Quick Navigation

Introduction

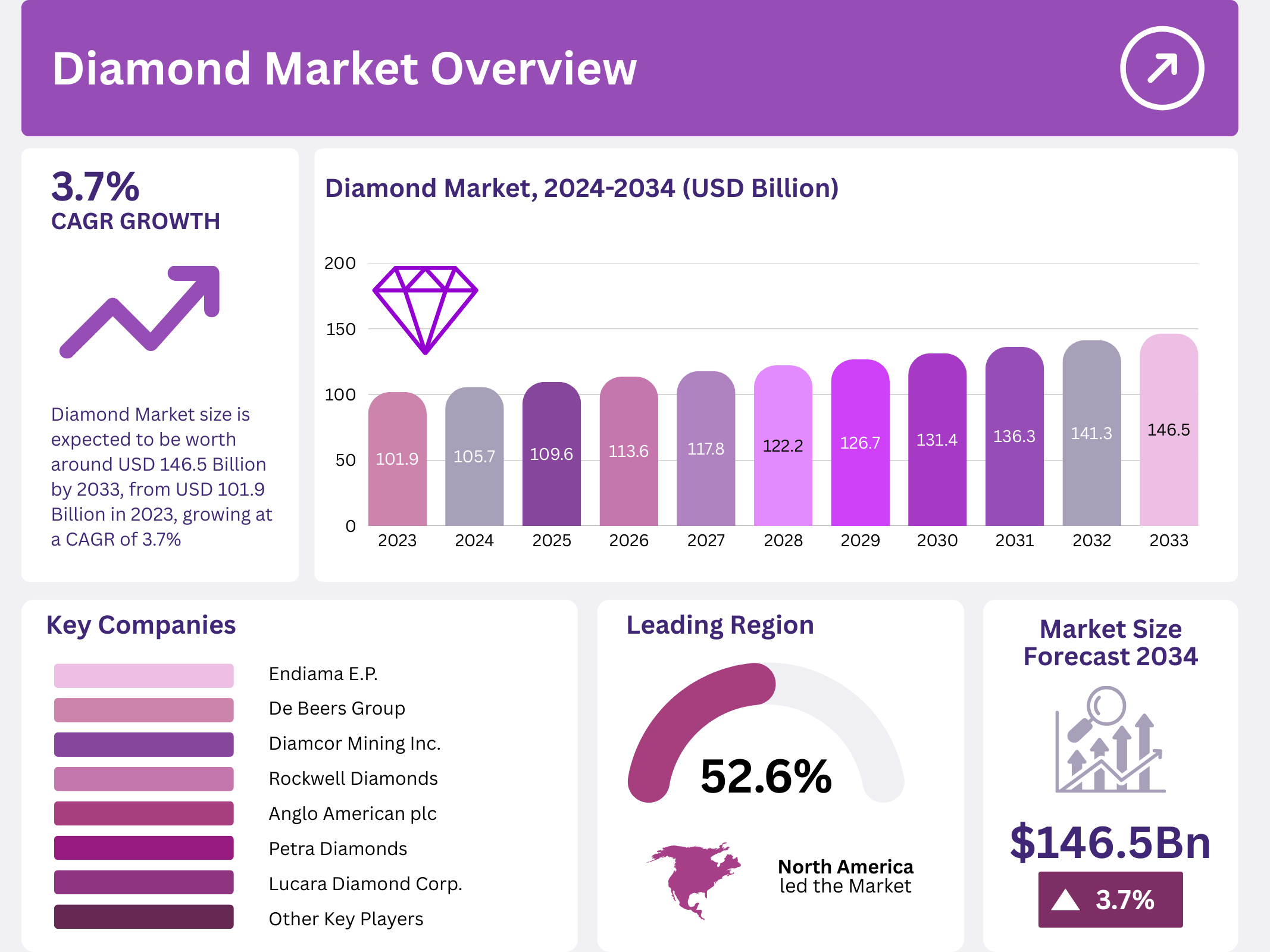

The global diamond market, valued at USD 101.9 billion in 2023, is projected to reach USD 146.5 billion by 2033, growing at a compound annual growth rate (CAGR) of 3.7% during the forecast period from 2024 to 2033.

