Global Web3 Blockchain Market Size, Share, Industry Analysis Report By Blockchain Type (Public, Private, Consortium, Hybrid), By Application (Cryptocurrency, Conversational AI, Data & Transaction Storage, Payments, Smart Contracts, Others), By Vertical (BFSI, E-commerce & Retail, Media & Entertainment, Healthcare & Pharmaceuticals, IT & Telecom, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 162086

- Number of Pages: 283

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Role of Generative AI

- Investment and Business Benefits

- Adoption and Usage

- Key Web3 Sectors

- Technical and Regulatory Trends

- US Market Size

- By Blockchain Type: Public

- By Application: Cryptocurrency

- By Vertical: BFSI

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

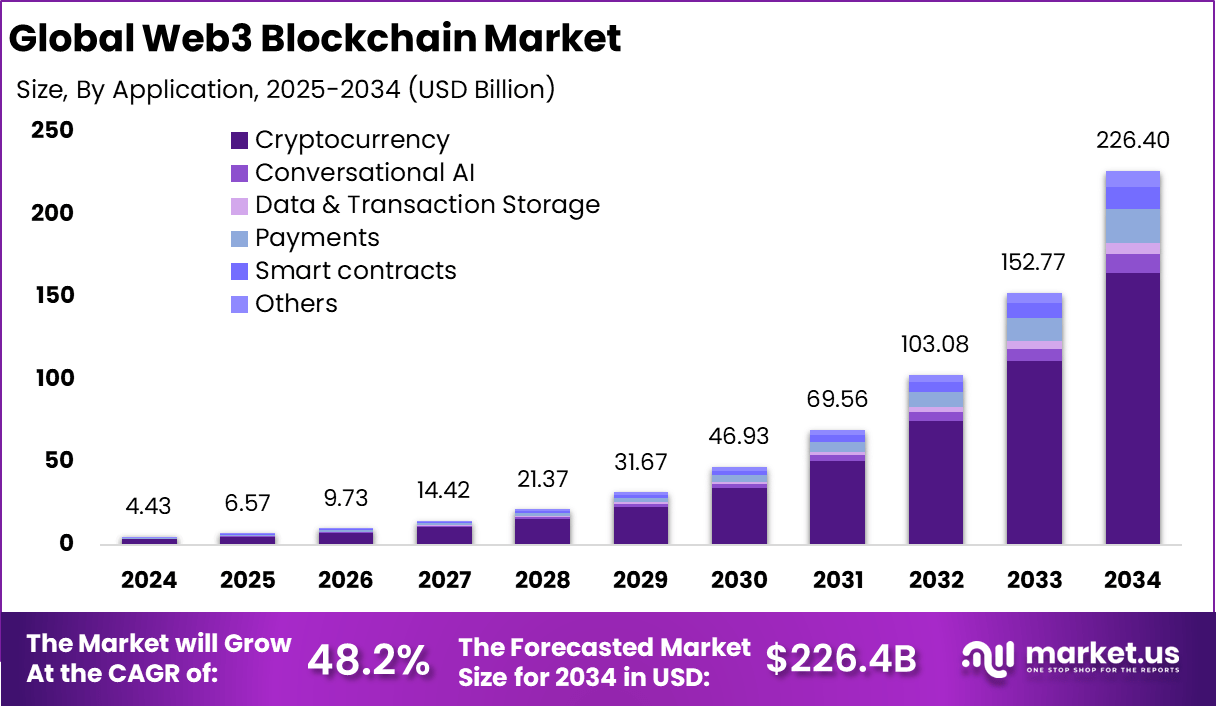

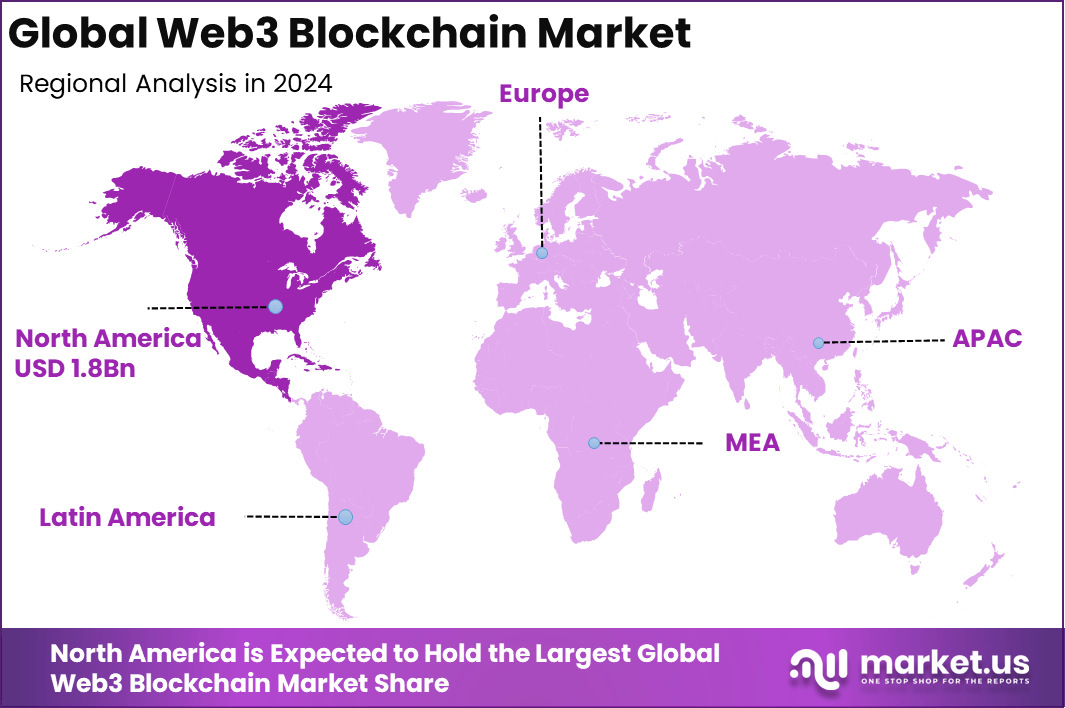

The Global Web3 Blockchain Market generated USD 4.43 billion in 2024 and is predicted to register growth from USD 6.57 billion in 2025 to about USD 226.4 billion by 2034, recording a CAGR of 48.2% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 41.2% share, holding USD 1.8 Billion revenue.

The Web3 blockchain market refers to the ecosystem of decentralized technologies, platforms, protocols and applications built on blockchain infrastructure that support the next generation of the internet. This includes public and private blockchains, decentralized applications (dApps), token-based economies, decentralized finance (DeFi), non-fungible tokens (NFTs), decentralized identity models and protocols.

