Global 3D Bioprinting Market By Product Type (Inkjet-based, Laser-based, Magnetic Levitation, Syringe-based, and Others), By Application (Medical (Tissue & Organ Generation, Medical Pills, Prosthetics & Implants, and Others), Food & Animal Product, Dental, Consumer/Personal Product Testing, Biosensors, and Bioinks), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 96002

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

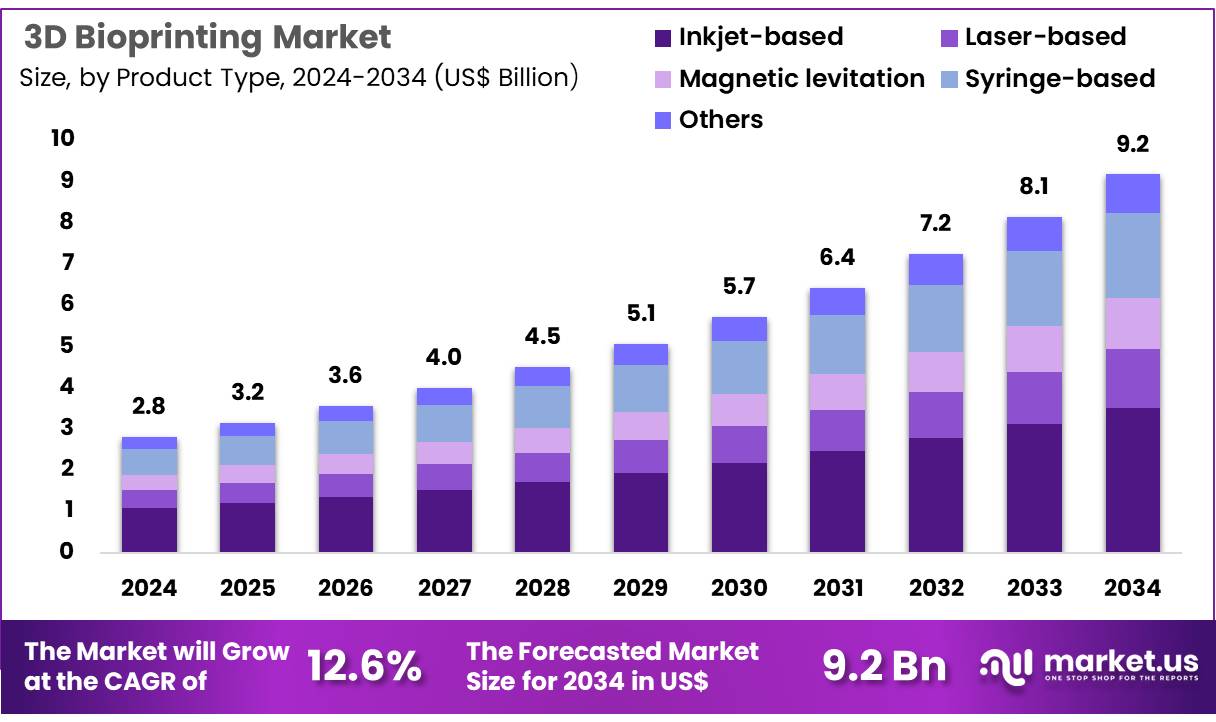

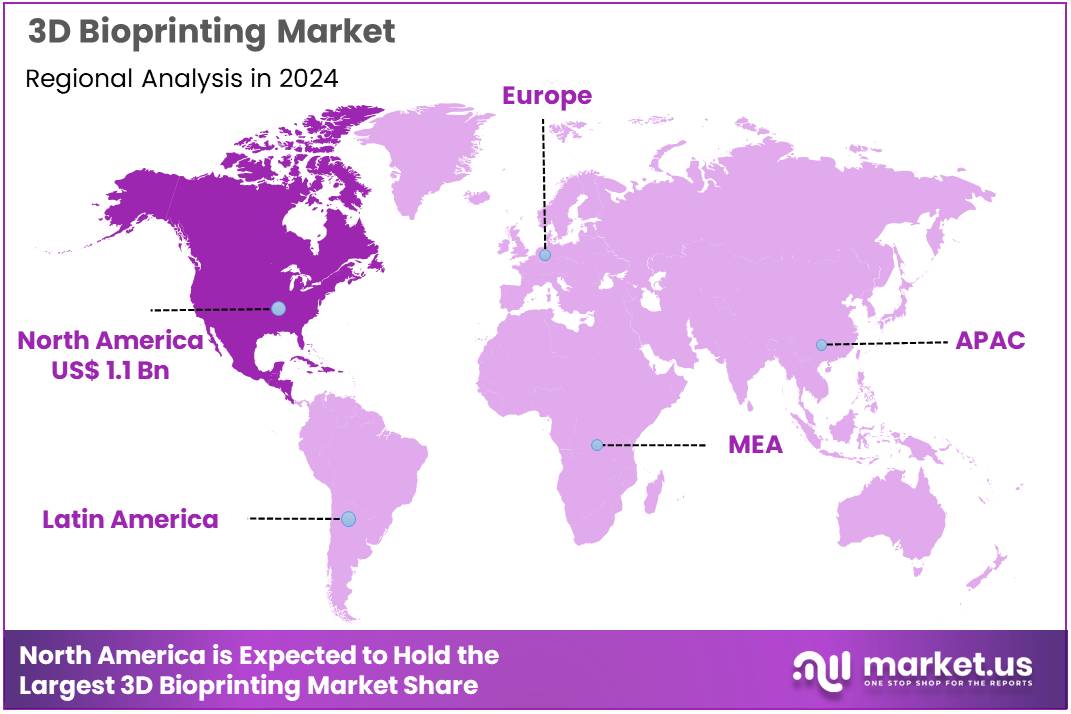

Global 3D Bioprinting Market size is expected to be worth around US$ 9.2 Billion by 2034 from US$ 2.8 Billion in 2024, growing at a CAGR of 12.6% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.5% share with a revenue of US$ 1.1 Billion.

Rising demand for personalized medicine propels the 3D bioprinting market as researchers prioritize cutting-edge solutions to address complex tissue engineering and regenerative therapy challenges. Scientists increasingly harness bioprinting for organoid development, fabricating intricate liver models to evaluate drug toxicity and metabolism in preclinical trials, reducing reliance on animal testing. This driver intensifies with the critical shortage of transplantable organs, where bioprinting systems create vascularized scaffolds for cardiac tissue repair, enhancing compatibility for heart failure patients.

Hospitals adopt these technologies for advanced wound healing, producing bioactive skin grafts tailored for burn victims to accelerate tissue regeneration and minimize scarring. In June 2025, Stony Brook University’s Renaissance School of Medicine introduced TRACE, a novel bioprinting technique leveraging collagen-based bioinks to construct highly biocompatible tissue structures for clinical applications. According to the NIH, over 100,000 patients await organ transplants annually, highlighting the pressing need for scalable bioprinting solutions to transform medical care.

