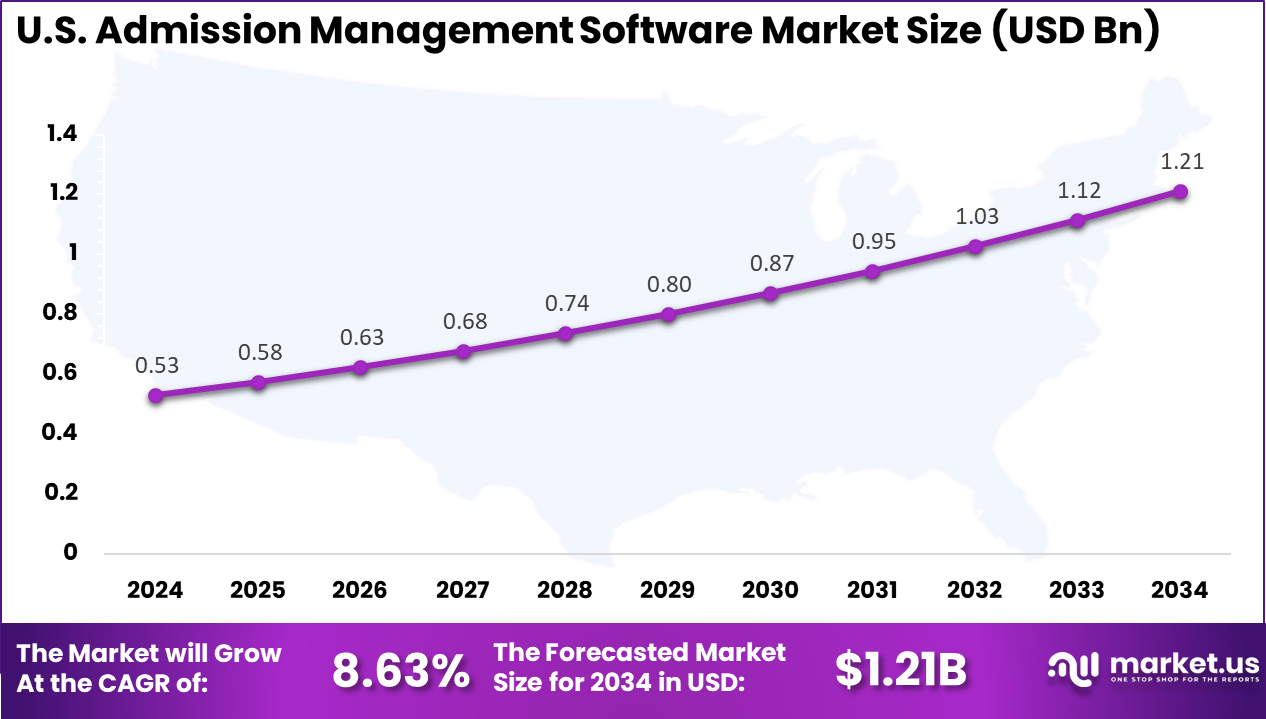

- The U.S. admission management software market reached USD 0.53 billion in 2024 and is expanding at an 8.63% CAGR, supported by digital transformation in education administration.

- North America held over 38.5% share globally, driven by advanced education infrastructure and early adoption of digital admission platforms.

Quick Market Facts

Technological Usage Trends

- AI-driven capabilities are now common, with about 63% of admission management solutions offering features such as applicant ranking, predictive yield analysis, and automated scheduling.

- Around 50% of educators are actively using mobile access, chatbots, and video-based assessments to shorten admission cycles and reduce manual effort.

- Nearly 60% of deployments are delivered through direct sales and digital channels, while premium and highly customized solutions account for roughly 30% of overall demand.

Operational Impact of Usage

- Automated admission platforms have reduced application processing time by up to 50%, improving speed and administrative efficiency.

- Institutions report close to 90% improvement in communication with prospective students through centralized messaging and automated follow-ups.

- Some colleges have recorded up to 60% growth in enrollment and around 30% improvement in student retention through personalized engagement.

- Centralized data management has improved accuracy for admissions and attendance records to over 95%, supporting better reporting and decision-making.

Role of Generative AI

Generative AI changes how schools handle admissions by creating custom letters and checking forms fast. It saves staff hours on repeat tasks and makes replies feel personal for each student. 88% of students use it now for writing help or quick summaries, compared to 53% before. This shift lets teams focus on tough choices instead of basics.

Chatbots run all day to answer questions on dates and rules. Schools see fairer reviews and quicker handling of growing piles of papers. Overall, it brings speed without losing the human touch in key spots. The tech digs into past data to find patterns that guide better picks for programs.

