Introduction

Blockchain Technology Statistics: Blockchain technology indicates a paradigm shift in how digital ecosystems operate, emphasizing transparency, decentralization, and trust. Originally designed for cryptocurrency, blockchain has evolved into a foundational technology driving innovation across various industries, including finance, logistics, energy, and public administration.

Its applications in smart contracts, decentralized finance (DeFi), and secure data exchange demonstrate its potential to streamline operations while enhancing transparency and accountability. The increasing participation of enterprises, growing regulatory clarity, and the rise of blockchain-as-a-service platforms are accelerating mainstream adoption. As industries integrate blockchain into their digital transformation strategies, these statistics shed light on its expanding market influence, sustainability impact, and the evolving standards shaping the future of decentralized global systems.

Editor’s Choice

- More than 560 million individuals globally are currently engaged with blockchain technology, reflecting its integration into mainstream digital ecosystems.

- Over 85 million users actively utilize blockchain wallets, demonstrating growing confidence in decentralized finance and asset ownership.

- The global blockchain market is projected to reach $32.69 billion, driven by rising enterprise adoption and cross-industry digital transformation.

- Worldwide spending on blockchain-based solutions is expected to total $19 billion, underscoring its strategic importance in secure data management and process automation.

- Nearly 20,000 cryptocurrencies exist today, though only about 10,025 remain active, highlighting the competitive and volatile nature of the crypto landscape.

- Approximately 90% of surveyed businesses have implemented blockchain in some capacity, signaling widespread enterprise-level integration.

- Around 86% of business leaders believe blockchain can significantly enhance efficiency, transparency, and operational trust within their organizations.

- In the United States, crypto-related scams have resulted in losses of nearly $5.6 billion, underscoring the urgent need for enhanced digital security and robust regulatory safeguards.

Moreover

- As of July 15, 2022, the global count of blockchain wallet holders reached 83,434,000.

- Worldwide investment in blockchain solutions is projected to hit USD 11.7 billion by 2022.

- Nearly 8% of the global population is already interacting with blockchain technology.

- Total recorded transactions on Blockchain.com climbed to 748,655,000 by July 15, 2022.

- Global spending on blockchain technologies amounted to USD 6.6 billion in 2021.

- The United States alone is expected to invest more than USD 2.5 billion in blockchain capabilities.

- An estimated 9 out of 10 blockchain platforms required upgrades or complete replacement in 2021.

- Blockchain adoption in the banking sector has the potential to reduce infrastructure costs by 30%, resulting in savings of more than USD 10 billion

- The FBI reportedly holds 5% of all bitcoins in circulation.

- By 2025, around 55% of healthcare applications are anticipated to integrate blockchain for commercial use.

- By the end of 2020, nearly 60% of CIOs had evaluated incorporating blockchain into their operational systems.

Blockchain Adoption and Growth Statistics

- Global blockchain solution spending is projected to nearly triple, rising from USD 6.6 billion in 2021 to almost USD 19 billion in 2024.

- Approximately 40 million people, roughly 0.5% of the global population, currently use blockchain, and adoption is expected to expand rapidly, with nearly 80% of the world potentially using blockchain within the next decade.

- NFTs, gaming, and metaverse projects recorded 159 deals in Q2 2022, marking the third straight quarter with more than 150 transactions in these segments.

- Blockchain integration has the potential to cut investment banks’ infrastructure expenses by up to 30%.

- The deployment of blockchain in food and agriculture is expected to reach a value of USD 1.48 billion by 2026.

- The top blockchain-adopting nations include the Bahamas, Lebanon, Japan, South Africa, China, the United Kingdom, Switzerland, Singapore, the United States, and Estonia, collectively shaping global leadership.

- Further, by 2025, healthcare-related blockchain spending is projected to reach USD 5.61 billion as digital transformation accelerates.

- Investments in blockchain gaming totalled USD 5 billion in the first half of 2022, with full-year funding expected to reach approximately USD 12 billion.

- Major global banks are allocating USD 50 billion to create a blockchain-based digital settlement infrastructure.

- A PwC 2020 “Time for Trust” analysis estimates that blockchain could boost global GDP by USD 1.76 trillion by 2030.

- Nearly 9 out of 10 governments worldwide intend to invest in blockchain technologies.

