Global Yogurt Powder Market Size, Share, Growth Analysis By Product (Whole Yogurt Powder, Skimmed Yogurt Powder, Semi-Skimmed Yogurt Powder), By Type (Regular, Low-Fat, Non-Fat), By Flavor (Plain, Flavored), By Application (Food and Beverage Industry, Nutraceuticals, Dietary Supplements, Cosmetics And Personal Care Products, Others), By Distribution Channel (Supermarkets And Hypermarkets, Convenience Stores, Online Retailing, Specialty Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158264

- Number of Pages: 347

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

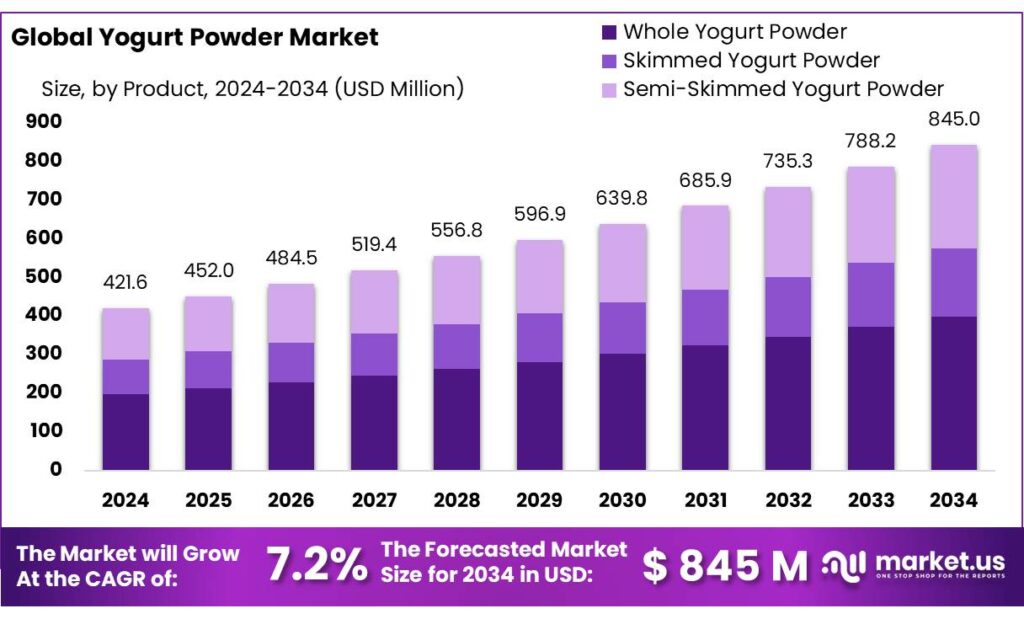

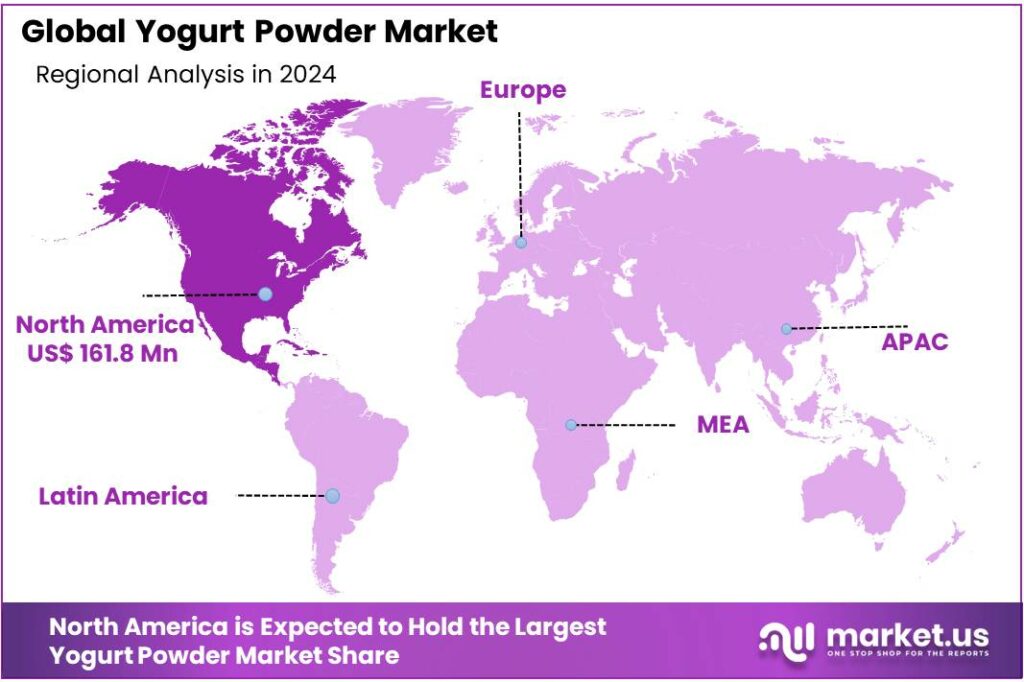

The Global Yogurt Powder Market size is expected to be worth around USD 845.0 Million by 2034, from USD 421.6 Million in 2024, growing at a CAGR of 7.2% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 38.4% share, holding USD 161.8 Million in revenue.

The yogurt powder industry in India is experiencing significant growth, driven by increasing consumer demand for convenient, shelf-stable, and functional dairy products. Yogurt powder, produced through spray drying of yogurt, offers extended shelf life and retains the nutritional benefits of fresh yogurt, making it ideal for use in smoothies, bakery items, and as a probiotic supplement.

- For instance, Banas Dairy, one of India’s largest dairy cooperatives, announced a payment of ₹2,909.8 crore to its stakeholders and plans to set up a milk powder plant with a capacity of 150 metric tonnes. Similarly, Milky Mist Dairy operates a fully automated mozzarella plant and has plans to expand its product range, including yogurt-based products.

