Wearable Injectors Market By Type (On-Body Injectors and Off-Body Injectors), By Applications (Oncology, Diabetes, Autoimmune Disease, Cardiovascular Disease, and Other Applications), By Technology, By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2024

- Report ID: 101436

- Number of Pages: 287

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

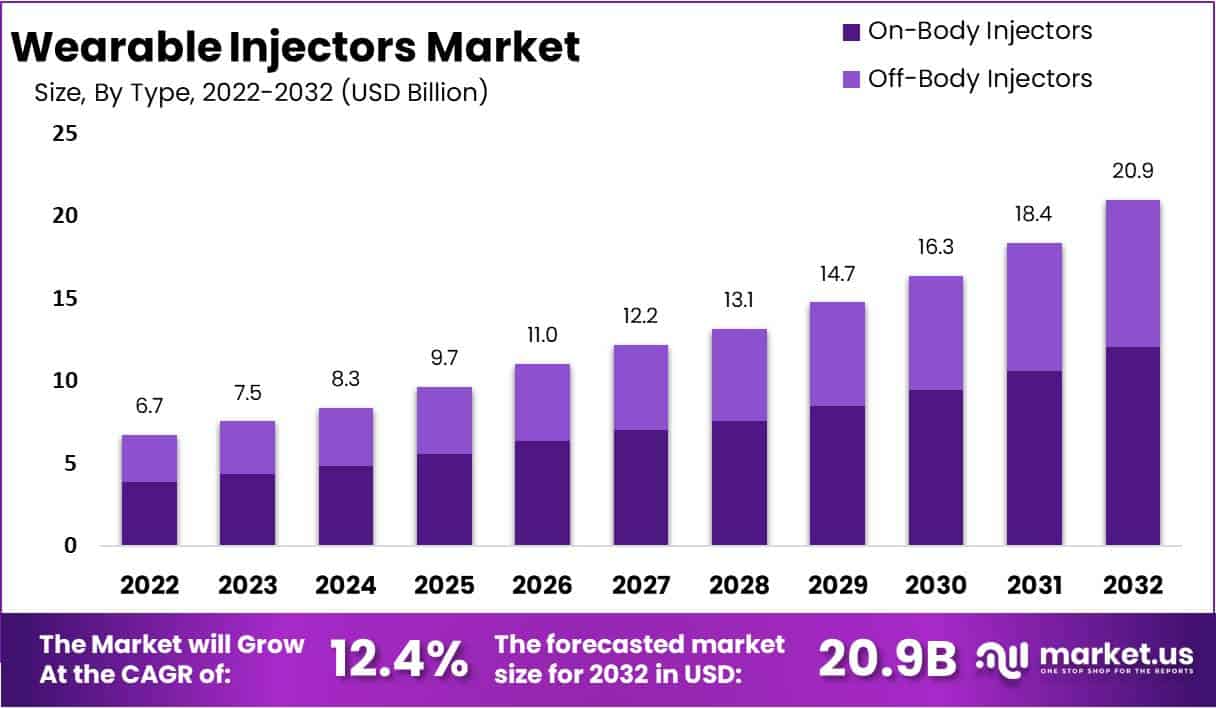

The Global Wearable Injectors Market Size is expected to be worth around USD 20.9 Billion by 2032, from USD 6.7 Billion in 2022, growing at a CAGR of 12.4% during the forecast period from 2023 to 2032.

Wearable Injectors can be used for drug delivery. They are a handheld, portable device that is designed to deliver drugs. The technology is self-scalable and self-managed by patients. It is vital for people suffering from chronic diseases like diabetes, obesity, hypertension, or other conditions.

Under proper supervision, the wearable injection device enhances the ability to administer the right amount of medical fluid. It is widely used in hospitals, clinics, and other healthcare facilities. Market drivers include the rising prevalence of chronic diseases, increasing geriatric populations, and growing concern about needle stick injuries.

