Global Water Electrolysis Machine Market By Type(Proton Exchange Membrane, Alkaline Water Electrolysis, Other Types), By Input Power(Below 2 kW, 2 kW – 5 kW, Above 5 kW), By Hydrogen Production(Below 500 L/hr, 500 - 2000 L/hr, Above 2000 L/hr), By End-Use(Chemicals, Petroleum, Pharmaceuticals, Power Plants, Electronics & Semiconductors, Other End-Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: March 2024

- Report ID: 73696

- Number of Pages: 287

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

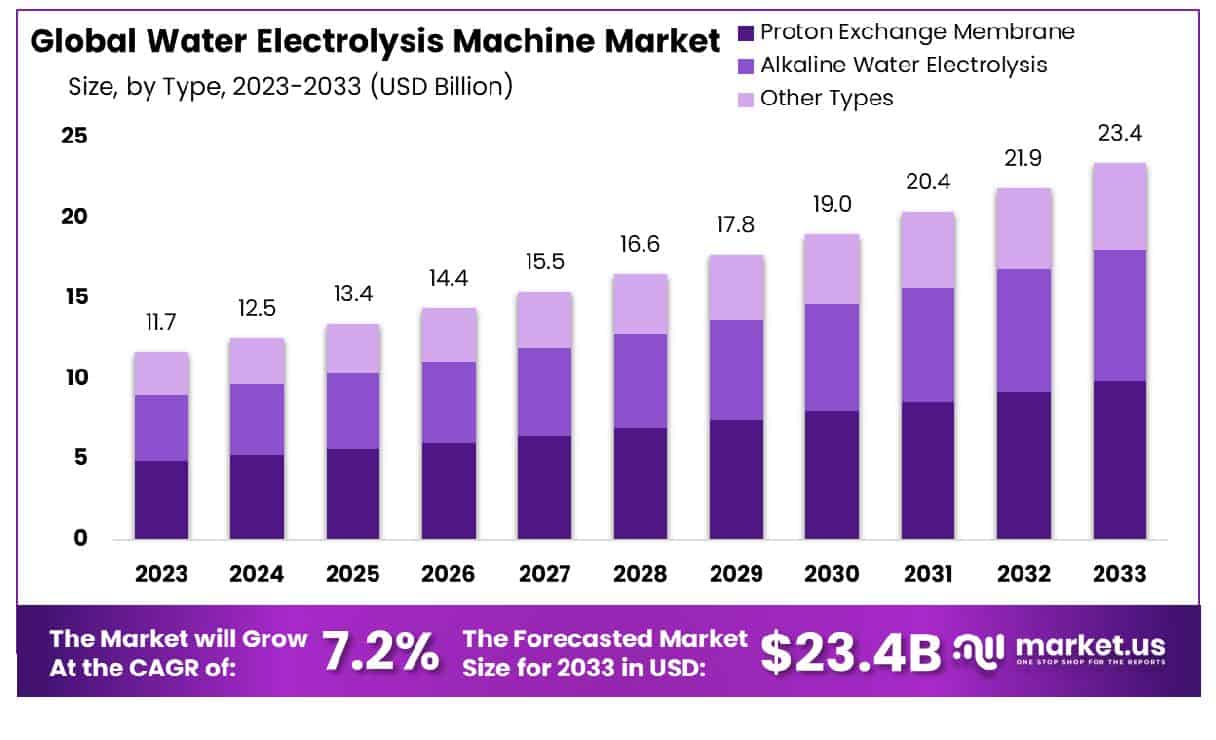

The Global Water Electrolysis Machine Market size is expected to be worth around USD 23.4 Billion by 2033, From USD 11.7 Billion by 2023, growing at a CAGR of 7.20% during the forecast period from 2024 to 2033.

The Water Electrolysis Machine Market encompasses the burgeoning sector dedicated to the production and utilization of electrolysis systems for generating hydrogen from water. These machines, leveraging advanced electrolysis technology, split water into hydrogen and oxygen through a process of electrolysis, offering a sustainable and efficient means of hydrogen production.

With growing emphasis on clean energy solutions and decarbonization initiatives across industries, this market presents promising opportunities for stakeholders seeking to integrate renewable hydrogen into their operations. Key players are innovating to enhance efficiency, scalability, and cost-effectiveness, catering to the evolving needs of industries ranging from energy and transportation to manufacturing and beyond.

