Global Winter Sporting Goods Market Size, Share, Growth Analysis By Product (Sleds [Plastic, Foam, Others], Tubes [Plastic, Foam, Others]), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 177820

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

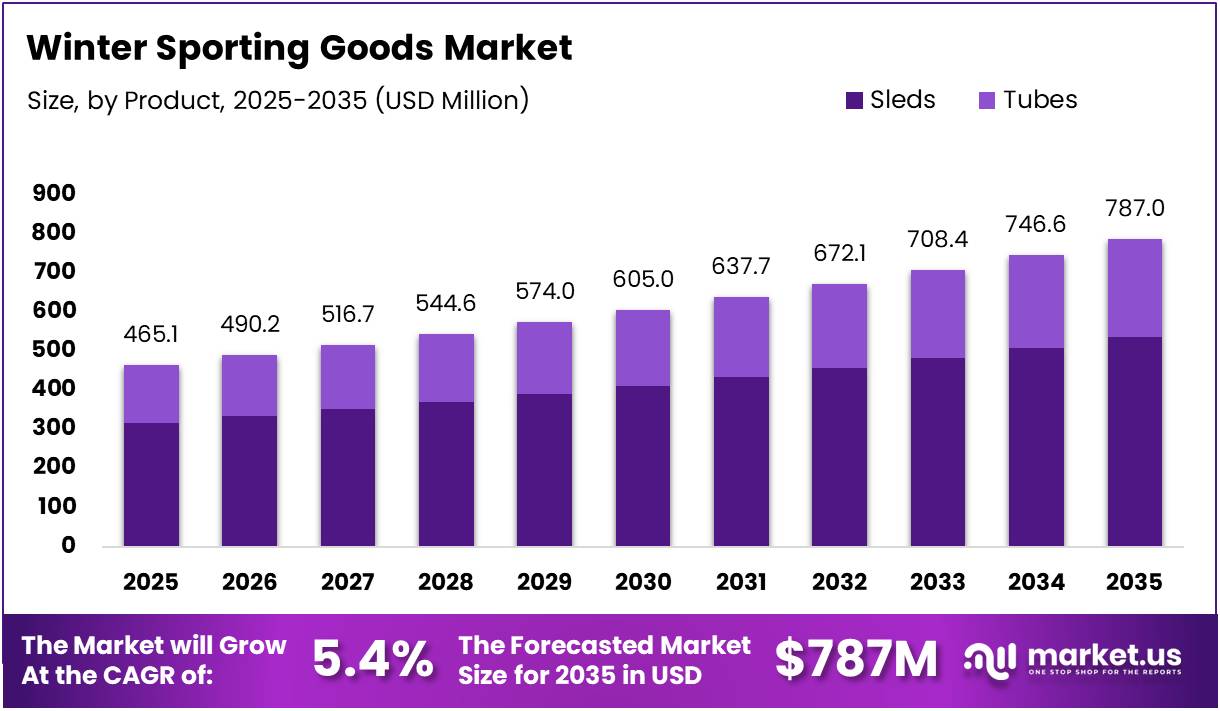

The Global Winter Sporting Goods Market size is expected to be worth around USD 787 Million by 2035 from USD 465.1 Million in 2025, growing at a CAGR of 5.4% during the forecast period 2026 to 2035.

The Winter Sporting Goods Market encompasses equipment and accessories designed for snow-based recreational activities. This includes sleds, tubes, protective gear, and related products used in skiing, snowboarding, sledding, and other winter sports. The market serves both recreational participants and professional athletes across diverse climates.

Winter sporting goods have gained significant traction due to increasing consumer interest in outdoor winter activities. Moreover, seasonal tourism to ski resorts and snow destinations continues to drive consistent demand for quality equipment. These products range from basic recreational items to premium performance gear with advanced materials and technology.