Yogurt powder, derived from skimmed milk powder (SMP), plays a crucial role in the dairy industry. India’s SMP production is forecasted at 740,000 metric tons (MT) in the 2023 market year, marking a nearly 6% increase from the previous year. This rise in SMP production supports the growing demand for yogurt powder, which is utilized in various applications such as functional foods, nutritional supplements, and cosmetic formulations.

Government initiatives have further bolstered the dairy sector. For instance, the Odisha state government, under the Mukhyamantri Kamadhenu Yojana, plans to distribute 10,000 high-yielding cows to farmers to boost milk production. Additionally, the government has launched several new dairy plants and animal fodder plants, with investments totaling ₹221.73 crore, to enhance dairy infrastructure and support value-added dairy products.

India’s dairy industry is a cornerstone of its agricultural economy, contributing approximately 4% to the national GDP and providing livelihoods to over 80 million rural households. The country is the world’s largest producer of milk, accounting for about 23% of global production. This robust dairy sector forms a solid foundation for the growth of yogurt powder production.

Key Takeaways

- Yogurt Powder Market size is expected to be worth around USD 845.0 Million by 2034, from USD 421.6 Million in 2024, growing at a CAGR of 7.2%.

- Whole Yogurt Powder held a dominant market position, capturing more than a 47.2% share.

- Regular Yogurt Powder held a dominant market position, capturing more than a 44.5% share.

- Plain Yogurt Powder held a dominant market position, capturing more than a 58.3% share.

