Global Active Toughening Agent for Epoxy Resin Market By Product Type(Rubbery Elastomer Toughening Agent, Thermoplastic Resin Toughening Agent, Hyper-Branched Polymer, Core-Shell Latex Polymer, Others), By Application(Coatings, Adhesives, Composite Materials, Others), By End-use(Building and Construction, Automotive and Transportation, Electrical and Electronics, Marine, Others), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024–2033

- Published date: April 2024

- Report ID: 19556

- Number of Pages: 339

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

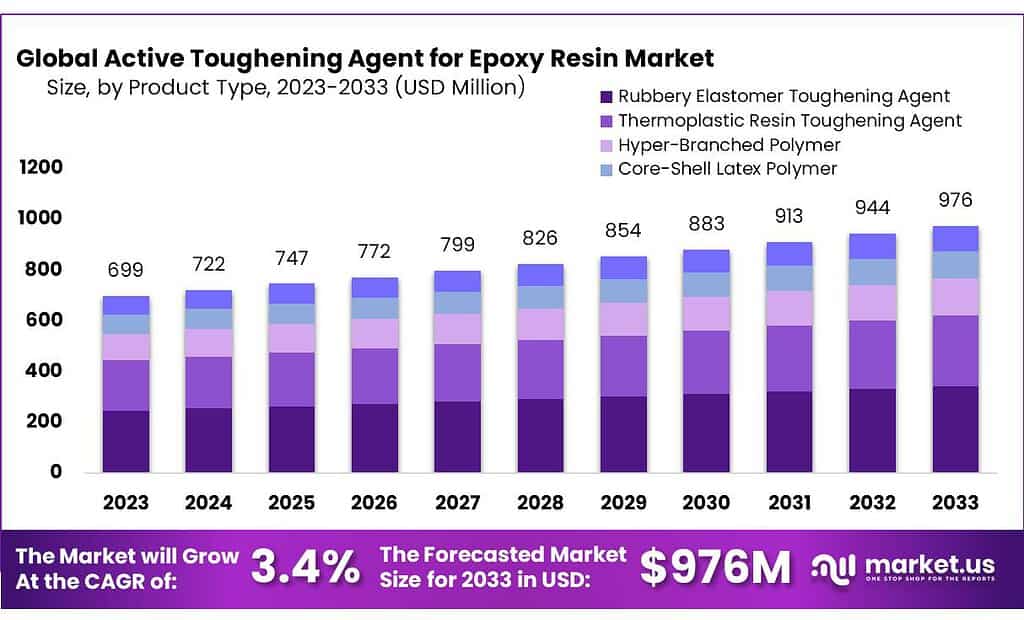

The global Active Toughening Agent for Epoxy Resin Market size is expected to be worth around USD 976 Million by 2033, from USD 699 Million in 2023, growing at a CAGR of 3.4% during the forecast period from 2023 to 2033.

In the context of the epoxy resin market, an active toughening agent refers to a substance or compound added to epoxy resins to enhance their toughness or impact resistance. Epoxy resins, while known for their excellent adhesive and mechanical properties, can sometimes exhibit brittleness or susceptibility to cracking under certain conditions, especially when subjected to impact or stress.

Active toughening agents work by dispersing within the epoxy resin matrix and modifying its molecular structure to improve its resistance to cracking and impact. These agents may include elastomers, such as rubber particles or thermoplastic polymers, which act as energy absorbers and prevent crack propagation within the resin matrix.

By incorporating active toughening agents into epoxy resin formulations, manufacturers can produce composite materials with enhanced mechanical properties, including increased flexibility, toughness, and resistance to fracture. This is particularly beneficial in applications where the epoxy resin is subjected to dynamic loading or harsh environmental conditions, such as in aerospace, automotive, construction, and marine industries.

Key Takeaways

- Market Growth: Expected USD 976 million value by 2033, with a 3.4% CAGR from 2023.

- Dominant Product: Rubbery Elastomer Toughening Agents held a 34.5% market share in 2023.

