Global Winter Care Cream Products Market Size, Share, Growth Analysis By Type (Normal Skin Care Cream, Oily Skin Care Cream, Dry Skin Care Cream), By Application (Households, Hospitals, Cancer Centers, Surgical Centers, Ambulatory Surgical Centers, Others), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172165

- Number of Pages: 273

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

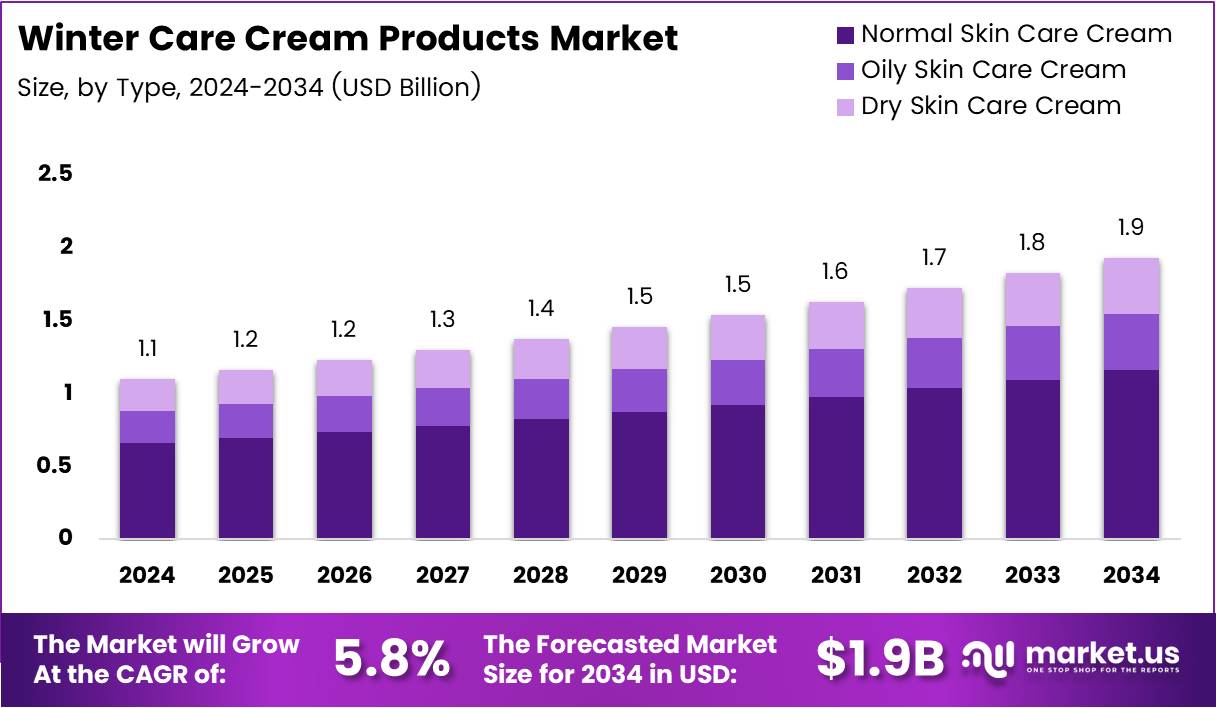

The Global Winter Care Cream Products Market is projected to reach approximately USD 1.9 Billion by 2034, up from USD 1.1 Billion in 2024. This growth reflects a robust compound annual growth rate of 5.8% during the forecast period from 2025 to 2034.

Winter care cream products represent specialized moisturizing formulations designed to combat seasonal dryness, cold-induced skin damage, and environmental stressors. These products address skin barrier restoration during harsh winter months when humidity drops and heating systems intensify dehydration.

The market continues expanding as consumers increasingly recognize the importance of season-specific skincare regimens. Growing awareness about dermatological health drives demand for targeted winter protection. Urbanization patterns expose populations to combined challenges of indoor heating and outdoor cold exposure.

Consumer behavior shifts significantly as multi-generational demographics embrace winter skincare routines. Men, children, and elderly populations now actively seek protective formulations beyond traditional moisturizers. Daily skincare adoption rates demonstrate this trend, with 82% of women and 62% of men following consistent routines according to market research surveys.

Product innovation accelerates through dermatologist-recommended formulations incorporating barrier-repair ingredients. Manufacturers prioritize medical-grade moisturizers that address clinical conditions like xerosis and eczema. Natural and organic segments gain traction as consumers demand transparency in ingredient sourcing and formulation safety.