Top driving factors for Web3 adoption include increasing concerns over data privacy, the demand for transparency in transactions, and the rise of digital assets. Decentralization allows users to own their data, reducing risks associated with centralized data storage. Additionally, technological advancements such as 5G, AI integration, and modular blockchain frameworks are helping Web3 overcome scalability and efficiency challenges, fueling accelerated adoption.

According to Market.us, The Global Web3 Market is estimated to be valued at USD 6.63 billion in 2024 and is projected to reach approximately USD 177.58 billion by 2033, expanding at a robust CAGR of 44.1% during the forecast period. The growth of this market can be attributed to the rising adoption of decentralized technologies, blockchain-based applications, and smart contract platforms across industries seeking improved transparency and data ownership.

The demand for Web3 technologies is mainly growing around blockchain infrastructure upgrades, decentralized applications (dApps), and energy-efficient consensus mechanisms like Proof of Stake (PoS). Innovations such as sharding, layer 2 scaling, and sidechains enhance performance by increasing transaction throughput and lowering latency. AI-driven autonomous agents integrated with Web3 systems are poised to elevate efficiency in industries such as finance and logistics.

Top Market Takeaways

- Public blockchains accounted for 48.2% of the global Web3 blockchain market, reflecting their dominance in open, decentralized ecosystems.

- Cryptocurrency applications captured 72.8%, showing that digital assets remain the primary use case driving Web3 adoption.

