Global Zero-emission Aircraft Market Size, Share, Industry Analysis Report By Application (Commercial Aviation, General Aviation, Military Aviation), By Propulsion Technology (Hydrogen, Hybrid Electric, Fully Electric), By Range (Short-Range, Medium-Range, Long-Range), By Aircraft Type (Fixed-Wing, Rotorcraft, Unmanned Aerial Systems, Regional Turboprop/Turbofan), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 162365

- Number of Pages: 379

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

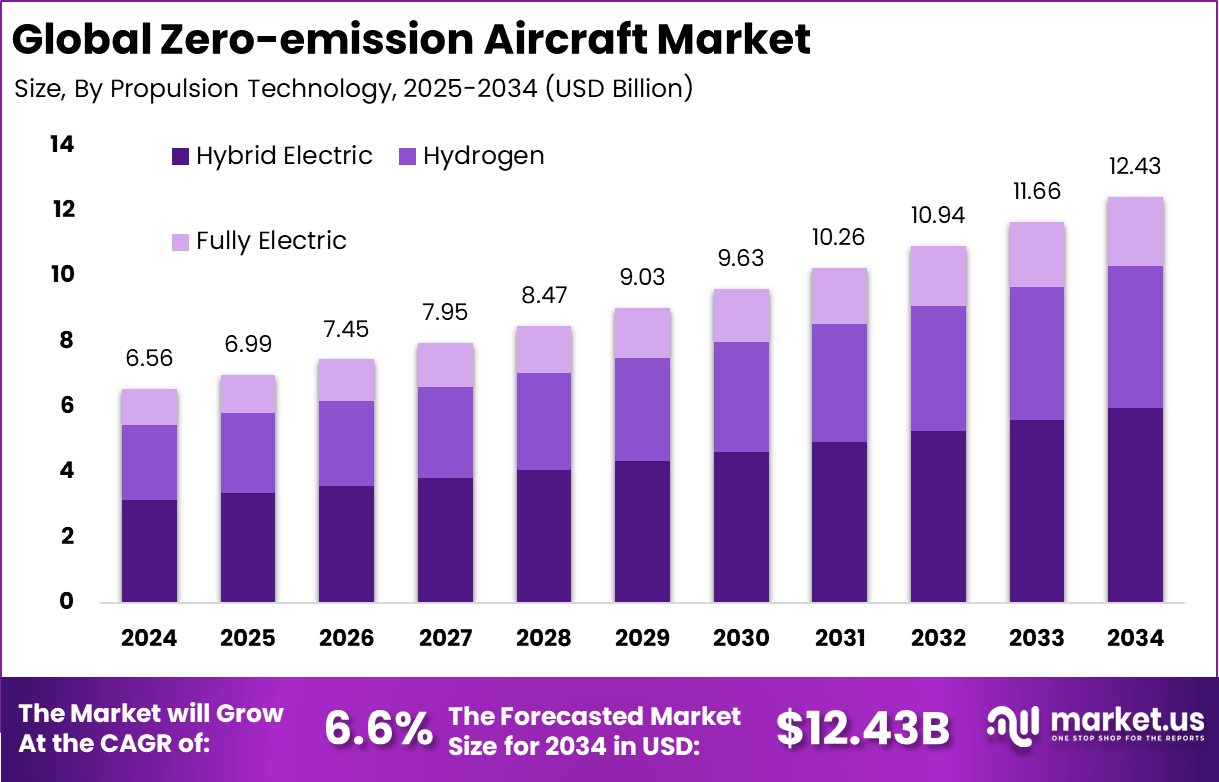

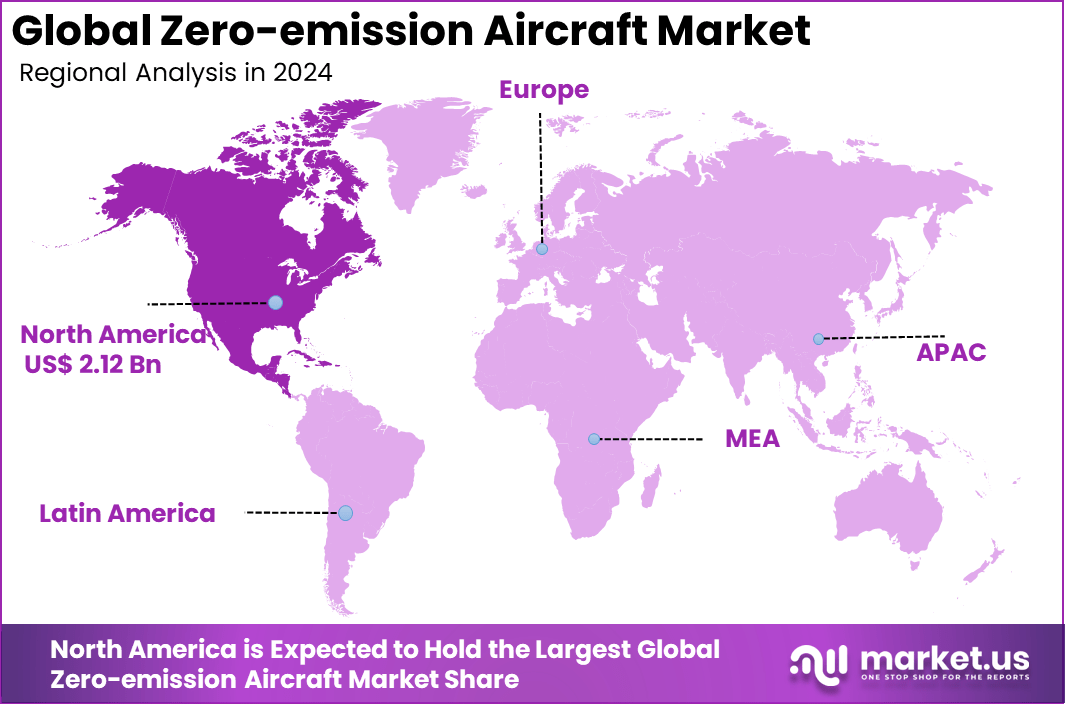

The Global Zero-emission Aircraft Market size is expected to be worth around USD 12.43 billion by 2034, from USD 6.56 billion in 2024, growing at a CAGR of 6.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 32.4% share, holding USD 2.12 billion in revenue.

The zero-emission aircraft market refers to the development and deployment of aircraft that generate no carbon dioxide emissions during operation, typically through electric, hydrogen fuel-cell, or hybrid propulsion systems. These aircraft span a range of types including small commuter planes, regional aircraft, unmanned aerial systems, and urban air mobility vehicles. The market is gaining attention as the aviation sector seeks to reduce its environmental impact and meet decarbonisation targets

Environmental concerns and stricter government policies are among the strongest forces propelling the zero-emission aircraft market. Rising global awareness about climate change has led to tighter emission reduction commitments, making zero-emission aircraft highly attractive. Advances in electric propulsion and hydrogen fuel cell technologies have also played a vital role, offering more efficient, lightweight, and cost-effective solutions for future aircraft.

