Company Overview

Salesforce Statistics: Salesforce, Inc. is a customer relationship management (CRM) technology company that empowers organizations of all sizes and industries to strengthen customer connections through data, artificial intelligence (AI), and trust-driven solutions. The company operates through 1 business segment. Its flagship offering, the AI-powered Customer 360 platform, integrates customer data, marketing automation, analytics, integration, commerce, and AI capabilities to deliver a unified view of customer interactions.

Salesforce primarily markets its products on a subscription basis, utilizing both direct sales channels and a global network of partners. The company serves a diverse range of sectors, including manufacturing, retail, financial services, healthcare and life sciences, nonprofit, automotive, consumer goods, energy and utilities, education, media, and technology.

With operations across the Asia-Pacific, Americas, Europe, and Africa, Salesforce maintains a presence in 92 cities through 105 offices worldwide. Headquartered in San Francisco, California, the US, the company employed 76,453 people as of January 31, 2025.

(Source: Company Website)

History of Salesforce, Inc

1900’s

- 1999: Salesforce was founded in Telegraph Hill, San Francisco, by Marc Benioff with co-founders Parker Harris, Dave Mellenhoff, and Frank Dominguez. Their vision was to simplify CRM systems by offering them as Software-as-a-Service (SaaS), eliminating the need for complex installations.

- SaaS soon transformed enterprise operations, enabling faster adoption of cloud-based CRM and laying the foundation for the modern software subscription model.

2000’s

- 2003: Salesforce hosted its first Dreamforce conference, unveiling Sforce 2.0—the first on-demand platform to build, host, and run client-service applications. The event became a global stage for product innovation.

- 2004: The company completed its IPO on the New York Stock Exchange, generating $110 million in revenue and gaining strong investor confidence.

- 2005: Salesforce launched AppExchange, a marketplace allowing third-party developers to create and distribute apps to its user base, expanding the ecosystem significantly.

- 2006: The introduction of Apex, a proprietary programming language similar to Java, allowed developers to execute logic directly within Salesforce’s cloud environment.

- In the same year, Salesforce introduced Visualforce, a framework for building dynamic user interfaces that supports multiple scripting languages, including JavaScript and Flash.

- 2008: The debut of Force.com marked Salesforce’s entry into the Platform-as-a-Service (PaaS) segment. Enabling faster cloud app creation and deployment, integrated with Salesforce architecture.

Later 2010’s

- 2011: Salesforce diversified into marketing through acquisitions of Radian6 (social listening), Buddy Media (social content management), and ExactTarget (marketing automation), forming the foundation of the Marketing Cloud.

- 2013: The company launched Salesforce1, a mobile platform offering CRM access and app integration on smartphones, enabling real-time business connectivity.

- 2014: Salesforce introduced Trailhead, an interactive learning platform that provides hands-on tutorials for users and developers to master Salesforce tools.

- 2015: The release of Lightning transformed Salesforce into a modern, data-driven platform with faster app development, a refined interface, and advanced automation.

- 2016: Salesforce launched Einstein, its AI layer, enabling predictive analytics and intelligent automation across cloud services to enhance decision-making and customer insights.

- 2018: Salesforce acquired MuleSoft to strengthen enterprise integration, helping organizations connect legacy systems to modern cloud infrastructure.

- 2019: The acquisition of Tableau expanded Salesforce’s analytics portfolio. Emphasizing its data-centric strategy and supporting visualization-driven business intelligence.

Later 2020’s

- 2020:

- Salesforce introduced several rapid-response solutions during COVID-19

- Salesforce Care – free tools for maintaining business continuity.

- Work.com – resources and analytics for workforce management during reopening.

- Vaccine Cloud – a healthcare platform for vaccine distribution support.

- The company also completed its largest deal, acquiring Slack for $27.7 billion, strengthening its enterprise collaboration ecosystem.

- 2021:

- Salesforce expanded its DevOps capabilities with integrated deployment, testing, and code scanning tools to enhance development efficiency and security.

- The company launched Salesforce+, a streaming platform providing live and on-demand business content.

- Traditional automation tools were replaced with Flow, a next-generation workflow automation system designed for complex business processes.

- 2022:

- Salesforce achieved record revenue of $26.5 billion, marking a 25% year-over-year growth, and expanded operations to 113 cities with over 78,000 employees.

- Partnered with Meta Platforms to integrate WhatsApp with the Customer 360 platform, enhancing customer engagement through messaging.

- Introduced Slack First Customer 360, connecting teams, customers, and partners within a unified ecosystem.

- Released the DevOps Center for streamlined development collaboration and the NFT Cloud for businesses to create and manage digital assets securely.

