Global 3D Imaging in Smartphone Market By Component (Hardware (3D Sensors & Modules, Cameras, Others), Software, Services), By Technology (Stereo Vision, Structured Light, Time-of-Flight, LiDAR, Others), By Application (3D Scanning & Modelling, Augmented Reality & Gaming, Other Applications), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 171871

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Component Analysis

- Technology Analysis

- Application Analysis

- Key reasons for adoption

- Benefits

- Usage

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

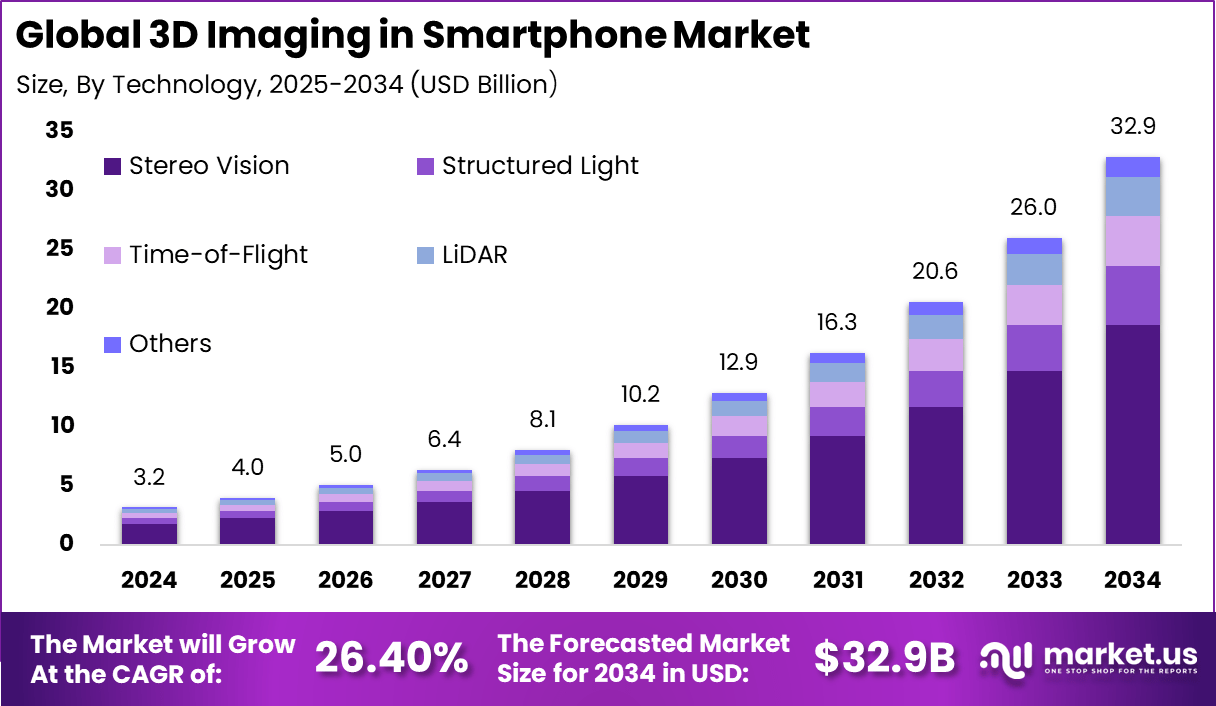

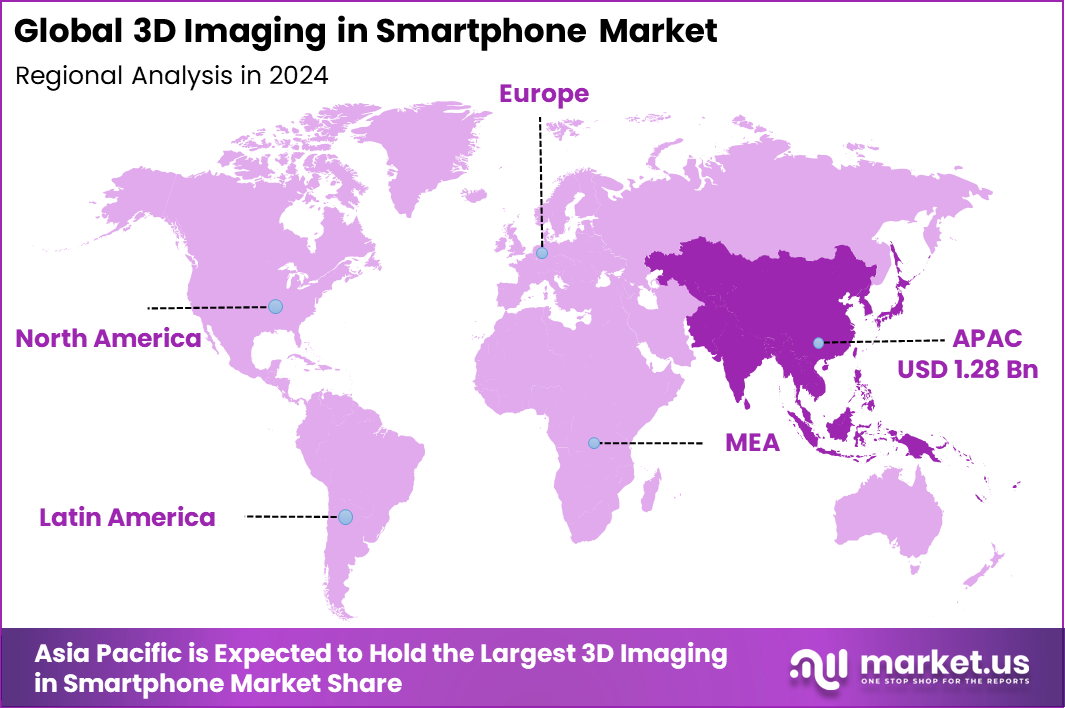

The Global 3D Imaging in Smartphone Market generated USD 3.2 billion in 2024 and is predicted to register growth from USD 4 billion in 2025 to about USD 32.9 billion by 2034, recording a CAGR of 26.40% throughout the forecast span. In 2024, Asia Pacific held a dominan market position, capturing more than a 40.8% share, holding USD 1.28 Billion revenue.

The 3D imaging in smartphone market refers to the integration of advanced sensors and software in mobile devices that capture depth information and three-dimensional representations of scenes, objects, or faces. These technologies may include time-of-flight sensors, structured light systems, stereoscopic camera setups, and software-based depth mapping. 3D imaging enhances capabilities for photography, augmented reality, facial recognition, and spatial measurement.

Growth in this market is supported by increasing consumer demand for richer visual experiences and improved security features. Smartphone manufacturers are incorporating 3D imaging components to differentiate products, improve image quality, and support emerging applications such as virtual try-on, immersive video, and advanced gesture controls. As the ecosystem of applications evolves, demand for accurate and dependable 3D capture grows.

The main driving factors for the 3D imaging in smartphone market are linked to rising consumer demand for richer camera features and enhanced user interaction. Smartphone users are increasingly expecting high quality imaging that supports social media, video creation, and AR applications. The growth of AR ecosystems, driven by gaming, shopping, and interactive experiences, encourages OEMs to embed 3D depth sensing and reconstruction capabilities.

Demand analysis indicates that interest in 3D imaging continues to grow as applications expand beyond photography into utility and entertainment functions. Consumers are drawn to devices that offer more natural and immersive interactions, including AR gaming, virtual try-ons for retail, and real-world object scanning for measurement or design work. Demand is strongest in segments where premium devices compete on camera and user experience features.

Emerging markets are also showing increasing adoption as 3D imaging capabilities become available in mid-range devices at lower cost points. As software ecosystems evolve to make better use of depth data, investment in 3D imaging technologies is expected to remain strong among smartphone manufacturers seeking to differentiate products and meet evolving user expectations.

Top Market Takeaways

- By component, hardware took 83.4% of the 3D imaging in smartphone market, as it includes cameras and sensors for depth capture.

- By technology, stereo vision held 56.8% share, using dual cameras to create 3D images and effects.

