Global Bisphenol A Market By Application(Polycarbonate Resins, Epoxy Resins, Unsaturated Polyester Resins, Flame Retardants, Others), By End-Use Industry(Electricals and Electronics, Packaging, Automotive, Paint and Coatings, Building and Construction, Healthcare, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: May 2024

- Report ID: 120589

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

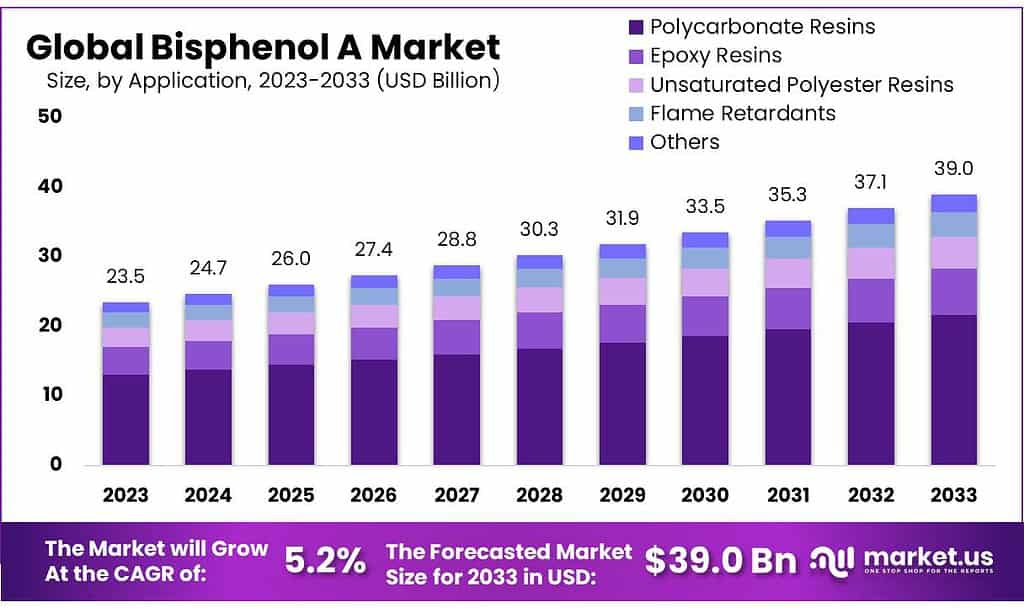

The global Bisphenol A Market size is expected to be worth around USD 39 billion by 2033, from USD 23.5 billion in 2023, growing at a CAGR of 5.2% during the forecast period from 2023 to 2033.

The Bisphenol A (BPA) market refers to the global industry involved in the production and distribution of Bisphenol A, a chemical compound extensively used in manufacturing polycarbonate plastics and epoxy resins. These materials are found in a wide array of products, including water bottles, sports equipment, medical devices, dental devices, and the linings of metal food cans.

BPA is synthesized through the condensation of acetone and phenol and is valued for its ability to produce clear, tough, and heat-resistant products. The demand for BPA is primarily driven by its widespread use in the packaging industry, particularly for food and beverages, due to its ability to extend the shelf life of canned foods and prevent corrosion and contamination.

However, the BPA market faces significant regulatory challenges due to health concerns associated with its use. Studies have suggested that BPA can seep into food or beverages from containers made with the compound, leading to potential health effects on the brain, behavior, and prostate gland of fetuses, infants, and children. As a result, there is increasing consumer and regulatory pushback against BPA, with demands for BPA-free products and the development of safer alternatives.

In response, manufacturers are exploring BPA-free materials and new polymer technologies that do not rely on BPA, particularly in applications involving contact with food and drink. The market is also witnessing a shift towards sustainable practices, with increased recycling of polycarbonate plastics and innovations in bio-based polymers.

Despite these challenges, BPA remains in high demand in certain industrial applications where alternatives cannot match its performance characteristics. The market is also supported by growth in industries such as automotive, electronics, and construction, where the properties of polycarbonate plastics are highly valued.

Key Takeaways

- Market Growth: Bisphenol A market projected to reach USD 39 billion by 2033 from USD 23.5 billion in 2023, with 5.2% CAGR.

- Application Dominance: Polycarbonate resins hold over 55.6% market share due to widespread use in various products.

