Company Overview

Anheuser-Busch InBev SA/NV Statistics: Anheuser-Busch InBev SA/NV is a global beverage and brewing leader engaged in the production, distribution, and marketing of non-alcoholic beverages, alcoholic beers, and soft drinks. The company’s business operations are strategically divided into 5 major geographic regions—Middle Americas, North America, Europe, Middle East & Africa (EMEA), South America, and Asia Pacific, allowing it to maintain a strong international presence and effectively serve diverse consumer markets worldwide.

Anheuser-Busch InBev maintains a strong, widespread presence across global markets, operating in key regions of Africa, Asia-Pacific, Europe, the Americas, and North America. In Africa, the company has established operations in 18 countries, including Botswana, Eswatini, Ghana, Lesotho, Malawi, Mauritius, Mozambique, Namibia, Nigeria, South Africa, South Sudan, Tanzania, Uganda, Zambia, and Zimbabwe, serving as major production and distribution hubs for its diverse portfolio of beer brands.

Across the Asia-Pacific region, AB InBev operates in China, India, Japan, and South Korea, supporting its strategy to meet growing demand in both emerging and mature markets. Within Europe, the brewer maintains an extensive network spanning 19 countries, encompassing Western, Central, and Eastern Europe.

In the Middle American region, the company operates in Colombia, Cuba, the Dominican Republic, Ecuador, El Salvador, Guatemala, Honduras, Mexico, Panama, and Peru. In South America, its footprint includes Argentina, Bolivia, Brazil, Chile, Paraguay, and Uruguay. By North America, AB InBev’s core presence is anchored in Canada and the United States, reflecting its deep historical roots and continued leadership in the global brewing industry.

History of Anheuser-Busch

- 1240: Monks at the Notre-Dame de Leffe Abbey in Belgium began crafting what would become the renowned Leffe beer recipe.

- 1366: The Den Hoorn brewery was established in Leuven, Belgium, laying the foundation for what is now known as Stella Artois.

- 1397: Brewing operations started at Munich’s historic Spaten brewery, marking one of Germany’s earliest large-scale beer producers.

- 1445: The monks of Hoegaarden developed their distinctive wheat-beer recipe, giving birth to Belgium’s classic white ale tradition.

- 1847: Irish immigrant John Kinder Labatt opened his brewery in London, Ontario, shaping the beginnings of Canada’s brewing industry.

- 1876: Adolphus Busch introduced Budweiser in St. Louis, Missouri, pioneering the American-style lager that became an international icon.

- 1885: The Antarctica brewery was founded in São Paulo, Brazil, marking a milestone in South America’s beer heritage.

- 1888: Brahma Brewery emerged in Rio de Janeiro, expanding Brazil’s brewing culture and later becoming one of its flagship brands.

- 1890: Otto Bemberg established Quilmes in Argentina, producing beer inspired by traditional German brewing techniques.

- 1892: Charles Glass launched Castle Brewery in Johannesburg, South Africa, during the booming gold-rush era.

1900’s

- 1900: The Harbin brewery was founded in China, setting the stage for the country’s oldest beer brand.

- 1925: Cervecería Modelo began operations in Mexico City, soon gaining prominence across Latin America.

- 1926: Stella Artois was introduced as a festive holiday brew in Leuven, eventually becoming a global favourite.

- 1987: The merger of Brouwerij Artois and Piedboeuf Brewery formed Interbrew, bringing together leading Belgian brands such as Jupiler.

- 1998: Two of Brazil’s largest brewers, Brahma and Antarctica, united to form Ambev, strengthening their position in Latin America.

- 2004: Interbrew and Ambev merged to create InBev, establishing one of the first truly global brewing companies.

- 2008: InBev acquired Anheuser-Busch, forming Anheuser-Busch InBev (AB InBev) and expanding into the U.S. market.

- 2013: Grupo Modelo of Mexico, known for Corona, officially joined the AB InBev family.

- 2014: Oriental Brewery of South Korea rejoined AB InBev, reinforcing the company’s presence in Asia.

- 2016: AB InBev completed its merger with SABMiller, creating the world’s largest and most influential brewing group.

