Company Overview

Adobe Statistics: Adobe Inc. is a global leader in developing software for printing, publishing, and digital graphics, empowering users to create, manage, and optimize content across multiple digital platforms. Its solutions enable individuals and organizations to design, measure, deliver, and enhance digital experiences that drive engagement and innovation. The company serves a diverse user base comprising creative professionals, enterprises, developers, educators, small businesses, and consumers worldwide. Adobe’s strategic focus lies in 2 major growth areas, Digital Media and Digital Experience, supported by its 3 reportable business segments: Digital Media, Digital Experience, and Publishing & Advertising.

With a broad international footprint, Adobe operates across North America, Europe, the Asia-Pacific region, the Middle East, Africa, and South America. Adobe’s key innovation and operational hubs are located in the United States, Canada, India, China, Japan, Australia, the United Kingdom, France, Germany, and Brazil, enabling the company to deliver localized services and global-scale digital solutions. This extensive global presence underscores Adobe’s position as a driving force in creative technology and experience-led transformation across industries.

Adobe History

1900’s

- 1982: John Warnock and Charles Geschke founded Adobe, introducing an all-digital approach to revolutionize printing and publishing.

- 1985: Adobe PostScript became the first international standard for computer printing, transforming desktop publishing.

- 1987: The launch of Adobe Illustrator gave digital artists precision and creative flexibility.

- 1989: Adobe made PostScript font technology an open standard, encouraging industry-wide adoption.

- 1990–1991: Adobe introduced Photoshop, redefining digital imaging, followed by Premiere, which transformed professional video editing.

- 1993: The launch of PDF and Adobe Acrobat revolutionized document sharing and productivity.

- 1999: Adobe InDesign marked a new era in digital publishing.

2000’s

- 2003: The company introduced the “freemium” model through Acrobat Reader, democratizing access to PDF tools.

- 2005: With Flash, Adobe shaped the future of web video and interactive gaming experiences.

- 2008: PDF was released as an open standard, enhancing global compatibility.

- 2012: Adobe Marketing Cloud unified analytics, targeting, and advertising — pioneering the digital marketing software category.

- 2012: Adobe transitioned to a subscription-based model with Creative Cloud, transforming software accessibility.

- 2016: Adobe Sensei introduced AI capabilities across its creative suite, driving automation and intelligent creativity.

- 2019: The Content Authenticity Initiative was founded to promote trust and transparency in digital media.

- 2019: Adobe Experience Platform was launched to centralize customer data management.

- 2021: Adobe Express made advanced creative tools from Photoshop, Illustrator, and Premiere accessible to all users.

- 2023: Adobe Firefly became the first commercially safe generative AI model for creative applications.

- 2024: Adobe GenStudio redefined enterprise content workflows by integrating planning, creation, and measurement capabilities.

Major Acquisitions of Adobe

- 2005: Macromedia, Inc.

- 2009: Omniture, Inc.

- 2010: Day Software

- 2012: Behance

- 2015: Fotolia

- 2018: Magento, Marketo

- 2019: Allegorithmic

- 2020: Workfront

- 2021: Frame.io

Adobe Employee Analysis Statistics

- As of November 29, 2024, Adobe employed 30,709 people across its global operations.

- Around 50% of the workforce was based in the United States, while the remaining 50% was positioned in international offices, reflecting a balanced global talent structure.

- The company reported an overall attrition rate of 7.8% during fiscal year 2024, highlighting strong employee retention levels.

- Approximately 81% of employees participated in Adobe’s most recent employee engagement survey, indicating high workforce involvement and a strong commitment to organizational

(Source: Adobe Annual Report)