- Web3 ventures accounted for 57% of blockchain funding in Q2 2022, securing USD 3.7 billion out of the total USD 6.5 billion

(Source: Statista, Imaginovation)

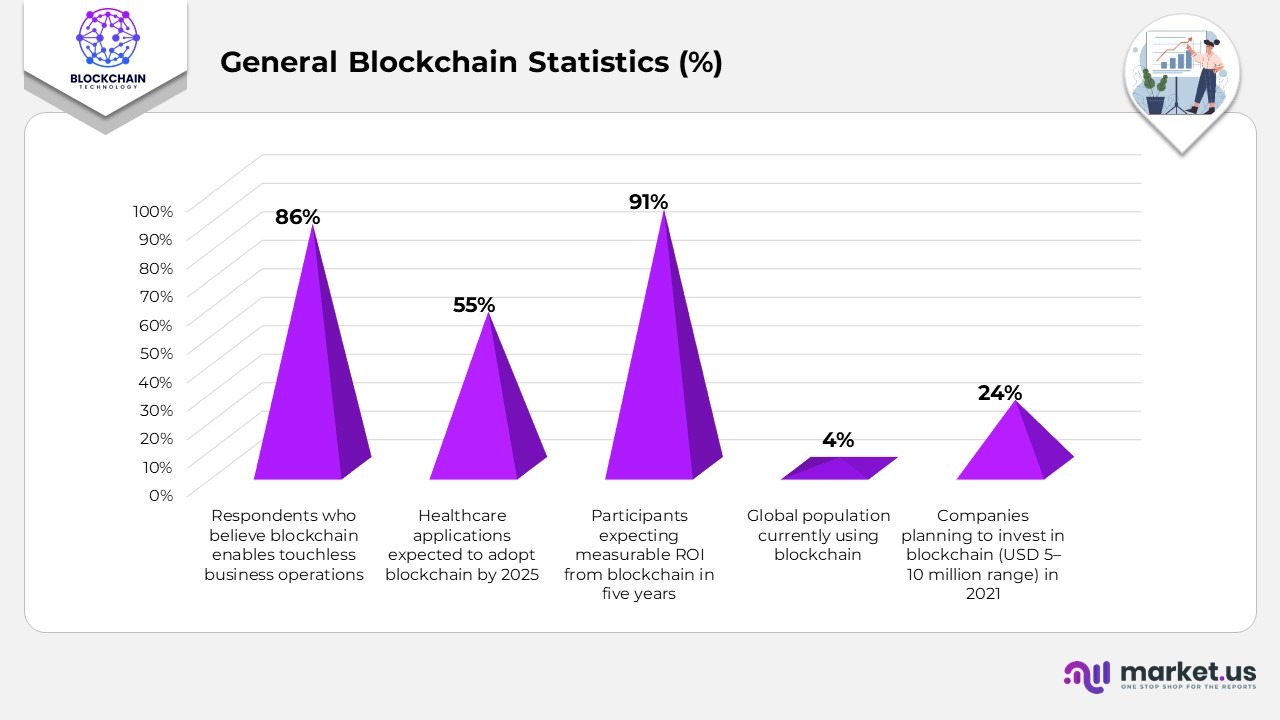

General Blockchain Statistics

- A Deloitte study indicates that 86% of respondents view blockchain as a key enabler for shifting toward touchless business processes.

- By 2025, an estimated 55% of healthcare applications are expected to use blockchain for commercial-level deployment.

- The same survey shows that 91% of participants expect a strong and measurable return on their blockchain investments within the next five years.

- Financial institutions stand to save as much as USD 12 billion per year through blockchain-based efficiencies.

- Roughly 9% of the world’s population is already engaging with blockchain technology.

- The Solana blockchain remains the most active, processing around 5 million transactions daily.

- Ethereum remains the most advanced blockchain ecosystem, supporting over 5,000 active projects.

- There are now over 82 million Bitcoin wallets globally.

- As of February 2021, blockchain networks collectively recorded 369 million transactions.

- Worldwide spending on blockchain solutions reached USD 6.6 billion in 2021.

- More than 20 countries have either implemented or are investigating the use of central bank-issued digital currencies.

- In 2021, 24% of companies planned to invest between USD 5 million and USD 10 million in blockchain technology.

(Source: Deloitte, PwC, Forbes, Finances Online, BIS, UPay)

