Global Waterless Cosmetics Market, By Product Type (Skincare, Haircare, Makeup, and Other Product Types), By Nature (Synthetic, Organic), By Distribution Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Dec. 2024

- Report ID: 103929

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Driving Factors

- Restraining Factors

- COVID-19 Impact Analysis

- By Product Type Analysis

- By Nature Analysis

- By Distribution Channel Analysis

- Waterless Cosmetics Market Segments

- Opportunity

- Trends

- Regional Analysis

- Key Regions and Countries

- Market Share & Key Players Analysis

- Top Key Players in Global Waterless Cosmetics Market

- Recent Developments

- Report Scope

Report Overview

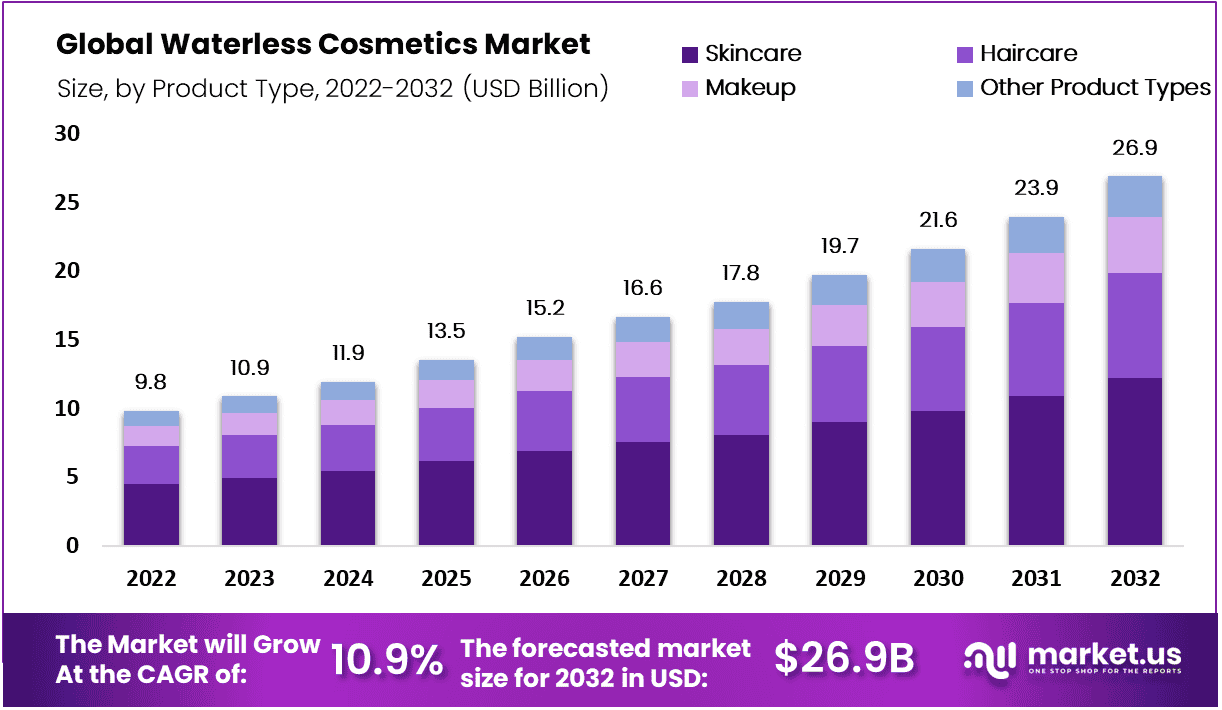

In 2022, the global waterless cosmetics market was worth US$ 9.8 billion. It is anticipated to grow a CAGR of 10.9% between 2023-2032. It will reach US$ 26.9 billion by 2032.

Waterless cosmetics, also known as anhydrous cosmetics, are beauty products that are formulated without the use of water as an ingredient. Instead of relying on water as a base, these products are created using various oil-based, wax-based, or powder-based formulations. Waterless cosmetics have gained popularity in recent years due to their potential environmental benefits and longer shelf life.

