Company Overview

Qualcomm Statistics: Qualcomm Incorporated is a global technology leader advancing intelligent computing through the development and commercialization of foundational technologies. The company focuses on on-device artificial intelligence (AI), high-performance, low-power computing, and advanced wireless connectivity. It operates across three main business segments: QTL (Qualcomm Technology Licensing), QCT (Qualcomm CDMA Technologies), and QSI (Qualcomm Strategic Initiatives).

The QCT segment represents Qualcomm’s semiconductor business, which develops and supplies integrated circuit platforms and system software that deliver advanced connectivity, efficient computing, and superior performance. These solutions are utilised in mobile devices, automotive systems, including digital cockpits, ADAS, and autonomous driving, as well as Internet of Things (IoT) applications such as consumer electronics, industrial devices, and edge networking products.

The QTL segment manages Qualcomm’s intellectual property portfolio by granting licenses and usage rights to key wireless communication technologies, including patents essential for the manufacture and sale of wireless products. The QSI segment focuses on making strategic investments to support emerging technologies and business opportunities. Additionally, Qualcomm has non-reportable operations, including QGOV (Qualcomm Government Technologies) and a Data Center division, formerly known as the cloud computing processing initiative.

The company maintains a strong global presence with around 170 offices in more than 30 countries, including Brazil, China, Germany, India, Japan, Singapore, South Korea, and the United Kingdom. As of September 28, 2025, Qualcomm employed approximately 52,000 people worldwide, comprising full-time, part-time, and temporary staff spread across over 200 locations in 38 countries. The majority of employees work in engineering and technical roles, reflecting the company’s culture of innovation. During fiscal 2025, Qualcomm reported a voluntary turnover rate of approximately 6%, underscoring its ability to retain a highly skilled and specialized workforce.

Historical Milestones of Qualcomm Incorporated

- 1965: Publication of Principles of Communication Engineering by Irwin Jacobs, laying the theoretical foundation for modern digital communications.

- 1968: Andrew Viterbi and Irwin Jacobs co-founded Linkabit, a company that pioneered advancements in digital and satellite communications.

- 1980: Linkabit merged with M/A-COM, forming M/A-COM Linkabit, expanding its research and product development capabilities.

- 1985: Qualcomm Incorporated was founded, marking the beginning of a new era in wireless communication innovation.

- 1988: Qualcomm introduced the OmniTRACS messaging system, one of the first commercial satellite-based communication and tracking solutions for the transportation industry.

- 1993: The U.S. Telecommunications Industry Association officially adopted Qualcomm’s CDMA technology as the standard for cellular communications, solidifying its global influence.

- 1999: Qualcomm and Ericsson reached a patent infringement settlement, paving the way for collaboration and cross-licensing in mobile technologies.

- 2002: China Unicom adopted Qualcomm’s CDMA technology, marking a major expansion of its presence in the Asian telecommunications market.

