Quick Navigation

Introduction

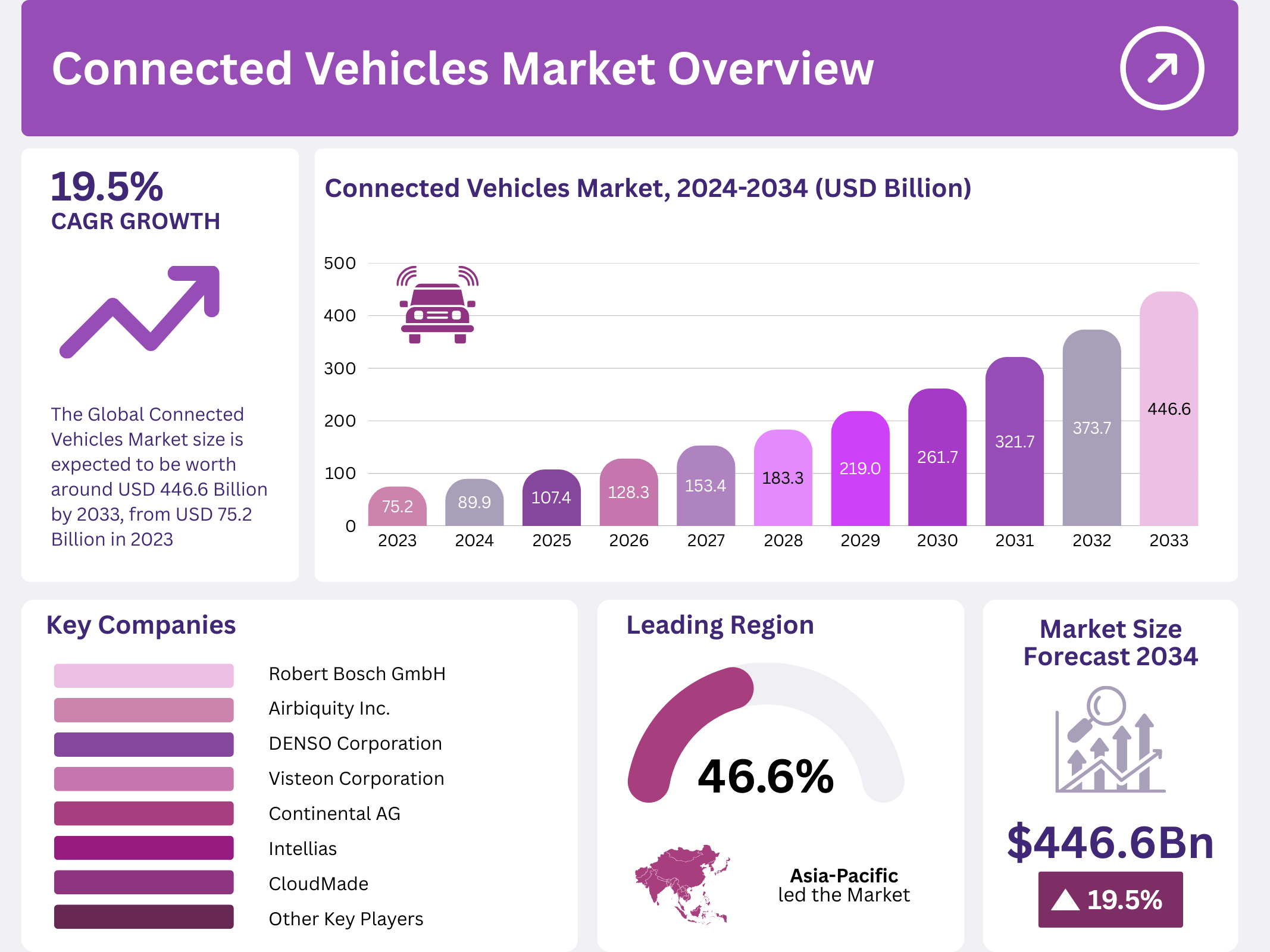

The global Connected Vehicles Market is on a rapid growth trajectory, with an expected market size of USD 446.6 Billion by 2033, up from USD 75.2 Billion in 2023, growing at a robust CAGR of 19.5% from 2024 to 2033. This market growth is driven by advancements in vehicle connectivity technologies, including vehicle-to-vehicle (V2V), vehicle-to-infrastructure (V2I), and other wireless communication technologies that improve vehicle safety, efficiency, and overall driving experience.

