Quick Navigation

Overview

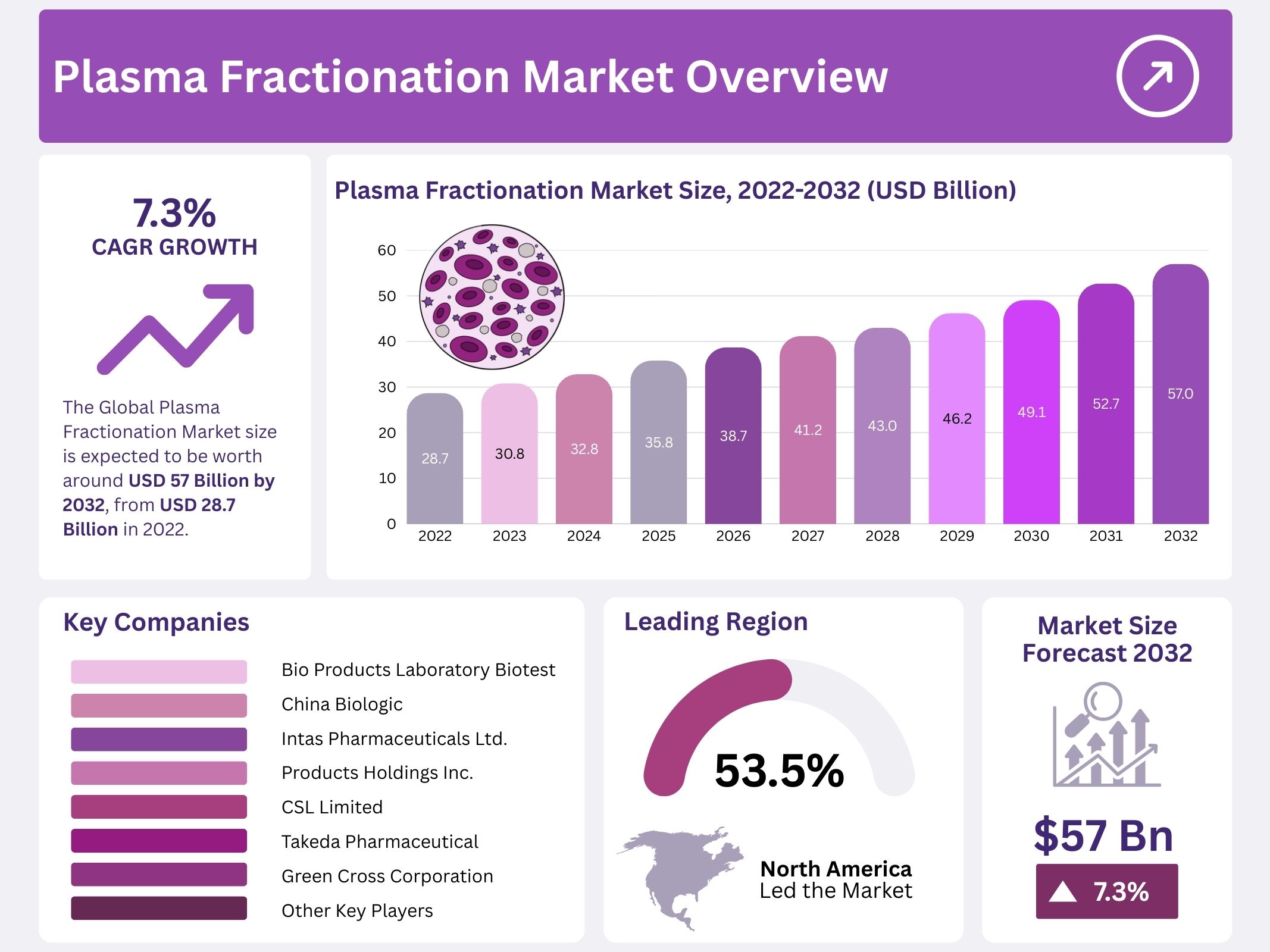

The Global Plasma Fractionation Market was valued at USD 28.7 billion in 2022 and is projected to reach USD 57.0 billion by 2032. The market is expected to grow at a CAGR of 7.3% between 2023 and 2032. Plasma fractionation is a process of separating plasma into components such as albumin, immunoglobulins, and coagulation factors. These plasma-derived products are widely used in the treatment of rare and chronic diseases, immune deficiencies, and bleeding disorders.