Distribution channels evolve rapidly with e-commerce platforms expanding accessibility across geographic boundaries. Direct-to-consumer brands leverage digital marketing to educate consumers about climate-specific skincare needs. Offline retail maintains dominance while online channels capture growing market share through convenience and personalized recommendations.

Regional variations influence product development strategies as manufacturers tailor formulations to specific climatic conditions. Northern markets with prolonged winter seasons demonstrate stronger adoption rates compared to temperate regions. Government regulations increasingly mandate safety testing and labeling requirements for cosmetic products, ensuring consumer protection standards.

Key Takeaways

- Global Winter Care Cream Products Market valued at USD 1.1 Billion in 2024, projected to reach USD 1.9 Billion by 2034.

- Market expanding at a CAGR of 5.8% during the forecast period 2025-2034.

- Normal Skin Care Cream segment dominates with 47.8% market share in type analysis.

- Households application segment leads with 51.2% market share.

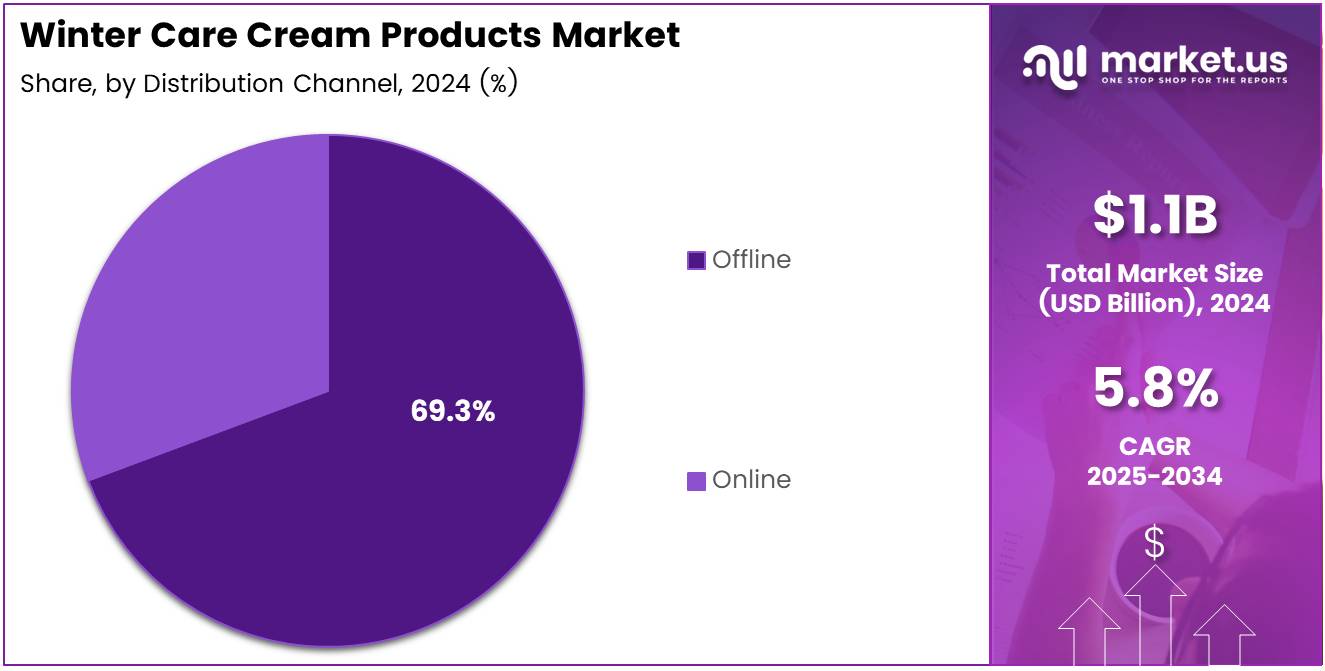

- Offline distribution channel commands 69.3% of total market share.

