Global Wine E-commerce Market Size, Share, Industry Analysis Report By Service Level (Instant/On-Demand, Same/Next-Day, Scheduled), By Wine Type (Red Wine, White Wine, Rose Wine, Others), By Applications (Commercial, Residential), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 161999

- Number of Pages: 370

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

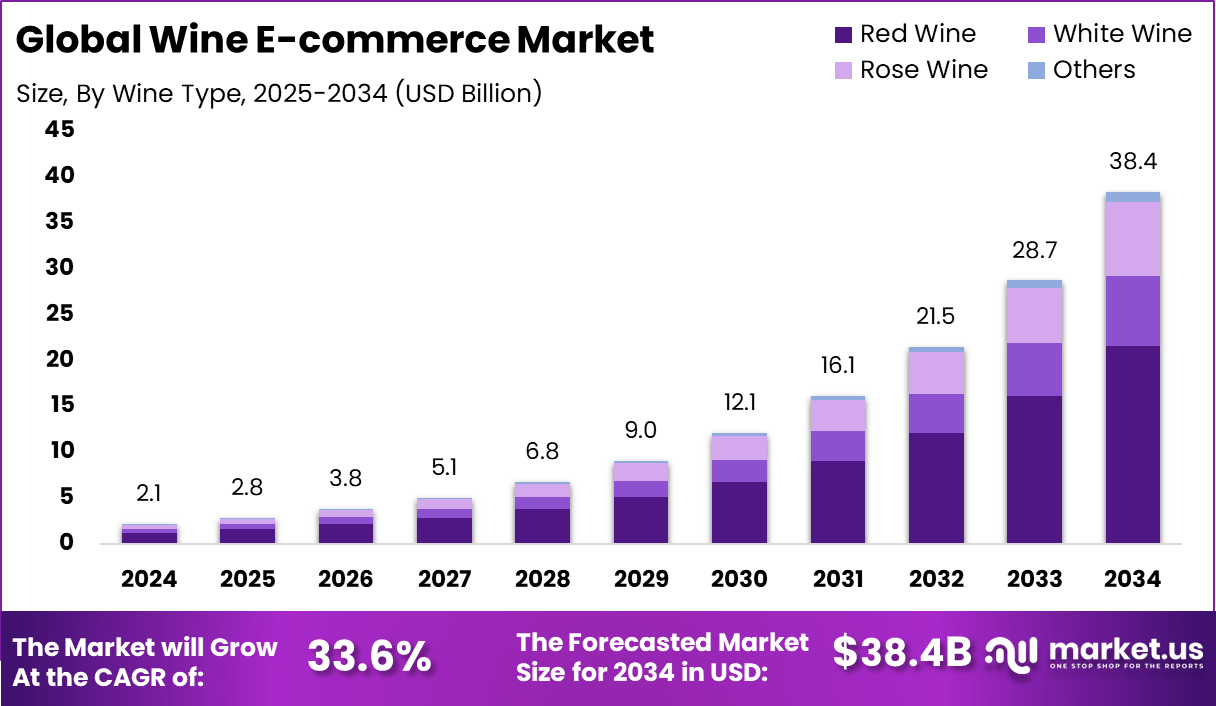

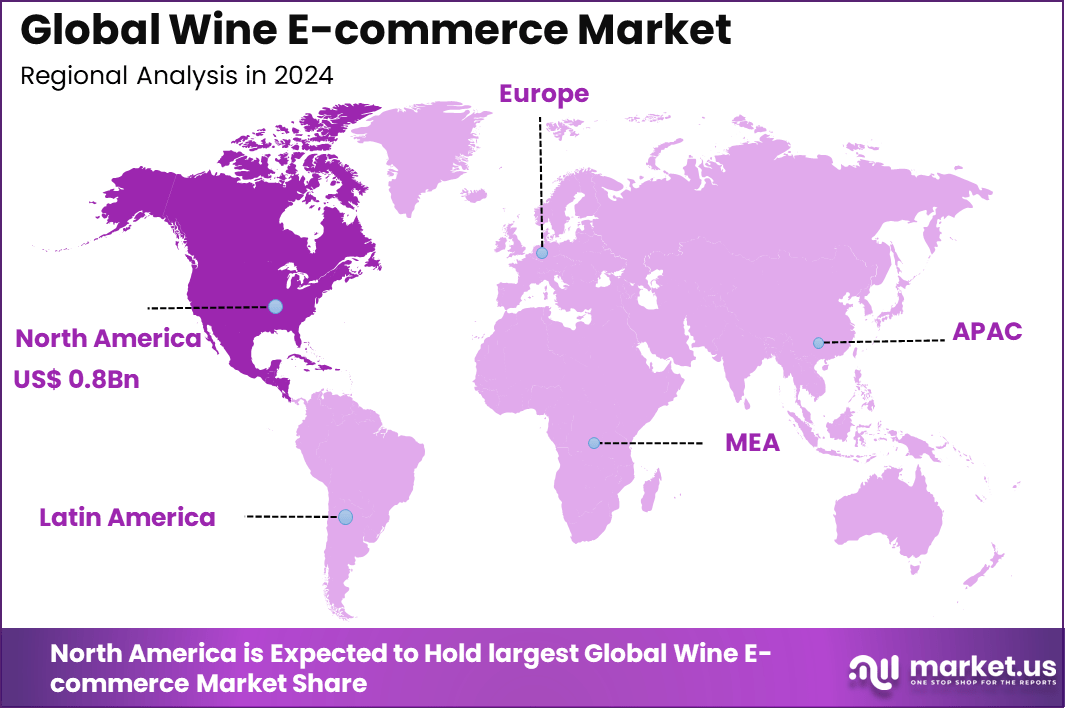

The Global Wine E-commerce Market generated USD 2.1 billion in 2024 and is predicted to register growth from USD 2.8 billion in 2025 to about USD 38.4 billion by 2034, recording a CAGR of 33.6% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 39.3% share, holding USD 0.8 Billion revenue.

The wine e-commerce market involves the online sale and delivery of wines through digital platforms, marketplaces, direct-to-consumer websites, apps, and subscription models. It covers domestic and imported labels, premium wines, everyday table wines, and curated collections. Both established retailers and independent wineries operate through online channels to reach consumers without relying solely on physical distribution.

Growth is influenced by increased consumer comfort with online alcohol shopping, wider product availability, and the convenience of home delivery. Digital platforms allow access to regional and international varieties that are not always stocked in local stores. Personalized recommendations, virtual tastings, and targeted promotions support customer engagement. Legal changes in some markets have enabled broader direct shipping to consumers.

Top Market Takeaways

- Instant or on-demand wine delivery held 38.9% of the market, showing consumers favour quick access over scheduled services.

- Red wine accounted for 56.2%, making it the most ordered category across delivery platforms.