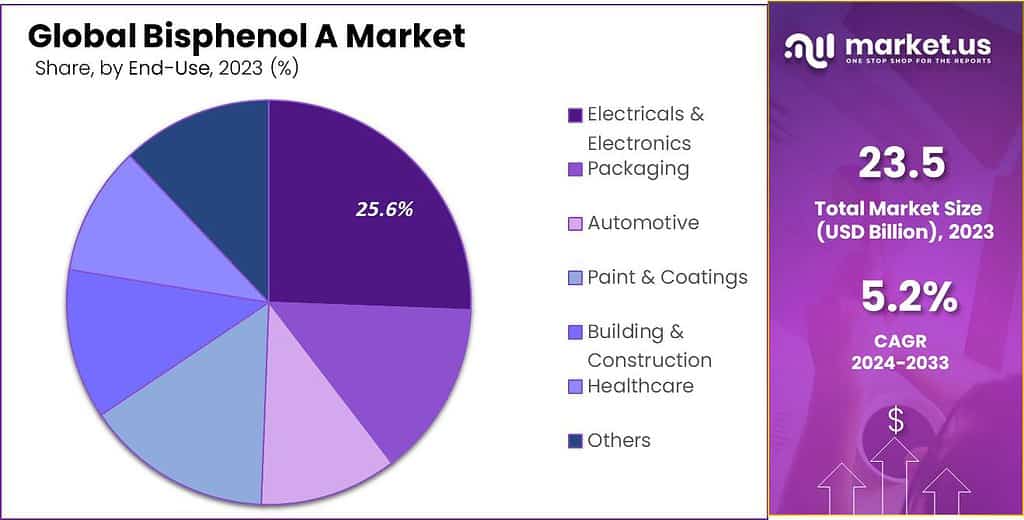

- End-Use Industry Dynamics: Electricals & Electronics accounted for more than 25.6% of the Bisphenol A market share in 2023.

- Regional Dominance: Asia-Pacific leads the Bisphenol A market, accounting for over 53.7% of the market share.

By Application

In 2023, Polycarbonate Resins held a dominant market position in the Bisphenol A market, capturing more than a 55.6% share. This significant market share is attributed to the extensive use of polycarbonate resins in various applications, including the production of eyewear lenses, electronic components, and automotive parts. Polycarbonate resins are highly valued for their transparency, strength, and high impact resistance, making them ideal for safety-related and durable consumer products.

Epoxy Resins also play a crucial role, especially in coatings and adhesives, where they are used for their superior adhesive properties and resistance to environmental degradation. This application is vital in the construction and electronics industries, where durable and reliable materials are essential.

Unsaturated Polyester Resins are used in fiberglass reinforcements and non-reinforced plastics, commonly found in automotive parts and marine applications. Although this segment captures a smaller portion of the market, it is essential for producing high-performance composites.

Flame Retardants are another significant application area for Bisphenol A. These compounds are incorporated into a variety of consumer and industrial products to enhance fire resistance, crucial for ensuring safety in electrical and building applications.

By End-Use Industry

In 2023, Electricals & Electronics held a dominant market position in the Bisphenol A (BPA) market, capturing more than a 25.6% share. This sector extensively utilizes BPA in the manufacture of polycarbonate and epoxy resins, which are integral components of electrical and electronic housings, parts, and assemblies. The demand in this segment is driven by the need for durable, heat-resistant materials in consumer electronics, appliances, and components.

Packaging is another significant end-use industry, where BPA is used in the production of polycarbonate plastics and epoxy resins for food and beverage containers. Despite growing regulatory scrutiny and consumer preference shifts towards BPA-free products, this sector continues to consume a substantial amount of BPA, particularly in non-food applications.

The Automotive industry also relies on BPA-based products, particularly polycarbonate materials, for parts such as headlamps, dashboards, and internal panels. These components benefit from the material’s strength and clarity, essential for both safety and aesthetic purposes.

In Paints & Coatings, BPA is used in the formulation of epoxy resins that serve as protective coatings. These coatings are applied to metal products and structures, providing resistance to corrosion and environmental wear, crucial for maintaining the integrity and longevity of such materials.

Building & Construction utilizes BPA in a variety of applications, including the production of epoxy-based sealants and adhesives that are used to bind and protect building materials. BPA’s properties ensure that these materials are durable and can withstand various environmental stresses.

Healthcare is a critical industry for BPA use, especially in medical devices where polycarbonate plastics are used for items that require sterility, clarity, and durability. The material’s impact resistance and transparency are particularly valued in this sector.

