Global 3D Printing Metal Market By Form (Filament and Powder); By Metal Type (Titanium, Stainless Steel, Nickel, Aluminum, and Others); By Application (Aerospace & Defense, Medical & Dental, Automotive, Electronics, and Others); By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast: 2023-2033

- Published date: Nov 2023

- Report ID: 31671

- Number of Pages: 292

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

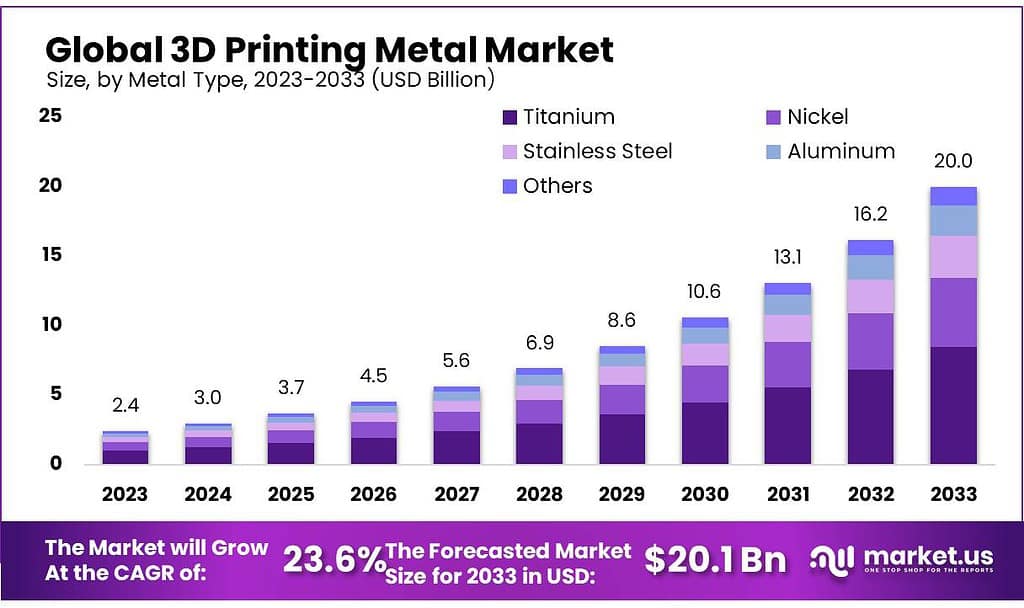

The global 3D Printing Metal market size is expected to be worth around USD 20.0 billion by 2033, from USD 2.4 billion in 2023, growing at a CAGR of 23.6% during the forecast period from 2023 to 2033.

This market demand is expected to grow on account of increased investments from 3D printer companies. Mantle Inc, a 3D component manufacturer, raised US$25 million in funding to install commercial 3D printers in 2022.

It has produced more than 1 million parts to be used in medical devices, dishwasher components, and deodorant packaging. The company’s TrueShape 3D printer technology has improved lead times and reduced costs by about 65% during production.

Note: Actual Numbers Might Vary In Final Report

Key Takeaways

- Market Growth Projection: The 3D Printing Metal market is set to skyrocket, with an expected worth of USD 20.0 billion by 2033 from USD 2.4 billion in 2023, exhibiting a remarkable CAGR of 23.6% during 2023-2033.

- Driving Factors: Increased investments from 3D printer companies are propelling market demand. For instance, Mantle Inc. secured US$25 million funding in 2022, enhancing production efficiency and reducing costs by approximately 65%.

- Form Analysis: Powder form dominates the market, holding over 89.3% revenue share. The demand for accurately characterized metal powder particles is rising, especially particles ranging from 15 to 75 μm for optimal 3D printing results.

- Metal Type Insights: Titanium products hold the highest revenue share (42.4%) and are expected to grow significantly due to their non-corrosive properties and suitability for aerospace applications.