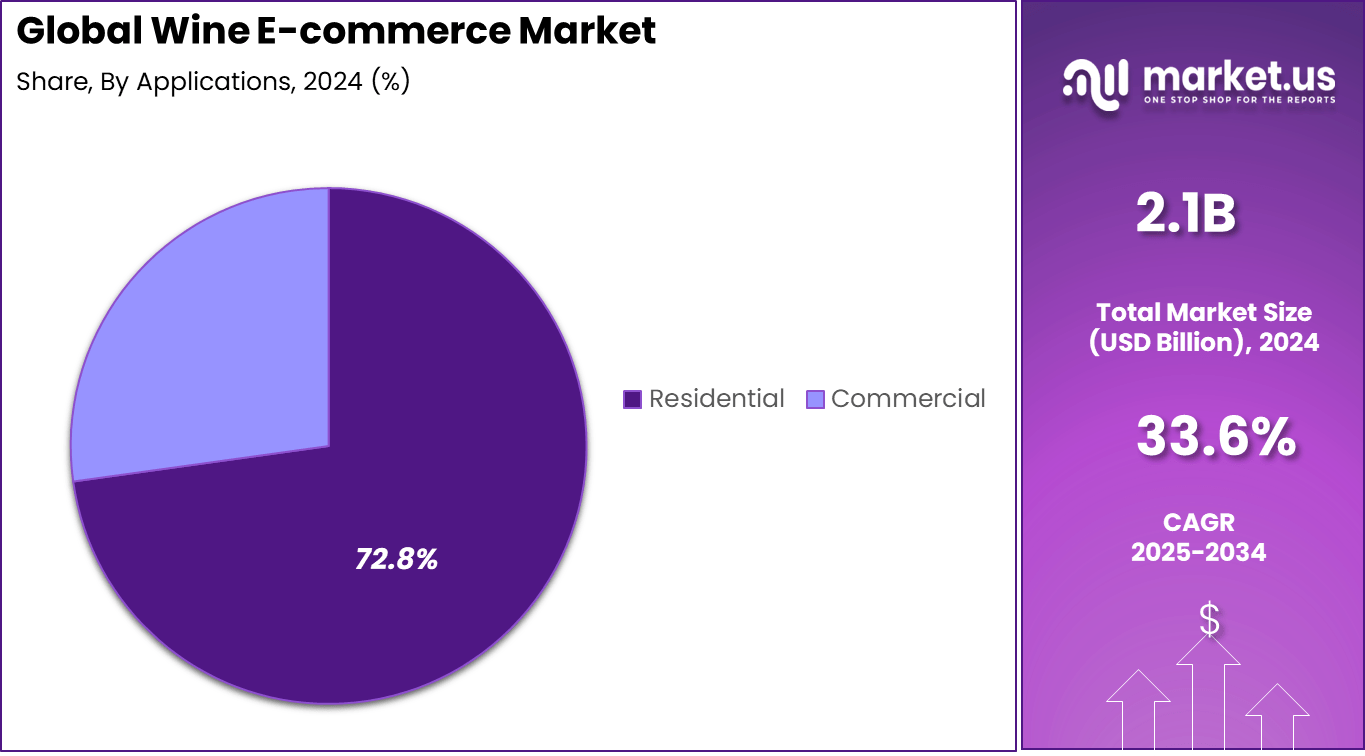

- Residential customers drove 72.8% of total demand, confirming that home consumption remains the primary use case.

- North America captured 39.3% of global share, supported by strong adoption of app-based alcohol delivery.

- The US market stood at USD 0.75 Billion with a fast 31.7% CAGR, driven by convenience purchases and higher spending on premium wine at home.