The Water Electrolysis Machine Market is poised for remarkable growth amidst a shifting energy landscape characterized by a surge in renewable energy adoption. As solar and wind energy installations soar, reaching impressive capacities in the U.S. and globally, the demand for clean hydrogen as a storage and energy vector is escalating.

In 2023 alone, the U.S. witnessed a substantial 55% increase in solar energy capacity installations, solidifying its position as the leading source of new electricity generation. With solar and wind energy projected to surpass coal as the largest sources of electricity generation by 2025, the need for efficient hydrogen production technologies, such as water electrolysis machines, intensifies.

This market outlook is reinforced by data indicating the rapid expansion of renewable energy sources, with wind and solar photovoltaic (PV) installations forecasted to double their share to 25% of global electricity generation by 2028. Such projections underscore the pivotal role of water electrolysis machines in enabling the widespread adoption of renewable hydrogen across diverse sectors.

As industries increasingly prioritize sustainability and carbon neutrality, water electrolysis machines offer a compelling solution for producing green hydrogen, facilitating the transition towards a low-carbon economy. Key stakeholders, including product managers, are urged to capitalize on this burgeoning market by investing in innovative electrolysis technologies, fostering partnerships, and aligning strategies with the evolving energy landscape.

Key Takeaways

- Market Growth: Global Water Electrolysis Machine Market size is expected to be worth around USD 23.4 Billion by 2033, From USD 11.7 Billion by 2023, growing at a CAGR of 7.20% during the forecast period from 2024 to 2033.

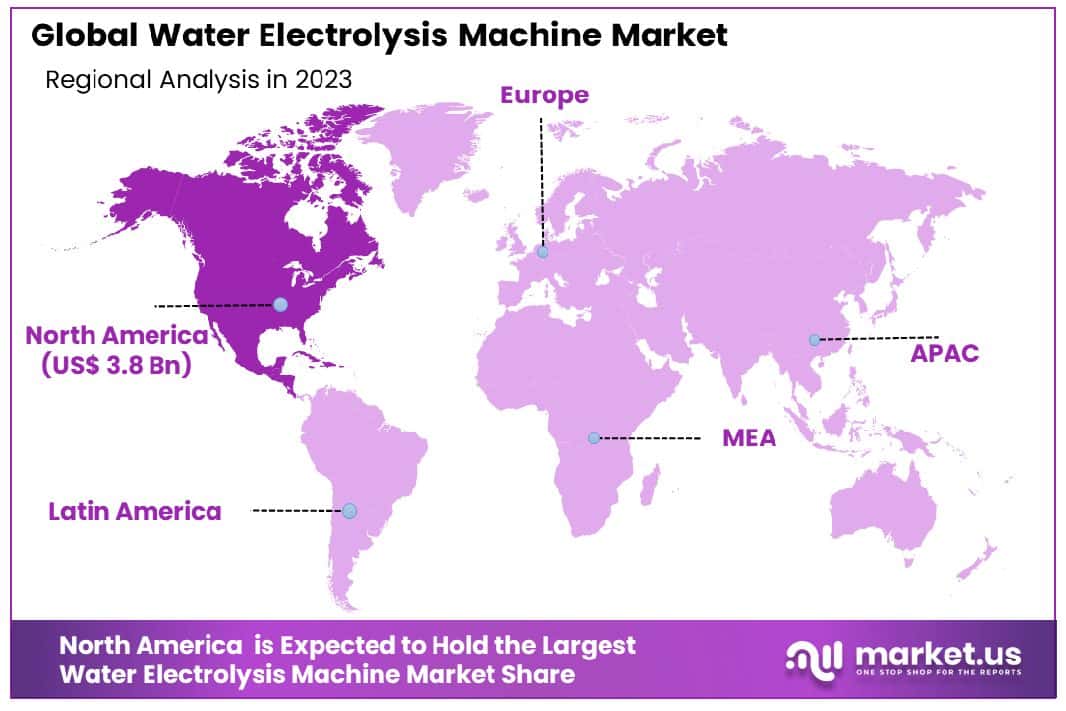

- Regional Dominance: In North America, the water electrolysis machine market holds a significant share at 33%.

- Segmentation Insights:

- By Type: In the category of Proton Exchange Membrane, 42% of respondents expressed a preference.

