Global Wireless Router Market Size, Share, Growth Analysis By Product Type (Standalone Routers, Mesh Wi-Fi Systems, Mobile Hotspot Routers, Industrial/Rugged Routers), By Wi-Fi Standard (802.11n (Wi-Fi 4), 802.11ac (Wi-Fi 5), 802.11ax (Wi-Fi 6), 802.11be (Wi-Fi 7)), By Frequency Band (Single-Band, Dual-Band, Tri-/Quad-Band), By End-user Industry (Residential, Enterprise, BFSI, Education, Healthcare, Media and Entertainment, Retail, Government and Public Sector, Others), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 172859

- Number of Pages: 354

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Product Type Analysis

- By Wi-Fi Standard Analysis

- By Frequency Band Analysis

- By End-user Industry Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Wireless Router Market Company Insights

- Recent Developments

- Report Scope

Report Overview

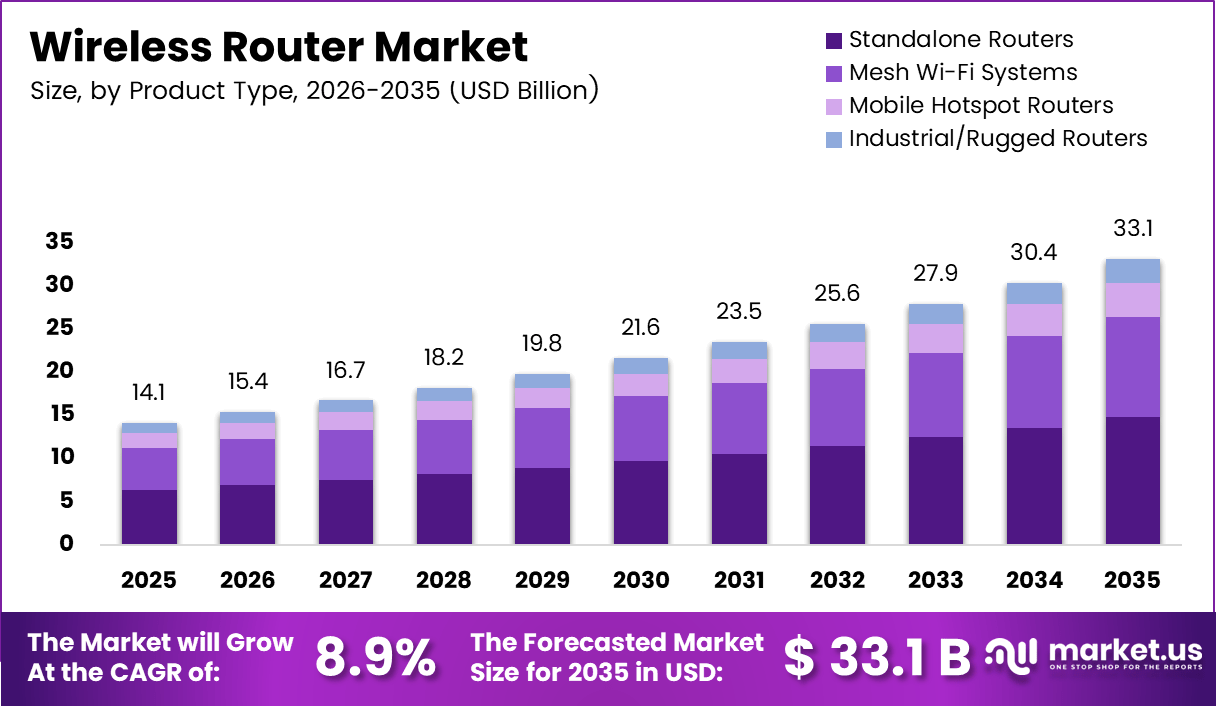

The Global Wireless Router Market Market size is expected to be worth around USD 33.1 billion by 2035, from USD 14.1 billion in 2025, growing at a CAGR of 8.9% during the forecast period from 2026 to 2035.

The Wireless Router Market represents the ecosystem of networking devices that distribute internet connectivity wirelessly across homes, enterprises, and public environments. this market sits at the intersection of digital infrastructure, connectivity demand, and user experience. Moreover, rising device density continues reshaping router performance expectations and purchasing decisions globally.

wireless routers enable seamless data transmission across residential and commercial networks, supporting mobility and operational continuity. Consequently, demand remains closely linked to broadband expansion and digital service penetration. Simple installation, scalability, and improved reliability increasingly position wireless routers as essential infrastructure rather than optional hardware components.

