Global Whipping Cream Market Size, Share, Growth Analysis By Source (Dairy, Non-dairy), By Type (Fresh, Premix), By End Use (Bakery and Confectionery, Desserts, Beverages, Others), By Distribution Channel (Hypermarkets/supermarkets, Specialty stores, Online, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157931

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

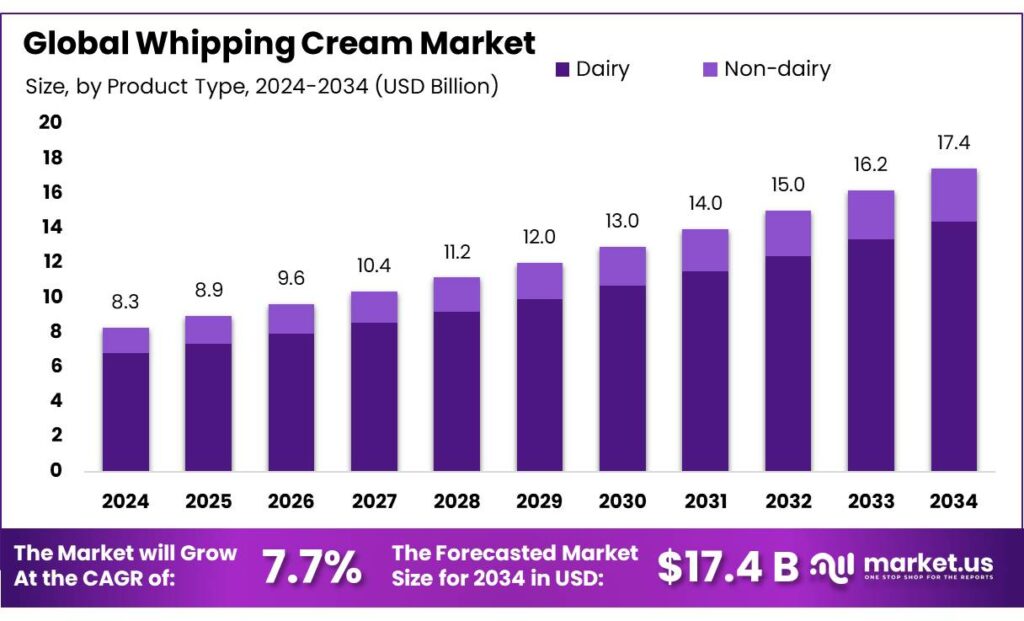

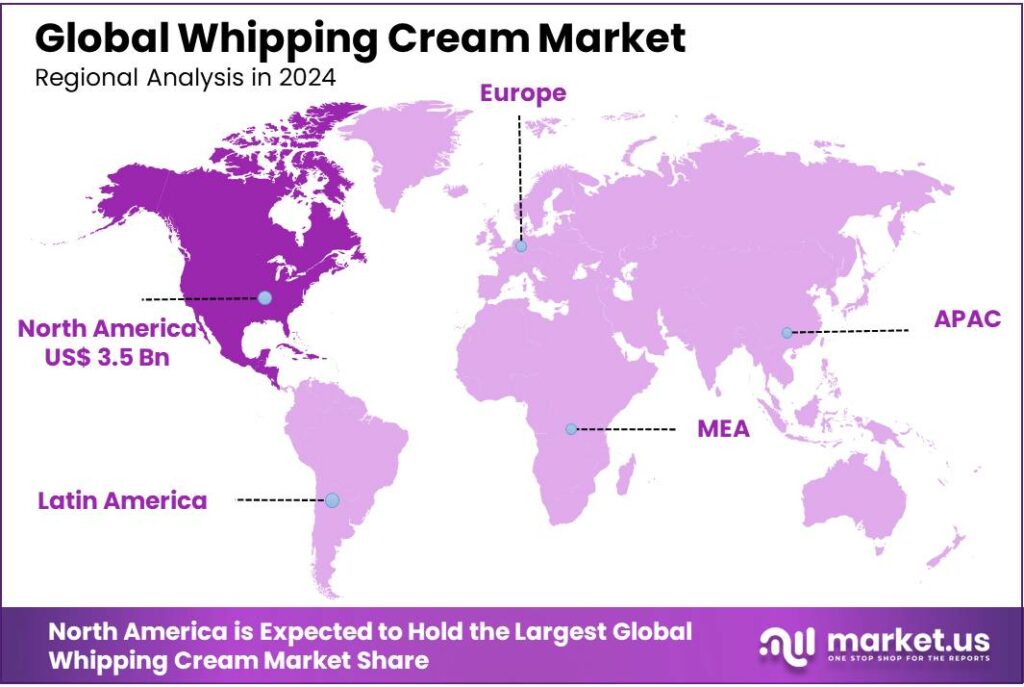

The Global Whipping Cream Market size is expected to be worth around USD 17.4 Billion by 2034, from USD 8.3 Billion in 2024, growing at a CAGR of 7.7% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 42.80% share, holding USD 3.5 Billion in revenue.

