Quick Navigation

Overview

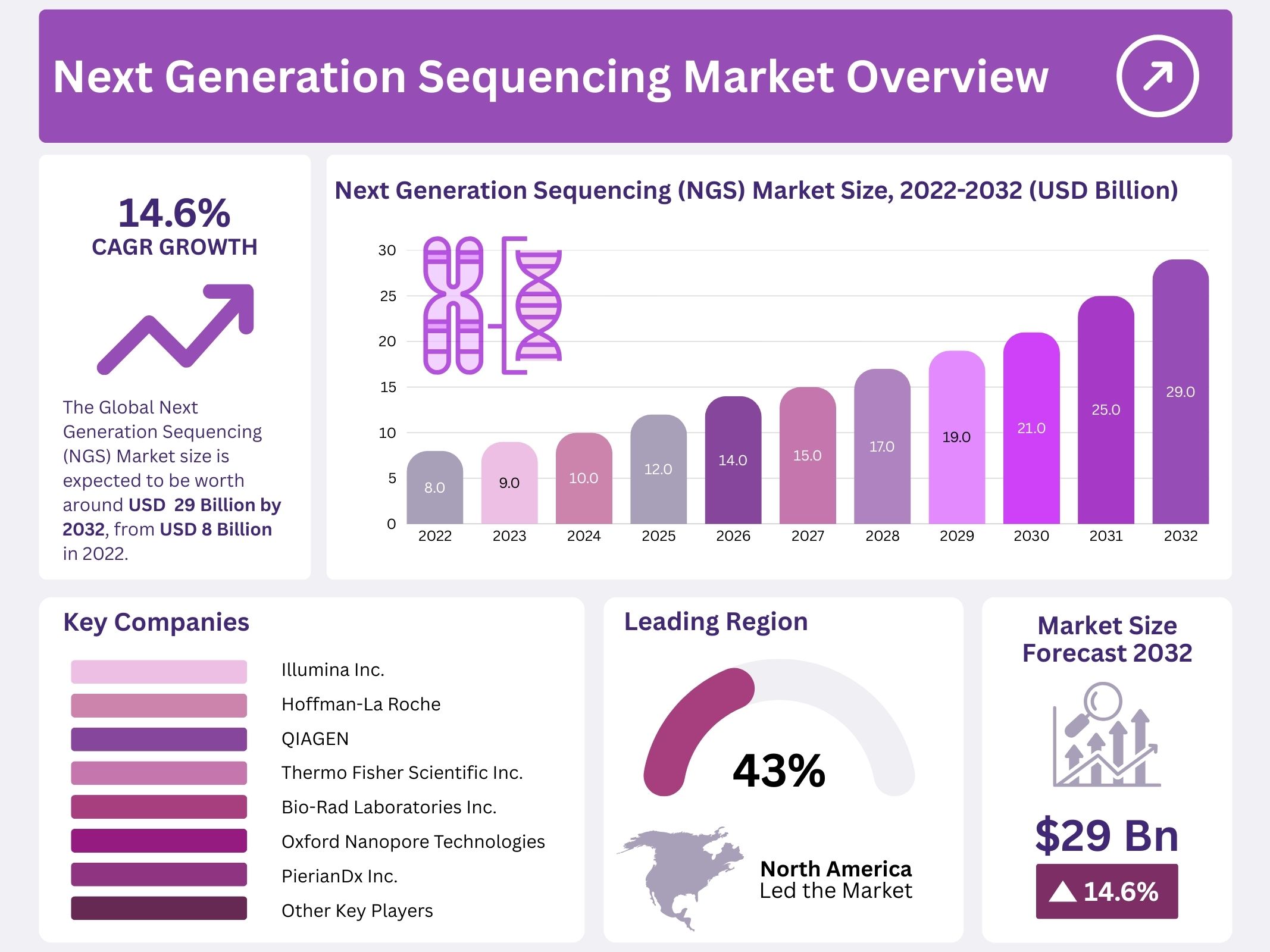

The global Next Generation Sequencing (NGS) Market was valued at USD 8 billion in 2022 and is projected to reach nearly USD 29 billion by 2032, registering a CAGR of 14.6% during the forecast period. NGS refers to a set of advanced sequencing technologies that allow faster, cheaper, and more accurate DNA and RNA sequencing compared to traditional methods such as Sanger sequencing. These techniques have transformed genomic research, clinical diagnostics, and molecular biology by enabling large-scale and high-throughput analysis.