Waterless cosmetics reduce the demand for water, which is a precious resource. The production and distribution of water-based products can contribute to water scarcity and environmental degradation. By eliminating water from formulations, waterless cosmetics can have a lower ecological footprint. These cosmetics often contain highly concentrated active ingredients, as there is no need for dilution with water. This can result in more potent and effective products, offering better results for the skin.

High growth in the cosmetics and personal care sector and growing demand for environment-friendly and sustainable beauty products are major factors driving the waterless cosmetics market growth during the estimated time period. Moreover, rising disposable income, growing awareness about the benefits of waterless products, and technical developments are expected to contribute to market growth during the projection period.

Driving Factors

Growing Cosmetics and Personal Care Industry

According to a Study, the Indian beauty and personal care (BPC) industry rank eighth globally, with a value of $15 billion and a 10% annual growth rate. According to the analysis, skincare and cosmetics would be the two industries driving the market’s predicted expansion by 2030. Therefore, the growing cosmetics and personal care industry is likely to fuel the growth of the waterless cosmetics market during the projection period.

Increasing Disposable Income

Disposable incomes in many countries across the world have increased significantly in recent years. Growing disposable income has led to higher spending on personal care, cosmetics, and consumer goods, among other products. The U.S. Bureau of Economic Analysis estimates that in April 2023, personal income increased by $80.1 billion (0.4 percent on a monthly basis). DPI (disposable personal income) rose by $79.4 billion.

Personal expenditures rose by $156.0 billion (0.8%), while consumer spending rose by $151.7 billion. India’s disposable personal income climbed to 274133408 INR Million (USD 3345.352 billion) in 2022, according to the U.K. Ministry of Statistics and Programme Implementation. The minimum level was 91540 INR Million, while the maximum level was 206752288 INR Million. Thus, growing disposable income is likely to boost the demand for waterless cosmetics market during the projected time period, as more consumers are spending on personal care products.

Restraining Factors

Texture and Application Issues

Waterless cosmetics often have different textures and consistencies compared to their water-based counterparts. While some people may prefer these textures, others may find them less appealing or harder to apply smoothly. For example, waterless lipsticks or eyeshadows can be drier and less creamy, making them less comfortable to wear or blend. Thus, texture and application issues may limit the waterless cosmetics market growth during the projected time period.

Lack of Adequate Product Options

Water is a common ingredient in many cosmetic products, serving as a base or solvent for various formulations. By eliminating water, certain product types, such as liquid foundations or creams, may be more challenging to create in waterless form. This limitation can result in a narrower range of choices for consumers. As a result, a lack of adequate product options is expected to have a negative impact on the growth of the market during the projection period.

Potential for Increased Sensitivity or Dryness

Water has hydrating properties, and its absence in waterless cosmetics can contribute to a drier overall experience. Certain skin types, particularly those prone to dryness or sensitivity, may find waterless cosmetics less suitable for their needs. Without the moisturizing effect of water, these products may not provide sufficient hydration or could potentially exacerbate dryness and irritation. Therefore, such sensitivity or dryness issues may restrain the waterless cosmetics market growth during the estimated time period.

COVID-19 Impact Analysis

The COVID-19 crisis has upset the worldwide beauty sector. Due to significant store closures, first-quarter revenues were sluggish. Prolonged lockdowns around the world have had a significant influence on consumers’ health and well-being, as well as their lifestyles.

Aside from that, the outbreak spurred many to adopt a self-care routine or Do-it-Yourself (DIY) regimen. This clear shift in customer perception has also had an impact on the sales of beauty items, especially waterless cosmetics. Furthermore, the epidemic has spurred ethical purchasing, with consumers shifting their focus to local and regional brands. It is likely to contribute to the waterless cosmetics market growth during the projection period.

By Product Type Analysis

Skincare Products are Likely to Witness Highest Demand

The skincare segment dominated the waterless cosmetics market in 2022 with the largest revenue share of 45.5%. Waterless skincare products have indeed gained significant popularity and witnessed a growing demand in recent years. These products are formulated to minimize or eliminate the need for water as a primary ingredient.