Market growth remains steady as digital lifestyles intensify across work, education, and entertainment environments. Additionally, remote work adoption and cloud-based services continue reinforcing router replacement cycles. As a result, manufacturers increasingly focus on throughput efficiency, low latency performance, and wider coverage to address evolving bandwidth-intensive use cases.

Government investment further strengthens market momentum through national broadband missions and rural connectivity initiatives. Moreover, regulatory bodies emphasize spectrum optimization and interference management to improve wireless quality. These initiatives indirectly support router adoption by expanding last-mile connectivity and encouraging standardized wireless deployment across residential and institutional networks.

Opportunities increasingly emerge from smart homes, connected classrooms, and small office networks seeking stable wireless performance. Furthermore, mesh networking and software-driven management enhance value propositions for users with limited technical expertise. Therefore, the market benefits from both replacement demand and first-time adoption in underserved regions.

According to the research, a wireless access point connects devices using radio frequencies across 900 MHz, 2.4 GHz, 3.6 GHz, 5 GHz, and 60 GHz bands, defining modern connectivity standards. Additionally, IEEE states that the 802.11 standard governs communication protocols for wireless routers and wireless access points, ensuring interoperability.

according to study, the 802.11ac Wave 2 standard supports higher throughput and multi-user performance, driving adoption in bandwidth-heavy environments. Typical service coverage extends up to 150 feet indoors and 300 feet outdoors, according to IEEE specifications, influencing router placement strategies and purchase decisions in residential and enterprise settings.

Key Takeaways

- The Global Wireless Router Market is projected to reach USD 33.1 billion by 2035, expanding from USD 14.1 billion in 2025 at a CAGR of 8.9%.

- Standalone Routers lead the product segment with a market share of 44.7%, driven by high adoption across households and small offices.

- Dual-Band routers dominate the frequency band segment, accounting for 56.2% of total market share due to balanced coverage and speed.

- The Residential end-user segment holds the largest share at 43.8%, supported by increasing broadband penetration and smart device usage.

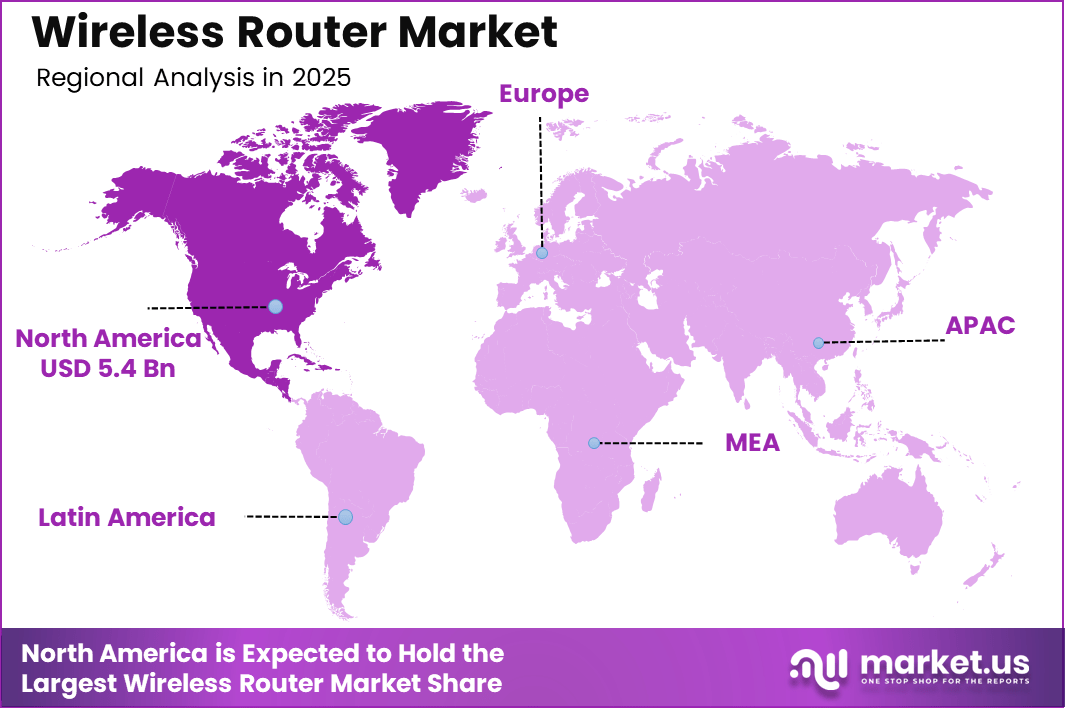

- North America leads the regional market with a share of 38.4%, valued at USD 5.4 billion, backed by advanced digital infrastructure.

