Global Color Coated Steel Market Size, Share, And Business Benefits By Coating Type (Polyester (Regular Modified, Silicon Modified, High Durability), Polyvinylidene Fluoride (PVDF), Polyurethane (PU), Plastisol, Others), By Finish Type (Matte, Glossy, Metallic), By End-use (Building and Construction (Roofing, Cladding and Facades, Doors and Windows, Interior Decoration, HVAC, Others), Consumer Goods(Appliances, Furniture, Others), Automotive (Interior, Exterior, Under the Hood), Electronics, Packaging, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 104617

- Number of Pages: 356

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

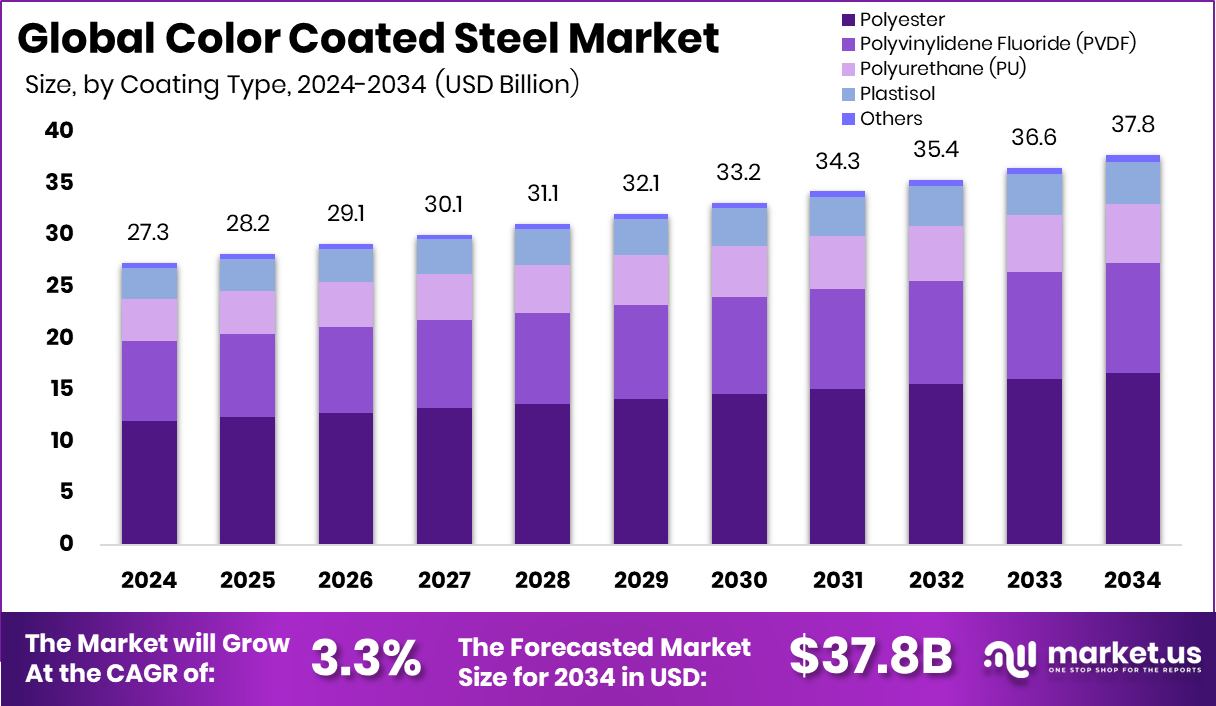

The Global Color Coated Steel Market is expected to be worth around USD 37.8 billion by 2034, up from USD 27.3 billion in 2024, and grow at a CAGR of 3.3% from 2025 to 2034. Rising demand in housing and industrial projects continues to boost Asia-Pacific’s 43.9% market expansion.

Color coated steel is a pre-painted or coated metal product made by applying a protective organic layer to steel surfaces. Typically manufactured through a continuous coil coating process, it includes layers of paint, film, or powder on galvanized or cold-rolled steel sheets. These coatings enhance resistance to corrosion, weather, and chemical exposure while offering aesthetic appeal.

The color coated steel market refers to the global trade and production ecosystem surrounding these pre-finished steel products. It involves raw material supply (steel coils), coating technologies, processing units, and downstream applications across construction, infrastructure, consumer goods, and transportation sectors. With growing demand for low-maintenance, corrosion-resistant building materials, the market is expanding steadily, particularly in developing economies witnessing a construction boom.

The growth of the color coated steel market can be attributed to increasing urbanization and infrastructural development, especially in emerging economies. Demand for energy-efficient and low-maintenance construction materials has led to wider adoption of coated steel in residential and commercial projects. Additionally, government-led housing and smart city missions have accelerated the use of sustainable steel products.

