Global Wearable Medical Devices Market By Product Type (Diagnostic Devices, Therapeutic Devices) By Grade (Consumer-Grade, and Clinical), By Application (Sports And Fitness, Remote Patient Monitoring, and Home Healthcare), By Distribution Channel (Pharmacies, Online Channel, and Hypermarkets), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 27935

- Number of Pages: 351

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

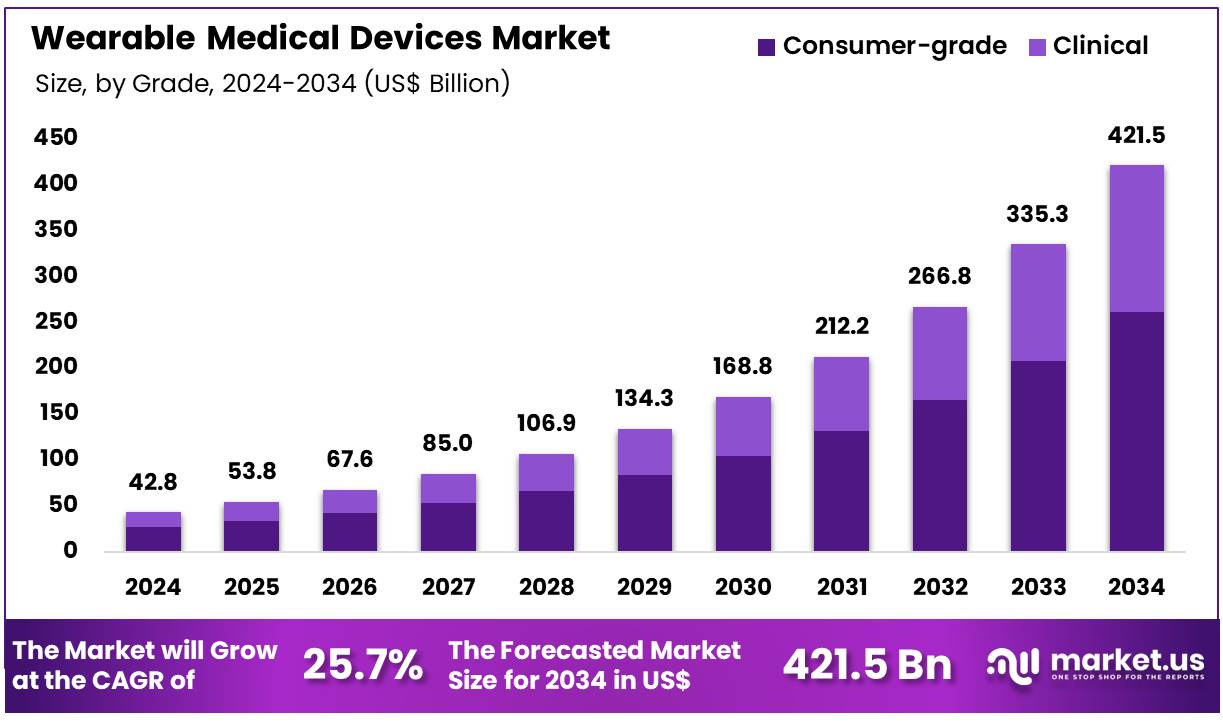

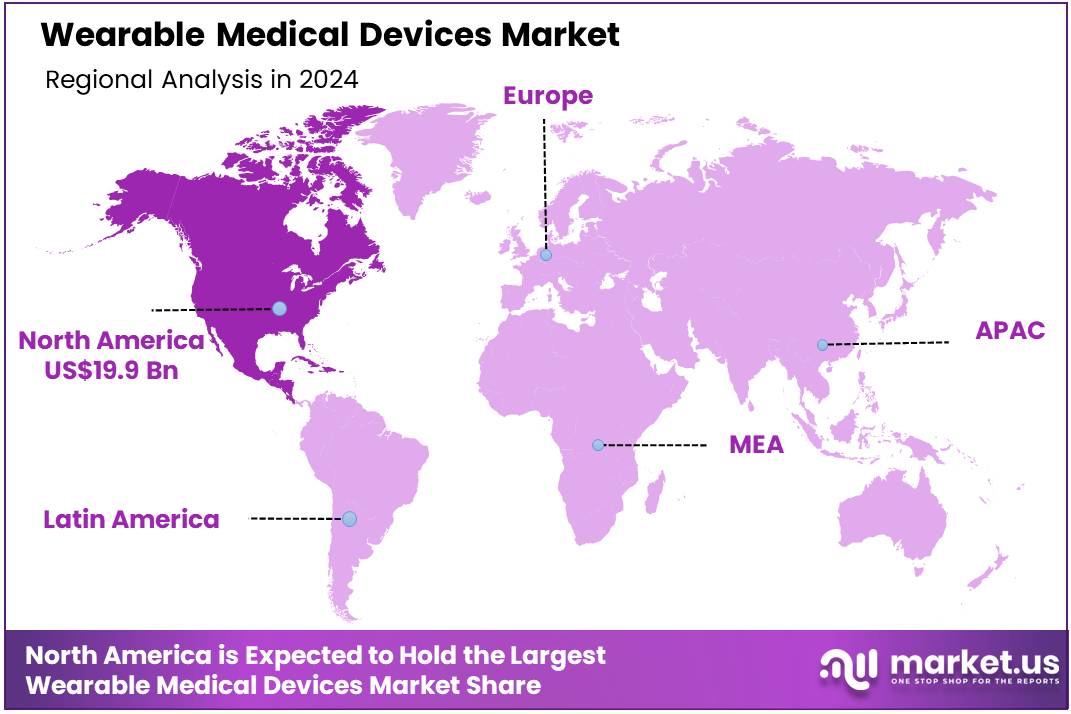

Global Wearable Medical Devices Market size is expected to be worth around US$ 421.5 Billion by 2034 from US$ 42.8 Billion in 2024, growing at a CAGR of 25.7% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 46.5% share with a revenue of US$ 19.9 Billion.

Rising prevalence of chronic conditions drives the wearable medical devices market as healthcare professionals seek continuous monitoring tools to manage patient health effectively. Physicians increasingly prescribe wearables for cardiovascular applications, tracking heart rhythm irregularities to prevent strokes in at-risk individuals. This driver escalates with the demand for respiratory monitoring, where devices detect oxygen saturation dips in COPD patients for timely interventions.

Clinics utilize these systems for hypertension management, alerting users to blood pressure spikes via smart bands. In May 2024, Koninklijke Philips N.V. launched the ePatch with the AI-powered Cardiologs platform across 14 hospitals, enabling 14-day heart monitoring to improve arrhythmia detection. According to the WHO, cardiovascular diseases cause 17.9 million deaths annually, emphasizing the essential role of wearables in proactive care across clinical settings.

Growing integration of artificial intelligence fosters substantial opportunities in the wearable medical devices market. Developers create AI-enhanced patches that analyze sleep patterns, supporting neurology applications by identifying seizure precursors in epilepsy patients. Health organizations explore wearables for wound care, monitoring healing progress through moisture sensors in diabetic foot ulcers.