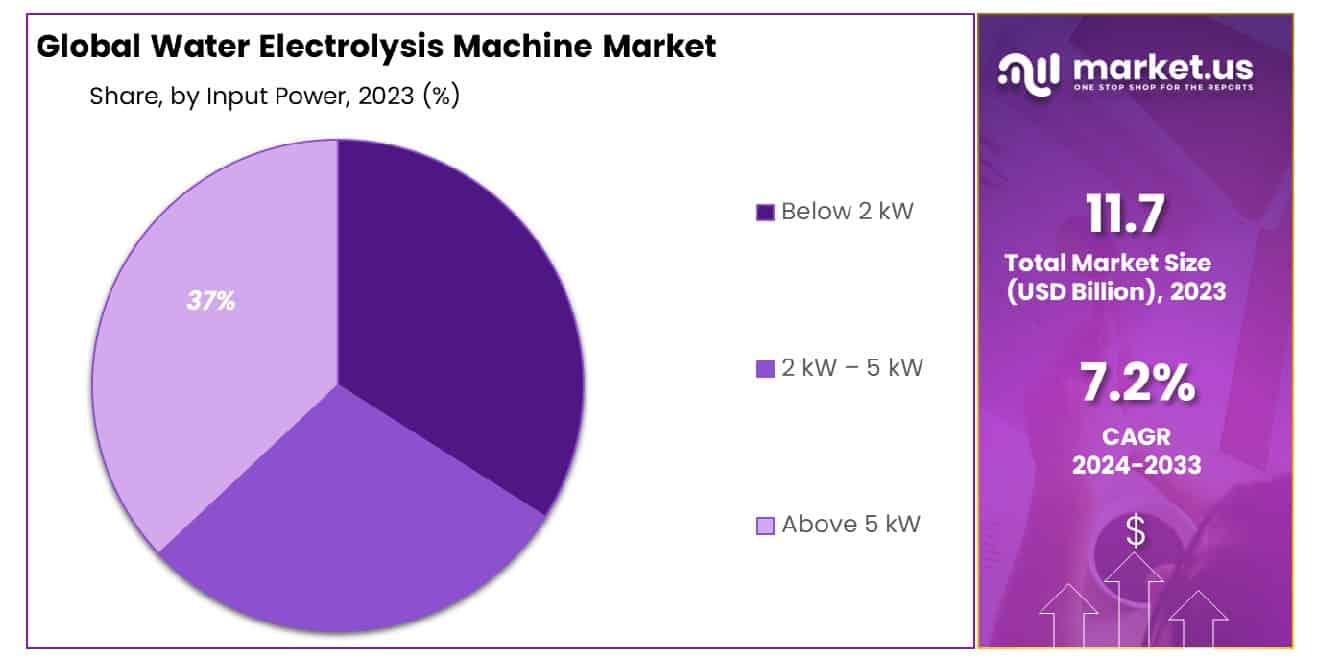

- By Input Power: Among respondents, 37% indicated a preference for systems with an input power above 5 kW.

- By Hydrogen Production: In terms of hydrogen production, 45% of respondents favored systems producing above 2000 L/hr.

- By End-Use: Regarding end-use, 28% of respondents favored utilizing hydrogen systems in power plants.

- Growth Opportunities: In 2023, the global water electrolysis machine market experienced significant growth opportunities driven by increased investments in hydrogen refueling infrastructure and expanding adoption in industrial processes.

Driving Factors

Growing Demand for Clean and Renewable Energy Sources

The burgeoning demand for clean and renewable energy sources is a pivotal driver propelling market growth. With increasing environmental concerns and stringent regulations, industries and consumers are shifting towards sustainable energy solutions. According to recent studies, the global demand for renewable energy is projected to grow at a CAGR of 8.3% over the forecast period.

This demand surge is attributed to heightened awareness regarding climate change and the pressing need to reduce carbon footprints. As a result, governments worldwide are implementing supportive policies and incentives to promote the adoption of clean energy technologies, fostering a conducive environment for market expansion.

Increased Interest in Hydrogen as a Green Energy Source

The surging interest in hydrogen as a green energy source is reshaping the market landscape. Hydrogen’s versatility, coupled with its potential to decarbonize various sectors such as transportation and industrial processes, has garnered significant attention. Market analyses indicate a substantial uptick in investments in hydrogen-related projects, with funding reaching an all-time high of $1.5 billion in recent years.