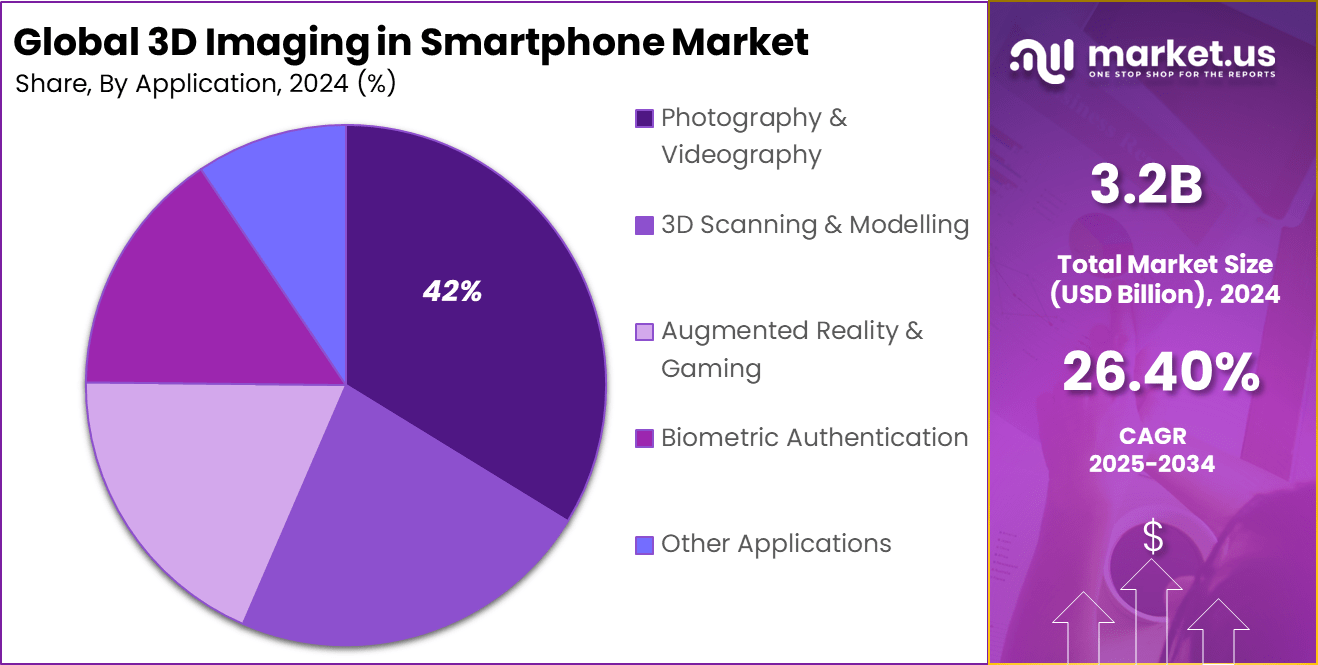

- By application, photography and videography led with 41.6%, enabling portrait modes and AR features.