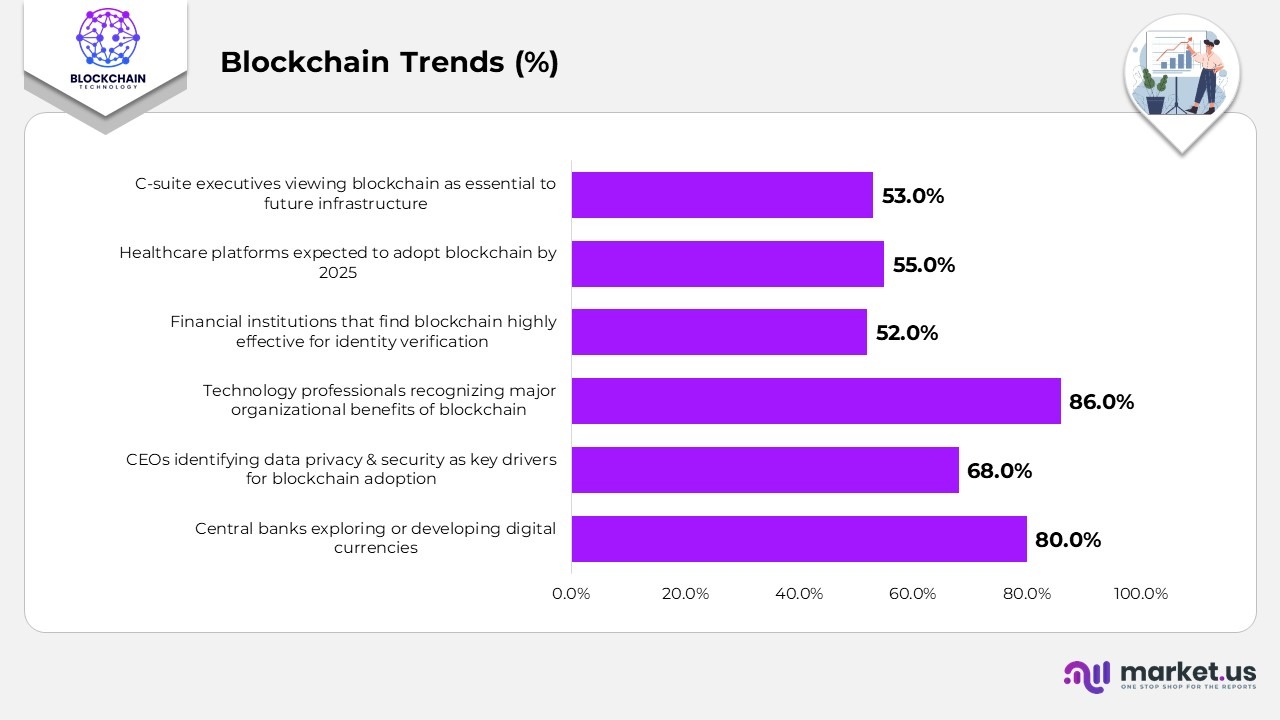

Blockchain Trends

- Close to 80% of central banks worldwide are actively assessing or developing their own digital currencies.

- Blockchain is forecast to create more than USD 3.1 trillion in business value by 2030.

- The global Internet of Things (IoT) industry is projected to reach USD 1,463.2 billion by 2027.

- A Deloitte survey indicates that 68% of CEOs view data privacy and security as the leading drivers for faster blockchain adoption.

- Deloitte also reports that 86% of seasoned technology professionals recognize blockchain as delivering substantial benefits to their organizations.

- Roughly 52% of financial services institutions see blockchain as highly effective for customer identity verification processes.

- South Korea’s blockchain sector, valued at USD 20.1 billion in 2016, is projected to soar to USD 356.2 billion by 2023.

- More than 100 Chinese companies are currently providing blockchain-based applications to the market.

- By 2025, an estimated 55% of healthcare platforms are expected to incorporate blockchain, with over USD 270 billion in assets already transferred through blockchain systems.

- The blockchain gaming market is on track to reach USD 39.7 billion by 2025.

- Approximately 53% of C-suite executives view blockchain as a foundational element of future corporate infrastructure.

- Blockchain adoption in the food and agriculture segment is projected to reach USD 1.48 billion by 2026.

Several major global enterprises are utilizing blockchain networks for various applications, including:

-

- Adobe – Ethereum

- Andreessen Horowitz – Ethereum, Bitcoin, Flow, Solana, Near, Arweave, Celo, and more

- Allianz – Corda, Hyperledger Fabric

- Anthem – Hyperledger Fabric

- Ant Group – AntChain

- P. Moller–Maersk – TradeLens, Hyperledger Fabric

- Aon – Corda

- BHP – MineHub, Hyperledger Fabric

- Baidu – XuperChain

- Block – Bitcoin

(Source: Economic Times, Statista, Deloitte, CoindeskBinance, PwC)