By Product Type Analysis

Standalone Routers dominate with 44.7% due to their affordability, ease of deployment, and broad compatibility.

In 2025, Standalone Routers held a dominant market position in the By Product Type Analysis segment of Wireless Router Market Market, with a 44.7% share. These routers remain widely preferred across households and small offices due to simple installation, cost efficiency, and sufficient performance for moderate bandwidth needs. Moreover, replacement demand continues supporting steady adoption.

Mesh Wi-Fi Systems increasingly attract users requiring seamless connectivity across larger spaces. These systems address coverage gaps through interconnected nodes, improving user experience. Consequently, adoption grows in smart homes and multi-floor buildings, where uninterrupted connectivity and simplified network management increasingly influence purchasing behavior.

Mobile Hotspot Routers support on-the-go connectivity for professionals, travelers, and temporary setups. Their portability and cellular integration enable internet access without fixed broadband. Therefore, demand aligns closely with remote work trends, field operations, and rising mobile workforce requirements across multiple industries.

Industrial and Rugged Routers serve harsh operational environments requiring durability and reliability. These routers support manufacturing, transportation, and energy infrastructure networks. As industrial digitization advances, rugged designs gain relevance for maintaining stable connectivity under extreme temperature, vibration, and electromagnetic interference conditions.

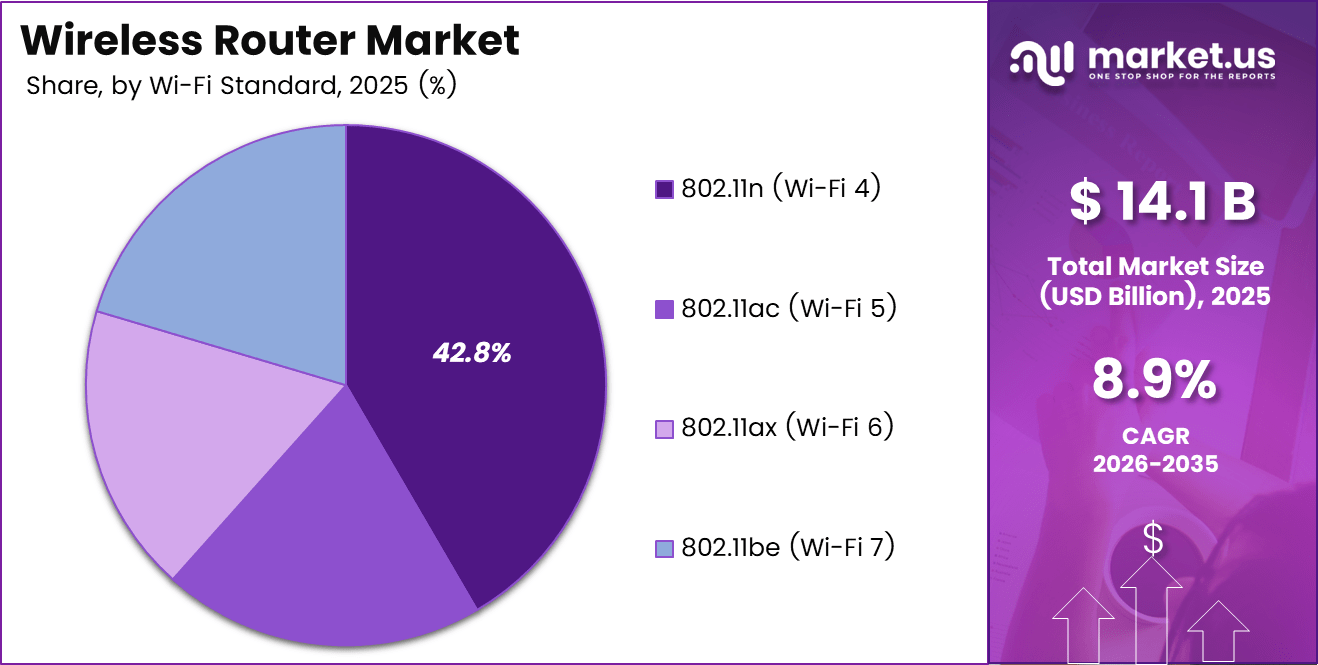

By Wi-Fi Standard Analysis

802.11n (Wi-Fi 4) dominates with 41.6% due to its continued use in legacy networks and cost-sensitive deployments.