The market experiences steady growth driven by rising participation in adventure-based winter sports. Additionally, consumer spending on premium equipment reflects growing disposable incomes in key markets. However, demand patterns remain closely tied to seasonal weather conditions and accessibility to winter sports facilities.

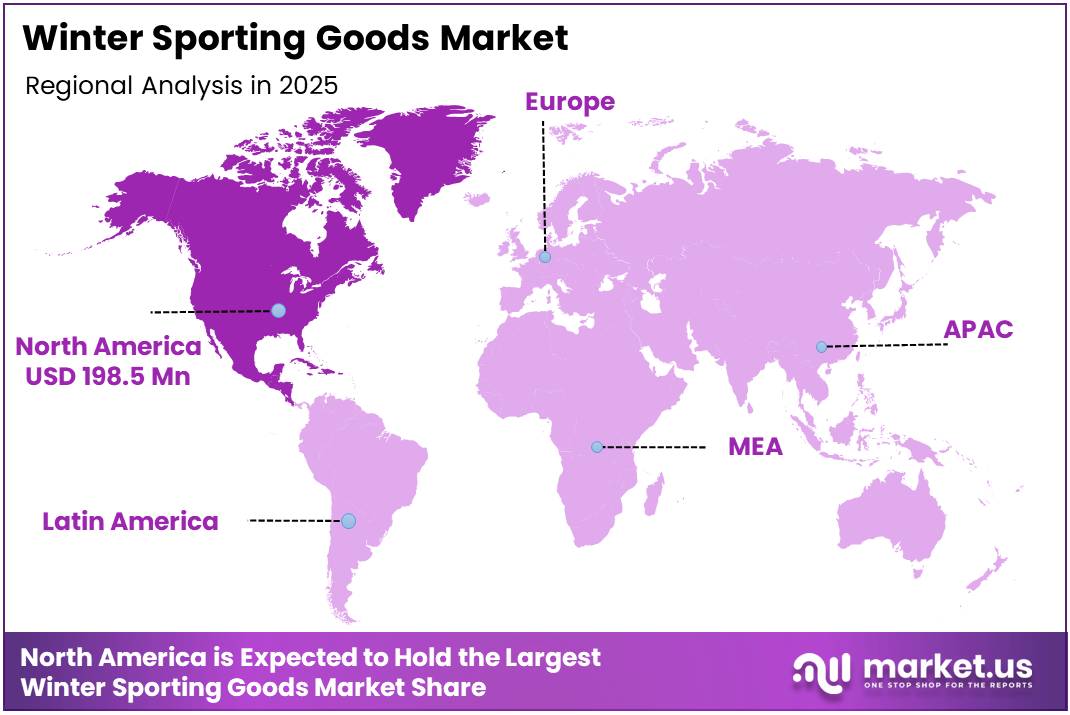

North America dominates this market landscape, benefiting from established winter sports culture and infrastructure. Furthermore, European markets show strong participation rates with well-developed ski tourism sectors. Asia Pacific represents an emerging opportunity as winter sports gain popularity in countries like China and Japan.

Government investments in winter sports infrastructure support market expansion, particularly in regions hosting international competitions. Consequently, improved accessibility to skiing and snowboarding facilities encourages broader participation. These developments create favorable conditions for sustained market growth throughout the forecast period.

According to Generali, safety awareness is increasing with 77% of participants always wearing helmets while skiing or snowboarding. Additionally, about 25% wear protective gear beyond helmets. This trend reflects growing consumer focus on safety and injury prevention in winter sports activities.

The market also benefits from innovations in product design and materials technology. Therefore, manufacturers increasingly focus on lightweight, durable, and eco-friendly equipment options. These developments align with evolving consumer preferences for sustainable and high-performance winter sporting goods across all segments.