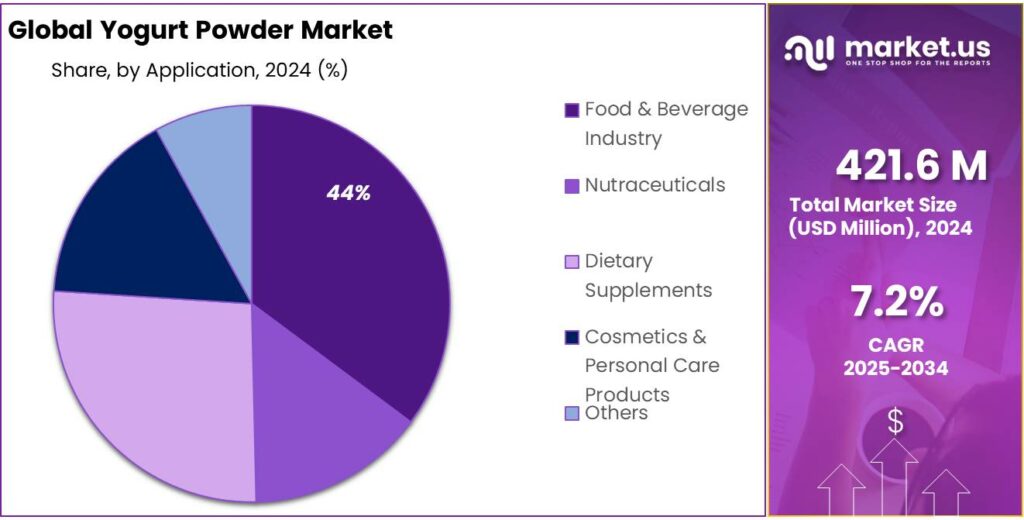

- Food & Beverage Industry held a dominant market position in the yogurt powder sector, capturing more than a 44.8% share.

- North America held a dominant position in the global yogurt powder market, capturing more than 38.4% of the market share, translating to an estimated revenue of approximately USD 161.8 million.

By Product Analysis

Whole Yogurt Powder Leads Market with 47.2% Share in 2024

In 2024, Whole Yogurt Powder held a dominant market position, capturing more than a 47.2% share. This significant market presence is attributed to its rich, creamy texture and nutritional profile, making it a preferred choice among consumers seeking full-fat dairy products. The versatility of whole yogurt powder in various applications, including bakery products, smoothies, and nutritional supplements, further bolsters its demand.

The growing consumer preference for natural and minimally processed foods has also contributed to the rise in whole yogurt powder consumption. As awareness about the benefits of probiotics and the importance of gut health increases, whole yogurt powder, with its intact fat content and live cultures, aligns well with these health-conscious trends.

By Type Analysis

Regular Yogurt Powder Holds 44.5% Market Share in 2024

In 2024, Regular Yogurt Powder held a dominant market position, capturing more than a 44.5% share. This segment’s popularity is driven by its versatility and wide range of applications across various industries. Regular yogurt powder serves as a key ingredient in the food and beverage sector, particularly in products like smoothies, baked goods, and dairy-based snacks. Its neutral flavor profile and ease of incorporation make it a preferred choice among manufacturers seeking to enhance the nutritional content of their products without altering taste.

The demand for Regular Yogurt Powder is further bolstered by increasing consumer awareness of health and wellness. As more individuals seek convenient and nutritious food options, the inclusion of yogurt powder in everyday products aligns with these health-conscious trends. Additionally, the extended shelf life and stability of yogurt powder compared to fresh yogurt contribute to its growing adoption in both domestic and industrial applications.

By Flavor Analysis

Plain Yogurt Powder Maintains Market Leadership with 58.3% Share in 2024

In 2024, Plain Yogurt Powder held a dominant market position, capturing more than a 58.3% share. This substantial share is attributed to its versatility and widespread adoption across various applications. Plain yogurt powder serves as a neutral base in numerous food products, including smoothies, baked goods, salad dressings, and nutritional supplements. Its ability to blend seamlessly with other ingredients without overpowering flavors makes it a preferred choice among manufacturers.

The clean-label trend, where consumers favor products with minimal additives and preservatives, has further bolstered the demand for plain yogurt powder. Its natural composition aligns with the growing consumer preference for transparency and simplicity in food ingredients. Additionally, plain yogurt powder retains the probiotic benefits of traditional yogurt, appealing to health-conscious individuals seeking functional food options.