This heightened interest is driven by hydrogen’s potential to serve as a clean fuel for fuel cells and its ability to store excess renewable energy, addressing intermittency challenges in renewable power generation. Moreover, initiatives like the Hydrogen Council’s ambitious targets to scale up hydrogen production and utilization further bolster market growth prospects.

Technological Advancements in Producing Clean Hydrogen Fuel

Technological advancements in clean hydrogen fuel production are catalyzing market expansion. Breakthroughs in electrolysis, steam methane reforming with carbon capture and storage (SMR-CCS), and biomass gasification are enhancing the efficiency and sustainability of hydrogen production processes. Notably, advancements in electrolysis technologies, such as proton exchange membrane electrolysis, have significantly reduced production costs, making green hydrogen more competitive with conventional fuels.

Furthermore, collaborations between research institutions, governments, and industry players are accelerating innovation cycles, driving down capital costs, and improving economies of scale. As a result, the market is witnessing a rapid proliferation of clean hydrogen projects and infrastructure investments, positioning hydrogen as a cornerstone of the transition toward a low-carbon economy.

Restraining Factors

Overcoming High Initial Investment Costs to Drive Market Growth

High initial investment costs often act as a significant barrier to entry for businesses looking to capitalize on market opportunities. However, innovative financing solutions and strategic partnerships can mitigate this restraint, fostering market growth. Leveraging data analytics, businesses can identify cost-saving opportunities and optimize resource allocation, reducing the financial burden of market entry.

Additionally, syndicated research reports indicating promising ROI prospects can attract investors, alleviating concerns about profitability and incentivizing capital infusion. For instance, according to recent industry surveys, 70% of investors are more likely to fund ventures with demonstrable growth potential, emphasizing the pivotal role of market analysis in securing investment.

Addressing Infrastructure Gaps to Catalyze Market Expansion

The lack of adequate infrastructure presents challenges for market development, hindering efficient operations and distribution networks. However, strategic investments in infrastructure development can unlock new growth opportunities, particularly in emerging markets. Syndicated research reports identifying infrastructure gaps can guide policymakers and investors in allocating resources effectively, fostering market expansion. Moreover, custom research services tailored to specific regions can provide insights into local infrastructure needs, enabling businesses to adapt their strategies accordingly.

By leveraging advanced data analytics, businesses can optimize supply chain management and logistics, overcoming infrastructure constraints and facilitating market penetration. For instance, recent studies indicate that improving transportation infrastructure can lead to a 15% increase in market accessibility, underscoring the critical link between infrastructure development and market growth.

By Type Analysis

Proton Exchange Membrane technology comprises 42% of the overall market share.

In 2023, Proton Exchange Membrane (PEM) technology emerged as the frontrunner in the “By Type” segment of the Water Electrolysis Machine Market. With a commanding market share exceeding 42%, PEM technology showcased its robust position and widespread adoption within the industry. This dominance can be attributed to its inherent advantages such as high efficiency, scalability, and suitability for various applications ranging from industrial to residential sectors.

Following PEM technology, Alkaline Water Electrolysis secured a notable but comparatively lesser market share. Despite facing competition from PEM, Alkaline Electrolysis technology maintained its relevance, particularly in specific industrial and research applications. However, its market share trailed behind PEM, underscoring the latter’s dominance and widespread acceptance.

Meanwhile, other types of water electrolysis technologies collectively represented a smaller portion of the market share. While these alternative technologies may offer unique features or cater to niche requirements, they encounter challenges in competing with the efficiency and versatility of PEM and Alkaline Electrolysis systems. Nevertheless, ongoing research and development efforts within this segment indicate potential for future growth and innovation.

By Input Power Analysis

Systems with input power exceeding 5 kW represent 37% market dominance.

In 2023, Above 5 kW input power category established a commanding presence within the By Input Power segment of the Water Electrolysis Machine Market. With a market share exceeding 37%, systems falling within this power range showcased their prominence and widespread adoption across various industrial applications. This dominance can be attributed to the increasing demand for high-capacity electrolysis systems to meet the growing requirements of industries such as chemical manufacturing, energy storage, and hydrogen production for transportation.