Financial Analysis

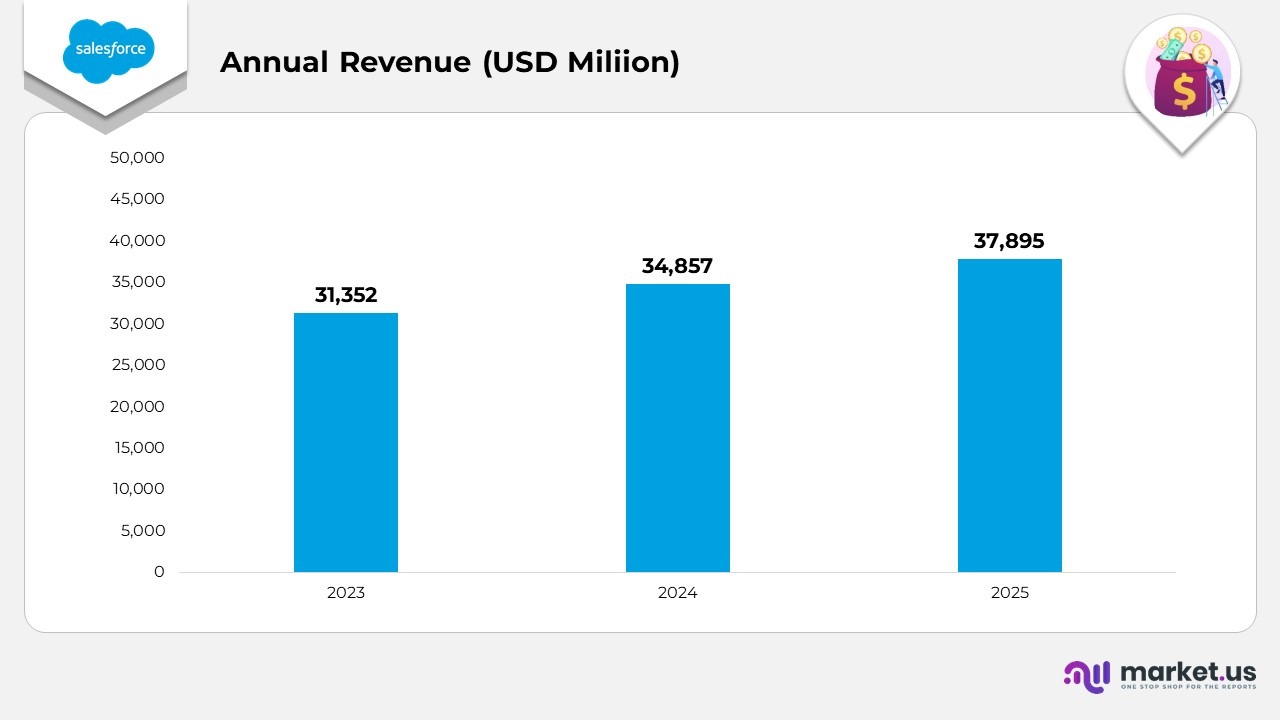

- In 2023, Salesforce reported USD 31,352 million in revenue, establishing a strong foundation supported by steady demand for its cloud-based CRM and AI-driven customer engagement tools.

- In 2024, Revenue grew to USD 34,857 million, reflecting a year-over-year increase of 11.2%. This growth was primarily driven by enhanced product integration, the expansion of Customer 360, and continued enterprise adoption across various sectors, including healthcare, financial services, and manufacturing.

- In 2025, Salesforce’s revenue reached USD 37,895 million, representing an 8.7% year-over-year growth from 2024. The rise was attributed to deeper penetration of AI-powered services, stronger cross-cloud synergies, and increasing global enterprise subscriptions.

- Over the 3 years (2023–2025), Salesforce maintained a CAGR of 8.7%, demonstrating consistent. Healthy growth momentum and reinforcing its leadership in the global CRM and enterprise software ecosystem.

(Source: Salesforce, Inc. Annual Report)

