Global Disposable Medical Gloves Market Analysis By Material (Natural Rubber, Nitrile, Vinyl, Neoprene, Polyethylene, Other Materials), By Application (Examination, Surgical), By End-use (Hospitals, Home Healthcare, Outpatient/Primary Care Facilities, Other End-Uses) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2023

- Report ID: 18371

- Number of Pages: 335

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

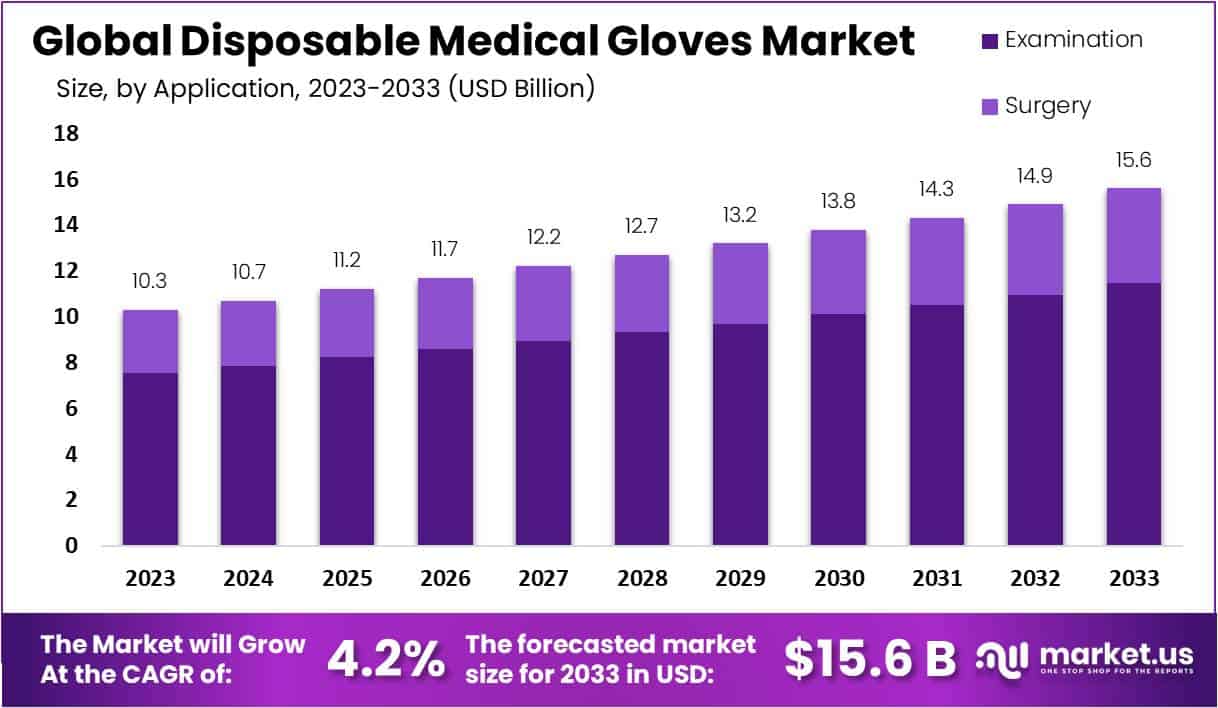

The Disposable Medical Gloves Market Size is anticipated to reach approximately USD 15.6 billion by 2033, showing significant growth from the USD 10.3 billion recorded in 2023. This represents a Compound Annual Growth Rate (CAGR) of 4.2% during the forecast period spanning from 2024 to 2033.

Disposable medical gloves are essential personal protective equipment (PPE) used in healthcare settings to establish a protective barrier between the hands of the wearer and potential sources of infection or contaminants. These gloves come in various materials, such as latex, nitrile, or vinyl, offering options based on wearer preferences, allergies, and procedural requirements. Latex gloves, derived from natural rubber, provide flexibility and comfort but may trigger latex allergies. Nitrile gloves, made from synthetic rubber, offer excellent puncture resistance and serve as a latex-free alternative. Vinyl gloves, composed of polyvinyl chloride (PVC), present a cost-effective choice but may not match the durability of latex or nitrile options.