It flags strong matches based on scores and interests early on. This helps cut bias and speed up reviews during busy seasons. Institutions report smoother flows and happier applicants from clear updates. As more join in, training staff stays key to blending AI right. In the end, it turns raw info into smart steps that fit real needs on the ground.

U.S. Market Size

The market for Admission Management Software within the U.S. is growing tremendously and is currently valued at USD 0.53 billion, the market has a projected CAGR of 8.63%. The market is growing due to rising student enrollments that strain manual processes, pushing institutions toward automated platforms for faster application handling.

Cloud adoption accelerates this shift, offering scalability and remote access amid hybrid learning trends. Demand surges from higher education’s need for data analytics to boost retention and compliance with strict privacy rules. Integration with CRM systems further streamlines workflows, drawing large universities into digital solutions.

For instance, in October 2025, Workday, Inc. accelerated U.S. dominance in admission management software as over 650 institutions worldwide, including key North American universities like Centre College and Drake University, adopted Workday Student for AI-powered admissions and enrollment.

In 2024, North America held a dominant market position in the Global Admission Management Software Market, capturing more than a 38.5% share, holding USD 0.58 billion in revenue. This dominance is due to advanced tech infrastructure that supports the quick adoption of digital tools in education.

Universities here face high application volumes, driving demand for automated systems to manage enrollments efficiently. Strong focus on data security and compliance pushes institutions toward cloud platforms. Partnerships between software providers and large schools speed up implementations, while hybrid learning models increase the need for remote access features.

For instance, in August 2025, Ellucian, Inc. reinforced North American leadership by winning EdTech Breakthrough’s Education Administration Solution Provider of the Year for the fourth year, showcasing AI-driven admissions tools like Ellucian Apply that streamline processes and combat fraud.

Component Analysis

In 2024, The Software/Platform segment held a dominant market position, capturing an 82.4% share of the Global Admission Management Software Market. Institutions depend on these tools to manage applications, track documents, and verify details all in one system. This dominance stems from the push to automate routine tasks that once took hours of manual effort.

Schools and colleges find these platforms reliable during peak admission periods when accuracy matters most. The integration with existing systems makes them a natural fit for daily workflows. Staff appreciate how software platforms simplify complex processes like applicant screening and record keeping. Real experiences show fewer errors and faster turnaround times, which build trust in these solutions.

Over time, institutions have shifted away from basic services toward full platforms that offer customization. This trend reflects a practical need for tools that grow with enrollment demands. Updates and support keep these systems current without heavy IT involvement.

For Instance, in October 2025, Oracle Corporation achieved the first 1EdTech certification for its PeopleSoft Campus Solutions student information system. This milestone supports seamless integrations for admission platforms, helping institutions manage applications through robust software tools. The certification ensures future-proof connections during cloud migrations, easing the shift to advanced platforms.

Deployment Mode Analysis

In 2024, the Cloud-Based segment held a dominant market position, capturing a 91.7% share of the Global Admission Management Software Market. Educational setups choose this mode for access from any location, ideal for remote teams or multi-campus operations. Scalability handles sudden surges in applications without buying new servers. Costs stay low since maintenance falls to providers. Security features meet education data standards, giving peace of mind to administrators.

Collaboration improves as teams view live data together, cutting miscommunication during deadlines. Institutions report easier rollouts with cloud setups compared to on-site installs. Automatic backups and updates ensure smooth runs year-round. This preference grows from real needs in fast-paced admissions cycles. Schools value the flexibility that keeps them agile amid changing student flows.

For instance, in August 2025, Ellucian won EdTech Breakthrough’s Education Administration Solution Provider of the Year for the fourth time. The award highlights their cloud platform’s AI and automation across admissions and retention. Cloud delivery enables flexible, personalized experiences for higher education users.

Organization Size Analysis

In 2024, The Large Institutions segment held a dominant market position, capturing a 58.6% share of the Global Admission Management Software Market. They process thousands of applications, needing strong systems for tracking and compliance across departments. Advanced analytics help spot enrollment patterns early, aiding strategic planning. Dedicated IT teams support the full implementation of feature-rich tools. This scale drives demand for robust capabilities beyond basic functions.

Linking software to wider student management systems creates seamless operations from admission to graduation. Large groups handle diverse applicant pools with tools for detailed reviews and reporting. Investments pay off through efficiency gains that smaller peers might overlook. Experiences highlight how these systems manage volume without breakdowns. Growth in complex needs solidifies their market lead.