Opportunities also arise in fertility tracking, where devices predict ovulation cycles to assist reproductive health planning. In April 2025, Stanford Medicine partnered with Samsung to refine the Galaxy Watch’s sleep apnea detection, advancing AI for continuous sleep monitoring. The FDA authorized 124 new medical devices in 2023, with a notable portion focused on wearable innovations, underscoring the market’s potential for expanded, intelligent health solutions.

Recent trends in the wearable medical devices market highlight hybrid care models and consumer-grade integrations to promote remote wellness. Innovators emphasize telehealth-compatible wearables for gastrointestinal applications, logging symptom data to guide irritable bowel syndrome treatments. In April 2025, Somnology collaborated with Samsung on a hybrid sleep care model, delivering personalized insights from wearable-generated reports.

Trends also include biosignal sensors for musculoskeletal rehab, aiding post-injury mobility assessments. Industry data shows 66% of new wearable users in 2020 adopted them for chronic condition management, reflecting sustained momentum toward accessible devices. These evolutions indicate a strategic progression toward seamless, data-empowered personal health ecosystems.

Key Takeaways

- In 2024, the market generated a revenue of US$ 42.8 Billion, with a CAGR of 25.7%, and is expected to reach US$ 421.5 Billion by the year 2034.

- The product type segment is divided into diagnostic devices and therapeutic devices, with diagnostic devices taking the lead in 2024 with a market share of 57.6%.

- Considering grade, the market is divided into consumer-grade and clinical. Among these, consumer-grade held a significant share of 62.1%.

