Global 2-methyl Quinoline Market Size, Share, and Industry Analysis Report By Purity (98 percent, 99 percent, Others), By Application (Pharmaceuticals, Agrochemicals, Dyes, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 172987

- Number of Pages: 222

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

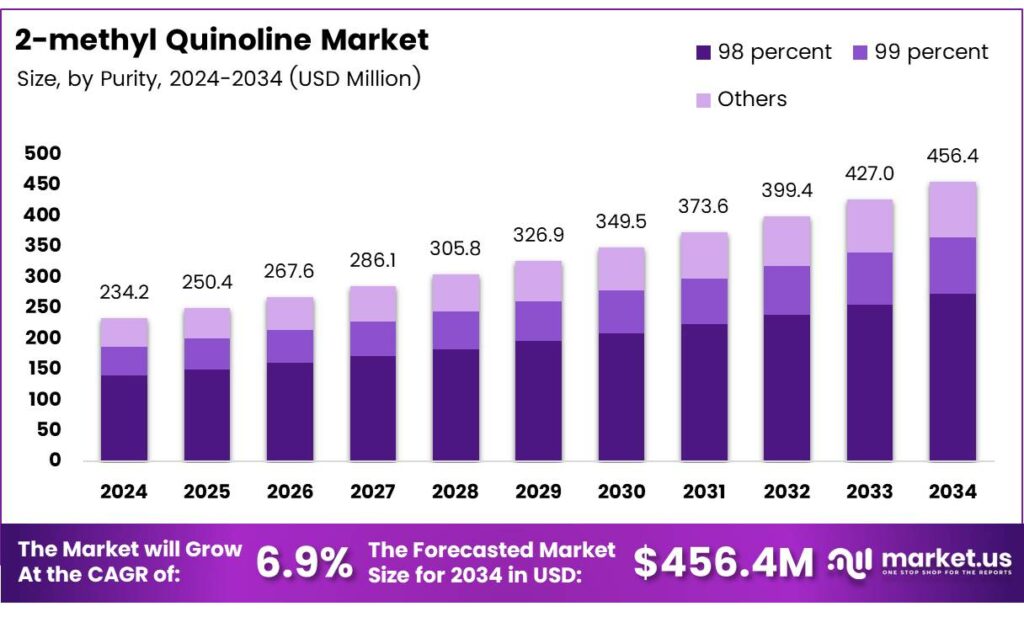

The Global 2-methyl Quinoline Market size is expected to be worth around USD 456.4 million by 2034, from USD 234.2 million in 2024, growing at a CAGR of 6.9% during the forecast period from 2025 to 2034.

The 2-methylquinoline is best understood as a specialty heterocyclic chemical used as an intermediate across pharmaceuticals, agrochemicals, dyes, and specialty synthesis routes. It supports downstream value chains where purity, reaction stability, and controlled reactivity directly influence final product performance and regulatory acceptance.

The 2-methylquinoline market remains niche but strategically important, driven by steady demand from fine chemical manufacturing and custom synthesis activities. Growth is supported by rising pharmaceutical intermediate demand, increasing agrochemical formulation volumes, and broader adoption of quinoline derivatives in functional chemical research pipelines.

Indexes, 2-methylquinoline is a light-sensitive crystalline powder ranging from white to slightly yellow in appearance. It has a melting point of –2 °C, a boiling point of 248 °C, and a density of 1.058 g/mL at 25 °C. These physical characteristics support predictable processing, controlled distillation, and stable performance during industrial synthesis and downstream formulation activities.

- Physicochemical references note that 2-methylquinoline exhibits a very low vapor pressure of <0.1 hPa at 20 °C, along with a refractive index of 1.612 and a flash point of 175 °F. It requires storage below +30 °C to maintain stability. These parameters directly influence packaging selection, transportation safety protocols, and compliant industrial handling practices.

2-methylquinoline is practically insoluble in water but soluble in chloroform, with a saturated aqueous solution showing a pH of 6.9 at 20 °C. A pKa value of 5.83 and logP of 2.59 indicate moderate lipophilicity and controlled chemical reactivity. Identifiers such as Merck Index 14,8047, BRN 110309, and CAS 91-63-4 support traceability, regulatory compliance, and transactional confidence across the market value chain.

Key Takeaways

- The Global 2-methylquinoline Market is projected to grow from USD 234.2 million in 2024 to USD 456.4 million by 2034, registering a 6.9% CAGR during 2025–2034.

- The 98 percent grade leads the market with a dominant share of 54.4%, supported by cost efficiency and broad industrial usability.