By removing water as a filler ingredient, skincare products can be formulated with a higher concentration of active ingredients. This allows for more effective delivery of beneficial components to the skin, potentially yielding enhanced results. Thus, the high efficiency offered by waterless skincare products in is a major factor driving the growth of the segment.

Also, haircare products are expected to witness high growth over the forecast period. Waterless haircare products, such as dry shampoos, are convenient for people on the go or those who don’t have access to water, such as when traveling or camping. These products provide a quick and easy way to refresh and clean the hair without the need for traditional washing and rinsing.

Frequent washing and exposure to water can sometimes disrupt the natural balance of the scalp, leading to dryness, oiliness, or irritation. Waterless haircare products allow for less frequent washing, reducing the potential for scalp issues while still providing cleansing and freshness. Therefore, high convenience and the potential to avoid scalp issues are major factors driving the growth of the segment.

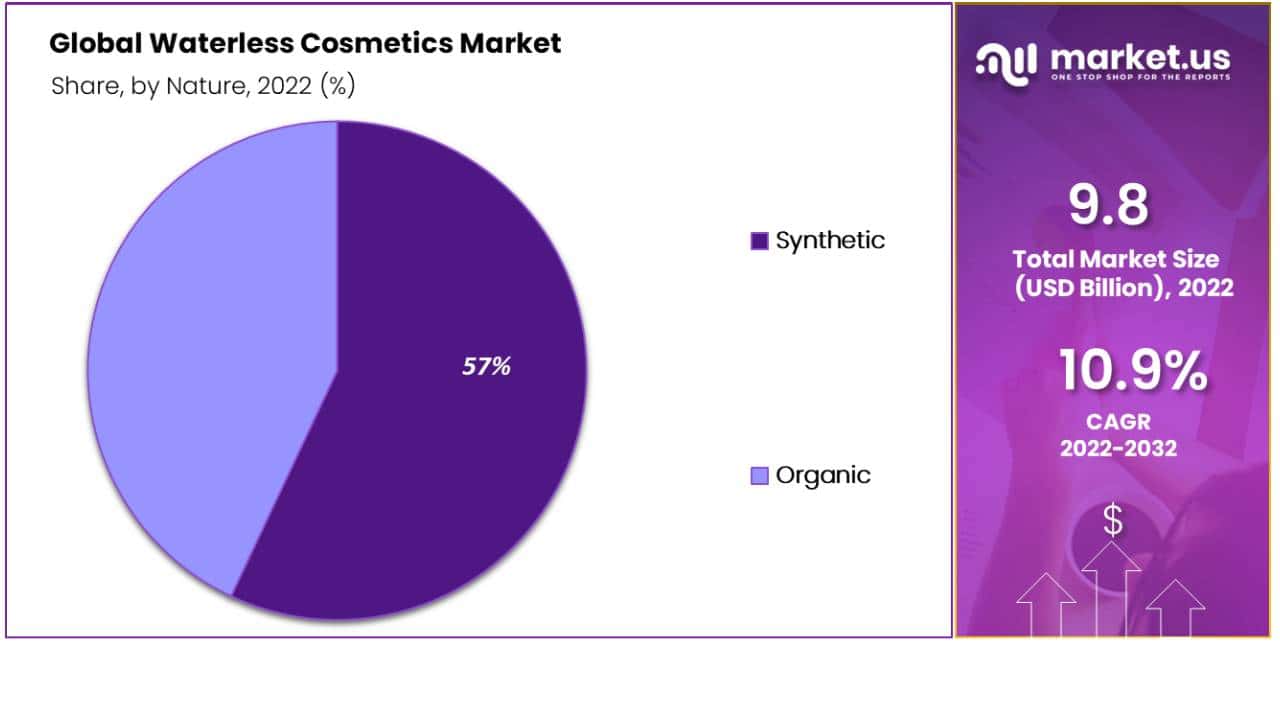

By Nature Analysis

Synthetic Waterless Cosmetics Dominate the Market

The synthetic segment leads the nature segment by accounting for a revenue share of 57% of waterless cosmetics market in 2022. The growth of the segment is stimulated by key factors such as, easy availability of several cosmetics and ingredients, high affordability, along with increasing product launches. Moreover, the demand for synthetic waterless cosmetics is fuelled by rising disposable consumer income, along with growing demand for flawless skin among individuals. It is anticipated to positively impact the growth of the segment during the projection period.