Key Takeaways

- Global Winter Sporting Goods Market projected to reach USD 787 Million by 2035 from USD 465.1 Million in 2025

- Market expected to grow at CAGR of 5.4% during forecast period 2026-2035

- North America leads with 42.70% market share, valued at USD 198.5 Million

- Sleds segment dominates By Product category with 68.2% market share

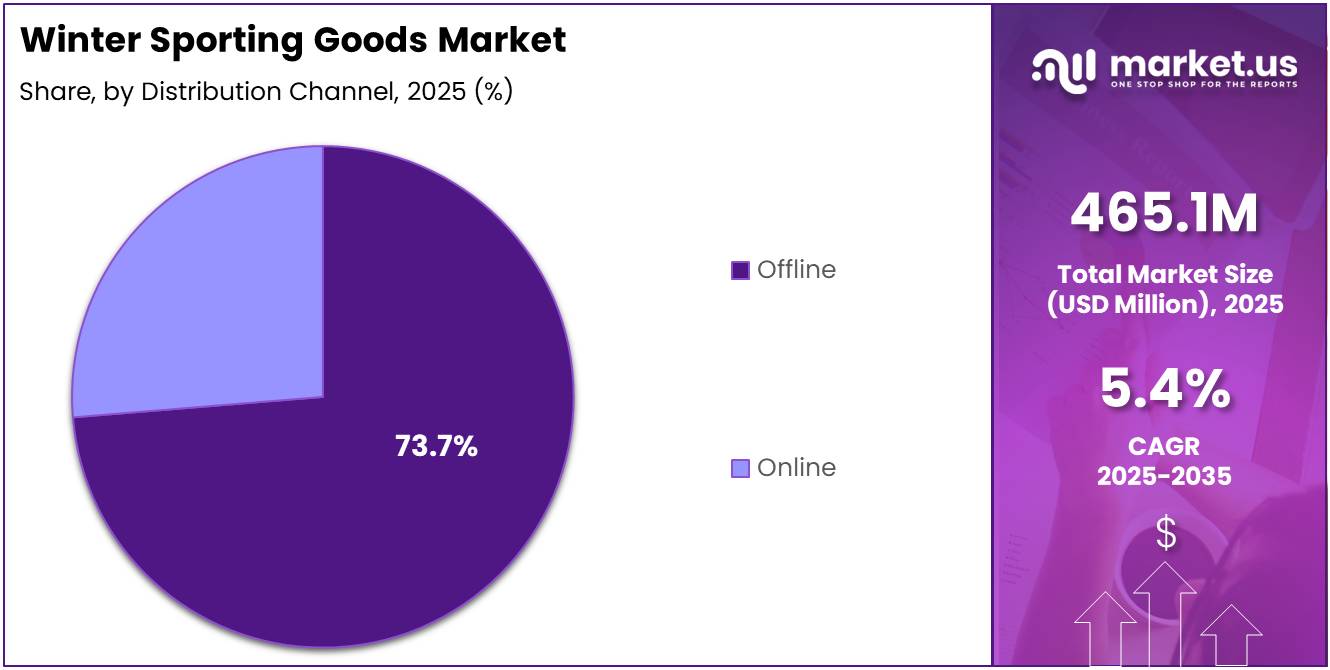

- Offline distribution channel accounts for 73.7% of total market share

By Product Analysis

Sleds dominates with 68.2% due to widespread recreational use and affordability.

In 2025, Sleds held a dominant market position in the By Product segment of Winter Sporting Goods Market, with a 68.2% share. Sleds remain the most popular winter sporting product due to their accessibility, affordability, and universal appeal across age groups. Their simple design and ease of use make them ideal for casual winter recreation. Moreover, plastic and foam variants offer different price points catering to diverse consumer segments.

Tubes represent a growing segment within winter sporting goods, offering enhanced safety and comfort features. These inflatable products provide cushioned rides and are particularly popular in snow tubing parks and commercial facilities. Additionally, tubes come in various materials including plastic and foam options. Their portability and storage convenience make them attractive for both individual consumers and rental operations.