Key Market Segments

By Application

- Polycarbonate Resins

- Epoxy Resins

- Unsaturated Polyester Resins

- Flame Retardants

- Others

By End-Use Industry

- Electricals and Electronics

- Packaging

- Automotive

- Paint and Coatings

- Building and Construction

- Healthcare

- Others

Drivers

Increasing Demand in the Automotive and Electronics Industries

One significant driver for the Bisphenol A (BPA) market is the increasing demand from the automotive and electronics industries. BPA-based polycarbonate plastics and epoxy resins are essential materials in both sectors due to their excellent mechanical properties, including high impact resistance, durability, and clarity. These materials are critical in manufacturing a variety of components that require precision and reliability under high-stress conditions.

In the automotive industry, the push towards more energy-efficient and safer vehicles is intensifying the need for lightweight yet strong materials. BPA-derived polycarbonate is used extensively in the production of automotive parts such as headlights, dashboards, windows, and protective covers.

These components benefit from polycarbonate’s lightweight, which contributes to overall vehicle weight reduction and improved fuel efficiency. Furthermore, the inherent toughness and heat resistance of polycarbonate enhances the safety features of automobiles, making it a preferred material for manufacturers.

Similarly, in the electronics industry, BPA-based polycarbonates are utilized in a myriad of applications, including smartphone cases, laptop cases, and other durable housings for electronic devices.

The demand in this sector is propelled by the global growth in consumer electronics consumption, driven by technological advancements and the increasing availability of high-tech products to broader markets. Polycarbonate’s ability to protect while maintaining a high-quality aesthetic finish is highly valued in the electronics market.

Moreover, the growth of these industries in emerging markets presents additional expansion opportunities for BPA manufacturers. Rapid urbanization and industrialization in regions such as Asia-Pacific are leading to increased production facilities and a higher consumer base for automotive and electronic products. This regional market expansion is expected to continue driving the demand for BPA-based materials as these economies grow and modernize.

Environmental concerns and regulatory changes also play a crucial role in shaping the demand for BPA. While there are significant pressures to reduce BPA usage due to potential health risks, the industry’s response has been to innovate with BPA-free alternatives or develop new formulations that mitigate these concerns without compromising on performance. This ongoing innovation not only addresses environmental and health regulations but also opens up new applications and markets for BPA derivatives.

Restraints

Health Concerns and Regulatory Restrictions

One of the major restraints facing the Bisphenol A (BPA) market is the growing concern over its health impacts, leading to increased regulatory restrictions globally. BPA is widely scrutinized due to its classification as an endocrine disruptor, which can mimic estrogen and has been linked to various health issues including reproductive disorders, heart disease, diabetes, and developmental problems in children. These health concerns have prompted significant public and scientific debate, influencing consumer behavior and regulatory policies.

The impact of these health concerns on the BPA market is profound. In response, governments around the world have begun to implement stricter regulations concerning the use of BPA, particularly in food contact materials and children’s products. For example, the European Union and Canada have banned BPA in baby bottles and other baby food containers. Similarly, the United States Food and Drug Administration (FDA) has banned BPA in sippy cups and baby bottles, although it remains in use in other products.

These regulatory actions are complemented by a shift in consumer preferences towards BPA-free products. The demand for safer, non-toxic materials has led to significant growth in the market for alternatives to BPA-based products. Manufacturers are increasingly pressured to find and implement safer materials that do not compromise product quality or incur substantial costs.

Furthermore, the ongoing research linking BPA exposure to health risks continues to fuel debates and scientific studies, keeping the issue in the public eye and maintaining pressure on policymakers to extend regulations. This ongoing scrutiny creates a volatile market environment for BPA, where manufacturers must navigate not only the existing regulatory landscape but also anticipate further restrictions.

The combination of health concerns, regulatory actions, and shifting consumer preferences forms a significant restraint on the BPA market. These factors drive the industry’s research and development efforts towards safer alternatives, reshape market dynamics, and redefine competitive strategies within the chemical manufacturing sector. As this trend continues, the BPA market may face diminished growth prospects unless effective and acceptable alternatives are developed and adopted widely.

Opportunity

Growth in Eco-friendly BPA Alternatives

A significant opportunity within the Bisphenol A (BPA) market is the burgeoning demand for eco-friendly and health-conscious alternatives to traditional BPA-based products. As awareness of BPA’s potential health risks grows among consumers and regulators, there is a notable shift towards materials that offer similar benefits without the associated risks. This trend is not just reshaping consumer preferences but is also opening new avenues for innovation in chemical manufacturing.