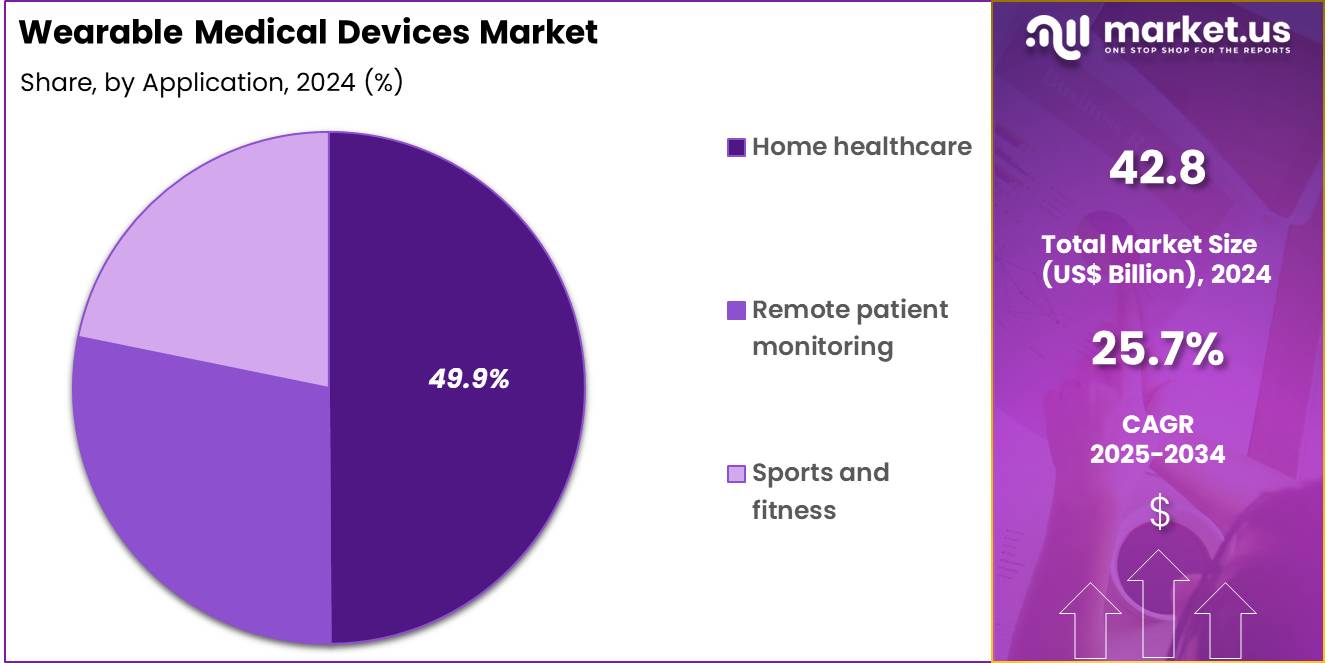

- Furthermore, concerning the application segment, the market is segregated into sports and fitness, remote patient monitoring, and home healthcare. The home healthcare sector stands out as the dominant player, holding the largest revenue share of 49.9% in the market.

- The distribution channel segment is segregated into pharmacies, online channel, and hypermarkets, with the pharmacies segment leading the market, holding a revenue share of 36.5%.

- North America led the market by securing a market share of 46.5% in 2024.

Product Type Analysis

Diagnostic devices account for 57.6% of the wearable medical devices market and are expected to maintain strong growth due to increasing demand for real-time health monitoring. The rising prevalence of chronic diseases such as cardiovascular conditions, diabetes, and respiratory disorders is anticipated to drive demand for wearable diagnostic solutions. These devices enable continuous monitoring of vital signs, providing early detection of health anomalies and reducing hospitalizations.

Technological advancements, including sensors, AI integration, and connectivity with smartphones and cloud platforms, are likely to enhance device capabilities and adoption. Consumer awareness about health management and preventive care is expected to support further expansion of diagnostic wearables. Hospitals, clinics, and homecare settings are increasingly integrating these devices into patient care protocols. Regulatory approvals and standards for wearable diagnostics are improving trust among healthcare providers.

Continuous innovation in compact, user-friendly designs is projected to encourage broader adoption. The growing trend of telemedicine and remote consultations further strengthens the demand for diagnostic devices. Partnerships between technology companies and healthcare providers are expected to accelerate market penetration.