By Distribution Channel Analysis

Offline dominates with 73.7% due to preference for physical product inspection before purchase.

In 2025, Offline held a dominant market position in the By Distribution Channel segment of Winter Sporting Goods Market, with a 73.7% share. Traditional retail stores, sporting goods chains, and specialty winter sports shops remain preferred channels for equipment purchases. Consumers value the ability to physically inspect products, assess quality, and receive expert guidance from sales staff. Moreover, immediate product availability during peak winter seasons drives offline channel preference.

Online channels are experiencing gradual growth as e-commerce infrastructure improves and digital adoption increases. Digital platforms offer convenience, competitive pricing, and wider product selection compared to physical stores. Additionally, online channels provide access to customer reviews, detailed specifications, and seasonal discounts. The COVID-19 pandemic accelerated this shift, making consumers more comfortable purchasing sporting goods online without physical examination.

Key Market Segments

By Product

- Sleds

- Plastic

- Foam

- Others

- Tubes

- Plastic

- Foam

- Others

By Distribution Channel

- Offline

- Online

Drivers

Rising Participation in Recreational Winter Sports Drives Market Expansion

Growing consumer interest in outdoor winter activities fuels steady demand for sporting goods equipment. Adventure tourism and seasonal travel to snow destinations encourage consumers to invest in quality gear. Moreover, winter sports participation extends beyond traditional markets into emerging regions with developing infrastructure. This expanding consumer base creates sustained growth opportunities for manufacturers and retailers.

Increasing disposable incomes enable consumers to spend more on premium winter sporting equipment and accessories. Quality-conscious buyers seek durable, high-performance products that enhance their winter sports experience. Additionally, social media and digital content showcasing winter sports adventures inspire broader participation. These factors collectively drive consumer willingness to invest in specialized equipment rather than basic alternatives.

Seasonal tourism growth to ski resorts and snow parks generates consistent equipment purchases from both tourists and locals. Furthermore, families increasingly view winter sports as bonding activities, driving demand for products across age groups. Event hosting and winter sports competitions also boost local market interest. These recreational trends establish strong foundations for sustained market growth through 2035.

Restraints

Climate Variability Challenges Market Demand Stability

Unpredictable weather patterns and shortened snow seasons directly impact consumer purchasing decisions for snowboarding equipment and other winter sporting goods.Warmer winters reduce snowfall frequency and duration, limiting opportunities for winter sports participation. Consequently, consumers hesitate to invest in equipment that may see limited use. This climate uncertainty creates demand volatility that challenges manufacturers and retailers in inventory and production planning.

Limited accessibility to winter sports infrastructure in non-snow-prone regions significantly restricts market penetration and growth potential. Many geographic areas lack natural snow conditions or artificial facilities for winter sports activities. Moreover, building and maintaining snow parks or indoor facilities requires substantial investment. This infrastructure gap prevents market expansion into tropical and temperate regions with interested consumers but inadequate facilities.

Seasonal nature of winter sporting goods creates concentrated demand periods, complicating business sustainability for specialized retailers. Additionally, equipment storage requirements and single-season utility reduce purchase frequency compared to year-round sporting goods. These factors collectively restrain market growth by limiting both geographic reach and purchase cycles. Therefore, market participants must navigate these inherent challenges affecting long-term revenue stability and expansion strategies.

Growth Factors

Technological Innovation Creates New Market Opportunities

Development of lightweight and smart-integrated winter sporting equipment attracts tech-savvy consumers seeking enhanced performance experiences. Modern materials technology enables production of stronger yet lighter products that improve user experience and safety. Additionally, integration of tracking devices and wearable technology appeals to data-driven consumers. These innovations differentiate premium products and justify higher price points in competitive markets.