Market expansion is expected to be supported by rising healthcare spending and the demand for continuous monitoring. Additionally, the wearable injectors market growth will also be accelerated by the rising demand for home-based treatments. Market expansion is also driven by robust healthcare infrastructure and an increase in lifestyle disorders. The market’s growth will be impeded by low demand in emerging economies and high wearable injector prices.

Key Takeaways

- The Wearable Injectors Market is witnessing remarkable growth, expected to reach USD 20.9 Billion by 2032 at a CAGR of 12.4% from 2023 to 2032.

- By Type, On-body injectors (57.6% of 2022 revenue) and off-body injectors are prominent segments, with off-body injectors growing at a CAGR of 16.2%. On-body injectors offer flexibility in dosing and reduce healthcare costs.

- Based on Applications, Oncology (30% of market share in 2022) dominates, driven by the need for self-administration of anti-tumor drugs. The autoimmune diseases segment is expected to grow at a CAGR of 16.5%.

- Spring-based injectors (38.5% of 2022 market share) lead, owing to ease of use. The rotary pump segment is expected to grow at a CAGR of 14.4% due to high customer demand.

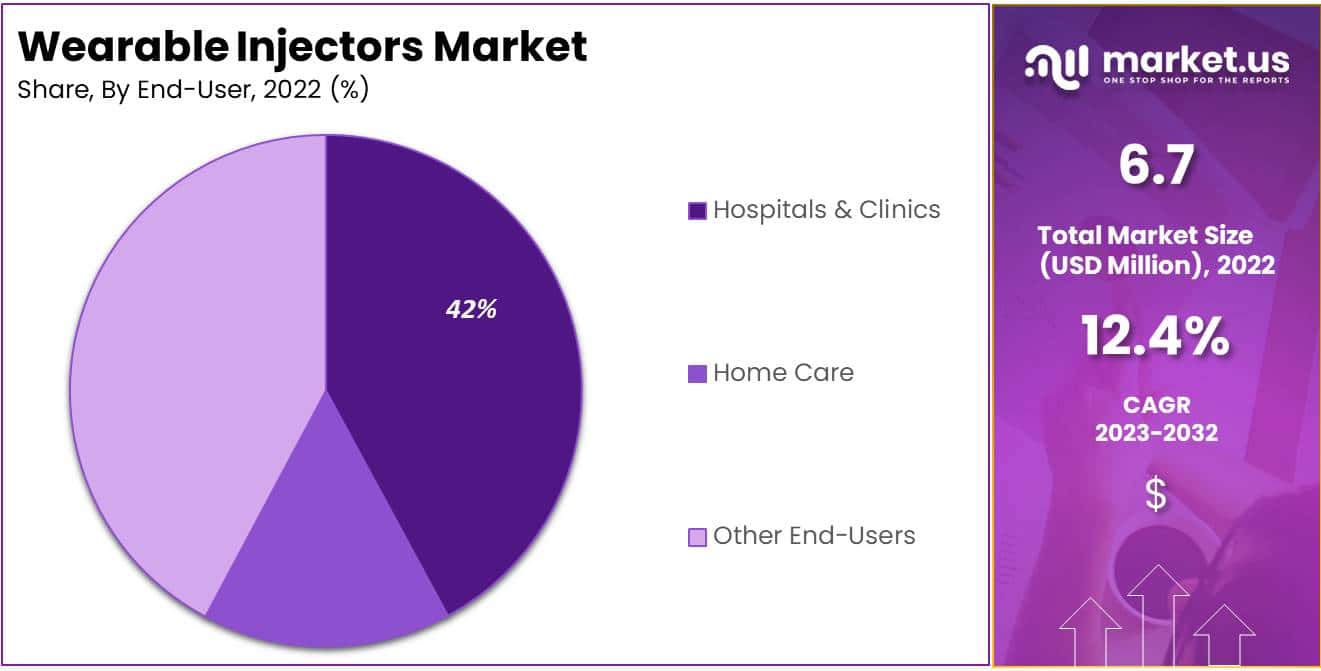

- The home care segment (42.1% market share in 2022) is dominating the End-Users segment, fueled by the demand for home-based healthcare and cost savings.