The rising prevalence of chronic and rare diseases is a major driver of market growth. Plasma-derived therapies, including coagulation factor concentrates, play a vital role in treating hemophilia and controlling excessive bleeding during surgeries. Immunoglobulins are increasingly being prescribed for patients with primary and secondary immune deficiencies, as well as autoimmune and inflammatory disorders. This sustained demand for long-term therapies continues to strengthen the adoption of plasma fractionation globally.

The aging population is contributing significantly to market expansion. Elderly individuals are more vulnerable to immune deficiencies, neurological disorders, and liver-related conditions, all of which require plasma-based treatments. Parallel to this, rising awareness of rare diseases through patient advocacy programs and global health campaigns has improved diagnosis rates. Early detection ensures timely therapy initiation, further driving the use of plasma-derived products.

Technological advancements are reshaping the industry. Chromatographic separation and improved virus inactivation methods have enhanced product safety, efficiency, and yield. At the same time, governments are promoting voluntary plasma donations and expanding plasma collection networks. Advanced plasmapheresis techniques and supportive regulations ensure consistent supply and high-quality standards, enabling wider access to therapies and improving trade opportunities across international markets.

Emerging economies such as China, India, and Brazil are creating new avenues for growth. These regions are witnessing rapid healthcare infrastructure development, rising insurance coverage, and increased expenditure on advanced treatments. Pharmaceutical companies are also investing in acquisitions, collaborations, and new plasma collection centers to strengthen their supply chains and expand their product portfolios. Together, these strategic efforts, coupled with favorable reimbursement policies, are expected to accelerate global market expansion over the coming years.

Key Takeaways

- The global plasma-derived therapy market is projected to reach USD 57.0 billion by 2032, expanding steadily at a compound annual growth rate of 7.3%.

- Immunoglobulins represent the largest product segment in this market, followed by coagulation factors and albumin, reflecting their broad clinical applications and high therapeutic demand.

- Centrifugation is the most widely utilized method for plasma fractionation, while chromatography and depth filtration also hold significant roles in downstream processing.

- Neurology emerges as the leading application area, with hematology and oncology following closely, driven by rising treatment needs for complex neurological and hematological disorders.

- Hospitals and clinics dominate as the primary end-users, whereas academic institutes and clinical research laboratories form the second largest share in the plasma-derived therapies market.

- Growth is driven by increasing incidences of immunodeficiency disorders, expanded use of plasma-derived therapies across specialties, and demand for advanced treatments for complex medical conditions.

- However, the emergence of recombinant therapies as effective alternatives poses a key restraint, challenging the continued adoption of plasma-derived medicines in some therapeutic areas.

Regional Analysis

In 2022, North America accounted for 53.5% of the total market share. The dominance of this region is supported by the presence of significant market players. Growth is also attributed to the expansion of plasma collection facilities and the increasing consumption of immunoglobulins. Furthermore, the feasibility of plasma collection and distribution has enhanced the supply capacity, contributing to the overall regional expansion. These factors establish North America as a leading contributor to global market development in plasma fractionation.

The Asia-Pacific market is experiencing steady growth in plasma fractionation products. This progress is driven by increased research and development funding from public and private sectors. Supportive government regulations and rising immunoglobulin usage further strengthen market prospects. Additionally, the increasing prevalence of targeted diseases in the aging population has created a higher demand for blood-related treatments. These conditions have expanded the application of plasma-based products across healthcare facilities, positioning Asia-Pacific as a key growth hub in the forecast period.

The market expansion in North America is also supported by rising awareness of plasma-based therapies. Increasing cases of respiratory diseases and other chronic health conditions have heightened the demand for plasma treatments. The adoption of plasma therapies has grown significantly in addressing breathing problems and blood-related disorders. Moreover, enhanced awareness campaigns have contributed to higher revenue growth in this region. Collectively, these drivers reinforce North America’s strong position in the plasma fractionation market while also setting the stage for further long-term advancements.