Statistics of Adobe Financial Analysis

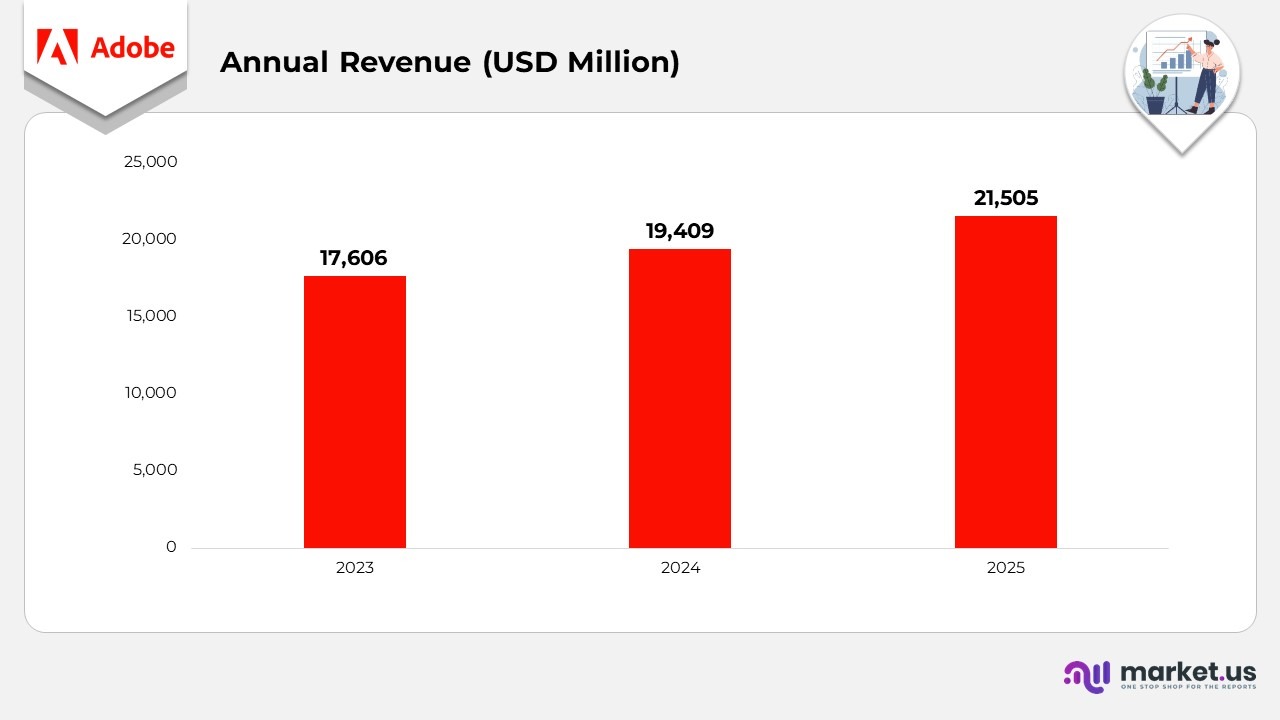

- In 2023, Adobe reported annual revenue of USD 17,606 million, reflecting a steady performance supported by strong demand across its creative and digital media offerings.

- Revenue increased to USD 19,409 million in 2024, marking a solid 2% year-over-year growth, driven by higher subscription adoption and the expansion of enterprise digital experience solutions.

- By 2025, Adobe’s revenue reached USD 21,505 million, representing a further 8% annual increase, attributed to strong uptake of AI-powered tools like Firefly and growing Creative Cloud memberships.

Subscription Revenue Analysis

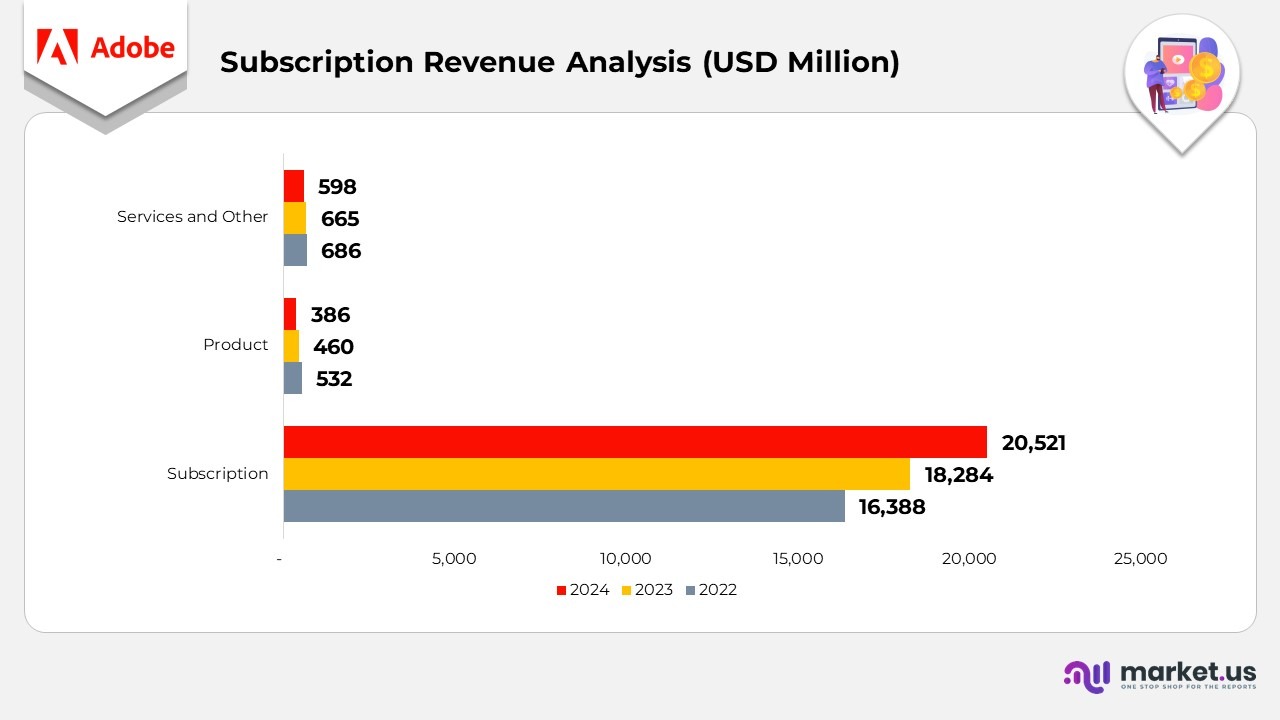

- In 2024, Adobe generated USD 20,521 million in subscription revenue, up from USD 18,284 million in 2023 and USD 16,388 million in 2022, reflecting its continued success in cloud-based services and recurring income models.