Growing advancements in bioink formulations and automation unlock substantial opportunities in the 3D bioprinting market, enabling tailored applications across diverse medical fields. Innovators formulate biocompatible hydrogels infused with growth factors, supporting cartilage regeneration for osteoarthritis patients undergoing joint repair surgeries. Academic institutions utilize bioprinting for oncology research, creating 3D tumor models to study drug resistance and tumor microenvironment interactions, accelerating targeted therapy development.

Opportunities also emerge in reproductive medicine, where bioprinted ovarian scaffolds restore hormonal function in infertility treatments, offering hope for improved outcomes. In June 2025, University of British Columbia researchers integrated AI with bioprinting to optimize sperm growth for male infertility, enhancing precision in reproductive care. The FDA reports 15 new 3D-printed medical devices cleared in 2024, underscoring the transformative potential of bioprinting to drive personalized, innovative therapeutic strategies.

Recent trends in the 3D bioprinting market emphasize AI-driven automation and patient-specific solutions to enhance clinical precision and scalability. Developers advance bioprinting for dental applications, producing customized periodontal implants that integrate seamlessly with patient anatomy, reducing recovery times. In April 2025, National University of Singapore researchers combined AI and bioprinting to create personalized gum grafts, offering a less invasive alternative to traditional tissue harvesting for dental reconstruction.

Trends also include high-throughput bioprinting systems for bone graft production, streamlining trauma surgery with biocompatible constructs for fracture repair. Industry insights indicate a 40% surge in bioprinting patent filings in 2024, reflecting robust innovation in scalable tissue fabrication. These advancements signal a strategic evolution toward precision-driven, faced with patient-centric bioprinting ecosystems that redefine medical treatment possibilities.

Key Takeaways

- In 2024, the market generated a revenue of US$ 2.8 Billion, with a CAGR of 12.6%, and is expected to reach US$ 9.2 Billion by the year 2034.

- The product type segment is divided into inkjet-based, laser-based, magnetic levitation, syringe-based, and others, with inkjet-based taking the lead in 2023 with a market share of 38.3%.