Financial Analysis

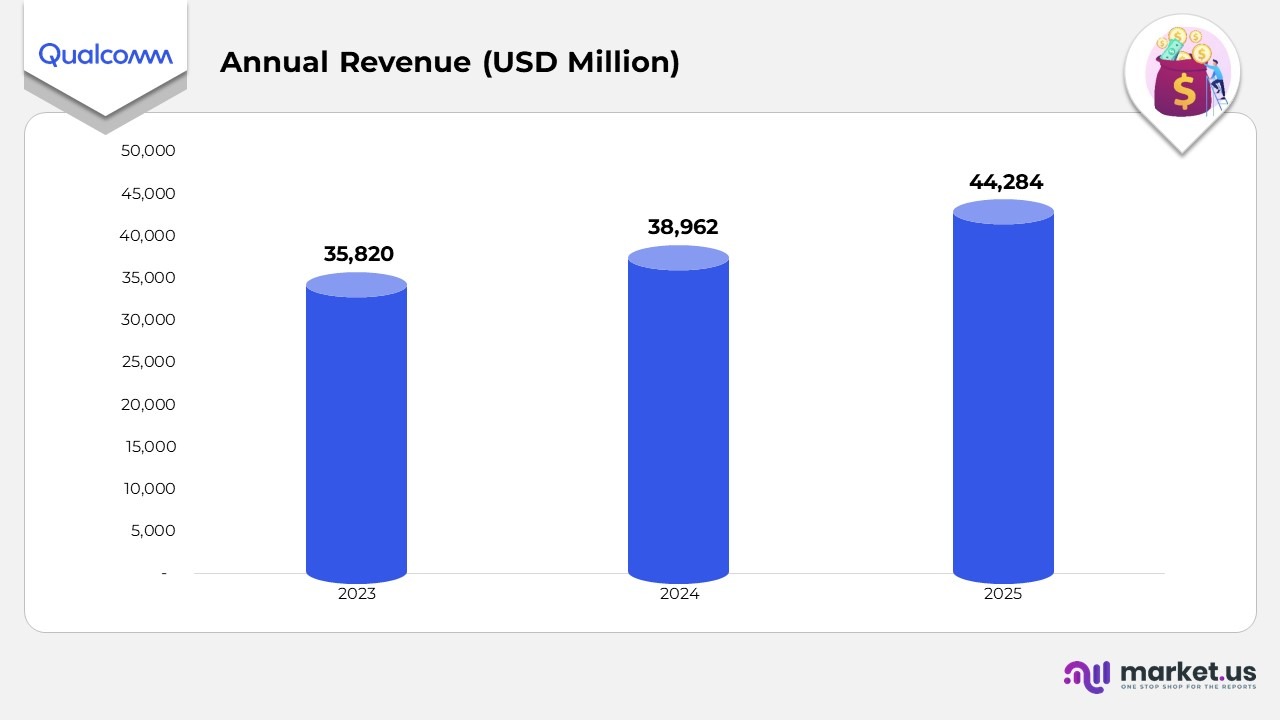

- In 2023, Qualcomm achieved annual revenue of $35.82 billion USD, reflecting steady performance supported by sustained demand for mobile processors and connectivity technologies across global markets.

- In 2024, revenue increased to 38,962 million USD, marking an approximate 9% growth compared to the previous year. This rise was driven by expanding adoption of 5G chipsets, higher penetration in automotive electronics, and growing strength in the IoT

- In 2025, Qualcomm’s annual revenue reached 44,284 million USD, representing a significant 14% increase from 2024. The growth was fueled by rising demand for AI-powered processors, expansion in edge computing and cloud connectivity, and a boost from licensing and platform services.

(Source: Qualcomm Annual Report)

Segmental Analysis

- The QCT (Qualcomm CDMA Technologies) segment achieved revenues of 38,367 million USD in 2025, up from 33,196 million USD in 2024 and 30,382 million USD in 2023. This growth was driven by rising demand for advanced chipsets across smartphones, automotive systems, and IoT devices.

- The cost of revenues for QCT rose to 19,302 million USD in 2025, compared with 16,648 million USD in 2024 and 15,367 million USD in 2023, reflecting higher production volumes and increased manufacturing activity.

- Operating expenses (R&D and SG&A) in the QCT segment reached 7,395 million USD in 2025, slightly higher than 7,221 million USD in 2024 and 7,091 million USD in 2023, indicating continued investment in product innovation and new technology development.

- As a result, EBT for QCT increased to 11,670 million USD in 2025, up from 9,527 million USD in 2024 and 7,924 million USD in 2023, showing strong profitability and operational leverage.

- The QTL (Qualcomm Technology Licensing) segment recorded revenues of 5,582 million USD in 2025, compared with 5,572 million USD in 2024 and 5,306 million USD in 2023, supported by stable licensing income and the renewal of major agreements.

Moreover

- Costs and expenses for QTL totalled 1,539 million USD in 2025, compared with 1,545 million USD in 2024 and 1,678 million USD in 2023, reflecting improvements in operational cost efficiency.

- Consequently, EBT for QTL reached 4,043 million USD in 2025, showing consistent growth from 4,027 million USD in 2024 and 3,628 million USD in 2023, driven by the strength of Qualcomm’s patent portfolio.

- The QSI (Qualcomm Strategic Initiatives) segment posted an EBT of 180 million USD in 2025, an improvement from 104 million USD in 2024 and a loss of 12 million USD in 2023, reflecting successful investment management.

- Investment income for QSI stood at 193 million USD in 2025, up from 105 million USD in 2024 and compared to a loss of 13 million USD in 2023, highlighting stronger returns from portfolio ventures and strategic initiatives.