- Revenue from product sales declined to USD 386 million in 2024, compared to USD 460 million in 2023 and USD 532 million in 2022, aligning with the company’s strategic shift toward subscription offerings.

- Services and other revenue contributed USD 598 million in 2024, down slightly from USD 665 million in 2023 and USD 686 million in 2022, indicating a streamlined focus on core digital experiences and creative solutions.

(Source: Adobe Annual Report)

Adobe Geographical Revenue Analysis

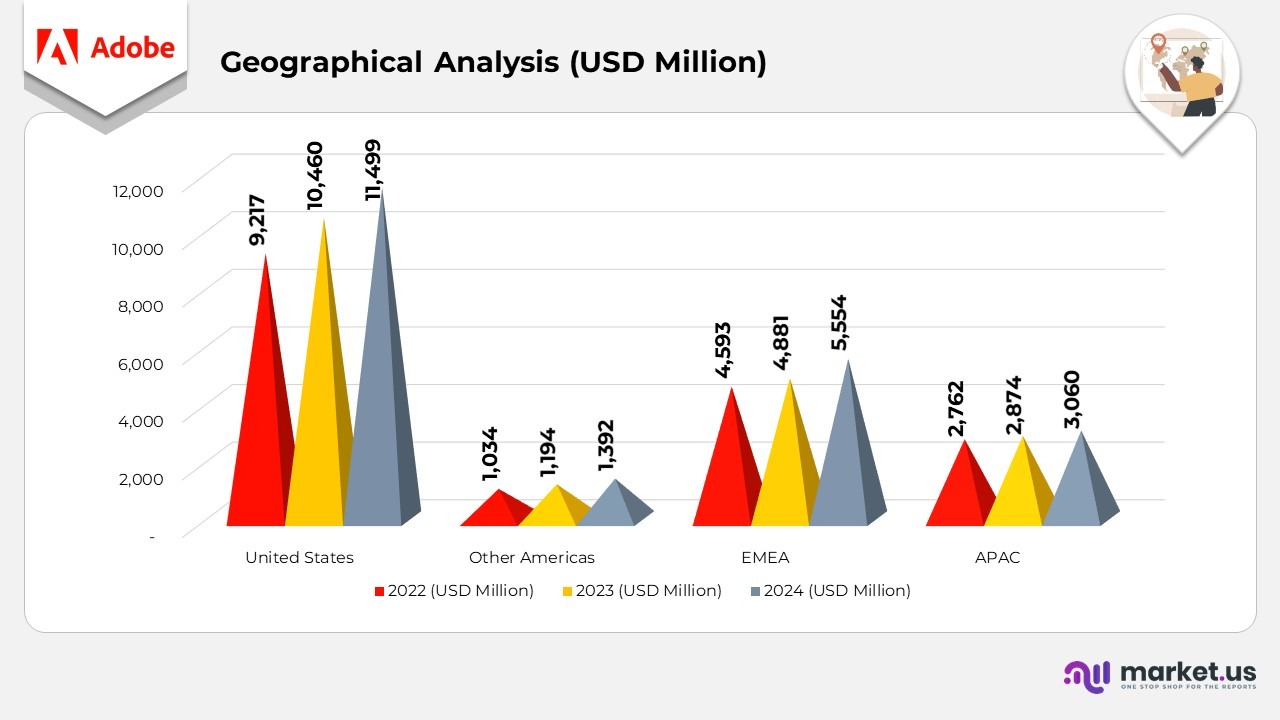

- The United States contributed $ 11,499 million in 2024, compared to $ 10,460 million in 2023 and $ 9,217 million in 2022, maintaining its position as the company’s largest revenue market.

- Other parts of the Americas recorded 1,392 million in 2024, up from 1,194 million in 2023 and 1,034 million in 2022, reflecting continued growth in emerging economies.

- The EMEA region generated $5,554 million in 2024, up from $4,881 million in 2023 and $4,593 million in 2022, driven by strong demand for Adobe’s creative and experience solutions.

- The APAC region reported $3,060 million in 2024, compared to $2,874 million in 2023 and $2,762 million in 2022, indicating solid expansion in key Asian markets.