Grade Analysis

Consumer-grade wearables hold 62.1% of the market and are projected to grow rapidly due to their affordability, convenience, and accessibility. Rising health consciousness among individuals, increasing fitness awareness, and the desire for proactive health monitoring are anticipated to fuel adoption. Consumer-grade devices, including smartwatches, fitness trackers, and personal monitoring devices, allow users to track vital signs, sleep, and activity levels easily.

Integration with mobile apps and cloud platforms enhances usability and engagement, supporting sustained market growth. The increasing popularity of self-care and home healthcare initiatives is expected to drive consumer-grade adoption further. Additionally, manufacturers are launching innovative designs with improved sensor accuracy, battery life, and data analytics, making devices more attractive.

Social trends emphasizing preventive healthcare and personalized wellness plans are likely to encourage wider use. Partnerships with insurance providers and wellness programs are expected to boost consumer acceptance. Evolving e-commerce channels and retail availability enhance market reach. The combination of affordability, convenience, and real-time data monitoring ensures consumer-grade devices remain a dominant segment.

Application Analysis

Home healthcare applications hold 49.9% of the wearable medical devices market and are expected to grow steadily due to the rising demand for remote patient monitoring and aging-in-place initiatives. Patients increasingly prefer receiving care at home, reducing hospital visits while ensuring continuous health monitoring. Wearable devices in home healthcare allow caregivers and healthcare providers to track vital signs, detect early warning signals, and manage chronic conditions remotely. Telemedicine integration further enhances their utility by providing real-time data to clinicians.

The growth of home healthcare is supported by government initiatives, healthcare reimbursement policies, and rising awareness of patient-centric care. Devices that monitor cardiovascular health, blood glucose, and respiratory function are increasingly adopted in home settings. Advances in wireless connectivity, data security, and cloud-based platforms improve reliability and user experience.

The rising prevalence of chronic diseases, particularly among aging populations, is expected to sustain demand. Partnerships between device manufacturers and healthcare service providers are likely to drive further adoption. Home healthcare’s focus on convenience, safety, and proactive care ensures the continued expansion of wearable devices in this application.

Distribution Channel Analysis

Pharmacies account for 36.5% of the distribution channel segment and are anticipated to remain a key channel for wearable medical devices due to their accessibility and consumer trust. Pharmacies provide a convenient point of sale for both diagnostic and therapeutic devices, ensuring availability for home-based users. The growing consumer preference for over-the-counter health monitoring devices and wearable diagnostics is expected to boost sales through pharmacies.

Pharmacists increasingly provide guidance on proper use and interpretation of wearable devices, enhancing adoption and user confidence. Strategic partnerships between device manufacturers and pharmacy chains are likely to expand product reach and marketing initiatives. The convenience of immediate purchase, combined with professional advice, strengthens the role of pharmacies as a distribution channel.

Additionally, pharmacies are increasingly integrating digital services and e-commerce options to complement in-store availability. Awareness campaigns and health promotion initiatives in pharmacies are expected to drive consumer education and adoption. Rising demand for self-monitoring and preventive healthcare solutions further supports pharmacy-based sales. Overall, pharmacies are projected to continue serving as a central distribution point for wearable medical devices, particularly for home healthcare and consumer-grade products.

