Global Workforce Management Market By Component Type (Software and Services), By Deployment (On-Premises, Cloud, and Hybrid), By Enterprise (Small and Middle Enterprises, Large Enterprises), By Solution (Workforce Analytics, Workforce Scheduling, Time and Attendance Management, Performance and Goal Management, Leave and Absence Management, Task Management, Fatigue Management, Others), By End-Use Industry (IT and Telecommunication, BFSI, Government, Healthcare, Education, Manufacturing, Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: April 2024

- Report ID: 22447

- Number of Pages: 298

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

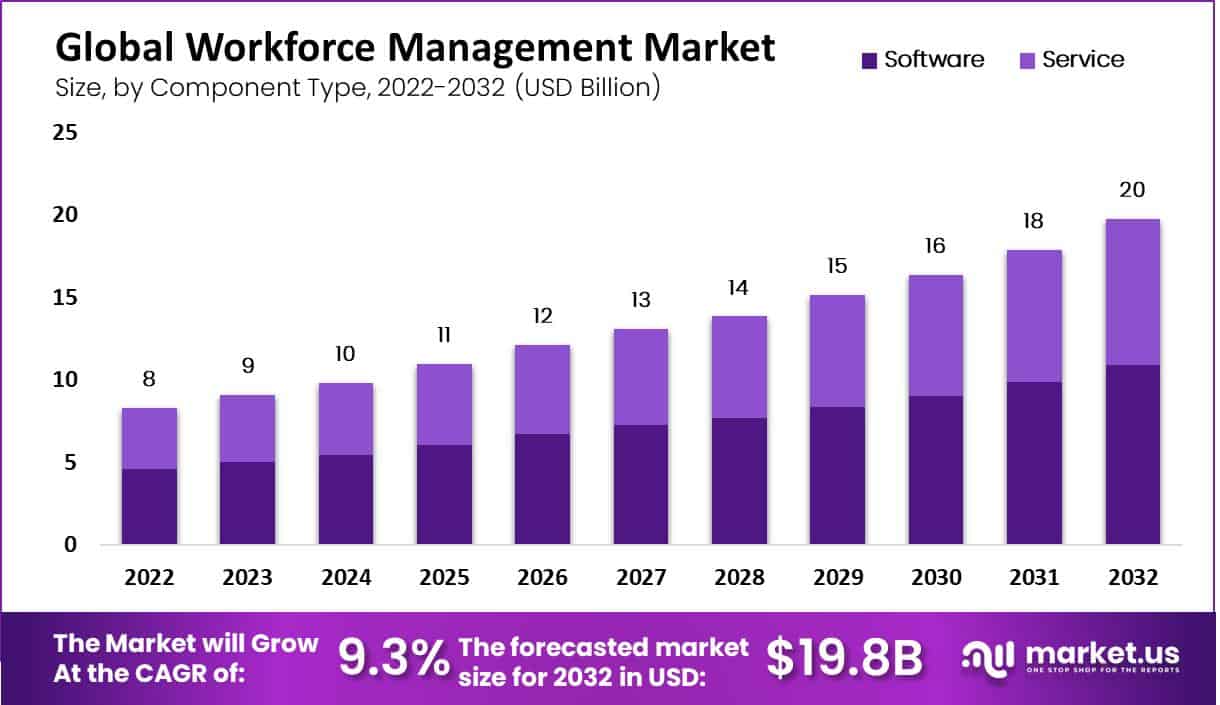

The Global Workforce management Market size is expected to be worth around USD 20 Billion by 2033, from USD 9 Billion in 2023, growing at a CAGR of 9.3% during the forecast period from 2024 to 2033.

Workforce management refers to the strategic processes and systems implemented by organizations to optimize their workforce and ensure efficient utilization of human resources. It involves activities such as employee scheduling, time and attendance tracking, workforce analytics, and task allocation. The goal of workforce management is to improve productivity, reduce costs, and enhance overall operational efficiency.

The workforce management market is a rapidly growing industry that provides software solutions and services to assist organizations in managing their workforce effectively. These solutions typically include features like scheduling algorithms, time tracking tools, performance management modules, and communication platforms. The market caters to a wide range of industries, including retail, healthcare, manufacturing, hospitality, and contact centers.