Salesforce Statistics By Segmental Analysis

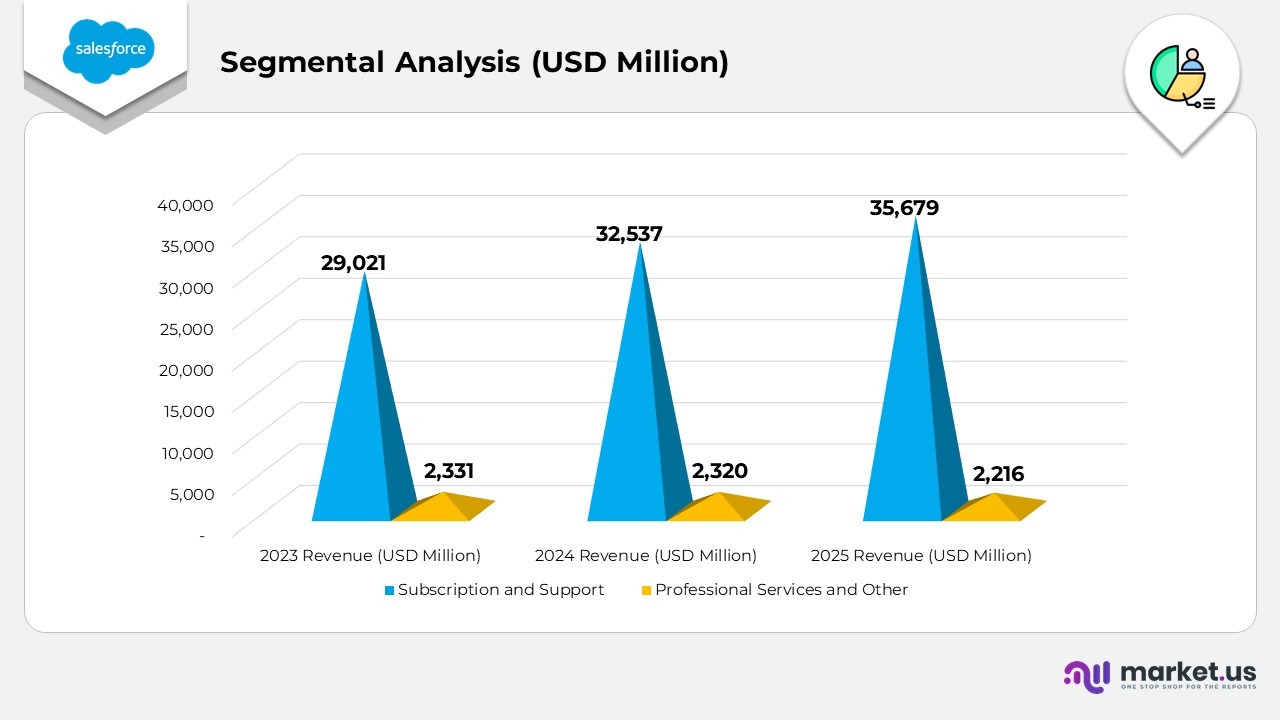

Subscription and Support

- In 2023, Salesforce generated USD 29,021 million from subscription and support services, forming the backbone of its recurring revenue model.

- In 2024, revenue increased to USD 32,537 million, representing a 12.1% year-over-year growth. Driven by the adoption of the Customer 360 platform by enterprises, AI-driven automation, and cloud integration.

- In 2025, revenue increased further to USD 35,679 million, reflecting a 9.7% growth over the previous year, driven by the continued expansion of AI features, such as Einstein, and stronger renewal rates across various industries.

Professional Services and Other

- In 2023, Salesforce earned USD 2,331 million from professional services and related activities, including consulting, implementation, and training.

- In 2024, this figure slightly declined to USD 2,320 million, as the company streamlined service delivery and emphasized scalable self-service platforms like Trailhead.

- In 2025, revenue from this segment reached USD 2,216 million, representing a 4.5% year-over-year decrease. Primarily due to the company’s focus on subscription-led growth and automation-based service delivery, rather than manual professional engagements.

(Source: Salesforce, Inc. Annual Report)