The drive for BPA-free products has catalyzed the development and adoption of advanced polymers and composites that mimic the desirable properties of BPA-based polycarbonates and epoxies—such as clarity, high impact resistance, and durability—but with safer chemical compositions. These new materials are increasingly being used in a wide array of applications, including food containers, water bottles, baby products, and medical devices, markets where safety and non-toxicity are paramount.

Moreover, the regulatory pressure compelling manufacturers to reduce or eliminate BPA in products is paralleled by incentives and support for sustainable material research. Governments and environmental organizations worldwide are promoting the use of green chemistry through grants, tax incentives, and subsidies, further encouraging the shift towards safer alternatives. This regulatory landscape creates a fertile ground for companies that invest in alternative chemical research and product development, offering them a competitive edge.

Additionally, technological advancements in material science enable the creation of high-performance BPA alternatives that meet stringent safety standards. Companies that can innovate and scale the production of these alternatives effectively will tap into a rapidly growing market segment keen on sustainability and health.

Furthermore, expanding into emerging markets where regulatory frameworks are still evolving presents a strategic opportunity. These regions offer a new consumer base and less saturated markets for BPA-free products. By establishing a presence in these markets early, companies can build brand loyalty and influence local standards and practices, positioning themselves as leaders in safe and sustainable materials.

Trends

Increasing Regulatory Impact and Shift Towards BPA-Free Products

A pivotal trend in the Bisphenol A (BPA) market is the intensifying regulatory impact concerning the use of BPA in consumer products, coupled with a significant shift towards BPA-free alternatives. This trend is largely driven by growing health concerns over BPA’s estrogenic effects and its association with various health issues, including hormonal disruptions and potential links to certain types of cancer. As a result, there is a notable increase in legislative actions globally, with many countries imposing bans or restrictions on BPA use, particularly in food contact materials and children’s products.

This regulatory push has spurred a notable trend in the market: the rise of BPA-free products. Consumers are increasingly demanding safer, non-toxic alternatives, which has led manufacturers across various sectors—especially in packaging, healthcare, and consumer goods—to innovate and market products made without BPA. The demand for BPA-free products is not just a niche market trend but is becoming a mainstream demand, reshaping the competitive landscape of industries that traditionally relied on BPA.

Moreover, the move towards BPA-free products is not merely reactive but strategic. Companies are viewing the regulatory challenges as an opportunity to differentiate their products and capture new market segments. Innovations in material science have facilitated the development of advanced polymers that mimic the advantageous properties of BPA-based plastics, such as clarity and high-impact resistance, without the associated health risks. These new materials are gaining traction, not only in consumer markets but also in industrial applications where safety and environmental compliance are critical.

Additionally, this trend towards BPA-free products is accelerating investments in research and development within the chemical industry. Companies are dedicating considerable resources to developing and testing alternative materials that can provide sustainable solutions without compromising on performance. This ongoing innovation is likely to continue, driven by both consumer advocacy and evolving regulatory landscapes.

The shift towards BPA-free alternatives is transforming the BPA market from one focused on managing risks and regulatory compliance to one emphasizing sustainability and health safety as core values. This trend represents a significant realignment of industry priorities and offers a roadmap for how the chemical sector might continue to evolve in response to environmental and health concerns. The ability of companies to adapt to this trend will likely define their future success and resilience in the market.

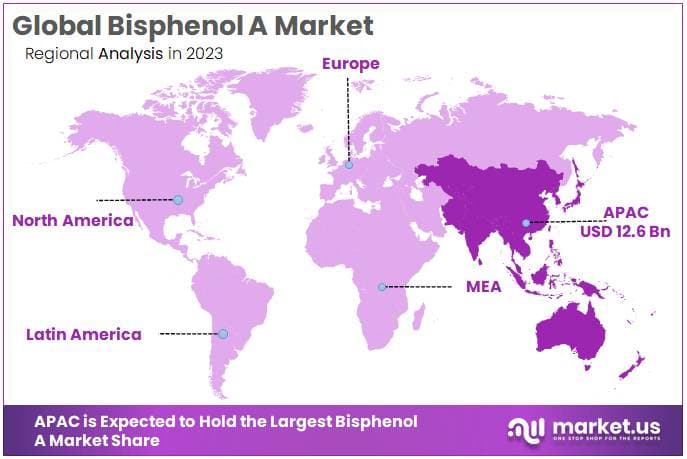

Regional Analysis

In the Bisphenol A (BPA) market, the Asia Pacific region emerges as a dominant force, securing a significant market share of 53.7%. Projections suggest that the market is on track to achieve a valuation of USD 12.6195 billion by the end of the forecast period. This growth is primarily driven by substantial adoption across critical sectors such as plastics manufacturing, epoxy resins, and thermal paper coatings.