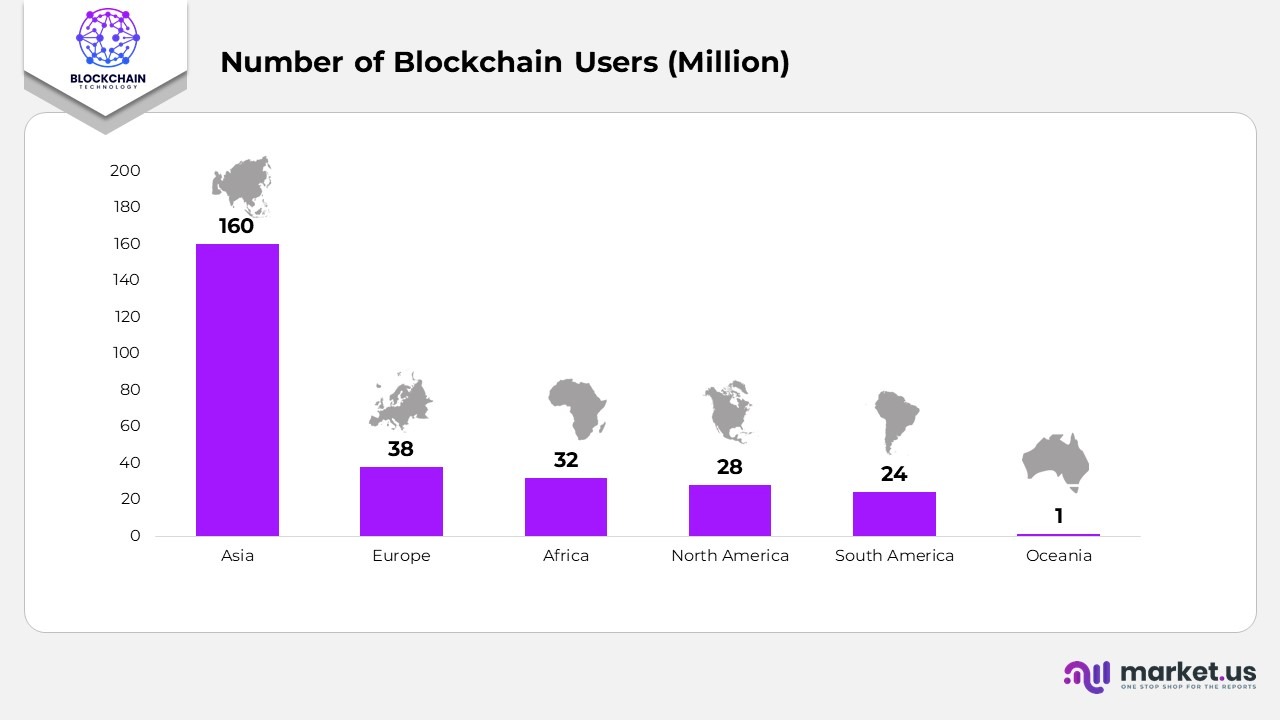

Blockchain Users Statistics

- Global adoption of blockchain remains modest, with roughly 1 in 20 people actively using the technology, far fewer than the number who are familiar with blockchain or cryptocurrencies.

- By 2025, the worldwide blockchain user base is projected to surpass 560 million, reflecting expanding digital engagement.

- This level of usage corresponds to about 9% of the total global population.

- Asia leads global blockchain adoption with an estimated 160 million users across the region.

- Europe follows with around 38 million individuals actively engaged with blockchain technologies.

- Africa records nearly 32 million users, reflecting steady growth in digital financial adoption.

- North America accounts for approximately 28 million blockchain users, driven by growing interest in cryptocurrency and decentralized applications.

- South America has close to 24 million users, indicating increasing traction in emerging digital ecosystems.

- Oceania contributes roughly 1 million users, showing early-stage but developing adoption within the region.

(Source: Zippia Demandsage, Kruschecompany)