For instance, in June 2025, ZeroAvia Inc. signed a partnership deal with UK regional airline Loganair to develop hydrogen-electric powertrains for aircraft, including the De Havilland Twin Otter. The UK government awarded ZeroAvia a grant for a £10.8 million project to develop liquid hydrogen management systems integrated into flight testbeds.

According to Market.us, The Aircraft Aftermarket was valued at USD 41.1 bn in 2024 and is anticipated to reach USD 86.3 bn by 2034, registering a CAGR of 7.7% from 2025 to 2034. Growth in this market is supported by continuous aircraft fleet modernization, increasing passenger air travel, and expanding MRO capacities worldwide. In 2024, North America held a dominant position with USD 18.1 bn in revenue, backed by a well-established ecosystem of OEMs, airlines, and service providers.

In parallel, Connected Aircraft Market is projected to grow from USD 8.2 billion in 2023 to approximately USD 31.3 billion by 2033, exhibiting a CAGR of 14.3% during 2024-2033. This growth is attributed to increasing demand for in-flight connectivity, rising adoption of IoT-enabled aviation systems, and the growing emphasis on real-time data exchange for operational efficiency and enhanced passenger experience.

The market is witnessing increased demand for smaller and short-range aircraft capable of zero emissions. Urban mobility solutions, such as electric vertical takeoff and landing (eVTOL) aircraft, are expected to see rapid adoption as cities aim to decrease traffic congestion and pollution. Additionally, there is growing interest in hydrogen-powered commercial aircraft for longer routes, with many stakeholders exploring cost-effective ways to operate environmentally friendly flights.