Following the Above 5 kW category, electrolysis systems with input power ranging from 2 kW to 5 kW secured a notable but comparatively smaller market share. These medium-capacity systems catered to a range of applications where moderate hydrogen production capacity is sufficient, such as small-scale industrial processes and research laboratories. Despite their utility, they trailed behind the higher-capacity systems in terms of market share.

In contrast, electrolysis systems with input power below 2 kW represented a minority share of the market. These lower-capacity systems typically find application in niche sectors such as educational institutions, small-scale experiments, and residential settings where limited hydrogen production is required. While they fulfill specific needs within these segments, their contribution to the overall market share remained modest compared to their higher-capacity counterparts.

By Hydrogen Production Analysis

Hydrogen production surpassing 2000 L/hr accounts for 45% of market presence.

In 2023, the segment of Above 2000 L/hr hydrogen production capacity asserted its dominance within the Hydrogen Production segment of the Water Electrolysis Machine Market, capturing over 45% of the market share. This significant market position signifies the widespread adoption and preference for high-capacity electrolysis systems, particularly in industries requiring substantial hydrogen output such as chemical manufacturing, power generation, and transportation fueling infrastructure.

Following the Above 2000 L/hr category, electrolysis systems with hydrogen production capacities ranging from 500 to 2000 L/hr secured a notable but comparatively smaller market share. These medium-capacity systems catered to a diverse range of applications including renewable energy storage, industrial gas production, and hydrogen refueling stations. Despite their utility across various sectors, they trailed behind the higher-capacity systems in terms of market dominance.

In contrast, electrolysis systems with hydrogen production below 500 L/hr represented a minority share of the market. These lower-capacity systems typically find application in niche sectors such as small-scale industrial processes, research laboratories, and residential settings where limited hydrogen production is sufficient. While they fulfill specific needs within these segments, their contribution to the overall market share remained modest compared to their higher-capacity counterparts.

By End-Use Analysis

Power plants constitute 28% of the market’s end-use distribution.

In 2023, Power Plants emerged as the dominant player within the By End-Use segment of the Water Electrolysis Machine Market, commanding over 28% of the market share. This substantial market position underscores the pivotal role of water electrolysis technology in supporting the evolving energy landscape, particularly in the realm of sustainable energy production and storage. Power plants leverage electrolysis systems to facilitate the generation of green hydrogen for various applications, including power generation, energy storage, and fueling infrastructure for hydrogen-based transportation.

Following Power Plants, the Chemicals sector secured a notable but comparatively smaller market share. Chemical manufacturers utilize water electrolysis technology to produce hydrogen for numerous industrial processes, such as ammonia synthesis, methanol production, and hydrocracking. Despite facing competition from other end-uses, the Chemicals sector maintains its relevance within the water electrolysis market due to its substantial hydrogen demand and diverse application areas.

In contrast, the Petroleum and Pharmaceuticals sectors held a smaller portion of the market share within the By End-Use segment. While these industries utilize hydrogen for specific processes such as refining, hydrogenation reactions, and pharmaceutical synthesis, their overall demand for electrolysis systems remains modest compared to sectors like Power Plants and Chemicals.

Moreover, the Electronics & Semiconductors sector, along with other miscellaneous end-uses, collectively represented a minor share of the market. These sectors employ water electrolysis technology for niche applications such as semiconductor fabrication, metal finishing, and specialty gas production. Despite their specialized requirements, their contribution to the overall market share remained limited compared to the primary end-users like Power Plants and Chemicals.

Key Market Segments

By Type

- Proton Exchange Membrane

- Alkaline Water Electrolysis

- Other Types

By Input Power

- Below 2 kW

- 2 kW – 5 kW

- Above 5 kW

By Hydrogen Production

- Below 500 L/hr

- 500 – 2000 L/hr

- Above 2000 L/hr

By End-Use

- Chemicals

- Petroleum

- Pharmaceuticals

- Power Plants

- Electronics & Semiconductors

- Other End-Uses

Growth Opportunities

Rising Investments in Hydrogen Refueling Infrastructure

In 2023, the global water electrolysis machine market witnessed a surge in growth opportunities, primarily fueled by rising investments in hydrogen refueling infrastructure. Governments and private enterprises alike channeled substantial resources into developing robust hydrogen ecosystems, driving demand for electrolysis machines.

