Global White Oil Market By Grade( Technical/Industrial Grade, Pharmaceuticals Grade), By Application(Personal Care, Adhesives, Agriculture, Textile, Food and Beverage, Pharmaceutical, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Dec 2023

- Report ID: 51246

- Number of Pages: 284

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

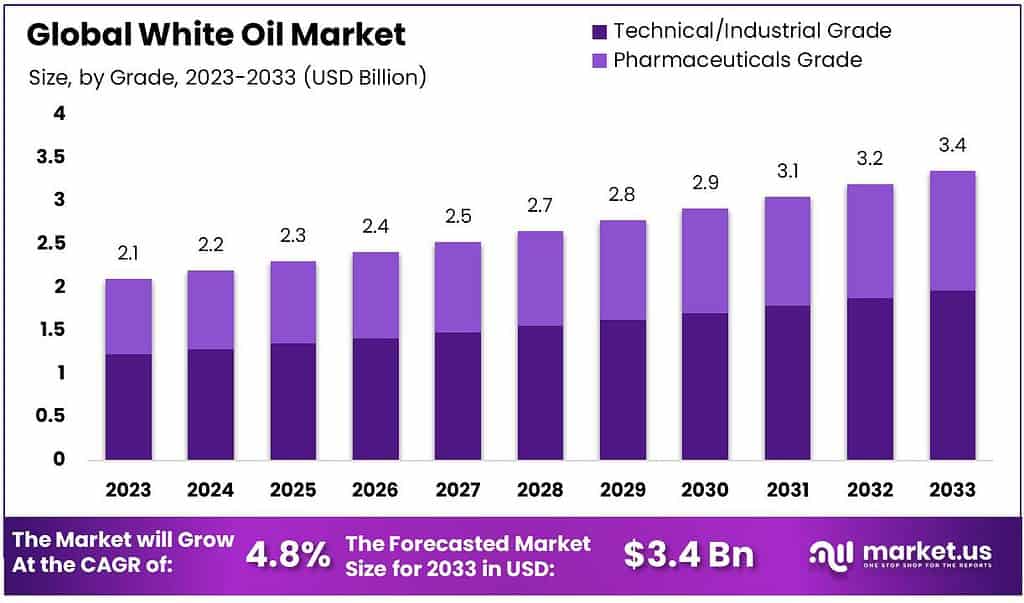

The global white oil market size is expected to be worth around USD 35.3 billion by 2033, from USD 2.1 billion in 2023, growing at a CAGR of 4.8% during the forecast period from 2023 to 2033.

The increased demand in the personal and pharmaceutical sectors is expected to drive the demand for products. The market is expected to grow due to the rising product demand in the medicinal and cosmetics industry. White oils are pure, stable, colorless, and odorless mineral oils that have been filtered to make them non-toxic.

Note: Actual Numbers Might Vary In Final Report

Key Takeaways

- Market Growth and Projected Growth: The white oil market is expected to grow at a CAGR of 4.8% from 2023 to 2033. Market Worth: Anticipated to reach approximately USD 35.3 billion by 2033 from USD 2.1 billion in 2023.

- Grades: Technical/Industrial Grade dominated with over 58.6% market share in 2023. Pharmaceuticals Grade held around 28.9%.