The whipping cream industry in India is experiencing significant growth, driven by the country’s robust dairy sector and evolving consumer preferences. India, being the world’s largest milk producer, contributes over 25% to global milk production. This vast milk supply forms the foundation for the burgeoning whipping cream market, which is increasingly utilized in various culinary applications, including desserts, bakery products, and beverages.

The whipping cream segment benefits from this expansive milk supply, serving both household and commercial sectors. The Indian dairy industry is characterized by a dual structure: the unorganized sector, comprising traditional milkmen and local vendors, accounts for 64% of milk sales, while the organized sector, including cooperatives and private dairies, processes the remaining 36%. Amul, India’s largest dairy cooperative, exemplifies the organized sector’s reach, collecting 35 million litres of milk daily and commanding a 75% share of the national milk market.

Government initiatives play a pivotal role in supporting the dairy sector’s expansion. The Indian government’s goal to double the country’s milk processing capacity to 108 MMT by 2025 is a testament to its commitment to enhancing dairy infrastructure. Additionally, the implementation of the Ethanol Blended Petrol (EBP) programme, which mandates 20% ethanol blending by 2025, has led to innovative uses of dairy byproducts. For instance, Amul has initiated large-scale trials to produce bioethanol from whey, a byproduct of cheese and paneer production.

- In 2025, India’s cow and water buffalo milk production is forecasted to rise to 216.5 million metric tons, up from 211.7 million metric tons in 2024. This surge in milk production is attributed to factors such as improved herd management, better feed quality, and favorable climatic conditions.

Key Takeaways

- Whipping Cream Market size is expected to be worth around USD 17.4 Billion by 2034, from USD 8.3 Billion in 2024, growing at a CAGR of 7.7%

- Dairy held a dominant market position in the Whipping Cream Market, capturing more than an 82.5% share.

- Fresh held a dominant market position in the Whipping Cream Market, capturing more than a 67.8% share.

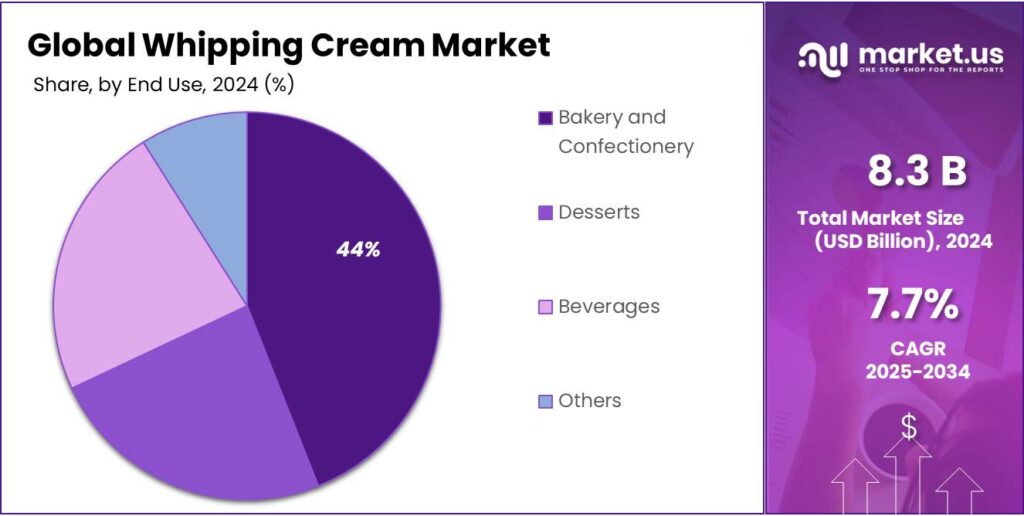

- Bakery and Confectionery held a dominant market position in the Whipping Cream Market, capturing more than a 44.9% share.

- Hypermarkets/Supermarkets held a dominant market position in the Whipping Cream Market, capturing more than a 43.2% share.

- North America stands as the dominant region in the global whipping cream market, commanding a substantial share of 42.80% in 2024, equating to an estimated market size of approximately USD 3.5 billion.

By Source Analysis

Dairy dominates the Whipping Cream Market with 82.5% share in 2024 due to its widespread use and preference.