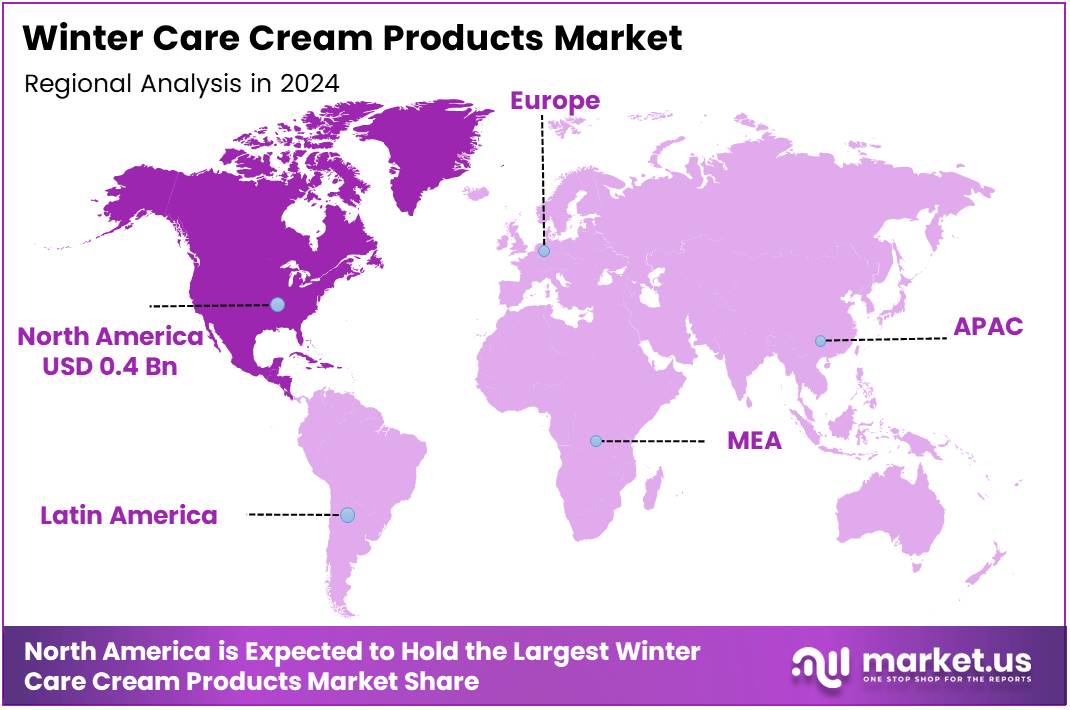

- North America leads regional markets with 39.4% share, valued at USD 0.4 Billion.

By Type

Normal Skin Care Cream dominates with 47.8% market share due to broad consumer applicability and balanced formulation requirements.

In 2024, Normal Skin Care Cream held a dominant market position in the By Type segment of Winter Care Cream Products Market, with a 47.8% share. This segment appeals to the widest consumer demographic seeking preventive winter skincare solutions. Formulations balance hydration without excessive oil content, making them suitable for everyday use. Manufacturers prioritize lightweight textures that absorb quickly while providing lasting moisture retention throughout winter conditions.

Oily Skin Care Cream addresses specific challenges faced by consumers with sebum-prone complexions during winter months. These products utilize mattifying ingredients combined with hydration agents to prevent both dryness and excess shine. The segment grows steadily as awareness increases about maintaining skin balance even when temperatures drop. Gel-based and water-light formulations dominate this category, offering hydration without clogging pores or adding greasiness.

Dry Skin Care Cream caters to consumers experiencing severe dehydration and flaking during cold seasons. These intensive formulations incorporate rich emollients, occlusives, and humectants to repair compromised skin barriers. The segment attracts consumers with existing dermatological conditions requiring therapeutic-grade moisturization. Product development focuses on overnight repair creams and ultra-nourishing textures that provide extended protection against harsh environmental elements.

By Application

Households application dominates with 51.2% market share driven by daily personal care routines and family-wide usage patterns.

In 2024, Households held a dominant market position in the By Application segment of Winter Care Cream Products Market, with a 51.2% share. Residential consumers purchase winter care creams for regular preventive skincare within family settings. Multiple household members utilize these products across different age groups and skin types. The convenience of at-home application and over-the-counter accessibility drives consistent purchasing behavior throughout winter seasons.

Hospitals represent specialized application settings where winter care creams address medical dermatology needs. Healthcare facilities utilize therapeutic-grade moisturizers for patients experiencing treatment-related skin dryness or sensitivity. Medical-grade formulations meet stringent safety and efficacy standards required in clinical environments. Dermatology departments stock winter care products as part of comprehensive treatment protocols for various skin conditions.

Cancer Centers require specialized winter skincare products for patients undergoing chemotherapy and radiation treatments. These therapies often cause severe skin sensitivity and moisture barrier disruption. Winter conditions compound these challenges, necessitating gentle yet effective moisturizing solutions. Oncology-approved formulations avoid fragrances and irritants while delivering intensive hydration for compromised skin.