- The hospitals and clinics segment is growing at a CAGR of 15.7% due to the rising prevalence of chronic diseases.

- North America (34% of market share in 2022) leads the market due to a developed healthcare system and key market players.

- Asia Pacific is emerging as a significant market, supported by favorable government policies and a growing geriatric population.

Type Analysis

Based on type, the market for wearable injectors is segmented into on-body injectors and off-body injectors. In 2022, the on-body wearable injections made up 57.6% of the total revenue. This is due to the increased demand for these patches that are easy to apply to the skin (stomach). They can also be used at home and are water-resistant. On-body wearable injectors offer the following benefits:

- Reduced healthcare costs (decreased hospital visits)

- Management of the lifecycle (intravenous to subcutaneous)

- Changes in dosage frequency

- Flexible dosing

- Refrigerated drugs can be automatically warmed by an automatic heating system

The off-body segment will continue to grow due to the increasing investments in the development and enhancement of off-body injectors. As these devices are painless to remove, have adhesive problems to the skin, and can cause skin irritation or sensitivity, the off-body wearable injections will grow at the highest CAGR of 16.2 during the forecast period.

Application Analysis

Based on applications, the global wearable injector market is divided into oncology, diabetes, autoimmune disease, cardiovascular disease, and other applications. In 2022, 30% of the total market share was held by oncology. Globally, oncology is becoming more common. However, managing it is expensive.

Although many biologic drugs can be used in Oncology, they require frequent administrations and visits to specialized clinics or hospitals. This results in high costs and patient discomfort. Patients suffering from oncology are increasingly turning to wearable injectors for their ability to self-inject the drug and improve their lives. Their ability to deliver anti-tumor drugs automatically and safely is a major growth driver.

The segment of autoimmune diseases is expected to grow at a CAGR of 16.5% during the forecast period. The market for wearable injectors is growing due to the increasing demand for drug delivery. A growing number of wearable injectors to treat high diabetes burdens worldwide has led to a large segment of the diabetes market.

Technology Analysis

Based on technology, the market for wearable injectors is classified into spring-based, motor-driven, rotary pump, expanding battery, and other technologies. In 2022, the largest share was held by the spring-based wearable injections segment at 38.5%.

Market dominance is partly due to the ease of use and the ability to distribute medication subcutaneously by pressing one or more buttons. The spring-based sector is expected to dominate the market. According to a study, the Subject injector, a spring-based subcutaneous injection device, can deliver a precise 3 mL, 1CP viscous dose in just 4 minutes.

Due to the ease of use and higher customer demand, the rotary pump segment of wearable injectors is projected to grow at a CAGR rate of 14.4% over the forecast period.

End-User Analysis

Based on end-user, the market is segmented into hospitals & clinics, home care, and other end-users. With a market share of nearly 42.1%, the home care segment led the wearable injections market in 2022. This market is expanding due to the growing demand for home-based healthcare.

The need for advanced drug delivery devices that require minimal expertise and less hospitalization is expected to positively drive the global demand for wearable injections. Affordable wearable injectors and the growing demand for healthcare savings will drive the home care market.

The high cost of hospital therapy drives home care market growth. The fastest CAGR for the hospital segment is 15.7%. This is mostly due to the rising prevalence of chronic diseases.

Key Market Segments

Based on Type

- On-Body Injectors

- Off-Body Injectors

Based on Applications

- Oncology

- Diabetes

- Autoimmune Disease

- Cardiovascular Disease

- Other Applications

Based on Technology

- Spring-based

- Motor-driven

- Rotary Pump

- Expanding Battery

- Other Technologies

Based on End-User

- Hospitals & Clinics

- Home Care

- Other End-Users

Drivers

Rising prevalence of chronic diseases and the low cost of wearable injectors

To better manage the increasing number of chronic diseases, there has been a greater emphasis on wearable injectors to increase patient compliance and help with patient management. Treatment of chronic diseases like diabetes and heart disease requires injectables to be administered daily or weekly. This highlights the importance of using efficient and convenient injection technology.