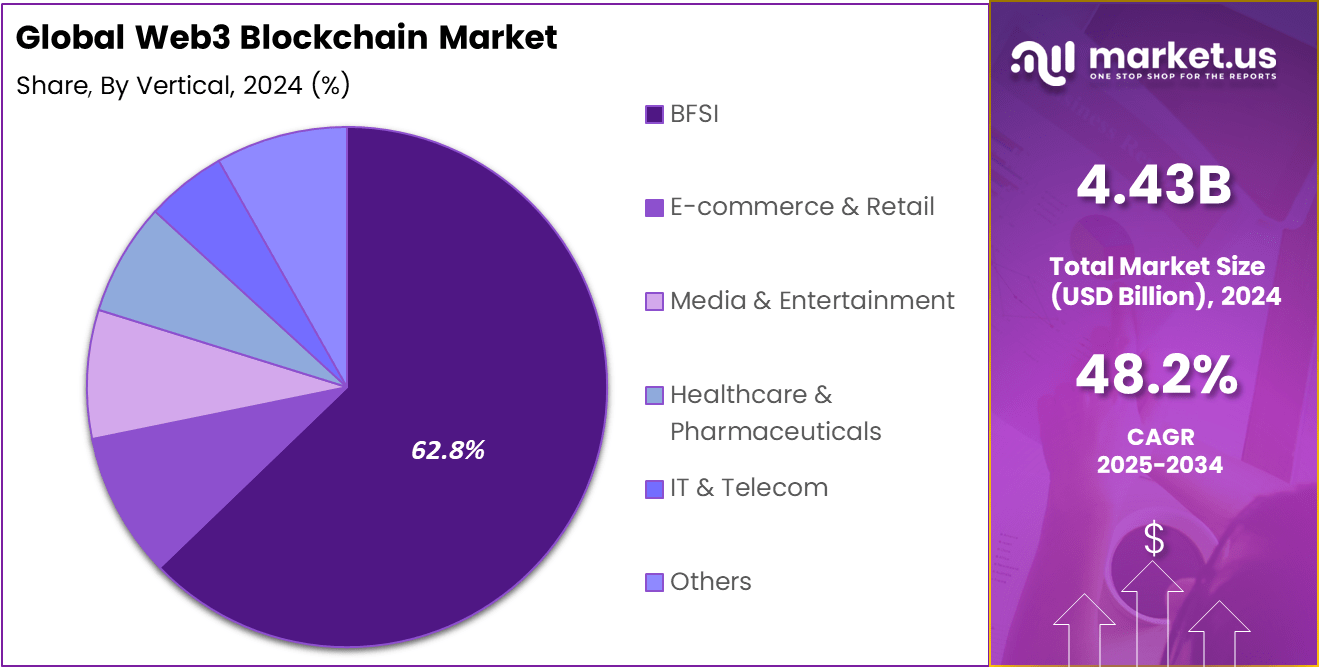

- The BFSI sector contributed 62.8%, highlighting strong adoption in banking and financial services for secure and transparent transactions.

- North America led the market with 41.2% share, supported by early blockchain integration and favorable investment activity.