Consistent demand is being driven by the construction sector, especially for prefabricated structures and durable roofing materials. The growing trend toward aesthetic architectural finishes, along with the material’s ability to withstand extreme climates, has pushed usage across coastal, industrial, and high-humidity regions. Its recyclability also supports long-term sustainability targets.

Key Takeaways

- The Global Color Coated Steel Market is expected to be worth around USD 37.8 billion by 2034, up from USD 27.3 billion in 2024, and grow at a CAGR of 3.3% from 2025 to 2034.

- Polyester coatings dominate the Color Coated Steel Market, contributing 44.2% due to cost-effectiveness and durability.

- Matte finish leads with 46.4%, preferred for its modern appearance and anti-reflective surface properties.

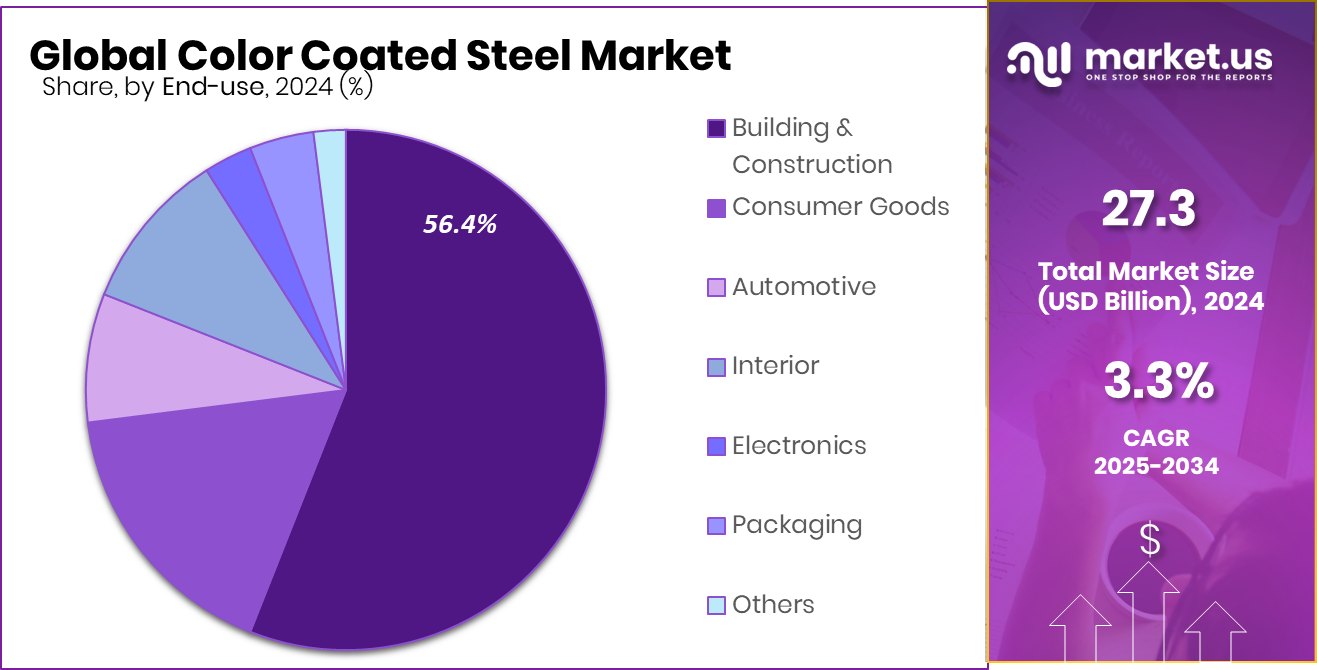

- The building and construction sector drives 56.4% of demand, fueled by urban infrastructure and prefabricated structure expansion.

- The Asia-Pacific’s held a 43.9% share, driven by strong construction and infrastructure growth.

By Coating Type Analysis

By coating type, polyester dominates the Color Coated Steel Market with a 44.2% share.

In 2024, Polyester held a dominant market position in the “By Coating Type” segment of the Color Coated Steel Market, accounting for a 44.2% share. This leadership is primarily driven by polyester’s cost-effectiveness, wide availability, and balanced performance characteristics suited for diverse end-use applications. Its durability, weather resistance, and color retention capabilities make it a preferred coating choice for architectural panels, roofing sheets, and general construction materials, especially in moderate environmental conditions.