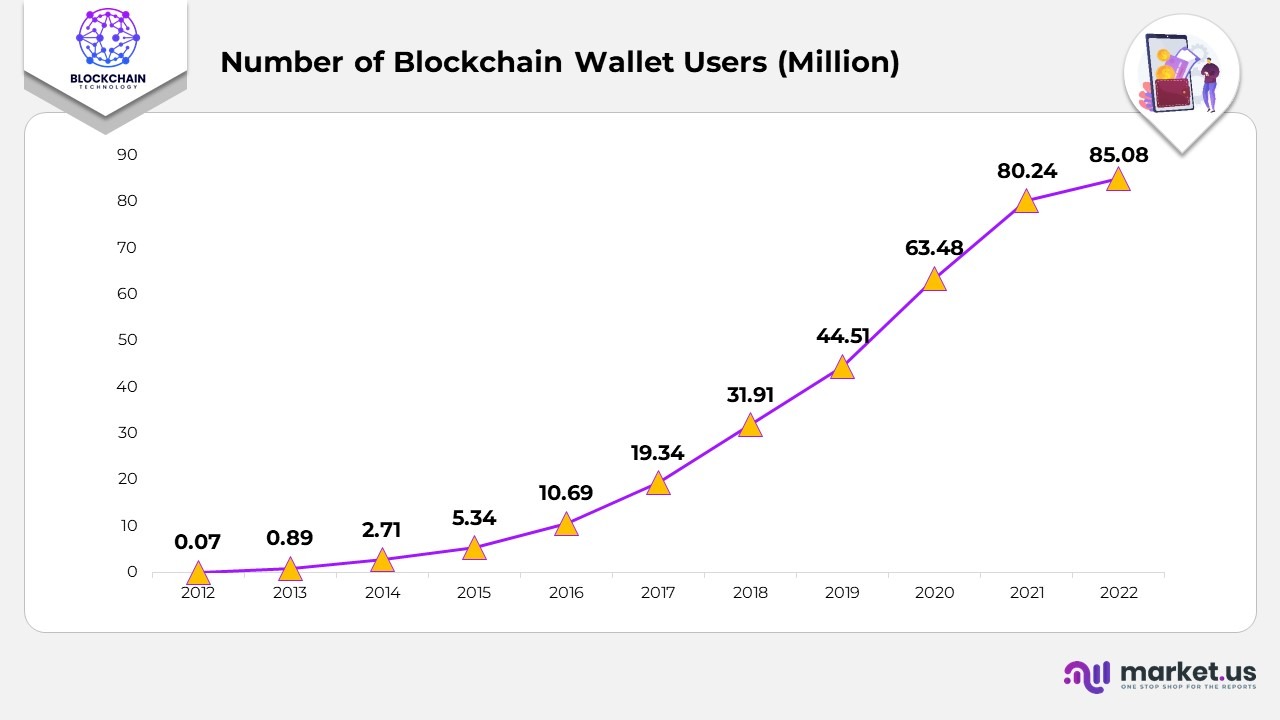

Blockchain Wallet Users Statistics

- Global blockchain wallet usage has surpassed 85 million users, showing remarkable growth over the last decade.

- In 2016, blockchain wallets numbered just over 10 million, but by 2021, this figure had accelerated to more than 80 million, marking an impressive 70 million increase within five years.

- The adoption trend shows consistent year-on-year expansion, reflecting rising interest in digital assets and decentralized technologies.

- In 2022, blockchain wallet usage reached approximately 85.08 million, marking a significant global rise in adoption.

- By 2021, the number of users had reached nearly 24 million, maintaining a strong upward growth pattern.

- In 2020, wallet holders increased to around 48 million, marking one of the sharpest year-to-year jumps.

- During 2019, the number of active wallets grew to approximately 51 million, reinforcing the accelerating pace of adoption.

- In 2018, usage reached nearly 31.91 million, driven by growing interest in cryptocurrency technologies.

- The year 2017 saw wallet numbers rise to about 34 million, almost doubling the count from the previous year.

- In 2016, the total number of blockchain wallets reached close to 69 million, indicating early steps toward mass adoption.

- For 2015, wallet usage stood at approximately 34 million, continuing its gradual upward progression.

- In 2014, the number of blockchain wallets was around 71 million, reflecting early-stage market activity.

- In 2013, global wallet usage hovered near 89 million, showing the initial phase of experimentation with blockchain.

- Back in 2012, blockchain wallets were still emerging, with only 07 million recorded worldwide.

(Source: Zippia Demandsage, Kruschecompany)

Blockchain’s Expanding Influence on Digital Infrastructure

- Around 60% of CIOs across various industries believe that integrating blockchain into their digital ecosystems will be essential by the end of 2024.

- For 53% of senior executives, blockchain is now viewed as a core component of digital infrastructure, offering improved resource efficiency and greater operational flexibility.

- Confidence in digital assets is even stronger within financial services, where 76% of executives express optimism about the sector’s blockchain-driven future.

- An overwhelming 96% of financial institutions expect blockchain to gain stronger mainstream acceptance in the coming years, especially due to its real-time processing capabilities.

- The food and agriculture industry continues to accelerate investment, with blockchain adoption projected to reach USD 1.48 billion by 2026.

- Blockchain’s potential to enhance election transparency has gained substantial visibility, with numerous pilot initiatives underway globally.

- Government support remains high, with 90% of countries endorsing blockchain adoption, particularly in sectors such as supply chain, finance, and public services.

- Web3-focused startups secured the largest share of blockchain investments in Q2 2022, a trend that has continued in subsequent years.

- Leading central banks are evaluating investments of up to USD 50 billion in blockchain-based systems, primarily for digital cash and settlement applications.

- In the healthcare sector, 4 out of 10 executives believe blockchain implementation should be prioritized to improve data integrity and system efficiency.

- A 2021 global survey found that 45% of businesses are considering blockchain for strengthening cybersecurity, especially to enhance secure data exchange and encryption.

(Source: CoinLaw, Statista)

Blockchain Confidence and Challenges Statistics

- A global survey of senior business leaders shows that 87% believe blockchain will significantly enhance productivity and strengthen integration across business operations.

- In the same group, 86% anticipate that blockchain adoption will unlock new business models and generate expanded revenue opportunities.

- However, only 83% expressed strong confidence in blockchain’s ability to improve financial reporting accuracy and transparency.

- Blockchain integration has enabled several investment banks to reduce their infrastructure requirements by nearly 70%, resulting in notable operational and maintenance cost savings.

- Despite offering major advantages over traditional systems, blockchain remains vulnerable to security breaches, with multiple attacks targeting cryptocurrency assets over the past decade.

- Decentralized Finance (DeFi) platforms frequently face cyber intrusions, including a recent incident involving the Li.fi protocol, which resulted in losses of up to USD 10 million in digital assets.

- While centralised protective measures exist, blockchain ecosystems still require more robust endpoint security, particularly for users who need stronger control over access and authentication.

- The absence of a central governing authority raises concerns about the use of blockchain in sensitive sectors, highlighting the need for improved systems to manage and monitor private and public keys.

- Between 2017 and 2023, the number of countries working on sovereign digital currencies doubled, with 111+ nations exploring Central Bank Digital Currencies (CBDCs) by 2023.