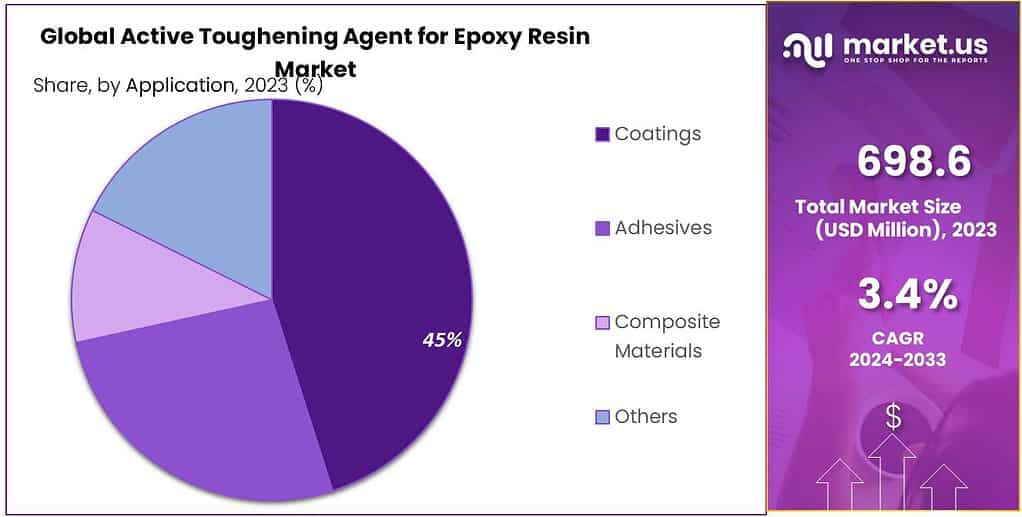

- Leading Application: The coatings segment captured over 46.4% market share in 2024.

- Primary Industry: Building & Construction sector dominated with over 47.4% market share in 2024.

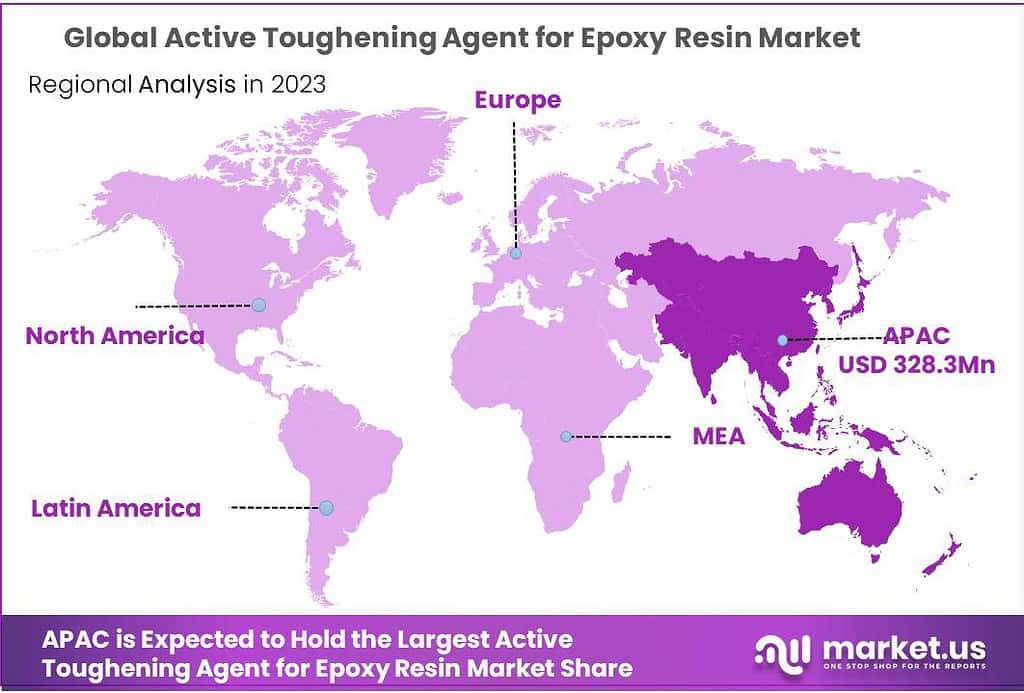

- Regional Analysis: Asia Pacific has 47% leads, with North America and Europe significant markets driven by industry demand.