Also, the organic segment is anticipated to grow at a high rate over the projection period. The demand for organic waterless cosmetics has been gaining momentum in recent years due to the increasing consumer preference for natural and sustainable beauty products. Organic waterless cosmetics combine the benefits of organic ingredients with the convenience and sustainability of waterless formulations.

Water scarcity and the environmental impact of excessive water consumption are pressing concerns globally. Organic waterless cosmetics address these issues by minimizing or eliminating the use of water as a primary ingredient, reducing water waste, and conserving this valuable resource. This aligns with the growing desire for eco-friendly and sustainable beauty choices. Thus, a rising preference for natural cosmetic products is a key factor driving the segment growth.

By Distribution Channel Analysis

Supermarkets & Hypermarkets Lead the Market

The supermarkets & hypermarkets segment is likely to hold the largest revenue share of 49% of waterless cosmetics market in 2022. Supermarkets and hypermarkets often leverage economies of scale to offer competitive prices. Due to their large size and purchasing power, they can negotiate better deals with suppliers and manufacturers, resulting in lower prices for consumers. This makes these stores attractive to shoppers seeking affordable options and value for their money.

With their comprehensive product offerings, supermarkets and hypermarkets provide a convenient shopping experience. Consumers can find everything they need in one place, eliminating the need for multiple visits to different specialty stores. This saves time and effort, making these stores a preferred choice for busy individuals or families. Thus, high affordability, along with convenience offered by supermarkets and hypermarkets, are key factors driving the segment growth during the estimated time period.

Furthermore, online retailers are projected to witness the fastest growth during the estimated time period. The growth of the segment can be attributed to growing internet penetration, flexibility, and convenience offered by online retailers, along with the availability of a wide range of options.

Online retailers often provide additional convenience features, such as fast and reliable shipping, flexible return policies, and options for doorstep delivery. Some retailers offer subscription services or auto-replenishment programs, ensuring regular delivery of essential items. These services cater to the needs and preferences of busy consumers, further enhancing the convenience factor. These have been the main determinants for waterless cosmetics market growth

Waterless Cosmetics Market Segments

Product Type

- Skincare

- Haircare

- Makeup

- Other Product Types

Nature

- Synthetic

- Organic

Distribution Channel

- Supermarkets & Hypermarkets

- Specialty Stores

- Online Retailers

- Other Distribution Channels

Opportunity

Key Investments by Cosmetic Companies Can Encourage Growth in Waterless Cosmetics Market

Several cosmetic companies are constantly focused on new strategic investments. For instance, the Clarins group, in February 2023, announced an investment of 135 million euros to build a new cosmetics manufacturing facility on a 13.5-hectare location in Troyes, Northeastern France. In addition to the one in Pontoise, close to Paris, this will serve as the group’s second production location.

Moreover, in June 2023, BOLD, the corporate venture capital fund of L’Oréal, announced an investment in Debut, making it the company’s sole beauty sector investor. The funding will allow Debut, a biotech firm based in the United States, to swiftly develop its manufacturing platform and fulfill the rising demand for breakthrough compounds used in cosmetics, skincare, and packaging.

The investment expands on L’Oréal and Debut’s existing joint development programs, which use Debut’s broad IP portfolio, from which more than 7,000 compounds may be developed in order to bring high-value, more sustainable products to market faster. Such key investments by several cosmetic companies are likely to provide lucrative growth opportunities for the waterless cosmetics market during the projection period.