(Source: Adobe Annual Report)

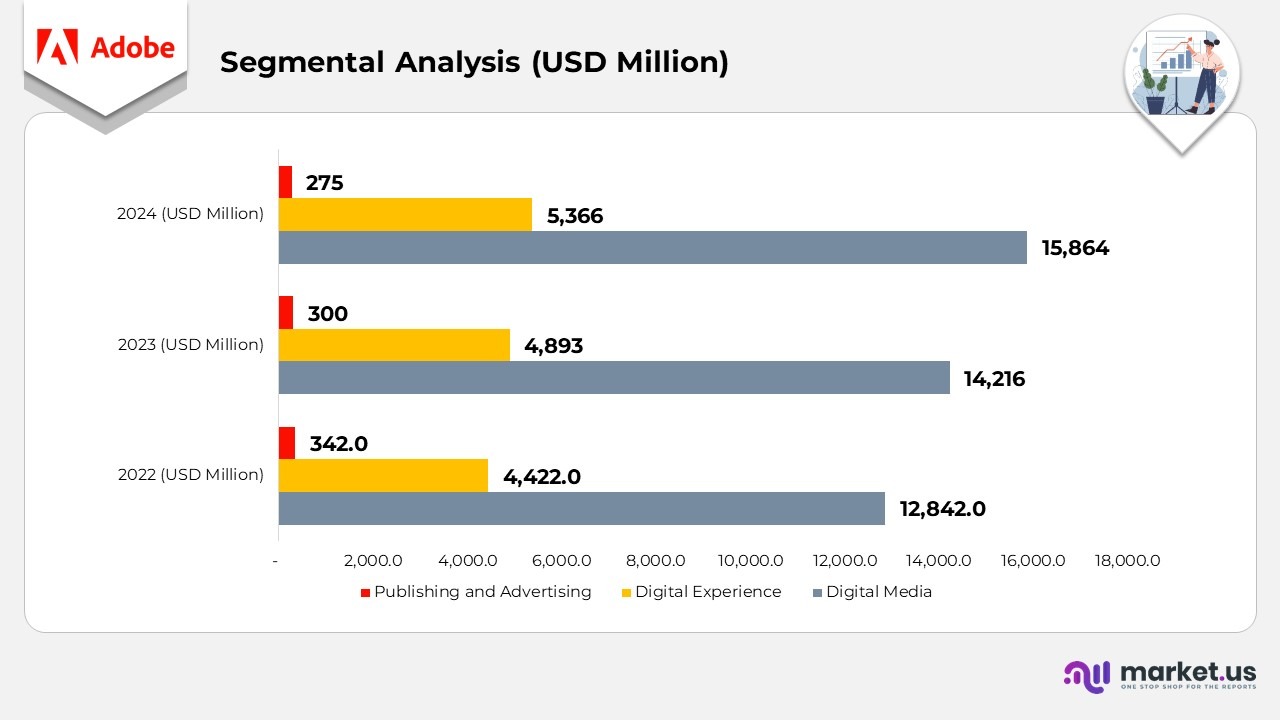

Segmental Analysis

- The Digital Media segment generated 15,864 million in 2024, up from 14,216 million in 2023 and 12,842 million in 2022, marking a 12% year-over-year increase and contributing 74% to Adobe’s total revenue.

- The Digital Experience segment recorded $5,366 million in 2024, compared to $4,893 million in 2023 and $4,422 million in 2022, reflecting a 10% annual growth rate while maintaining a 25% share of total revenue.

- The Publishing and Advertising segment reported $275 million in 2024, down from $300 million in 2023 and $342 million in 2022, representing an 8% decrease and accounting for 1% of total revenue.

Adobe Digital Media Statistics

- The Creative Cloud division contributed USD 12,682 million in 2024, up from USD 11,517 million in 2023 and USD 10,459 million in 2022, marking a 10%

- The Document Cloud segment achieved USD 3,182 million in 2024, compared with USD 2,699 million in 2023 and USD 2,383 million in 2022, indicating a strong 18%

- The segment’s performance improvement was primarily driven by rising demand for subscription-based Creative and Document Cloud services, higher engagement across customer segments, and the transition to premium subscription offerings with greater revenue per user.

(Source: Adobe Annual Report)

Fast Fact of Adobe

- Over 400 billion PDFs were opened and 16 billion documents were edited through Adobe Acrobat over the past year, underscoring its dominance in digital document workflows.

- Adobe Firefly has enabled the creation of over 9 billion images across various creative applications, including Photoshop, Illustrator, and Express, underscoring the strong adoption of AI-driven design tools.

- Adobe Scan remains the top scanning application on iOS and Android with over 150 million downloads and more than 5 billion documents scanned and created digitally.

- Adobe Express experienced remarkable traction, achieving a 96% quarter-over-quarter increase in monthly active mobile users and an 86% year-over-year surge in cumulative creations, driven by continuous innovation and product enhancements.

- Adobe Document Cloud continues to promote sustainability, delivering 90% cost savings and a 95% reduction in environmental impact compared to traditional paper-based workflows.