Diamonds, renowned for their unparalleled hardness and brilliance, are primarily used in luxury jewelry, industrial applications, and cutting-edge technological processes. The market is experiencing significant growth driven by both natural and synthetic diamonds, with expanding production capabilities and shifting consumer preferences for sustainable options.

As both luxury products and industrial tools, diamonds play an important role in numerous sectors globally, including luxury goods, manufacturing, and even emerging technological applications. This press release outlines key market trends, growth drivers, and challenges, alongside significant regional insights and future opportunities within the diamond market.

Key Takeaways

- The global diamond market is expected to grow from USD 101.9 billion in 2023 to USD 146.5 billion by 2033, achieving a 3.7% CAGR.

- Natural diamonds account for 93.8% of the market share, largely due to their status as luxury symbols in jewelry.

- Jewelry and ornaments hold 91.5% of the diamond market’s application segment, driven by high consumer demand for luxury items.

- North America leads the market with a 52.6% share, valued at USD 53.6 billion in 2023.

- The rise of lab-grown diamonds is expected to challenge the dominance of natural diamonds, catering to eco-conscious consumers and the growing demand for affordable luxury.

Market Segmentation Overview

By Type:

- Natural Diamonds: The dominant segment, comprising 93.8% of the total market share. Natural diamonds are prized for their authenticity, rarity, and cultural significance, particularly in engagement rings and high-end jewelry.

- Synthetic Diamonds: While smaller, this segment is experiencing robust growth, driven by advancements in technology and increasing consumer awareness about the environmental and ethical benefits of lab-grown diamonds. Synthetic diamonds are becoming more popular due to their cost-effectiveness and sustainability credentials.

By Application:

- Jewelry and Ornaments: The largest application segment, making up 91.5% of the market share. Diamonds are most commonly used in fine jewelry, especially in engagement rings, necklaces, and bracelets, which are considered status symbols in various cultures.

- Industrial Use: Though a smaller portion of the market, industrial diamonds are essential for cutting, grinding, and drilling due to their hardness and thermal conductivity. The industrial application segment contributes to various sectors, such as automotive, aerospace, and electronics.

Drivers

- Economic Growth and Increased Disposable Income: As economies grow, particularly in emerging markets, disposable income is on the rise, fueling consumer demand for luxury products such as diamonds.

- Technological Advancements in Production: Innovations in mining techniques, diamond processing, and the development of synthetic diamonds have led to increased efficiency and reduced costs, making diamonds more accessible to a broader audience.

- Consumer Preference for Luxury and Status Symbol Products: Diamonds are often associated with success, prosperity, and love, especially in the form of engagement rings. Their cultural and emotional value continues to drive demand, particularly among affluent consumers.

- Lab-Grown Diamonds: The rising popularity of synthetic diamonds is a key factor propelling market growth. Lab-grown diamonds appeal to millennials and eco-conscious buyers who are drawn to the ethical and environmental advantages of these products.

- Expansion of E-Commerce: Online platforms are increasingly playing a central role in the distribution of diamond products, broadening their reach and making them more accessible to consumers across the globe.

Use Cases

- Luxury Jewelry: The most significant use of diamonds is in the jewelry sector, where they are incorporated into high-end pieces like engagement rings, necklaces, and earrings. Diamonds continue to be a symbol of luxury, and their use in these products is expected to remain strong.

- Industrial Applications: Diamonds are used in various industrial processes, such as cutting, grinding, and drilling, where their hardness and thermal conductivity are highly valuable. These diamonds are essential components in precision instruments and are increasingly used in the manufacture of high-end technological equipment.

- Investment: Due to their intrinsic value, diamonds have become an attractive alternative investment asset, particularly in regions where economic stability and wealth accumulation are prevalent.

Major Challenges

- Ethical Concerns: As consumers become more conscious of the environmental and human rights implications of diamond mining, ethical sourcing is becoming increasingly important. Conflict diamonds, in particular, pose a threat to market stability and consumer confidence. Efforts to counteract this challenge include the Kimberley Process Certification Scheme, which aims to eliminate conflict diamonds from the market.