Note: Actual Numbers Might Vary In The Final Report

The landscape of workforce management is undergoing a significant transformation, characterized by the integration of advanced technologies that cater to the evolving demands of the modern workplace. The year 2024 marks a pivotal moment in this evolution, with the adoption of workforce management solutions featuring gamification and social collaboration tools projected to experience a noteworthy increase of 20% over the previous year. This surge underscores the critical role these innovative solutions play in boosting employee engagement and productivity across various organizations.

Simultaneously, there is a growing trend among employers towards the utilization of technology for enhanced monitoring of employee activities. Approximately 16% of employers have escalated their use of technologies to observe employee behaviors closely. This includes methods such as virtual clocking in and out, tracking usage of work computers, and monitoring of employee emails or internal communications/chat. This trend reflects an increasing emphasis on optimizing workforce efficiency and ensuring adherence to organizational policies and objectives.

Furthermore, the demographic shift in the workforce composition, with millennials constituting 30% of the workforce, necessitates a reevaluation of technological strategies within organizations. Millennials, having grown up in the digital age, bring distinct expectations and proficiencies to the workplace. This demographic shift prompts organizations to advance their technological deployments, ensuring they remain aligned with market dynamics and retain a competitive edge.

Key Takeaways

- Rapid Market Growth: The Workforce Management Market is swiftly expanding, anticipated to reach USD 20 billion by 2032, with a significant CAGR of 9.3% between 2023 and 2032.

- Impact of Mobile Devices: The rising use of mobile devices is poised to significantly influence the market, as businesses aim to improve their mobile capabilities, indicating a shift towards more flexible and remote-friendly work environments.

- Implementation of Advanced Technologies: Integrating Artificial Intelligence (AI) and the Internet of Things (IoT) into workforce management solutions presents new growth opportunities, allowing for better tracking and analysis of employee data for improved decision-making.

- Dominance of Certain Sectors: The IT and telecommunications sector leads the market, reflecting a high demand for workforce management solutions due to the large workforce in these industries. Additionally, the BFSI sector is expected to grow rapidly, showcasing increased adoption of workforce management solutions in this field.

- Software and Service Dominance: The service segment dominates the market, offering various analytical and resource management solutions. Workforce analytics and time and attendance management software play a crucial role in the workforce management sector.

- Emerging Trends: Businesses are adopting workforce management solutions to streamline labor-related activities, emphasizing the trend of standardization and optimization for improved efficiency and productivity.

- Restraining Factors: Limited awareness of workforce management software in small and medium enterprises, especially in developing economies, poses a significant challenge to market growth, highlighting the need for increased awareness and education about the benefits of such solutions

- Key Market Players: Leading companies in the Workforce Management Market include Kronos, Inc., Oracle Corporation, SAP SE, and other key players, showcasing the competitive landscape of the industry.

