Quick Navigation

Overview

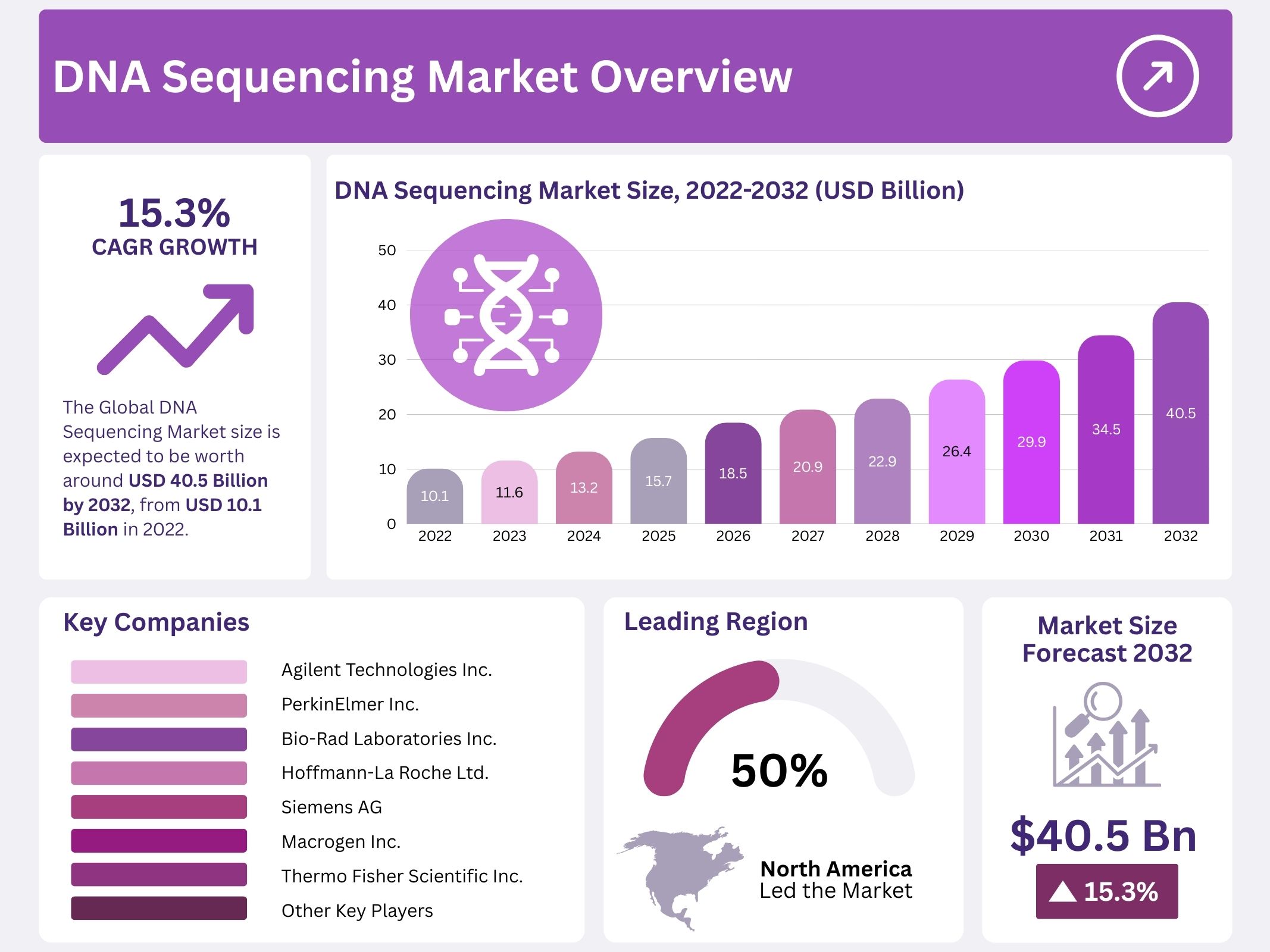

The global DNA Sequencing Market is forecasted to reach USD 40.5 billion by 2033, rising from USD 10.1 billion in 2023. This growth reflects a strong compound annual growth rate (CAGR) of 15.3% during 2024–2033. A key driver is the growing demand for precision medicine. DNA sequencing enables treatments tailored to unique genetic profiles, making it central to oncology, rare diseases, and pharmacogenomics. Increased use of genomic diagnostics and targeted therapies is accelerating adoption, establishing sequencing as a cornerstone in modern clinical practice.

Falling sequencing costs are another critical factor. The cost of sequencing a human genome has declined drastically, from about USD 100 million in 2001 to less than USD 1,000 today. This affordability has unlocked wider applications across clinical diagnostics, research, and commercial testing. Hospitals, research centers, and private laboratories are increasingly integrating sequencing services due to reduced financial barriers. This trend has democratized access and widened the market base, driving higher adoption rates worldwide.