- By 2024, the Bitcoin blockchain alone had expanded to 85 GB, showcasing the growing scale and influence of blockchain technology worldwide.

(Source: CoinLaw, Statista)

Ethereum Blockchain Statistics

- On March 18, 2023, the Ethereum network handled an average of 043 million daily transactions, reflecting its high network activity.

- By March 2023, the circulating supply of Ethereum had reached approximately 45 million ETH.

- Unlike Bitcoin’s fixed supply model, Ethereum operates without a predetermined maximum supply.

- Ethereum dominates the decentralized finance ecosystem, capturing 4% of the total DeFi market.

- As of March 16, 2023, the platform recorded 413,904 active Ethereum wallet addresses.

- The most active wallet on the Ethereum blockchain is owned by OpenSea, the widely used NFT marketplace.

- Combined, Bitcoin and Ethereum hold over 50% of the global cryptocurrency market share.

- The latest available figures indicate that the value of Ethereum is approximately USD 1,064.81.

- Digital ledger technology generally falls into four categories: public, private, hybrid, and consortium

- The Ethereum ecosystem supports over 3,000 decentralized applications (DApps), making it one of the largest smart contract platforms.

(Source: Coindesk, Ycharts, Coinmarketcap, Statista)

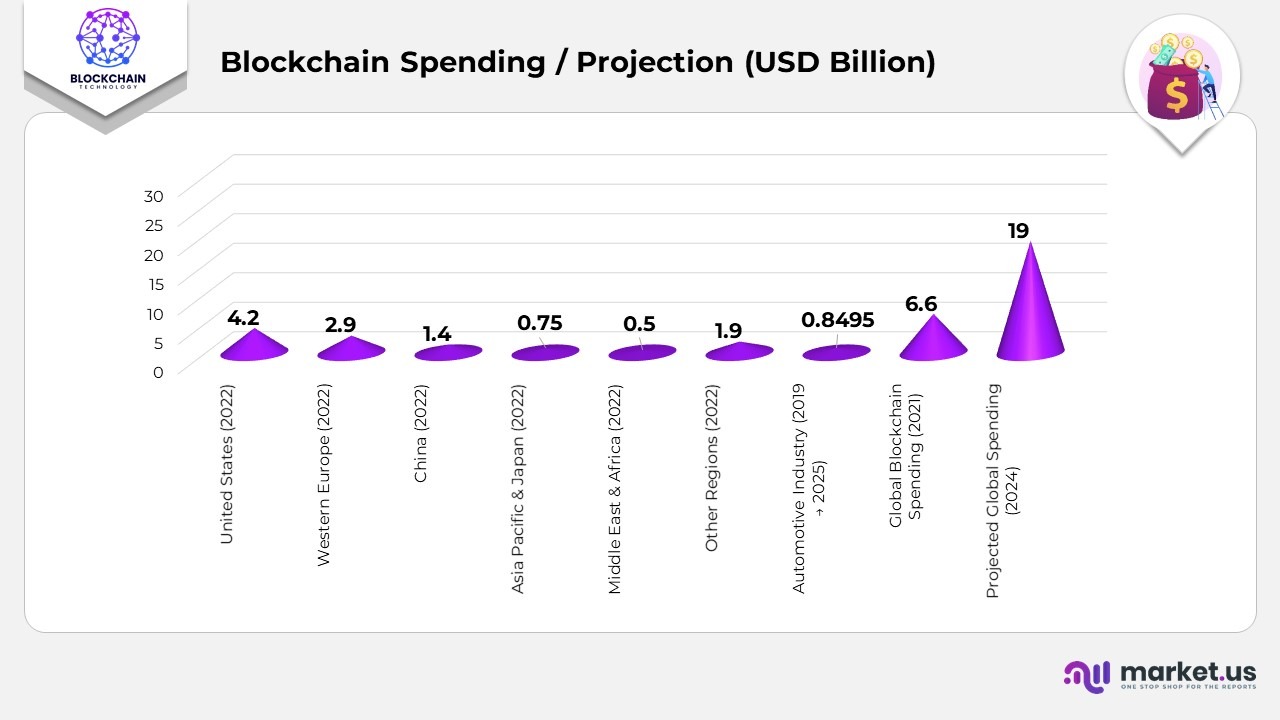

Blockchain Spending Statistics

- In 2022, the United States is projected to lead global blockchain spending, with investments of nearly USD 4.2 billion in various solutions.

- Western Europe follows with an estimated USD 2.9 billion in blockchain expenditure, while China is expected to allocate around USD 1.4 billion.

- Across the Asia Pacific and Japan region, combined blockchain investments are anticipated to reach about USD 0.75 billion.

- The Middle East and Africa are forecasted to contribute roughly USD 0.5 billion, with all other regions together accounting for an additional USD 1.9 billion.

- Blockchain adoption in the automotive industry is poised for significant expansion, growing from USD 849.5 million in 2019 to a projected USD 14.731 billion by 2025.