Key Takeaway

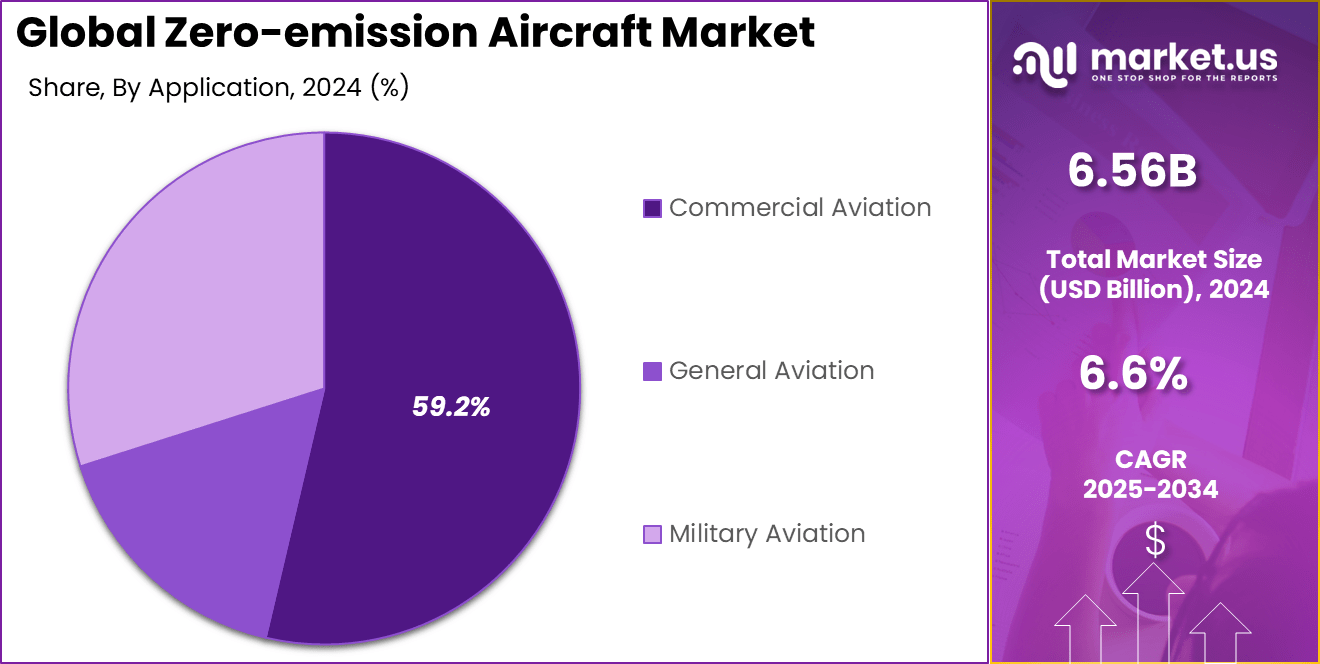

- The Commercial Aviation segment led with 59.2%, driven by airlines’ transition toward sustainable operations and low-carbon technologies.

- Hybrid Electric aircraft accounted for 48.1%, reflecting growing adoption of fuel-efficient hybrid propulsion systems.

- Short-Range aircraft held 62.7%, as regional travel and commuter routes emerge as early adopters of zero-emission flight solutions.

- Fixed-Wing designs captured 44.6%, supported by their suitability for passenger and cargo transport applications.