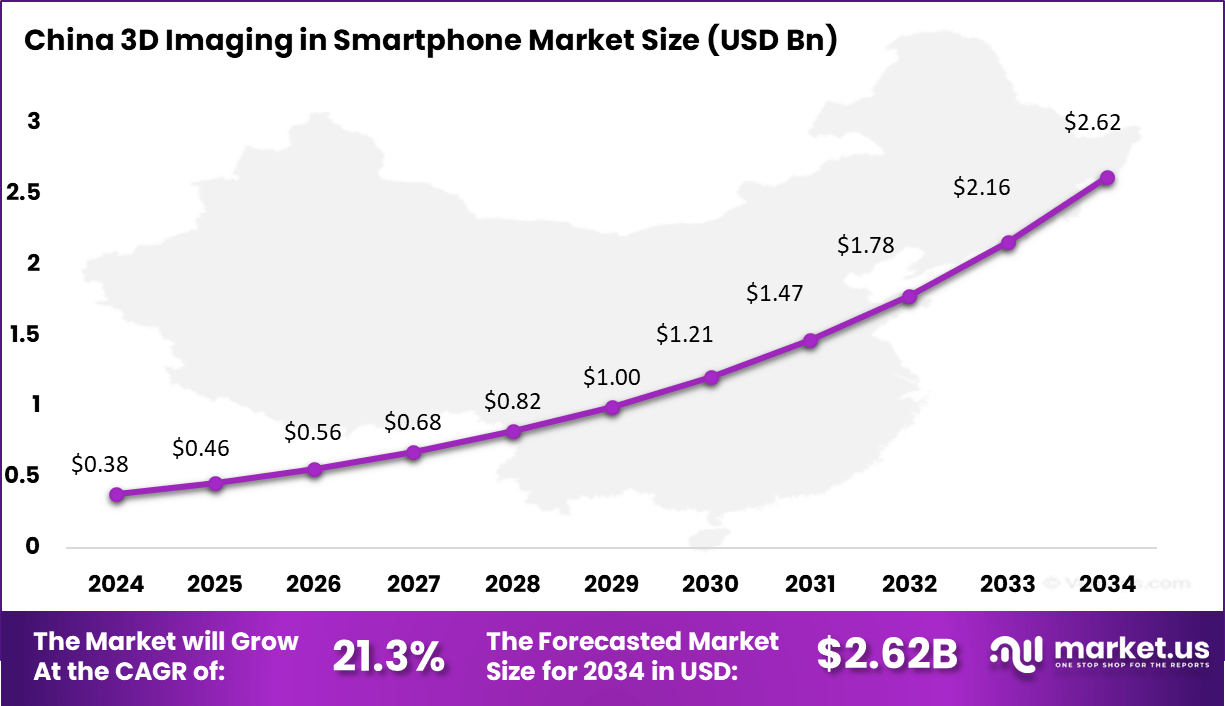

- Asia-Pacific had 40.8% of the global market, with China at USD 0.38 billion in 2025 and growing at a CAGR of 21.3%.

Component Analysis

The hardware segment holds 83.4% of the 3D Imaging in Smartphone market, indicating that most value in this market is driven by physical components integrated into smartphones. These include depth sensors, camera modules, infrared emitters, and supporting optical elements.

Hardware components are essential for capturing depth information and enabling three-dimensional imaging features directly on the device. Their high share reflects the need for precise and reliable components to deliver accurate 3D data.

From a market perspective, smartphone manufacturers continue to invest heavily in advanced hardware to differentiate their devices. Improved camera systems support better depth perception, facial recognition, and immersive imaging experiences. The dominance of hardware shows that performance and image quality remain key priorities for smartphone users and device makers alike.

Technology Analysis

Stereo vision accounts for 56.8% of the technology segment, making it the most widely used approach for 3D imaging in smartphones. This technology uses two or more cameras to capture images from different angles and calculate depth through image comparison. Stereo vision is favored because it can be implemented using existing camera setups with minimal additional hardware.

The adoption of stereo vision is driven by its cost efficiency and compatibility with thin smartphone designs. It supports depth mapping for photography, augmented reality, and face recognition features. The strong share of this technology reflects its balance between accuracy, ease of integration, and consumer demand for advanced imaging capabilities.

Application Analysis

Photography and videography represent 42% of application demand, making them the largest use case for 3D imaging in smartphones. Depth-based imaging enhances portrait modes, background blur, and scene segmentation, leading to more professional-looking photos and videos. Users increasingly expect high-quality imaging features as a standard part of smartphone experience.

For device manufacturers, advanced imaging capabilities help attract consumers and justify premium pricing. 3D imaging also supports creative video effects and improved focus accuracy. The strong share of photography and videography reflects the continued importance of camera performance as a key purchasing factor in the smartphone market.