Segmentation Analysis

The plasma fractionation market has been significantly influenced by the growing demand for immunoglobulins. Their increasing application in primary and secondary immune deficiencies, autoimmune disorders, and inflammatory diseases has driven this growth. Research advancements in immunology have further strengthened this trend. In 2022, immunoglobulins were expected to account for the largest share of the global plasma fractionation market. The abundance of plasma-derived immunoglobulins and their broad therapeutic usage, particularly in immunodeficiency treatment, played a vital role in the segment’s expansion within the overall market structure.

On the product basis, the market is segmented into immunoglobulins, coagulation concentrates, albumins, and protease inhibitors. Among these, immunoglobulins have remained the largest and fastest-growing category. Their rising therapeutic applications across multiple medical fields support this dominance. Increasing demand for high-quality treatments and reliable plasma-derived products has enhanced this trend. The product segment is also expected to witness continuous growth due to wider usage across chronic and rare disease treatments, ensuring consistent demand and broad acceptance within the global healthcare sector.

By method, centrifugation captured the highest share of 33.32% in 2021 and is projected to grow at the fastest pace during the forecast period. The method supports high-quality blood separation and ensures improved clinical outcomes. Rising adoption of centrifugation instruments is expected to accelerate market expansion. At the same time, advances in chromatographic fractionation and filtration techniques have enhanced plasma protein production. The development of new therapeutic solutions such as protease inhibitors and anticoagulants through chromatography is creating new opportunities and further driving industry growth.

In terms of applications, immunoglobulins accounted for a significant share in 2022 due to their role in treating immunodeficiency disorders. Their advantages in metabolic disorder management, immunosenescence, and targeted therapies have supported growth. Neurology was also a leading field, supported by the rising incidence of neurological diseases and the increased use of plasma-derived products for treatment. End users such as hospitals and clinics dominated the market owing to rising healthcare spending, expansion of facilities, and increasing adoption of plasma-based therapies. Academic institutes and research laboratories also contributed to the segment’s expansion.

Key Players Analysis

The plasma fractionation market is experiencing significant growth, driven by expansion strategies and investments from key players. Companies are focusing on partnerships, mergers, acquisitions, and regional expansions to strengthen their positions. New facilities, such as a 117,000-square-foot unit producing single-use collection devices for the FDA-9 Rika Plasma Donation system, highlight advancements in supply plasma collection. Strategic collaborations are enabling wider customer reach, while technological developments and infrastructure investments are ensuring greater efficiency in production and distribution.

Major companies in this market are directing efforts toward large-scale manufacturing facilities to meet the rising demand for plasma-derived therapies. For instance, a facility costing US$250 million has been developed to produce advanced medical supplies aimed at supporting society and addressing healthcare needs. Terumo Blood and Cellular Technology, located in Douglas County, Colorado, illustrates the expansion of capacity beyond 2022. These investments are intended to create sustainable supply chains and reinforce commitments to improving accessibility of plasma-based therapies globally.

The market is led by notable players, including Bio Products Laboratory, Biotest AG, China Biologic, Intas Pharmaceuticals Ltd., CSL Limited, Takeda Pharmaceutical Company Limited, Green Cross Corporation, and Grifols. These companies are adopting strategies such as product innovation, international collaborations, and technological enhancements to gain competitive advantage. Alongside these leaders, several emerging participants are also contributing to the industry landscape. Collectively, these efforts are fostering innovation, accelerating plasma supply capabilities, and supporting the growing demand for therapeutic solutions worldwide.

Market Key Players

- Bio Products Laboratory Biotest AG

- China Biologic

- Intas Pharmaceuticals Ltd.

- Products Holdings Inc.

- CSL Limited

- Takeda Pharmaceutical Company Limited

- Green Cross Corporation

- Grifols

- Other Key Players

Challenges and Opportunities

Challenges

1. High Capital Investment

Setting up plasma fractionation facilities demands very high financial investment. The costs cover infrastructure, advanced equipment, and cutting-edge technology. Such requirements create significant entry barriers for new companies. Emerging players often struggle to secure the necessary funds, which restricts competition. Established companies hold an advantage because they can absorb the costs and achieve economies of scale. Investors also face long payback periods, making the sector less attractive for quick returns. As a result, capital intensity continues to limit growth for smaller firms, consolidating market power among leading players with deep financial resources.