In 2025, 802.11n (Wi-Fi 4) held a dominant market position in the By Wi-Fi Standard Analysis segment of Wireless Router Market Market, with a 41.6% share. This standard remains common in older residential and institutional networks where basic connectivity meets functional requirements, sustaining its installed base globally.

802.11ac (Wi-Fi 5) supports higher data rates and multi-device environments. Consequently, it serves as a transitional standard for users upgrading from older routers. Adoption remains strong in households and offices seeking improved streaming, conferencing, and online collaboration performance.

802.11ax (Wi-Fi 6) addresses congestion challenges through better spectral efficiency and device handling. Therefore, demand increases in smart homes, enterprises, and educational institutions managing multiple connected devices simultaneously, supporting improved latency and network stability.

802.11be (Wi-Fi 7) represents emerging adoption driven by ultra-high-speed and low-latency requirements. Although still early-stage, this standard supports next-generation applications such as immersive media, advanced gaming, and real-time industrial communication.

By Frequency Band Analysis

Dual-Band dominates with 56.2% due to balanced performance across speed and coverage.

In 2025, Dual-Band routers held a dominant market position in the By Frequency Band Analysis segment of Wireless Router Market Market, with a 56.2% share. These routers efficiently manage traffic across two frequency bands, reducing congestion and supporting diverse household and enterprise applications.

Single-Band routers primarily serve basic connectivity needs. Their lower cost supports adoption in entry-level markets and legacy setups. However, performance limitations restrict suitability for high-bandwidth applications and multi-device usage environments.

Tri and Quad-Band routers cater to advanced networking demands. These configurations support high-density device environments, reducing interference and improving throughput. Consequently, adoption grows among tech-savvy consumers, gaming households, and enterprise networks.

By End-user Industry Analysis

Residential dominates with 43.8% driven by household internet penetration and smart device adoption.

In 2025, Residential users held a dominant market position in the By End-user Industry Analysis segment of Wireless Router Market Market, with a 43.8% share. Rising broadband subscriptions, remote work, and streaming services continue increasing router demand across households.

Enterprise adoption focuses on network reliability, scalability, and security. Businesses invest in routers supporting collaboration platforms and cloud applications. Consequently, demand aligns with digital workplace expansion and hybrid work models.

BFSI networks require secure and stable connectivity to support digital transactions and branch operations. Therefore, routers with enhanced security features gain relevance within financial institutions.

Education institutions rely on wireless routers to support digital classrooms and remote learning. Similarly, healthcare settings use routers for connected devices, telemedicine, and data access. Media, retail, government, and other sectors increasingly depend on reliable wireless infrastructure to support digital engagement and service delivery.

By Distribution Channel Analysis

Online dominates with 56.9% due to convenience, wider product access, and competitive pricing.

In 2025, Online channels held a dominant market position in the By Distribution Channel Analysis segment of Wireless Router Market Market, with a 56.9% share. E-commerce platforms simplify product comparison, pricing transparency, and doorstep delivery, accelerating consumer adoption.

Offline channels remain relevant for enterprise buyers and users seeking installation support. Physical retail enables hands-on evaluation and personalized assistance. Consequently, offline sales persist in regions where technical guidance and trust influence purchasing decisions.

Key Market Segments

By Product Type

- Standalone Routers

- Mesh Wi-Fi Systems

- Mobile Hotspot Routers

- Industrial/Rugged Routers

By Wi-Fi Standard

- 802.11n (Wi-Fi 4)

- 802.11ac (Wi-Fi 5)

- 802.11ax (Wi-Fi 6)

- 802.11be (Wi-Fi 7)

By Frequency Band

- Single-Band

- Dual-Band

- Tri-/Quad-Band

By End-user Industry

- Residential

- Enterprise

- BFSI

- Education

- Healthcare

- Media and Entertainment

- Retail

- Government and Public Sector

- Others

By Distribution Channel

- Online

- Offline

Key Players

Drivers

Rapid Migration Toward Multi-Device, High-Bandwidth Connectivity Drives Market Growth

The Wireless Router Market Market is strongly driven by the rapid increase in connected devices within homes and enterprises. Households now use multiple smartphones, smart televisions, laptops, and IoT devices simultaneously. As a result, demand for routers that can handle high bandwidth and multiple connections continues to rise steadily across regions.