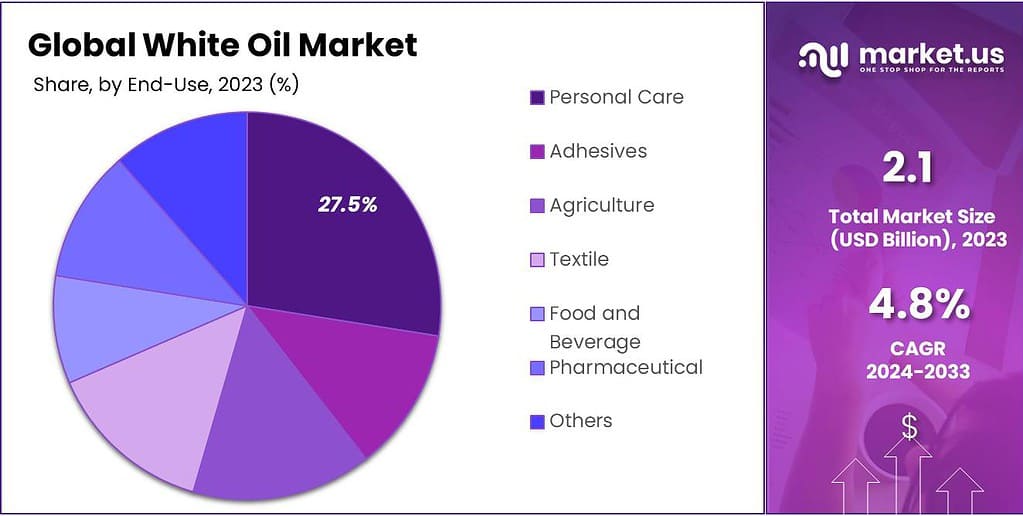

- Applications: Personal Care: Led the market with more than a 27.5% share in 2023. Used extensively in skincare, lotions, cosmetics, and various personal care items.

- Drivers: Growing demand in the pharmaceutical sector due to white oil’s purity, vital for various medicinal products and preparations. Viscoelastic properties and high purity making white oil a preferred choice for pharmaceutical formulations.

- Restraints: Potential allergic reactions in some individuals, emphasizing the need for caution and immediate medical attention.

- Opportunities: Increasing utilization in the plastic industry for enhancing properties and manufacturing processes of plastics and polymers.

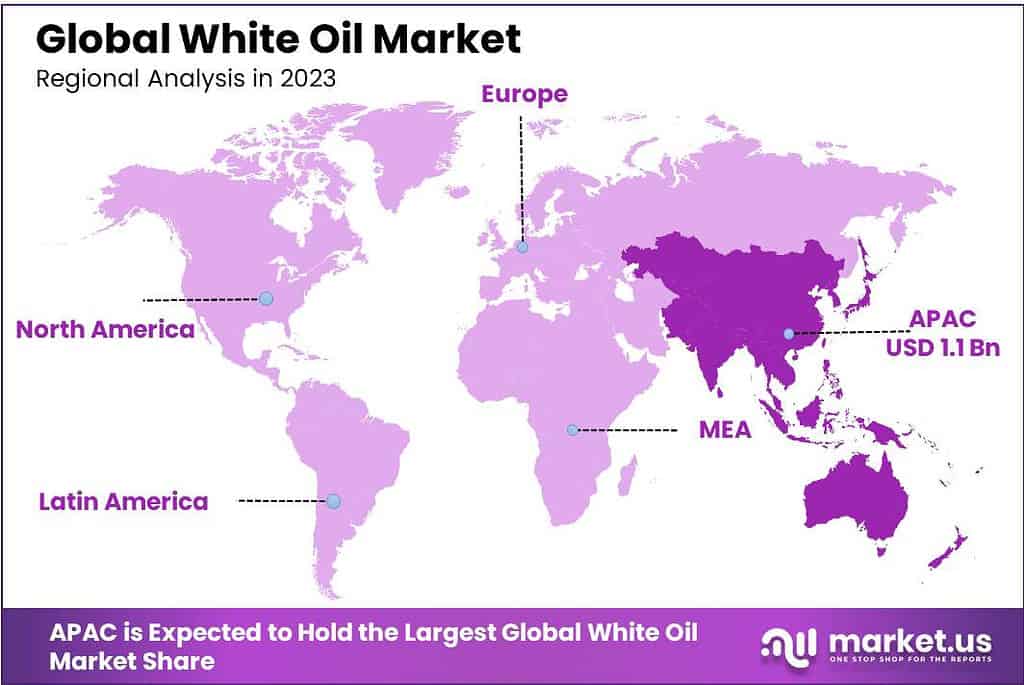

- Asia Pacific: Dominated the market in 2023 with over 48.9% share due to increased demand from the pharmaceutical industry.

- Prominent Players: BP Corporation, Sinopec Corporation, Exxon Mobil Corporation, among others.

By Grade

In 2023, Technical/Industrial Grade was the big shot, grabbing over 58.6% of the market. This grade is used in machinery, coatings, and various industrial applications due to its reliability. Its sturdy nature makes it a top choice for businesses needing consistent performance.

On the other hand, Pharmaceuticals Grade, while smaller in market share, around 28.9%, has its significance. This grade meets stringent quality standards crucial for medications and healthcare products. Its purity and safety make it indispensable in the pharmaceutical industry.

Both grades play pivotal roles in distinct sectors. Technical/Industrial Grade serves the robust demands of manufacturing and machinery, while pharmaceutical-grade caters to the critical needs of health and medicine. The balance between these segments showcases the diverse applications and significance within their respective industries.