- Adobe Stock’s content library expanded to over 450 million total assets, including 246 million photos, 166 million vectors and illustrations, 31 million videos, 99,000 music tracks, 2 million premium assets, and over 1 million free creative resources.

- Every 1 million transactions through Adobe Sign generates more than USD 7.2 million in cost savings, conserves 105 million liters of water, preserves 31,000 trees, and cuts carbon emissions equivalent to removing 2,300 cars from the road annually.

- More than 1 billion files have been accessed through Liquid Mode, Adobe’s AI-powered mobile reading experience that enhances document accessibility and engagement.

(Source: Adobe Annual Report)

Adobe User and Audience Statistics

- Adobe’s Creative Campus program has expanded globally, with over 70 institutions leveraging its tools to foster digital creativity and innovation in education.

- More than 400 billion PDFs were opened using Adobe’s document solutions, reinforcing its leadership in digital productivity and file management.

- Approximately 87% of Fortune 10 companies rely on Adobe’s software ecosystem to power design, marketing, and digital experience operations.

- The Behance creative community now exceeds 50 million members. Serving as a hub for global collaboration and portfolio showcasing.

- Over 60 million K–12 students utilize Adobe’s tools for learning and creative expression, supporting the next generation of digital creators.

- Adobe’s global workforce surpasses 29,000 employees, reflecting its strong operational scale and talent-driven innovation across markets.

(Source: StatsUp)

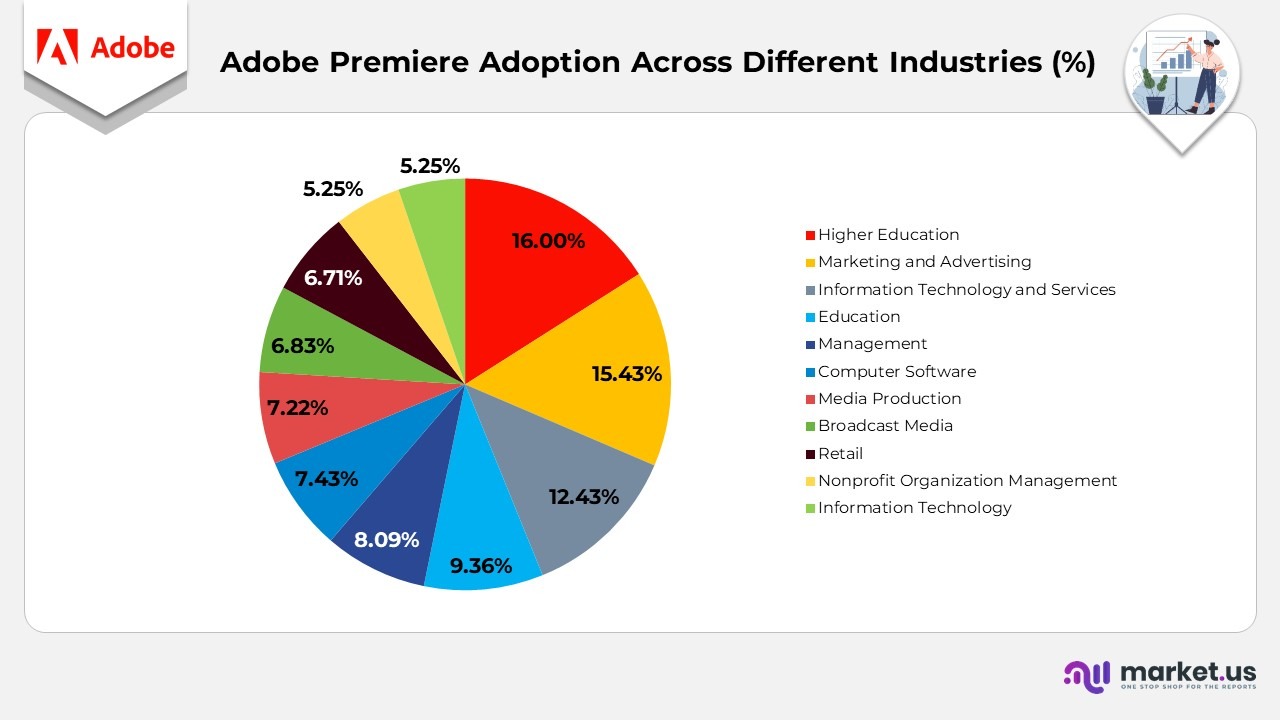

Adobe Premiere Adoption Across Different Industries

- The higher education sector leads Adobe Premiere’s user base, accounting for 16% of total users. Representing approximately 1,433 institutions and professionals who leverage the tool for creative learning and training purposes.

- Marketing and advertising follow closely, with a 15.43% share, comprising approximately 1,382 users who utilize Premiere for campaign production, brand storytelling, and promotional video content creation.

- The information technology and services segment holds 43%, with nearly 1,114 users integrating Adobe Premiere for digital solutions and multimedia project development.

