Global A2 Milk Market Product Form(Liquid, Powder), By Application(Infant Formula, Dairy Product, Bakery and Confectionery, Other Applications), Distribution Channel(B2B, B2C, Supermarkets/Hypermarkets, Grocery Stores, Convenience Stores, Specialty Stores, Online Retailing), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Aug 2024

- Report ID: 116805

- Number of Pages: 365

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

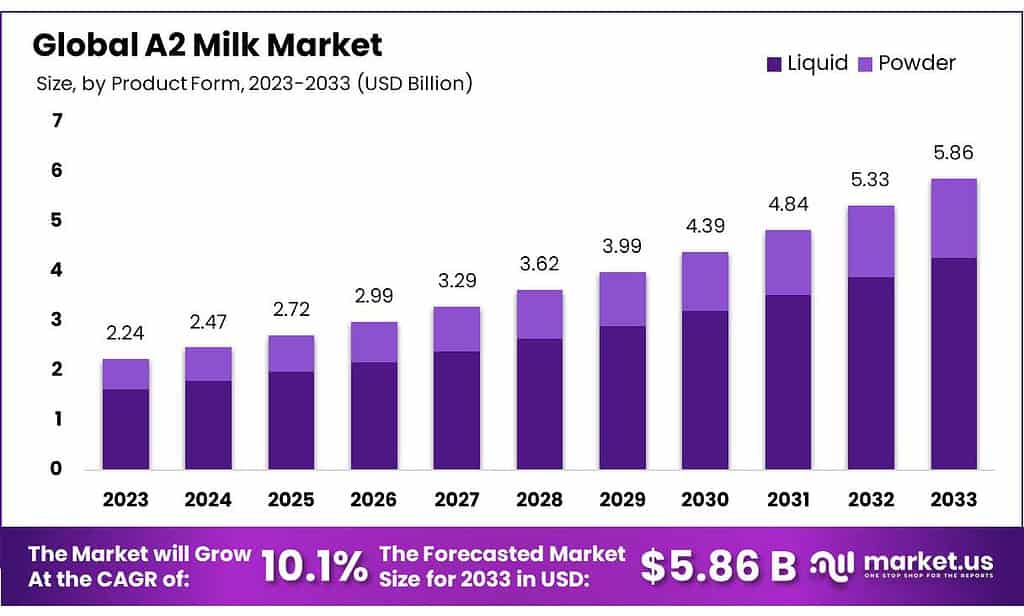

The Global A2 Milk Market size is expected to be worth around USD 5.9 billion by 2033 from USD 2.24 billion in 2023, growing at a CAGR of 10.10% during the forecast period 2024 to 2033.

A2 milk is the milk that contains only A2 β-casein proteins, unlike regular milk which contains A1 and A2 proteins. It is a bovine milk mainly obtained from certain breeds of cows and buffalos such as Jersey, Gir, Guernsey, Charolais, Hallikar, Sahiwal, Murrah, and others. These breeds of cows and buffalos belong to different parts of the globe and contain A2 milk proteins, predominantly.

A2 protein is easier to digest compared to A1 which makes it a popular choice among consumers who are sensitive to lactose According to the 2022 report published by the National Institute of Health (NIH), A2 milk consumption is associated with easy digestibility, hunger, and wholesome nutrition. The report also urges the dairy industry to protect this genotype of milk for healthy milk consumption.

A2 milk is enriched with calcium, A2 beta-casein proteins, and several vitamins that have immense health benefits. The product is also available in different fat concentrations, which attracts customers who are conscious about their health & well-being.

These consumers are also willing to pay higher prices compared to regular milk, to buy A2 milk and its other derivatives. This milk is widely used in various sports nutrition formulae as a quickly digestible & nutrition-rich base. The growing consumption of A2 cow milk as a healthier alternative to regular milk is thus expected to drive the global A2 milk market during the projection period.

Key Takeaways

- In 2023, the global A2 milk market generated a revenue of USD 24 billion, with a CAGR of 10.10%, and is expected to reach USD 5.9 billion by the year 2033.

- The product form segment held a major share of the market, with the liquid segment taking the lead in 2023 with a market share of 8% owing to the traditional use of milk as a cold & hot beverage.

- By application, the infant formula segment accounted for a significant share of 5% as A2 milk provides complete nutrition to infants who are unable to avail the breast milk from their mothers.