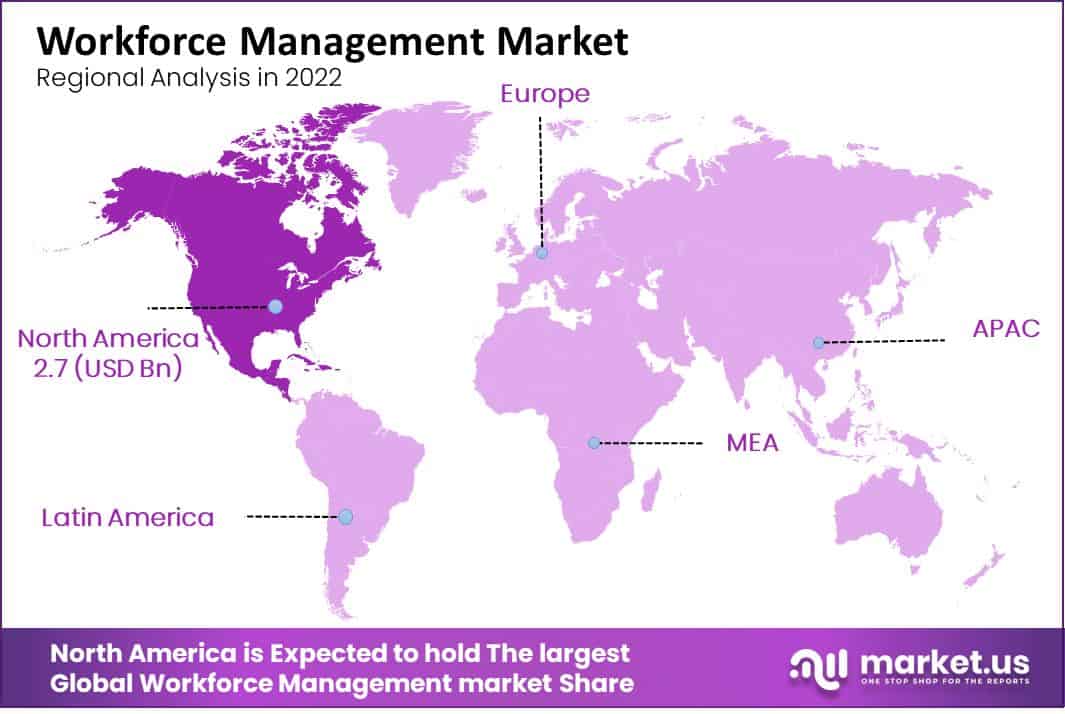

- Market Insights by Region: North America holds the largest market share, driven by the adoption of cloud infrastructure by large enterprises, while the Asia Pacific region is expected to exhibit the fastest growth, fueled by the expansion of manufacturing industries.

Component Type Analysis

The services Segment is Dominant in Workforce Management

Based on component type, the market for workforce management is classified into software and services. The service segment is dominant as it comprises analytics and resource management. This segment is expected to hold lucrative growth during the forecast period. Workforce management services are the way in which employers strategically allocate individuals as well as resources, and track their attendance, to comply with constantly changing workplace laws and regulations.

Workforce management services include statistical forecasting and historical analysis to determine common workforce trends for the organization. Services are expected to exhibit significant growth in the forecast period owing to the adoption of workforce management software. Workforce management software helps organizations streamline and automate the process that manages workers’ time, organizes and deploys the labor force efficiently, manages self-service, and ensures employee safety.