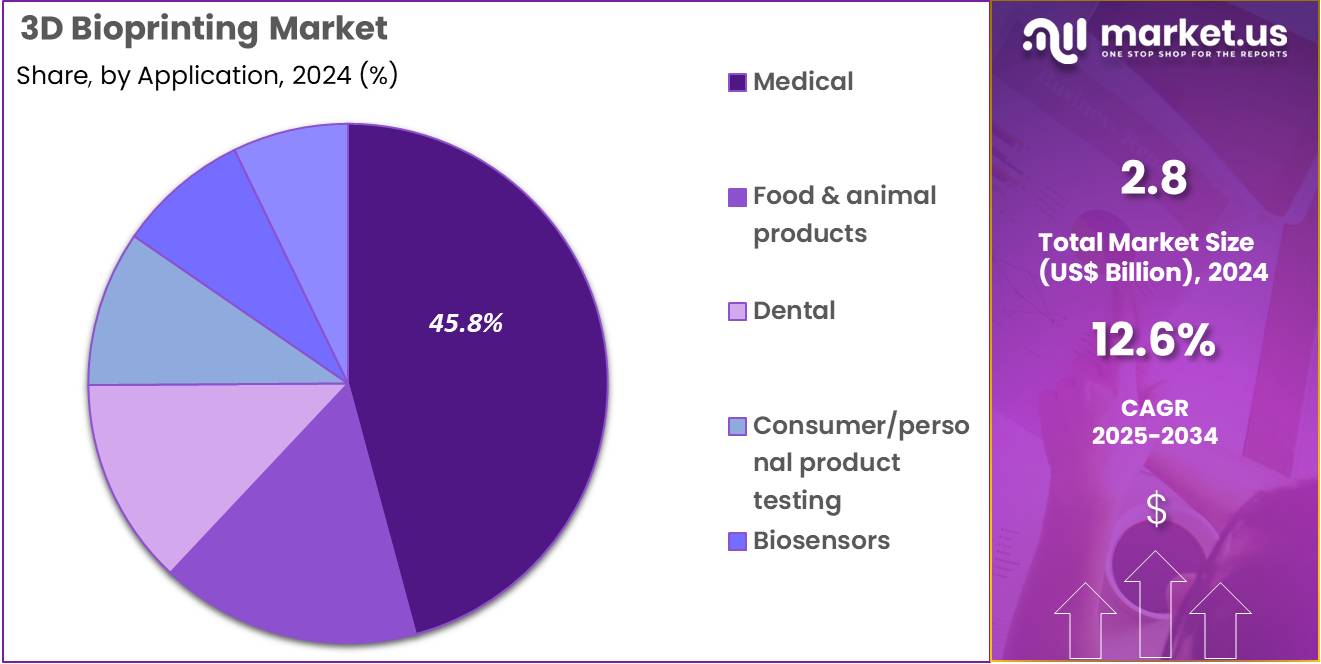

- The application segment is segregated into medical, food & animal product, dental, consumer/personal product testing, biosensors, and bioinks, with the medical segment leading the market, holding a revenue share of 45.8%.

- North America led the market by securing a market share of 39.5% in 2024.

Product Type Analysis

Inkjet-based 3D bioprinting holds the largest share at 38.3% and is expected to continue growing due to its cost-effectiveness, precision, and adaptability in various applications, particularly in medical and consumer product testing. Inkjet-based bioprinting uses drop-on-demand technology, allowing for high-resolution printing of biomaterials, which is critical for producing complex tissues and organs in medical research.

The segment is anticipated to grow as it allows for high-throughput, reproducible, and precise deposition of cells and bioinks. Inkjet-based printers are increasingly used in developing organ structures, including blood vessels, tissues, and skin, for regenerative medicine. The demand for personalized medicine, where patient-specific tissues or prosthetics are needed, is likely to further drive the adoption of inkjet-based systems.

Additionally, advancements in bioinks and printing substrates are expected to improve the performance and scalability of inkjet-based bioprinting, contributing to the segment’s growth. The increasing integration of this technology in pharmaceutical testing, where it helps simulate human tissues for drug testing, is anticipated to boost the market’s expansion.

Application Analysis

The medical application segment holds 45.8% of the 3D bioprinting market and is expected to remain the dominant area due to the growing demand for personalized healthcare solutions, including tissue engineering, regenerative medicine, and organ printing. 3D bioprinting in the medical field is anticipated to accelerate as it enables the development of complex tissue structures for drug testing, disease modeling, and the creation of replacement tissues.