The disposable medical gloves market has witnessed significant growth, driven by heightened awareness of hygiene and safety in healthcare settings. This expansion is fueled by an increased number of healthcare facilities and the global emphasis on combating infectious diseases. The market encompasses gloves made from diverse materials like latex, nitrile, and vinyl, with nitrile gloves gaining popularity due to their hypoallergenic nature and chemical resistance. Key end-users include healthcare professionals, and these gloves find applications in various sectors requiring hand protection. Adherence to regulatory standards is vital for manufacturers in this dynamic market. Noteworthy players engage in strategic collaborations and innovations to fortify their market presence.

Key Takeaways

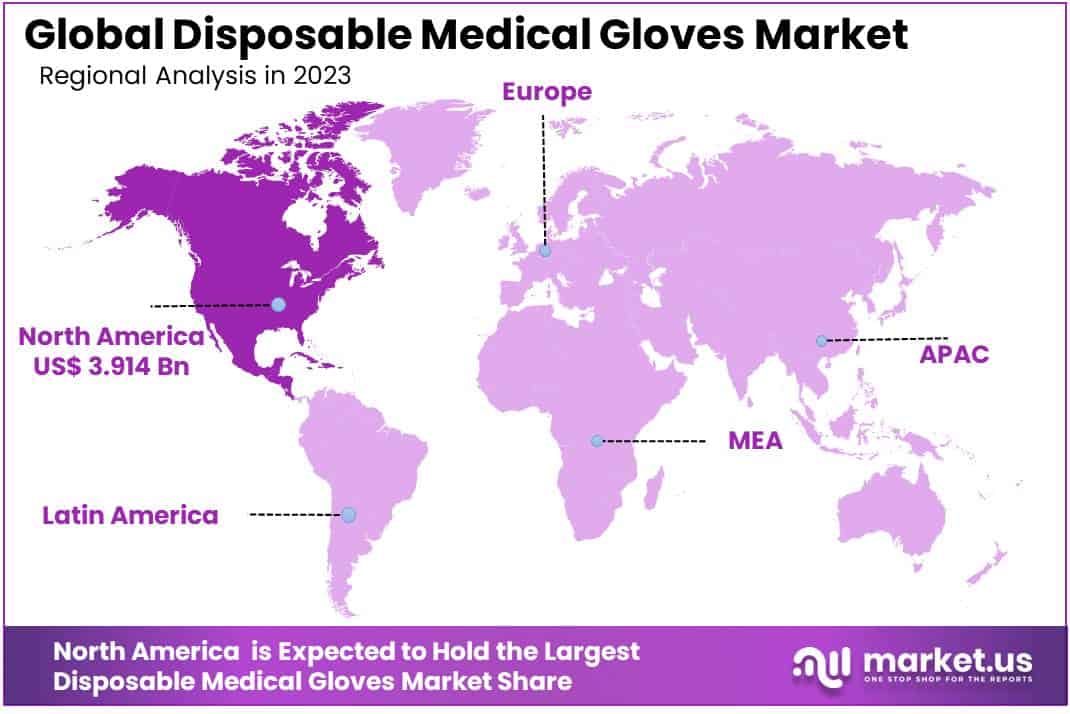

- In 2023, North America dominated the global disposable gloves market, holding a 38% share valued at approximately USD 3.9 billion.