Clinical applications of DNA sequencing continue to expand. In oncology, sequencing is applied for tumor profiling and liquid biopsy testing. Infectious disease management has also benefited, with sequencing used for outbreak tracking and pathogen surveillance. Prenatal and newborn screening are becoming more advanced, while rare disease diagnostics are improving with genetic insights. These diverse applications have created multiple revenue streams, reducing dependency on a single market segment and supporting steady growth in both developed and emerging healthcare markets.

Technological advancements are strengthening market potential. Innovations such as next-generation sequencing (NGS), single-cell sequencing, and long-read sequencing are enhancing accuracy, throughput, and scalability. Emerging technologies like nanopore sequencing and AI-driven bioinformatics are further widening possibilities for research and clinical applications. These innovations are expected to reduce turnaround times, improve data reliability, and extend adoption in new domains. The continuous evolution of sequencing platforms remains a major force behind the expansion of this high-growth market.

Expanding Applications and Future Opportunities

The rising focus on genomics and biotechnology research is a significant growth catalyst. Large-scale programs such as the Human Genome Project, All of Us Research Program in the United States, and the 100,000 Genomes Project in the UK have accelerated adoption. Both public and private investments are fueling sequencing infrastructure and applications. Sequencing is now widely used in drug discovery and biomarker development, supporting pharmaceutical research and clinical trials. This integration is driving industry expansion and unlocking broader therapeutic opportunities.

Consumer genomics and direct-to-consumer (DTC) testing are another growth avenue. Popular DNA kits from companies like 23andMe and AncestryDNA have raised awareness among the general population. Consumers are becoming more engaged in genetic testing for ancestry, health traits, and wellness insights. While DTC testing directly boosts consumer-driven markets, it also indirectly supports clinical adoption by familiarizing individuals with genetic insights. This increased public engagement is contributing to the overall growth of the sequencing ecosystem.

Government and private investments further reinforce the industry. National genomic databases, healthcare digitization programs, and public-private partnerships are strengthening sequencing infrastructure globally. Venture capital interest in sequencing-related startups is also on the rise, promoting innovation and accessibility. These investments ensure that sequencing technologies continue evolving while also reaching wider healthcare and research settings. This institutional support plays a pivotal role in sustaining growth momentum over the coming decade.

Beyond healthcare, DNA sequencing is finding applications in agriculture, forensics, and environmental sciences. In agriculture, sequencing supports crop genomics and livestock breeding. In forensics, it enhances accuracy in criminal investigations. Environmental monitoring and evolutionary biology are additional areas benefiting from sequencing insights. The integration of artificial intelligence and big data analytics also improves data interpretation and clinical feasibility. These applications extend the market’s reach beyond healthcare, broadening the total addressable market and creating new opportunities for stakeholders worldwide.

Key Takeaways

- In 2022, consumables were identified as the leading revenue contributor, outpacing other categories in generating the highest financial returns.

- Next-generation sequencing stood out as the largest revenue driver in sequencing, establishing its dominance over other sequencing technologies during the year.

- The oncology segment recorded the highest CAGR between 2023 and 2032, reinforcing its position as the fastest-growing application area in the market.

- Academic and research institutes captured the largest market share among end-users, highlighting their central role in driving demand within this industry.

- North America achieved the highest revenue share in 2022, accounting for 44.3% of the total, and solidified its leadership position globally.

- Asia-Pacific is forecasted to witness the most rapid growth from 2023 to 2032, positioning the region as an emerging powerhouse in this market.

Regional Analysis

North America is projected to dominate the global DNA sequencing market, with a share of 44.3%. The growth in this region is driven by a strong focus on personalized medicine and the rising demand for genome sequencing services. High adoption of advanced sequencing technologies also supports its leading position. In addition, the presence of well-established healthcare infrastructure and research facilities contributes to the widespread integration of sequencing applications. These combined factors strengthen North America’s role as the primary market leader.

Europe is anticipated to expand its share during the forecast period. The region benefits from the presence of prominent research institutions and genomics-focused academic programs. Growing awareness of genome sequencing applications in clinical settings supports this trend. Furthermore, robust healthcare systems and government funding for biotechnology research stimulate the adoption of sequencing technologies. These factors are expected to accelerate market penetration. As a result, Europe is positioned as the second most significant market after North America, with steady growth projected.

Asia-Pacific is expected to grow at a faster pace compared with other regions. This acceleration is attributed to its large population base and ongoing government initiatives to promote precision medicine. Notably, projects such as IndiGen in India aim to establish genomic databases for healthcare applications. Such initiatives enhance local expertise and provide a foundation for innovation. Increasing investments in research infrastructure and rising healthcare expenditure are further driving the regional demand. This positions Asia-Pacific as the fastest-growing market for DNA sequencing.

The Middle East, Africa, and Latin America are also projected to experience rising acceptance of genome sequencing technologies. These regions are currently in the early stages of adoption, but supportive government policies and investments are creating opportunities. Improvements in healthcare infrastructure and growing interest in biotechnology are key factors supporting future growth. The demand for advanced diagnostic tools is also increasing. Together, these developments indicate a gradual but positive trajectory, with higher adoption rates anticipated during the forecast period.