As the demand for organ transplants increases, bioprinting offers the potential to create organs tailored to the patient’s specific needs, which is projected to be a game-changer in the field of medicine. The rising prevalence of chronic diseases and the need for customized treatments are expected to further fuel this growth.

Moreover, bioprinted tissues are increasingly used for drug development, allowing for more accurate preclinical testing of new therapies, reducing the need for animal testing, and increasing the speed at which drugs can reach the market. With advances in bioprinting technology, including improvements in cell viability, resolution, and biomaterial innovation, the medical segment is poised for sustained growth. Additionally, regulatory approvals and funding from governments and private organizations are likely to further support innovation and adoption in this field.

Key Market Segments

By Product Type

- Inkjet-based

- Laser-based

- Magnetic Levitation

- Syringe-based

- Others

By Application

- Medical

- Tissue & Organ Generation

- Medical Pills

- Prosthetics & Implants

- Others

- Food & Animal Product

- Dental

- Consumer/Personal Product Testing

- Biosensors

- Bioinks

Drivers

The growing global investment in tissue engineering research is driving the market.

The market for 3D bioprinting is fundamentally propelled by the immense increase in research and development (R&D) funding directed toward regenerative medicine and tissue engineering. This financial injection, primarily from government and private entities, allows for the continuous refinement of bioprinting technology, bio-ink materials, and cell viability protocols, which are critical for the eventual clinical success of bioprinted organs and tissues.

The ability of researchers to create more complex, vascularized, and functional tissue constructs, such as ‘organoids’ or ‘organs-on-chips,’ is directly tied to the level of investment available for experimentation and advanced equipment acquisition. This R&D focus is validating the technology as a viable pathway to personalized medicine, thereby drawing in further commercial interest and driving market expansion from a purely theoretical discipline to one with tangible product pipelines.

For instance, the US National Institutes of Health (NIH) awarded millions in research grants to institutions in 2022 to accelerate the development of bioprinting applications for regenerative medicine, which directly fuels the intellectual and technological foundation of the market. This substantial, directed public funding highlights the government’s vested interest in maturing the technology for eventual clinical translation, acting as a crucial driver for the entire industry.

Restraints

High capital and operational costs are restraining the market.

The widespread adoption of 3D bioprinting technology, particularly in smaller academic institutions and commercial laboratories, is significantly restrained by the extraordinarily high costs associated with both the equipment and the specialized biological materials. Bioprinters themselves are high-precision, complex machines that require substantial capital investment, often costing hundreds of thousands of dollars for advanced, research-grade models.

Moreover, the recurring operational costs, specifically the price of bio-inks and living cell cultures, are substantial, contributing to an unfavorable cost-per-experiment ratio compared to traditional 2D cell culture methods. This financial barrier limits the accessibility of the technology, concentrating advanced research capabilities in only the largest, best-funded institutions, thereby slowing the overall pace of innovation and commercialization by smaller entities.

The financial burden can be quantified in terms of essential material costs: in 2023, the hydrogels segment, a primary material in bioprinting, was estimated to account for approximately $714.8 million in revenue, underscoring the massive cost commitment required for just the consumable bio-materials. This figure illustrates that the core bioprinting inputs represent a significant expenditure, serving as a material restraint on wider, global market entry and rapid scalability.

Opportunities

The development of organ-on-a-chip models for drug discovery is creating growth opportunities.

The application of 3D bioprinting in creating sophisticated ‘organ-on-a-chip’ models for drug discovery and toxicity testing represents one of the most immediate and commercially viable opportunities for the market. These micro-engineered systems mimic the physiological functions and pathological conditions of human organs with far greater accuracy than traditional 2D cell cultures or animal models, offering a superior platform for preclinical drug assessment.

By providing a human-relevant testing environment, these bioprinted models can significantly reduce the high failure rate of drug candidates in human clinical trials, thereby accelerating the time-to-market for new therapeutics and dramatically cutting R&D costs for pharmaceutical companies. The strong demand from the pharmaceutical sector for more predictive models highlights this substantial opportunity.