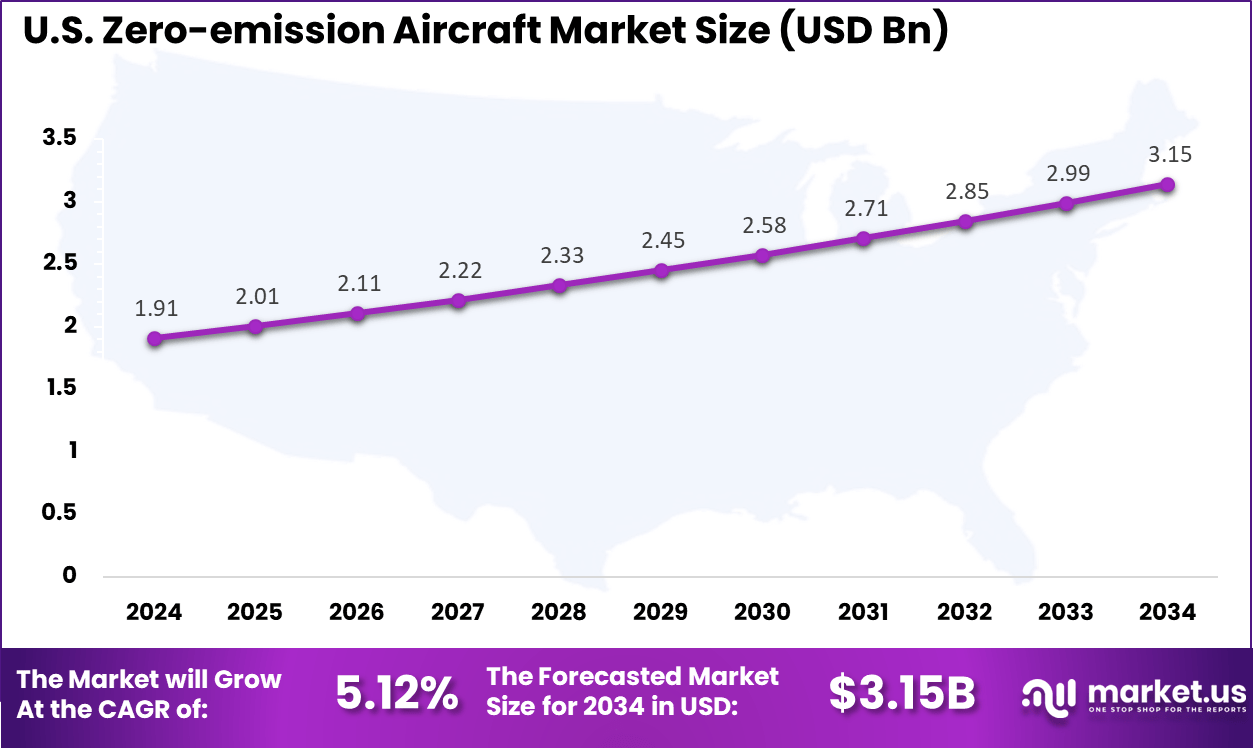

- The US market reached USD 1.91 Billion in 2024, registering a strong 5.12% CAGR, underpinned by federal sustainability programs and clean-aviation investments.

- North America dominated with 32.4% of global share, supported by advanced aerospace infrastructure and ongoing development of electric and hydrogen-powered aircraft.

Investment and Business Benefits

Investment in zero-emission aircraft is expanding through public grants and private capital, particularly in R&D and infrastructure like hydrogen supply chains at airports. The US may see a hydrogen fuel premium decrease from 29-40% in 2030 to being cheaper than fossil jet fuel by 2050. Early movers benefit from subsidies and can target regional routes where smaller electric planes operate well.

Manufacturers developing scalable platforms for retrofitting or new builds attract interest due to the growing market need for sustainable aviation. Businesses adopting these technologies gain from lower operating and maintenance costs since electric motors have fewer parts. Noise reduction can enable more flexible airport operations, while sustainable practices improve brands’ public perception and help comply with tightening carbon regulations.

The European Commission forecasts that sustainable aviation fuels and new aircraft technologies will account for 83% of emission cuts by 2050. However, limitations in battery energy density and infrastructure cost remain notable barriers. Government policies, technological innovation, and collaboration will drive further progress toward net-zero aviation.

U.S. Market Size

The market for Zero-emission Aircraft within the U.S. is growing tremendously and is currently valued at USD 1.91 billion, the market has a projected CAGR of 5.12%. This dominance is due to government incentives promoting clean aviation technology, stringent emission regulations, and rising fuel costs that make electric and hybrid aircraft economically attractive.

Federal and state support programs enhance R&D for propulsion technologies and battery advancements, accelerating commercialization. Besides regulatory and economic factors, heightened environmental awareness among consumers and corporate sustainability commitments are prompting airlines to pursue greener fleets.

For instance, in September 2024, Bye Aerospace, a Colorado-based U.S. company, commenced the construction of its first all-electric aircraft, the eFlyer 2. This milestone marks a significant advance in the zero-emission aircraft sector, with the eFlyer 2 designed as a fully electric, FAA Part 23 certified training aircraft that can reduce operating costs by up to 80% compared to traditional powerplants.