Polyester coatings are widely adopted due to their compatibility with various steel substrates and their ability to deliver long-term protection without significantly increasing material costs. The segment’s performance in 2024 was also supported by ongoing infrastructure projects and steady demand in the housing sector, particularly across Asia and the Middle East, where low-cost yet reliable building materials remain essential.

Moreover, polyester coatings support a broad range of color and gloss options, enhancing the visual appeal of steel products without compromising functional properties. The segment’s dominant share reflects not only its commercial viability but also its continued relevance across both legacy and modern construction frameworks, where durability, economy, and aesthetic flexibility are critical.

By Finish Type Analysis

Matte finish leads in the Color Coated Steel Market, holding 46.4% segment share.

In 2024, Matte held a dominant market position in the “By Finish Type” segment of the Color Coated Steel Market, with a 46.4% share. This dominance is attributed to the growing preference for non-reflective and subdued surface finishes in modern architecture and industrial design. Matte finish provides a contemporary aesthetic appeal, especially favored in exterior cladding, roofing panels, and facade systems where glare reduction and subtle appearance are desirable.

The increasing use of matte-coated steel in residential and commercial buildings has been supported by its ability to offer a sophisticated look while maintaining the functional benefits of coated steel such as corrosion resistance and surface protection. Additionally, matte surfaces tend to hide scratches, fingerprints, and imperfections better than glossy alternatives, making them suitable for high-contact and exposed areas.

In markets prioritizing minimalistic and modern design themes, matte coatings have become a go-to option for architects and builders. The segment’s 46.4% share in 2024 reflects a clear industry trend toward low-sheen finishes that blend aesthetic preference with practical application. This strong uptake is further fueled by the finish’s compatibility with varied coating materials and substrates, ensuring it remains a top choice across diverse construction and industrial uses.

By End-use Analysis

The building and construction sector drives the Color Coated Steel Market with a 56.4% contribution.

In 2024, Building and Construction held a dominant market position in the “By End-use” segment of the Color Coated Steel Market, with a 56.4% share. This leadership reflects the sector’s consistent demand for durable, low-maintenance, and aesthetically adaptable materials across residential, commercial, and infrastructure projects. Color-coated steel, known for its corrosion resistance, thermal stability, and visual appeal, is widely utilized in roofing, cladding, ceilings, and facades—key components in modern construction frameworks.

The 56.4% market share in 2024 was strongly supported by ongoing urbanization and the execution of large-scale infrastructure developments, especially in developing economies. Builders and architects continue to prefer coated steel due to its long service life and ability to withstand extreme weather conditions, which reduces lifecycle costs and maintenance requirements.

Its growing acceptance in green building practices, where recyclable and energy-efficient materials are prioritized, also contributed to the segment’s dominance. With its functional versatility and design flexibility, color-coated steel remains central to meeting the evolving needs of the construction sector.

Key Market Segments

By Coating Type

- Polyester

- Regular Modified

- Silicon Modified

- High Durability

- Polyvinylidene Fluoride (PVDF)

- Polyurethane (PU)

- Plastisol

- Others

By Finish Type

- Matte

- Glossy

- Metallic

By End-use

- Building and Construction

- Roofing

- Cladding and Facades

- Doors and Windows

- Interior Decoration

- HVAC

- Others

- Consumer Goods

- Appliances

- Furniture

- Others

- Automotive

- Interior

- Exterior

- Under the Hood

- Electronics

- Packaging

- Others

Driving Factors

Urban Infrastructure Growth Is Boosting Steel Demand

The rising demand for color coated steel is mainly driven by rapid urban infrastructure development across growing economies. Cities are expanding fast, and governments are investing heavily in new housing, commercial buildings, airports, metro stations, and industrial parks. These projects need long-lasting, low-maintenance, and visually appealing materials, which makes color-coated steel a preferred choice.

Its resistance to corrosion, lightweight nature, and easy installation help speed up construction without compromising quality. In countries like India, China, and parts of Southeast Asia, construction is happening at a record pace, increasing the need for strong yet cost-effective materials.

Restraining Factors

Fluctuating Raw Material Prices Affect Market Stability

One major factor holding back the growth of the color coated steel market is the frequent fluctuation in raw material prices, especially steel and coating chemicals. The market depends heavily on stable prices of cold-rolled steel, galvanized steel, zinc, and resins used in coatings. When prices rise suddenly due to supply chain issues, global trade tensions, or high energy costs, manufacturers face increased production expenses.

These costs are often passed on to buyers, reducing competitiveness and affecting demand. Uncertain pricing also makes it difficult for construction companies and other users to plan their budgets, leading to delayed or cancelled projects. As a result, unpredictable raw material prices continue to be a strong barrier to steady market growth and long-term contracts.