- Other notable user groups include education (36%), management (8.09%), and computer software (7.43%), indicating wide adoption across diverse professional functions.

- Creative industries, such as broadcast media (6.83%), media production (7.22%), and retail (6.71%), continue to drive demand for marketing, advertising, and digital content distribution.

- Additionally, the nonprofit organization management and information technology sectors each represent 25%, highlighting the software’s growing relevance across social and technical domains.

(Source: Enlyft)

Adobe Stock Asset Composition by Media Type Statistics

- Adobe Stock currently hosts an extensive media collection, featuring over 180 million photos available for commercial and creative use.

- The platform features over 61 million vector graphics, providing scalable and design-ready visual assets.

- A growing collection of 22 million illustrations offers creators a diverse range of artistic content across various styles.

- Users have access to over 70,000 customizable templates, simplifying content creation for digital and print media.

- Video creators can explore a library of 24 million high-quality stock videos, suited for a wide range of production needs.

- The audio section features approximately 61,000 royalty-free sound files, catering to film, gaming, and marketing projects.

- For 3D artists, Adobe Stock offers 18,000 advanced 3D assets, enabling enhanced visual design and animation workflows.

- The platform also provides over 20,000 premium fonts, enriching creative typography options across Adobe applications.

(Source: Stock Photo Secrets)

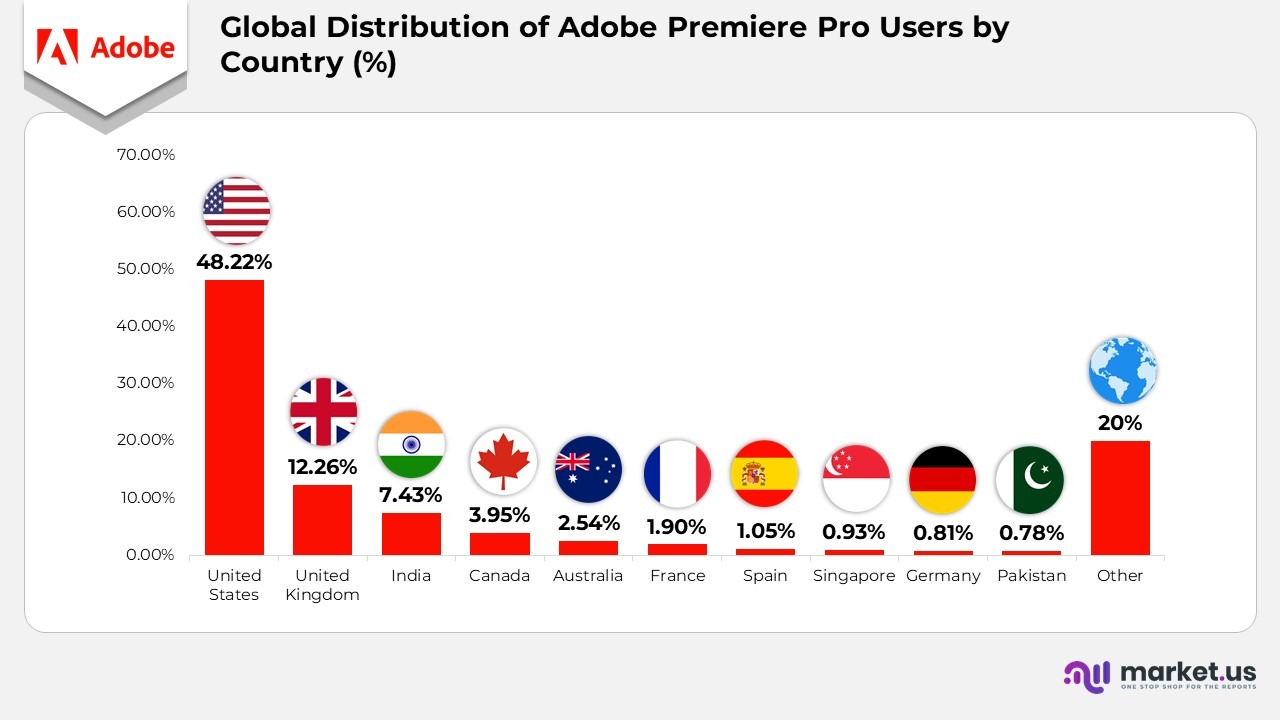

Distribution of Premiere Pro Users by Country

- The United States leads with 22% of Adobe Premiere Pro users, showcasing its dominance in professional video editing and creative content production.

- The United Kingdom holds 26%, reflecting strong adoption within the advertising, media, and entertainment sectors.

- India accounts for 43%, driven by its rapidly growing digital creator and post-production industry.

- Canada represents 95%, supported by a robust educational and media landscape.

- Australia contributes 54%, with increasing engagement from freelancers and media studios.