In 2024, North America held a dominant market position in the Global Zero-emission Aircraft Market, capturing more than a 32.4% share, holding USD 2.12 billion in revenue. The market is growing due to strong government backing, extensive R&D investments, and active development of electric and hydrogen-powered aircraft.

Many key manufacturers and startups specializing in electric propulsion are based in the region, particularly the U.S. and Canada. State policies targeting emission reductions and ambitious sustainable aviation goals, especially in places like California, have accelerated innovation and deployment of zero-emission aircraft technologies. This supportive ecosystem positions North America as a critical hub for the future of clean aviation globally.

For instance, in October 2025, BETA Technologies announced plans to certify its CX300 eCTOL (all-electric conventional takeoff and landing) aircraft and is developing the Alia-250 eVTOL model. The CX300 has received significant orders from notable organizations and targets certification and delivery in 2025, spotlighting their dual approach to electric aviation solutions.

Propulsion Technology Analysis

In 2024, the Hybrid Electric segment held a dominant market position, capturing a 48.1% share of the Global Zero-emission Aircraft Market. This technology blends conventional power with electric propulsion, offering improved efficiency and reduced emissions. Hybrid electric aircraft are favored for their ability to extend range and reduce fuel consumption compared to purely electric options, making them suitable for various flight operations.

Advancements in hybrid powertrains and energy management systems continue to boost this segment’s appeal. Increasing investments in hybrid propulsion systems support greener aviation solutions while keeping costs and performance optimized, especially for short to medium-haul flights.

For instance, in July 2025, Airbus SE announced progress in hybrid electric propulsion systems for their upcoming zero-emission aircraft models, aiming to capture a significant share within the 48.1% propulsion technology segment. Their developments focus on combining electric and traditional engines to extend flight range, aligning with current market demands for sustainability and efficiency.

Range Analysis

In 2024, The Short-Range segment held a dominant market position, capturing a 62.7% share of the Global Zero-emission Aircraft Market. These aircraft are primarily used for regional flights, urban air mobility, and commuter routes where distances are typically under 500 miles. Short-range flights benefit more immediately from electric and hybrid technologies due to current battery limitations that restrict long-haul capabilities.

Short-range aircraft adoption is spurred by rising demand for sustainable, cost-effective air travel in dense urban and regional corridors. Additionally, regulatory pressure to cut emissions, particularly in short-haul aviation, further propels this segment’s growth as airlines look for cleaner alternatives in busy domestic markets.

For Instance, in September 2024, Heart Aerospace unveiled the ES-30, a hybrid-electric short-range regional aircraft designed to carry 30 passengers with an electric zero-emission range of up to 125 miles, extendable further using hybrid power. Backed by FAA grants, this aircraft targets the short-range segment with a focus on electric and hybrid-electric propulsion, supporting sustainable regional air travel.

Aircraft Type Analysis

In 2024, The Fixed-Wing segment held a dominant market position, capturing a 44.6% share of the Global Zero-emission Aircraft Market. These aircraft provide the ideal platform for integrating electric and hybrid propulsion owing to their design efficiencies and payload capacities. Fixed-wing zero-emission models are being developed to replace smaller regional jets and commuter planes, allowing cleaner, quieter flights while meeting industry performance standards.

Constant technological enhancements, such as lightweight materials and electric system integrations, are making fixed-wing aircraft more energy-efficient. This segment sees robust interest for retrofits and new builds alike, as airlines seek to align with sustainability goals while preserving operational reliability and passenger capacity.

For Instance, in February 2025, Embraer S.A. and GKN plc announced a collaboration to explore hydrogen-powered flight demonstrators focusing on hybrid-electric and hydrogen combustion propulsion technology for fixed-wing aircraft. This partnership aims to accelerate the adoption of hydrogen in aviation, particularly targeting sub-regional fixed-wing planes, reinforcing the commitment to clean propulsion innovations.

Application Analysis

In 2024, the Commercial Aviation segment held a dominant market position, capturing a 59.2% share of the Global Zero-emission Aircraft Market. This dominance is due to the push to decarbonize passenger air travel. These are increasingly used for regional and short-haul flights, where electric and hybrid models can replace conventional jets effectively. The commercial sector views these technologies as essential to meeting stricter emissions regulations and improving corporate sustainability profiles.