Expansion of e-commerce platforms and direct-to-consumer sales channels transforms winter sporting goods distribution dynamics. Online marketplaces provide manufacturers direct access to consumers, reducing intermediary costs and improving profit margins. Furthermore, digital channels enable personalized marketing and targeted seasonal promotions. This distribution evolution creates new revenue streams and expands market reach beyond traditional geographic limitations.

Growing demand for rental and subscription-based winter equipment services addresses consumer preferences for flexibility without ownership commitments. These business models particularly appeal to occasional participants and tourists who prefer temporary access over purchases. Moreover, rental services reduce financial barriers to winter sports participation, expanding the consumer base. Consequently, service-based models complement traditional sales while creating recurring revenue opportunities for market participants.

Emerging Trends

Sustainability Reshapes Product Development and Consumer Preferences

Surge in demand for eco-friendly and recyclable winter sports equipment materials reflects growing environmental consciousness among consumers. Manufacturers increasingly adopt sustainable production practices and biodegradable materials to meet these preferences. Additionally, brands highlighting environmental commitments gain competitive advantages in marketing and customer loyalty. This sustainability trend influences product design, material selection, and overall market positioning strategies across the industry.

Integration of wearable technology and performance tracking devices transforms winter sports gear into connected equipment ecosystems. Smart helmets, GPS-enabled devices, and sensor-equipped products provide real-time performance data and safety monitoring. Furthermore, these technologies enable social sharing and competitive features that enhance user engagement. Young consumers particularly drive adoption of tech-integrated products, establishing new expectations for premium winter sporting goods.

Growing preference for custom-fitted and personalized winter sporting equipment addresses diverse consumer needs and body types. Advanced manufacturing techniques enable cost-effective customization previously available only in professional-grade equipment. Moreover, personalization extends beyond fit to include design aesthetics and functional specifications. This trend creates differentiation opportunities for brands while enhancing customer satisfaction through tailored products meeting individual requirements and preferences.

Regional Analysis

North America Dominates the Winter Sporting Goods Market with a Market Share of 42.70%, Valued at USD 198.5 Million

North America leads the global market with a 42.70% share valued at USD 198.5 Million, driven by established winter sports culture and extensive infrastructure. The region benefits from major mountain and ski resorts, well-developed tourism sectors, and high consumer spending on recreational equipment. Additionally, strong retail networks and e-commerce penetration facilitate product accessibility. The United States and Canada represent primary markets with consistent demand driven by domestic participation and international tourism.

Europe Winter Sporting Goods Market Trends

Europe maintains significant market presence with strong skiing traditions in Alpine countries and Nordic regions. Well-established ski tourism infrastructure and high participation rates drive steady equipment demand. Moreover, European consumers demonstrate preference for premium quality products and sustainable manufacturing practices. Countries like Switzerland, Austria, France, and Germany lead regional consumption with mature markets and sophisticated consumer preferences.

Asia Pacific Winter Sporting Goods Market Trends

Asia Pacific represents an emerging market with growing interest in winter sports, particularly in China, Japan, and South Korea. Government investments in winter sports infrastructure and hosting of international events boost regional participation. Additionally, rising middle-class incomes enable increased spending on recreational activities and equipment. The region shows strong growth potential despite limited natural snow conditions in many areas.

Latin America Winter Sporting Goods Market Trends

Latin America demonstrates limited but growing market participation concentrated in countries with mountainous regions supporting winter sports. Chile and Argentina lead regional activity with ski resorts attracting domestic and international tourists. However, market size remains constrained by climate conditions and economic factors. Nonetheless, premium segments show steady demand from affluent consumers seeking quality equipment for seasonal activities.

Middle East & Africa Winter Sporting Goods Market Trends

Middle East and Africa represent niche markets with minimal natural winter sports infrastructure but growing artificial facility development. Indoor ski parks and snow facilities in Gulf countries create unique market opportunities. Additionally, tourism to international ski destinations drives some equipment purchases. However, overall market contribution remains small compared to traditional winter sports regions with natural snow conditions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Tube Pro, Inc. specializes in manufacturing high-quality snow tubes and winter sporting accessories for recreational and commercial markets. The company focuses on durable construction and safety features that appeal to families and snow park operators. Their product portfolio includes various sizes and designs catering to different age groups and usage scenarios. Moreover, Tube Pro maintains strong distribution networks across North American markets, ensuring broad product availability during peak winter seasons.