Segmentation Analysis

The consumables segment has captured the largest revenue share in the DNA sequencing market. This dominance is attributed to the extensive availability of reagents and kits for different stages of library construction, including adapter ligation, DNA fragmentation, enrichment, quality control, and amplification. Their versatility enhances adoption as these consumables support low-input and formalin-fixed specimens. The inclusion of ready-to-use components makes workflows simplified and efficient, reducing errors. This ease of use has significantly contributed to the rising demand across research and diagnostic applications worldwide.

Next-Generation Sequencing (NGS) has emerged as the leading segment by sequencing type and is expected to maintain dominance. NGS has transformed genome sequencing by reducing costs, improving accuracy, and enabling high-throughput results. The declining cost of sequencing and rapid technological progress have supported this growth. The COVID-19 pandemic further accelerated NGS adoption as a clinical diagnostic tool. Meanwhile, third-generation sequencing technologies such as SMRT and Nanopore sequencing are projected to grow rapidly, offering longer reads, faster preparation, and eliminating PCR amplification.

The oncology segment holds the largest revenue share within DNA sequencing applications. This growth is due to its significant role in cancer diagnostics and treatment development. NGS technology provides a low-cost and high-throughput method, capable of detecting clinically actionable variants across multiple genes in a single test. The FDA’s approval of the Guardant360 CDx assay highlights its clinical impact. This liquid biopsy diagnostic enables less invasive testing, greater patient comfort, and improved efficiency. These developments emphasize the increasing importance of precision medicine in oncology.

Academic and research institutes represent the largest end-user segment of the DNA sequencing market. Their dominance is driven by the widespread adoption of NGS and Sanger sequencing for large-scale research projects. Rising funding and investment programs further strengthen this trend. For example, DNA Script and the Broad Institute secured USD 23.0 million from IARPA to integrate NGS and enzymatic DNA synthesis in one platform. Collaborations with Illumina are also enhancing technological capabilities. These initiatives highlight the critical role of research institutions in advancing sequencing technologies globally.

Key Players Analysis

The global DNA sequencing market is marked by intense competition. Leading companies such as Illumina, Inc., Agilent Technologies, QIAGEN, PerkinElmer, and Thermo Fisher Scientific dominate the sector. Their market position is supported by strong distribution channels, large-scale production, and emphasis on quality management. These firms are actively expanding their product portfolios to meet increasing global demand. The competitive environment is shaped by ongoing investments in innovation, partnerships, and advanced sequencing technologies aimed at enhancing accessibility and precision.

PerkinElmer has strengthened its presence in the genomics space through strategic initiatives. One notable collaboration was established with FDNA to launch Face2Gene LABS. This platform integrates PerkinElmer’s genomic testing expertise with FDNA’s Next-Generation Phenotyping (NGP) technology. The aim is to accelerate diagnosis and enhance accuracy in genomic services. This initiative highlights how companies are adopting advanced digital tools to improve diagnostic outcomes and strengthen their positions in the competitive DNA sequencing landscape.

Face2Gene LABS demonstrates the growing integration of artificial intelligence with genomic testing. By combining NGP technology with sequencing solutions, PerkinElmer and FDNA provide faster and more reliable diagnoses of rare genetic disorders. This reflects the increasing role of AI-driven technologies in healthcare. The launch also emphasizes PerkinElmer’s commitment to improving patient outcomes. Such collaborations underline the strategic focus of key players on delivering high-quality, efficient, and technology-driven genomic services to address unmet clinical needs.

Market Key Players

- Agilent Technologies Inc.

- PerkinElmer Inc.

- Bio-Rad Laboratories, Inc.

- Hoffmann-La Roche Ltd.

- Siemens AG

- Macrogen, Inc.

- Thermo Fisher Scientific, Inc.

- Roche Holdings AG

- Other Key Players

Conclusion

The DNA sequencing market is set for strong and sustained growth, driven by its vital role in modern healthcare and research. Broader use in cancer care, rare disease diagnosis, and infectious disease monitoring is making sequencing essential in clinical practice. Falling costs and ongoing technology improvements are further expanding access. Growing investments from governments, institutions, and private players are ensuring wider adoption and innovation. Applications are also reaching new fields such as agriculture, forensics, and environmental studies. With rising global awareness and consumer engagement, DNA sequencing is moving beyond laboratories into mainstream healthcare, solidifying its place as a cornerstone of future medical and scientific progress.

Get in Touch with Us:

Market.us (Powered By Prudour Pvt. Ltd.)

Address: 420 Lexington Avenue, Suite 300, New York City, NY 10170, United States.

Contact No: +1 718 874 1545 (International), +91 78878 22626 (Asia).

Email: [email protected]

View More

DNA Microarray Market || Viral Vectors and Plasmid DNA Manufacturing || DNA Origami Market || DNA Modifying Enzymes Market || DTC (Direct to Consumer) DNA Test Kits Market || DNA Synthesis Market || Plasmid DNA Manufacturing Market || Viral Vector and Plasmid DNA Manufacturing Market || DNA Repair Drugs Market