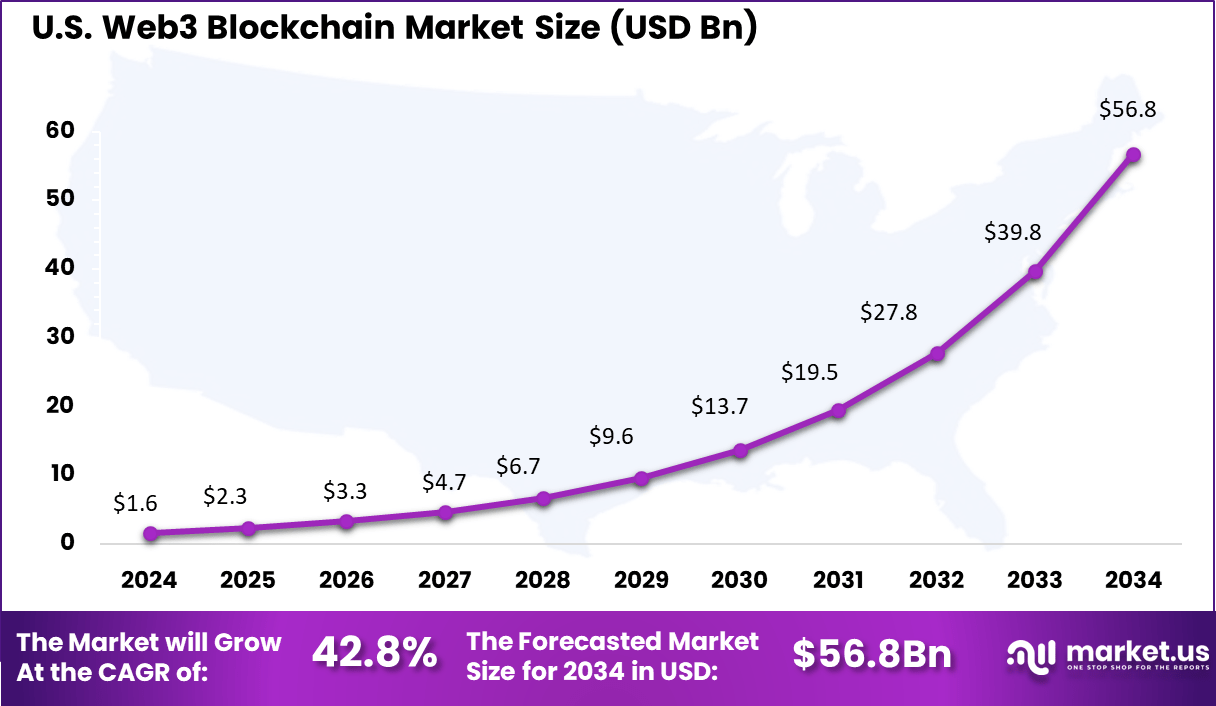

- The US market reached USD 1.61 Billion in 2024 with a remarkable 42.8% CAGR, driven by institutional adoption, digital currency expansion, and regulatory clarity.

Role of Generative AI

Generative AI is making a significant impact on Web3 by improving how decentralized applications operate and how data is managed. It boosts the productivity of decentralized applications by around 30%, allowing smarter and more efficient financial services and tokenization processes.

This combination of AI and blockchain is pushing Web3 beyond simple programming to systems that can learn and adapt, enhancing user experience and decision-making within the ecosystem. In 2025, over 17,000 AI agents have been launched on Web3 platforms, handling 4.5 million daily active wallets and covering 19% of all Web3 activity, a sharp rise from 9% earlier this year.

The rise of AI agents shows growing investor confidence as these projects raised $1.39 billion in funding in 2025, marking a 9.4% increase over the prior year. This investment reflects how AI is becoming essential for data analysis, automation, and creating more secure and personalized Web3 environments.

Investment and Business Benefits

Investment opportunities in the Web3 market are expanding as venture capital and institutional investors increase funding in blockchain infrastructure, dApps, and digital asset platforms. The growing ecosystem presents chances to invest in emerging protocols and infrastructure that address limitations of earlier blockchain versions.

While investments carry volatility due to the evolving nature of Web3, the long-term potential for disruption across industries like finance, supply chain, and entertainment attracts significant interest. Innovative financing methods such as tokenomics and DeFi protocols also open novel paths for participation and returns. Business benefits from Web3 adoption are substantial and include operational efficiencies, reduced costs, and new market possibilities.

Smart contracts automate transaction processes, lowering manual oversight and minimizing errors. The decentralized structure reduces dependency on intermediaries, enhancing speed and reducing fees. Transparency fosters trust between businesses and clients while empowering communities with governance roles. Additionally, Web3 enables organizations to tap into decentralized finance and tokenized assets, creating fresh revenue streams and competitive advantages.

Adoption and Usage

The global crypto and Web3 ecosystem has expanded rapidly in early 2025, with over 560 million people worldwide owning cryptocurrencies and using Web3 tools. This represents approximately 6.8% of the global population. Projections suggest that the total crypto user base could exceed 1.5 billion by 2030, reflecting strong momentum in mainstream adoption.

- Highest regional adoption: Emerging markets are leading this growth. In 2024, Nigeria recorded an adoption rate of 84%, followed by South Africa (66%), Vietnam (60%), and the Philippines (54%). These countries show how financial inclusion and mobile-first ecosystems are driving accelerated adoption.

- Wallet creation: Blockchain infrastructure is expanding quickly, with approximately 1.68 billion wallets created across all chains. While this figure includes inactive accounts, non-custodial wallets are projected to grow by 20-30% in the second half of 2025, signaling increased interest in self-sovereign asset management.

- Daily active users (dUAW): Activity across decentralized applications (dApps) has strengthened. In Q1 2025, Daily Unique Active Wallets (dUAW) reached 24.6 million, driven primarily by gaming, decentralized finance (DeFi), and social media platforms. This demonstrates how utility-based use cases are anchoring long-term adoption.