Geographical Analysis By Salesforce Statistics

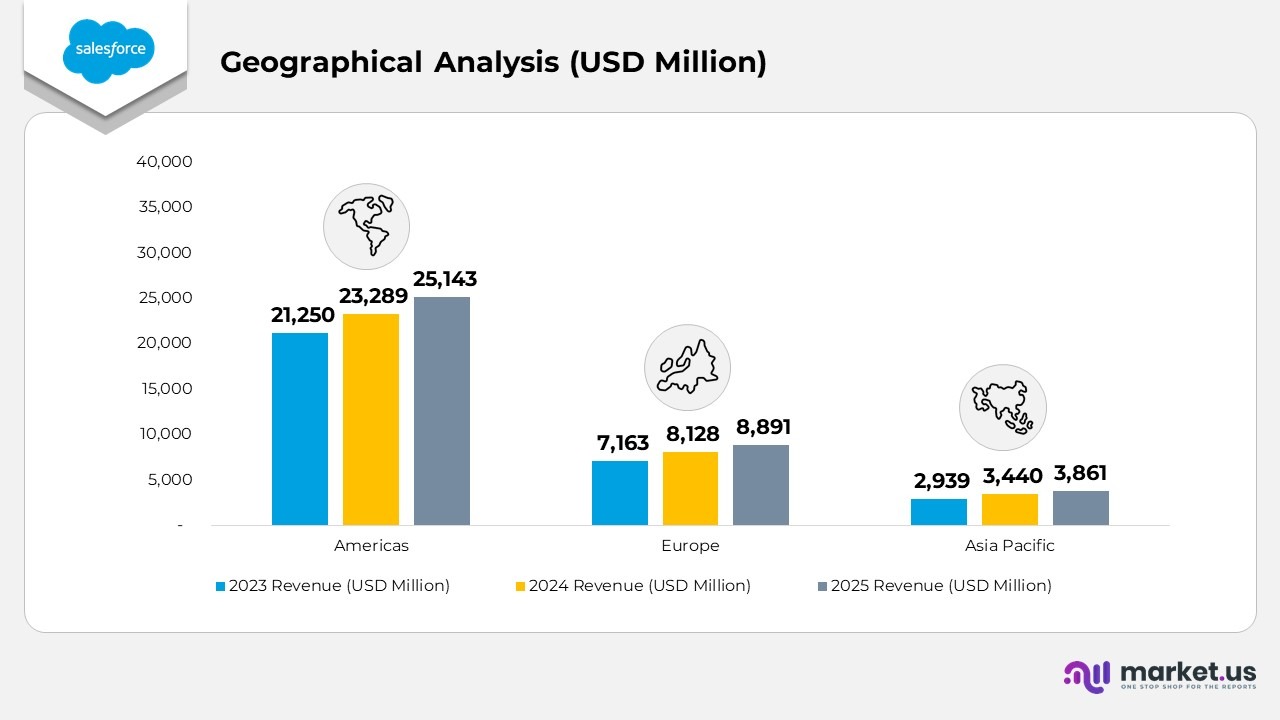

Americas

- In 2023, Salesforce earned USD 21,250 million, representing its strongest revenue base across global operations.

- In 2024, revenue increased to USD 23,289 million, representing a year-over-year (YoY) growth of 9.6%, driven by the widespread adoption of cloud CRM and Customer 360 solutions across the US and Latin America.

- In 2025, revenue reached USD 25,143 million, translating to a YoY increase of 8.0%, driven by robust enterprise renewals, AI integration in customer management, and continued leadership in the North American CRM market.

Europe

- In 2023, Salesforce generated USD 7,163 million in Europe, supported by strong demand from financial and retail sectors.

- In 2024, revenue climbed to USD 8,128 million, reflecting a YoY growth of 13.4%. Driven by investments in localized data infrastructure and AI-enabled service tools.

- In 2025, revenue advanced to USD 8,891 million, indicating a YoY growth of 9.4%. Supported by broader EU adoption of digital transformation solutions and growing trust in Salesforce’s data compliance standards.

Asia Pacific

- In 2023, Salesforce recorded USD 2,939 million, marking a growing presence in emerging markets such as India, Japan, and Australia.

- In 2024, revenue increased to USD 3,440 million, showing a YoY rise of 17.0%, reflecting strong enterprise cloud uptake and regional digitalization programs.

- In 2025, revenue reached USD 3,861 million, a YoY increase of 12.2%, supported by expanding regional partnerships, AI-powered product offerings, and deeper penetration into Southeast Asian markets.

(Source: Salesforce, Inc. Annual Report)