In 2024, Dairy held a dominant market position in the Whipping Cream Market, capturing more than an 82.5% share. This strong presence is driven by the long-established preference for dairy-based whipping cream due to its superior texture, flavor, and stability when whipped. Dairy whipping cream is widely used in both household cooking and professional food service applications, particularly in desserts, cakes, and pastries, where its creamy consistency and natural taste are highly valued.

The demand for dairy whipping cream remains robust, supported by consumer trust in the natural ingredients and high nutritional value of dairy products. As the global food industry continues to innovate with plant-based alternatives, dairy products maintain a dominant role due to their rich culinary versatility and cultural significance. Additionally, dairy whipping cream’s ability to deliver consistent results in recipes, especially in high-end confectionery, continues to fuel its market leadership.

By Type Analysis

Fresh whipping cream dominates with 67.8% share in 2024 due to its preference for quality and freshness.

In 2024, Fresh held a dominant market position in the Whipping Cream Market, capturing more than a 67.8% share. This dominance is primarily driven by the preference for fresh whipping cream in culinary applications, where its rich texture, superior taste, and ability to hold its form when whipped are highly valued. Fresh whipping cream is widely used in both home kitchens and professional food services, especially for creating smooth, creamy toppings and fillings for desserts, cakes, and pastries.

The growing trend of consumers seeking fresh and natural ingredients further supports the strong demand for fresh whipping cream. Additionally, its relatively short shelf life and need for refrigeration make it an ideal choice for high-quality, artisanal, and homemade products. In 2025, the fresh whipping cream segment is expected to retain its leadership, as consumers continue to prioritize fresh, minimally processed foods for both taste and nutritional benefits. The segment’s sustained growth is also fueled by increasing applications in the foodservice industry, where the demand for premium ingredients remains high.

By End Use Analysis

Bakery and Confectionery dominates the Whipping Cream Market with 44.9% share in 2024 due to its essential role in dessert production.

In 2024, Bakery and Confectionery held a dominant market position in the Whipping Cream Market, capturing more than a 44.9% share. This strong market share is driven by the essential role that whipping cream plays in the production of various bakery and confectionery products. Its ability to create light, airy textures and rich flavors makes it an indispensable ingredient in cakes, pastries, mousse, and other desserts. The smooth, stable consistency of whipped cream is key to achieving the desired finish in many sweet treats.

The segment’s growth is also supported by the increasing consumer demand for premium and indulgent baked goods, where fresh, high-quality ingredients are prioritized. In 2025, bakery and confectionery is expected to maintain its dominant position, driven by ongoing innovations in product formulations and the rising popularity of customized desserts. The expansion of the global foodservice industry, along with increased spending on celebratory cakes and premium confections, will continue to fuel the demand for whipping cream in this segment.

By Distribution Channel Analysis

Hypermarkets/Supermarkets dominate the Whipping Cream Market with 43.2% share in 2024 due to wide consumer reach and convenience.

In 2024, Hypermarkets/Supermarkets held a dominant market position in the Whipping Cream Market, capturing more than a 43.2% share. This dominance is largely due to the convenience and accessibility that hypermarkets and supermarkets provide to consumers. These retail outlets offer a wide variety of whipping cream options, including both fresh and long-life varieties, catering to different consumer preferences. The one-stop shopping experience, coupled with competitive pricing and frequent promotions, makes hypermarkets and supermarkets the preferred choice for purchasing whipping cream.

The segment’s strong performance is further supported by the increasing trend of consumers preferring to buy multiple household products in a single trip, which includes essential items like whipping cream. In 2025, hypermarkets and supermarkets are expected to maintain their leadership, fueled by expanding store networks, enhanced in-store experiences, and the growing trend of online grocery shopping, which further boosts the convenience factor for consumers looking to purchase whipping cream alongside other ingredients.

Key Market Segments

By Source

- Dairy

- Non-dairy

By Type

- Fresh

- Premix

By End Use

- Bakery and Confectionery

- Desserts

- Beverages

- Others

By Distribution Channel

- Hypermarkets/supermarkets

- Specialty stores

- Online

- Others

Emerging Trends

Government Support for Dairy Infrastructure and Processing

A significant trend shaping the whipping cream market in India is the substantial government investment in dairy infrastructure and processing capabilities. This support is pivotal in enhancing the production and quality of dairy products, including whipping cream, thereby fostering market growth.