2. Regulatory and Compliance Complexity

The plasma fractionation sector operates under strict regulatory frameworks. Agencies such as the FDA, EMA, and WHO enforce detailed guidelines for plasma collection, processing, and product approval. Meeting these standards requires extensive documentation, audits, and monitoring. Compliance delays product development and increases operational costs. Any deviation can result in penalties, recalls, or restrictions on product sales. Smaller firms face particular difficulties due to limited resources. As regulations evolve, continuous adaptation is necessary, adding to compliance burdens. This complexity extends timelines and raises risks, creating major barriers for companies seeking to launch or expand plasma-derived therapies.

3. Limited Plasma Supply

Human plasma is the only source for fractionation and depends entirely on voluntary donations. The supply is unpredictable and can be disrupted by donor shortages or stricter eligibility rules. Seasonal variations and regional differences further limit availability. Events such as pandemics or geopolitical issues also restrict donation activities. Since demand for plasma-derived therapies is growing worldwide, the imbalance between supply and demand intensifies. This shortage pressures manufacturers, who must compete for plasma procurement. Expanding donor recruitment campaigns and improving collection infrastructure remain critical, but progress is slow, making supply stability a continuing challenge for the industry.

4. Product Safety and Quality Concerns

Ensuring product safety is one of the greatest challenges in plasma fractionation. Risks of contamination, viral transmission, and immune reactions must be carefully managed. Advanced pathogen inactivation, viral testing, and filtration methods are required. While these technologies reduce risks, they also raise production costs. Regulatory authorities demand rigorous safety checks, further lengthening timelines. Any compromise in safety damages trust and can result in bans or recalls. Manufacturers must constantly invest in quality control systems and updated technologies. Balancing safety, compliance, and cost efficiency remains a complex challenge for the sector, impacting margins and patient confidence.

5. Operational Challenges

Plasma fractionation is a highly complex and time-consuming process. It requires multiple steps such as cryoprecipitation, chromatography, and ultrafiltration. These steps must be carried out with precision to ensure yield and product quality. The industry depends on skilled professionals, and shortages of trained staff slow operations. Process inefficiencies and batch failures can lead to delays and losses. Scaling up production adds further complications, as even minor errors have significant impacts. Continuous staff training and process optimization are essential, yet costly. These operational hurdles make plasma fractionation a demanding industry with high risks and operational pressures.

6. Price Pressures

The plasma fractionation market faces increasing pricing pressures. Competition among established global players intensifies as demand grows. At the same time, governments and insurance providers impose strict cost-containment measures. This reduces profit margins for manufacturers. Balancing affordability for patients while covering high production costs creates tension. Expensive compliance, safety technologies, and supply challenges further squeeze margins. Smaller companies find it difficult to compete under such financial pressure. Price reductions also limit investments in innovation and expansion. The growing demand for affordable plasma-derived therapies ensures that price pressure will remain a persistent and significant industry challenge.

Opportunities

1. Growing Demand for Plasma-Derived Therapies

The demand for plasma-derived therapies is increasing due to the rising incidence of rare diseases and chronic conditions. Patients with hemophilia, immune deficiencies, and neurological disorders depend on products like immunoglobulins, albumin, and clotting factors. The global burden of these diseases continues to grow. This is driving healthcare providers to rely more on plasma therapies for long-term treatment and management. The trend is further supported by better diagnostic rates and improved healthcare access. As awareness of these conditions rises, the need for plasma-derived treatments is expected to expand, creating strong opportunities for industry players.

2. Expansion in Emerging Markets

Emerging markets in Asia-Pacific, Latin America, and the Middle East are witnessing rapid growth in healthcare spending. Governments in these regions are supporting the development of plasma fractionation facilities. Public and private investments are improving the supply chain and infrastructure for plasma therapies. With rising patient populations and growing access to advanced healthcare, the demand for plasma-derived products is increasing. Supportive government initiatives, along with rising medical tourism in some regions, are accelerating growth. These markets offer high potential for global plasma companies to expand their operations and strengthen their long-term presence in new geographies.