At the same time, accelerated deployment of fiber-to-the-home and gigabit broadband infrastructure supports higher internet speeds. Consequently, users require routers capable of distributing these speeds efficiently. This infrastructure expansion directly boosts router upgrades, especially in urban and suburban areas with improving broadband penetration.

Growing reliance on cloud applications, video streaming platforms, and real-time collaboration tools further strengthens market momentum. Remote work, online education, and digital entertainment require stable, high-speed wireless connectivity. Therefore, routers are no longer optional devices but essential components of daily digital operations.

In addition, rising adoption of smart home ecosystems increases the need for continuous and reliable wireless coverage. Smart lighting, security systems, and voice assistants depend on uninterrupted connectivity. Hence, consumers increasingly prioritize router performance, coverage consistency, and reliability when making purchase decisions.

Restraints

Network Security Concerns and Cost Sensitivity Restrain Market Expansion

Despite strong demand, the Wireless Router Market Market faces notable restraints related to pricing. Many consumers remain highly sensitive to the cost of premium and next-generation routers. As advanced models carry higher prices, adoption slows among budget-conscious households and small businesses.

Security vulnerabilities also present significant challenges. Increasing incidents of data breaches and unauthorized network access raise concerns among users. Consequently, fear of compromised personal and business data discourages some buyers from upgrading or adopting wireless routers.

Limited technical awareness among end users further restricts market growth. Many consumers struggle to configure advanced router features effectively. As a result, complex setup processes reduce perceived value and lower satisfaction, especially for non-technical users.

Moreover, signal interference in dense urban environments affects router performance. High device density, building materials, and overlapping networks reduce speed and coverage quality. Therefore, inconsistent performance in crowded areas continues to limit user confidence and adoption.

Growth Factors

Rising Demand for Advanced Wi-Fi Standards Creates New Growth Opportunities

The Wireless Router Market Market presents strong growth opportunities through increasing demand for Wi-Fi 6 and Wi-Fi 7 routers. These standards offer improved speed, lower latency, and better device handling. Consequently, residential and commercial users increasingly seek upgrades to support modern digital usage.

Investments in smart cities and digitally connected public infrastructure also open new opportunities. Governments and municipalities focus on connected transportation, public Wi-Fi, and digital services. As a result, reliable wireless routing solutions become essential for urban digital transformation initiatives.

Emerging economies further contribute to market expansion as internet access continues to grow. Increasing broadband penetration and smartphone usage drive first-time router adoption. Therefore, affordable and scalable router solutions find strong demand in developing regions.

Additionally, expanding digital education and healthcare services create long-term opportunities. These sectors rely on stable wireless connectivity for online learning and telemedicine, supporting sustained router demand over time.

Emerging Trends

Shift Toward Mesh Networking and Smart Management Shapes Market Trends

One major trend in the Wireless Router Market Market is the shift toward mesh networking systems. These systems provide seamless coverage across large homes and enterprises. Consequently, users benefit from fewer dead zones and more consistent connectivity.

Another important trend is the growing preference for app-based router management. Users increasingly expect easy setup, monitoring, and control through mobile applications. Therefore, simplified user interfaces enhance overall customer experience and satisfaction.

Energy efficiency also gains importance as consumers become more environmentally conscious. Adoption of eco-designed and power-efficient routers supports sustainability goals. As a result, energy-saving features increasingly influence purchasing decisions.

Finally, cybersecurity-focused routers are gaining attention. Advanced firewall protection, parental controls, and built-in security features address growing data protection concerns. Hence, security integration continues shaping product innovation and market differentiation.

Regional Analysis

North America Dominates the Wireless Router Market Market with a Market Share of 38.4%, Valued at USD 5.4 billion

North America leads the Wireless Router Market Market due to advanced broadband infrastructure, high internet penetration, and widespread adoption of connected devices. In 2025, the region accounted for 38.4% of the market, valued at USD 5.4 billion, supported by strong demand from residential and enterprise users. Continuous upgrades toward high-speed connectivity and smart home adoption further reinforce regional dominance.

Europe Wireless Router Market Market Trends

Europe demonstrates steady growth driven by digital transformation initiatives and expanding fiber-based broadband networks. Increasing remote work adoption and emphasis on reliable home connectivity support consistent router demand. Additionally, regulatory focus on spectrum efficiency and digital inclusion contributes to sustained market expansion across both urban and semi-urban areas.

Asia Pacific Wireless Router Market Market Trends

Asia Pacific represents a high-growth region fueled by rapid urbanization, expanding middle-class populations, and rising internet access. Growing smartphone usage and digital education initiatives increase household router adoption. Moreover, ongoing investments in broadband infrastructure across emerging economies strengthen long-term market potential.