- The addition of 5-10 wt% of CTBN rubber can increase the fracture toughness of epoxy resins by up to 200%.

By Product Type

In 2023, Rubbery Elastomer Toughening Agent held a dominant market position, capturing more than a 34.5% share. These toughening agents, composed of rubbery materials, are widely preferred for their ability to improve the flexibility and impact resistance of epoxy resin formulations. They act as energy absorbers, preventing crack propagation and enhancing the durability of epoxy-based materials in various applications.

Thermoplastic Resin Toughening Agent emerged as another significant segment in the market, driven by their effectiveness in enhancing the toughness and fracture resistance of epoxy resins. These agents, consisting of thermoplastic polymers, disperse within the epoxy matrix to reinforce its mechanical properties, making them suitable for demanding applications requiring high-performance materials.

Hyper-Branched Polymer toughening agents gained traction in the market due to their unique molecular structure, which allows for efficient dispersion within epoxy resin formulations. These polymers improve the toughness and flexibility of epoxy-based materials, contributing to their increased adoption in industries such as aerospace, automotive, and electronics.

Core-Shell Latex Polymer toughening agents also witnessed growth in demand, offering enhanced compatibility with epoxy resins and improved impact resistance. These agents feature a core-shell structure, with the core composed of rubbery materials and the shell providing compatibility with the epoxy matrix, resulting in superior toughening effects and mechanical properties.

By Application

In 2024, Coatings held a dominant market position, capturing more than a 46.4% share. These toughening agents are extensively used in coatings to enhance durability, scratch resistance, and adhesion to substrates, making them ideal for protective coatings in industries such as automotive, construction, and marine.

Adhesives emerged as another significant application segment in the market, driven by the need for strong and resilient bonding solutions in various industries. Toughening agents play a crucial role in improving the toughness and impact resistance of epoxy adhesives, ensuring reliable performance in demanding applications.

Composite Materials witnessed growing demand for toughening agents, especially in the manufacturing of high-performance composite structures for aerospace, automotive, and sporting goods industries. These agents enhance the mechanical properties of composite materials, including strength, stiffness, and impact resistance, resulting in lightweight yet durable end products.

Overall, the segmental analysis of the active toughening agent market for epoxy resins underscores the diverse range of applications where these additives play a critical role in enhancing performance and durability. As industries continue to demand high-performance materials for a wide range of applications, the market for active toughening agents is expected to witness steady growth, driven by ongoing innovations and advancements in epoxy resin formulations.

By End-use

In 2024, Building & Construction held a dominant market position, capturing more than a 47.4% share. These toughening agents are extensively used in construction materials such as concrete, flooring, and structural adhesives to improve strength, durability, and resistance to environmental factors, contributing to the longevity of infrastructure projects.

Automotive & Transportation emerged as another significant end-use segment in the market, driven by the demand for lightweight yet robust materials in vehicle manufacturing. Toughening agents enhance the impact resistance and structural integrity of epoxy-based composites used in automotive components, contributing to fuel efficiency and vehicle performance.

Electrical & Electronics witnessed a growing demand for toughening agents, particularly in the production of insulating materials, circuit boards, and electronic encapsulants. These agents improve the mechanical and thermal properties of epoxy resins, ensuring reliable performance and longevity in demanding electrical applications.

Marine applications also utilize toughening agents to enhance the durability and corrosion resistance of epoxy coatings, adhesives, and composites used in boat construction and marine infrastructure. These agents protect harsh marine environments, including saltwater, UV radiation, and abrasion, extending the lifespan of marine structures and vessels.

Overall, the segmental analysis of the active toughening agent market for epoxy resins highlights the diverse range of end-use applications where these additives play a crucial role in enhancing performance and durability. As industries continue to prioritize lightweight, strong, and resilient materials, the demand for active toughening agents in epoxy resin formulations is expected to witness sustained growth, driven by ongoing innovations and advancements in manufacturing processes.