Key Web3 Sectors

Decentralized Finance (DeFi)

After reaching its peak in late 2024, DeFi’s Total Value Locked (TVL) declined to about $156 billion in Q1 2025 but rebounded to $161 billion by Q3 2025. Ethereum continues to dominate, though Layer-2 solutions and alternative blockchains are capturing increasing activity. Institutional integration is progressing, with an estimated 60% of global financial institutions exploring or adopting DeFi models, signaling growing mainstream acceptance.

Blockchain Gaming (GameFi)

GameFi remains the most active sector in Web3. In Q3 2025, it recorded 4.66 million daily unique active wallets, representing the largest share of Web3 engagement. Although funding levels in 2025 were lower than in 2024, venture capital continues to back innovative projects, highlighting confidence in gaming-driven adoption.

Decentralized Physical Infrastructure Networks (DePINs):

DePINs have emerged as one of the fastest-growing sectors. Valued at $30 billion in early 2025, the ecosystem includes more than 1,500 active projects. These networks apply blockchain to real-world infrastructure such as wireless connectivity, expanding practical use cases beyond traditional finance and gaming.

Decentralized Autonomous Organizations (DAOs)

By early 2025, there were more than 13,000 DAOs collectively managing treasuries worth over $40 billion. DAOs are becoming a central pillar of decentralized governance, with participation expected to accelerate as more enterprises experiment with community-driven structures.

Non-Fungible Tokens (NFTs)

NFT trading volumes fell sharply in early 2025 but showed signs of stabilization later in the year. Interest has shifted toward utility-driven use cases, including NFTs for ticketing and identity verification, which are gaining traction in real-world applications.

Technical and Regulatory Trends

- Layer-2 scaling: Ethereum’s Layer-2 protocols, such as Base, Arbitrum One, and Polygon, now process nearly 50% of decentralized exchange (DEX) volume on Ethereum, reinforcing their critical role in scalability and cost reduction.

- Regulatory developments: Oversight is intensifying across global markets. In the United States, the passage of the GENIUS Act in July 2025 established a regulatory framework for stablecoins, marking a significant milestone for compliance in the DeFi ecosystem.

- Security improvements: After major losses from hacks in 2023, security practices have strengthened. Most large Web3 projects now undergo third-party smart contract audits, reducing systemic vulnerabilities and building user trust.

- AI and blockchain convergence: The fusion of artificial intelligence with blockchain is becoming a defining trend. This integration is improving the productivity of decentralized applications and is expected to attract dedicated investment rounds, fostering new applications across finance, gaming, and identity solutions.

US Market Size

North America holds a dominant position in the global Web3 blockchain market, capturing a significant 41.2% share. The U.S. market, in particular, is valued at approximately USD 1.61 billion and is experiencing a rapid compound annual growth rate of 42.8%.

This dominance can be attributed to North America’s robust technological infrastructure, proactive regulatory frameworks, and strong support from institutional investors. The presence of numerous leading blockchain firms and startups further enhances the region’s capacity to innovate and scale Web3 technologies.

The region’s mature financial markets have eagerly embraced blockchain solutions, especially in decentralized finance (DeFi), NFTs, and digital asset management, reinforcing North America’s pivotal role globally. Additionally, government initiatives, research programs, and venture capital influx sustain the fast pace of Web3 development. With growing enterprise adoption across industries such as finance, healthcare, and supply chain, North America continues to set trends and drive advancements in the Web3 blockchain ecosystem.

By Blockchain Type: Public

In 2024, The public blockchain segment holds a significant share of 48.2% in the Web3 blockchain market. Public blockchains are decentralized networks accessible to anyone, making them highly transparent and secure. Their open nature encourages community participation, driving innovation and fostering trust among users.

The wide adoption of public blockchains is largely due to their role in enabling cryptocurrencies, NFTs, and decentralized applications. Public blockchains support various use cases by providing a secure and tamper-proof environment.

Their ability to facilitate peer-to-peer transactions without intermediaries has made them fundamental to the Web3 ecosystem’s growth. This popularity is reflected in the high market share and continued investment in public blockchain infrastructure.

By Application: Cryptocurrency

In 2024, Cryptocurrency leads the Web3 blockchain market by application, capturing 72.8% of the share. Cryptocurrencies are digital currencies secured by cryptography and operate independently of traditional financial systems. They have driven the majority of blockchain adoption by providing a new form of decentralized, borderless money.