Middle East and Africa Wireless Router Market Market Trends

The Middle East and Africa region shows gradual growth supported by digital government programs and improving connectivity infrastructure. Increasing adoption of wireless internet in educational institutions and public facilities drives demand. However, market expansion remains influenced by uneven broadband availability across countries.

Latin America Wireless Router Market Market Trends

Latin America experiences moderate growth as internet penetration steadily improves across residential and small business segments. Demand is supported by expanding broadband services and increased use of digital entertainment platforms. Price-sensitive consumers continue favoring cost-effective wireless router solutions.

U.S. Wireless Router Market Market Trends

The U.S. market benefits from high device density, advanced networking standards, and strong replacement demand. Widespread remote work, cloud adoption, and smart home integration sustain router upgrades. Additionally, continued investments in broadband expansion programs support long-term market stability.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Wireless Router Market Company Insights

Cisco Systems, Inc. remains a core benchmark for enterprise grade wireless routing in 2025, supported by its breadth across campus, branch, and managed cloud networking portfolios. The company is expected to sustain momentum through security led differentiation, tighter integration with switching and software defined networking stacks, and a stronger push toward simplified lifecycle management for IT teams.

In 2025, Tenda is anticipated to keep expanding share in value driven consumer and small office segments, where buyers prioritize easy setup, stable coverage, and low total cost. Its growth is expected to track rising multi device home usage and the continued replacement cycle for older Wi Fi routers, especially in price sensitive markets that favor broad retail availability.

As a volume focused brand, TP-LINK CORPORATION PTE. LTD. is projected to benefit from its wide product ladder spanning entry to performance tiers, helping it address both mass market households and prosumer needs. The company is expected to strengthen competitiveness through fast feature refresh cycles, tighter mesh positioning, and improved user experience through companion app control and network optimization tools.

From a market positioning lens, Belkin is likely to lean on design led differentiation and reliability centered branding in 2025, especially for consumers seeking straightforward, premium home connectivity. Its performance is expected to benefit from partnerships and channel strength, along with demand for routers that fit modern home layouts and support smart home traffic without complexity.

Top Key Players in the Market

- Cisco Systems, Inc.

- Tenda

- TP-LINK CORPORATION PTE. LTD.

- Belkin

- D-Link (India) Limited.

- EDIMAX Technology Co., Ltd.

- Huawei Device Co., Ltd.

- NETGEAR

- Xiaomi

- ASUSTeK Computer Inc.

Recent Developments

- In July 2, 2025, Hewlett Packard Enterprise closed the acquisition of Juniper Networks to deliver an industry leading, cloud native, and AI driven networking portfolio. The integration strengthened capabilities across enterprise, data center, and service provider networks through advanced automation, AI Ops, and secure infrastructure.

- In April 2025, 5Gstore acquired router assets from Ericsson and Semtech, reviving the iconic Cradlepoint and Sierra Wireless brands. This acquisition expanded its 5G and IoT connectivity portfolio, reinforcing its presence in enterprise, industrial, and mission critical networking markets.

Report Scope

Report Features Description Market Value (2025) USD 14.1 billion Forecast Revenue (2035) USD 33.1 billion CAGR (2026-2035) 8.9% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Standalone Routers, Mesh Wi-Fi Systems, Mobile Hotspot Routers, Industrial/Rugged Routers), By Wi-Fi Standard (802.11n (Wi-Fi 4), 802.11ac (Wi-Fi 5), 802.11ax (Wi-Fi 6), 802.11be (Wi-Fi 7)), By Frequency Band (Single-Band, Dual-Band, Tri-/Quad-Band), By End-user Industry (Residential, Enterprise, BFSI, Education, Healthcare, Media and Entertainment, Retail, Government and Public Sector, Others), By Distribution Channel (Online, Offline) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Cisco Systems, Inc., Tenda, TP-LINK CORPORATION PTE. LTD., Belkin, D-Link (India) Limited., EDIMAX Technology Co., Ltd., Huawei Device Co., Ltd., NETGEAR, Xiaomi, ASUSTeK Computer Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cisco Systems, Inc.

- Tenda

- TP-LINK CORPORATION PTE. LTD.

- Belkin

- D-Link (India) Limited.

- EDIMAX Technology Co., Ltd.

- Huawei Device Co., Ltd.

- NETGEAR

- Xiaomi

- ASUSTeK Computer Inc.