Leading economies in the region, such as China, India, Japan, and South Korea, are propelling this growth trajectory. These nations demonstrate a remarkable surge in BPA consumption, indicative of the increasing demand for BPA-based products across various industries. Moreover, the region’s dedication to innovative manufacturing practices and export-oriented strategies further strengthens its position in the global BPA market.

In North America, the BPA market is witnessing steady expansion. This upward trend is fueled by growing demand from industries utilizing BPA in the production of polycarbonate plastics, epoxy resins for coatings, and thermal paper. The region’s robust manufacturing infrastructure and advancements in chemical processes play a pivotal role in driving the adoption of BPA-based products.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In the Bisphenol A (BPA) market, several key players play pivotal roles in shaping the industry landscape and driving market dynamics. Prominent companies such as Dow Chemical Company, Covestro AG, SABIC, Mitsui Chemicals, Inc., and LG Chem stand out as major influencers.

Market Key Players

- SABIC Innovative Plastics

- Dow Chemical

- Mitsubishi Chemical

- Vinmar International

- LG Chem

- Merck KGaA

- Mitsui Chemical Corporation

- Chang Chun Group

- Nan Ya Plastics Corporation

- Covestro AG

- Lihuayi Weiyuan Chemical Co. Ltd

- Kumho P&B Chemicals

- Teijin

- Bayer Material Science

- Samyang Innochem

Recent Developments

In 2023, SABIC Innovative Plastics demonstrates steady growth in BPA production and sales, as reflected in month-wise data trends. The company’s comprehensive product portfolio and strong market presence contribute to its sustained success in meeting customer demands across various industries.

In 2023, Dow Chemical demonstrates consistent growth in BPA production and sales, evident from month-wise data trends. The company’s commitment to research and development enables it to introduce innovative BPA-based solutions tailored to diverse industry needs.

Report Scope

Report Features Description Market Value (2023) USD 23.5 Bn Forecast Revenue (2033) USD 39 Bn CAGR (2024-2033) 5.2% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Application(Polycarbonate Resins, Epoxy Resins, Unsaturated Polyester Resins, Flame Retardants, Others), By End-Use Industry(Electricals and Electronics, Packaging, Automotive, Paint and Coatings, Building and Construction, Healthcare, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape SABIC Innovative Plastics, Dow Chemical, Mitsubishi Chemical, Vinmar International, LG Chem, Merck KGaA, Mitsui Chemical Corporation, Chang Chun Group, Nan Ya Plastics Corporation, Covestro AG, Lihuayi Weiyuan Chemical Co. Ltd, Kumho P&B Chemicals, Teijin, Bayer Material Science, Samyang Innochem Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Bisphenol A Market?Bisphenol A Market size is expected to be worth around USD 39 billion by 2033, from USD 23.5 billion in 2023

What is the CAGR for the Bisphenol A Market?The Bisphenol A Market is expected to grow at a CAGR of 5.2% during 2024-2033.Name the major industry players in the Toluene Diisocyanate Market?SABIC Innovative Plastics, Dow Chemical, Mitsubishi Chemical, Vinmar International, LG Chem, Merck KGaA, Mitsui Chemical Corporation, Chang Chun Group, Nan Ya Plastics Corporation, Covestro AG, Lihuayi Weiyuan Chemical Co. Ltd, Kumho P&B Chemicals, Teijin, Bayer Material Science, Samyang Innochem

-

-

- SABIC Innovative Plastics

- Dow Chemical

- Mitsubishi Chemical

- Vinmar International

- LG Chem

- Merck KGaA

- Mitsui Chemical Corporation

- Chang Chun Group

- Nan Ya Plastics Corporation

- Covestro AG

- Lihuayi Weiyuan Chemical Co. Ltd

- Kumho P&B Chemicals

- Teijin

- Bayer Material Science

- Samyang Innochem