A key factor driving market growth is the increasing adoption of NGS in clinical diagnostics. Its application in detecting rare diseases, infectious pathogens, and genetic disorders has expanded significantly. During the COVID-19 pandemic, NGS played a vital role in sequencing viral samples and accelerating vaccine development. For instance, Oxford Nanopore Technologies’ MinION Mk1C device was used by Chinese researchers to sequence COVID-19 samples. Partnerships among healthcare companies, such as OPKO Health and GeneDx, further highlight the integration of NGS into neonatal and rare disease diagnostics.

Technological advancements in NGS instrumentation and methods are fueling further market expansion. Companies are innovating new platforms that integrate enzymatic DNA synthesis with sequencing. Government-led genome mapping projects, such as the French Plan for Genomic Medicine 2025 and the U.K.’s 100,000 Genomes Project, are contributing to the generation of large-scale genomic databases. These initiatives support better disease understanding, cancer research, and drug development while expanding opportunities for bioinformatics services.

The rapid rise of genomics programs across nations is another significant growth driver. NGS is increasingly used in pharmacogenomics, enabling faster drug discovery and personalized medicine approaches. Its efficiency, cost-effectiveness, and ability to deliver rapid results make it an essential tool for laboratories and clinical research centers. Supported by government backing and proactive healthcare adoption, NGS has become a promising technology for diagnosis, treatment, and biomedical research worldwide.

Key Takeaways

- The global next-generation sequencing (NGS) market was valued at USD 7.6 billion in 2022, reflecting strong demand across multiple applications.

- The market is anticipated to expand at a CAGR of 14.6% from 2023 to 2032, indicating consistent growth prospects over the forecast period.

- Incremental revenue generation is projected to reach USD 29.7 billion by 2032, showcasing significant long-term opportunities in the NGS industry.

- Based on technology, the targeted sequencing segment captured the largest revenue share of 73% in 2022, highlighting its dominance in global adoption.

- By application, the oncology segment led the market in 2022, contributing 28.5% of global revenue due to increasing cancer diagnostics and research activities.

- Considering workflow, the pre-sequencing segment accounted for the largest share at 56% in 2022, demonstrating its crucial role in sequencing processes.

- Academic research institutions were the leading end-users in 2022, contributing the highest revenue, emphasizing their dominant role in NGS advancements and utilization.

- Geographically, North America held the largest market share of 43% in 2022, driven by advanced healthcare infrastructure and widespread adoption of NGS.

- The Asia Pacific market is projected to grow at a substantial CAGR between 2023 and 2032, supported by increasing investments in genomics research.

- In oncology, NGS applications enable detection of copy number variants, translocations, and critical genetic insights, assisting in precision cancer diagnosis and treatment planning.

- Rising prevalence of chronic diseases and demand for genetic testing have been driving NGS adoption in diagnostics for accurate and personalized healthcare solutions.

- In drug discovery, next-generation sequencing supports identification of drug resistance and treatment responses, significantly accelerating research and development of new therapeutic solutions.

Regional Analysis

North America held the largest share of the next-generation sequencing market in 2022, accounting for 43% of total revenues. The region’s dominance was driven by the presence of several clinical laboratories that actively use next-generation sequencing for genetic testing services. Rising demand for advanced diagnostic methods has supported this growth. In addition, a strong research ecosystem and the widespread adoption of sequencing in clinical settings have positioned North America as a leading hub for the development of advanced genetic technologies.

The region also benefits from high investments in research and development. A well-established medical research framework continues to support innovation and the adoption of sequencing platforms. Government support, industry collaboration, and funding initiatives have strengthened the clinical and academic use of sequencing technologies. These factors are expected to play a crucial role in sustaining growth across the forecast period. As a result, North America is anticipated to retain its leadership in the global next-generation sequencing market.

The Asia-Pacific market is projected to experience the fastest expansion over the coming decade. Rapid advancements in sequencing technologies, particularly from Japan and China, are driving growth in this region. In addition, improving healthcare systems and investments in clinical research are contributing to increased adoption. Emerging economies such as India and Australia are enhancing their R&D capabilities, creating new opportunities. With ongoing improvements in healthcare infrastructure and rising demand for genomic applications, Asia-Pacific is well-positioned to emerge as a highly lucrative market for next-generation sequencing.

Segmentation Analysis

The targeted sequencing segment dominated the Next-Generation Sequencing (NGS) market in 2022, accounting for 73% of the technology share. This dominance is attributed to its efficiency in analyzing specific gene locations and identifying isolated genetic expressions. Companies such as Illumina Inc. and Pacific Biosciences have introduced advanced targeted sequencing platforms, enabling accurate detection of genetic variants. Targeted sequencing has emerged as the standard in molecular cancer diagnostics, particularly for solid tumors and hematologic malignancies, and is expected to grow alongside whole genome sequencing in the forecast period.