Key Market Segments

By Product Type

- Rubbery Elastomer Toughening Agent

- Thermoplastic Resin Toughening Agent

- Hyper-Branched Polymer

- Core-Shell Latex Polymer

- Others

By Application

- Coatings

- Adhesives

- Composite Materials

- Others

By End-use

- Building & Construction

- Automotive & Transportation

- Electrical & Electronics

- Marine

- Others

Drivers

Major Driver for Active Toughening Agent for Epoxy Resin Market: Increasing Demand for High-Performance Materials

The escalating demand for high-performance materials across various industries stands as a major driver propelling the growth of the active toughening agent market for epoxy resins. As industries continue to evolve and innovate, there is a growing need for materials that offer enhanced strength, durability, and reliability to meet the demands of modern applications.

One of the primary drivers fueling this demand is the automotive sector, where lightweight yet robust materials are essential for improving fuel efficiency, reducing emissions, and enhancing vehicle performance. Active toughening agents play a crucial role in reinforcing epoxy-based composites used in automotive components such as body panels, chassis, and structural reinforcements. These agents enhance impact resistance, fatigue life, and overall structural integrity, contributing to safer and more fuel-efficient vehicles.

Moreover, the construction industry is experiencing rapid growth, driven by urbanization, infrastructure development, and increasing investments in sustainable building practices. Active toughening agents are utilized in construction materials such as concrete, flooring, and adhesives to improve strength, durability, and resistance to environmental factors. As construction projects become more complex and demanding, the demand for high-performance epoxy resins reinforced with toughening agents is expected to rise significantly.

Furthermore, the aerospace and defense sectors require materials that can withstand extreme conditions, including high temperatures, vibrations, and mechanical stresses. Active toughening agents enhance the toughness and fracture resistance of epoxy-based composites used in aircraft components, missile casings, and military vehicles, ensuring reliable performance in challenging environments.

Additionally, the electronics industry relies on epoxy resins for encapsulating and protecting sensitive electronic components from moisture, heat, and mechanical shock. Active toughening agents improve the mechanical properties and reliability of epoxy-based encapsulants and coatings, safeguarding electronic devices and extending their lifespan.

Moreover, emerging applications in renewable energy, such as wind turbine blades and solar panels, require materials capable of withstanding harsh environmental conditions and prolonged exposure to UV radiation. Active toughening agents enhance the durability and fatigue resistance of epoxy resins used in renewable energy applications, contributing to the reliability and longevity of renewable energy infrastructure.

Restraints

Major Restraint for Active Toughening Agent for Epoxy Resin Market: Environmental and Health Concerns

One of the significant restraints facing the active toughening agent market for epoxy resins is the growing awareness and concern regarding environmental and health implications associated with certain additives and chemicals used in these products. As sustainability and health-consciousness become increasingly prominent in consumer and regulatory landscapes, manufacturers and end-users alike are facing pressure to prioritize eco-friendly and safe alternatives.

One key concern revolves around the use of certain chemicals and additives in active toughening agents that may pose risks to human health and the environment. Some toughening agents may contain volatile organic compounds (VOCs), hazardous solvents, or toxic substances that can potentially leach into the environment during production, use, or disposal. These chemicals may contribute to air and water pollution, pose risks to workers’ health during manufacturing processes, and raise concerns about long-term exposure effects on consumers and communities.

Furthermore, there are growing concerns about the environmental impact of epoxy resin-based materials, including their end-of-life disposal and recycling challenges. While epoxy resins offer exceptional performance and durability, their non-biodegradable nature and complex chemical compositions pose challenges for sustainable waste management and recycling efforts. Active toughening agents, as integral components of epoxy resin formulations, may further complicate recycling processes and increase the environmental footprint of epoxy-based materials.

Moreover, regulatory scrutiny and stringent environmental standards impose constraints on the use of certain chemicals and additives in epoxy resin formulations, including active toughening agents. Regulatory compliance requirements, such as restrictions on hazardous substances and emissions limits, may necessitate reformulation or substitution of certain additives to ensure compliance and market acceptance.

Additionally, the complexity and variability of environmental regulations across different regions and markets further complicate the development and commercialization of active toughening agents for epoxy resins. Manufacturers must navigate a complex regulatory landscape, ensuring compliance with diverse requirements while balancing performance, cost, and market demand considerations.