(Source: Company Website)

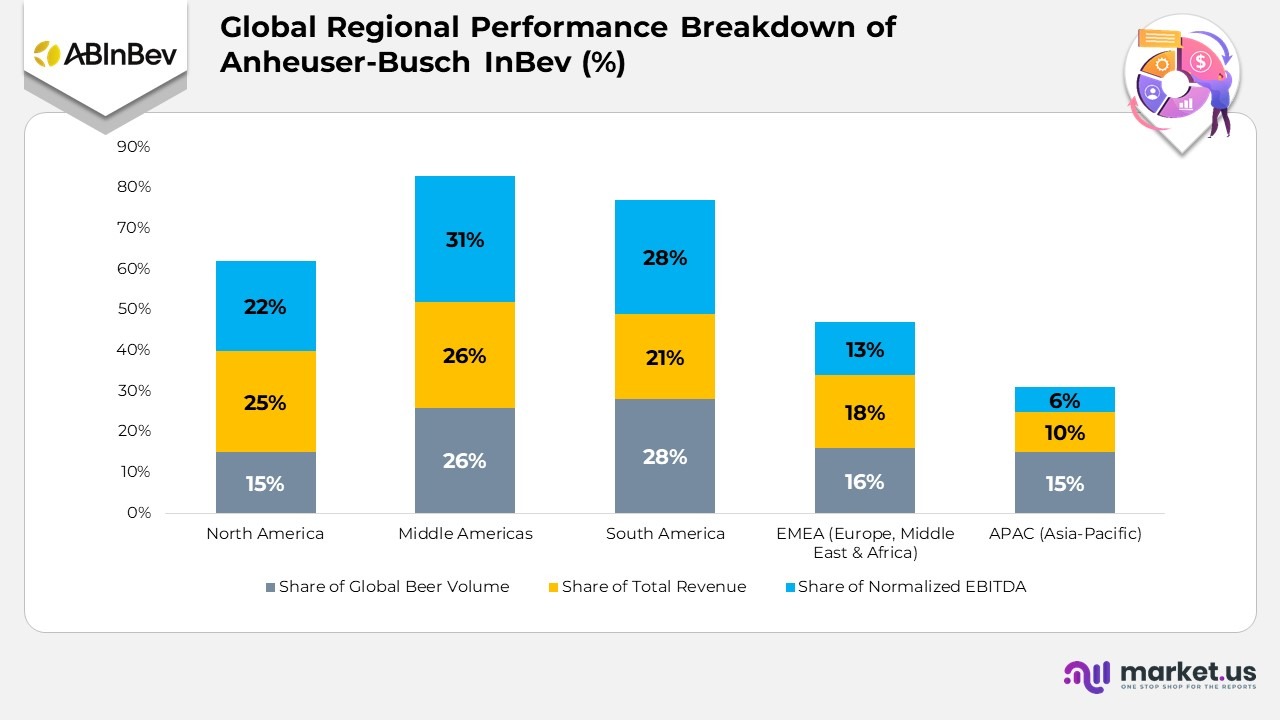

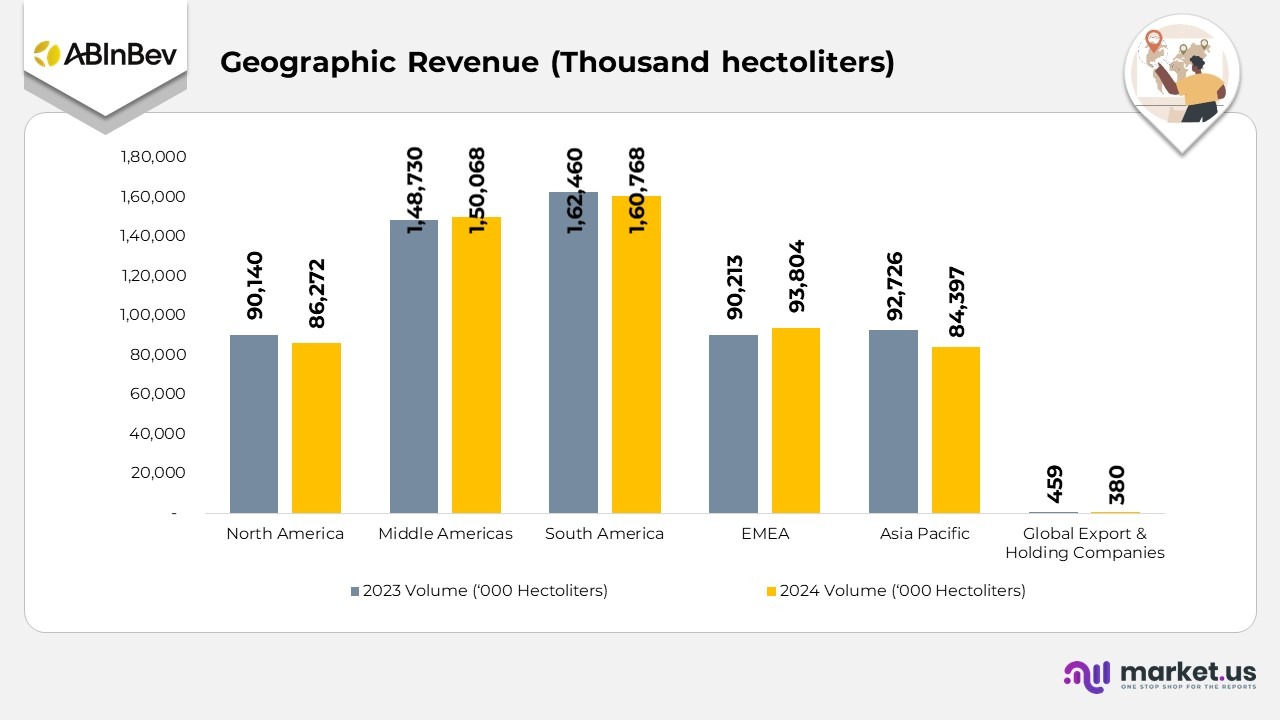

Regional Performance Breakdown of Anheuser-Busch InBev

- North America contributes 15% of Anheuser-Busch InBev’s global beer volume, generating 25% of total revenue and 22% of normalized EBITDA.

- The Middle Americas account for 26% of worldwide beer production, driving 26% of total revenue and 31% of normalized EBITDA.

- South America represents 28% of the company’s total beer volume, contributing 21% of overall revenue and 28% of normalized EBITDA.

- The EMEA region (Europe, Middle East & Africa) makes up 16% of global beer volume, producing 18% of total revenue and 13% of normalized EBITDA.

- The APAC region (Asia-Pacific) accounts for 15% of AB InBev’s global beer volume, 10% of total revenue, and 6% of normalised EBITDA.

(Source: Anheuser-Busch InBev SA/NV Annual Report)