By Application Analysis

Food & Beverage Industry Leads Yogurt Powder Market with 44.8% Share in 2024

In 2024, the Food & Beverage Industry held a dominant market position in the yogurt powder sector, capturing more than a 44.8% share. This substantial share underscores the sector’s pivotal role in driving the demand for yogurt powder across various applications. The versatility of yogurt powder makes it an essential ingredient in numerous food and beverage products, including smoothies, baked goods, salad dressings, and nutritional supplements. Its ability to enhance the nutritional profile of these products while offering a longer shelf life compared to fresh yogurt further contributes to its widespread adoption.

The growing consumer preference for convenient, health-conscious food options has significantly bolstered the demand for yogurt powder. As consumers become more health-aware, they seek products that offer nutritional benefits without compromising on convenience. Yogurt powder, rich in probiotics, proteins, and essential vitamins, aligns well with these consumer preferences. Additionally, its stability and extended shelf life make it an attractive option for manufacturers aiming to meet the increasing demand for functional foods.

By Distribution Channel Analysis

Supermarkets & Hypermarkets Dominate Yogurt Powder Distribution with 37.7% Share in 2024

In 2024, Supermarkets & Hypermarkets held a dominant market position, capturing more than a 37.7% share of the yogurt powder distribution channel. This significant share is attributed to the extensive reach and accessibility these retail formats offer to consumers. Supermarkets and hypermarkets provide a wide array of products under one roof, allowing consumers to compare different brands and products conveniently. The strategic placement of yogurt powder products in prominent shelf locations and the use of attractive packaging are key strategies employed by manufacturers to boost sales in this segment.

The dominance of supermarkets and hypermarkets is further reinforced by their ability to offer competitive pricing and promotional deals, which attract a large customer base. Additionally, these retail outlets often have established supply chains and logistics, ensuring consistent product availability and timely restocking. The physical presence of these stores in both urban and suburban areas enhances consumer trust and loyalty, contributing to sustained demand for yogurt powder products.

Key Market Segments

By Product

- Whole Yogurt Powder

- Skimmed Yogurt Powder

- Semi-Skimmed Yogurt Powder

By Type

- Regular

- Low-Fat

- Non-Fat

By Flavor

- Plain

- Flavored

By Application

- Food & Beverage Industry

- Nutraceuticals

- Dietary Supplements

- Cosmetics & Personal Care Products

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Retailing

- Specialty Stores

- Others

Emerging Trends

Surge in Demand for Functional Dairy Products, Including Yogurt Powder

The yogurt powder market is experiencing significant growth, driven by increasing consumer demand for functional dairy products that offer convenience and health benefits. This trend is particularly evident in India, where the dairy sector is undergoing a transformation supported by robust government initiatives and evolving market dynamics.

India has emerged as the world’s largest milk producer, with an estimated production of 207 million metric tons in 2023, marking a 2% increase from the previous year. This abundant milk supply forms the foundation for the burgeoning yogurt powder market. The government’s support through schemes like the Production Linked Incentive Scheme for Food Processing Industry (PLISFPI) aims to bolster the food processing sector, enhancing infrastructure and technology adoption.

The yogurt powder market’s growth is also fueled by shifting consumer preferences towards health-conscious and on-the-go food options. Functional yogurt products, including yogurt powder, are gaining popularity due to their probiotic benefits and versatility in various applications, from beverages to snacks. The expansion of e-commerce platforms has further facilitated the accessibility of these products, catering to urban consumers’ fast-paced lifestyles.

- For instance, Amul, India’s largest dairy cooperative, has achieved a dominant 75% share of the national milk market by successfully combining cultural reverence for cows with Gandhian principles of economic cooperation. Established in 1946 to counter British-era monopoly exploitation, it now encompasses over 18,000 village-level co-ops and involves 3.6 million farmers. Amul collects 35 million liters of milk daily and pays promptly, ensuring small producers’ stability.