Opportunities

Major Opportunity for Active Toughening Agent for Epoxy Resin Market: Innovation and Product Development

One of the significant opportunities in the active toughening agent market for epoxy resins lies in innovation and product development. As industries continue to evolve and demand high-performance materials for a wide range of applications, there is a growing need for advanced toughening agents that offer enhanced properties, versatility, and sustainability.

Innovation in toughening agent technology presents an opportunity to develop new formulations that address emerging challenges and meet evolving market demands. Research and development efforts focused on optimizing the molecular structure, composition, and performance characteristics of toughening agents can lead to the development of next-generation additives with superior properties, such as increased toughness, impact resistance, and compatibility with epoxy resins.

Furthermore, there is an opportunity to explore novel materials and additives for toughening epoxy resins, including bio-based, renewable, and environmentally friendly alternatives. Sustainable sourcing and production methods, along with the use of bio-derived or recycled materials, can reduce the environmental footprint of toughening agents and epoxy resin-based materials while meeting performance requirements and market expectations.

Moreover, the customization and tailoring of toughening agents to specific applications and end-use requirements present opportunities for niche market segments and specialized applications. By understanding the unique performance needs of different industries, such as automotive, aerospace, electronics, and renewable energy, manufacturers can develop tailored solutions that offer optimal performance and value to customers.

Additionally, advancements in manufacturing processes, such as nanotechnology and additive manufacturing, enable the production of toughening agents with precisely controlled properties and microstructures. These advanced manufacturing techniques offer opportunities to develop toughening agents with enhanced dispersion, compatibility, and performance characteristics, unlocking new possibilities for improving the performance and durability of epoxy resin-based materials.

Furthermore, the growing demand for sustainable and environmentally friendly materials presents opportunities for active toughening agents that contribute to the circular economy and support the transition to a more sustainable future. By developing toughening agents from renewable or recycled sources and implementing eco-friendly production processes, manufacturers can capitalize on market trends and meet the sustainability preferences of customers and regulators.

Trends

Major Trend in Active Toughening Agent for the Epoxy Resin Market: Increasing Emphasis on Sustainable Solutions

One of the major trends shaping the active toughening agent market for epoxy resins is the increasing emphasis on sustainable solutions. As environmental concerns and regulatory pressures continue to intensify, industries are seeking alternatives that minimize environmental impact and promote sustainability throughout the product lifecycle.

A key aspect of this trend is the growing demand for bio-based and renewable toughening agents derived from natural sources such as plant oils, lignin, and bio-based polymers. These sustainable alternatives offer advantages such as reduced carbon footprint, biodegradability, and compatibility with eco-friendly manufacturing processes, aligning with the principles of the circular economy and sustainable development.

Moreover, there is a rising interest in recycling and upcycling toughening agents and epoxy resin-based materials to minimize waste and resource consumption. Strategies such as closed-loop recycling, material reclamation, and waste valorization enable the recovery and reuse of valuable components from end-of-life products, contributing to resource efficiency and waste reduction.

Additionally, the adoption of eco-friendly production processes and green chemistry principles is becoming increasingly prevalent in the development and manufacturing of toughening agents. Technologies such as solvent-free processing, water-based formulations, and energy-efficient manufacturing methods help reduce environmental emissions, waste generation, and energy consumption, supporting sustainable production practices.

Furthermore, there is a growing focus on product transparency and lifecycle assessments to evaluate the environmental footprint of toughening agents and epoxy resin-based materials. Life cycle assessment (LCA) methodologies provide insights into the environmental impacts of products from raw material extraction to end-of-life disposal, enabling informed decision-making and sustainable product design.

Moreover, regulatory initiatives and voluntary certifications related to sustainability, such as eco-labeling and green certifications, are driving industry efforts to adopt sustainable practices and materials. Compliance with environmental regulations and adherence to sustainability standards are increasingly becoming prerequisites for market acceptance and competitive advantage in the active toughening agent market for epoxy resins.