Quick Market Facts

- Market Growth: USD 2.1 Billion

- Market Future Opportunities: USD 38.4 Billion

- CAGR : 33.6%

- North America: Largest market in 2024

US Market Size

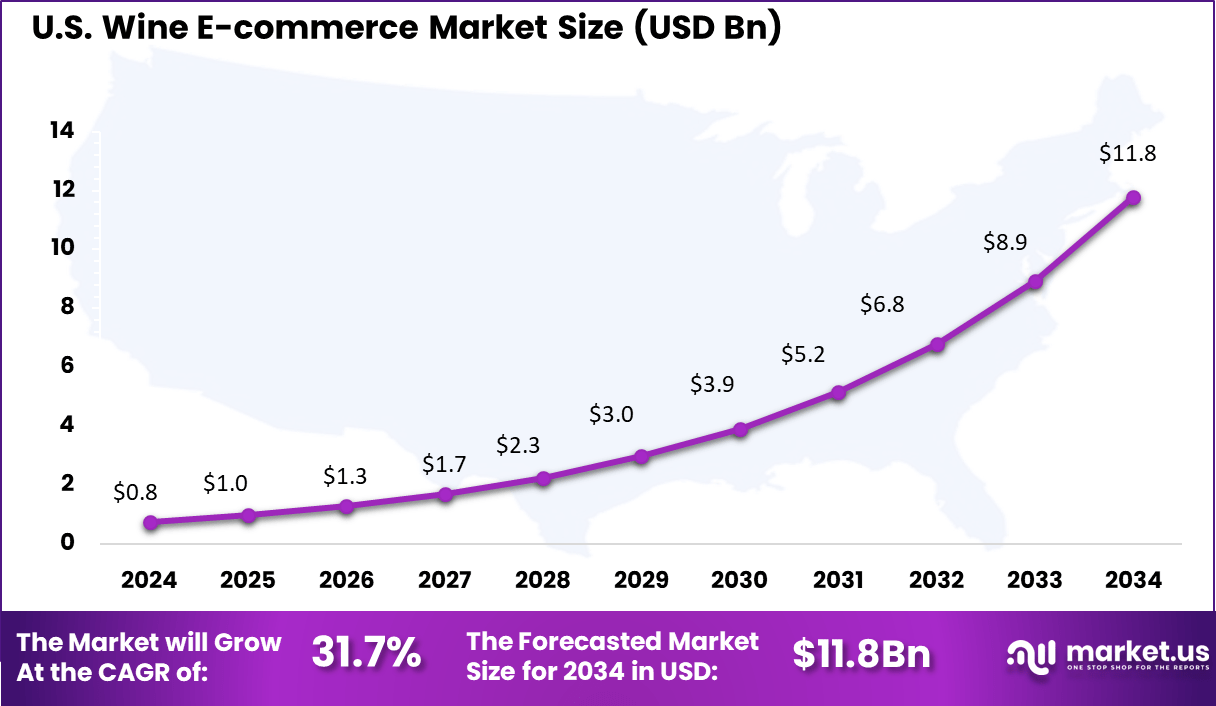

According to the Wine Institute, Americans consumed 899 million gallons of wine in 2023, reflecting a stable demand across both casual and premium segments. Most consumers continue to purchase wine through supermarkets and specialty stores, which remain the primary retail channels. However, the digital shift is reshaping purchasing behavior as online wine sales have nearly doubled their share of total revenue over the past decade.

Mobile commerce is set to play a dominant role in this shift. By 2027, mobile wine sales are expected to exceed desktop purchases at a 60/40 split, signaling stronger engagement through apps and mobile-optimized platforms. This transition highlights the increasing influence of digital channels in shaping the future of wine retail in the United States.

The U.S. Wine E-commerce Market was valued at USD 0.8 Billion in 2024 and is anticipated to reach approximately USD 11.8 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 31.7% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than a 39.3% share and achieving approximately USD 0.8 billion in revenue. The region’s leading status is driven by its advanced digital retail infrastructure, high levels of internet and smartphone penetration, and a strong culture of online purchasing for alcoholic beverages.

Consumers in the U.S. and Canada are increasingly embracing the convenience of remote wine ordering, including curated subscriptions and direct-to-consumer delivery models, which has bolstered online wine sales relative to other regions. The region’s structural advantages further reinforce its leadership. Established online wine retailers and platforms have developed sophisticated age-verification, logistics, and fulfillment systems to comply with regulatory complexities, enabling smoother market operations.

In parallel, the proliferation of premium and super-premium wine segments among North American consumers has elevated average order values and encouraged e-commerce channel expansion. Under these conditions, North America has maintained its pre-eminent share in the global wine-e-commerce sector.

By Service Level

In 2024, the service-level segment corresponding to Instant/On-Demand channels claimed approximately 38.9% of the wine e-commerce market. This share reflects increasing consumer demand for immediate fulfilment and convenience in online wine purchase. The growth of mobile ordering, local delivery networks and aggregators has enabled wine purchases within hours, thereby reducing friction for impulse or last-minute buying.