The strong market presence of cryptocurrency applications is attributed to rising investor interest, greater merchant acceptance, and growing awareness among consumers. Blockchain technology ensures security and transparency in transactions, further boosting cryptocurrency’s dominance in the Web3 market.

By Vertical: BFSI

In 2024, The Banking, Financial Services, and Insurance (BFSI) sector dominates the vertical market segment with a share of 62.8%. This sector utilizes Web3 blockchain solutions to improve the efficiency, transparency, and security of financial transactions and services. Applications include cross-border payments, fraud detection, identity verification, and smart contracts.

The BFSI sector is willing to invest heavily in blockchain technologies due to the need for regulatory compliance, risk mitigation, and cost reduction. The sector’s high market share underscores its role as a key driver of blockchain adoption in various use cases throughout the financial ecosystem.

Emerging Trends

One major emerging trend is the integration of decentralized finance (DeFi) into traditional finance systems. This merge is making transactions faster and more transparent while regulators are beginning to clarify rules, creating stronger trust in DeFi platforms. Cross-chain ecosystems are also gaining attention with solutions being developed to enable seamless asset transfer between different blockchain networks, improving collaboration across platforms.

Another trend is the development of unified standards for the metaverse and self-sovereign identity. These advances are making virtual interactions smoother and giving individuals control over their own digital identity without relying on centralized authorities. The digital asset ownership revolution is also growing, as virtual real estate markets expand and NFTs find new applications beyond collectibles, creating fresh opportunities for digital ownership and monetization.

Growth Factors

Web3 growth is mainly driven by the demand for greater security, privacy, and user control compared to traditional internet models. Blockchain’s decentralized nature provides a transparent and tamper-proof environment, which attracts more users and developers to the space. Increasing adoption of AI technology in Web3 platforms enhances operational efficiency and helps smart contracts become more autonomous and adaptive.

Strong community support and developer engagement also fuel Web3’s growth. Interest in decentralized autonomous organizations (DAOs) shows rising adoption of AI for governance and decision-making processes, creating models that are more scalable and efficient. Efforts to build scalable and energy-efficient blockchains are addressing the need for handling higher user volumes and reducing environmental impact, making the blockchain ecosystem more sustainable.

Key Market Segments

By Blockchain Type

- Public

- Private

- Consortium

- Hybrid

By Application

- Cryptocurrency

- Conversational AI

- Data & Transaction Storage

- Payments

- Smart contracts

- Others

By Vertical

- BFSI

- E-commerce & Retail

- Media & Entertainment

- Healthcare & Pharmaceuticals

- IT & Telecom

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rising Demand for Decentralized Transactions

The demand for decentralized transactions is a major force driving growth in the Web3 blockchain market. Web3 technologies use decentralized protocols that remove the need for trusted intermediaries, enabling peer-to-peer transactions with enhanced transparency and security. This appeals strongly to users and businesses looking to reduce reliance on centralized institutions and avoid associated risks such as data breaches or censorship.

Moreover, the increasing integration of AI and IoT with blockchain enhances the capabilities and applications of Web3, making it relevant across industries such as finance, supply chain, and healthcare. This broad utility and the promise of secure, decentralized exchanges have led to significant investments and innovation, fueling the market’s rapid expansion.

Restraint

Regulatory Uncertainty and Scrutiny

A significant restraint on the Web3 blockchain market is the evolving and often unclear regulatory environment. Governments and regulatory bodies worldwide are still formulating their policies on digital assets, smart contracts, and decentralized governance models. The lack of consistent regulations creates uncertainty for businesses and investors, slowing broader institutional adoption.

This ambiguity is particularly impactful for heavily regulated industries that require clear compliance frameworks before integrating Web3 solutions. The varying legal interpretations of blockchain-based contracts and governance structures, such as decentralized autonomous organizations (DAOs), add complexity. Navigating these evolving rules presents a challenge for market players seeking stability and long-term growth.

Opportunity

Enhanced Transparency and Trust

Web3 offers unprecedented opportunities to increase transparency and build trust in digital interactions. Blockchain technology ensures data immutability, meaning all recorded transactions are permanent and visible to network participants. This transparency empowers users with more control over their data and assets while reducing fraud and disputes.