(Source: Qualcomm Annual Report)

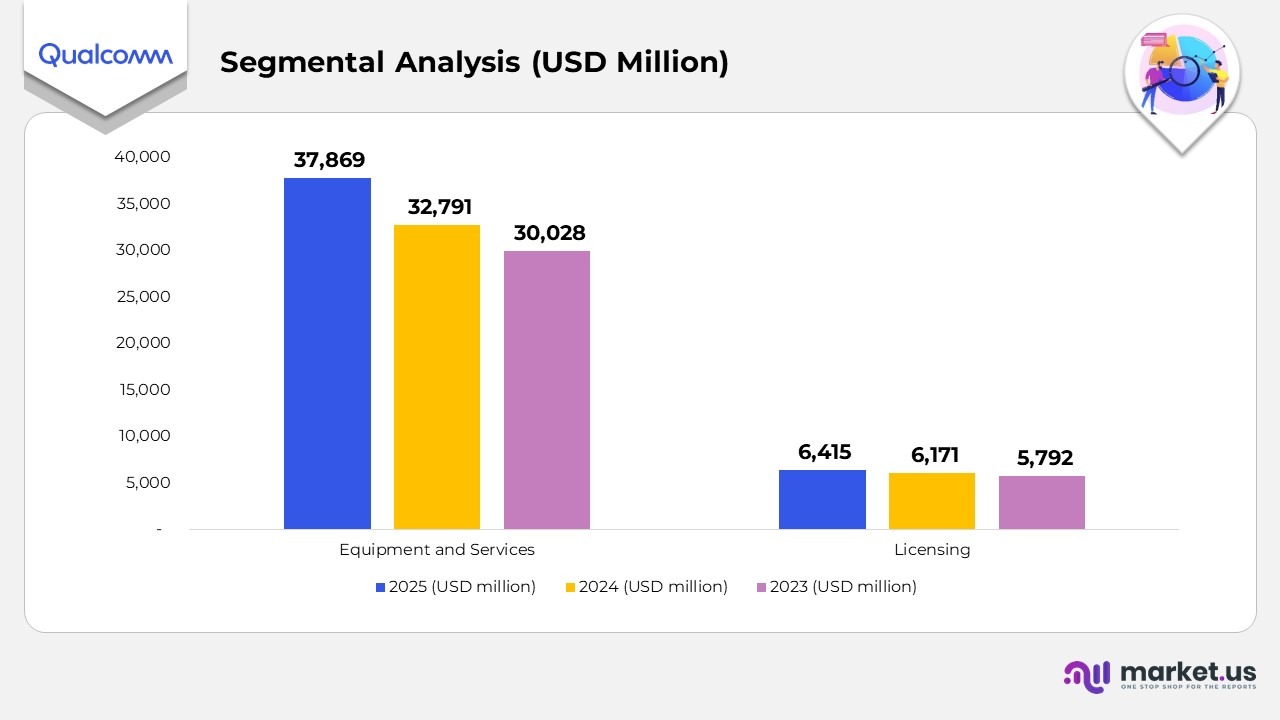

Qualcomm Revenue Breakdown by Sub-Segment

- In 2025, Qualcomm’s total revenue was driven primarily by strong growth in its Equipment and Services segment, which generated 37,869 million USD, up from 32,791 million USD in 2024 and 30,028 million USD in 2023. The increase reflects expanding demand for semiconductors, 5G chipsets, and connected devices across automotive, mobile, and IoT markets.

- The Licensing segment contributed 6,415 million USD in 2025, compared to 6,171 million USD in 2024 and 5,792 million USD in 2023. New technology licensing agreements, renewals of existing contracts, and the expansion of patent coverage in wireless communication and AI-driven devices drove this steady growth.

(Source: Qualcomm Annual Report)