Growth Opportunity

Rising Green Building Projects Create New Demand

A major growth opportunity for the color coated steel market lies in the global rise of green and sustainable building projects. Governments, architects, and developers are increasingly choosing eco-friendly materials to meet environmental regulations and energy-efficiency goals. Color coated steel fits well into these plans because it is recyclable, durable, and supports energy-saving designs like cool roofs.

Its long lifespan reduces replacement needs, and special coatings can reflect sunlight, lowering indoor temperatures and energy use. Many new building codes now favor materials that offer both performance and environmental benefits. As more cities adopt green construction standards, the demand for smart, sustainable materials like color-coated steel is expected to increase, opening new avenues for market expansion in both developed and emerging regions.

Latest Trends

Textured Finishes Enhance Aesthetic Appeal of Steel

A prominent recent trend in the color-coated steel market is the increasing popularity of textured and patterned surface finishes. Architects, designers, and builders are choosing steel sheets with wood grain, stone, embossed, or metallic textures to deliver more creative and visually engaging façades. These finishes help mimic natural materials, allowing for stylish building exteriors and interiors without sacrificing durability or performance.

Textured coatings also help hide minor surface imperfections and show less wear over time, making them suitable for high-traffic or outdoor areas. As consumer tastes shift toward more visually distinctive structures, manufacturers are responding with a wider palette of textured color color-coated steel options.

Regional Analysis

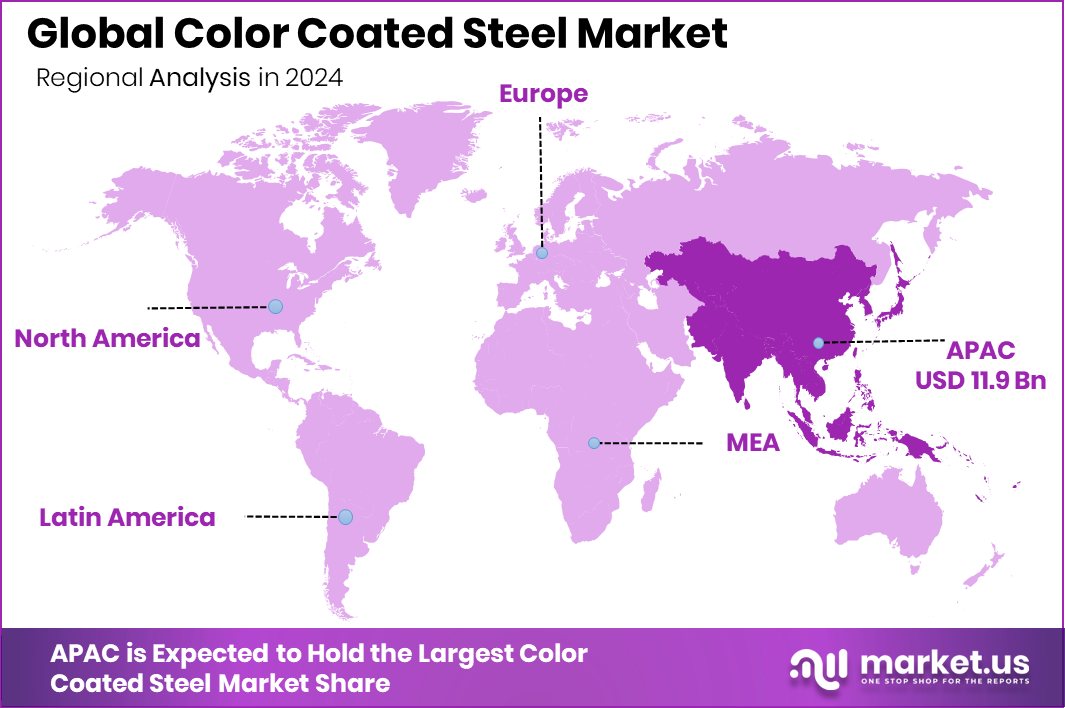

In Asia-Pacific, color color-coated steel market reached USD 11.9 billion, dominating globally.

In 2024, Asia-Pacific emerged as the leading region in the Color Coated Steel Market, accounting for a significant 43.9% share, equivalent to USD 11.9 billion in market value. The region’s dominance is strongly supported by ongoing urbanization, rapid industrialization, and government-backed infrastructure projects in countries such as China, India, and Southeast Asian nations. The high demand for roofing, cladding, and structural components in both residential and commercial construction has further driven market expansion.

In North America, the market remained steady, supported by demand for pre-painted steel in renovation and energy-efficient building systems. Europe experienced moderate growth, driven by sustainable construction trends and environmental compliance across manufacturing sectors. Middle East & Africa observed increasing usage in infrastructure development, though from a smaller base.