Drivers

Government Support and Infrastructure Development

A significant driving factor for the yogurt powder industry is the robust support from the Indian government, particularly through initiatives aimed at enhancing dairy production and infrastructure. The dairy sector is a cornerstone of India’s rural economy, employing over 80 million people and contributing approximately 40% to the agricultural GDP. Recognizing its importance, the government has launched several programs to bolster the sector.

One such initiative is the White Revolution 2.0, which focuses on modernizing dairy farming practices, improving milk yield, and promoting value-added dairy products like yogurt powder. This program aims to address regional disparities and enhance the overall efficiency of dairy operations.

- Additionally, the government’s emphasis on infrastructure development, including cold chain logistics and processing facilities, has facilitated the growth of the yogurt powder market. For instance, Amul Dairy’s plans to set up a ₹100 crore processing plant in Assam are a testament to the expanding infrastructure supporting dairy product manufacturing.

These government-backed initiatives not only boost production capacities but also ensure a steady supply of quality milk, which is essential for yogurt powder production. The combination of increased milk production, improved infrastructure, and supportive policies creates a conducive environment for the yogurt powder industry to thrive.

Restraints

Challenges in Dairy Processing Infrastructure

One of the primary challenges hindering the growth of the yogurt powder industry in India is the inadequate dairy processing infrastructure. Despite being the world’s largest milk producer, India faces significant gaps in its dairy supply chain, particularly in areas like cold storage, transportation, and processing facilities. These infrastructural deficiencies result in high levels of milk wastage, estimated at approximately 30% annually, due to spoilage and inadequate storage facilities.

The lack of advanced processing plants further exacerbates the situation. While some regions have made strides, many areas still rely on outdated equipment and methods, leading to inefficiencies and inconsistent product quality. For instance, the absence of modern spray drying facilities, essential for producing high-quality yogurt powder, limits the industry’s ability to meet both domestic and international standards.

Recognizing these challenges, the Indian government has initiated several programs to bolster the dairy infrastructure. The Mega Food Parks Scheme, for example, aims to establish state-of-the-art processing units and cold chain facilities across the country. Under this scheme, the government provides grants of up to ₹50 crore to each food park, with the expectation of creating significant employment opportunities and enhancing the processing capacity of dairy products.

Despite these efforts, the pace of infrastructure development remains slow. Delays in land acquisition, regulatory approvals, and the high costs associated with setting up modern facilities continue to impede progress. As a result, many dairy producers struggle to scale up operations and meet the growing demand for value-added products like yogurt powder.

Opportunity

Expansion of Dairy Processing Infrastructure

A significant growth opportunity for the yogurt powder industry in India lies in the expansion and modernization of dairy processing infrastructure. Despite being the world’s largest milk producer, India faces challenges in processing capacity and technology, which hinders the production of value-added dairy products like yogurt powder. Addressing these infrastructural gaps can unlock substantial growth potential for the sector.

The Indian government has recognized the importance of enhancing dairy processing capabilities and has introduced several initiatives to address these challenges. One such initiative is the Dairy Processing and Infrastructure Development Fund (DIDF), launched with an outlay of ₹11,184 crore. The scheme aims to modernize milk processing plants, establish new chilling and value-added product plants, and improve infrastructure for milk procurement and testing.

Furthermore, the National Programme for Dairy Development (NPDD) has been restructured for the period 2021–2026 with an enhanced budget of ₹2,790 crore. The program focuses on improving milk procurement, processing capacity, and quality control, aiming to establish 10,000 new Dairy Cooperative Societies and generate approximately 3.2 lakh employment opportunities, with 70% benefiting women.

These government-led initiatives not only aim to increase processing capacity but also emphasize the importance of quality control and value addition in dairy products. By investing in modern processing technologies and infrastructure, the yogurt powder industry can enhance product quality, reduce wastage, and meet the growing domestic and international demand for dairy-based products.