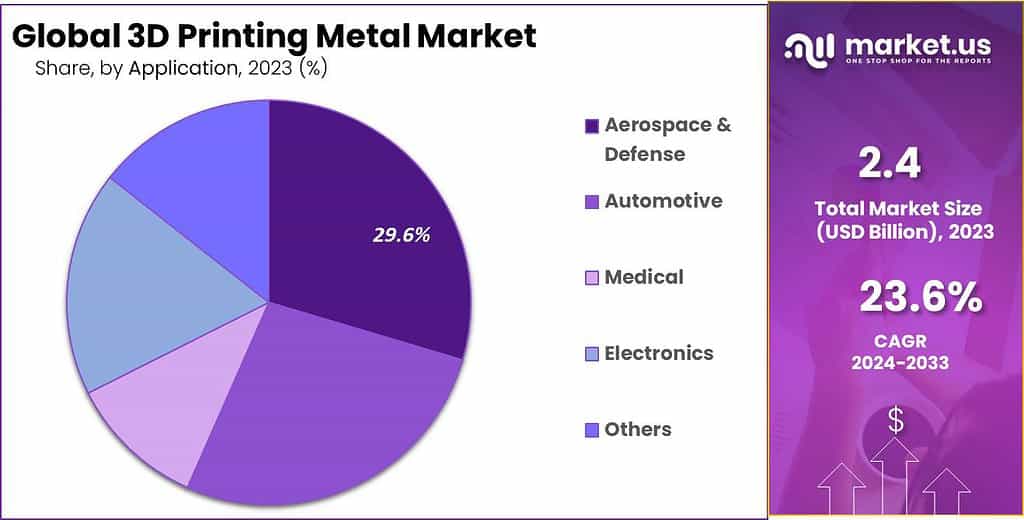

- Application Analysis: Aerospace and defense currently occupy the largest market share (29.6%), leveraging 3D printing for quicker production of complex components. Medical and dental applications are expected to witness a growth rate of 27.4%.

- Market Challenges: Challenges include high costs due to stringent specifications for metal powders used in the process. Meeting precise requirements for metal powders poses a considerable challenge for manufacturers.

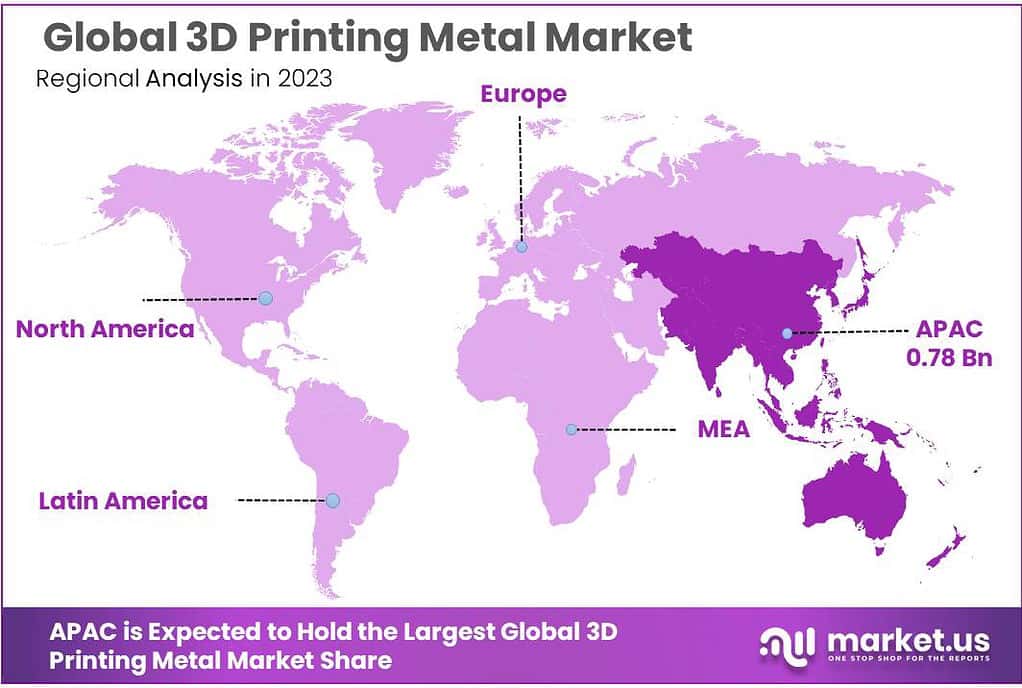

- Regional Dynamics: Asia Pacific leads the market share (32.5%), with Europe projected to experience the fastest CAGR (26.2%) from 2023-2032. Countries like the UK and India are adopting 3D printing technology for aerospace and medical applications.

- Market Players: Key players include Proto Labs, Voxeljet AG, Stratasys LTD., Renishaw PLC, General Electric Company, and more, engaging in mergers and acquisitions to expand their offerings.

Form Analysis

The powder form is the largest segment scope in this market size, with a revenue share greater than 89.3%. The properties of metal powder particles are affected by a variety of parameters. These parameters not only affect the additive build process but also the properties of the final component.

This includes the physical and chemical properties of raw materials, which must be accurately known and characterized. This will likely increase the demand for metal dust in the future. For a fine print on the final product launches, the 3D-printed metal particles must be tiny, usually in the wide range of 15 to 75 μm (microns).