- By distribution channel, the B2C segment among the other sub-segments held a significant share of the market with 5% of the global A2 milk market.

- The Asia Pacific region led the market by securing a market share of8% in 2023 as the Asia Pacific contains a majority of cattle breeds that give complete A2 milk.

- A2 milk does not contain A1 β-casein protein which often causes digestive discomfort, milk allergies, or lactose intolerance in some individuals.

- The presence of A2 beta-casein protein in the milk reduces gut inflammation and is found in the milk of mammals such as sheep, goats, cows, and even human milk.

- A2 milk is known to lower autism syndrome in children by promoting better cognitive health.

By Product Form Analysis

Based on product form, the market is categorized into liquid and powder segments. The liquid segment held the largest share of the market in 2023, claiming a market share of 72.8% owing to its convenience. This is also attributed to the increasing demand for ready-to-drink beverages.

The growing popularity of milkshakes, milk-based drinks, and other specialty beverages having a base formula of A2 milk is gaining market traction. For everyday consumption, the liquid form of milk is widely available in local stores. Furthermore, the rising trend of making homemade milk products such as smoothies, protein shakes, and other healthy recipes with A2 milk as a main ingredient is expected to drive this segment.

The powder segment is projected to grow at a significant rate during the forecast period owing to the rising applications of A2 milk powder in a variety of food preparations. A2 milk powder is increasingly being adopted in pediatric nutrition formulations owing to its ease of digestibility. The powdered form of A2 milk takes comparatively smaller space for storage and has a long shelf life.

It can be imparted in various bakery items, confectionery, sauces, salad dressings, curries, and soups to give them a creamy texture. Moreover, the manufacturers of A2 milk have widened the scope for product innovation by using A2 milk powder in several experimental formulations, which is projected to drive this segment during the projection period.

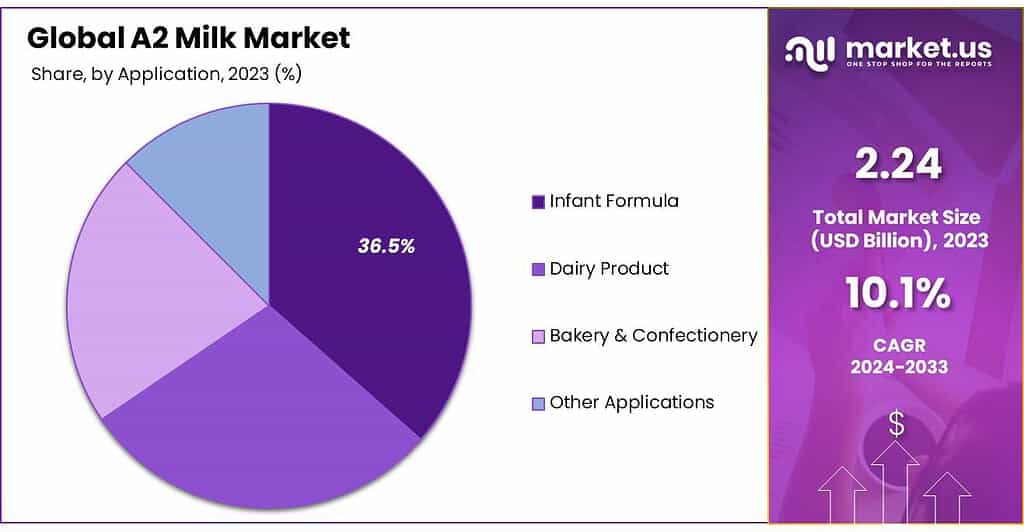

By Application Analysis

Based on the application segment, the market is divided into infant formula, dairy products, bakery & confectionery, and other applications. Among these, the infant formula segment held a significant market share of 36.5%, due to the rising demand for premium infant formula, worldwide. Infants are fed with formulae to fulfill their nutritional requirements. It is mostly used by mothers who are unable to feed their children due to insufficient supply of milk, certain medical conditions, and in cases of surrogacy. Mothers and parents who have adopted children but cannot lactate naturally are also recommended the infant formula food.