- Additional markets include Spain (1.05%), France (1.90%), Singapore (0.93%), Germany (0.81%), and Pakistan (0.78%), reflecting the widespread international adoption of this technology.

- Collectively, other countries make up 20% of Adobe Premiere Pro’s total global user base.

(Source: Enlyft, PXCH Holding I, SendShort, LLC. )

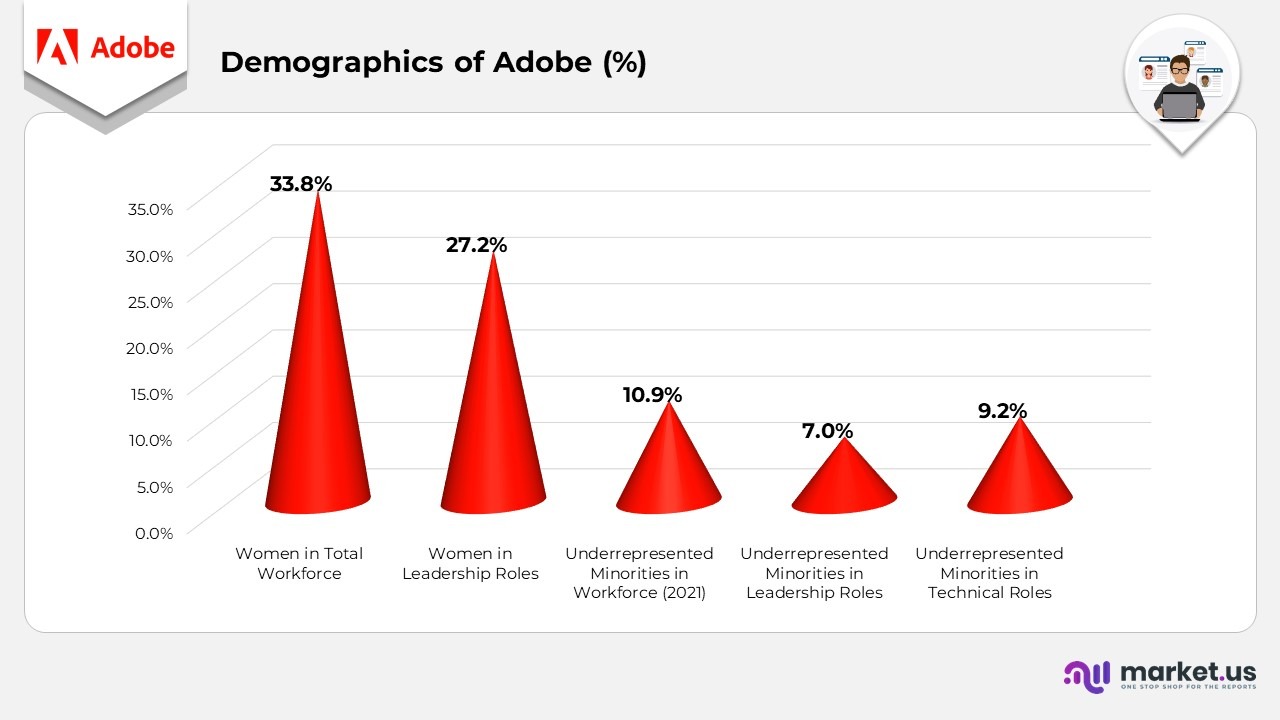

Demographics of Adobe

- Women represent 8% of Adobe’s global workforce, reflecting the company’s ongoing efforts to promote gender balance across all departments.

- Approximately 2% of leadership roles are held by women, showing steady progress in advancing female representation in executive positions.

- Between 2017 and 2021, the number of employees identifying as women increased by 58%, rising from 5,527 to 8,743. Indicating a consistent improvement in inclusivity initiatives.

- In 2021, approximately 10.9% of Adobe’s total workforce identified as underrepresented minorities. Underscoring the company’s commitment to inclusive hiring practices.

- Over the same period (2017–2021), the number of underrepresented minority employees in the US increased by 8%, from 746 to 1,561. Marking nearly a doubling of representation.

- These employees currently hold 7% of leadership positions and account for 2% of technical roles. Demonstrating Adobe’s commitment to building an equitable workplace across all levels.

(Source: Thrivemyway)

Adobe Premiere Pro User Distribution by Company Size

- Companies with over 10,000 employees form the largest user group, representing nearly 47% of all Adobe Premiere Pro users. Highlighting its popularity among large enterprises and global organizations.

- The next major segment comprises companies with 1,000–5,000 employees, contributing approximately 25% of the total user base. Primarily consisting of mid-to-large technology and media firms.

- Average company size data indicates 5 employees correspond to 12,353 users, while those with 30 employees account for 137,880 users.

- Mid-sized companies with 125 employees have an estimated 549,625 users, and those averaging 350 employees include 771,050 users.

- Larger organizations with 750 employees comprise about 1,188,000 users, while companies with 3,000 employees total 7,551,000 users.