For Instance, in July 2025, Technolutions hosted Slate Summit 2025, unveiling dashboard widgets and portal enhancements. These features aid large institutions in managing high-volume admissions data. The updates focus on comprehensive CRM for complex enrollment processes in universities.

Application Analysis

In 2024, The Application & Enrollment Management segment held a dominant market position, capturing a 47.3% share of the Global Admission Management Software Market. This area covers submissions to confirmations, forming the core of institutional processes. Automation handles checks and notifications, freeing staff for higher-value tasks. Real-time updates boost applicant satisfaction with clear status tracking. Insights into pools help meet enrollment goals effectively.

Demand rises as schools focus on user-friendly online forms and quick decisions. Tools balance targets by analyzing applicant data swiftly. Institutions gain from streamlined cycles that reduce drop-offs. Practical use shows direct improvements in completion rates. This focus remains key as competition for students intensifies across education levels.

For Instance, in May 2025, Ellucian released its 2025 Product Innovation Update with an AI-driven registration redesign. Mobile-friendly enrollment from any device reduces errors in application management. Advisors can now handle registrations directly, speeding up the process for institutions.

End-User Analysis

In 2024, The Higher Education segment held a dominant market position, capturing a 68.9% share of the Global Admission Management Software Market. Universities compete fiercely for talent, relying on software for precise handling of varied applications. Automated scoring and eligibility checks match their rigorous standards.

Integration with research and finance systems extends value beyond admissions. High volumes push toward digital fairness and speed. Features evolve to support merit-based selections and diverse criteria. Data-heavy tools provide edges in forecasting and personalization. Institutions shape market offerings through their advanced requirements.

For Instance, in November 2025, Ellucian launched the Connect Program to deepen higher education engagement. The initiative integrates tools for recruitment and alumni relations tailored to universities. It supports end-to-end student success in competitive higher ed landscapes.

Emerging Trends

In the admission management software market, a notable trend is the increasing integration of cloud-based platforms that allow educational institutions to process applications, manage enrolments, and communicate with applicants through scalable, internet-accessible systems.

These cloud solutions reduce dependency on local servers and enable access from multiple locations, supporting distributed administrative teams and remote operations. This shift enhances institutional agility and improves delivery of admission processes. Another emerging trend is the use of automation and workflow optimisation within admission software.

Automated features manage tasks such as application sorting, eligibility screening, document verification reminders, and status notifications. This automation reduces manual effort, accelerates decision timelines, and supports consistent handling of high volumes of applications, particularly in institutions with large applicant pools.

Growth Factors

A key growth factor in the admission management software market is the increasing volume of student applications driven by globalisation of education. Institutions are accepting applicants from diverse geographic regions, which increases complexity in handling varying academic records, documentation types, and regulatory requirements.

Software solutions that provide structured workflows and centralised data support efficient processing and help institutions scale operations without proportionately increasing administrative staff. Another important growth factor is the demand for enhanced applicant experience and communication.

Prospective students expect timely updates, clear guidance, and easy access to application portals. Admission management software that offers personalised dashboards, automated notifications, and self-service features improves transparency and reduces the administrative burden associated with answering routine inquiries.

Key Market Segments

By Component

- Software/Platform

- Services

By Deployment Mode

- Cloud-based

- On-premises

By Organization Size

- Large Institutions

- Small and Medium-sized Institutions

By Application

- Application & Enrollment Management

- Document & Fee Management

- Student Communication & CRM

- Reporting & Analytics

By End-User

- Higher Education (Universities, Colleges)

- K-12 Schools

- Corporate Training & Certification Bodies

Driver

A principal driver of the admission management software market is the need for accurate and centralised data management. Institutions handle large volumes of sensitive applicant data, including academic records, identity documents, and communication logs. Centralised software platforms reduce errors, improve data integrity, and provide a single source of truth for all stakeholders involved in admission decisions.

Another driver is the focus on operational efficiency and cost reduction. Manual admission processes require significant human resources, are prone to inconsistencies, and prolong review cycles. Software that automates repetitive tasks, enforces standardised procedures, and supports real-time tracking of application progress helps institutions reduce processing time and administrative costs.

Restraint

A significant restraint in this market is the variation in technology adoption rates among educational institutions. Many smaller schools or community-based academies may rely on traditional paper-based methods or basic digital tools due to cost concerns or limited technical expertise. This uneven adoption slows overall market growth and highlights the challenge of delivering solutions that fit diverse institutional capacities.

Another restraint arises from privacy and compliance challenges related to student data. Admission systems collect personal, academic, and sometimes financial information, which must be protected under data protection regulations. Ensuring that software platforms meet regional privacy laws and secure sensitive information adds complexity to implementation and ongoing maintenance.