Compared to other drug delivery systems, wearable injectors are inexpensive, and this cost-effectiveness is anticipated to boost the demand for wearable injectors. The expansion of the biopharmaceutical industry has led to the development of wearable injectors, which propels the overall growth of the industry.

Wearable injectors will not cause needle stick injuries, unlike parenteral and intravenous injections

Advanced injector technology ensures that the patient is not in direct contact with any needles. The needle can be inserted by attaching the injector and pressing the button. After the medicine has been released, the patient is alerted visually, audibly, and tactilely. The needle retracts automatically and locks out, allowing for safe and easy disposal. This limits the chances of needle stick injuries and boosts market growth.

Restraints

High cost of wearable injectors

As an alternative to having to admit the patient to a hospital for medical support, wearable injectors can be used. Technology platforms must be affordable to patients, payers, and pharmaceutical companies in order to achieve widespread adoption. Their adoption rate is lower among patients because they are more expensive than oral medication and autoinjectors.

Unfavorable reimbursement policies in developing countries

Many developing countries don’t offer reimbursement for wearable insulin pumps. Wearable insulin pumps in India are not covered by insurance, and there are no guidelines for their use. Patients with Type 1 diabetes in China must pay the full cost of insulin pumps, supplies, and other out-of-pocket costs. In China, patients with Type 1 diabetes are not eligible for reimbursement. This will negatively impact the future growth of the market.

Opportunity

Increase in demand for biologics and mAbs

According to PhRMA (Pharmaceutical Research and Manufacturers of America), as many as 907 biologics have been in development over the past few years. The number of biological drugs in development is continuing to increase exponentially, with more than 2,700 remedies in development as of now, more than tripling the 907 in development over the past years.

mAb-based biotherapies account for 50% of the top 100 drugs and are projected to maintain a dominant position in the pharmaceutical market. Their efficacy in self-administration and convenience are likely to make wearable injectors the most prominent options.

American Lung Organisation reports that 500-1200 new cases of pulmonary arterial hypertension are reported each year. Wearable injectors can treat chronic diseases like rheumatoid arthritis, pulmonary arterial hypertension, and cancer. Wearable injectors have advanced features that allow for increased usage by patients around the world. This is driving the market size of wearable injectors delivery of such drugs.

Trends

Innovative injectors have a major impact on the expansion of the market

Dual Cartridge Injectors, Sonceboz’s wearable injector and Auto Reconstitution Injectors, reusable autoinjectors, Amgen wearable injection devices, and Subcutaneous Drug Delivery Devices are all being used in mAb-based biotherapy, infusion therapy, and at-home drug delivery. There are many innovative injectors, such as the QuickDose wearable injection device from CCBio, Sorrel Medical’s wearable drug delivery platform, E3D’s on-body injector, and the SmartDose injector containing Freedom60 syringe fusion.

This is driving up demand for wearable injectors market trends. These new products will have a major impact on the market for large volumes of wearable injectors, ultra-large volumes of wearable injectors, the market for wearable drug delivery devices, the market for wearable defibrillators, and the industry in wearable technology.

Regional Analysis

North America held the largest share of 34% in 2022

Based on region, the global wearable injectors market share is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Wearable injectors are on the rise in North America due to a highly developed healthcare system, the rising prevalence of chronic diseases, and lifestyle-related illnesses.

There has been an increase in demand for injectors in North America due to the presence of key market players such as Johnson & Johnson Services, Inc. and Becton, Dickinson, and Company. The rising disposable incomes and reimbursements for therapeutic drug delivery will further boost market growth.

Asia Pacific will register a higher CAGR over the forecast period than other regions. This can be attributed in part to favorable government policies for medical devices like wearable injectors and an increase in the geriatric population.

In the coming years, Germany will hold a significant portion of the global market. The main reason behind this is the fast-paced lifestyle that has made cardiovascular diseases (CVDs) a leading cause of death worldwide.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Emerging key players in the market are working on their strategic policies to expand their portfolios and appearance in the global market. Additionally, they are involved in new product launches, partnerships, collaborations, mergers & acquisitions, and competitive pricing.