- In 2024, the Indian government launched the “White Revolution 2.0,” aiming to modernize the dairy sector by establishing 200,000 new cooperatives and increasing milk procurement from 660 lakh kg/day to 1,007 lakh kg/day by 2028-29. This initiative is expected to bolster milk production, ensuring a steady supply of high-quality raw material for dairy products.

For instance, under the Dairy Processing and Infrastructure Development Fund (DIDF), the government sanctioned ₹43 crore for the establishment of an ice cream plant in Trichy with a capacity of 6,000 liters per day. Such investments enhance processing capabilities, enabling the production of value-added products like whipping cream.

These government initiatives not only improve the efficiency and capacity of dairy processing but also ensure the availability of quality dairy products in the market. As the dairy sector continues to modernize, the whipping cream market is poised for sustained growth, driven by enhanced production and processing capabilities.

Drivers

Government Support and Policy Initiatives

The Indian government has implemented several initiatives to bolster the dairy sector, which significantly impacts the whipping cream industry. These measures aim to enhance milk production, improve infrastructure, and support farmers, thereby creating a conducive environment for the growth of dairy-based products.

One of the key initiatives is the National Programme for Dairy Development (NPDD), launched in 2014, which merges various schemes to promote dairy farming and improve milk production. The program focuses on enhancing the productivity of dairy animals, improving infrastructure, and ensuring better market access for farmers. This initiative has led to the establishment of numerous dairy plants and has facilitated the growth of the dairy sector across the country.

- Additionally, the Animal Husbandry Infrastructure Development Fund (AHIDF), with a corpus of ₹2,100 crore, provides financial assistance to the private sector for the establishment of dairy processing and chilling infrastructure. This fund aims to modernize the dairy industry, improve the quality of dairy products, and reduce wastage, thereby benefiting products like whipping cream.

The Pradhan Mantri Kisan Sampada Yojana (PMKSY) is another significant scheme that offers financial assistance for the creation of modern infrastructure for food processing, including dairy products. Under this scheme, subsidies are provided for setting up processing units, cold chains, and packaging units, which are crucial for the production and distribution of products like whipping cream.

Restraints

Inadequate Cold Storage and Logistics Infrastructure

A significant challenge hindering the growth of the whipping cream industry in India is the insufficient cold storage and logistics infrastructure. Despite being the world’s largest milk producer, India’s dairy sector faces substantial losses due to inadequate facilities for preserving milk and its products.

Reports indicate that over 50% of Indian dairy farmers lack access to reliable cold storage infrastructure, leading to major milk spoilage and economic losses each year. This deficiency is particularly pronounced in rural areas, where refrigerated storage is scarce, resulting in increased spoilage rates and inconsistent supply chains.

The absence of proper cold storage facilities directly impacts the quality and shelf life of dairy products like whipping cream. Without adequate refrigeration, these products are susceptible to spoilage, limiting their availability and increasing wastage. This not only affects consumer trust but also poses challenges for producers aiming to meet the growing demand for premium dairy products.

- For instance, the Dairy Infrastructure Development Fund (DIDF), with a financial outlay of ₹10,000 crore, aims to modernize milk processing plants and create additional infrastructure for processing more milk. This includes the installation of electronic milk adulteration testing equipment at the village level, enhancing the quality and safety of dairy products.

Additionally, the National Programme for Dairy Development (NPDD) focuses on creating and strengthening infrastructure for milk procurement, processing, and quality control. Key components include the establishment of milk chilling plants, advanced milk testing laboratories, and the formation of new dairy cooperative societies. As of July 2025, approximately 31,908 dairy cooperative societies have been organized or revived, enrolling 17.63 lakh new milk producers and increasing daily milk procurement by 120.68 lakh kilograms. Furthermore, over 61,677 village-level milk testing laboratories and 5,995 bulk milk coolers with a combined capacity of 149.35 lakh liters have been established under this program.

Opportunity

Government Initiatives Driving Growth in the Whipping Cream Industry

India’s dairy sector, integral to the country’s agricultural landscape, is undergoing significant transformation through targeted government initiatives aimed at enhancing infrastructure, quality control, and market access. These efforts are creating a conducive environment for the growth of value-added products like whipping cream.

The Revised National Programme for Dairy Development (NPDD), with a financial outlay of ₹2,790 crore for the 2021–2026 period, focuses on modernizing dairy infrastructure. Key components include the establishment of milk chilling plants, advanced milk testing laboratories, and the formation of new dairy cooperative societies.

- As of July 2025, approximately 31,908 dairy cooperative societies have been organized or revived, enrolling 17.63 lakh new milk producers and increasing daily milk procurement by 120.68 lakh kilograms. Additionally, over 61,677 village-level milk testing laboratories and 5,995 bulk milk coolers with a combined capacity of 149.35 lakh liters have been established under this program.