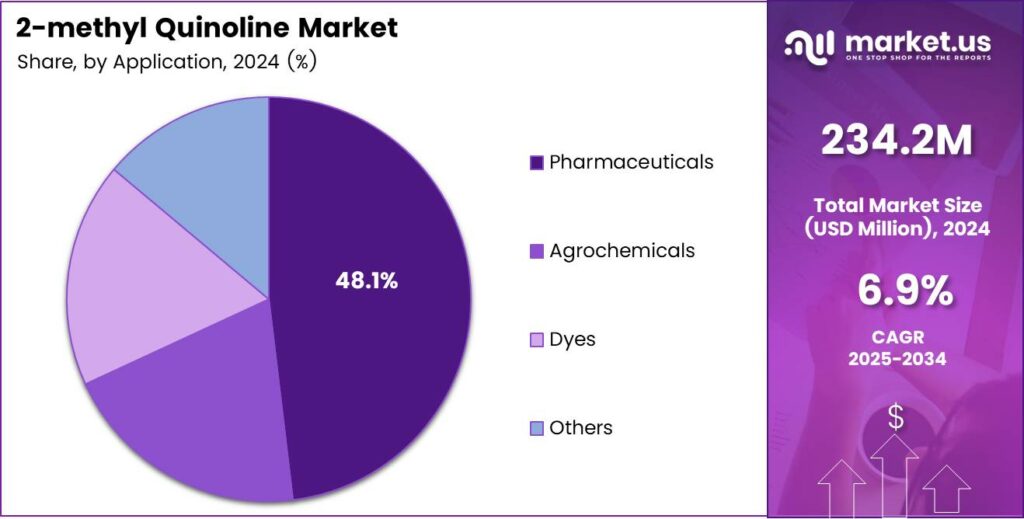

- Pharmaceuticals dominate with a market share of 48.1%, reflecting strong reliance on 2-methylquinoline as a drug synthesis intermediate.

- Asia Pacific is the leading region, accounting for 43.2% of global revenue and valued at USD 101.1 million in 2024.

By Purity Analysis

98 percent dominates with 54.4% due to its balance of performance and cost efficiency.

In 2024, 98 percent held a dominant market position in the By Purity Analysis segment of the 2-methyl Quinoline Market, with a 54.4% share. This grade is widely preferred as it offers reliable chemical stability while remaining economically practical. As a result, it is commonly adopted across routine industrial and formulation-based uses.

The 99 percent purity segment follows closely, driven by demand from applications that require higher consistency and tighter quality control. Although more expensive, this grade is chosen where performance reliability is critical. Gradually, it is gaining attention in value-added and specialty chemical production environments.

The Others category includes customized and lower-purity variants tailored for niche or non-critical applications. These grades are often selected for experimental, intermediary, or cost-sensitive uses. While smaller in scale, this segment supports flexibility in supply and addresses diverse operational needs.

By Application Analysis

Pharmaceuticals dominate with 48.1% supported by steady medicinal compound demand.

In 2024, Pharmaceuticals held a dominant market position in the By Application Analysis segment of the 2-methyl Quinoline Market, with a 48.1% share. This dominance is linked to its role as an intermediate in drug synthesis. Consistent demand and regulatory-driven quality need to support its strong position.

The Agrochemicals segment represents a significant application area, benefiting from its use in crop protection and chemical intermediates. Growth here is supported by ongoing agricultural productivity needs. Although smaller than pharmaceuticals, it remains a stable and recurring source of demand.

The Dyes segment relies on 2-methyl Quinoline for producing colorants used in textiles and industrial coloring. This application benefits from steady manufacturing activity. Demand fluctuates with fashion and industrial cycles, yet it remains an essential supporting segment.

The Others category includes laboratory research, specialty formulations, and minor industrial uses. While limited in volume, it plays an important role in innovation and customization. Together, these applications ensure balanced and diversified market utilization.

Key Market Segments

By Purity

- 98 percent

- 99 percent

- Others

By Application

- Pharmaceuticals

- Agrochemicals

- Dyes

- Others

Emerging Trends

Shift Toward High-Purity and Process-Optimized Production Shapes Market Trends

The 2-methylquinoline market is growing focus on high-purity grades. Pharmaceutical and fine chemical manufacturers increasingly demand consistent quality to meet strict formulation and regulatory requirements. This pushes suppliers to invest in advanced purification and quality control systems.

- 2-methylquinoline is a fine chemical — a high-value intermediate produced in small volumes (usually less than 1,000 tonnes per year worldwide) for use in pharmaceuticals and specialty products. Fine chemicals typically sell for more than $10 per kilogram, reflecting their precision use and strict quality needs.

Producers are improving reaction efficiency, yield, and waste reduction to align with sustainability goals. Cleaner production processes not only reduce costs but also help companies meet environmental compliance standards. Supply chain localization is also gaining attention.