- Enterprises with an average of 7,500 employees account for 5,812,500 users, whereas companies with 10,000 employees reach approximately 14,180,000 users.

- Collectively, firms with 5,000 or more employees account for 19.25% of total users, underscoring the trend of enterprise-focused adoption.

- Smaller businesses show minimal penetration, with 50–200 employees (1.82%), 200–500 employees (2.55%), 10–50 employees (0.46%), and 1–10 employees (0.04%).

(Source: Enlyft, SendShort, LLC. )

Growth Trend of Adobe Premiere Pro User Base

- Adobe Premiere Pro’s global user base expanded significantly from around 5 million in 2019 to nearly 30 million in 2024. Marking a sharp increase driven by digital media adoption.

- The surge in users is primarily attributed to the rise of online video content. The growth of social media creators, and continuous enhancements to Adobe’s Creative Suite features.

- In 2020, the platform saw approximately 9 million users, followed by 16 million in 2021. Indicating a steep year-over-year growth trajectory.

- By 2022, the number of users had risen to nearly 21.7 million, accelerating further to 26 million in 2023, before reaching the 30 million milestone in 2024.

- This consistent expansion highlights Adobe’s strong positioning among professional editors, production studios, and independent creators worldwide.

(Source: Filmstro, Enlyft)

Adobe Patents

| Patent Title | Patent / Publication Number | Filed Date | Date of Patent / Publication |

|---|---|---|---|

| Relightable Scene Reconstructions Consuming Radiance Guided Material Extraction | 20250329106 | April 18, 2024 | October 23, 2025 |

| Reconstructing Linear Gradients | 12450692 | September 1, 2022 | October 21, 2025 |

| Modifying Digital Images via Adaptive Interpreting Order of Image Objects | 12450750 | June 29, 2023 | October 21, 2025 |

| Non-Fungible Token Foundation Workflow with Automated Rights Management | 12450318 | September 1, 2023 | October 21, 2025 |

| Image Localizability Classifier | 12450936 | November 5, 2021 | October 21, 2025 |

| Classifying Image Styles of Images Based on Procedural Style Embeddings | 12450870 | April 3, 2023 | October 21, 2025 |

| Methods and Systems for Determining Characteristics of a Dialogue Between a Computer and a User | 12451132 | February 9, 2023 | October 21, 2025 |

| Performing Multiple Segmentation Tasks | 12450747 | January 23, 2023 | October 21, 2025 |

| Efficiently Inference of Digital Videos Using Machine-Learning Models | 12450504 | July 12, 2024 | October 21, 2025 |

| Systems for Resolving Conflicts in Collaborative Digital Content Editing | 12452321 | April 27, 2023 | October 21, 2025 |

| Machine Learning Modelling for Protection Against Online Disclosure of Sensitive Data | 12444010 | October 18, 2023 | October 14, 2025 |

| Reflowing Infographics for Cross-Device Display | 12443790 | August 9, 2023 | October 14, 2025 |

| Using Reinforcement Learning to Recommend Data Visualizations | 12443621 | May 20, 2024 | October 14, 2025 |

| Self-Supervised Audio-Visual Learning for Correlating Music and Video | 20250316062 | June 23, 2025 | October 9, 2025 |

| Generative Artificial Intelligence (AI) Content Strategy | 20250315856 | April 3, 2024 | October 9, 2025 |

| Generation Using Depth-Conditioned Autoencoder | 12437427 | August 26, 2022 | October 7, 2025 |

| Controllable Dynamic Appearance for Neural 3D Portraits | 12437492 | April 7, 2023 | October 7, 2025 |

| Distributing Multimedia Content to Digital-Signage Devices | 12436722 | May 12, 2023 | October 7, 2025 |

| Generating Templates Using Structure-Based Matching | 12437505 | October 13, 2022 | October 7, 2025 |

| Expansion with Configurable Localization Threshold and Localized Seam Carving | 12437411 | November 14, 2022 | October 7, 2025 |

(Source: Justia Patents)

Recent Developments

- In January 2022, Adobe strengthened its creative solutions portfolio by acquiring Abstract Notebooks. A software company specialising in collaborative design and version management tools.

- In February 2022, Adobe entered into a strategic collaboration with LiveRamp to enhance omnichannel. People-based targeting and measurement, helping marketers achieve seamless audience activation across channels.

- In March 2022, Adobe expanded its partnership with BMW Group to accelerate the digital transformation of the company’s sales and marketing division. Focusing on data-driven personalization and connected customer experiences.

- In March 2022, the company introduced new AI-powered enhancements within Adobe Experience Cloud, powered by Adobe Sensei. Its proprietary artificial intelligence engine that enhances automation and predictive analytics capabilities.

- In March 2022, Adobe expanded its global partner ecosystem to deliver more personalised customer experiences. Enhancing technology collaborations and strengthening its presence across diverse markets.

(Source: Adobe Press Releases)