Deployment Analysis

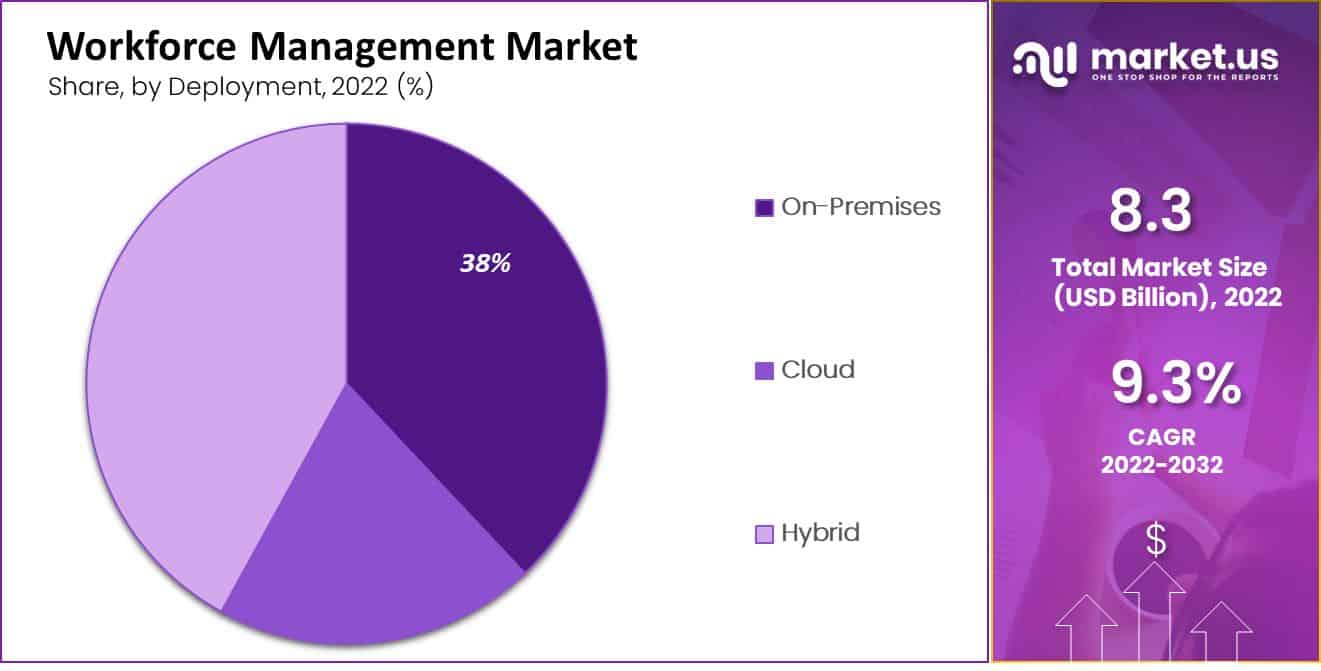

On-Premises with Largest Market Revenue Share

Based on deployment type the market is classified into on-premises, cloud, and hybrid. The on-premises segment was dominant in the market with the largest market revenue share of 38% in 2022. On-premises deployments are easily accessible by clients due to their physical presence in data centers.

The on-premises deployments minimize reliance on the internet and also help in the protection of data from fraud and cyber-attacks. These also help in reducing monthly costs and resolving various IT-related issues. Financial services and banking industries store the financial information of their customers. Hence, the demand for on-premises deployments in such industries is increasing.

The cloud deployments segment is expected to grow at the fastest CAGR during the forecast period due to the increasing connectivity of data through multi-cloud environments. Several organizations are adopting cloud services due to significant benefits such as enhanced collaboration, scalability, and cost-effectiveness.

Note: Actual Numbers Might Vary In The Final Report

Enterprise Analysis

The large Enterprises Sector is Dominant

By enterprises market for workforce management is classified into small and medium enterprises and large enterprises. Workforce management in large enterprises is dominant as in large enterprises there is a significant need for workforce planning which enables sustainable organizations’ performance through better decision-making about the future individual needs of the business. Small enterprise business is done on a small scale, so workforce management is not much applicable in small and medium enterprises.

Solution Analysis

Workforce Analytics Segment is Dominant

Based on the solution, the workforce management market is classified into workforce scheduling, time and attendance management, workforce analytics, leave and absence management, task management, performance and goal management, fatigue management, and others. The time and attendance management segment was dominant in the market with the largest market share in 2022.

The time and attendance management systems in all organizations ensure the accuracy of employees’ time and attendance, pay, and absence requests. It also allows businesses a greater degree of control over labor costs. The task management segment is expected to grow at the fastest CAGR during the forecast period.

Task management is the process of monitoring project tasks from start to finish at various stages. This includes proactively making decisions about tasks. Task management helps in providing fatigue management applications and also helps in employee capabilities management. A leave management system helps record, manage, and track employee leave requests.

End-User Industry Analysis

IT and Telecommunication Sector is Dominant

By end-use industries market for workforce management is classified into IT and telecommunication, BFSI, government, healthcare, education, manufacturing, retail, and others. The IT and telecommunications industry segment was dominant in the market with the largest market share in 2022. This sector has the largest workforce compared to other industries. As a result, the demand for workforce management solutions is more in such industries.

BFSI is expected to grow at the fastest CAGR during the forecast period. The consequences of inaccurate scheduling cause a direct impact on the health of patient care and financial performance. Thus demand workforce management solutions is increasing in healthcare industries. The demand for workforce management solutions is increasing in manufacturing industries to make a balance between labor productivity and costs of labor. WFM solutions in education offer to schedule non-pupil days such as staff insets and training days for teachers.

Key Market Segments

Based on Component Type

- Software

- Service

Based on Deployment

- On-Premises

- Cloud

- Hybrid

Based on Enterprises

- Small and Middle Enterprises

- Large Enterprises

Based on Solution

- Workforce Analytics

- Workforce Scheduling

- Time and Attendance Management

- Performance and Goal Management

- Leave and Absence Management

- Task Management

- Fatigue Management

- Others

Based on End-Use Industry

- IT and Telecommunication

- BFSI

- Government

- Healthcare

- Education

- Manufacturing

- Retail

- Others

Driver

One key driver for the workforce management market is the increasing demand for automation and digitization in workforce processes. Organizations are adopting workforce management solutions to streamline their operations, reduce manual effort, and improve overall efficiency.

According to the analysis conducted by Cedar, it has been observed that through the application of systematic labor management, an enterprise employing approximately 5,000 individuals and with a payroll of around ~USD 300 million is capable of achieving annual savings of roughly ~USD 6.0 million.