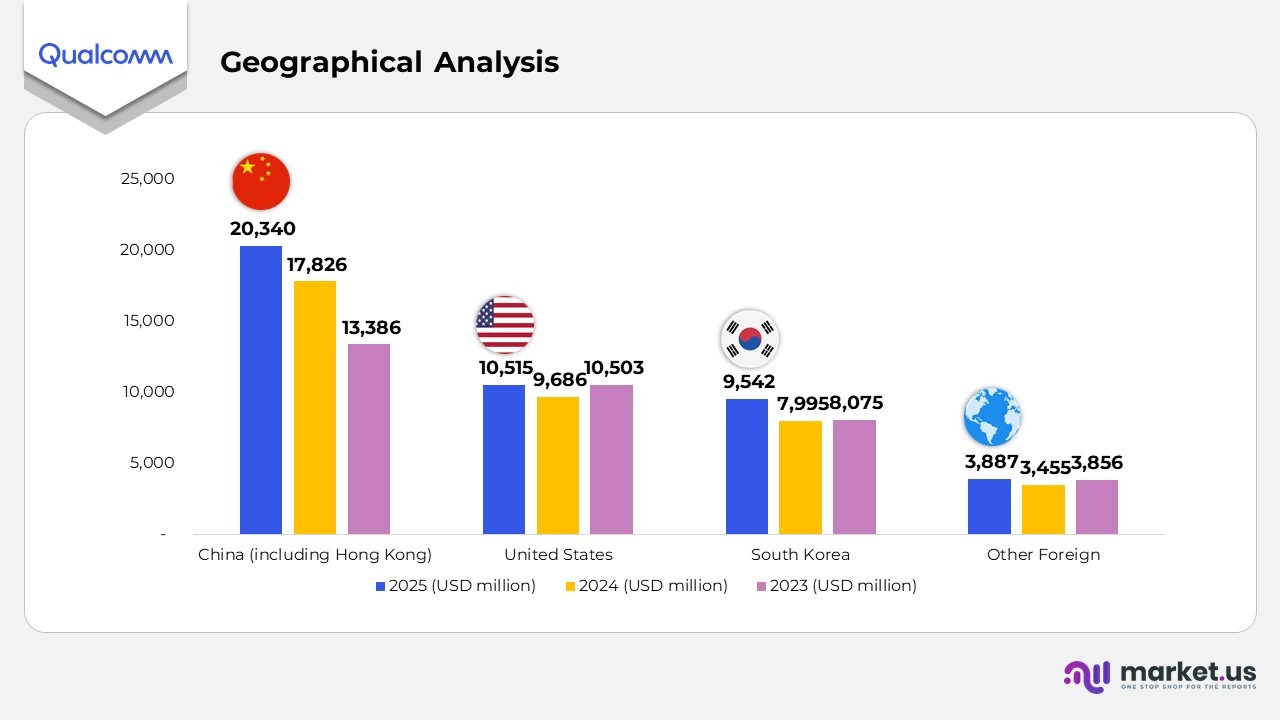

Geographical Revenue Analysis

- In 2025, revenue from China (including Hong Kong) reached 20,340 million USD, representing 46% of Qualcomm’s total revenue. This increased from 17,826 million USD in 2024 and 13,386 million USD in 2023, reflecting continued strong demand from Chinese OEMs and semiconductor clients.

- The United States contributed 10,515 million USD in 2025, accounting for 24% of total revenue, compared with 9,686 million USD in 2024 and 10,503 million USD in 2023. The modest year-over-year growth highlights stable performance in domestic markets despite industry fluctuations.

- South Korea generated 9,542 million USD in 2025, or 21% of overall revenue, up from 7,995 million USD in 2024 and 8,075 million USD in 2023. The growth was supported by increased demand for chipsets from leading mobile and electronics manufacturers.

- Revenue from other foreign markets totaled 3,887 million USD in 2025, maintaining a 9% share of total revenue, compared to 3,455 million USD in 2024 and 3,856 million USD in 2023, indicating steady contributions from diversified international regions.

(Source: Qualcomm Annual Report)