The drug testing and development segment is forecast to account for a significant share of the market, which is projected to reach approximately $858 million by the year 2030, showing a strong focus on this application area. This clear and measurable commercial application facilitating faster, cheaper, and more accurate drug development provides an immediate revenue pathway and justifies further investment in the underlying bioprinting technology.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic pressures, including elevated interest rates and inflationary strains, challenge innovators in the tissue engineering domain by constraining capital investments and delaying R&D timelines, yet they spur efficiency gains through cost-optimized material formulations that sustain a projected 18.8% compound annual growth rate from 2024 to 2025. Geopolitical tensions, such as supply chain disruptions from regional conflicts, escalate raw material volatility and hinder cross-border collaborations, potentially slowing prototype scaling, but they encourage diversified sourcing strategies that bolster resilience and accelerate domestic talent development in advanced fabrication techniques.

Current U.S. tariffs on imported components and equipment intensify cost burdens for assembly lines, eroding margins and complicating affordability for emerging biotech startups, while simultaneously igniting a rush in localized production that witnessed a 22% surge in entry-level system shipments during the first quarter of 2025 amid preemptive stockpiling. These headwinds, though formidable, catalyze strategic pivots toward tariff-proof ecosystems, positioning forward-thinking enterprises to harness untapped efficiencies and forge pathways to scalable, sovereign advancements in regenerative solutions.

Latest Trends

Increased regulatory engagement by the US FDA is a recent trend.

A prominent trend from 2024 is the increasingly formalized engagement of the U.S. Food and Drug Administration (FDA) with 3D bioprinted products, moving the technology closer to clinical reality. This trend involves the agency developing clearer pathways and frameworks specifically tailored for the evaluation and approval of complex, living products generated by bioprinting, a necessary step for investor confidence and mass-market deployment.

Rather than relying solely on existing medical device or pharmaceutical regulations, the FDA is adapting its approach to address the unique challenges of cell viability, material biocompatibility, and structural integrity of bioprinted tissues. This regulatory clarity is a key indicator of market maturation, signaling that initial products are advancing toward commercial availability.

A significant development demonstrating this momentum is the FDA’s clearance of a tissue-engineered vascular graft in late 2024, a product that leverages principles directly related to advanced tissue construction. This action by the FDA marks a critical milestone, offering a clear regulatory template for future biologics and bioengineered implants and solidifying 2024 as a pivotal year for the commercial-clinical translation of 3D bioprinting.

Regional Analysis

North America is leading the 3D Bioprinting Market

In 2024, North America held a 39.5% share of the global 3D bioprinting market, stimulated by substantial federal investments in regenerative medicine and strategic partnerships between universities and biotech firms to develop vascularized tissue constructs for clinical trials in wound healing and vascular grafts. Research institutions leveraged advanced extrusion-based printers to fabricate patient-specific scaffolds, accelerating pre-clinical validations for liver and kidney models that address organ shortage crises.

The FDA’s accelerated pathways for bio-ink classifications encouraged experimentation with hydrogel composites, enhancing print resolution and cell viability in heterogeneous structures. Collaborative consortia focused on multi-material systems integrated stem cell encapsulation, yielding prototypes for cartilage regeneration in orthopedic applications.

Heightened emphasis on ethical sourcing of biomaterials aligned with national bioethics guidelines, fostering public trust in translational pipelines. Economic rationales from reduced animal testing costs propelled adoption in pharmaceutical screening, optimizing lead compound efficacy assessments. These catalysts underscored the region’s innovation hub status for biofabrication. The National Institute of Biomedical Imaging and Engineering awarded $2 million to Penn State University in 2023 for high-speed 3D bioprinting of bones, tracheas, and organs.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts project the Asia Pacific 3D bioprinting sector to expand during the forecast period, as national agencies prioritize tissue engineering to combat chronic shortages in transplantable organs amid demographic pressures. Governments in China and South Korea allocate resources to state labs for extrusion platforms, equipping researchers to engineer skin substitutes for burn victims in high-incidence regions. Biotech enterprises partner with public institutes to refine laser-assisted deposition techniques, anticipating breakthroughs in corneal reconstruction for aging populations.

Innovation centers in Australia and Singapore pioneer sacrificial ink strategies, positioning academic teams to create perfusable heart patches for cardiovascular simulations. Regional bodies estimate subsidizing open-source software for design optimization, bridging computational gaps in peripheral facilities through grant programs.

Local developers advance electrospinning hybrids, synchronizing with clinical registries to validate neural scaffolds for spinal cord repairs. These endeavors establish the region as a nexus for scalable biofabrication. Japan’s Agency for Medical Research and Development launched the Strengthening Program for Pharmaceutical Startup Ecosystem in 2022, offering subsidies up to 5 billion JPY for biopharma ventures including 3D bioprinting technologies.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading companies in the tissue fabrication sector are driving innovation by investing in extrusion and laser-assisted technologies to accelerate the creation of vascularized organoids for drug screening pipelines. They form strategic partnerships with academic consortia to develop bioinks compatible with stem cell differentiation, enabling the transition from lab discoveries to therapeutic applications. Enterprises are also acquiring intellectual property from startups, incorporating advanced techniques such as magnetic levitation to improve multi-material layering precision.