Cost of Revenue Analysis By Salesforce Statistics

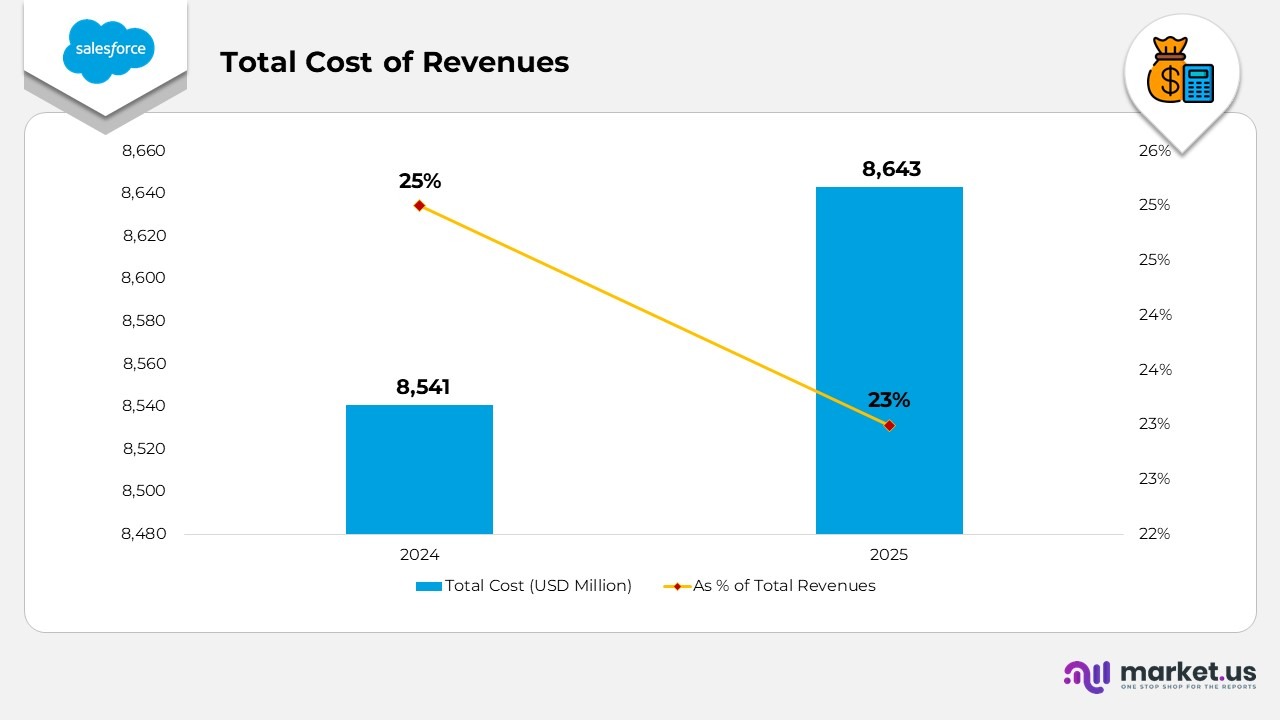

Total Cost of Revenues

- The overall cost of revenues was USD 8,541 million in 2024, accounting for 25% of total revenues.

- In 2025, the total cost increased slightly to USD 8,643 million, or 23% of total revenues, marking a variance of USD 102 million.

- The decline in cost percentage suggests improved operational efficiency, effective use of automation, and optimized resource utilization across business segments.

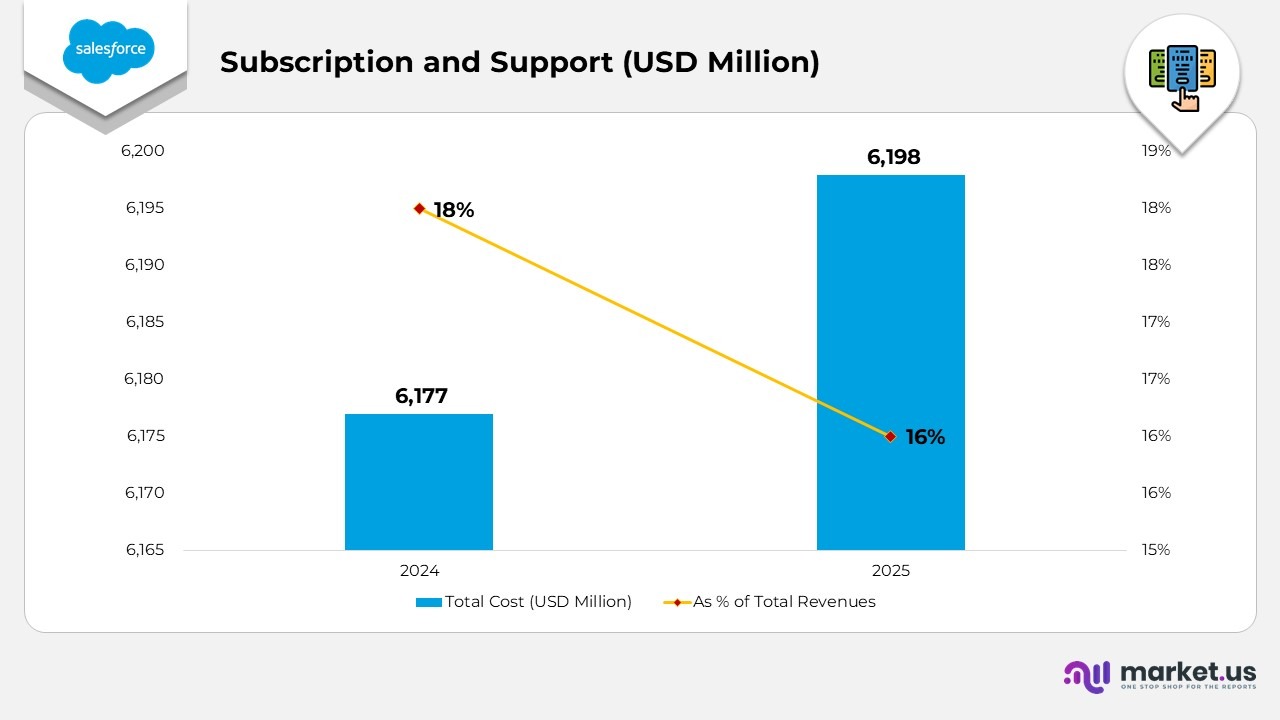

Salesforce Statistics By Subscription and Support

- In 2024, the cost of subscription and support stood at USD 6,177 million, accounting for 18% of total revenues.