Application Analysis

In 2023, Personal Care products were the top players, securing more than a 27.5% share of the market. These oils are extensively used in skincare, lotions, and cosmetics, valued for their purity and gentle properties, making them a staple in everyday personal care routines.

White oil is used as both a base ingredient as well as an emollient in the production of personal care products. It is widely used in the manufacture of many personal care products, including cosmetics, skin creams and moisturizers, baby items, body oils, hair oils, shampoos, and fragrances.

It is a softening agent, emollient, or chemical contact inhibitor that exhibits inertness to other chemicals. The product’s excellent hydrophobicity makes it ideal for making water-resistant creams. Royal Dutch Shell N.V. produces and distributes Ondina X (a medicinal-grade, white oil) for personal care industries due to its exceptional binding properties.

Over the forecast period, adhesives will experience the highest revenue-based CAGR at 4.6%. This is due to an increase in the demand for white oil as a diluent for hot melt and pressure-sensitive adhesives. White oil is compatible with the skin and induces transparency. It also maintains the color stability required to achieve the desired adhesive production yield.

White oil’s performance characteristics are expected to increase white oil consumption in agriculture. White oil has no odor or taste and can be applied directly to grains to prevent dust from forming. White oil can also be blended with crop protection chemicals, or other oils to make an insecticide or protective liquid spray for plants.

Note: Actual Numbers Might Vary In Final Report

Key Market Segments

By Grade

Technical/Industrial Grade

Pharmaceuticals GradeBy Application

- Adhesives

- Agriculture

- Food

- Pharmaceutical

- Personal Care

- Textile

- Polymers

- Other Applications

Drivers

The expanding pharmaceutical sector serves as a significant driver for the demand and utilization of white oil. In this industry, white oil plays a pivotal role across various pharmaceutical products and preparations. Its applications span a wide spectrum, including the production of laxative jellies, balms, creams, ointment bases, capsule lubricants, pelletizing aids, and even vaccinations.

One of the critical aspects contributing to the preference for white oil in pharmaceuticals is its exceptionally high purity level. Pharmaceutical-grade white oil, renowned for its purity, finds extensive use due to the stringent quality standards required in pharmaceutical formulations. Its purity ensures a high level of safety and efficacy in medicinal products, meeting the regulatory criteria essential for pharmaceutical applications.

White oil’s viscosity characteristics, typically falling within the light to medium range, further contribute to its suitability for medicinal purposes. These viscosities make it ideal for various pharmaceutical formulations, offering the desired consistency and ease of application in different pharmaceutical products.

The pharmaceutical industry’s reliance on white oil showcases the versatility and indispensability of this substance in creating a diverse range of medicinal products. Its purity, combined with specific viscosity properties, makes white oil a preferred choice for pharmaceutical applications where safety, quality, and consistency are paramount. As the pharmaceutical sector continues to expand and innovate, the demand for high-quality ingredients like white oil is expected to persist, driving its significance in this dynamic industry.

Restraints

White oil is mostly safe for cosmetics and medicine, but some folks might have rare allergies to it. Even though one part of white oil is FDA-approved for cosmetics, some people can still have allergic reactions. These reactions can range from mild skin issues like rashes to severe problems like trouble breathing or swelling. It’s rare, but folks with known allergies need to be careful with products containing white oil. Fast action is essential if any unexpected reaction occurs.

For individuals experiencing any unexpected or adverse symptoms after using products containing white oil, seeking immediate medical attention is advised. Understanding and identifying potential allergic reactions to white oil can help ensure the safe and responsible use of products within the cosmetics and pharmaceutical industries.

Opportunities

The plastic industry presents a promising opportunity for the increased use of white oils. Specifically, low-volatility white oils play a crucial role in manufacturing plastics and various types of polymers. They serve multiple purposes such as improving and controlling the flow of the melted polymer, providing release properties, and altering the physical characteristics of the final product.

In the production of thermoplastic elastomers, white oils play an indispensable role. These oils are essential components that help in achieving the desired properties and characteristics in these materials. Moreover, in cases where a light color or food approval is necessary, elastomeric materials that don’t need vulcanization rely on white oil as an extender. This extension property aids in making the manufacturing process simpler and more efficient.

Overall, the rising demand in the plastic industry for white oils stems from their versatility and functionality in enhancing the properties and fabrication processes of various plastic and polymer-based materials. This increasing reliance on white oils showcases their significance as key additives in the plastic manufacturing sector, offering opportunities for improved product quality and streamlined production methods.