Decision-makers focus on bringing in talent from biomaterials engineering, forming interdisciplinary teams to address scalability challenges in clinical applications. With a growing presence in regenerative hotspots across Europe and South America, these companies leverage public grants to align innovations with national healthcare priorities. They also deploy milestone-based licensing agreements with pharmaceutical partners, using predictive modeling to reduce investment risks and accelerate commercialization.

Organovo Holdings, Inc., founded in 2007 and headquartered in San Diego, California, is a clinical-stage biotechnology firm specializing in engineering functional three-dimensional human tissues for drug validation before human trials. The company uses its proprietary NovoGen Bioprinter technology to create highly accurate models of liver and intestinal tissues, helping with toxicology assessments and efficacy evaluations for conditions like inflammation.

Organovo is advancing its FXR314 compound through Phase 2 studies for ulcerative colitis, using tissue-derived insights to refine dosing regimens. CEO Keith Murphy leads a focused team dedicated to utilizing predictive preclinical data to streamline development processes. The company collaborates with biopharma partners to develop disease-specific tissue constructs, speeding up the candidate selection process. Organovo strengthens its position as a pioneer in the field by combining cutting-edge fabrication techniques with its therapeutic goals to reshape the landscape of precision medicine.

Top Key Players

- Vivax Bio, LLC

- Regemat 3D S.L.

- Poietis

- Organovo Holdings, Inc.

- Inventia Life Science PTY LTD

- EnvisionTEC, Inc.

- Cyfuse Biomedical K.K.

- Cellink Global

- Allevi

- 3D Bioprinting Solutions

Recent Developments

- In June 2025, researchers at Uppsala University developed lab-grown models resembling human nerve tissue using 3D bioprinting technology. The breakthrough aims to address the challenges of testing treatments for neurodegenerative diseases like ALS, as motor neurons are difficult to access in the spinal cord. Using patients’ skin cells, spinal cord organoids can be created, enabling more effective testing of potential treatment options, contributing to the advancement of regenerative medicine in the wearable medical devices market.

- In April 2025, a collaboration between Black Drop Biodrucker GmbH, NMI Natural and Medical Sciences Institute, and TU Darmstadt led to the development of a new bioink that enhances nutrient transport in printed tissue. This breakthrough has significant implications for tissue engineering and regenerative medicine, contributing to the evolution of bioprinted medical devices used in wearable healthcare technologies.

- In April 2025, Carnegie Mellon University announced the successful printing of insulin-producing pancreatic tissue using its FRESH (Functional Regenerative Embedding of Stem Cells in Hydrogel) method. This breakthrough has significant implications for regenerative medicine and diabetes treatment, with FluidForm Bio aiming to move toward clinical trials. This innovation is a major step forward in the 3D bioprinting market, as it demonstrates the potential of bioprinting to produce functional tissues for disease treatment, particularly for chronic conditions like diabetes. The successful creation of insulin-producing tissue shows the expanding capabilities of 3D bioprinting, driving the market forward by highlighting the technology’s potential to revolutionize healthcare solutions, offering personalized and scalable treatments.

Report Scope

Report Features Description Market Value (2024) US$ 2.8 Billion Forecast Revenue (2034) US$ 9.2 Billion CAGR (2025-2034) 12.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Inkjet-based, Laser-based, Magnetic Levitation, Syringe-based, and Others), By Application (Medical (Tissue & Organ Generation, Medical Pills, Prosthetics & Implants, and Others), Food & Animal Product, Dental, Consumer/Personal Product Testing, Biosensors, and Bioinks) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Vivax Bio, LLC, Regemat 3D S.L., Poietis, Organovo Holdings, Inc., Inventia Life Science PTY LTD, EnvisionTEC, Inc., Cyfuse Biomedical K.K., Cellink Global, Allevi, 3D Bioprinting Solutions. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Vivax Bio, LLC

- Regemat 3D S.L.

- Poietis

- Organovo Holdings, Inc.

- Inventia Life Science PTY LTD

- EnvisionTEC, Inc.

- Cyfuse Biomedical K.K.

- Cellink Global

- Allevi

- 3D Bioprinting Solutions