Key Market Segments

By Product Type

- Diagnostic Devices

- Vital Sign Monitoring Devices

-

-

- Heart Rate Monitors

- Activity Monitors

- Electrocardiographs

- Pulse Oximeters

- Spirometers

- Blood Pressure Monitors

- Others

-

-

- Sleep Monitoring Devices

-

-

- Sleep trackers

- Wrist Actigraphs

- Polysomnographs

- Others

-

-

- Electrocardiographs Fetal And Obstetric Devices

- Neuromonitoring Devices

-

-

- Electroencephalographs

- Electromyographs

- Others

-

- Therapeutic Devices

- Pain Management Devices

-

-

- Neurostimulation Devices

- Others

-

-

- Insulin/Glucose Monitoring Devices

-

-

- Insulin Pumps

- Others

-

-

- Rehabilitation Devices

-

-

- Accelometers

- Sensing Devices

- Ultrasound Platform

- Others

-

-

- Respiratory Therapy Devices

-

-

- Ventilators

- Positive Airway Pressure (PAP) Devices

- Portable Oxygen Concentrators

- Others

-

By Grade

- Consumer-Grade

- Clinical

By Application

- Sports And Fitness

- Remote Patient Monitoring

- Home Healthcare

By Distribution Channel

- Pharmacies

- Online Channel

- Hypermarkets

Drivers

The Rising Prevalence of Chronic Diseases is driving the market

The increasing global incidence of chronic diseases, such as cardiovascular conditions and diabetes, is a primary driver for the wearable medical devices market. This surge in long-term illnesses necessitates continuous and proactive patient monitoring beyond traditional clinical settings. Wearable devices offer a convenient and non-invasive solution to track vital signs, glucose levels, heart rhythms, and physical activity in real-time, empowering both patients and healthcare providers.

By facilitating early detection of concerning trends or acute events, these devices can potentially mitigate the risk of severe complications and reduce the frequency of costly hospital visits. The sheer scale of the challenge posed by chronic conditions underscores the demand for these monitoring solutions. For instance, the Centers for Disease Control and Prevention (CDC) reported that in the United States, approximately 6 in 10 Americans live with at least one chronic disease.

The financial burden of this is substantial, with the total estimated cost of diagnosed diabetes alone in the US reaching US$413 billion in 2022 for medical costs and lost productivity. This immense and growing health and economic burden provides a powerful impetus for adopting affordable, continuous monitoring technologies like wearable medical devices.

Restraints

Data Privacy and Security Concerns are restraining the market

The widespread adoption of wearable medical devices is significantly restrained by increasing concerns surrounding the privacy and security of sensitive personal health information (PHI) that these devices collect. Wearables gather a constant stream of granular, real-time physiological data, which, if breached or misused, could expose users to substantial risks, including identity theft, discrimination, or manipulation.

This data is often transmitted and stored on cloud-based platforms, creating numerous vulnerability points that need robust cybersecurity measures, which are often costly and complex for manufacturers to implement and maintain. Regulatory requirements, such as those related to the Health Insurance Portability and Accountability Act (HIPAA) in the US, add a layer of complexity and potential delay to the product development and market entry process, especially for clinical-grade wearables. The need to ensure regulatory compliance and guarantee absolute data protection for every device is a major technical and financial hurdle that can slow down innovation and deter consumer trust.

Opportunities

The Proliferation of Remote Patient Monitoring (RPM) is creating growth opportunities

The expansion of remote patient monitoring (RPM) services represents a substantial growth opportunity for the wearable medical devices market, fundamentally changing how healthcare is administered, particularly for the long-term management of chronic conditions. RPM systems use wearables to seamlessly collect and transmit a patient’s vital health data directly to their healthcare providers, allowing for continuous oversight and facilitating timely clinical interventions. This model enhances patient engagement and significantly improves clinical outcomes by replacing episodic clinic visits with proactive, data-driven care.

The shift to virtual care is highly favored by both consumers, who seek convenience, and providers, who aim for greater operational efficiency and reduced readmission rates. The increasing integration of wearables into structured RPM programs highlights this opportunity. A clear indicator of the trend’s strong adoption in clinical practice is the massive increase in billing for these services.

In the United States, for example, the number of Medicare claims for Remote Physiological Monitoring (RPM) services experienced a significant surge, increasing more than five-fold over a three-year period leading up to 2023. This dramatic increase in claims and reimbursement demonstrates the massive scaling of remote patient monitoring as a standard practice within the established healthcare system, thereby solidifying the market opportunity for compliant wearable medical devices.

Impact of Macroeconomic / Geopolitical Factors

Persistent supply chain volatilities and climbing energy benchmarks compel innovators in the health monitoring gadget domain to shelve advanced biosensor integrations, diverting funds to buffer inventories against erratic procurement cycles. Surging trans-Pacific alliance strains and Suez Canal congestions throttle shipments of flexible PCB substrates, stretching validation intervals and amplifying freight premiums for Indo-European joint ventures.

Resourceful trailblazers, though, secure tie-ups with Chilean copper refiners, instilling traceability protocols that allure impact-driven venture capital. Mounting lifestyle disease epidemics steer insurer premiums toward remote vitals trackers, galvanizing fleet deployments in corporate health regimens.