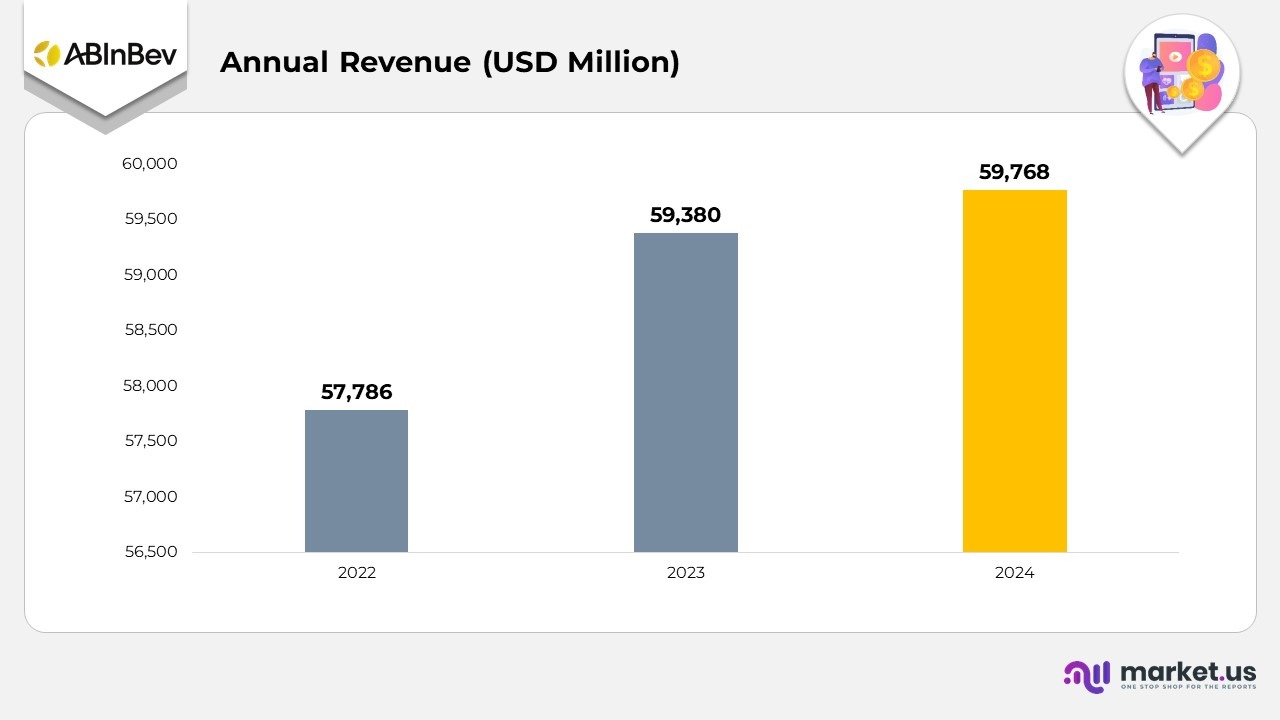

Financial Analysis Anheuser-Busch InBev SA/NV Statistics

- In 2022, Anheuser-Busch InBev generated annual revenue of USD 57,786 million, marking a strong performance year, driven by sustained global consumption and a stable presence across major markets.

- In 2023, the company’s revenue increased to USD 59,380 million, up 2.8% from the previous year. This growth was primarily driven by the robust performance of its premium portfolio and effective pricing initiatives across key regions.

- By 2024, AB InBev’s revenue climbed further to USD 59,768 million, a 7% uptick over 2023, demonstrating financial resilience amid inflationary challenges and evolving market dynamics.

- Collectively, between 2022 and 2024, the company recorded overall revenue growth of 3.4%, underscoring its steady expansion, strong brand positioning, and well-balanced global operations.

Segmental Revenue

- In North America, AB InBev’s sales volume declined from 90,140 thousand hectoliters in 2023 to 86,272 thousand hectoliters in 2024, representing an 8% organic decrease, primarily due to subdued consumer demand and category softness.

- In the Middle Americas, production increased from 148,730 thousand hectoliters in 2023 to 150,068 thousand hectoliters in 2024, marking a 9% organic growth, supported by stable market conditions and improved brand mix.

- South America saw a moderate rise from 162,460 thousand hectoliters in 2023 to 160,768 thousand hectoliters in 2024, translating to a 0% organic growth, driven by premiumization and effective distribution expansion.

- The EMEA region (Europe, Middle East & Africa) recorded a rise from 90,213 thousand hectoliters in 2023 to 93,804 thousand hectoliters in 2024, reflecting strong consumer engagement and innovation-led performance, with organic growth of 4.

- 0%.

- In the Asia Pacific, volumes dropped from 92,726 thousand hectoliters in 2023 to 84,397 thousand hectoliters in 2024, resulting in an 8.9% organic decline, driven by macroeconomic headwinds and weaker regional consumption.

- The Global Export and Holding Companies segment decreased from 459 thousand hectoliters in 2023 to 380 thousand hectoliters in 2024, posting an 8% decline, mainly due to restructuring and lower export demand.

- Overall, AB InBev Worldwide registered a total volume of 575,706 thousand hectoliters in 2024, compared to 584,728 thousand hectoliters in 2023, indicating an overall organic contraction of 1.4%, as volume softness in key regions offset moderate growth in others.

North America Anheuser-Busch InBev SA/NV Statistics

- North America reported an 8% decline in total volumes during 2024.

- In the United States, sales to wholesalers (STWs) dropped by 9%, even with two additional selling days in the year.

- Sales-to-retailers (STRs) in the U.S. declined by 0%, reflecting softer demand early in the year.