Challenges

The price changes of raw materials used to make white oil can be unpredictable. This happens because of conflicts between countries and regions where these materials come from. These unpredictable prices might affect how much white oil is available in the future. Sometimes, there might not be enough raw materials available, and other times, their prices might drop too much, making it hard for the market to grow.

In 2023, the biggest use of white oil was in personal care products. This happened because more people became focused on their health and wanted personal care items. White oil is an indispensable component in creating cosmetic and skincare products, such as makeup, moisturizers, baby care products, lotions, hair oils, shampoos, perfumes, and water-resistant creams.

Regional Analysis

With a market share of over 48.9%, the Asia Pacific region was the dominant region in 2023. This is due to increased demand from the regional pharmaceutical industry. The growth of the pharmaceutical industry is mainly due to increased purchasing power, rising affordability, and increasing awareness among consumers.

The industry spends a lot on R&D and is constantly developing new products. These products are priced to appeal to different levels of consumers.

Over the forecast period, Africa and the Middle East are expected to experience a substantial revenue-based CAGR of 4.12% This is due to the expansion of the regional pharmaceutical industry. Market growth is expected to be positive due to the growth of the Middle East’s pharmaceutical industry, particularly in Saudi Arabia. This is due to rising health spending and government support.

The industry will see an increase in the use of the product as a grease-free lubricant in many industries, including food, bakery, and textile. The upcoming years will see a rise in demand for fast-food and bakery items in North America.

This is due to changing lifestyles and increased demand for products for handling dough and food-handling machinery lubrication. North American market growth is expected to be driven by the expansion of the pharmaceutical industry. Market growth will be aided by the U.S.’s growing pharmaceutical industry as a result.

Note: Actual Numbers Might Vary In Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

White oil is highly competitive, with big international brands placing great emphasis on building long-term relationships with end-users. The competition will increase with the continued growth of the pharmaceutical and personal care sectors.

British Petroleum Corporation, Sinopec Corporation, and Exxon Mobil Corporation all have high levels of integration throughout the value chain, as they also participate in the production process. These companies are well-known for being key producers and focus on the development of new uses for the product. The following are some of the most prominent players in global white oil markets:

Market Key Players

- HF Sinclair Corporation

- Savita Oil Technologies Limited

- Exxon Mobil Corporation

- Calumet Specialty Products Partners

- China Petrochemical & Chemical Corporation (Sinopec)

- NYNAS AB

- Chevron Corporation

- Petro-Canada Lubricants Inc.

- Renkert Oil

- Atlantic Performance Oils

- Sasol

- Sonneborn LLC

Recent Development

In April 2022, Indorama Ventures Public Company Limited (IVL) announced the successful completion of their acquisition of Oxiteno SA. By doing so, IVL broadened its development profile into lucrative markets in Latin America and North America – becoming the continent’s top producer of surfactants with opportunities for expansion throughout Europe and Asia.

In October 2022, the Saudi Arabian Oil Company’s base oil company, Luberef, opened a new plant in Yanbu for producing transformer oil and white oil, which are used in the food, pharmaceutical, and energy industries. The facility will make it possible for the Kingdom to localize these specialized goods. Producers and operators of base oil-related businesses will be drawn to the venture.

Report Scope

Report Features Description Market Value (2023) USD 283.6 Billion Forecast Revenue (2033) USD 2.1 Billion CAGR (2023-2032) 4.8% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade( Technical/Industrial Grade, Pharmaceuticals Grade), By Application(Personal Care, Adhesives, Agriculture, Textile, Food and Beverage, Pharmaceutical, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape HF Sinclair Corporation, Savita Oil Technologies Limited, Exxon Mobil Corporation, Calumet Specialty Products Partners, China Petrochemical & Chemical Corporation (Sinopec), NYNAS AB, Chevron Corporation, Petro-Canada Lubricants Inc., Renkert Oil, Atlantic Performance Oils, Sasol, Sonneborn LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- HF Sinclair Corporation

- Savita Oil Technologies Limited

- Exxon Mobil Corporation

- Calumet Specialty Products Partners

- China Petrochemical & Chemical Corporation (Sinopec)

- NYNAS AB

- Chevron Corporation

- Petro-Canada Lubricants Inc.

- Renkert Oil

- Atlantic Performance Oils

- Sasol

- Sonneborn LLC