Additionally, the US enactment of 60% duties on Chinese-sourced semiconductors under Section 301 extensions from March 2025 burdens the sector by spiking assembly expenses for pulse oximeters and activity pods, eroding entry-level pricing and spurring consolidation among midstream assemblers. This escalation frays co-innovation threads with Guangdong clusters, episodically stunting OTA update cadences. Visionary operators harness IRA rebates to bootstrap Arizona cleanroom ventures, trailblazing biofeedback algorithms and seeding expertise in flexible electronics.

Latest Trends

Integration of Artificial Intelligence (AI) and Machine Learning (ML) is a recent trend

A recent and pivotal trend in the wearable medical device market is the deep integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms, which are moving devices beyond simple data collection to advanced, personalized predictive health analytics. AI-enabled wearables analyze continuous data streams to identify subtle patterns that may signal the onset of a health issue, offering truly proactive and individualized care. This capability transforms raw data into actionable clinical insights, improving the accuracy of diagnostics and therapeutic interventions.

A strong indicator of this trend’s momentum is the increasing number of regulatory clearances for AI-enabled medical devices, including wearables. As per the US Food and Drug Administration (FDA) data on Software as a Medical Device (SaMD) clearances, the pace of innovation is clear: from October 2024 to May 2025, numerous wearable or sensor-based digital health technology (sDHT) devices have received FDA clearance or approval.

For example, during this period, notable clearances included a continuous glucose monitoring system by Dexcom, an ECG feature for a wearable by Whoop, and an Ambulatory blood pressure monitoring device by BioBeat Technologies, Ltd., signifying a strong push toward clinically validated, AI-enhanced wearable technologies in the 2024-2025 timeframe.

Regional Analysis

North America is leading the Wearable Medical Devices Market

In 2024, North America captured a 46.5% share of the global Wearable Medical Devices market, propelled by heightened integration of continuous glucose monitors and ECG-enabled smartwatches into routine chronic disease surveillance protocols for diabetes and atrial fibrillation patients. Healthcare networks adopted these ambulatory tools to enable remote vital sign trending, reducing clinic visits by facilitating data feeds directly into physician dashboards for timely adjustments in insulin dosing or anticoagulation therapy.

The surge in hybrid care delivery models post-pandemic amplified reliance on devices with fall detection and activity tracking, particularly among the elderly demographic facing mobility limitations. Regulatory momentum through streamlined 510(k) pathways encouraged manufacturers to innovate in battery-efficient sensors, ensuring prolonged wearability without compromising signal fidelity. Payer policies from private insurers expanded coverage for FDA-designated devices, incentivizing consumer uptake in preventive cardiology programs.

Collaborative pilots in community wellness initiatives demonstrated efficacy in early hypertension detection, correlating with lowered emergency department admissions. These strategic evolutions highlighted the area’s focus on seamless, patient-empowered monitoring ecosystems. The FDA cleared 17 AI/ML-enabled wearable medical devices from 2022 to 2024, encompassing innovations in cardiovascular and anesthesiology monitoring.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Health authorities across Asia Pacific anticipate the wearable medical devices sector to expand markedly during the forecast period, as strategic allocations target ambulatory monitoring tools to manage escalating metabolic disorders in urbanizing societies. Regulators in India and South Korea direct resources toward subsidized ECG patches, empowering general practitioners to oversee arrhythmia risks in high-density labor forces without invasive procedures.

Technology developers collaborate with state labs to refine sweat-based biosensors, projecting accurate hydration assessments for athletes in humid climates. Innovation precincts in Singapore and Taiwan pioneer haptic feedback bands, positioning rehabilitation centers to guide stroke survivors through personalized gait exercises.

Governments estimate deploying network-linked oximeters in remote outposts, bridging diagnostic voids in island territories via satellite uplinks. Local consortia advance neural interface headsets, synchronizing with public health apps to track migraine patterns in professional cohorts. These pursuits cultivate a robust arena for proactive, culturally attuned health oversight. India’s Ministry of Electronics and Information Technology invested 10 billion INR in AI R&D in 2024, encompassing advancements in wearable health analytics.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading companies in the ambulatory monitoring market are driving growth by introducing multifunctional trackers with integrated biosensors capable of continuous ECG and SpO2 monitoring, with a focus on preventive cardiology. They form co-marketing partnerships with fitness brands to promote hybrid devices, increasing visibility among wellness-conscious consumers. Innovators invest in flexible substrate materials to create lightweight, durable wearables suitable for daily use.