- In 2025, the cost slightly increased to USD 6,198 million, representing 16% of total revenues, with a variance of USD 21 million.

- The marginal rise indicates efficient cost management relative to revenue growth, driven by automation, infrastructure optimization, and improved service scalability.

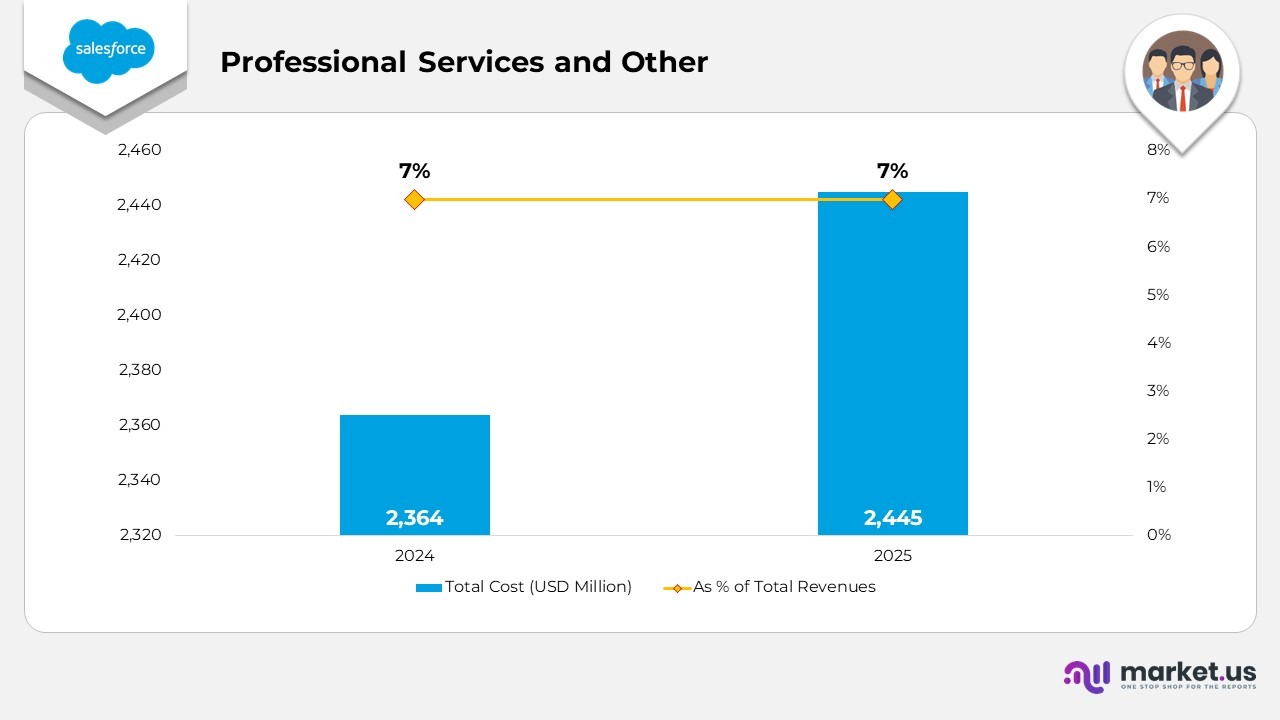

Professional Services and Other By Salesforce Statistics

- In 2024, this segment recorded costs of USD 2,364 million, forming 7% of total revenues.

- In 2025, costs rose to USD 2,445 million, maintaining the same 7% share, with a variance of USD 81 million.

- The increase reflects expanded consulting engagements and service delivery expenses related to new enterprise implementations and technical support.

(Source: Salesforce, Inc. Annual Report)