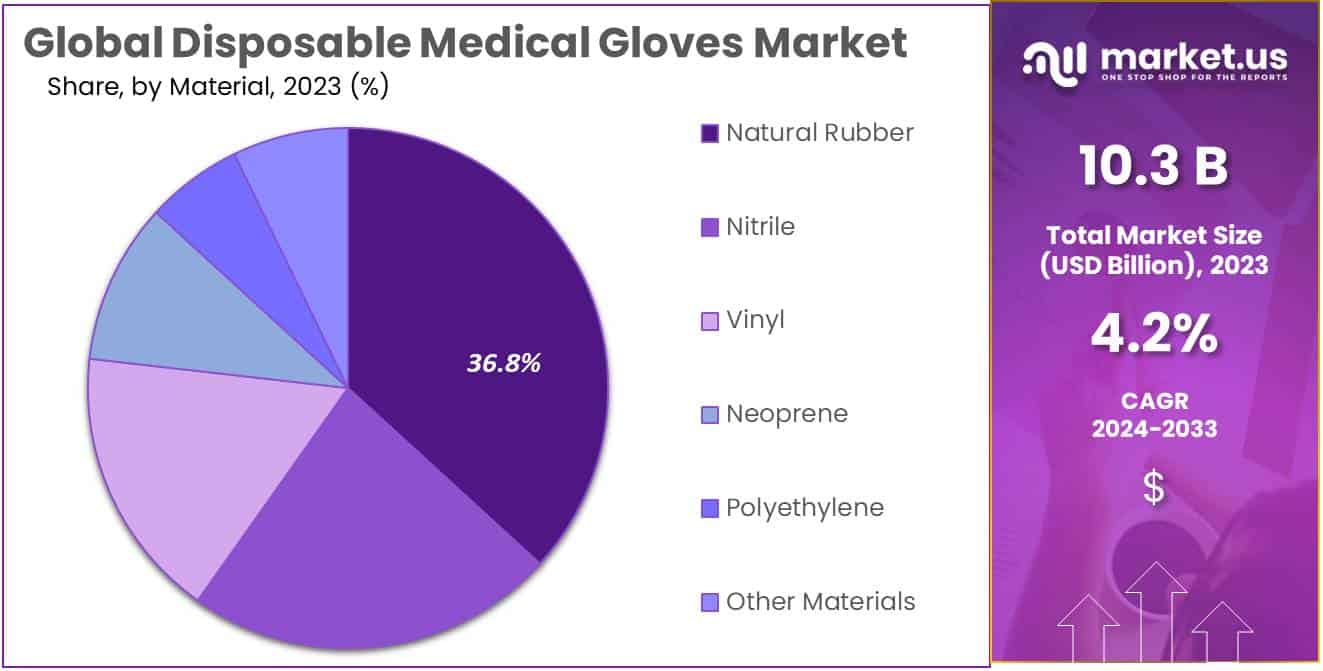

- Natural rubber gloves led with 36.8% share due to their high flexibility, tactile sensitivity, and versatile use across various medical applications.

- Examination gloves contributed over 73.4% to global revenues, underscoring their critical role in preventing cross-contamination during routine patient care.

- Hospitals accounted for 54.4% of market demand, supported by rising admissions, aging populations, and an increase in hospital-acquired infections.

- Nitrile gloves are expected to grow the fastest, appreciated for their strong barrier protection, chemical resistance, and being a safe option for latex-sensitive users.

- North America’s leadership is further reinforced by strict regulatory frameworks, ensuring high trust and widespread adoption in clinical environments.

- Challenges such as environmental waste, supply chain instability, and fluctuating raw material costs continue to impact market growth and manufacturer margins.

- Consumer trends show rising demand for powder-free gloves and nitrile variants, reflecting increasing awareness of health, hygiene, and allergy prevention.

- Industry players are prioritizing product innovation, tailored offerings, and collaborative partnerships to address evolving needs and improve market penetration.

- Growth prospects are enhanced by new technologies, improved healthcare access, and the expansion of telehealth services demanding consistent glove use.