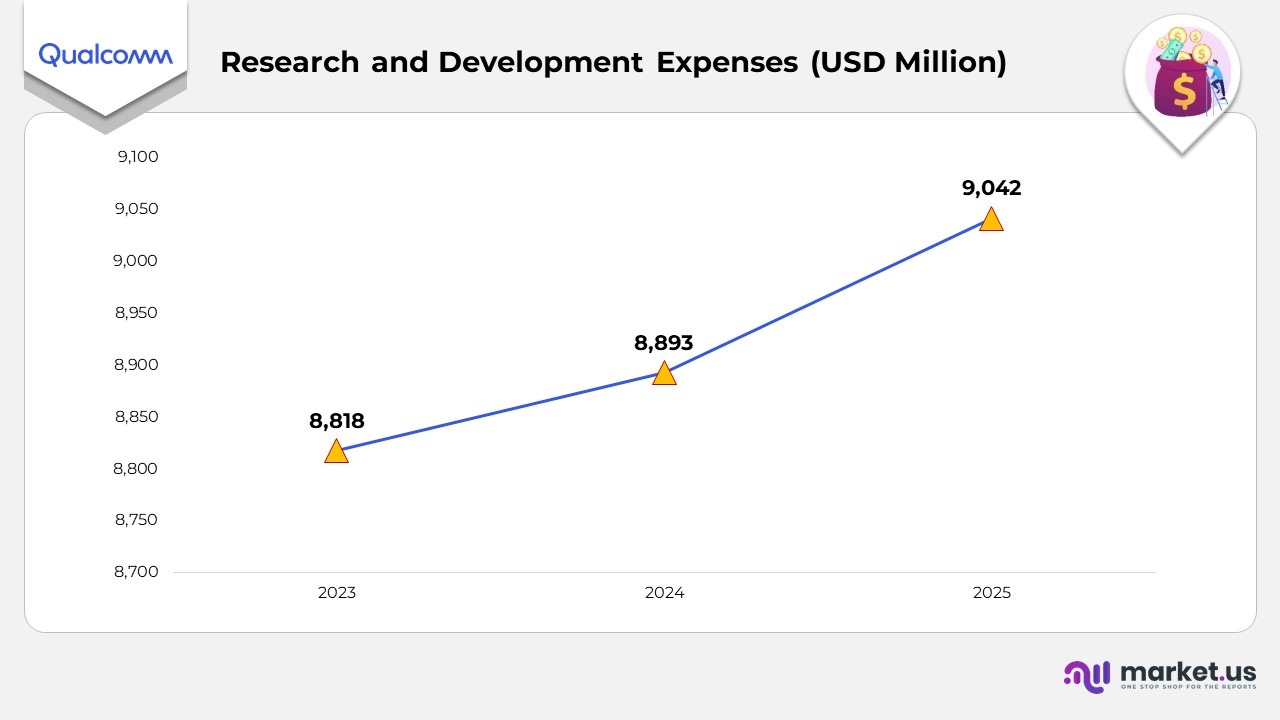

Research and Development Expenses

- In 2023, Qualcomm reported research and development (R&D) expenses of $8.818 billion USD, reflecting sustained investment in core technologies and innovation programs.

- In 2024, R&D spending slightly increased to 8,893 million USD, emphasizing continued efforts in wireless communication, chipset design, and product optimization across multiple business units.

- In 2025, R&D expenses increased further to $ 9,042 million USD, primarily driven by a USD 118 million increase in share-based compensation. The overall rise also reflected a 314 million USD boost in non-recurring engineering cost reimbursements for product development projects, which helped offset higher employee-related expenses.

(Source: Qualcomm Annual Report)