Opportunity

A clear opportunity exists in the development of mobile-friendly and applicant-centric interfaces that support on-the-go access for prospective students. As applicants increasingly use smartphones and tablets, solutions that offer responsive portals, mobile notifications, and simple uploading of documents can enhance convenience and encourage timely application completion.

Another opportunity lies in the integration of advanced analytics and predictive tools that support admission strategy. Analytics can help institutions identify trends in applicant demographics, yield rates, and funnel performance, enabling more targeted outreach and forecasting. Such insights improve planning and help institutions optimise recruitment and retention strategies.

Challenge

One of the main challenges for the admission management software market is ensuring seamless integration with existing campus systems such as student information systems, financial aid platforms, and learning management systems. Disparate systems can create data silos and operational friction if not properly coordinated, which can detract from overall institutional efficiency.

Another challenge involves maintaining accessibility and inclusiveness for diverse applicant populations. Admission software must support students with varying levels of digital literacy and offer multilingual interfaces where appropriate. Ensuring equitable access while maintaining security and process integrity requires thoughtful design and ongoing refinement.

Key Players Analysis

Ellucian, Workday, Oracle, SAP, and Unit4 lead the admission management software market with enterprise platforms that support applicant tracking, enrollment workflows, and data driven decision making. Their solutions are widely used by universities and large education systems to manage high application volumes. These companies focus on scalability, compliance, and integration with student information systems. Rising digitalization of higher education admissions continues to reinforce their leadership.

TargetX, Technolutions, Campus Management, Jenzabar, Tribal Group, Liaison International, and Hyland strengthen the market with CRM based admissions, recruitment automation, and document management tools. Their platforms help institutions improve applicant engagement, streamline reviews, and increase conversion rates. These providers emphasize usability, configurable workflows, and analytics.

Symplicity, CollegeNET, OpenApply, and other players expand the landscape with flexible and cost effective admission management systems. Their offerings target private institutions, international schools, and smaller colleges. These companies focus on faster deployment, cloud delivery, and applicant friendly interfaces. Increasing demand for transparent, digital first admissions processes continues to drive steady growth in the admission management software market.

Top Key Players in the Market

- Ellucian, Inc.

- Workday, Inc.

- Oracle Corporation

- TargetX

- Technolutions, Inc.

- Campus Management Corp.

- Jenzabar, Inc.

- Tribal Group plc

- Hyland Software, Inc.

- Unit4

- SAP SE

- Liaison International, Inc.

- Symplicity, Inc.

- CollegeNET, Inc.

- OpenApply

- Others

Recent Developments

- In August 2025, Ellucian, Inc. won EdTech Breakthrough’s Education Administration Solution Provider of the Year award for the fourth straight time. Their CRM tools now unify student data for better admissions outreach and tracking. Schools use these to spot at-risk applicants early and send tailored follow-ups. This keeps enrollment pipelines strong amid tough competition. Real-world results show faster decisions and higher yields.

- In September 2025, Workday, Inc. rolled out Workday Student at Columbus State, starting with Autumn 2026 applications. New applicants fill forms directly in the system, cutting steps and errors. This unifies data from apply to enroll, giving advisors real-time views. Staff save hours on manual checks, focusing on support instead. Early feedback points to smoother onboarding for everyone involved.

Report Scope

Report Features Description Market Value (2024) USD 1.5 Bn Forecast Revenue (2034) USD 4.01 Bn CAGR(2025-2034) 10.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software/Platform, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Institutions, Small and Medium-sized Institutions), By Application (Application & Enrollment Management, Document & Fee Management, Student Communication & CRM, Reporting & Analytics), By End-User (Higher Education (Universities, Colleges), K-12 Schools, Corporate Training & Certification Bodies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Ellucian, Inc., Workday, Inc., Oracle Corporation, TargetX, Technolutions, Inc., Campus Management Corp., Jenzabar, Inc., Tribal Group plc, Hyland Software, Inc., Unit4, SAP SE, Liaison International, Inc., Symplicity, Inc., CollegeNET, Inc., OpenApply, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Admission Management Software MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Admission Management Software MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ellucian, Inc.

- Workday, Inc.

- Oracle Corporation

- TargetX

- Technolutions, Inc.

- Campus Management Corp.

- Jenzabar, Inc.

- Tribal Group plc

- Hyland Software, Inc.

- Unit4

- SAP SE

- Liaison International, Inc.

- Symplicity, Inc.

- CollegeNET, Inc.

- OpenApply

- Others