The particles should not be distributed in a way that is too uneven to achieve the best results. Filaments are usually a mix of metals and polymers. In this case, the metal is coated by a layer of PLA or ABS. Manufacturers are working hard to develop more cost-effective printing methods for filaments than the selective laser melting process. This is expected to increase filament demand over the forecast period.

By Metal Type Analysis

The highest revenue share was accounted for by the titanium products segment at 42.4% in 2022. This segment is projected to grow at the fastest CAGR over the forecast period. Due to their non-corrosive properties and resistance to harsh environments, there will be an increase in the demand for titanium-based product segments.

Market growth will likely be driven by traditional polymer 3D printers’ capability of producing semi-metallic items when combined with polymers or filaments, via traditional 3D printers.

It is expected that titanium powder will soon be developed for 3D printing applications due to the ability of the aerospace & defense industry to absorb high initial costs and adapt to changing technologies. A new aerospace approach, which is aided by complex geometric structures, will drive 3D printing technology and subsequently increase the demand for titanium powder.

Due to its widespread demand across industries, stainless steel 3d printing will likely experience strong interest over the coming years. Parts printed using stainless steel are light but strong. Plus, stainless can even help produce large objects with quality surface prints!

Application Analysis

The largest share, over 29.6%, was accounted for by the aerospace and defense sector in 2023. 3D printing allows aerospace and defense industry key players to produce complex components in shorter durations. Senvol, a 3D data specialist for the aerospace & defense industry, was awarded funding in 2023 by the U.S. Department of Defense.

The segment of medical & dental applications is expected to experience the highest revenue growth rate of 27.4%, in terms of volume over the forecast period. Several medical companies use 3D printing for various medical application purposes. Monogram, for instance, uses 3D printing to develop orthopedic implants. Open Bionics also developed robotic prosthetics using 3D printing that are low-cost.

The automotive market driver is another crucial segment of the 3D-printed metal market. 3D printing metal market technology will be used by the automotive industry players to produce hollow components with thinner walls and mix various raw materials. This is anticipated to have a positive impact on the future growth trajectory of this market potential.

Note: Actual Numbers Might Vary In Final Report

Key Market Segments

By Form

- Filament

- Powder

By Metal Type

- Titanium

- Stainless Steel

- Nickel

- Aluminum

- Others

By Application

- Defense & Aerospace Sector

- Medical & Dental

- Electronics

- Automotive

- Others

Drivers

Mass Customization of products with complex design and structure

Customization is the prevailing trend in the 3D printing sector. This technology has significantly simplified life by enabling consumers to design and innovate using computer software, and then translate those designs into physical objects through printing.

In the realm of 3D printing with metals, the focus is on delivering personalized, lightweight items while keeping production costs low via mass manufacturing. The beauty of 3D printing lies in its ability to realize intricate, tailored designs that were once challenging to create.

Restraint

Limitation of printer size

3D printing is constrained by the size of the machine’s build platform, which can vary across printers. Typically, these platforms measure around 250 × 250 × 300 mm, although larger printers go up to 400 × 400 × 380 mm.

However, the resulting parts are often smaller than the printer’s dimensions due to metal shrinking during the cooling process post-sintering. Although there are printers capable of producing larger parts, they come with a hefty price tag, making them impractical for many businesses.

Additionally, these larger printers have longer printing times for sizable products. Consequently, the size limitations of printed parts stand as a significant obstacle in the market’s expansion.

Opportunity

Potential to enhance manufacturing and supply chain management

The rapidly expanding 3D printing metals market holds immense potential to revolutionize manufacturing and supply chain management. Metal-based 3D printing offers numerous advantages, including tailored mass production and efficient short runs.

Unlike traditional manufacturing methods, it eradicates the need for specific tooling. While conventional manufacturing boasts lower costs per unit, it necessitates substantial upfront investments in tooling, rendering production more expensive for smaller batches in comparison to 3D printing.

Moreover, metal 3D printing aids in curbing waste generation during production by constructing parts layer by layer.

Challenge

Specific material requirements

The market growth of 3D printing metals has been hindered significantly by the high associated costs. This is primarily due to the stringent specifications for the metal powders used in the process. Metals must undergo a conversion process into powder form, ensuring that each particle maintains a spherical shape.

This specific shape is crucial as it enhances packing efficiency and facilitates better flow properties during printing. Moreover, the spherical form directly influences the density and mechanical attributes of the final product, ensuring uniformity across layers.

However, meeting these precise requirements for metal powders poses a considerable challenge for manufacturers of 3D printed metal goods. Despite these challenges, the segment focused on powdered metals continued to dominate the 3D printing metal market in 2021, enabling the creation of high-density products with intricate geometries.