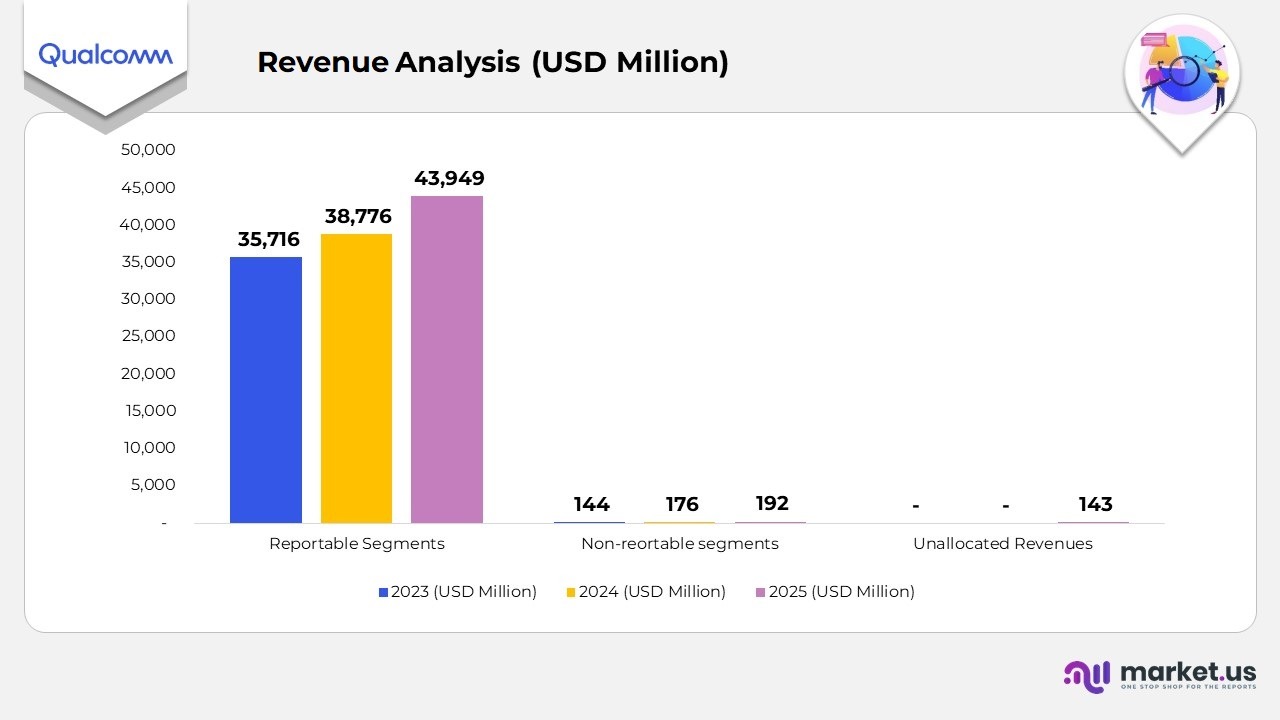

Qualcomm Revenue Distribution by Segment

- In 2025, total revenue from reportable segments reached 43,949 million USD, reflecting a significant rise from 38,786 million USD in 2024 and 35,716 million USD in 2023. This increase highlights strong performance across Qualcomm’s key business divisions, particularly in semiconductors and licensing.

- Non-reportable segments generated 192 million USD in 2025, up slightly from 176 million USD in 2024 and 144 million USD in 2023, showing a consistent contribution from smaller and emerging business initiatives.

- Unallocated revenues totaled 143 million USD in 2025, compared to 0 in 2024 and a loss of 40 million USD in 2023, indicating improved financial efficiency and recognition of previously deferred or miscellaneous income sources.

(Source: Qualcomm Annual Report)