Key reasons for adoption

- Strong demand for advanced camera features that improve user experience

- Growing focus on secure biometric authentication in mobile devices

- Rising use of augmented reality applications in everyday smartphone usage

- Need for accurate depth sensing to support premium photography features

- Differentiation by smartphone brands in a highly competitive market

Benefits

- Improved image quality with better depth, focus, and background separation

- More reliable face recognition for device unlocking and secure payments

- Enhanced augmented reality performance with precise object and space mapping

- Better low light photography through depth aware image processing

- Higher user engagement driven by interactive and immersive features

Usage

- Capturing portrait photos with natural blur and accurate edge detection

- Enabling face based authentication for security and identity verification

- Supporting augmented reality apps for gaming, shopping, and education

- Improving video effects such as real time filters and depth adjustment

- Assisting camera based measurement and scanning applications

Emerging Trends

Key Trend Description ToF Sensor Miniaturization Smaller time of flight chips fit into smartphones more easily. AI Enhanced Depth Sensing AI improves 3D depth maps for better portraits and augmented reality. Under Display 3D Cameras Depth sensors are placed behind screens to keep phone designs clean. Multi Sensor Fusion Time of flight is combined with structured light for accurate face scanning. AR VR Camera Support 3D cameras enable mixed reality apps, games, and interactive content. Growth Factors

Key Factors Description Face Unlock Demand Secure 3D biometric systems are preferred over 2D in premium smartphones. AR App Explosion Games and camera filters require depth data for realistic effects. Mid Range Adoption Lower sensor costs bring 3D cameras to more phone price segments. 5G Speed Boost High speed data supports live 3D streaming and video calling. Camera Wars Heat Up Smartphone brands compete using advanced 3D camera features. Key Market Segments

By Component

- Hardware

- 3D Sensors & Modules

- Cameras

- Others

- Software

- Services

By Technology

- Stereo Vision

- Structured Light

- Time-of-Flight

- LiDAR

- Others

By Application

- 3D Scanning & Modelling

- Augmented Reality & Gaming

- Photography & Videography

- Biometric Authentication

- Other Applications

Regional Analysis

Asia Pacific accounted for 40.8% share, supported by large scale smartphone manufacturing, strong consumer electronics demand, and rapid adoption of advanced camera technologies. Smartphone brands in the region have increasingly integrated 3D imaging features to enhance photography, facial recognition, and augmented reality experiences.

Demand has been driven by rising consumer expectations for premium camera performance and secure biometric authentication. The presence of major component suppliers and device manufacturers has enabled faster integration and cost optimization of 3D imaging modules.

China reached a market value of USD 0.38 Billion and is projected to grow at a 21.3% CAGR, reflecting strong domestic smartphone production and rapid consumer adoption of advanced features. Chinese smartphone manufacturers have actively adopted 3D imaging to support facial authentication, camera enhancements, and immersive applications. High competition among brands has accelerated innovation and pushed faster rollout of 3D sensing technologies across different price segments.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Demand for Advanced Imaging and Differentiated User Experiences

A key driver of this market is demand for advanced imaging capabilities that extend beyond traditional camera functions. Consumers expect smartphones to offer professional-grade photography and video tools. 3D imaging supports features such as portrait mode depth effects, background separation, and contextual scene understanding that improve visual quality.

Another driver is the pursuit of differentiated user experiences. Smartphone manufacturers compete on features that set products apart in a crowded market. Integrating accurate 3D imaging systems supports innovations in security, AR applications, and multimedia experiences. These distinct capabilities contribute to product positioning and brand appeal.

Restraint Analysis

Component Cost and Power Consumption Constraints

A significant restraint in the 3D imaging in smartphone market is the cost of incorporating advanced sensors and processing hardware. Depth sensing components such as time-of-flight sensors and structured light modules add production expense. Higher bill-of-materials costs can affect device pricing and limit adoption in lower-priced segments.

Another restraint arises from increased power consumption and space requirements. 3D imaging systems require additional processing and sensor power, which can affect battery life. Integrating multiple camera modules and associated hardware also consumes internal space within a smartphone’s limited form factor. Balancing performance and power efficiency remains a design challenge.

Opportunity Analysis

Expansion Into AR-Driven Applications and Health-Related Use Cases

There is strong opportunity in expanding 3D imaging use beyond traditional photography into AR-driven applications. Industries such as retail and real estate can use 3D spatial capture for virtual try-on, furniture placement previews, and immersive product interactions. These applications improve customer engagement and may support commerce directly through mobile devices.

Another opportunity lies in health-related use cases. 3D imaging can support posture analysis, motion tracking, and body measurement tools that assist fitness and wellness applications. When combined with machine learning, smartphones could offer diagnostics-adjacent functions such as gait analysis or wound tracking. As health-oriented applications evolve, 3D imaging can play a supporting role.