Oncology represented the leading application segment in 2022, with a 28.5% market share. The dominance is supported by the increasing global incidence of cancer and the need for precise tools to study cancer cells. NGS enables rapid detection of common and rare genetic mutations, providing critical insights for therapy. Leading businesses continue to integrate NGS in oncology and RNA sequencing. Meanwhile, consumer genomics is expanding due to frequent product launches and rising demand for genealogy and paternity testing, further diversifying the application base.

In terms of workflow, the pre-sequencing segment held the largest share at 56% in 2022. Pre-sequencing is a crucial phase that ensures accurate measurement and preparation for sequencing processes. Automation technologies, such as liquid-handling robotic systems, streamline workflows and improve efficiency. These systems allow researchers to focus on analysis rather than manual handling. The growing adoption of automation in sequencing workflows enhances throughput, reduces error rates, and accelerates data generation, which is vital for large-scale genomic studies and clinical applications.

Academic research remained the leading end-use segment, capturing 53% of the market share in 2022. Universities and research centers are primary adopters of NGS, utilizing the technology for disease gene discovery, cancer research, and genomic studies. Pharmaceutical and biotechnology firms are also increasing investment in large-scale sequencing projects to advance drug development. However, challenges remain in building viable clinical applications and achieving greater adoption in clinical settings. Rising demand for NGS scholarships and research initiatives is expected to support future growth in the academic research segment.

Key Players Analysis

The next-generation sequencing (NGS) industry is characterized by strong competition among global players. A notable development took place in March 2022 when Integrated DNA Technologies (IDT) acquired Swift Biosciences, a pioneer in genomic NGS library preparation kits. This acquisition strengthened IDT’s product portfolio and research capabilities, especially in the academic and clinical research segments. Such strategic moves demonstrate the commitment of companies to expand their technological base and enhance market presence, ultimately fueling innovation and accelerating the adoption of NGS technologies across diverse applications.

The industry is also defined by a high level of rivalry, where companies pursue aggressive strategies to secure competitive advantage. Collaborations, mergers, acquisitions, and regional expansions are widely observed among leading participants. These initiatives are primarily aimed at enhancing product offerings, widening geographical reach, and increasing market share. Furthermore, partnerships in high-growth regions have become a key focus, enabling companies to leverage emerging opportunities in biotechnology research, precision medicine, and clinical diagnostics. This competitive environment continues to shape the evolution of the global NGS market.

Several major players dominate the competitive landscape and drive advancements within the NGS sector. These include Illumina, Thermo Fisher Scientific, Pacific Biosciences, Qiagen, Agilent Technologies, and Oxford Nanopore Technologies. Each of these companies focuses on developing innovative sequencing platforms, consumables, and analytical solutions. Their strategies revolve around research investments, alliances with academic institutions, and strengthening distribution networks. Collectively, these organizations contribute to technological progress while ensuring accessibility to advanced sequencing tools, thereby fostering significant growth opportunities across healthcare, life sciences, and industrial research applications.

Market Key Players

- Illumina Inc.

- Hoffman-La Roche

- QIAGEN

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories Inc.

- Oxford Nanopore Technologies

- PierianDx Inc.

- Genomatix GmbH

- DNASTAR Inc.

- Perkin Elme Inc.

- Eurofins GATC Biotech GmbH

- BGI

- Precigen Inc.

- Macrogen Inc.

- Pillar Biosciences Inc.

- Agilent Technologies Inc.

- Other key players

Conclusion

The global next-generation sequencing market is on a strong growth path, supported by rising demand in clinical diagnostics, oncology research, and drug discovery. Advances in sequencing technologies, coupled with government-backed genomic initiatives, are making NGS more accessible and efficient. Academic institutions, healthcare providers, and biotechnology companies are adopting these solutions at a fast pace, driving innovation in precision medicine and personalized treatments. North America remains the leading region, while Asia-Pacific shows the highest growth potential with expanding research investments. With strong competition among key players and continuous product innovation, the NGS market is expected to play a transformative role in healthcare and life sciences over the coming years.

Get in Touch with Us:

Market.us (Powered By Prudour Pvt. Ltd.)

Address: 420 Lexington Avenue, Suite 300, New York City, NY 10170, United States.

Contact No: +1 718 874 1545 (International), +91 78878 22626 (Asia).

Email: [email protected]

View More

Nerve Repair and Regeneration Market || Neuroregeneration Therapy Market || Next Generation Cancer Diagnostics Market || Clinical Oncology Next Generation Sequencing Market || Macular Edema and Macular Degeneration Market