Surgical Centers and Ambulatory Surgical Centers utilize winter care creams for post-operative skin recovery protocols. Surgical procedures can temporarily weaken skin barrier function, requiring specialized moisturization support. Winter months present additional healing challenges due to low humidity and temperature fluctuations. Medical professionals recommend specific formulations that support tissue repair without interfering with healing processes.

Other applications encompass spas, wellness centers, and professional skincare clinics offering seasonal treatment programs. These facilities integrate winter care creams into comprehensive skincare services and retail product lines. Professional recommendations from aestheticians and dermatologists influence consumer purchasing decisions significantly within this segment.

By Distribution Channel

Offline distribution dominates with 69.3% market share through established retail presence and immediate product accessibility.

In 2024, Offline distribution held a dominant market position in the By Distribution Channel segment of Winter Care Cream Products Market, with a 69.3% share. Traditional retail channels including pharmacies, supermarkets, specialty stores, and department stores maintain strong consumer preference.

Physical shopping allows customers to examine product textures, test samples, and receive immediate assistance from beauty consultants. Established brand presence across multiple retail touchpoints reinforces consumer trust and facilitates impulse purchases during winter months.

Online distribution channels experience rapid growth as e-commerce platforms expand skincare product accessibility. Digital retail offers convenience, competitive pricing, and comprehensive product information including user reviews and ingredient analysis. Direct-to-consumer brands leverage online channels to build relationships through subscription models and personalized recommendations. Mobile commerce and social media integration create seamless purchasing experiences that attract younger demographics seeking winter skincare solutions.

Key Market Segments

By Type

- Normal Skin Care Cream

- Oily Skin Care Cream

- Dry Skin Care Cream

By Application

- Households

- Hospitals

- Cancer Centers

- Surgical Centers

- Ambulatory Surgical Centers

- Others

By Distribution Channel

- Offline

- Online

Drivers

Rising Incidence of Seasonal Skin Conditions Drives Winter Care Cream Demand

The increasing prevalence of seasonal xerosis, eczema, and cold-induced skin barrier damage significantly propels market expansion. Winter months trigger dermatological challenges as low temperatures reduce natural skin moisture retention. Cold weather compromises the lipid barrier, leading to increased transepidermal water loss and flaking.

Urban populations face compounded exposure to environmental stressors during winter seasons. Low humidity levels combined with indoor heating systems create exceptionally dry conditions that strip skin moisture. Air pollution particles interact with compromised skin barriers, intensifying irritation and sensitivity. These factors collectively drive consumers toward specialized winter protection formulations.

Growing consumer preference for dermatologist-recommended moisturizing creams reflects increased health consciousness. Medical professionals increasingly prescribe medicated formulations for preventive and therapeutic winter skincare. Evidence-based recommendations influence purchasing decisions as consumers prioritize clinically proven efficacy over marketing claims alone.

Demographic expansion across winter skincare adoption creates substantial market opportunities. Men, children, and geriatric populations now actively participate in seasonal skincare routines beyond traditional female-dominated categories. This multi-generational adoption pattern broadens the consumer base and increases household purchasing frequency throughout winter periods.

Restraints

Seasonal Demand Fluctuations Create Market Challenges

Seasonal demand concentration presents significant challenges for winter care cream manufacturers and retailers. Sales volumes peak sharply during autumn and winter months before declining precipitously in spring and summer. This cyclical pattern creates inventory management complications and revenue volatility that affects business planning and resource allocation.

Manufacturers must balance production capacity to meet seasonal peaks without excess inventory carrying costs during off-seasons. Retailers face similar challenges in shelf space allocation and promotional timing. Cash flow irregularities impact smaller brands disproportionately, limiting their ability to compete with established players maintaining year-round operations.

Consumer sensitivity to product textures restrains market penetration despite growing awareness. Many traditional winter care formulations feature heavy, greasy consistencies that consumers find uncomfortable for daily use. Slow absorption rates discourage application frequency, particularly among working professionals requiring quick-drying products. Product residue concerns affect consumer satisfaction and repeat purchase behavior.

Formulation challenges persist as manufacturers attempt to balance intensive moisturization with acceptable aesthetic properties. Heavy occlusive ingredients effective for barrier repair often compromise product elegance. Consumer preference increasingly demands lightweight textures delivering clinical-grade hydration without cosmetic drawbacks traditionally associated with therapeutic moisturizers.