Challenge Analysis

Standardization and Interoperability Across Devices and Apps

A major challenge in this market is achieving standardization and interoperability. Different manufacturers implement varying 3D imaging hardware and software approaches, which results in inconsistent output across devices. Application developers must adapt to multiple formats and sensor characteristics, increasing development complexity.

Another challenge is privacy and ethical use of depth data. 3D imaging captures detailed representations of user faces and environments. Ensuring that data is processed securely, with explicit user consent and strong privacy controls, is crucial. Regulatory requirements and user expectations for data protection may influence how 3D imaging features are designed and deployed.

Competitive Analysis

Apple Inc., Samsung Electronics, Huawei Corporation, Sony Group Corporation, and LG Electronics lead the 3D imaging in smartphone market through advanced camera modules, depth sensors, and software driven imaging features. Their devices integrate structured light, time of flight, and LiDAR based systems to support facial recognition, AR applications, and enhanced photography. These companies focus on image accuracy, low power consumption, and seamless hardware software integration.

Qualcomm and MediaTek Inc. strengthen the market by supplying chipsets with dedicated image signal processors and AI engines optimized for 3D sensing. Their platforms enable real time depth mapping, object detection, and computational photography across mid range and premium smartphones. These providers emphasize performance efficiency and scalability. Rising adoption of AI driven camera features continues to support their market relevance.

Xiaomi, Oppo, Vivo, Google, OnePlus, ZTE, Sharp, and ASUS expand the market by integrating 3D imaging into consumer focused smartphones. Their offerings support portrait effects, biometric security, and immersive AR use cases. These brands focus on cost efficiency, rapid innovation, and user experience. Growing demand for advanced mobile imaging continues to drive steady market growth.

Top Key Players in the Market

- Apple Inc.

- Samsung Electronics

- Huawei Corporation

- Sony Group Corporation

- LG Electronics

- Qualcomm

- MediaTek Inc.

- Xiaomi

- Oppo

- Vivo

- OnePlus

- ZTE

- Sharp

- ASUS

- Others

Future Outlook

The future outlook for the 3D Imaging in Smartphone market is expected to remain positive as device makers look to improve user experience and security. 3D imaging is being used for facial recognition, depth sensing, and advanced camera features, which support more accurate authentication and better photo quality.

Growing use of augmented reality applications is also supporting demand, as depth data improves realism and interaction. In the coming years, smaller sensors, lower power consumption, and better software integration are likely to make 3D imaging a standard feature across mid range and premium smartphones.

Recent Developments

- September 2025 – Apple Inc.: Debuted iPhone 17 with upgraded 48MP Fusion front camera and Center Stage for enhanced 3D facial mapping. This builds on Face ID with better low-light depth sensing, powering AR features in iOS 19.

- November 2024 – Huawei Corporation: Launched Mate 70 series with ToF 3D sensor across all models for advanced face unlock. Pro variants add depth to 13MP selfie cams, working in total darkness unlike 2D rivals.

Report Scope

Report Features Description Market Value (2024) USD 3.2 Bn Forecast Revenue (2034) USD 32.9 Bn CAGR(2025-2034) 26.40% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware (3D Sensors & Modules, Cameras, Others), Software, Services), By Technology (Stereo Vision, Structured Light, Time-of-Flight, LiDAR, Others), By Application (3D Scanning & Modelling, Augmented Reality & Gaming, Other Applications) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Apple Inc., Samsung Electronics, Huawei Corporation, Sony Group Corporation, LG Electronics, Qualcomm, MediaTek Inc., Xiaomi, Oppo, Vivo, Google, OnePlus, ZTE, Sharp, ASUS, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  3D Imaging in Smartphone MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

3D Imaging in Smartphone MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Apple Inc.

- Samsung Electronics

- Huawei Corporation

- Sony Group Corporation

- LG Electronics

- Qualcomm

- MediaTek Inc.

- Xiaomi

- Oppo

- Vivo

- OnePlus

- ZTE

- Sharp

- ASUS

- Others