Regional Insights

North America Leads Yogurt Powder Market with 38.4% Share in 2024

In 2024, North America held a dominant position in the global yogurt powder market, capturing more than 38.4% of the market share, translating to an estimated revenue of approximately USD 161.8 million. This robust market presence is primarily driven by the United States, which remains the largest consumer of yogurt products in the region. The growing consumer preference for convenient, shelf-stable dairy products, coupled with increasing health consciousness, has significantly contributed to the demand for yogurt powder.

The market’s expansion is also supported by strategic investments from key industry players. For instance, Chobani, a leading Greek yogurt producer, announced a $1.2 billion investment to establish its third U.S. dairy processing plant in upstate New York, aiming to meet the rising demand for its products and support innovation in their offerings. Such investments are anticipated to enhance production capabilities and distribution networks, thereby facilitating the growth of the yogurt powder market in North America.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Glanbia plc is a global nutrition company renowned for its dairy and nutritional ingredients. They offer a diverse range of yogurt powder products, including OptiSol 1061, which provides minimal viscosity impact in drinkable yogurts, enhancing the organoleptic experience. Their yogurt powders are utilized in various applications such as fresh dairy products, beverages, bars, cereals, desserts, sauces, and dressings, catering to the growing demand for convenient and nutritious food options.

Kerry Group plc is a global leader in taste and nutrition innovation, providing a wide array of ingredients for the food and beverage industry. They offer yogurt powder solutions that deliver authentic tart cultured yogurt flavor, suitable for various applications without affecting functionality. Kerry’s yogurt powders are free from flavors, colors, and gums, aligning with the clean label trend and catering to the growing consumer preference for natural ingredients.

Batory Foods is a trusted food ingredient supplier in the U.S., offering a comprehensive portfolio of high-quality ingredients for food and beverage manufacturers. Their yogurt powder offerings include various flavors and formulations, such as cultured nonfat milk powder and whey protein-based powders. Batory Foods emphasizes quality and expert support, serving as a reliable partner for manufacturers seeking to incorporate yogurt powder into their products.

Top Key Players Outlook

- Glanbia plc

- Epi Ingrédients

- Kerry Group plc.

- Batory Foods

- Bluegrass Ingredients, Inc.

- Prolactal

- CP Ingredients

- Ace International LLP

- EasiYo Products Limited

- ENKA SÜT A.S.

Recent Industry Developments

In 2024, Glanbia plc, a leading global nutrition company, continued to strengthen its position in the yogurt powder sector through its subsidiary, Glanbia Nutritionals. The company reported a 14.0% revenue growth in its Nutritional Solutions division, driven by a 3.6% increase in volume and a 0.4% rise in pricing.

In 2024 Batory Foods, expanded its capabilities by opening a 16,000-square-foot Innovation Center in Wilmington, Illinois. This facility includes a dedicated lab and blending area, enhancing Batory Foods’ ability to provide customized solutions and technical support to its clients.

Report Scope

Report Features Description Market Value (2024) USD 421.6 Mn Forecast Revenue (2034) USD 845.0 Mn CAGR (2025-2034) 7.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Whole Yogurt Powder, Skimmed Yogurt Powder, Semi-Skimmed Yogurt Powder), By Type (Regular, Low-Fat, Non-Fat), By Flavor (Plain, Flavored), By Application (Food and Beverage Industry, Nutraceuticals, Dietary Supplements, Cosmetics And Personal Care Products, Others), By Distribution Channel (Supermarkets And Hypermarkets, Convenience Stores, Online Retailing, Specialty Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Glanbia plc, Epi Ingrédients, Kerry Group plc., Batory Foods, Bluegrass Ingredients, Inc., Prolactal, CP Ingredients, Ace International LLP, EasiYo Products Limited, ENKA SÜT A.S. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Glanbia plc

- Epi Ingrédients

- Kerry Group plc.

- Batory Foods

- Bluegrass Ingredients, Inc.

- Prolactal

- CP Ingredients

- Ace International LLP

- EasiYo Products Limited

- ENKA SÜT A.S.