For example, rapid delivery models originally popular in food and grocery are extending into alcohol and wine categories, supporting the prominence of this service-level segment. Moreover, regulatory shifts and digital verification systems have lowered barriers for online wine sales in many jurisdictions, enabling retailers and platforms to offer shorter-lead-time fulfilments reliably.

By Wine Type

In 2024, the wine-type segment of Red Wine accounted for roughly 56.2% of the wine e-commerce market. This dominant share underscores the longstanding consumer preference for red varietals in online channels, often attributed to their perceived premium positioning, greater consumer familiarity, and association with occasions and gifting. Previous studies corroborate that red wines lead the online still-wine market in share.

Red wine’s performance in the e-commerce context is further supported by its suitability for longer storage, online cataloguing and pre-purchase decision making. Consumers purchasing red wine online may place less emphasis on immediate consumption and more on selection, ratings and provenance, making them more comfortable transacting via digital channels.

By Application

In 2024, the application segment defined by Residential consumption captured approximately 72.8% of the wine e-commerce market. This strong share reflects the fact that most online wine purchases are directed to end-consumers in domestic settings rather than commercial accounts such as restaurants or hospitality.

Growth in at-home socialising, remote working and home entertainment experiences has reinforced the dominance of residential usage. Consumers increasingly view online wine platforms as convenient substitutes for physical stores, with services tailored to home delivery, subscriptions and direct-to-consumer shipment.

Emerging Trends

A notable trend in the wine e-commerce market is the rise of virtual tastings and immersive digital wine discovery experiences. Consumers are increasingly seeking guidance and storytelling rather than simply browsing lists of labels, and many online platforms have responded by hosting live webinars, curator-led tastings, and interactive pairing sessions. For example, reports highlight how platforms are using augmented reality labels, AI-driven personalization and mobile-first experiences to enhance engagement.

This shift indicates that online wine shopping is moving from a transaction to an experience, which can strengthen brand loyalty and encourage repeat purchases among users who may previously have reserved wine exploration for in-store visits. Over time, the capability to replicate or even improve the physical wine sampling experience online could reshape how consumers discover and buy wine.

Growth Factors

The market growth is further supported by the rapid expansion of digital adoption and lifestyle changes. Increased internet penetration, wider use of smartphones, and secure payment options are making online purchases seamless.

Alongside this, consumer lifestyles are shifting towards premiumisation, where buyers show more interest in unique and quality wines. Social media influence and food pairing culture are also motivating people to try new wine varieties. These factors collectively boost the pace of adoption for online wine shopping.

Key Market Segments

By Service Level

- Instant/On-Demand

- Same/Next-Day

- Scheduled

By Wine Type

- Red Wine

- White Wine

- Rose Wine

- Others

By Applications

- Commercial

- Residential

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Mobile-based purchasing has removed many barriers that once limited online wine buying. Customers no longer need a computer to explore options, compare types or place orders. Mobile apps and optimized websites make the process faster, especially when payment methods are already stored. Easy navigation and fast checkouts have made online alcohol shopping more practical.

Mobile use has also introduced younger demographics to online wine shopping. Social media links, push notifications and app-based promotions play a direct role in capturing attention. As digital habits continue to influence daily spending, wine has become part of regular online shopping routines rather than an occasional purchase.

Restraint

A notable restraint facing the wine e-commerce market is legal and logistical complexity around alcohol shipping and age verification, which increases cost and friction. Many jurisdictions impose strict rules on direct-to-consumer shipments, licensing and cross-border fulfillment, limiting access or forcing platforms to restrict their service area.

Moreover, the fragile and temperature-sensitive nature of wine adds logistic cost and risk (packing, climate-control during transit, returns due to spoilage) which raises the barrier for smaller operators and can reduce margins. These restraints slow broader adoption or make expansion into new regions more challenging.