Drivers

Rising Use of 2-Methylquinoline in Pharmaceutical Intermediates Drives Market Demand

The 2-methylquinoline market is mainly driven by its growing use as a key intermediate in pharmaceutical manufacturing. Many drug molecules and active pharmaceutical ingredients rely on quinoline derivatives because of their stable chemical structure and predictable reactivity.

The steady growth of agrochemical production. 2-methylquinoline is used in the synthesis of crop protection chemicals that help improve yield and protect crops from pests and diseases. Rising global food demand and pressure on agricultural productivity support the continuous consumption of such intermediates.

The compound is also valued in dye and pigment manufacturing. Its ability to support color stability and chemical bonding makes it useful in specialty dyes. Expansion of the textile, leather, and specialty coating industries indirectly supports market growth. As pharmaceutical companies expand production of antibiotics, anti-malarial drugs, and specialty therapeutics.

Restraints

Stringent Environmental and Handling Regulations Restrain Market Expansion

One of the main restraints in the 2-methylquinoline market is increasing regulatory pressure related to chemical handling and environmental safety. As a nitrogen-containing heterocyclic compound, it requires controlled storage, transport, and disposal. Compliance with safety standards raises operational costs for manufacturers and distributors.

- Environmental concerns also limit wider adoption. Regulations related to emissions, wastewater discharge, and hazardous waste management can slow down production expansion, especially for small and mid-scale producers. Led chemical manufacturers to maintain high standards of purity — often >98% for pharmaceutical grade materials — which in turn supports higher prices and stable demand for 2-methylquinoline.

Health and safety risks during manufacturing are another restraint. Prolonged exposure can pose occupational hazards, requiring protective equipment, training, and controlled environments. These requirements increase overhead costs and reduce flexibility in operations.

Growth Factors

Expansion of Specialty Chemicals Manufacturing Creates New Growth Opportunities

Growth opportunities in the 2-methylquinoline market are closely linked to the expansion of specialty chemical production worldwide. Increasing demand for high-value intermediates in pharmaceuticals, agrochemicals, and advanced materials opens new application areas for this compound. Manufacturers focusing on high-purity grades can benefit from premium pricing.

Emerging markets present strong opportunities as local pharmaceutical and agrochemical industries scale up domestic production. Governments in several regions are promoting local chemical manufacturing to reduce import dependence, which supports demand for core intermediates like 2-methylquinoline.

Process optimization and cleaner synthesis technologies also create opportunities. Adoption of improved catalysts and energy-efficient production methods can reduce environmental impact and operating costs, making production more sustainable and competitive.

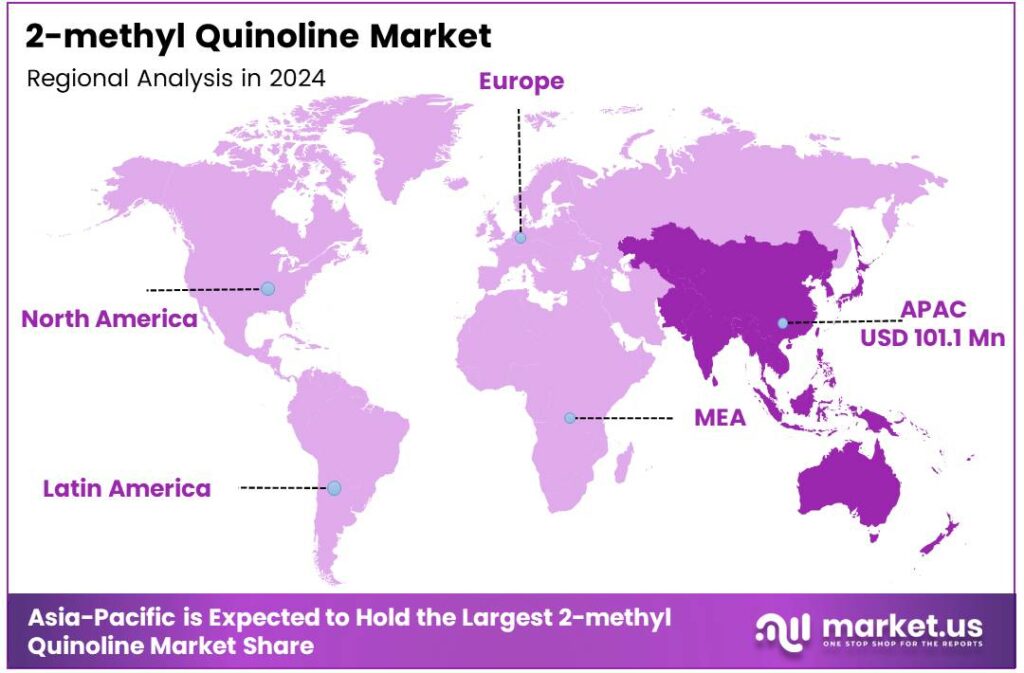

Regional Analysis

Asia Pacific Dominates the 2-Methylquinoline Market with a Market Share of 43.2%, Valued at USD 101.1 Million

Asia Pacific leads the 2-methylquinoline market due to strong demand from pharmaceuticals, agrochemicals, and dye intermediates across key manufacturing economies. The region benefits from large-scale chemical production capacity, cost-efficient synthesis, and growing downstream consumption. In 2024, Asia Pacific accounted for a dominant 43.2% share, generating USD 101.1 Million in revenue, supported by rising export activity and expanding specialty chemical applications.