As connected vehicles become a standard in automotive technology, the landscape is witnessing increased consumer demand for safety features, real-time traffic alerts, and seamless integration with smartphones and IoT-based technologies.

The advent of 5G and increasing investments from governmental and private entities further accelerate the market’s expansion. The increasing push for autonomous driving capabilities and enhanced road safety features is transforming how vehicles communicate with one another and the surrounding infrastructure. By harnessing the potential of advanced connectivity technologies, the Connected Vehicles Market is poised for a transformative shift in the years to come.

Key Takeaways

- The global Connected Vehicles Market is expected to reach USD 446.6 Billion by 2033, up from USD 75.2 Billion in 2023, growing at a CAGR of 19.5%.

- Asia Pacific dominated the market in 2023, holding a significant 46.6% market share and generating USD 35.0 Billion in revenue.

- Vehicle to Vehicle (V2V) communication held the largest market share in 2023, accounting for 41.1% of the total market.

- OEMs (Original Equipment Manufacturers) held the largest share of the end-user segment in 2023, accounting for 81.2%.

- The Passenger Cars segment dominated the vehicle type segment, holding 75.2% of the total market share in 2023.

- Internal Combustion Engine (ICE) vehicles accounted for 77.2% of the propulsion segment in 2023, dominating the market.

Use Cases

- Autonomous Driving: Connected vehicles play a critical role in enabling autonomous driving by allowing cars to communicate with one another and with infrastructure, making real-time decisions to navigate roads safely.

- Traffic Management: Vehicle-to-infrastructure communication can optimize traffic flow and reduce congestion by adjusting traffic signals and alerting vehicles to road conditions and accidents.

- Fleet Management: Commercial vehicles benefit from connectivity by providing real-time tracking, maintenance updates, and optimized route management, leading to reduced operational costs.

- Driver Assistance: Advanced driver-assistance systems (ADAS) powered by connectivity technologies provide features like lane departure warnings, collision avoidance, and adaptive cruise control.

Market Segmentation Overview

- By Communication

- Vehicle to Vehicle (V2V): This segment leads the market with 41.1% share, as it enhances real-time communication between vehicles, improving safety and traffic flow.

- Vehicle to Infrastructure (V2I): A significant portion of the market, V2I communications help vehicles interact with road infrastructure like traffic signals and signs to optimize driving decisions.

- Vehicle to Pedestrian (V2P): This technology improves safety by alerting drivers to the presence of pedestrians, especially in urban settings.

- Vehicle to Device (V2D): Facilitates the integration of personal devices with vehicle systems, enhancing user experience and connectivity.

- By End-User

- Original Equipment Manufacturers (OEMs): Dominating with 81.2% of the market share, OEMs are heavily investing in embedded solutions and connectivity features that are integral to modern vehicles.

- Aftermarket: Though smaller, the aftermarket segment is growing as vehicle owners seek to integrate advanced connectivity features into older vehicles.

- By Connectivity

- Cellular: Leading with 40.3% market share, cellular connectivity is critical for real-time vehicle communications and supports applications like V2X communications.

- Dedicated Short Range Communications (DSRC): Vital for safety-critical communications, particularly in urban environments.

- Satellite and Wi-Fi: Play important roles in ensuring global connectivity, particularly in remote areas and urban environments.

- By Vehicle Type

- Passenger Cars: Holding 75.2% market share, the passenger cars segment is expected to continue dominating as consumers increasingly demand connected safety features and infotainment systems.

- Commercial Vehicles: This segment, though smaller, is growing due to the adoption of connected technologies that improve fleet management and logistics efficiency.