Material Analysis

The natural rubber industry segment dominated the market in 2023 and controlled more than 36.8% of total sales. These disposable medical gloves are tactile and can be used for a variety of tasks, including surgery and medical operations. They are constructed of natural rubber or latex. They are perfect for use with biological or water-based materials because they are also flexible and pleasant. Future demand for them will rise as a result of these causes. Vinyl disposable gloves are constructed of polyvinyl chloride and other plasticizers and can be used as latex-free gloves. For quick tasks when comfort is not a concern, vinyl gloves are a fantastic option. The market is anticipated to expand as a result of rising demand for FDA-approved, antimicrobial gloves.

Over the forecast period, the demand for disposable nitrile gloves will experience the greatest growth. Because of their superior barrier protection and durability, nitrile gloves are preferred in applications where blood-borne diseases or other contaminants can be a concern. They are also extremely comfortable and fit due to their high elasticity, memory, and excellent comfort. Neoprene gloves have a higher stretch rate than nitrile and latex gloves. Neoprene gloves are more comfortable and dry. These gloves are particularly useful for dentists, doctors, surgeons, and others who work with damp instruments. Neoprene gloves can be used to handle toxic chemicals, caustic compounds, and weak acids.

Application Analysis

In 2023, the market leader for examination applications was the segment. It contributed more than 73.4% to global revenue. This industry is expected to grow because of increased demand from the medical and dental sectors, which includes routine checkups and patient visits. For non-invasive physical examination applications, doctors, nurses, and other healthcare professionals can use exam gloves. Cross-contamination among healthcare workers, patients, and other healthcare workers is greatly reduced by this. The industry is set to grow further with the introduction of COVID-19. This will increase the demand for the examination gloves that frontline health workers use for testing or examination purposes.

The segment of surgical will see significant growth in the future. Because of rising rates of chronic diseases like cancer and heart disease, there will be a significant increase in surgical applications. They are more durable and used often by surgeons and nurses. These gloves are sterilized for surgical procedures and can be used repeatedly. These gloves can be precise in size, and provide surgeons with the tactile sensitivity and precision they require.

End-Use Analysis

In 2023, Hospitals segment held a dominant market position, capturing more than a 54.4% share. Due to the constantly increasing senior population, particularly in developed nations, these products will be in great demand. The demand for products in the hospital end-use segment is projected to be driven by the rising incidence of hospital-acquired infections like surgical site infections, ventilator-associated pneumonia, and bloodstream infections. Due to an increase in the number of elderly people and chronic health problems, the business is predicted to expand.

Home healthcare services are expected to grow at a substantial CAGR during the forecast period. This market segment will see an increase in product demand because of factors like growing home healthcare usage, and a growing geriatric population. Primary care physicians are those who provide primary healthcare to a specific patient population. Patients with undiagnosed symptoms and signs should consult primary care physicians. When working with patients not diagnosed with a condition, gloves are recommended to prevent cross-transmission. This segment is expected to grow because of the growing number of patients who seek primary care.

Key Market Segments

Material

- Natural Rubber

- Nitrile

- Vinyl

- Neoprene

- Polyethylene

- Other Materials

Application

- Examination

- Surgical

End-use

- Hospitals

- Home Healthcare

- Outpatient/Primary Care Facilities

- Other End-Uses

Drivers

Increasing Awareness of Hygiene and Safety

Growing awareness regarding the importance of infection prevention and control in healthcare settings is driving the demand for disposable medical gloves, as they play a crucial role in maintaining hygiene and safety standards.

Rising Incidence of Infectious Diseases

The global increase in the prevalence of infectious diseases, coupled with the ongoing challenges such as the COVID-19 pandemic, is boosting the demand for disposable medical gloves as a primary protective measure among healthcare professionals and the general public.

Stringent Regulations and Compliance Standards

Strict regulations and standards imposed by health authorities and regulatory bodies regarding the use of personal protective equipment (PPE) in healthcare settings are propelling the demand for disposable medical gloves, ensuring compliance and adherence to safety protocols.