- Global spending on blockchain technology reached an estimated USD 6.6 billion in 2021, with projections indicating growth toward nearly USD 19 billion by 2024.

(Source: Statista, International Data Corporation, Cision)

Bitcoin Blockchain Statistics

- As of March 2023, the Bitcoin network processes an average of more than 20,000 transactions per day.

- Genesis Coin remains the leading global producer of Bitcoin ATMs, dominating the market in terms of manufacturing.

- Blockchain.com reports a global user base of approximately 85 million Bitcoin wallets as of March 2023.

- The United States accounts for the vast majority of Bitcoin ATMs, hosting 11,386 machines, which represent approximately 4% of all units worldwide.

- Among publicly listed companies, MicroStrategy maintains the largest corporate Bitcoin holdings.

- Across the globe, a total of 14,915 Bitcoin ATMs are currently active, supporting widespread access to digital currency.

(Source: Statista)

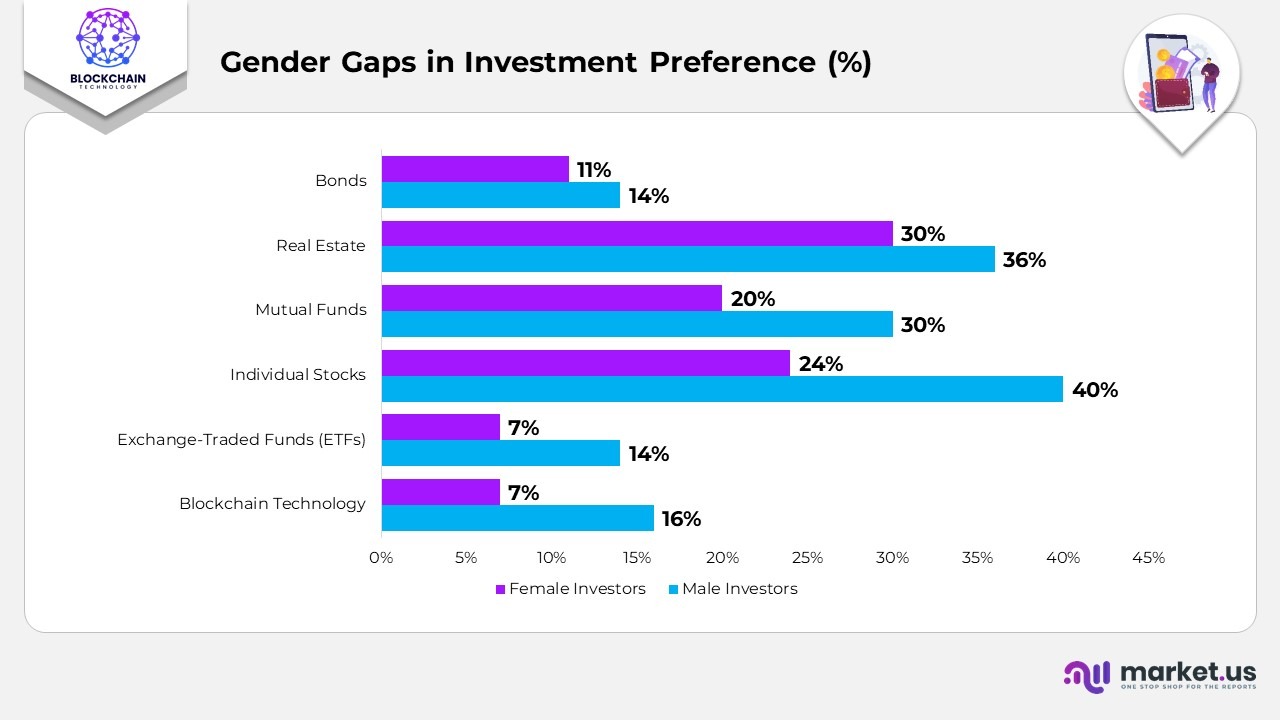

Gender Gaps in Investment Preference

- 16% of men invest in blockchain technology, compared with 7% of women, indicating a notably higher male inclination toward emerging digital assets.

- Exchange-traded funds (ETFs) draw interest from 14% of male investors and 7% of female investors.

- Individual stocks remain the top investment choice, with participation from 40% of men and 24% of women.

- Mutual funds are selected by 30% of men and 20% of women, showing moderate engagement from both genders.

- Real estate exhibits a smaller gender gap, with 36% of men and 30% of women investing in property-related opportunities.

- Bonds attract 14% of male investors and 11% of female investors, reflecting relatively similar interest in lower-risk assets.

(Source: Demandsage, Sciencedirect)

Most Widely Implemented Blockchains in Global Business

- Hyperledger Fabric stands out as the top choice, with 26 of the world’s 100 largest public companies using it for enterprise blockchain solutions.

- Ethereum ranks second, adopted by 18 major corporations for decentralized applications and smart contract capabilities.

- Quorum, an enterprise-focused blockchain, is used by 11 top global companies.