Passenger demand for environmentally responsible travel options is also shaping commercial aviation’s role in adopting zero-emission aircraft. Moreover, growing pressure from global agreements and national policies encourages airlines to invest in cleaner fleets, positioning commercial aviation as a key market for zero-emission aircraft advancements.

For Instance, in October 2025, BETA Technologies, Inc. teamed up with Air New Zealand to operate the ALIA CX300, an electric, zero-emission commercial aircraft designed for regional aviation. The ALIA CX300 leverages battery-electric propulsion, embodying the commercial aviation segment’s drive toward emission-free operations. This collaboration advances practical deployment of zero-emission aircraft in real-world commercial contexts.

Key Market Segments

By Propulsion Technology

- Hydrogen

- Hybrid Electric

- Fully Electric

By Application

- Commercial Aviation

- General Aviation

- Military Aviation

By Range

- Short-Range

- Medium-Range

- Long-Range

By Aircraft Type

- Fixed-Wing

- Rotorcraft

- Unmanned Aerial Systems

- Regional Turboprop/Turbofan

By Application

- Commercial Aviation

- General Aviation

- Military Aviation

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Growing Environmental Concerns and Regulations

The push for reducing carbon emissions from air travel and mitigating climate change has become a powerful driver for zero-emission aircraft adoption. Governments worldwide are enacting tougher environmental regulations that require cleaner technologies in aviation.

Airlines and manufacturers face pressure to meet aggressive carbon targets, making electric and hydrogen-powered aircraft attractive solutions. This regulatory environment encourages industry stakeholders to invest heavily in zero-emission propulsion systems, helping to accelerate market growth.

In addition to regulations, consumer preferences are shifting in favor of greener travel options. Passengers increasingly prefer airlines that prioritize sustainability, further motivating carriers to shift toward zero-emission fleets. This alignment of policy and consumer demand creates a market landscape conducive to rapid innovation and adoption of zero-emission aircraft.

For instance, in August 2025, Airbus SE advanced its zero-emission aircraft efforts by unveiling a hydrogen-powered prototype designed to reduce carbon emissions, aligning with the growing environmental concerns and regulatory push driving the market. This initiative reflects Airbus’s commitment to meeting future environmental regulations and consumer demand for sustainable aviation.

Restraint

High Development and Technology Costs

One of the main obstacles holding back the widespread acceptance of zero-emission aircraft is the significant cost associated with developing and deploying these technologies. Building electric propulsion systems or hydrogen fuel cells requires massive investment in research, manufacturing, and certification processes.

Compared to traditional fossil-fueled airplanes, zero-emission aircraft have higher production and maintenance costs, limiting their immediate appeal to budget-conscious airlines. Moreover, the infrastructure for supporting zero-emission aviation, such as hydrogen refueling stations or high-capacity electric charging points at airports, is still in early stages and expensive to establish. This additional capital requirement makes implementation more challenging and slows broader market growth.

For instance, in April 2025, The Boeing Company collaborated with Norsk e-Fuel to develop one of Europe’s first large-scale Power-to-Liquids facilities. This initiative focuses on producing sustainable aviation fuel (SAF) using green hydrogen and recycled CO₂ to help reduce aviation emissions by over 90%. Boeing’s ongoing investments in SAF production highlight their strategy to decarbonize aviation while balancing current technology challenges with cleaner fuel solutions.

Opportunities

Government Funding and Industry Collaboration

Government grants, subsidies, and strategic support programs present a significant opportunity for expanding the zero-emission aircraft market. Many nations are actively funding clean aviation projects to meet climate goals, reducing financial risks for developers and accelerating innovation cycles. This dedicated funding encourages collaboration between aircraft producers, technology suppliers, and research institutions, facilitating faster development of viable zero-emission aircraft models.

Collaborations foster the pooling of expertise and resources, enabling advances in key technologies like battery efficiency, fuel cells, and lightweight materials. These public-private partnerships also help drive certification pathways and standardization efforts critical for commercial introduction. Consequently, government funding coupled with collaborative ecosystems is catalyzing breakthroughs and paving the way for larger market adoption.

For instance, in September 2025, Rolls-Royce Holdings plc leveraged government funding opportunities by partnering with ZeroAvia, Inc. to co-develop hydrogen-electric propulsion systems. This collaboration exemplifies how government-backed programs and industry partnerships accelerate technological breakthroughs critical for market expansion in zero-emission aviation.