Market leaders are also acquiring algorithm specialists to enhance proprietary signal processing and improve diagnostic accuracy. Expansion into South America and Central Asia allows companies to align product certifications with emerging telemedicine regulations, accessing subsidized healthcare channels. Additionally, freemium app ecosystems are being developed to upsell advanced analytics, fostering habitual engagement and driving ancillary revenue.

Abbott Laboratories, founded in 1888 and headquartered in Chicago, Illinois, maintains a broad portfolio in diagnostics and nutrition, with its diabetes care division leading continuous glucose monitoring through the FreeStyle Libre ecosystem. The company provides millions of patients with flash-based sensors and readers that integrate seamlessly with insulin pumps, simplifying self-management for type 1 and type 2 diabetes. Abbott’s cross-functional teams focus on enhancing adhesive technologies and app interoperability while maintaining compliance with FDA and CE regulatory pathways.

CEO Robert B. Ford oversees a US$40 billion enterprise operating in 160 countries, emphasizing ethical data handling in connected health solutions. The firm collaborates with endocrinologists to enable family oversight through LibreLinkUp features without compromising privacy. By combining hardware innovation with software ecosystems, Abbott strengthens its leadership in delivering accessible, real-time metabolic insights.

Top Key Players

- Tandem Diabetes Care, Inc

- OMRON Healthcare, Inc

- Medtronic

- Koninklijke Philips N.V.

- Insulet Corporation

- GE HealthCare

- Garmin Ltd

- Fresenius Medical Care AG

- EMAY

- Dexcom, Inc

- Cognita Labs

- CAIRE Inc

- AliveCor, Inc

- Abbott

Recent Developments

- In February 2025, VitalConnect raised USD 100 million to commercialize its arrhythmia-detecting heart monitor. This investment drives the wearable medical devices market by increasing the availability of clinically validated devices that enable continuous cardiac monitoring and early detection of heart conditions.

- In January 2025, Smart Meter reported a 300% sales growth since 2022 and quadrupled its customer base, now serving over 350,000 patients. Its expansion drives the wearable medical devices market by demonstrating scalable adoption of patient-worn monitoring solutions that improve chronic disease management and remote care capabilities.

Report Scope

Report Features Description Market Value (2024) US$ 42.8 Billion Forecast Revenue (2034) US$ 421.5 Billion CAGR (2025-2034) 25.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Diagnostic Devices (Vital Sign Monitoring Devices (Heart Rate Monitors, Activity Monitors, Electrocardiographs, Pulse Oximeters, Spirometers, Blood Pressure Monitors, and Others), Sleep Monitoring Devices (Sleep Trackers, Wrist Actigraphs, Polysomnographs, and Others), Electrocardiographs Fetal And Obstetric Devices, Neuromonitoring Devices (Electroencephalographs, Electromyographs, and Others)), and Therapeutic Devices (Pain Management Devices (Neurostimulation Devices, and Others), Insulin/Glucose Monitoring Devices (Insulin Pumps, and Others), Rehabilitation Devices (Accelometers, Sensing Devices, Ultrasound Platform, and Others), Respiratory Therapy Devices (Ventilators, Positive Airway Pressure (PAP) Devices, Portable Oxygen Concentrators, and Others))), By Grade (Consumer-Grade, and Clinical), By Application (Sports And Fitness, Remote Patient Monitoring, and Home Healthcare), By Distribution Channel (Pharmacies, Online Channel, and Hypermarkets) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Tandem Diabetes Care, Inc, OMRON Healthcare, Inc, Medtronic, Koninklijke Philips N.V., Insulet Corporation, Google, GE HealthCare, Garmin Ltd, Fresenius Medical Care AG, EMAY, Dexcom, Inc, Cognita Labs, CAIRE Inc, AliveCor, Inc, Abbott. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Wearable Medical Devices MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Wearable Medical Devices MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Tandem Diabetes Care, Inc

- OMRON Healthcare, Inc

- Medtronic

- Koninklijke Philips N.V.

- Insulet Corporation

- GE HealthCare

- Garmin Ltd

- Fresenius Medical Care AG

- EMAY

- Dexcom, Inc

- Cognita Labs

- CAIRE Inc

- AliveCor, Inc

- Abbott