Regional Analysis

The Asia Pacific region is poised to lead the global active toughening agent market for epoxy resins, capturing a significant share of 47%. This growth is driven by the rising demand for high-performance materials in critical sectors such as automotive, electronics, and renewable energy. Substantial investments in research and development projects in countries like China, India, and various Southeast Asian nations are expected to fuel market expansion across the region, supported by the region’s thriving industrial activities and focus on sustainability.

In North America, economic progress and the expansion of industries requiring durable and eco-friendly materials, such as automotive and construction, are projected to drive demand for active toughening agents for epoxy resins. The region’s commitment to renewable energy targets and environmental conservation efforts further boosts this demand, positioning North America as a significant market for these additives.

Europe is also anticipated to witness significant growth in the active toughening agent market for epoxy resins. This growth is fueled by the transition towards sustainable energy sources and increasing demand from industries such as automotive, electronics, and construction. The European market’s emphasis on energy efficiency, sustainability, and environmental responsibility underscores the growing adoption of active toughening agents for epoxy resins in the region.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

The active toughening agent market for epoxy resin is characterized by a diverse array of manufacturers, suppliers, and distributors vying for market share across various regions and segments. Conducting a thorough market share analysis provides valuable insights into the competitive landscape, key players, and market trends shaping the industry.

Key Market Players

- Huntsman International LLC.

- China Petroleum & Chemical Corporation (Sinopec)

- BASF SE

- Solvay S.A.

- Olin Corporation

- Wacker Chemie AG

- Jiangsu Sanmu Group Co. Ltd.

- Dow Chemical Company Ltd.

- CVC Thermoset Specialties Inc.

- Gabriel

- Kukdo Chemical Co. Ltd.

- Hexion Inc.

Recent Developments

In 2024, Huntsman International LLC expanded its product portfolio with the launch of environmentally friendly toughening agents that are bio-based and sustainable, aligning with growing market demand for eco-friendly materials.

Report Scope

Report Features Description Market Value (2023) USD 699 Mn Forecast Revenue (2033) USD 976 Mn CAGR (2024-2033) 3.4% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type(Rubbery Elastomer Toughening Agent, Thermoplastic Resin Toughening Agent, Hyper-Branched Polymer, Core-Shell Latex Polymer, Others), By Application(Coatings, Adhesives, Composite Materials, Others), By End-use(Building and Construction, Automotive and Transportation, Electrical and Electronics, Marine, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Huntsman International LLC., China Petroleum & Chemical Corporation (Sinopec), BASF SE, Solvay S.A., Olin Corporation, Wacker Chemie AG, Jiangsu Sanmu Group Co. Ltd., Dow Chemical Company Ltd., CVC Thermoset Specialties Inc., Gabriel, Kukdo Chemical Co. Ltd., Hexion Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Active Toughening Agent for Epoxy Resin Market?Active Toughening Agent for Epoxy Resin Market size is expected to be worth around USD 976 Million by 2033, from USD 699 Million in 2023, growing at a CAGR of 3.4%

What CAGR is projected for the Active Toughening Agent for Epoxy Resin Market?The Active Toughening Agent for Epoxy Resin Market is expected to grow at 3.4% CAGR (2024-2033).Name the major industry players in the Active Toughening Agent for Epoxy Resin Market?Huntsman International LLC., China Petroleum & Chemical Corporation (Sinopec), BASF SE, Solvay S.A., Olin Corporation, Wacker Chemie AG, Jiangsu Sanmu Group Co. Ltd., Dow Chemical Company Ltd., CVC Thermoset Specialties Inc., Gabriel, Kukdo Chemical Co. Ltd., Hexion Inc.

Active Toughening Agent for Epoxy Resin MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

Active Toughening Agent for Epoxy Resin MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Huntsman International LLC.

- China Petroleum & Chemical Corporation (Sinopec)

- BASF SE

- Solvay S.A.

- Olin Corporation

- Wacker Chemie AG

- Jiangsu Sanmu Group Co. Ltd.

- Dow Chemical Company Ltd.

- CVC Thermoset Specialties Inc.

- Gabriel

- Kukdo Chemical Co. Ltd.

- Hexion Inc.