Challenges

Technological and Infrastructure Limitations

Despite advances, zero-emission aircraft face considerable technological and infrastructure challenges. Current battery technology limits flight range and payload capacity for many electric aircraft types, making long-haul zero-emission flights largely unfeasible today. Hydrogen propulsion systems require complex storage and refueling infrastructure that is costly and not widely available, restricting deployment mainly to well-equipped hubs initially.

Certification and safety regulations for these novel technologies are still evolving, introducing delays and uncertainties in commercial rollout schedules. Airports and air traffic management systems must also adapt to integrate zero-emission aircraft operations, necessitating significant planning and investment. Overcoming these technological and logistical barriers is essential to achieving large-scale adoption and realizing the environmental goals of the zero-emission aircraft sector.

For instance, in July 2025, Heart Aerospace AB faced a challenge as its hydrogen-powered aircraft faced certification delays due to emerging regulatory frameworks. This instance illustrates the technological and infrastructure limitations currently obstructing the commercial rollout of zero-emission aircraft despite promising developments.

Key Players Analysis

The Zero-Emission Aircraft Market is led by major aerospace manufacturers such as Airbus SE, The Boeing Company, and Rolls-Royce Holdings plc. These industry leaders are heavily investing in hydrogen propulsion systems, electric powertrains, and hybrid-electric configurations to reduce aviation’s carbon footprint. Their research collaborations with governments and energy providers are accelerating the transition toward sustainable aviation technologies suitable for both regional and long-haul applications.

Innovative startups and emerging players including ZeroAvia, Inc., Heart Aerospace AB, Bye Aerospace, Inc., and Wright Electric Inc. are pioneering battery-electric and hydrogen-electric propulsion systems for short- to medium-range aircraft. Their focus on lightweight design, high-efficiency energy storage, and modular propulsion architectures positions them as key contributors to the early adoption of zero-emission flight.

Additional players such as Ampaire Inc., Pipistrel d.o.o. (Textron Inc.), BETA Technologies, Inc., Embraer S.A., and GKN plc (Melrose Industries PLC), along with other key participants, are advancing hybrid-electric prototypes, distributed propulsion, and renewable fuel integration. Their engineering expertise and partnerships with aerospace suppliers and clean energy firms are driving commercialization, making zero-emission aviation increasingly viable in the coming decade.

Top Key Players in the Market

- Airbus SE

- The Boeing Company

- Rolls-Royce Holdings plc

- ZeroAvia, Inc.

- Heart Aerospace AB

- Bye Aerospace, Inc.

- Ampaire Inc.

- Pipistrel d.o.o. (Textron Inc.)

- Wright Electric Inc.

- BETA Technologies, Inc.

- Embraer S.A.

- GKN plc (Melrose Industries PLC)

- Others

Recent Developments

- In April 2025, Heart Aerospace prepared for the first fully electric experimental flight in the US of its Heart X1 demonstrator, precursor to the hybrid-electric 30-seater ES-30. The ES-30 promises up to 200km all-electric range with jet fuel backup extending range further. Heart Aerospace highlighted the importance of hybrid systems to combine sustainability and operational flexibility on regional routes.

- In May 2025, Boeing continued development of the X-66A Sustainable Flight Demonstrator with NASA, testing the Transonic Truss-Braced Wing to achieve up to 30% fuel reduction over current aircraft. Flight tests are set to start in 2028, aiming for more sustainable single-aisle aircraft. Boeing emphasized gradual technology maturation while pushing for net-zero emissions by 2050.

Report Scope

Report Features Description Market Value (2024) USD 6.5 Bn Forecast Revenue (2034) USD 12.4 Bn CAGR(2025-2034) 6.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Application (Commercial Aviation, General Aviation, Military Aviation), By Propulsion Technology (Hydrogen, Hybrid Electric, Fully Electric), By Range (Short-Range, Medium-Range, Long-Range), By Aircraft Type (Fixed-Wing, Rotorcraft, Unmanned Aerial Systems, Regional Turboprop/Turbofan Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Airbus SE, The Boeing Company, Rolls-Royce Holdings plc, ZeroAvia, Inc., Heart Aerospace AB, Bye Aerospace, Inc., Ampaire Inc., Pipistrel d.o.o. (Textron Inc.), Wright Electric Inc., BETA Technologies, Inc., Embraer S.A., GKN plc (Melrose Industries PLC), Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Zero-emission Aircraft MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Zero-emission Aircraft MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-