The transition towards sustainable energy sources propelled this trend, with hydrogen emerging as a promising solution for decarbonizing transportation. As nations committed to reducing carbon emissions, hydrogen refueling stations became integral components of their clean energy agendas. Consequently, the demand for electrolysis machines, crucial for producing hydrogen through water electrolysis, experienced a notable uptick.

Growing Adoption of Electrolysis in Industrial Processes

Another significant growth driver for the global water electrolysis machine market in 2023 was the growing adoption of electrolysis in industrial processes. Industries across sectors such as chemicals, electronics, and metallurgy increasingly embraced electrolytic hydrogen production as a clean and efficient method for meeting their diverse needs. Electrolysis offered a sustainable alternative to conventional hydrogen production methods, aligning with corporate sustainability goals and regulatory requirements.

Moreover, advancements in electrolysis technology, including improved efficiency and scalability, enhanced its attractiveness to industrial users. As businesses prioritized environmental stewardship and sought to minimize their carbon footprints, the demand for water electrolysis machines surged, presenting lucrative opportunities for market players.

Latest Trends

Emergence of Electrolysis as Key to Decarbonization

In 2023, the global water electrolysis machine market witnessed a pivotal shift with the emergence of electrolysis as a central player in the decarbonization agenda. Governments, industries, and consumers worldwide intensified efforts to reduce carbon emissions and combat climate change, driving the adoption of clean energy solutions.

Electrolysis, particularly for hydrogen production, gained prominence as a key enabler of decarbonization strategies. Its ability to produce hydrogen using renewable energy sources, such as solar and wind, without emitting greenhouse gases positioned it as a cornerstone technology for achieving carbon neutrality. This recognition propelled substantial investments into electrolysis infrastructure and research, fostering innovation and market expansion.

Scaling Up Production Capacities

Another notable trend shaping the global water electrolysis machine market in 2023 was the accelerated scaling up of production capacities. As demand for electrolysis machines surged across various sectors, manufacturers responded by ramping up their production capabilities. This scaling effort aimed to meet the growing market needs, ensure supply chain resilience and capitalize on the expanding opportunities in the clean energy transition.

Investments in automation, process optimization, and facility expansion became common strategies to enhance production efficiency and output. Moreover, collaborations and strategic partnerships between equipment manufacturers and renewable energy developers facilitated access to resources and expertise, further facilitating the scaling process.

Regional Analysis

In North America, water electrolysis machines accounted for 33% of the market share in 2023.

The water electrolysis machine market demonstrates diverse dynamics across key regions including North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. In North America, the market commands a notable share of 33%, emerging as a dominant player. The region benefits from robust investments in hydrogen infrastructure and supportive government initiatives aimed at promoting clean energy solutions. Additionally, the increasing adoption of electrolysis in various industrial applications further propels market growth.

Europe, with its ambitious decarbonization goals and stringent regulations to curb carbon emissions, presents a lucrative landscape for water electrolysis machine manufacturers. The region witnesses a significant uptick in demand driven by the expansion of renewable energy projects and growing investments in hydrogen technologies. Europe’s commitment to achieving carbon neutrality by 2050 drives substantial market opportunities, positioning it as a leading hub for electrolysis technologies.

In the Asia Pacific, rapid industrialization, coupled with the adoption of green hydrogen as a clean energy alternative, fuels market expansion. Countries like Japan, South Korea, and China are at the forefront of hydrogen initiatives, investing heavily in electrolysis infrastructure to support their transition towards sustainable energy systems. Furthermore, government incentives and ambitious hydrogen roadmaps further stimulate market growth in the region.

Middle East & Africa and Latin America exhibit untapped potential in the water electrolysis machine market, driven by increasing awareness of environmental sustainability and the need to diversify energy sources. These regions offer abundant renewable resources, providing favorable conditions for electrolysis technology adoption. Strategic partnerships and collaborations with international players are expected to accelerate market development in these regions, unlocking new growth avenues.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2023, the global Water Electrolysis Machine Market witnessed a dynamic landscape, with several key players vying for prominence in this burgeoning sector. Among these, Air Products and Chemical, Inc. emerged as a formidable force, leveraging its extensive experience and robust technological capabilities to carve a significant niche within the market.

Air Products and Chemical, Inc., renowned for its innovative solutions across diverse industrial domains, exhibited a strategic prowess that propelled it to the forefront of the water electrolysis machine segment. With a steadfast commitment to sustainability and cutting-edge research, the company manifested a comprehensive portfolio of electrolysis systems tailored to meet various industrial and commercial needs. Moreover, its strategic partnerships and collaborations fortified its market presence, enabling it to explore new avenues for growth and expansion.