Growth Opportunities

Climate-Specific Product Innovation Opens New Market Segments

Development of climate-specific and regionally tailored winter skincare formulations presents substantial growth opportunities. Different geographic regions experience varying winter conditions requiring customized product solutions. Manufacturers can capture market share by addressing specific environmental challenges unique to each climate zone.

Arctic and subarctic regions require ultra-protective formulations against extreme cold and wind exposure. Temperate zones need moderate hydration balancing indoor heating effects. Manufacturers developing regional product lines can command premium pricing through targeted efficacy positioning.

Expansion of natural, organic, and dermatologically tested winter care cream lines addresses evolving consumer preferences. Clean beauty movements drive demand for transparent ingredient sourcing and sustainable formulations. Certification from dermatological associations provides competitive differentiation and builds consumer trust in product safety and efficacy.

E-commerce penetration and direct-to-consumer brand growth revolutionize distribution strategies. Digital platforms enable niche brands to reach consumers without traditional retail barriers. Subscription models create predictable revenue streams while building customer loyalty through personalized product recommendations and seasonal reminders.

Multi-functional cream development combining moisturization, barrier repair, and UV protection addresses comprehensive winter skincare needs. Consumers increasingly prefer streamlined routines with products delivering multiple benefits. Formulations incorporating SPF protection recognize that UV damage continues during winter months despite reduced sun intensity perception.

Emerging Trends

Advanced Ingredient Technologies Transform Winter Skincare Formulations

The shift toward ceramide-rich, hyaluronic acid, and barrier-repair cream formulations represents a fundamental evolution in winter skincare science. Ceramides restore natural lipid barriers compromised by cold weather exposure. Hyaluronic acid provides multi-level hydration by attracting moisture into deeper skin layers while maintaining surface smoothness.

Barrier-repair technologies incorporate biomimetic ingredients that mimic skin’s natural moisturizing factors. These advanced formulations address root causes of winter dryness rather than providing temporary surface relief. Scientific validation through clinical trials supports premium positioning and justifies higher price points for technology-driven products.

Growing popularity of fragrance-free and sensitive-skin winter care products reflects increased awareness of potential irritants. Consumers with reactive skin seek minimal formulations eliminating unnecessary additives. Dermatologist recommendations increasingly favor unscented options that reduce allergic reaction risks while maintaining therapeutic efficacy.

Premiumization through clinical claims and long-lasting hydration labeling elevates market value propositions. Brands emphasize scientifically measured hydration duration extending beyond typical moisturizer performance. Claims such as 24-hour or 48-hour moisture retention differentiate premium products from standard offerings, justifying higher pricing through quantifiable benefits.

Adoption of sustainable packaging and clean-label ingredient transparency aligns with broader consumer values. Environmental consciousness drives demand for recyclable containers, reduced plastic usage, and refillable packaging systems. Ingredient transparency through complete disclosure and simplified labeling builds trust with health-conscious consumers scrutinizing product compositions before purchase decisions.

Regional Analysis

North America Dominates the Winter Care Cream Products Market with a Market Share of 39.4%, Valued at USD 0.4 Billion

North America leads the global winter care cream products market, commanding a 39.4% share valued at USD 0.4 Billion in the regional distribution. The region’s prolonged winter seasons across northern states and Canadian provinces drive consistent demand for specialized skincare solutions. High consumer awareness about dermatological health, combined with strong purchasing power, supports premium product adoption. Established retail infrastructure and advanced e-commerce penetration facilitate widespread product accessibility throughout the region.

Europe Winter Care Cream Products Market Trends

Europe represents a mature market with sophisticated consumer preferences for science-backed formulations and natural ingredients. Northern European countries demonstrate particularly strong adoption rates due to harsh winter climates. Regulatory frameworks emphasizing product safety and ingredient transparency shape market development. Premium and luxury segments perform strongly across Western European markets where consumers prioritize quality over price considerations.

Asia Pacific Winter Care Cream Products Market Trends

Asia Pacific exhibits the fastest growth trajectory driven by rising disposable incomes and expanding middle-class populations. Countries with distinct winter seasons show increasing adoption of specialized seasonal skincare routines. Korean and Japanese beauty innovations influence regional product development and consumer preferences. E-commerce platforms accelerate market penetration in emerging economies where traditional retail infrastructure remains underdeveloped in certain areas.