Advancements in Material Technology

Continuous innovations in glove material technology, such as the development of latex-free alternatives and enhanced durability, are driving market growth. Improved comfort, tactile sensitivity, and barrier protection are significant factors contributing to the adoption of disposable medical gloves.

Restraints

Environmental Concerns

The disposal of large quantities of disposable gloves contributes to environmental issues, including pollution and waste. The increasing awareness of environmental sustainability is a restraining factor, leading to the exploration of eco-friendly alternatives and recycling solutions.

Supply Chain Disruptions

The disposable medical gloves market has faced challenges related to supply chain disruptions, particularly during global crises like the COVID-19 pandemic. These disruptions impact the availability and pricing of raw materials, affecting overall market dynamics.

Cost Fluctuations of Raw Materials

The disposable medical gloves industry is sensitive to fluctuations in the prices of raw materials, such as latex and nitrile. Volatility in these material costs can impact the overall production cost and, subsequently, the pricing of disposable gloves.

Intense Market Competition

The market for disposable medical gloves is highly competitive, with numerous manufacturers and suppliers. Intense competition can lead to price wars and a focus on cost-cutting measures, potentially affecting the profit margins of market players.

Opportunities

Rapid Expansion of Healthcare Infrastructure

The ongoing global expansion and modernization of healthcare infrastructure, particularly in emerging economies, present significant growth opportunities for the disposable medical gloves market as increased healthcare facilities drive the demand for protective equipment.

Technological Advancements in Manufacturing Processes

The adoption of advanced manufacturing technologies, such as automation and robotics, presents opportunities for improving production efficiency, reducing costs, and ensuring a stable supply of high-quality disposable medical gloves.

Surge in Telehealth Services

The rise of telehealth services and remote patient monitoring is creating new avenues for growth in the disposable medical gloves market. Healthcare professionals providing remote consultations may still require protective equipment, contributing to increased demand.

Expansion into Non-Healthcare Sectors

The utilization of disposable medical gloves is expanding beyond healthcare settings into industries like food processing, pharmaceuticals, and manufacturing. Diversification into non-healthcare sectors provides additional growth prospects for market players.

Trends

Shift towards Powder-Free Gloves

There is a notable trend in the market toward the adoption of powder-free disposable gloves. Powder-free gloves are preferred for their reduced risk of allergies and contamination, aligning with the increasing focus on safety and hygiene.

Increasing Adoption of Nitrile Gloves

Nitrile gloves are gaining popularity over traditional latex gloves due to their hypoallergenic properties and resistance to punctures. The shift towards nitrile gloves is a prevailing trend, especially in healthcare settings.

Customization and Product Innovation

Manufacturers are increasingly focusing on product innovation and customization to meet specific end-user requirements. This trend includes the development of gloves with specialized features, such as antimicrobial coatings and enhanced durability.

Strategic Alliances and Partnerships

Companies in the disposable medical gloves market are forming strategic alliances and partnerships to strengthen their market presence. Collaborations between manufacturers, distributors, and healthcare organizations are becoming common to address supply chain challenges and enhance market reach.

Regional Analysis

In 2023, North America emerged as the leader in the Disposable Medical Gloves Market, commanding a significant market share of over 38% and boasting a market value of USD 3.9 billion for the year. This strong position was driven by robust demand for medical gloves, indicating a high level of awareness and adoption in the region.

The United States, in particular, played a pivotal role in North America’s dominance, with a substantial contribution to both market share and overall market value. The growing emphasis on hygiene, safety, and healthcare standards in the country propelled the demand for disposable medical gloves, solidifying its leading position.

Additionally, stringent regulations and compliance standards in North America further bolstered the market, as manufacturers adhered to quality and safety guidelines. This resulted in increased trust among end-users, including healthcare professionals, contributing to the overall market growth.

The rising awareness of infectious diseases and the importance of protective measures, especially in the wake of global health challenges, fueled the demand for disposable medical gloves in North America. The market’s resilience and adaptability to evolving healthcare landscapes have established it as a cornerstone in the regional healthcare sector.