North America represents a mature and technology-driven market, supported by stable demand from pharmaceutical synthesis and specialty chemical research. Strict quality standards and a focus on high-purity grades support consistent consumption. Growth remains steady, with demand driven by innovation-led applications rather than volume expansion.

Europe shows moderate but stable demand, backed by regulated pharmaceutical manufacturing and fine chemical usage. Environmental compliance and controlled production practices shape market dynamics. The region emphasizes value-added applications, with steady uptake in research-oriented and specialty formulation uses.

The Middle East and Africa market is emerging, supported by the gradual development of the chemical processing and pharmaceutical sectors. Demand is primarily import-driven, with increasing interest in downstream chemical diversification. Infrastructure investments are expected to support incremental growth over time.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE continues to play a stabilizing role in the global 2-methylquinoline market through its deep integration across downstream chemical value chains. Its strong process control, regulatory discipline, and ability to align 2-methylquinoline output with pharmaceutical and agrochemical intermediates support consistent demand from high-compliance end users.

Changzhou Sunlight Pharmaceutical Co., Ltd. is viewed as a key China-based supplier benefiting from proximity to pharmaceutical synthesis clusters. The company’s focus on cost-efficient production and steady domestic demand positions it well to serve both local formulators and export-oriented customers seeking reliable volumes of 2-methylquinoline.

China Skyrun Industrial Co., Ltd. has built a competitive edge by aligning 2-methylquinoline supply with broader heterocyclic and fine-chemical portfolios. Analysts note that its flexible manufacturing setup allows faster response to shifting application demand, particularly from agrochemical and specialty chemical manufacturers.

Eastman Chemical Company brings global market credibility through its emphasis on quality assurance, supply reliability, and long-term customer relationships. In 2024, its role in the 2-methylquinoline market is shaped less by volume leadership and more by serving high-specification applications where consistency, documentation, and global logistics capabilities are critical.

Top Key Players in the Market

- BASF SE

- Changzhou Sunlight Pharmaceutical Co., Ltd.

- China Skyrun Industrial Co., Ltd.

- Eastman Chemical Company

- Fujifilm Wako Pure Chemical Corporation

- Hubei Greenhome Fine Chemical Co., Ltd.

- Nanjing Chemlin Chemical Industry Co., Ltd.

- Shandong Taihe Chemicals Co., Ltd.

Recent Developments

- In 2024, BASF SE has been involved in advancements related to materials science, incorporating derivatives of 2-methylquinoline. Porous metal-organic framework (MOF) materials, where 2-methylquinoline-3,4-dicarboxylic acid serves as one of the bidentate organic ligands that coordinates with metal ions (such as copper or zinc) to form the framework.

- In 2025, the Fujifilm group specializes in laboratory chemicals, reagents, and fine chemicals. They offer 2-methylquinoline (also known as quinaldine) as a product in their catalog, listed under Wako 1st Grade with a specification assay of 80% (Capillary GC). It’s stored at room temperature and protected from light.

Report Scope

Report Features Description Market Value (2024) USD 234.2 Million Forecast Revenue (2034) USD 456.4 Million CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (98 percent, 99 percent, Others), By Application (Pharmaceuticals, Agrochemicals, Dyes, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape BASF SE, Changzhou Sunlight Pharmaceutical Co., Ltd., China Skyrun Industrial Co., Ltd., Eastman Chemical Company, Fujifilm Wako Pure Chemical Corporation, Hubei Greenhome Fine Chemical Co., Ltd., Nanjing Chemlin Chemical Industry Co., Ltd., Shandong Taihe Chemicals Co., Ltd. Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  2-methyl Quinoline MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

2-methyl Quinoline MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Changzhou Sunlight Pharmaceutical Co., Ltd.

- China Skyrun Industrial Co., Ltd.

- Eastman Chemical Company

- Fujifilm Wako Pure Chemical Corporation

- Hubei Greenhome Fine Chemical Co., Ltd.

- Nanjing Chemlin Chemical Industry Co., Ltd.

- Shandong Taihe Chemicals Co., Ltd.