Similarly, a retail organization generating a turnover of approximately ~USD 5.0 billion and employing a workforce of 60,000 can realize annual savings of about ~USD 2.5 million by adopting an effective time and labor management solution that streamlines the administration of time entries.

Automation helps in accurate forecasting and scheduling, reducing errors, and optimizing resource allocation. By automating tasks such as employee scheduling, time tracking, and reporting, organizations can save time, reduce costs, and enhance productivity. Furthermore, with the rise of remote work and flexible working arrangements, workforce management solutions enable organizations to effectively manage and monitor their distributed workforce.

Restraint

A major restraint for the workforce management market is the resistance to change and adoption challenges within organizations. Implementing workforce management solutions often requires significant changes in existing processes, systems, and employee behavior. This can lead to resistance from employees who may be accustomed to traditional methods or fear job displacement due to automation.

Additionally, organizations may face challenges in integrating workforce management solutions with their existing IT infrastructure, which can be complex and time-consuming. Overcoming these challenges requires effective change management strategies, training programs, and clear communication to gain buy-in from employees and ensure successful implementation.

Opportunity

An opportunity for the workforce management market lies in the growing trend of remote and distributed workforces. The COVID-19 pandemic has accelerated the adoption of remote work, and many organizations are now embracing hybrid work models. This shift presents an opportunity for workforce management solutions to provide efficient scheduling, collaboration, and performance tracking tools tailored to remote work environments.

Additionally, as organizations increasingly focus on employee well-being and work-life balance, workforce management solutions can offer features such as flexible scheduling, self-service portals, and employee engagement tools to support a positive remote work experience.

Challenge

A significant challenge for the workforce management market is data security and privacy concerns. Workforce management solutions collect and store sensitive personal and work-related data of employees, such as time logs, schedules, and performance metrics. Ensuring the security and privacy of this data is crucial to maintain trust and compliance with regulations like GDPR and CCPA.

Organizations must invest in robust data protection measures, encryption techniques, access controls, and regular security audits to safeguard employee data. Additionally, they need to establish transparent data governance policies and communicate them effectively to employees to address privacy concerns and build trust.

Emerging Trends

- Integration of Artificial Intelligence (AI) and Machine Learning (ML): The workforce management market is witnessing a growing trend of incorporating AI and ML technologies. These advanced technologies enable predictive analytics, intelligent scheduling, and real-time decision-making. Artificial Intelligence (AI) and ML algorithms can analyze vast amounts of workforce data, identify patterns, and make data-driven predictions for optimized workforce planning and resource allocation.

- Mobile Workforce Management Solutions: With the rise of remote work and the increasing use of mobile devices, there is a growing trend towards mobile workforce management solutions. These solutions allow employees to access their schedules, submit time-off requests, and communicate with their teams using mobile devices. Mobile workforce management offers greater flexibility and convenience, enabling employees to manage their work-related tasks anytime, anywhere.

- Advanced Analytics and Reporting: Workforce management solutions are incorporating advanced analytics and reporting capabilities to provide deeper insights into workforce performance. These analytics tools help organizations identify trends, patterns, and areas for improvement in workforce productivity and efficiency. By leveraging data-driven insights, organizations can make informed decisions, optimize workforce planning, and drive strategic improvements in their operations.

Growth Factors

- Increasing Demand for Workforce Optimization: Organizations across various industries are recognizing the need to optimize their workforce to achieve operational efficiency and cost savings. Workforce management solutions offer automation, accuracy, and real-time visibility into workforce data, enabling organizations to effectively schedule employees, manage workloads, and improve productivity.

- Rising Adoption of Cloud-based Solutions: The adoption of cloud-based workforce management solutions is growing rapidly. Cloud-based solutions offer scalability, flexibility, and cost-effectiveness, as they eliminate the need for on-premises infrastructure and provide easy access to data from anywhere. Organizations are increasingly leveraging cloud technology to streamline their workforce management processes and enhance collaboration among teams.

- Remote Work and Flexible Work Arrangements: The shift towards remote work and flexible work arrangements, accelerated by the COVID-19 pandemic, has led to increased demand for workforce management solutions. These solutions help organizations manage and monitor their distributed workforce, ensuring effective scheduling, communication, and performance tracking in remote work environments.