Additionally, healthcare professionals advise A2 milk-based formulae for infants who have a genetic history of lactose intolerance, which is projected to drive the segment in the years to come. For instance, according to a 2023 NIH report, in a controlled study conducted on infants, A2 GUM was seamlessly digested as traditional milk by healthy toddlers having good digestive health. This has helped key players in the market gain regulatory approval for manufacturing infant formula. For instance, on November 02, 2022, The A2 Milk Company acquired discretion approval from the FDA for supplying instant formula to the US.

By Distribution Channel Analysis

The global A2 milk market is segmented based on distribution channels into B2B, B2C, supermarkets/ hypermarkets, grocery stores, convenience stores, specialty stores, and online retailing. The B2C segment had a tremendous growth rate, with a share of 68.5% owing to the rapid expansion of e-commerce industries worldwide.

The rapid expansion of e-commerce giants such as Amazon, Thrive Market, Alibaba, and others has massively gained consumer trust over time. These websites follow customer-centric business models by providing customized product suggestions, attractive discounts, home delivery options, and a range of payment methods.

The increasing influence of social media channels helps these B2C channels maintain a direct-to-consumer approach in sales. The growing consumer interest in online grocery shopping is expected to drive this segment during the forecast period.

Key Market Segments

Product Form

- Liquid

- Powder

Application

- Infant Formula

- Dairy Product

- Bakery & Confectionery

- Other Applications

Distribution Channel

- B2B

- B2C

- Supermarkets/Hypermarkets

- Grocery Stores

- Convenience Stores

- Specialty Stores

- Online Retailing

Drivers

The increasing prevalence of lactose intolerance and dairy allergies drives the market.

Lactose intolerance is associated with the inability to digest milk proteins or sensitivity to A1 milk proteins. This inability leads one to allergic reactions such as nausea & vomiting, diarrhea, abdominal bloating, and pain. For instance, according to 2017 and 2023 reports published by the National Institute for Health (NIH), lactose intolerance is caused due to lactose malabsorption, and about 36% of the world population is dealing with it.

As A2milk protein is simpler to digest, it can still be consumed in moderation by the lactose-sensitive consumer. The rising awareness regarding lactose intolerance among milk consumers is expected to bolster the A2 milk market worldwide.

The growing awareness regarding A2 milk’s health benefits is projected to boost the market.

A2 milk contains anti-inflammatory properties that improve gut health by inducing good gut bacteria. It is rich in vitamins A & D and minerals that take care of overall eye, skin, hair, and bone health. The milk is also known to promote better cognitive abilities among children with autism.

As It is available in 1%, 2%, skimmed, and whole milk varieties it is mainly consumed by fitness-conscious consumers and sports players. For instance, according to the 2022 NIH report, A2 milk provides an ultimate source of nutrition for pre-workout and post-workout energy boosts among athletes. The increasing popularity of A2 milk for improving overall health and effective sports nutrition is expected to drive the market.

Restraints

High production costs of A2 milk restrain the market.

A2 milk is manufactured by segregating A1 β-casein proteins from regular milk. The milk is produced from selected cow & buffalo breeds. Manufacturers, thus have to farm those cattle by importing them from around the world. They also have to perform selective breeding and identify the A2 protein percentage in individual cows. Manufacturers have to invest a significant amount of funds in feeding high-quality organic feed and creating a healthy habitat for these animals. Compared to regular milk, A2 milk is not obtained in abundance.

This along with the additional costly processes of milk protein separation, meeting quality standards, and packaging impacts the end product costs. This is likely to prevent cost-sensitive customers from buying the product. It makes customers seek cheaper alternatives to A2 milk, such as regular non-dairy milk products, or stick to regular milk. Ultimately, this gives manufacturers a limited consumer base which in turn is likely to hamper the market.

Opportunities

Diversifying the A2 milk derivatives and other milk product offerings is projected to create lucrative opportunities for the market.

The players in the market are investing in research studies on A2 milk to find its newer applications. This is expected to help them diversify their product portfolios, thereby offering a range of A2 derivatives. Products such as A2 frozen yogurts, smoothies, milkshakes, and ice creams are popular among health-conscious consumers as quick snacks. These products are expected to continue to generate high revenue for the market if also made available in fruit blends.

A2 cheese and butter are among the products that reap the highest profits for the manufacturers as they are consumed daily. They can be blended with different spices, and herbs and made into different forms such as powder, slices, and spreads to attract a newer consumer base. Other products such as fresh cream, desserts, and milk powders, can be introduced with variations based on a fat percentage which is projected to gain traction in the global urban market. Furthermore, adding innovative flavors in A2 milk-based beverages is expected to bolster the market growth during the forecast period.