Trends

Growing Demand for Environment-Friendly and Sustainable Beauty Products

The latest buzzwords in customers’ skincare routines include “being organic,” “naturally produced,” “eco-friendly,” “sustainable,” and “vegan.” To represent sustainability, brands are also utilising language like “zero waste” and “eco-friendly packaging” when promoting their goods. Due to the fact that businesses are currently promoting products with claims like “clear beauty,” “water-free beauty,” “recyclable beauty,” and others, it has consequently become a hot topic of debate in the beauty industry.

Brands are increasingly interested in learning what factors influence consumer purchasing behavior when it comes to sustainability as a result of consumers’ increased attention to their health and well-being. Consumers are now more curious about the process than the product. Therefore, brands are attempting to comprehend this crucial change towards sustainable beauty brands and determine whether the savvy/conscious customer of today truly understands what it means for brands to “go green.” Hence, the growing demand for environment-friendly and sustainable beauty products is a new trend that is likely to boost the growth of the waterless cosmetics market in the upcoming time period.

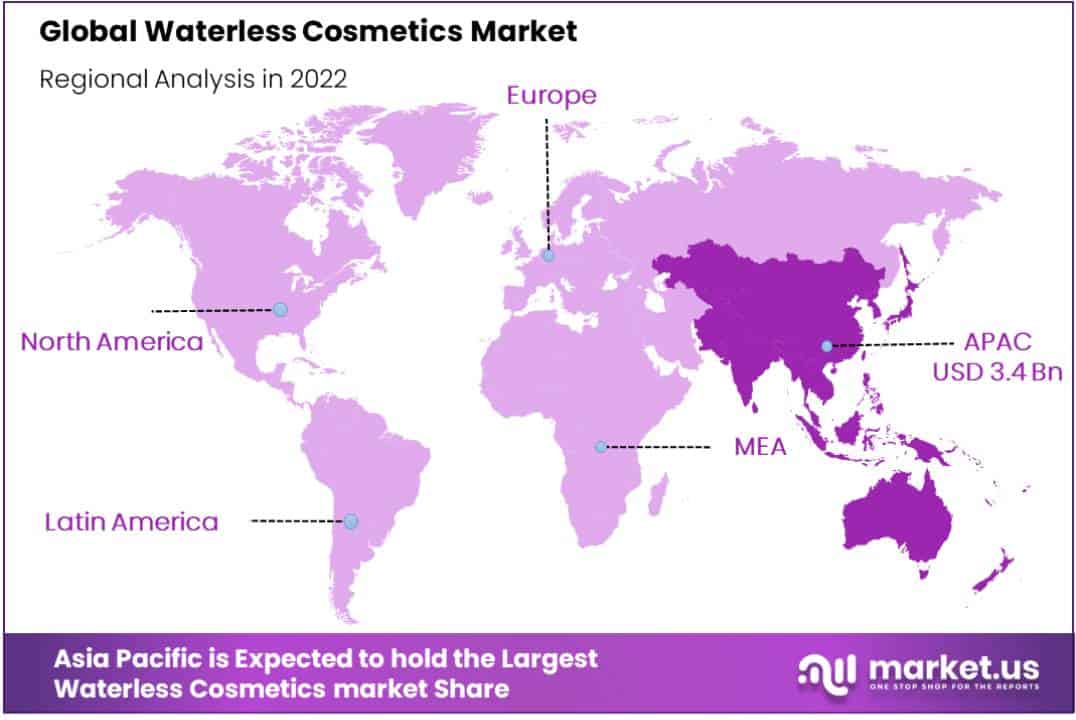

Regional Analysis

Asia-Pacific Leads the Market by Holding Major Revenue Share In Account

The Asia-Pacific region is expected to hold the largest share of 35% in the waterless cosmetics market during the projected time period. The growth of the market in the region is driven by increasing demand for waterless cosmetics from Asian nations such as India, China, Malaysia, South Korea, Thailand, etc., due to rising disposable income in these countries. Moreover, a rising number of product launches and technological advancements in the cosmetics and personal care sector are anticipated to boost the market growth in the region throughout the forecast period.