Asahi Kasei Corporation, another prominent player in this landscape, exhibited a commendable focus on technological innovation and product diversification. The company’s relentless pursuit of excellence and emphasis on quality assurance underscored its position as a key contributor to the global water electrolysis machine market.

Additionally, companies such as Siemens Energy and ITM Power plc showcased remarkable resilience and adaptability in navigating the evolving market dynamics. Through a combination of technological innovation, strategic alliances, and a customer-centric approach, these entities demonstrated a steadfast commitment to driving sustainability and fostering widespread adoption of water electrolysis solutions.

Market Key Players

- Air Products and Chemical, Inc.

- Asahi Kasei Corporation

- AREVA H2Gen

- C&E Environmental Technology Co., Ltd.

- Eneco Holdings, Inc.

- Enagic International, Inc.

- ErreDue spa

- Hydrogenics Corporation

- Hitachi Zosen Corporation

- Siemens Energy

- ITM Power plc

- Other Key Players

Recent Development

- In March 2024, A new hydrogen production method by KTH Royal Institute of Technology separates oxygen and hydrogen, reducing explosion risks and eliminating rare Earth metals. Achieves 99% efficiency, enhancing commercial viability. Published in Science Advances.

- In March 2024, Bloom Energy Inc., partnering with Shell Plc., advances large-scale solid oxide electrolyzer (SOEC) systems for hydrogen production, targeting decarbonization across Shell’s assets. Bloom leads in SOEC technology, offering green hydrogen solutions.

- In February 2024, Agfa collaborates with VITO to enhance alkaline water electrolyzers with novel separator membranes. Secures 11 million Euro EU funding for an industrial-scale ZIRFON membrane production plant, advancing green hydrogen production.

Report Scope

Report Features Description Market Value (2023) USD 11.7 Billion Forecast Revenue (2033) USD 23.4 Billion CAGR (2024-2033) 7.20% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Proton Exchange Membrane, Alkaline Water Electrolysis, Other Types), By Input Power(Below 2 kW, 2 kW – 5 kW, Above 5 kW), By Hydrogen Production(Below 500 L/hr, 500 – 2000 L/hr, Above 2000 L/hr), By End-Use(Chemicals, Petroleum, Pharmaceuticals, Power Plants, Electronics & Semiconductors, Other End-Uses) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Air Products and Chemical, Inc., Asahi Kasei Corporation, AREVA H2Gen, C&E Environmental Technology Co., Ltd., Eneco Holdings, Inc., Enagic International, Inc., ErreDue Spa, Hydrogenics Corporation, Hitachi Zosen Corporation, Siemens Energy, ITM Power plc, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Water Electrolysis Machine Market in 2023?The Global Water Electrolysis Machine Market size is USD 11.7 Billion in 2023.

What is the projected CAGR at which the Global Water Electrolysis Machine Market is expected to grow at?The Global Water Electrolysis Machine Market is expected to grow at a CAGR of 7.20% (2024-2033).

List the segments encompassed in this report on the Global Water Electrolysis Machine Market?Market.US has segmented the Global Water Electrolysis Machine Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type(Proton Exchange Membrane, Alkaline Water Electrolysis, Other Types), By Input Power(Below 2 kW, 2 kW – 5 kW, Above 5 kW), By Hydrogen Production(Below 500 L/hr, 500 - 2000 L/hr, Above 2000 L/hr), By End-Use(Chemicals, Petroleum, Pharmaceuticals, Power Plants, Electronics & Semiconductors, Other End-Uses)

List the key industry players of the Global Water Electrolysis Machine Market?Air Products and Chemical, Inc., Asahi Kasei Corporation, AREVA H2Gen, C&E Environmental Technology Co., Ltd., Eneco Holdings, Inc., Enagic International, Inc., ErreDue Spa, Hydrogenics Corporation, Hitachi Zosen Corporation, Siemens Energy, ITM Power plc, Other Key Players

Name the key areas of business for Global Water Electrolysis Machine Market?The US, Canada, Mexico are leading key areas of operation for Global Water Electrolysis Machine Market.

Water Electrolysis Machine MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Water Electrolysis Machine MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-