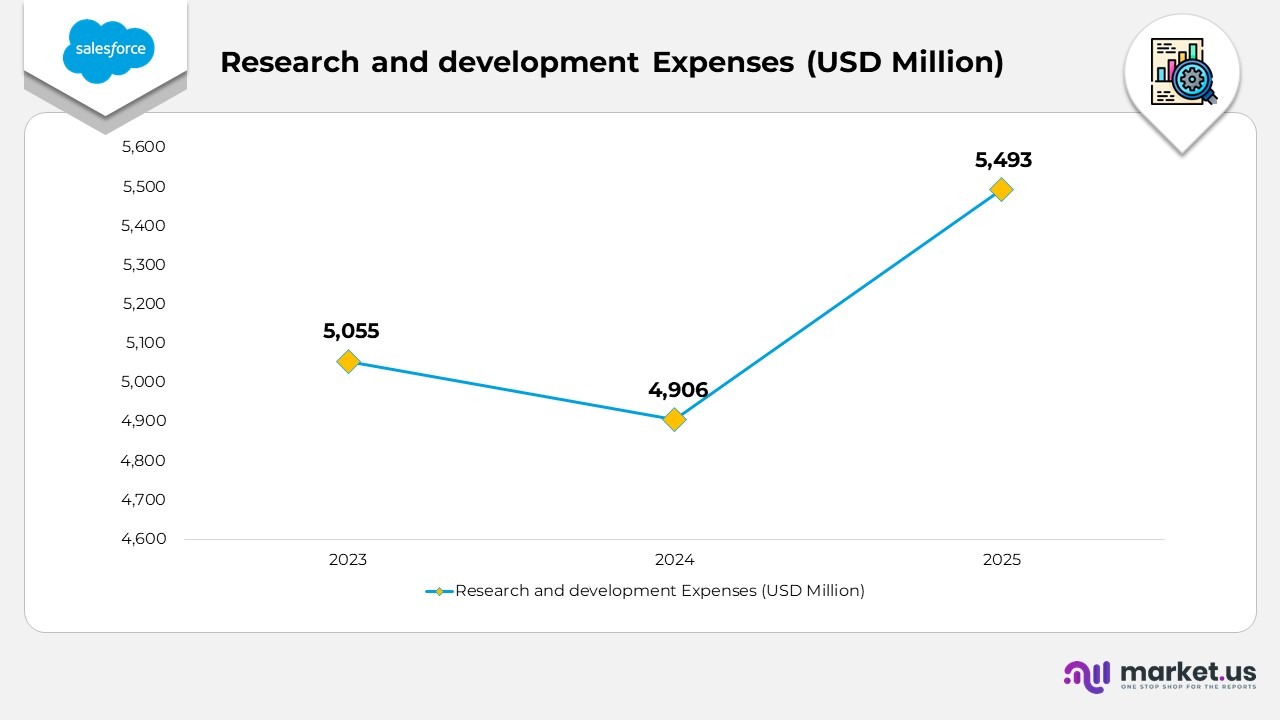

Salesforce Statistics By Research and Development Expenditure

- In 2023, Salesforce reported USD 5,055 million in research and development expenses, showcasing a strong focus on advancing innovation, artificial intelligence capabilities, and scalability across its global cloud ecosystem.

- In 2024, R&D investment slightly decreased to USD 4,906 million, reflecting a year-over-year decline of 2.9% as the company streamlined its development efforts and optimized prior investments in AI and data infrastructure.

- In 2025, Expenses increased to USD 5,493 million, indicating a year-over-year rise of 12.0%, driven by a renewed emphasis on integrating generative AI, enhancing the data cloud, and expanding product innovation within the Customer 360 platform.

(Source: Salesforce, Inc. Annual Report)

Salesforce Operating Expenses Statistics

Sales and Marketing

- In 2024, Salesforce’s sales and marketing expenses were USD 12,877 million, accounting for 37% of total revenue.

- In 2025, the figure increased to USD 13,257 million, representing 35% of total revenue and a variance of USD 380 million.

- The rise reflects Salesforce’s ongoing focus on expanding market reach, strengthening digital engagement strategies, and driving customer growth, while improved marketing automation helped reduce the expense-to-revenue ratio.

General and Administrative

- General and administrative expenses amounted to USD 2,534 million in 2024, representing 7% of total revenue.

- In 2025, this increased to USD 2,836 million, maintaining the 7% share with a variance of USD 302 million.

- The growth primarily stemmed from higher operational support costs, investments in governance, and system enhancements to support Salesforce’s expanding global workforce and infrastructure.

Restructuring

- In 2024, Salesforce incurred USD 988 million in restructuring expenses, which accounted for 3% of total revenue.

- In 2025, these costs declined to USD 461 million, representing 1% of revenue and a variance of USD 527 million.

- The significant reduction highlights the completion of major restructuring initiatives undertaken in the previous fiscal year, which have improved operational efficiency and cost discipline in 2025.

(Source: Salesforce, Inc. Annual Report)

Salesforce Patents and Applications Statistics

| Title | Type | Filed Date | Publication / Grant Date | Patent / Publication No. |

|---|---|---|---|---|

| Dynamic Graph Generation for Interactive Data Analysis | Grant | November 28, 2023 | September 23, 2025 | 12423353 |

| Controlling Just-In-Time Access to a Cluster | Application | October 18, 2024 | May 8, 2025 | 20250148112 |

| Sharing Data in a Data Storage System | Application | September 13, 2024 | January 2, 2025 | 20250005041 |

| Techniques for Data Retention | Application | August 29, 2024 | December 19, 2024 | 20240419676 |

| Techniques for Data Retention | Application | June 25, 2024 | December 12, 2024 | 20240411769 |

| Cloud-Based Dynamic Access to Private Resources | Application | March 27, 2023 | October 3, 2024 | 20240333716 |