Latest Trends

The rising trend of grass-fed, organic A2 milk fuels the market.

Cows and buffalos who are fed with natural grass give high-quality milk, owing to the naturally occurring nutrition in the grass. These cattle can get all the necessary nutrition from grass alone, which does not interrupt their natural digestive cycle.

This helps them ultimately reap high-quality milk which is packed with multivitamins, minerals, and proteins. These facts have recently gained consumers’ attention which has increased the demand for grass-fed cow’s A2 milk. Additionally, the growing consumer interest in organic food products is expected to propel the market in the years to coming years.

The rising global demand for functional foods boosts the market.

Consumers are increasingly seeking food options that provide specific nutritional benefits. Functional foods are foods that are minimally processed or added with nutritional factors to provide maximum benefit to the consumer. A2 milk is a functional food that is processed to get rid of the A1 beta-casein. It provides nutritional benefits beyond the basic nutrition requirements for infants and adults. As consumers are growing health conscious and aware, they seek premium dairy products to complete everyday protein requirements to follow balanced diets.

The changing lifestyle habits of consumers have led to a global shift toward healthy, on-the-go foods and snacks. The change in overall consumer behavior encourages players in the market to launch newer A2 milk products such as frozen yogurts, protein shakes, and meal replacement shakes. Availing functional foods having A2 milk as a main ingredient and adding other healthy ingredients such as omega-3 or probiotics, is poised to drive the market.

Geopolitical Impact Analysis

Geopolitical events play a crucial role in altering the global A2 milk market thereby shaping its growth trajectory. Trade agreements such as USMCA significantly reduced tariffs for imports and exports taking place between the US, Mexico, and Canada, in 2018 which still benefit the local players in the market. The Brexit scenario that took place in 2020 drastically hiked the import tariffs on trade between the UK and the EU despite of high demand for A2 milk produced in the UK.

Moreover, recent changes made in China’s regulatory structure for dairy imports have significantly impacted the dairy export profits of several countries. The changes were made as about 85% of the population in China is lactose-intolerant. This has created challenges for players in the market trading with China.

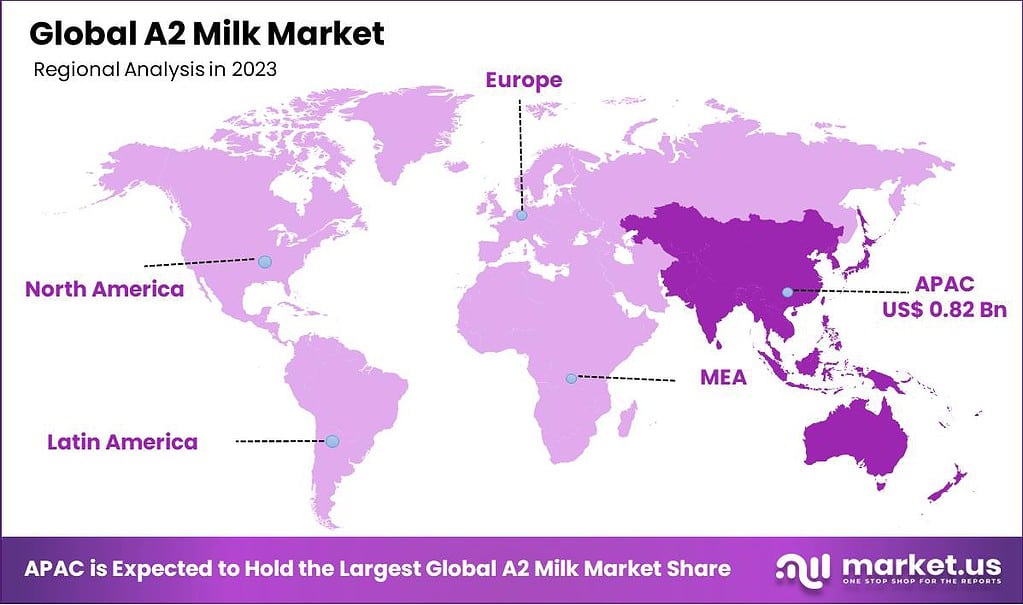

Regional Analysis

Asia Pacific is leading the Global A2 Milk Market.