- High Costs and Affordability: The high cost of natural diamonds continues to be a barrier for many consumers, limiting the market to high-income individuals. In response, lab-grown diamonds are becoming a more affordable and sustainable alternative.

- Supply Chain Issues: The diamond industry, like many other sectors, faces potential disruptions in its supply chain, including geopolitical tensions, trade restrictions, and logistical inefficiencies. These issues can affect both the availability and pricing of diamonds.

- Market Volatility: Diamond prices fluctuate based on supply-demand dynamics, making the market prone to instability. Such volatility can deter investment and impact consumer purchasing decisions.

Business Opportunities

- Expansion into Emerging Markets: As disposable incomes rise in regions such as Asia, Africa, and Latin America, the demand for luxury products, including diamonds, is expected to increase. Companies expanding into these regions can tap into a growing base of affluent consumers.

- Sustainable Diamond Sourcing: Companies that focus on sustainable and ethical sourcing practices, particularly in the production of synthetic diamonds, are well-positioned to capitalize on the increasing consumer demand for eco-friendly products.

- E-Commerce Growth: The rapid expansion of online platforms offers a significant opportunity for diamond retailers to broaden their market reach and engage with a more extensive customer base, particularly through virtual try-on technologies and other interactive tools.

- Technological Innovation: Ongoing innovations in diamond processing, synthetic diamond production, and the integration of smart technologies into diamond products present unique opportunities for companies to differentiate themselves in the market.

Regional Analysis

North America remains the dominant player in the diamond market, accounting for 52.6% of the global market share, valued at USD 53.6 billion in 2023. The region’s strong demand for luxury goods, high disposable incomes, and advanced retail infrastructure drive market growth. Major players in the region continue to benefit from a stable economy and technological advancements in diamond certification and cutting.

Europe, with its rich history in diamond craftsmanship and luxury products, continues to be a significant player in the diamond market. The region places great emphasis on ethical sourcing and transparency, making it an attractive market for consumers concerned about the environmental impact of diamond mining. Belgium, particularly Antwerp, remains a key global trading hub for diamonds.

The Asia Pacific region is witnessing rapid growth, particularly in countries like China and India, where rising disposable incomes and the expansion of e-commerce platforms are boosting demand for diamonds. These regions are expected to experience the highest growth in the coming years, with increasing demand for both natural and synthetic diamonds.

The Middle East, particularly Dubai, continues to be a major market for luxury diamonds, driven by high demand for bespoke diamond pieces. The region’s focus on high-end jewelry and luxury products further propels market growth.

Countries like Brazil are emerging as important markets for diamonds, with steady growth observed in consumer interest in luxury goods. The expansion of retail outlets and increasing investment in the luxury sector will likely support continued market growth in the region.

Recent Developments

- Rapaport and DMCC: In September 2024, Rapaport Diamond Corporation and DMCC hosted Dubai’s largest polished diamond auction at the Dubai Diamond Exchange. The event featured over 50,000 carats of diamonds, underscoring Dubai’s growing influence in the global diamond trading hub.

- Signet Jewelers and De Beers: In May 2024, Signet Jewelers partnered with De Beers to promote natural diamonds for a new generation of U.S. consumers. The collaboration aims for a 25% increase in engagement rings sales over the next three years.

- Malabar Gold & Diamonds: In October 2024, Malabar Gold & Diamonds launched renovated showrooms in Kuwait and Dubai, offering over 20,000 designs to enhance the customer experience.

- Tanishq and De Beers: In August 2024, Tanishq and De Beers formed a strategic partnership to promote natural diamonds in India, focusing on educating consumers and marketing campaigns targeting India’s growing middle class.

Conclusion

The global diamond market is poised for significant growth, driven by rising demand for luxury goods, technological advancements, and the increasing popularity of lab-grown diamonds. However, challenges such as ethical concerns and market volatility must be addressed to ensure continued success. Regional dynamics and business opportunities, particularly in emerging markets and e-commerce platforms, offer substantial growth potential for key players. With innovation and sustainability at the forefront, the diamond market is well-positioned to capitalize on evolving consumer preferences and technological progress.