- Corda supports blockchain operations in 8 leading corporations, particularly in finance and trade-related sectors.

- MediLedger, known for its healthcare and pharmaceutical applications, is utilized by 3 of the top companies.

- AxCore also appears in the portfolios of 3 top global enterprises.

- A diverse group of 12 companies relies on various other blockchain platforms outside the main listed networks.

(Source: Demandsage, Zippia)

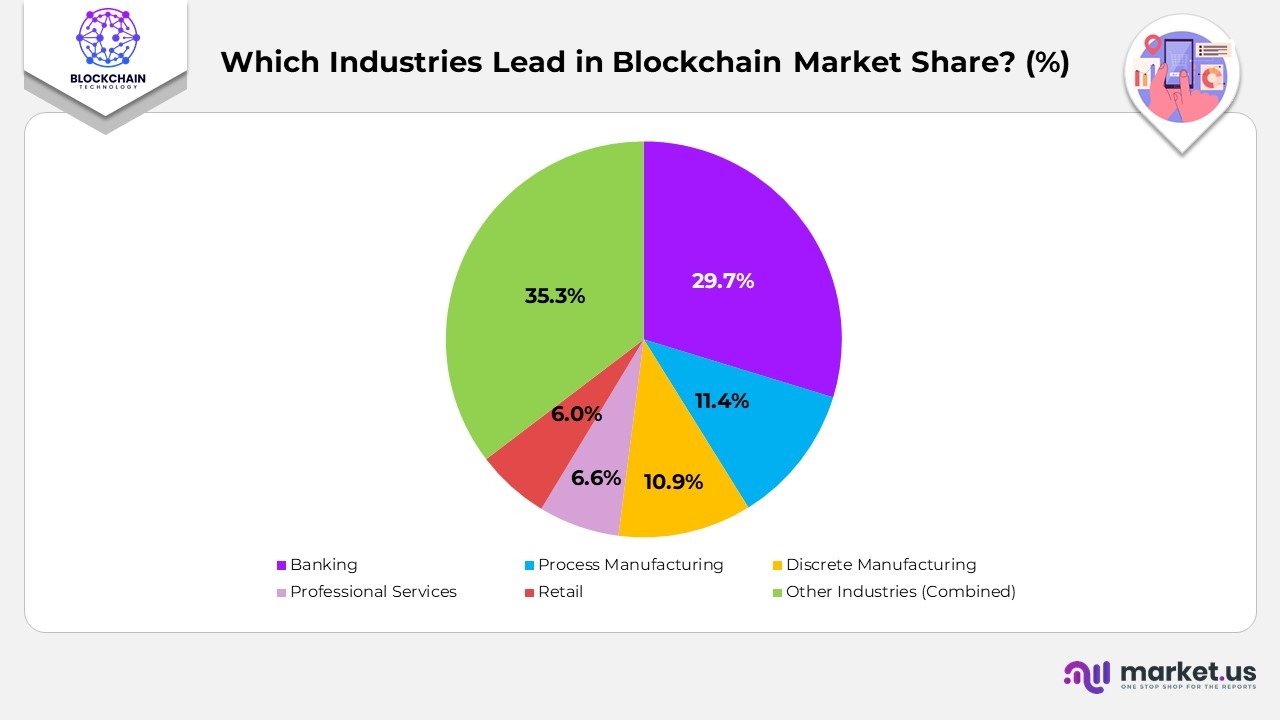

Which Industries Lead the Way in the Blockchain Market Share?

- Banking dominates the blockchain landscape, accounting for a substantial 29.7% share of the total market value.

- Process manufacturing accounts for 4%, showing steady integration of blockchain into production workflows.

- Discrete manufacturing holds 9%, reflecting its growing reliance on blockchain for tracking, automation, and quality assurance.

- Professional services contribute 6%, utilizing blockchain for secure data exchange and operational optimization.

- The retail sector represents 6%, supported by the adoption of blockchain technology in payments, logistics, and customer authentication.

- All other industries combined make up the remaining 3%, underscoring the broad applicability of blockchain across various sectors.

(Source: Demandsage, Statista, Chainanalysis)

Conclusion

Blockchain statistics emphasize the technology’s transition from powering cryptocurrencies to driving large-scale digital transformation across industries. Its adoption in sectors such as finance, healthcare, logistics, and government services showcases how decentralization, transparency, and security are reshaping global operations. With increased enterprise investments, regulatory progress, and trust in distributed systems, blockchain has emerged as a vital tool for improving data integrity, operational efficiency, and transactional trust.

Moreover, in the coming years, blockchain’s growth will hinge on its interoperability, scalability, and seamless integration with next-generation technologies, such as artificial intelligence and the Internet of Things. Further, as businesses advance their digital strategies, blockchain is set to become the foundation for secure data exchange, automated smart contracts, and decentralized innovation. Ultimately, it stands as a transformative enabler of a more transparent, efficient, and resilient global digital economy.