Complementing the NPDD, the Dairy Infrastructure Development Fund (DIDF), with a financial outlay of ₹10,005 crore, aims to modernize milk processing plants and create additional infrastructure for processing more milk. This includes the installation of electronic milk adulteration testing equipment at the village level, enhancing the quality and safety of dairy products.

Regional Insights

North America stands as the dominant region in the global whipping cream market, commanding a substantial share of 42.80% in 2024, equating to an estimated market size of approximately USD 3.5 billion. This leadership is primarily driven by the United States, which alone accounted for around USD 3 billion of this valuation in 2024. The region’s robust demand is propelled by the widespread use of whipping cream in various culinary applications, including bakery, confectionery, desserts, and beverages.

The U.S. dairy industry plays a pivotal role in this dominance, with the country producing approximately 215,000 metric tons of whipping cream annually. This production is supported by over 720 dairy farms dedicated to cream for whipping purposes. Such infrastructure ensures a consistent and high-quality supply of whipping cream to meet the growing consumer demand.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Established in 1946 by Stuart Hanan, Hanan Products Co., Inc. is a U.S.-based manufacturer specializing in premium whipped toppings, icings, and dessert fillings. The company caters primarily to commercial and supermarket bakeries across North America. With over 75 years of experience, Hanan emphasizes quality and innovation, offering both dairy and vegan options. Their product line includes All Natural Whipped Toppings, Vegan Whipped Toppings, Pre-Whipped Icings, and Kosher for Passover items. Hanan operates from Hicksville, New York, and serves local and international customers, including markets in Central and South America, Asia, Europe, and North America.

The Gujarat Co-operative Milk Marketing Federation Ltd. (GCMMF), known for its Amul brand, is India’s largest dairy cooperative. Founded in 1946, GCMMF markets a wide range of dairy products, including milk, butter, cheese, and whipping cream. In the fiscal year 2023–24, GCMMF reported a turnover of ₹65,911 crore (approximately USD 8 billion) and processed over 12 billion liters of milk. The organization is farmer-owned, with over 3.6 million milk producer members across 18 member unions. Amul’s whipping cream is marketed as a dairy-based product with 30% fat content, suitable for both cooking and as a topping. It is available in Tetra Pak packaging, ensuring a longer shelf life through UHT processing.

Founded in 1958, Gay Lea Foods is Ontario’s largest dairy products co-operative, producing a variety of dairy items, including butter, cheese, sour cream, and whipped cream. The co-operative is owned by over 1,300 dairy farmers across Ontario and Manitoba. Gay Lea Foods emphasizes community-focused values and high-quality, innovative dairy products. Their whipped cream offerings include both regular and dairy-free coconut-based options, catering to diverse consumer preferences. The company is headquartered in Mississauga, Ontario, and operates processing facilities in various locations within Canada.

Top Key Players Outlook

- Hanan Products Co., Inc.

- GCMMF

- Conagra Brands

- Gay Lea Foods Co-operative Ltd.

- Cabot Creamery

- Borden Dairy

- LACTALIS

- Granarolo S.p.A

- Arla Foods

- Dairy Farmers of America

Recent Industry Developments

In 2024, Gay Lea Foods initiated 17 sustainability projects across seven manufacturing facilities, including five LED retrofits and 12 natural gas projects.

In 2024, Conagra’s Refrigerated & Frozen segment, which includes Reddi-wip, reported net sales of $1.1 billion, marking a 7.2% decrease year-over-year. This decline was attributed to a 3.0% drop in volume and a 4.2% decrease in price/mix, reflecting challenges in consumer demand and cost pressures.

Report Scope

Report Features Description Market Value (2024) USD 8.3 Bn Forecast Revenue (2034) USD 17.4 Bn CAGR (2025-2034) 7.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Dairy, Non-dairy), By Type (Fresh, Premix), By End Use (Bakery and Confectionery, Desserts, Beverages, Others), By Distribution Channel (Hypermarkets/supermarkets, Specialty stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Hanan Products Co., Inc., GCMMF, Conagra Brands, Gay Lea Foods Co-operative Ltd., Cabot Creamery, Borden Dairy, LACTALIS, Granarolo S.p.A, Arla Foods, Dairy Farmers of America Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Hanan Products Co., Inc.

- GCMMF

- Conagra Brands

- Gay Lea Foods Co-operative Ltd.

- Cabot Creamery

- Borden Dairy

- LACTALIS

- Granarolo S.p.A

- Arla Foods

- Dairy Farmers of America