3. Technological Advancements

Technological innovation is transforming the plasma fractionation industry. Modern purification techniques and pathogen inactivation methods have improved safety standards. Automation and process optimization are increasing production efficiency while reducing costs. These advancements allow manufacturers to improve product yield and maintain strict compliance with regulatory requirements. Faster, safer, and more efficient production processes are enhancing trust in plasma-derived therapies. Companies adopting new technologies are also achieving better scalability and reduced contamination risks. Continuous research in biotechnology and plasma science ensures steady improvements. This trend provides long-term opportunities for firms investing in advanced plasma fractionation technologies.

4. Rising Awareness and Plasma Donation Initiatives

Awareness about plasma donation is increasing worldwide. Governments and non-government organizations are actively running campaigns to encourage voluntary plasma donation. Improved awareness is leading to better availability of plasma for medical use. Donation programs supported by hospitals, blood banks, and advocacy groups are ensuring steady supply chains. This has a direct impact on the production of immunoglobulins, albumin, and other life-saving products. Enhanced donor education and transparent policies are also improving participation rates. With the growth of such initiatives, the availability of raw plasma materials will expand. This will strengthen industry growth and ensure treatment accessibility.

5. Strategic Collaborations

Partnerships are becoming an important growth driver in the plasma fractionation sector. Biopharmaceutical companies are working with contract manufacturing organizations and government health agencies. These collaborations increase production capacity and support compliance with regulatory frameworks. Joint ventures also enable faster market penetration and better patient outreach. Companies are pooling resources to expand their presence in emerging markets. Partnerships also allow shared research, technology exchange, and improved risk management. Such strategic collaborations strengthen global supply chains and help firms overcome infrastructure challenges. This trend is expected to continue, driving long-term market growth and innovation.

6. Diversification of Plasma Products

The plasma fractionation industry is moving beyond traditional products such as immunoglobulins and albumin. Companies are investing in the development of specialized plasma-derived products for oncology, infectious diseases, and wound care. Expanding into new therapeutic areas provides additional revenue streams and reduces reliance on existing products. Innovation in product portfolios also improves treatment options for patients with complex conditions. As demand for advanced therapies increases, diversification creates strong growth opportunities. Companies focusing on expanding their product lines are likely to gain a competitive advantage. This trend is shaping the future direction of the plasma industry.

7. Personalized and Niche Treatments

Biotechnology and precision medicine are creating opportunities for personalized plasma-derived therapies. These therapies can be tailored to meet specific patient needs in rare or complex medical cases. Advances in genetic profiling and diagnostic tools are supporting this trend. Personalized treatment approaches improve patient outcomes and increase demand for specialized plasma products. The industry is also witnessing growth in niche markets where therapies are designed for small patient groups. Although such treatments require advanced infrastructure, they offer higher value and clinical effectiveness. This focus on targeted therapies is expected to shape future innovation in the plasma fractionation market.

Conclusion

The plasma fractionation market is showing strong and steady growth, supported by rising demand for therapies that treat rare and chronic diseases. The increasing use of plasma-derived products such as immunoglobulins and coagulation factors highlights their importance in modern healthcare. Advances in technology and supportive government initiatives are further strengthening production capacity and safety standards. Growing healthcare needs in emerging economies are creating new opportunities, while strategic collaborations and facility expansions are improving supply chains. Although challenges like high costs, strict regulations, and limited plasma supply remain, continuous innovation and global awareness are expected to ensure the long-term expansion of the plasma fractionation industry.

Get in Touch with Us:

Market.us (Powered By Prudour Pvt. Ltd.)

Address: 420 Lexington Avenue, Suite 300, New York City, NY 10170, United States.

Contact No: +1 718 874 1545 (International), +91 78878 22626 (Asia).

Email: [email protected]

View More

Platelet Rich Plasma Market || Mycoplasma Testing Market || Blood Plasma Fractionation Market || Blood Plasma Freezer Market || Plasma Protein Products Market || Plasma Derived Medicine Market