- By Propulsion

- Internal Combustion Engine (ICE) Vehicles: Dominating with 77.2% market share, ICE vehicles are still the primary vehicles in the connected car landscape but are expected to be gradually replaced by electric vehicles (EVs) in the future.

- Electric Vehicles (EVs): Rapidly growing in market share, EVs are becoming increasingly integrated with connected technologies to optimize performance and energy management.

Drivers

- Increased Demand for Safety and Efficiency: Connected vehicles offer real-time data communication, which improves road safety and optimizes traffic flow. These technologies can prevent accidents, reduce traffic congestion, and improve overall driving experiences.

- Consumer Demand for Convenience: The need for seamless integration with smartphones and other IoT devices is increasing, as consumers demand more convenience in their vehicles.

- 5G Integration: The introduction of 5G networks is a game-changer, providing faster, more reliable connectivity and enabling real-time communication between vehicles, infrastructure, and pedestrians. This is crucial for the development of autonomous driving technologies.

- Government Regulations and Support: Governments worldwide are pushing for higher safety standards, lower emissions, and smarter traffic management systems, which are contributing to the adoption of connected vehicles.

Major Challenges

- Cybersecurity and Data Privacy: As vehicles become more connected, they become more vulnerable to cyber-attacks. Ensuring robust security measures to protect against hacking and unauthorized data access is critical to the widespread adoption of connected vehicles.

- High Implementation Costs: The cost of implementing advanced connectivity and autonomous technologies is high, which can hinder adoption, particularly in developing regions.

- Regulatory Challenges: With the rapid pace of technological advancements, creating consistent global standards and regulations for connected vehicles is a complex challenge.

- Infrastructure Development: The widespread implementation of connected vehicle technologies requires significant infrastructure investments, which may not be feasible in certain regions.

Business Opportunities

- 5G Network Deployment: With the roll-out of 5G networks, there is an opportunity for businesses to develop and deploy connected vehicle technologies that leverage the benefits of ultra-fast connectivity and low latency.

- AI and Machine Learning Integration: The integration of AI and machine learning into connected vehicle systems opens new avenues for innovation, particularly in autonomous driving, predictive maintenance, and real-time traffic management.

- Mobility-as-a-Service (MaaS): The rise of MaaS is creating opportunities for businesses to offer personalized, efficient, and connected transportation solutions that combine multiple modes of transport into a seamless experience.

Regional Analysis

- Asia Pacific: Dominating the Connected Vehicles Market with 46.6% market share, the region benefits from strong government support for smart cities, significant investments in automotive technology, and widespread adoption of connected transportation solutions.

- North America: North America holds a crucial position with its high adoption rates of connected technologies, strict regulatory standards, and investments in autonomous driving and vehicle safety systems.

- Europe: Europe is focused on innovation and sustainability, with key markets such as Germany and France leading the way in automotive connectivity and autonomous driving technologies.

- Middle East & Africa: Gradually growing, the Middle East & Africa are exploring the potential of connected vehicles in improving traffic management and reducing environmental impact.

- Latin America: Latin America is in the early stages of adopting connected vehicle technologies, but the demand for smart transportation solutions is steadily rising.

Recent Developments

- July 2023: Visteon Corporation launched a new infotainment system designed to integrate seamlessly with multiple digital services, enhancing the in-vehicle experience.

- May 2023: Continental AG secured $50 million in funding to develop its autonomous driving technologies and connected vehicle solutions.

- March 2023: DENSO introduced an innovative connected vehicle platform aimed at enhancing safety through advanced diagnostics and real-time data analytics.

Conclusion

The Connected Vehicles Market is poised for significant growth, driven by advancements in communication technologies, the increasing adoption of 5G, and the growing demand for safety, convenience, and efficiency in vehicles. As governments and private entities continue to invest in this technology, the market will evolve, offering new business opportunities and driving the transition towards smarter, more connected transportation systems worldwide. Addressing challenges such as cybersecurity and infrastructure development will be key to realizing the full potential of connected vehicles in the years ahead.