Opportunity

A promising opportunity lies in tapping emerging markets whose consumers are gaining internet access, e-commerce experience, and curiosity about wine consumption. As report data shows, the Asia Pacific region is growing faster than mature markets owing to rising disposable incomes and changing lifestyles.

Online wine platforms that adapt to local tastes, language interfaces, mobile-first purchasing, and culturally relevant marketing can build early advantage in less-penetrated regions. By doing so, they can capture new customer segments before the market becomes highly saturated.

Challenge

One of the key challenges is maintaining consumer trust and differentiation in an increasingly crowded online marketplace. As more players enter the wine e-commerce space, standing out becomes harder—especially because product selection, shipping reliability and customer reviews all influence consumer loyalty.

Additionally, digital channels tend to reduce the sensory experience (tasting, touch, in-store consultation) which has been a traditional strength for wine retailers. Ensuring that online buyers feel confident in quality, provenance and value requires enhanced service, reliable reviews, transparent sourcing and strong logistics. Without these, conversion and retention may suffer.

Competitive Analysis

The Wine E-Commerce Market is led by major online platforms such as Drizly, Total Wine, Vivino, and Minibar. These companies provide extensive digital marketplaces offering delivery, product discovery, and user reviews. Their platforms enable consumers to compare wines by price, ratings, and origin while supporting fast fulfillment through partnerships with local retailers and distributors.

Large grocery and retail chains including Walmart To Go, Safeway, and Fresh Direct contribute through integrated online ordering and home delivery models. Their ability to combine everyday grocery services with alcohol delivery expands convenience for consumers and boosts cross-category sales. Harris Teeter also supports regional access with curbside pickup and scheduled deliveries.

Specialty platforms such as Naked Wines, WineAccess, BevMo! Corporation, Thirstie, Lot18, and Danta, along with other key participants, focus on curated selections, subscription models, and direct-to-consumer fulfillment. These companies emphasize personalized recommendations, premium sourcing, and exclusive membership offerings, shaping a more experience-driven e-commerce environment for wine enthusiasts.

Top Key Players in the Market

- Drizly

- Total Wine

- Minibar

- Fresh Direct

- BevMo! Corporation

- Safeway

- Harris Teetar

- Walmart To Go

- Vivino

- Thirstie

- Danta

- Naked Wines

- Lot18

- WineAccess

- Others

Recent Developments

- In May 2025, a major player in the packaged food and beverage sector expanded its presence in the wine category with the launch of a subscription platform called WinePass. The service provides members with access to curated selections, seasonal discounts, and exclusive releases. The move reflects a broader push toward recurring revenue models and direct customer engagement, particularly among consumers who prefer personalized offerings and at-home delivery options.

- In April 2025, regulators in the European Union advanced the Digital Single Market framework by approving policies that make it easier for wineries to sell across borders within member states. The update cleared long-standing barriers around licensing and delivery, allowing producers to ship directly to consumers in neighboring countries without separate national approvals. This decision is expected to increase cross-regional transactions and support smaller wineries that were previously limited to domestic sales.

Report Scope

Report Features Description Market Value (2024) USD 2.1 Bn Forecast Revenue (2034) USD 38.4 Bn CAGR(2025-2034) 33.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Service Level (Instant/On-Demand, Same/Next-Day, Scheduled), By Wine Type (Red Wine, White Wine, Rose Wine, Others), By Applications (Commercial, Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Drizly, Total Wine, Minibar, Fresh Direct, BevMo! Corporation, Safeway, Harris Teetar, Walmart To Go, Vivino, Thirstie, Danta, Naked Wines, Lot18, WineAccess, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Drizly

- Total Wine

- Minibar

- Fresh Direct

- BevMo! Corporation

- Safeway

- Harris Teetar

- Walmart To Go

- Vivino

- Thirstie

- Danta

- Naked Wines

- Lot18

- WineAccess

- Others