- The beer industry showed resilience in 2024, with volume and revenue trends improving steadily since the second quarter, gaining market share in total alcohol by value.

- The company’s mainstream beer portfolio regained momentum in the latter half of 2024, achieving segment share gains in both the third and fourth quarters.

- AB InBev strengthened its leadership in the no-alcohol beer category, supported by strong consumer demand following the launch of Michelob Ultra Zero in January 2025.

- Within the Beyond Beer segment, the spirits-based ready-to-drink (RTD) category accounted for 100% of the spirits industry’s value growth in 2024.

- The company’s RTD portfolio outperformed the overall category, delivering mid-teen volume growth, driven primarily by the success of the Cutwater and Nütrl brands.

- In Canada, total volumes declined slightly, recording a low single-digit decrease compared to the prior year.

Middle America’s Anheuser-Busch InBev SA/NV Statistics

- The Middle Americas region recorded a 9% increase in total volumes during 2024, reflecting steady growth across key markets.

- In Mexico, volumes rose by low single digits, surpassing overall industry growth and marking record-high production levels for the year.

- The company continued to expand its no-alcohol beer segment, with Corona Cero achieving strong double-digit volume growth, further reinforcing its leadership in the category.

- Digital transformation remained a key focus, with BEES Marketplace reporting a 24% rise in gross merchandise value (GMV) and the TaDa Delivery direct-to-consumer platform registering a 21% increase in order volume compared to 2023.

- In Colombia, volumes also grew by low single digits, supported by consistent category expansion and effective execution strategies.

- The beer category in Colombia strengthened further, gaining 85 basis points of total alcohol market share and reaching a new record in overall volume.

- Growth in Colombia was primarily driven by above-core brands, which posted high–single-digit volume growth, led by Corona and Stella Artois. At the same time, the mainstream portfolio achieved a low single-digit.

- In Peru, volumes declined by low single digits, though the company outperformed the broader industry, which remained subdued.

- In Ecuador, volumes were flat year over year, broadly in line with an industry affected by rolling blackouts and weaker consumer confidence.

South America Anheuser-Busch InBev SA/NV Statistics

- South America recorded a 1.0% decline in total volumes during 2024.

- In Brazil, overall volumes increased by 1.5%, supported by a 0.6% rise in beer volumes and a 4.1% increase in non-beer volumes. Both of which are estimated to have outperformed the industry.

- The company’s above-core beer brands drove strong results, posting low-teens volume growth led by Budweiser and Corona.

- Within the core beer segment, Brahma continued its upward trend. Achieving a mid-single-digit volume increase in 2024.

- AB InBev maintained leadership in the no-alcohol beer category. Where volumes rose by double-digits, driven by the success of Budweiser Zero and Corona Cero.

- The non-beer portfolio performed strongly, with the low- and no-sugar range growing volumes in the low-twenties during 2024.

- Digital expansion advanced significantly, as BEES Marketplace reported a 47% increase in gross merchandise value (GMV) compared to 2023.

- The Zé Delivery digital direct-to-consumer platform processed over 66 million orders in 2024, marking a 10% increase versus 2023.

- In Argentina, total volumes fell by high teens, aligning with broader industry trends amid persistent inflationary pressures that are impacting consumer demand.

EMEA Anheuser-Busch InBev SA/NV Statistics

- The EMEA region recorded a 4.0% increase in total volumes during 2024.

- In Europe, volumes grew by low single digits, outpacing the industry in 5 of 6 key markets, according to company estimates.

- The beer category remained resilient in 2024, gaining share of total alcohol in 5 of 6 major markets, with overall volumes rising compared to 2023.

- Growth in Europe was primarily driven by megabrands Stella Artois and Corona. This saw strong consumer engagement during events such as the French Open, Wimbledon, and the Olympic Games.

- In the UK, as of January 2025, the company expanded its portfolio with the San Miguel brand, becoming the country’s leading brewer.

- In the no-alcohol segment, Corona Cero was introduced in 27 markets, achieving strong double-digit volume growth.

- In South Africa, total volumes grew by mid-single digits, outperforming the industry across both beer and Beyond Beer categories.