Meanwhile, Latin America showed stable demand, with activity concentrated in urban housing and industrial zones. Across all regions, demand patterns vary based on construction activity, economic outlook, and climatic conditions influencing material choices. However, Asia-Pacific led the global landscape due to its volume-driven consumption, growing population, and expanding middle-class housing needs.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ArcelorMittal S.A. leveraged its vertically integrated production model to enhance supply chain efficiencies and ensure consistent quality throughout its color coated steel portfolio. Its global footprint enabled responsive delivery to diverse end-user markets, supported by ongoing investments in coating technology upgrades and processautomation. The company’s commitment to sustainability also resonated with demand for eco‑friendly construction materials.

JSW, a prominent Indian steel producer, expanded its market presence through capacity enhancement and aggressive pricing strategies. Focused on serving the fast‑growing domestic construction and infrastructure sectors, JSW emphasized product customization to meet regional heat and corrosion resistance requirements. Investment in local processing facilities enhanced production agility and reduced lead times, strengthening its competitive positioning in Asia.

Baowu, representing China’s steel leadership, capitalized on vast domestic demand and economies of scale. Its state-of-the-art coating lines enabled advanced finishes and high-volume output at competitive cost structures. Strategic alignment with national infrastructure objectives facilitated consistent order pipelines. Furthermore, the company emphasized R&D collaboration to improve coating performance and diversify its application in the automotive and appliance sectors.

Nippon Steel Coated Sheet Corporation introduced value‑added coatings and high‑quality finishes tailored to premium architectural and industrial applications. Its focus on technical excellence and brand reputation underpinned strong acceptance in mature markets such as Japan and Europe. Through selective overseas partnerships and joint ventures, the company extended its reach while maintaining strict quality control standards.

Top Key Players in the Market

- ArcelorMittal S.A.

- JSW

- Baowu

- Nippon Steel Coated Sheet Corporation.

- Novolipetsk Steel

- Nucor Corporation

- Salzgitter AG

- UNICOIL

- Tata BlueScope Steel

- Alucosuper New Materials Co., Ltd

- Batie Metal Products (Shandong) Co., Ltd.

- POSCO

- Shanghai Metal Corporation

- KOBE STEEL, LTD.

- ThyssenKrupp

- United States Steel Corporation

- Other Key Players

Recent Developments

- In April 2025, JSW Steel Coated Products Ltd. (JSWSCPL) successfully placed the winning bid to acquire Colour Roof India Limited through the Corporate Insolvency Resolution Process (CIRP). The deal was approved by creditors and now awaits formal sanction from the National Company Law Tribunal in Mumbai.

- In October 2024, ArcelorMittal entered into an Equity Purchase Agreement to acquire Nippon Steel’s 50% stake in the AM/NS Calvert joint venture in Alabama, securing full ownership of a leading North American flat‑rolled steel finishing facility with advanced coating capabilities.

Report Scope

Report Features Description Market Value (2024) USD 27.3 Billion Forecast Revenue (2034) USD 37.8 Billion CAGR (2025-2034) 3.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Coating Type (Polyester (Regular Modified, Silicon Modified, High Durability), Polyvinylidene Fluoride (PVDF), Polyurethane (PU), Plastisol, Others), By Finish Type (Matte, Glossy, Metallic), By End-use (Building and Construction (Roofing, Cladding and Facades, Doors and Windows, Interior Decoration, HVAC, Others), Consumer Goods(Appliances, Furniture, Others), Automotive (Interior, Exterior, Under the Hood), Electronics, Packaging, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ArcelorMittal S.A., JSW, Baowu, Nippon Steel Coated Sheet Corporation., Novolipetsk Steel, Nucor Corporation, Salzgitter AG, UNICOIL, Tata BlueScope Steel, Alucosuper New Materials Co., Ltd, Batie Metal Products (Shandong) Co., Ltd., POSCO, Shanghai Metal Corporation, KOBE STEEL, LTD., ThyssenKrupp, United States Steel Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ArcelorMittal S.A.

- JSW

- Baowu

- Nippon Steel Coated Sheet Corporation.

- Novolipetsk Steel

- Nucor Corporation

- Salzgitter AG

- UNICOIL

- Tata BlueScope Steel

- Alucosuper New Materials Co., Ltd

- Batie Metal Products (Shandong) Co., Ltd.

- POSCO

- Shanghai Metal Corporation

- KOBE STEEL, LTD.

- ThyssenKrupp

- United States Steel Corporation

- Other Key Players