Asia Pacific dominated the market with the highest revenue 0.82 billion, commanding a share of 36.8%. This is attributed to the increasing demand for A2-based healthy beverages across the region. Countries such as Japan, South Korea, and Australia have a higher per capita income compared to the other emerging economies in the region. Consumers from this region are capable of paying higher prices for A2 milk and are interested in purchasing premium products for health and well-being.

Similarly, consumers from countries such as India and China are shifting toward the consumption of A2 milk as it is easy to digest compared to regular milk. Furthermore, the increasing demand for A2 milk derivatives in the region is projected to bolster the market growth in Asia Pacific in the coming years. North America is expected to grow at a significant share during the projection period due to the increasing lactose intolerance among milk consumers in the region.

The countries such as the US, Canada, and Mexico are one of the major consumers of A2 milk in the region. The cow breeds such as Guernsey, Normande, Jersey, and the Brown Swiss Breeds in the region are mainly tamed, bred, and farmed in the region as main sources of A2 milk. A majority of consumers in North America are lactose-sensitive and have dairy allergies. For instance, according to the NIH report published in 2022, about 30% total US population had cow milk allergies (CMA) and about 2-3% of the total infant population had lactose malabsorption.

This has increased demand for A2 milk-based pediatric formulae for infants and A2 milk and its derivatives for adults. The region has gone under rapid urbanization in recent decades, which has consequently surged the demand for convenience foods and beverages. However, the increasing awareness regarding clean-label foods and functional foods has ultimately fueled the demand for A2 cow milk and A2 buffalo milk which is projected to fuel the market in the coming years.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The major players in the global A2 milk market are continuously investing in innovation and expansion. They execute several business strategies to stand out on the competitive ground. Companies such as Freedom Foods Group Limited, Vinamilk, Fonterra Cooperative Group Limited, and Erden Creamery Private Limited are major players known for their diversified global A2 milk production and supply chain network. These key players along with other industry participants collectively significantly influence the global A2 milk market’s growth, supply chain operations, and demand dynamics.

Top Key Players

- Erden Creamery Private Limited

- Fonterra Cooperative Group Limited

- Freedom Foods Group Limited

- Provilac Dairy Farms Private Limited

- The A2 Milk Company Limited

- Vedaaz Organics Pvt. Ltd.

- Vinamilk

- Other Key Players

Recent Developments

- In April 2023, The A2 Milk Company announced the launch of ‘The A2 Milk Grassfed Whole Milk’ and ‘A2 Milk Grassfed 2% Reduced Fat Milk, a valuable addition to their portfolio of grass-fed A2 Milk products.

- In August 2022, SwadeshiVIP, India’s leading A2 milk brand, launched A2 Shishu Milk, enriched with A2 beta casein which helps in the holistic development of children.

Report Scope

Report Features Description Market Value (2023) US$ 2.24 Bn Forecast Revenue (2033) US$ 5.86 Bn CAGR (2023-2033) 10.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Product Form(Liquid, Powder), By Application(Infant Formula, Dairy Product, Bakery and Confectionery, Other Applications), Distribution Channel(B2B, B2C, Supermarkets/Hypermarkets, Grocery Stores, Convenience Stores, Specialty Stores, Online Retailing) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Freedom Foods Group Limited, Vinamilk, Fonterra Cooperative Group Limited, Erden Creamery Private Limited, The A2 Milk Company Limited, Provilac Dairy Farms Private Limited, Vedaaz Organics Pvt. Ltd., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of A2 Milk Market?A2 Milk Market size is expected to be worth around USD 5.86 billion by 2033, from USD 2.24 billion in 2023

What is the CAGR for the A2 Milk Market?The A2 Milk Market expected to grow at a CAGR of 10.10% during 2023-2032.Who are the key players in the A2 Milk Market?Freedom Foods Group Limited, Vinamilk, Fonterra Cooperative Group Limited, Erden Creamery Private Limited, The A2 Milk Company Limited, Provilac Dairy Farms Private Limited, Vedaaz Organics Pvt. Ltd., Others

-

-

- Freedom Foods Group Limited

- Vinamilk

- Fonterra Cooperative Group Limited

- Erden Creamery Private Limited

- The A2 Milk Company Limited

- Provilac Dairy Farms Private Limited

- Vedaaz Organics Pvt. Ltd.

- Others