Regional Analysis

The global 3D printing metal market in the Asia Pacific accounted for the largest market share of 32.5% in 2023. Europe is predicted to experience the fastest regional CAGR of over 26.2% from 2023-2032. France, Spain, Italy, Germany, and the Netherlands are the top five countries in this region for the 3D printing of end-use industries parts.

These include the healthcare and aerospace industries. Some countries have developed a national strategy in additive manufacturing as part of their Industry 4.0 or advanced manufacturing strategies.

Attenborough Dental and Renishaw are major 3D printers in the U.K., for crowns or bridges, Bowman International for bearing boxes, and GKN for aerospace and automotive components. However, the vast majority in the U.K. has not yet adopted metal additive manufacturing technology. This indicates significant potential for additional market growth factors.

3D printing will continue to be a major driver of the Asia Pacific market. Hindustan Aeronautics Ltd., India’s largest aircraft manufacturer, uses metal AM technology to produce various components for its engineering program. HAL uses Direct Metal Laser Sintering (DMLS), for components of its Hindustan Turbofan Engine-25.

Note: Actual Numbers Might Vary In Final Report

Key Regions and Countries Covered

- North America

- The US

- Canada

- Mexico

- Europe

- Germany

- The UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of the Middle East & Africa

This global market is still in its early growth stage. It holds great potential because of its increasing penetration and adoption across all industries. Small companies are investing more in this market. Due to the greater competitive landscape, mergers & acquisition strategies are expected to increase in the market over the forecast period.

Aerojet Rocketdyne Holdings Inc. bought Metal 3D Materials Technology Inc. (3DMT), a provider of additive manufacturing solutions. 3DMT will allow the company to expand its offerings in the aerospace & defense industry.

Key Market Players

- Proto Labs, Inc.

- Voxeljet AG

- Stratasys LTD.

- The ExOne Company

- Renishaw PLC

- EOS GmbH Electro Optical Systems

- 3D Systems Corporation

- General Electric Company

- Materialise NV

- Hoganas AB

- Wipro 3D

- SLM Solutions Group AG

- Markforged, Inc.

- GKN PLC

- Arcam AB

- Carpenter Technology Corporation

- Sandvik AB

- Titomic Limited

Recent Development

In May 2022, the company unveiled the latest edition of Materialise’s market-leading data and build preparation software, Magics 26, at the RAPID+TCT Conference, a global pioneer in 3D printing solutions. Magics 26 combines its mesh capabilities with native CAD workflow support. Users get the best of both worlds by selecting the ideal process for each 3D printing project, increasing efficiency while retaining quality.

In May 2022, Materialise, a global leader in 3D printing solutions, introduced CO-AM, an open software platform to efficiently manage the additive manufacturing (AM) production process. CO-AM will give manufacturers cloud-based access to a full range of software tools that allow them to plan, manage and optimize every stage of their AM operations. With CO-AM, Materialise addresses the untapped potential to use AM for serial manufacturing and mass personalization.

Report Scope

Report Features Description Market Value (2023) USD 2.4 Billion Forecast Revenue (2033) USD 20.0 Billion CAGR (2023-2032) 23.5% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Filament and Powder); By Metal Type (Titanium, Stainless Steel, Nickel, Aluminum, and Others); By Application (Aerospace & Defense, Medical & Dental, Automotive, Electronics, and Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Proto Labs, Inc., Voxeljet AG, Stratasys LTD., The ExOne Company, Renishaw PLC, EOS GmbH Electro Optical Systems, 3D Systems Corporation, General Electric Company, Materialise NV, Hoganas AB, Wipro 3D, SLM Solutions Group AG, Markforged, Inc., GKN PLC, Arcam AB, Carpenter Technology Corporation, Sandvik AB, Titomic Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is 3D printing metal?3D printing metal, also known as metal additive manufacturing, refers to the process of creating three-dimensional metal parts or objects by selectively fusing powdered metals layer by layer.

What metals can be used in 3D printing?Various metals are compatible with 3D printing, including stainless steel, titanium, aluminum, nickel alloys, cobalt-chrome, copper, and precious metals like gold and silver.

Are there advancements in 3D printing metal technology?Yes, ongoing advancements include improvements in printing speed, development of new metal alloys, enhanced precision, larger printing capacities, and improvements in surface quality.

-

-

- Proto Labs, Inc.

- Voxeljet AG

- Stratasys LTD.

- The ExOne Company

- Renishaw PLC

- EOS GmbH Electro Optical Systems

- 3D Systems Corporation

- General Electric Company

- Materialise NV

- Hoganas AB

- Wipro 3D

- SLM Solutions Group AG

- Markforged, Inc.

- GKN PLC

- Arcam AB

- Carpenter Technology Corporation

- Sandvik AB

- Titomic Limited