- The beer market in South Africa returned to growth in 2024 after a decline in 2023. Supported by focused investments in megabrands that strengthened overall Brand Power.

Asia Pacific Anheuser-Busch InBev SA/NV Statistics

- The Asia Pacific region experienced an 8.9% decline in total volumes during 2024.

- In China, volumes fell by 11.8%, primarily due to a soft industrial environment that affected overall demand.

- The company remained focused on executing its strategic priorities, emphasizing premiumization, channel diversification, geographic expansion, and continued digital transformation.

- Investments in brand innovation and product variety continued. Particularly through the expansion of zero-sugar beverage options to meet evolving consumer preferences.

- With on-premise sales under pressure, AB InBev accelerated the premiumization of the in-home consumption segment. Strengthening its premium and super-premium brand portfolio.

- The BEES digital platform saw continued rollout and adoption; as of December 2024, it was active in more than 320 cities. With approximately 80% of total revenue generated through digital channels.

- In South Korea, volumes grew by mid-single digits in 2024, outperforming the broader industry across both on-premise and in-home channels.

- The country achieved its highest market share in the last 10 years. Supported by strong performance from the core portfolio and successful product innovations.

(Source: Anheuser-Busch InBev SA/NV Annual Report)

Anheuser-Busch Recent Patents

| Patent Title | Patent Number | Filing Date | Patent Date |

|---|---|---|---|

| Process for improving protein and fibre arrangements from brewers' spent grain | 12369602 | August 10, 2020 | July 29, 2025 |

| System for handling individual primary packaging containers | 12338083 | October 26, 2021 | June 24, 2025 |

| Beverage dispensing assembly with gas pressure regulation | 12338115 | September 16, 2021 | June 24, 2025 |

| Glass container with inkjet-printed imagery | 12319610 | September 30, 2022 | June 3, 2025 |

| Denesting apparatus for packaging materials | 12286318 | July 29, 2020 | April 29, 2025 |

| Packaging apparatus for secondary packages | 12269629 | July 29, 2020 | April 8, 2025 |

| Integrally blow-moulded bag-in-container | 12233589 | March 28, 2022 | February 25, 2025 |

| Method for treating wort in a boiling kettle | 12187990 | June 12, 2023 | January 7, 2025 |

| Shaping tool for forming secondary packages | 12162236 | July 30, 2020 | December 10, 2024 |

| Tear strip design for packaging | 12162655 | March 26, 2020 | December 10, 2024 |

| Modular handle for secondary packaging | 12151856 | July 5, 2019 | November 26, 2024 |

| Packaging apparatus for simultaneous product loading | 12110141 | July 30, 2020 | October 8, 2024 |

| Low-alcohol or alcohol-free malt beverage and production method | 20240150688 | November 16, 2020 | May 9, 2024 |

| Opening tool for beverage cans | 11873202 | May 16, 2022 | January 16, 2024 |

| Bag-in-container with interface vents | 11834226 | June 23, 2022 | December 5, 2023 |

| Roving beverage dispensing unit | 11753290 | February 26, 2021 | September 12, 2023 |

| Energy-absorbing bag-in-container and preform | 11752683 | May 2, 2022 | September 12, 2023 |

| Beer dispenser | D1036917 | January 28, 2022 | July 30, 2024 |

| Drink can | D1056724 | June 22, 2022 | January 7, 2025 |

| Tap for beer dispenser. | D1087692 | January 28, 2022 | August 12, 2025 |

(Source: Company Website)

Recent Developments

- In June 2019, BanQu Inc. expanded its partnership with Anheuser-Busch InBev through an investment agreement with ZX Ventures. Established in 2015, ZX Ventures focuses on developing innovative products and solutions that enhance supply chain transparency, efficiency, and traceability across emerging markets.

- In May 2019, Anheuser-Busch InBev launched its first in-house creative agency in Europe to operate more agilely and adaptively. This initiative aims to create culturally relevant products while promoting greater creativity and innovation.

- In January 2019, Anheuser-Busch InBev was recognized by the Bloomberg Gender-Equality Index as one of 230 companies globally committed to fostering inclusive and equitable workplaces.

(Source: Anheuser-Busch InBev SA/NV Press Releases)