Looking ahead, North America is poised to maintain its robust market position, with ongoing advancements in healthcare infrastructure, a commitment to safety protocols, and a continuous focus on public health. As the Disposable Medical Gloves Market evolves, North America is expected to remain a key player, shaping the industry’s trajectory in the coming years.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Ansell Ltd., Top Glove Corporation Bhd, Hartalega Holdings Berhad, and Supermax Corporation Berhad stand out as key players in the highly competitive Disposable Medical Gloves Market. These companies play a crucial role in shaping the industry landscape and meeting the escalating demand for disposable medical gloves.

Top Glove Corporation Bhd, a major player, boasts a global footprint and is recognized for its scale of production. The company’s cost-effective solutions make it a preferred choice for healthcare providers, contributing significantly to market share.

Hartalega Holdings Berhad has gained prominence for its emphasis on technological advancements. The company’s continuous efforts in research and development reflect in its cutting-edge glove offerings, meeting the evolving safety standards in the healthcare sector.

Supermax Corporation Berhad has positioned itself as a reliable supplier of disposable medical gloves. Its strategic initiatives, coupled with a robust distribution network, have enabled the company to maintain a strong market position and respond effectively to market dynamics.

In addition to these key players, there are other notable contributors to the Disposable Medical Gloves Market. These players, though not as large in scale, play essential roles in regional markets and niche segments. Their agility and focus on specialized products contribute to the overall competitiveness and diversity of the market.

Market Key Players

- Ansell Ltd.

- Top Glove Corporation Bhd

- Hartalega Holdings Berhad

- Supermax Corporation Berhad

- Kossan Rubber Industries Bhd.

- Cardinal Health

- Semperit AG Holding

- Rubberex

- Dynarex Corporation

- B. Braun Melsungen AG

Recent Developments

- In September 2023, Essity, a global hygiene and health company, revealed its intention to acquire Amerx, a prominent specialty gloves manufacturer, for a sum of $2.2 billion. The deal is slated to be finalized in early 2024.

- In October 2023, Moldex-Metric, a key player in personal protective equipment, introduced a novel range of biodegradable nitrile gloves. Crafted from a unique blend of nitrile and biodegradable materials, these gloves break down naturally into harmless substances over time.

- In November 2023, witnessed Ansell Healthcare, a major producer of surgical and examination gloves, announcing a merger with Polyguard, a global leader in infection control products. The amalgamation aims to establish a worldwide leader in healthcare protective products.

- In November 2023, Top Glove Corporation, the largest manufacturer of disposable gloves globally, disclosed plans to enhance its production capacity in Vietnam. The company is set to invest $100 million in a new manufacturing facility in Vietnam, slated to become operational in 2025.

Report Scope

Report Features Description Market Value (2023) USD 10.3 Bn Forecast Revenue (2033) USD 15.6 Bn CAGR (2024-2033) 4.2% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Material (Natural Rubber, Nitrile, Vinyl, Neoprene, Polyethylene, Other Materials), By Application (Examination, Surgical), By End-use (Hospitals, Home Healthcare, Outpatient/Primary Care Facilities, Other End-Uses) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Ansell Ltd., Top Glove Corporation Bhd, Hartalega Holdings Berhad, Supermax Corporation Berhad, Kossan Rubber Industries Bhd., Cardinal Health, Semperit AG Holding, Rubberex, Dynarex Corporation, B. Braun Melsungen AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Disposable Medical Gloves MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample

Disposable Medical Gloves MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Ansell Ltd.

- Top Glove Corporation Bhd

- Hartalega Holdings Berhad

- Supermax Corporation Berhad

- Kossan Rubber Industries Bhd.

- Cardinal Health

- Semperit AG Holding

- Rubberex

- Dynarex Corporation

- B. Braun Melsungen AG