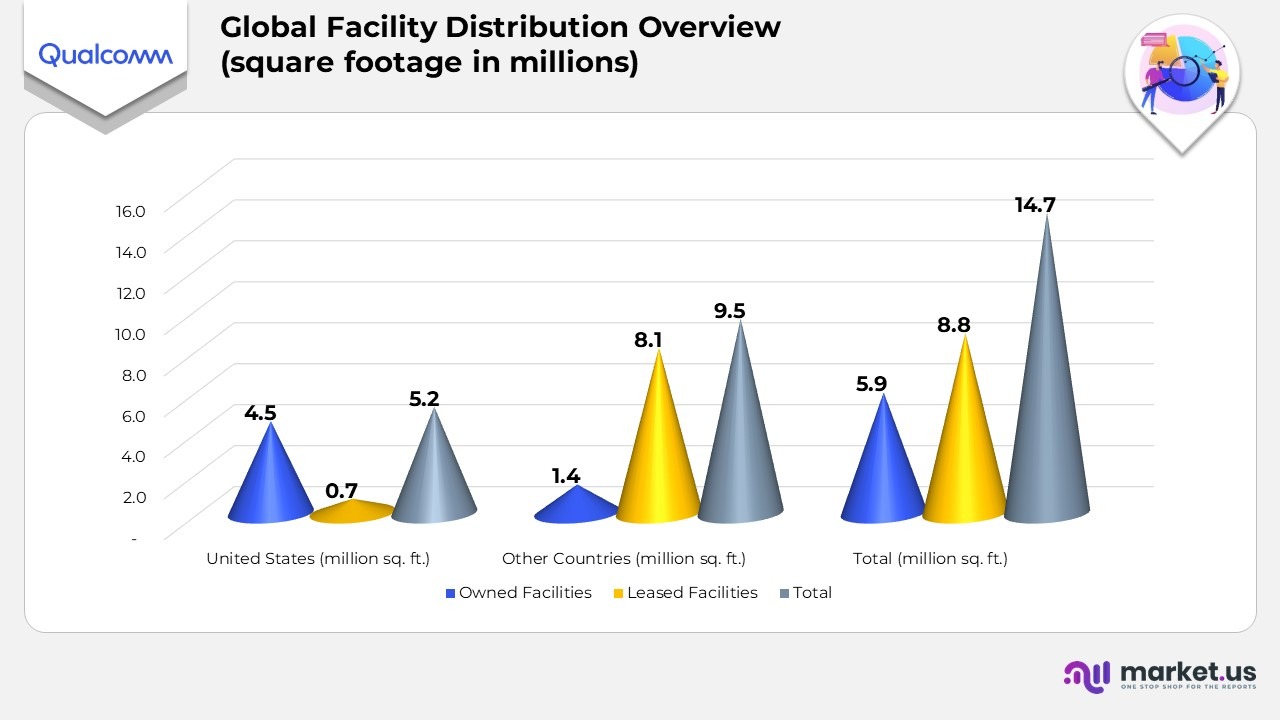

Global Facility Distribution Overview

- As of September 28, 2025, the company operated a total of 7 million square feet of facilities worldwide.

- In the United States, the total occupied space reached 2 million square feet, comprising 4.5 million square feet in owned facilities and 0.7million square feet in leased spaces.

- In other countries, the company managed 5 million square feet of facilities, comprising 1.4 million square feet owned and 8.1 million square feet leased.

- Overall, owned facilities accounted for 9 million square feet, reflecting long-term investments in infrastructure.

- Leased facilities represented 8 million square feet, highlighting the firm’s flexible global expansion and regional adaptability strategy.

(Source: Qualcomm Annual Report)

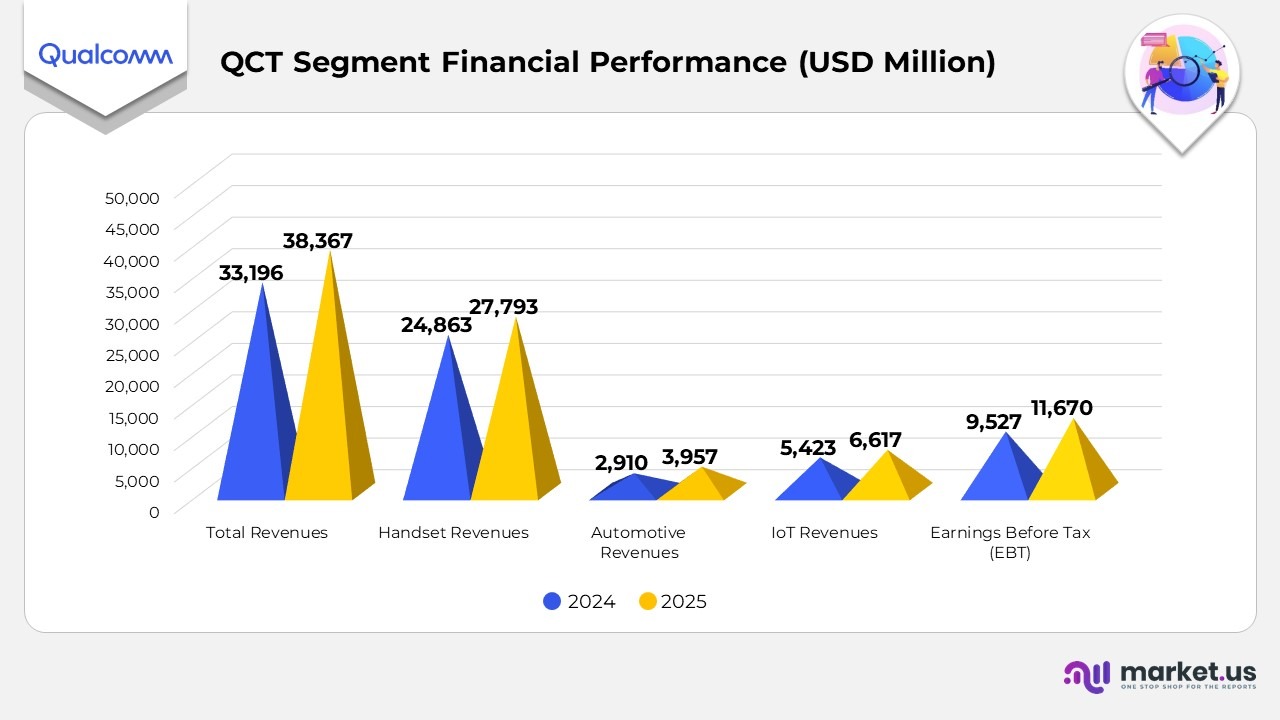

QCT Segment Financial Performance

- The QCT Segment generated total revenues of $38,367 million in 2025, marking an increase of $5,171 million from $33,196 million in 2024.