Middle East and Africa Winter Care Cream Products Market Trends

Middle East and Africa present niche opportunities in specific geographic pockets experiencing winter conditions. Northern African regions and mountainous areas demonstrate demand for protective skincare during cooler months. Urban populations in Gulf countries seek moisturizing solutions addressing air conditioning-induced dryness during winter travel to colder climates. Market development remains nascent but shows potential as skincare awareness increases across diverse consumer segments.

Latin America Winter Care Cream Products Market Trends

Latin America shows moderate growth concentrated in southern regions experiencing distinct winter seasons. Countries like Argentina and Chile demonstrate stronger adoption patterns compared to tropical northern regions. Urban consumers increasingly embrace international skincare trends including seasonal product rotation. Economic fluctuations impact premium product adoption, creating opportunities for mid-tier brands offering quality formulations at accessible price points.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Winter Care Cream Products Company Insights

Lancome maintains a strong position in the premium winter skincare segment through advanced formulation technologies and luxury positioning. The brand leverages scientific research to develop high-performance creams incorporating proprietary ingredients that address cold-weather skin challenges. Distribution through prestige channels and department stores reinforces brand exclusivity while digital platforms expand accessibility. Clinical studies validating product efficacy support premium pricing and build consumer trust in product performance during harsh winter conditions.

Nivea dominates the mass-market segment with trusted formulations offering reliable winter protection at accessible price points. The brand’s heritage in skincare moisturization creates strong consumer loyalty across multiple generations. Extensive retail distribution ensures product availability in diverse markets globally. Family-oriented marketing positions Nivea as a household staple for winter skincare needs across all age groups and skin types.

L’Oréal leverages its extensive research capabilities and diverse brand portfolio to capture multiple market segments simultaneously. The company’s recent acquisition strategies, including taking a majority stake in Medik8, demonstrate commitment to expanding science-backed skincare offerings. Innovation in formulation technologies and ingredient sourcing positions L’Oréal brands across premium and mass-market categories. Strategic investments in sustainable practices and digital commerce platforms align with evolving consumer values and shopping behaviors.

Neutrogena excels in the dermatologist-recommended segment with clinically proven formulations addressing specific winter skin concerns. The brand’s medical heritage and pharmaceutical-grade approach appeal to consumers seeking therapeutic solutions beyond cosmetic benefits. Clear ingredient labeling and fragrance-free options cater to sensitive skin populations requiring hypoallergenic winter protection. Strong pharmacy channel presence ensures accessibility for consumers prioritizing health-focused skincare purchases.

Key Players

- Lancome

- Nivea

- Garnier

- Shiseido

- Aesop

- Neutrogena

- Pond’s

- Lakmé

- L’Oréal

- Vesaline

Recent Developments

- September 2025: Karo Healthcare acquires science-backed skin care to strengthen presence in Northern Europe. This strategic acquisition expands Karo Healthcare’s portfolio in the dermatologically-focused skincare segment, particularly targeting winter care solutions for Nordic markets where harsh climates demand specialized formulations.

- June 2025: L’Oréal Groupe to acquire a majority stake in Medik8. This acquisition reinforces L’Oréal’s commitment to science-backed skincare innovation and expands its presence in the clinical-grade beauty segment. Medik8’s expertise in vitamin-based formulations complements L’Oréal’s winter skincare development strategies.

- November 2025: Pelthos Therapeutics Acquires Xepi® (ozenoxacin) Cream, 1% and Announces $18 Million Private Convertible Notes Financing. This development demonstrates growing investment in therapeutic skincare formulations. The acquisition strengthens Pelthos’s dermatology portfolio, potentially expanding into winter-specific medicated skincare applications addressing bacterial complications from dry, cracked skin.

Report Scope

Report Features Description Market Value (2024) USD 1.1 Billion Forecast Revenue (2034) USD 1.9 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Normal Skin Care Cream, Oily Skin Care Cream, Dry Skin Care Cream), By Application (Households, Hospitals, Cancer Centers, Surgical Centers, Ambulatory Surgical Centers, Others), By Distribution Channel (Offline, Online) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Lancome, Nivea, Garnier, Shiseido, Aesop, Neutrogena, Pond’s, Lakmé, L’Oréal, Vesaline Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Winter Care Cream Products MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Winter Care Cream Products MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Lancome

- Nivea

- Garnier

- Shiseido

- Aesop

- Neutrogena

- Pond's

- Lakmé

- L'Oréal

- Vesaline