| Impact Analysis Based on API Functional Testing | Grant | January 31, 2022 | September 3, 2024 | 12079114 |

| Incrementally Validating Security Policy Code Using Information From an Infrastructure as Code Repository | Application | May 7, 2024 | August 29, 2024 | 20240289259 |

| Systems and Methods for Cross-Domain Service Component Interaction | Application | February 14, 2024 | August 8, 2024 | 20240264728 |

| Channel Generation in a Communication Platform | Grant | April 28, 2021 | August 6, 2024 | 12058185 |

| Bot Builder Dialog Map | Grant | May 17, 2022 | Jul 23, 2024 | 12045706 |

| Monitoring Resource Utilization of an Online System Based on Browser Attributes Collected for a Session | Grant | November 5, 2019 | Jul 23, 2024 | 12047373 |

| Network Security for Multiple Functional Domains | Application | December 5, 2022 | June 6, 2024 | 20240187453 |

| Test Recorder for API Unit Testing | Grant | January 28, 2022 | June 4, 2024 | 12001323 |

| Incrementally Validating Security Policy Code Using IaC Repository | Grant | January 28, 2022 | May 7, 2024 | 11977476 |

| Dynamic Linking of Content Elements to Development Tool Resources | Grant | April 24, 2019 | February 20, 2024 | 11907734 |

| Method and System for Automatically Raising Functionality While Using a Key Application Without User Action | Application | February 24, 2023 | January 18, 2024 | 20240020141 |

| Generative Language Model for Few-Shot Aspect-Based Sentiment Analysis | Grant | September 8, 2021 | December 26, 2023 | 11853706 |

| Dialogue State Tracking Using a Global-Local Encoder | Grant | February 19, 2021 | December 5, 2023 | 11836451 |

| Systems and Methods for Artificial Intelligence-Based Root Cause Analysis of Service Incidents | Grant | September 16, 2021 | December 5, 2023 | 11836037 |

(Source: Justia Patents)

Recent Developments

- In October 2025, Salesforce announced a major partnership with Google to integrate Google’s advanced Gemini models into its new Agentforce 360 Platform, enabling next-generation AI-powered enterprise transformation and intelligent automation across business functions.

- In October 2025, the company formed a strategic alliance with Anthropic to deliver enterprise-grade AI solutions specifically designed for regulated and data-sensitive industries, emphasising trust, compliance, and secure deployment.

- In October 2025, Salesforce partnered with OpenAI to create a new era of employee and consumer experiences, powered by Agentforce 360 and OpenAI’s frontier models, which combine Salesforce’s AI CRM capabilities with OpenAI’s generative intelligence.

- In October 2025, a collaboration between Stripe and OpenAI was unveiled to develop an Instant Checkout integration guided by the Agentic Commerce Protocol (ACP). This initiative enables merchants using Agentforce Commerce to offer seamless, conversational AI-driven shopping experiences that boost conversion rates and accelerate growth.

- In October 2025, Salesforce announced a $15 billion investment in San Francisco over the next five years to establish the city as the global AI capital. The investment supports the launch of a new AI Incubator Hub at Salesforce’s headquarters, workforce development programs, and initiatives to help companies evolve into Agentic Enterprises.

- In October 2025, Marc and Lynne Benioff revealed a $100 million philanthropic gift to UCSF Benioff Children’s Hospitals to advance pediatric healthcare. Additionally, Salesforce contributed $39 million to local education and children’s programs, bringing combined donations from Salesforce and the Benioffs in the Bay Area to over $1 billion.

Moreover

- In June 2025, Salesforce collaborated with UChicago Medicine to deploy Agentforce for Health, an AI-powered platform designed to improve patient engagement, streamline care delivery, and enhance the overall healthcare experience.

- Further, in June 2025, the company launched Agentforce 3, a major upgrade to its digital labor platform, providing enterprises with greater control, transparency, and scalability in deploying and managing AI agents.

- In June 2025, Salesforce partnered with LIV Golf to modernize operations across its global golf league. The partnership aims to leverage autonomous AI agents to elevate fan interaction, enhance player experiences, and innovate broadcast management through real-time intelligence.

- Moreover, in May 2025, Salesforce entered a partnership with Ferrari to elevate the client experience worldwide. Integrating AI-driven personalization into customer engagement and luxury retail channels.

- In May 2025, the company signed a definitive agreement to acquire Informatica for approximately $8 billion in equity value (net of Salesforce’s existing investment). Under the deal, holders of Informatica Class A and B-1 shares will receive $25 in cash per share. Strengthening Salesforce’s data management and analytics portfolio.

- In May 2025, Salesforce partnered with Bouygues Telecom to integrate AI at the core of customer relations. Enhancing service delivery and engagement through intelligent automation and real-time analytics.

(Source: Salesforce, Inc. Press Release)