- Handset revenues rose to $27,793 million in 2025, up $2,930 million from $24,863 million in 2024, driven by stronger demand for premium mobile devices and advanced chipsets.

- Automotive revenues reached $3,957 million, an increase of $1,047 million from $2,910 million in the prior year, supported by growing adoption of digital cockpit and ADAS solutions.

- The IoT (Internet of Things) segment generated $6,617 million, up by $1,194 million from $5,423 million in 2024, reflecting the rising integration of connected technologies across industrial and consumer devices.

- Earnings Before Tax (EBT) rose to $11,670 million in 2025, compared to $9,527 million in 2024, indicating a gain of $2,143 million.

- EBT margin improved by 1 point, reaching 30% in 2025, up from 29% in 2024, signifying enhanced operational efficiency and profitability across all business verticals.

(Source: Qualcomm Annual Report)

Recent Developments

- In October 2025, Qualcomm acquired Arduino to expand its edge computing ecosystem and empower developers with greater access to its advanced edge technologies and products. This acquisition builds upon the earlier integrations of Edge Impulse and Foundries.io, reinforcing Qualcomm’s vision for a unified edge-to-cloud platform. The transaction remains subject to regulatory and customary approvals.

- In September 2025, Qualcomm partnered with HARMAN to advance Generative AI in automotive applications. By combining Qualcomm Technologies’ computing platforms with HARMAN’s in-cabin systems, the partnership enables intelligent features such as real-time ADAS visualization, contextual awareness, and emotion-responsive user interfaces for enhanced driver and passenger experiences.

- In September 2025, Qualcomm collaborated with Google Cloud to introduce Agentic AI experiences for the automotive industry, utilizing cloud intelligence to power more connected, adaptive, and efficient vehicle systems.

- In August 2025, Qualcomm entered a multi-year partnership with San Diego FC, becoming the front-of-kit sponsor for SDFC’s Right to Dream Academy team. This collaboration underscores Qualcomm’s commitment to community engagement and local youth development through sports and innovation.

- In August 2025, Qualcomm launched the Dragonwing Q-6690 processor, featuring integrated 5G, Wi-Fi 7, Bluetooth 6.0, and ultra-wideband connectivity. Designed for devices ranging from rugged handhelds to smart kiosks, it supports proximity-aware features and over-the-air software upgrades for OEMs and ODMs.

- In June 2025, Qualcomm partnered with Mission 44 through the Fueling Futures Initiative, committing to a long-term sponsorship that supports educational and social programs fostering youth empowerment globally.

- In June 2025, Qualcomm acquired Alphawave IP Group plc to accelerate its expansion into the data center market, leveraging Alphawave’s expertise in high-speed connectivity and semiconductor design.

Moreover

- In June 2025, Qualcomm completed the acquisition of Autotalks, a specialist in vehicle-to-everything (V2X) communication. This move strengthens Qualcomm’s automotive portfolio, enhancing vehicle safety, traffic efficiency, and intelligent transport connectivity.

- In May 2025, Qualcomm expanded its collaboration with Xiaomi Corporation to advance further innovation across mobile, computing, and IoT devices, reinforcing their joint leadership in smart technology development.

- In May 2025, Qualcomm partnered with Advantech to drive AI-powered IoT solutions, integrating Qualcomm’s edge computing technologies into Advantech’s platforms to accelerate industrial digitalization and intelligent automation.

- In May 2025, Qualcomm joined forces with e& to accelerate digital transformation for governments, enterprises, and industries through advancements in 5G and edge AI.

- In May 2025, Qualcomm signed an agreement with HUMAIN to develop AI data centers designed for hybrid cloud-to-edge AI services, enabling efficient data processing and enhanced scalability.

- In April 2025, Qualcomm acquired MovianAI Artificial Intelligence (AI) Application and Research JSC, enhancing its generative AI research and development capabilities for smartphones, PCs, and software-defined vehicles.

- In January 2025, Qualcomm collaborated with Desay SV to deliver an intelligent AI cabin platform powered by Snapdragon Elite Automotive Platforms, offering more personalized and connected in-vehicle experiences.

- In January 2025, Qualcomm also partnered with Amazon to create a next-generation AI-powered cabin experience using the Snapdragon Digital Cockpit Platform and Alexa Custom Assistant, integrating cloud-based intelligence and natural voice interaction to enhance automotive comfort and safety.

(Source: Qualcomm Press Release)