Airhead Sports Group offers diverse winter sporting products including tubes, sleds, and protective gear for snow sports enthusiasts. The company emphasizes innovation in product design and material technology to enhance user experience and safety. Additionally, Airhead leverages its brand reputation in water sports to cross-market winter products to existing customer base. Their multi-channel distribution strategy combines traditional retail partnerships with growing direct-to-consumer online sales platforms.

L.L. Bean represents a premium outdoor equipment retailer with extensive winter sporting goods offerings backed by strong brand heritage. The company’s commitment to quality and customer service positions it favorably among discerning consumers seeking reliable equipment. Furthermore, L.L. Bean’s integrated retail presence combines physical stores with robust e-commerce capabilities. Their lifetime satisfaction guarantee differentiates the brand in competitive markets where product durability and performance matter significantly to purchasing decisions.

Agit Global, Inc. manufactures winter sporting goods with focus on innovative designs and competitive pricing strategies targeting value-conscious consumers. The company serves both domestic and international markets through diversified distribution channels. Additionally, Agit invests in product development to introduce features that enhance safety and usability. Their flexible manufacturing capabilities enable quick response to market trends and seasonal demand fluctuations in different geographic regions.

Key players

- Tube Pro, Inc.

- Airhead Sports Group

- L.L. Bean

- Agit Global, Inc.

- Bestway Inflatables & Material Corp.

- Emsco Group

- Slippery Racer

- Franklin Sports Inc.

- Gizmo Riders

Recent Developments

- July 2025 – The Uvex Group, a leading manufacturer of winter sports protection equipment, was acquired by a private equity firm. This acquisition aims to accelerate product innovation and expand global market presence through strategic investments in technology and distribution networks.

- October 2025 – Women’s ski brand Halfdays successfully raised $10 Million in Series A funding to expand product lines and strengthen retail partnerships. The investment supports the company’s mission to make winter sports more accessible and inclusive for female participants across diverse skill levels.

- October 2025 – Ciele Athletics partnered with Woolmark to develop innovative winter apparel and headwear combining performance textiles with sustainable wool materials. This collaboration focuses on creating products that enhance comfort and functionality while meeting growing consumer demand for eco-friendly sporting goods.

- March 2025 – TSG expanded its snowsports protection range through a new partnership with RE ZRO for sustainable helmet materials. The collaboration introduces recyclable protection equipment addressing environmental concerns while maintaining high safety standards required for winter sports applications.

- February 2025 – Authentic Brands Group announced a strategic partnership with Outdoor Collective for the Spyder brand, aiming to enhance distribution and marketing capabilities. This partnership strengthens Spyder’s position in premium winter sporting goods and expands its reach across key retail channels.

Report Scope

Report Features Description Market Value (2025) USD 465.1 Million Forecast Revenue (2035) USD 787 Million CAGR (2026-2035) 5.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Sleds (Plastic, Foam, Others), Tubes (Plastic, Foam, Others)), By Distribution Channel (Offline, Online) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Tube Pro, Inc., Airhead Sports Group, L.L. Bean, Agit Global, Inc., Bestway Inflatables & Material Corp., Emsco Group, Slippery Racer, Franklin Sports Inc., Gizmo Riders Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Winter Sporting Goods MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Winter Sporting Goods MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Tube Pro, Inc.

- Airhead Sports Group

- L.L. Bean

- Agit Global, Inc.

- Bestway Inflatables & Material Corp.

- Emsco Group

- Slippery Racer

- Franklin Sports Inc.

- Gizmo Riders