Thus forming the competitive landscape in the market, they highly contribute to market growth. Many biopharmaceutical companies are looking for better ways to deliver biologic drugs. Wearable injectors may be the right solution.

Market Key Players

- Becton, Dickinson, and Company

- Ypsomed

- Amgen

- Insulet Corporation

- Tandem Diabetes Care, Inc.

- Johnson & Johnson Private Limited

- Hoffmann-La Roche AG

- Unilife Corporation

- West Pharmaceuticals Services, Inc.

- Medtronic

- SteadyMed Ltd.

- Other Key Players

Recent Developments

- In June 2024: Becton, Dickinson and Company (BD) announced its plans to acquire the Critical Care product group from Edwards Lifesciences for $4.2 billion in cash. This acquisition is aimed at expanding BD’s smart connected care solutions and establishing a stronger presence in advanced monitoring technologies. The transaction is expected to close by the end of the year, pending regulatory approvals. Critical Care, recognized for its innovative patient monitoring technologies and AI-driven clinical decision tools, reported over $900 million in revenue in 2023. The acquisition is projected to immediately contribute to BD’s revenue growth, gross margin, and earnings per share.

- In February 2024: Tandem Diabetes Care introduced the Tandem Mobi insulin pump with Control-IQ technology, marking a significant advancement in its product line. This new pump, designed to provide a tubeless insulin delivery option, supports both Dexcom G7 and G6 Continuous Glucose Monitoring (CGM) systems, offering enhanced flexibility and choice for diabetes management. The launch received positive feedback from early users and represents a significant step forward in diabetes care technology.

- In October 2023: Amgen completed the acquisition of Horizon Therapeutics plc for approximately $27.8 billion. This strategic move enhances Amgen’s portfolio with Horizon’s first-in-class, early-in-lifecycle medicines such as TEPEZZA® (teprotumumab-trbw), KRYSTEXXA® (pegloticase), and UPLIZNA® (inebilizumab-cdon), which are instrumental in treating rare inflammatory diseases.

- In April 2023: Ypsomed launched YpsoMate 5.5 mL and YpsoDose 10 mL, significant additions to its range of platform products for self-injection devices. These products represent a strategic expansion in Ypsomed’s portfolio, catering to the growing demand for higher-volume injectable drug delivery solutions. The launch is part of Ypsomed’s broader initiative to extend its manufacturing capacities in line with customer forecasts, aiming to support high-volume commercial productions. This development is not only about expanding Ypsomed’s product line but also strengthening its position in the market by catering to the evolving needs of pharmaceutical therapies requiring larger doses.

Report Scope

Report Features Description Market Value (2022) USD 6.7 Billion Forecast Revenue (2032) USD 20.9 Billion CAGR (2023-2032) 12.4% Base Year for Estimation 2022 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type – On-Body Injectors and Off-Body Injectors;

By Applications – Oncology, Diabetes, Autoimmune Disease, Cardiovascular Disease, and Other Applications;

By Technology – Spring-based, Motor-driven, Rotary Pump, Expanding Battery, and Other Technologies;

By End-User – Hospitals & Clinics, Home Care, and Other End-UsersRegional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Becton, Dickinson and Company, Ypsomed, Amgen, Insulet Corporation, Tandem Diabetes Care, Inc., Johnson & Johnson Private Limited, F. Hoffmann-La Roche AG, Unilife Corporation, West Pharmaceuticals Services, Inc., Medtronic, SteadyMed Ltd. and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Becton, Dickinson, and Company

- Ypsomed

- Amgen

- Insulet Corporation

- Tandem Diabetes Care, Inc.

- Johnson & Johnson Private Limited

- Hoffmann-La Roche AG

- Unilife Corporation

- West Pharmaceuticals Services, Inc.

- Medtronic

- SteadyMed Ltd.

- Other Key Players