Moreover, the North America region is likely to witness high growth during the estimated time period. The growth of the waterless cosmetics market in the region can be attributed to the rise in demand for natural beauty products and organic ingredients, along with the growing beauty and personal care industry in countries like the United States. Also, the key role played by social media influencers in promoting the use of high-quality natural cosmetics is expected to fuel the expansion of the market throughout the region during the projection period.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

The global waterless cosmetics market is significantly competitive and consists of major market players who dominate the market. The market is anticipated to grow at a high rate during the projection period due to increasing demand for environment-friendly products. Additionally, increasing investments in the cosmetic sector, the launch of new products, strategic investments, and key partnerships and collaborations are likely to contribute to the growth of the market in the upcoming time period.

Top Key Players in Global Waterless Cosmetics Market

- L’Oréal

- Kao Corporation

- Unilever Plc

- Procter & Gamble

- Ruby’s Organics

- Pinch of Colour

- Clensta

- Carter + Jane

- Taiki USA

- Ktein

- Loli

- Other Key Players

Recent Developments

- In December 2022, CHOSEN, an Indian cosmetics company, introduced two waterless skincare exfoliants. The Milk Route Waterless comprises lactic acid, whilst the Light Routine Gentle Waterless consists of salicylic acid. Waterless skincare exfoliants are a new innovation that permits preservative-free skincare solutions.

- In September 2021, WWP Beauty, a private label beauty formulation and packaging supplier, introduced a new waterless product line named Zero+. The product line includes three multifunctional items with “clean and inclusive” ingredients. Meanwhile, the packaging is produced from natural, renewable materials derived from farm waste. Skin Prep + Perfector has beetroot extract, elderberry extract, and sea moss; Face + Eyes + Lips Enhancer contains squalene, elderberry extract, and sea moss; and Brow Shaper + Styler contains Jamaican black castor oil and fenugreek.

Report Scope

Report Features Description Market Value (2022) US$ 9.8 Bn Forecast Revenue (2032) US$ 26.9 Bn CAGR (2023-2032) 10.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type- Skincare, Haircare, Makeup, and Other Product Types), By Nature- Synthetic, Organic, By Distribution Channel- Supermarkets & Hypermarkets, Specialty Stores, Online Retailers, and Other Distribution Channels Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape L’Oréal, Kao Corporation, Unilever Plc, Procter & Gamble, Ruby’s Organics, Pinch of Colour, Clensta, Carter + Jane, Taiki USA, Ktein, Loli, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

How big is the global waterless cosmetics market?The global waterless cosmetics market was valued at US$ 9.8 billion in 2022. It is expected to reach US$ 26.9 billion in revenue by 2032.

What are waterless cosmetics?Waterless cosmetics, also known as anhydrous cosmetics, are beauty products formulated without water as an ingredient. They use oil-based, wax-based, or powder-based formulations instead.

Why are waterless cosmetics gaining popularity?Waterless cosmetics have gained popularity due to their potential environmental benefits and longer shelf life.

What factors are driving the growth of the waterless cosmetics market?The growing cosmetics and personal care industry, increasing demand for environment-friendly and sustainable beauty products, rising disposable income, growing awareness about the benefits of waterless products, and technical developments are driving the market growth.

What are some key players in the waterless cosmetics market?Some key players in the waterless cosmetics market include L’Oréal, Kao Corporation, Unilever Plc, Procter & Gamble, Ruby’s Organics, Pinch of Colour, Clensta, Carter + Jane, Taiki USA, Ktein, Loli, and other key players.

Which distribution channels are utilized for waterless cosmetics?Waterless cosmetics are distributed through various channels, including supermarkets & hypermarkets, specialty stores, online retailers, and other distribution channels.

Which product types are included in the waterless cosmetics market?The waterless cosmetics market includes skincare, haircare, makeup, and other product types.

Waterless Cosmetics MarketPublished date: Dec. 2024add_shopping_cartBuy Now get_appDownload Sample

Waterless Cosmetics MarketPublished date: Dec. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- L’Oréal

- Kao Corporation

- Unilever Plc

- Procter & Gamble

- Ruby’s Organics

- Pinch of Colour

- Clensta

- Carter + Jane

- Taiki USA

- Ktein

- Loli