Industries like finance, supply chain management, and digital rights management stand to benefit greatly from this transparency. Smart contracts automate agreements with clear, auditable conditions, reducing reliance on intermediaries and improving operational efficiency. This ability to foster trust through transparent systems is a transformative opportunity driving Web3 adoption.

Challenge

Scalability and User Experience

Web3 faces significant challenges in scalability and delivering a smooth user experience. Current blockchain platforms struggle with processing large volumes of transactions quickly, leading to slower speeds and higher costs compared to centralized systems. These performance limitations restrict the ability of Web3 solutions to support mass adoption.

In addition, the complexity of interacting with blockchain tools such as wallets, private keys, and DAOs creates a steep learning curve for everyday users. This usability gap hampers user growth and the shift from niche crypto communities to mainstream audiences. Improving scalability and simplifying user interfaces remain critical hurdles for the Web3 market to overcome.

Competitive Analysis

The Web3 Blockchain Market is led by foundational ecosystem contributors such as the Ethereum Foundation, Polygon (Matic Network), Chainlink Labs, and ConsenSys. These organizations provide the core infrastructure that powers decentralized applications (dApps), smart contracts, and interoperability frameworks. Their technologies support use cases in decentralized finance (DeFi), NFTs, and digital identity management, forming the backbone of the modern Web3 landscape.

Prominent blockchain innovators including Filecoin, Flow (Dapper Labs), Uniswap Labs, Aave, and Ocean Protocol Foundation Ltd. are advancing decentralized storage, trading, lending, and data-sharing platforms. Their focus on scalability, transparency, and user empowerment enables frictionless digital ownership and peer-to-peer transactions while reducing reliance on centralized intermediaries.

Emerging and community-driven networks such as Helium Systems Inc., Decentraland, Tezos Foundation, Arweave, Radix DLT, Zilliqa, Alchemy Insights Inc., and Binance, along with other market participants, continue to expand the Web3 ecosystem. Their innovations in decentralized computing, 3D virtual environments, and blockchain infrastructure enhance accessibility, security, and real-world applicability of decentralized technologies across industries.

Top Key Players in the Market

- Antier Solutions

- Chainlink Labs

- Filecoin

- Ethereum Foundation

- Flow (Dapper Labs)

- Uniswap Labs

- Polygon (Matic Network)

- Ocean Protocol Foundation Ltd.

- ConsenSys

- Aave

- Helium Systems Inc.

- Decentraland

- Tezos Foundation

- Arweave

- Radix DLT

- Binance

- Zilliqa

- Alchemy Insights Inc.

- Others

Recent Developments

- September 2025: The Ethereum Foundation launched a dedicated AI team to support agentic payments and advanced smart contract automation, showing their commitment to integrating AI with blockchain applications.

- August 2025: Antier Solutions emphasized their role in accelerating Web3 adoption through new white-label blockchain solutions, helping enterprises quickly build blockchain applications. They also highlighted trends including DeFi and asset tokenization as growing areas of focus.

- June 2025: Flow by Dapper Labs reported a surge in ecosystem momentum, confirming increased developer activity and partnerships, furthering NFT and gaming integrations on their platform.

Report Scope

Report Features Description Market Value (2024) USD 4.43 Bn Forecast Revenue (2034) USD 226.40 Bn CAGR(2025-2034) 48.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Blockchain Type (Public, Private, Consortium, Hybrid), By Application (Cryptocurrency, Conversational AI, Data & Transaction Storage, Payments, Smart Contracts, Others), By Vertical (BFSI, E-commerce & Retail, Media & Entertainment, Healthcare & Pharmaceuticals, IT & Telecom, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Antier Solutions, Chainlink Labs, Filecoin, Ethereum Foundation, Flow (Dapper Labs), Uniswap Labs, Polygon (Matic Network), Ocean Protocol Foundation Ltd., ConsenSys, Aave, Helium Systems Inc., Decentraland, Tezos Foundation, Arweave, Radix DLT, Binance, Zilliqa, Alchemy Insights Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Antier Solutions

- Chainlink Labs

- Filecoin

- Ethereum Foundation

- Flow (Dapper Labs)

- Uniswap Labs

- Polygon (Matic Network)

- Ocean Protocol Foundation Ltd.

- ConsenSys

- Aave

- Helium Systems Inc.

- Decentraland

- Tezos Foundation

- Arweave

- Radix DLT

- Binance

- Zilliqa

- Alchemy Insights Inc.

- Others