- Compliance and Regulatory Requirements: Organizations face stringent compliance and regulatory requirements related to workforce management, such as labor laws, overtime regulations, and employee rights. Workforce management solutions help organizations automate compliance processes, ensure adherence to regulations, and maintain accurate records of employee working hours and schedules.

Regional Analysis

North America region is dominant in the global workforce management market with the largest revenue share of 32%. The growth of the market in the region is attributed to the increasing adoption of cloud infrastructure by large enterprises. Also increasing productivity and labor efficiency which help HRM solutions for task management, and attendance management process the demand for workforce management solutions is increasing. Increasing industrialization in developed countries such as the United States and Canada drives the market growth.

Asia Pacific region is expected to grow at the fastest CAGR during the forecast period due to expanding manufacturing industries in emerging economies such as China, Japan, and India. Companies in the Asia Pacific region started rapidly adopting WFM solutions to improve employee and company productivity, and performance. Also increasing adoption of cloud technologies is expected to drive market growth.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Emerging key players are focused on a variety of strategic policies to develop their respective businesses in foreign markets. Several workforce management companies are concentrating on expanding their existing operations and R&D facilities.

Top Market Leaders

- Kronos, Inc.

- Oracle Corporation

- SAP SE

- Automatic Data Processing, Inc.

- WorkForce Software, LLC.

- Ultimate Software

- Cornerstone OnDemand, Inc.

- IBM Corporation

- Verint

- Infor

- NetSuite, Inc.

- Other Key Players

Recent Developments

- February 2024: Trapeze’s Workforce Management (WFM) solution was chosen by the logistics company Qube to manage its workforce. This selection will help Qube streamline operations and improve workforce efficiency.

- January 2024: Valsoft Corporation Inc. acquired Easy Employer, marking a significant expansion in their market presence. This acquisition is expected to strengthen Valsoft’s capabilities and services in the workforce management domain.

- November 2023: Huntr and BetterPlace announced their collaboration. Together, they launched a platform designed for blue-collar enterprises. This partnership aims to provide comprehensive workforce solutions that cater specifically to the needs of blue-collar industries.

- June 2023: Strata Decision Technology introduced its Real-Time Workforce Management (RTWM) solution. This new tool is specially designed for nursing leaders, focusing on their financial and operational objectives. Built on the existing StrataJazz platform, it offers precise data to enhance communication with staff and support nursing leadership in making informed decisions.

Report Scope

Report Features Description Market Value (2023) USD 9 Bn Forecast Revenue (2032) USD 19.8 Bn CAGR (2023-2032) 9.3% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component Type- Software and Service; By Deployment- On-Premises, Cloud, and Hybrid; By enterprises- Small and Middle Enterprises, and Large Enterprises; By Solution- Workforce Analytics, Workforce Scheduling, Time and Attendance Management, Performance and Goal Management, Leave and Absence Management, Task Management, Fatigue Management, and Others; By End-Use Industry- IT and Telecommunication, BFSI, Government, Healthcare, Education, Manufacturing, Retail, and Others Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Kronos, Inc., Oracle Corporation, SAP SE, Automatic Data Processing, Inc., WorkForce Software, LLC., Ultimate Software, Cornerstone OnDemand, Inc., IBM Corporation, Verint, Infor, NetSuite, Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What will be the market size for Workforce Management Market in 2032?In 2032, the Workforce Management Market will reach USD 19.8 billion.

What CAGR is projected for the Workforce Management Market?The Workforce Management Market is expected to grow at 9.3% CAGR (2023-2032).

Name the major industry players in the Workforce Management Market.Kronos, Inc., Oracle Corporation, SAP SE, Automatic Data Processing, Inc., WorkForce Software, LLC., Ultimate Software and Other Key Players are the main vendors in this market.

List the segments encompassed in this report on the Workforce Management Market?Market.US has segmented the Workforce Management Market by geographic (North America, Europe, APAC, South America, and MEA). By Component Type, market has been segmented into Software and Service. By Deployment, the market has been further divided into, On-Premises, Cloud and Hybrid.

Workforce Management MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

Workforce Management MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Kronos, Inc.

- Oracle Corporation

- SAP SE

- Automatic Data Processing, Inc.

- WorkForce Software, LLC.

- Ultimate Software

- Cornerstone OnDemand, Inc.

- IBM Corporation

- Verint

- Infor

- NetSuite, Inc.

- Other Key Players