Global Waste Heat Recovery System Market Size, Share Analysis Report By Phase System (Liquid-liquid Phase System, Liquid-gas Phase System, Thermal Regeneration), By Application (Pre Heating, Power And Steam Generation, Others), By End-use (Petroleum Refinery, Power, Cement, Chemical, Other) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164665

- Number of Pages: 274

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

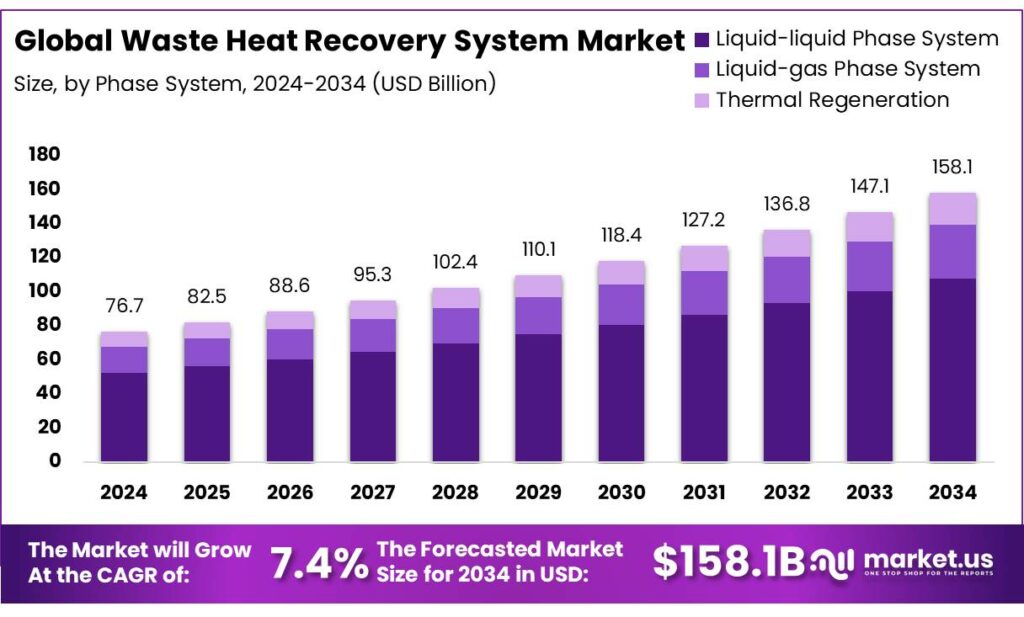

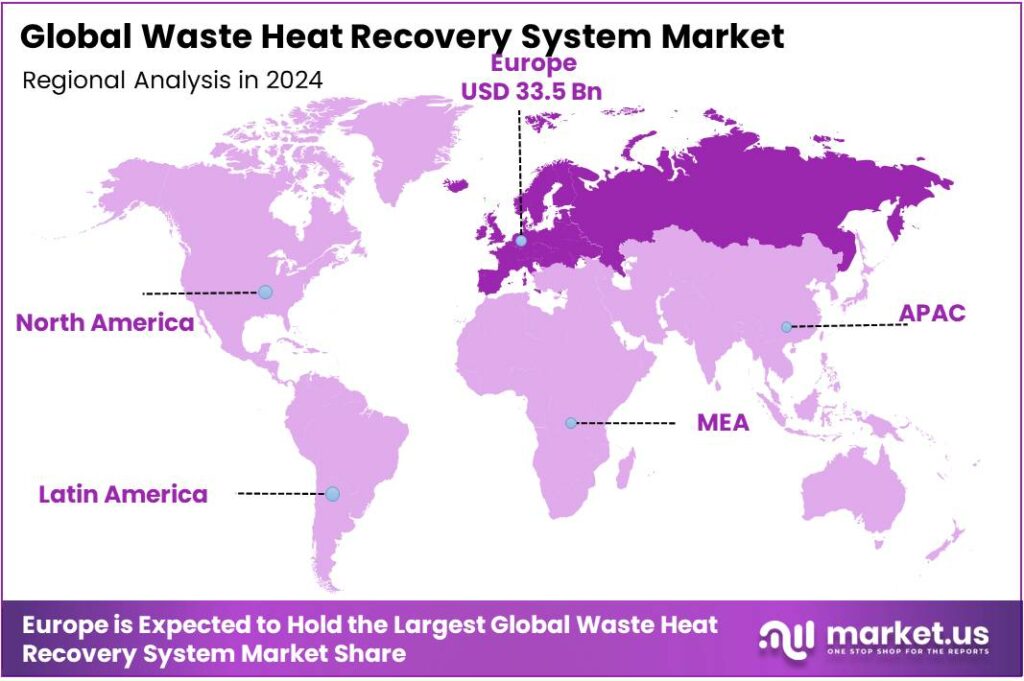

The Global Waste Heat Recovery System Market size is expected to be worth around USD 158.1 Billion by 2034, from USD 76.7 Billion in 2024, growing at a CAGR of 7.4% during the forecast period from 2025 to 2034. In 2024 Europe held a dominant market position, capturing more than a 43.8% share, holding USD 33.5 Billion in revenue.

Waste heat recovery systems (WHRS) are becoming a core efficiency lever across energy-intensive industries. The need is material: industry consumed 37% of global final energy in 2022—about 166 exajoules—driven by cement, steel, chemicals, and pulp & paper, where thermal processes dominate.

Capturing lost heat from flue gases, hot surfaces, and cooling streams can cut fuel use and emissions while stabilizing energy costs in volatile markets. Estimates from the U.S. Department of Energy (DOE) indicate that 20–50% of industrial energy input is still discharged as waste heat, underscoring a large technical and economic opportunity for recovery via recuperators, regenerators, ORC/steam cycles, and industrial heat pumps.

The industrial scenario is shifting as policy and capital align behind efficiency. In March 2024, the U.S. DOE announced up to $6 billion for 33 industrial decarbonization projects, expected to avoid 14 million metric tons of CO₂ annually—roughly the emissions of ~3 million cars—spanning steel, aluminum, cement, chemicals, and food processing; many projects include WHR and electrified heat pathways. The program leverages Bipartisan Infrastructure Law and Inflation Reduction Act funds to de-risk deployment at scale.

In the EU, the 2023 recast Energy Efficiency Directive (EU/2023/1791) elevates energy efficiency first and requires Member States to pursue cost-effective heating and cooling plans—explicitly referencing reductions in process losses and use of waste heat—creating clearer demand signals for WHRS. India’s Perform, Achieve, and Trade (PAT) scheme similarly drives efficiency in Designated Consumers; PAT Cycle-II achieved 13.28 MTOE of savings and avoided 61.34 MtCO₂, with Cycle-VII targeting a further 8.485 MTOE by FY2024-25.

Key driving factors include energy security, fuel-price volatility, and corporate net-zero commitments. Technically, the ability to valorize low- to mid-temperature streams 50–150 °C has improved with industrial heat pumps and thermal storage materials, enabling re-use within plants or export to nearby loads. The IEA highlights emerging solid-media thermal storage to buffer intermittent operations and raise recovery efficacy, improving both cost and emissions performance in heavy industry.

Policy is accelerating deployment with binding targets and codified roles for waste heat. The European Union’s recast Energy Efficiency Directive sets a 2030 goal to cut final energy consumption by at least 11.7% versus the 2020 reference, translating to a cap of 763 Mtoe of final energy and 992.5 Mtoe of primary energy by 2030; these obligations cascade to member-state programs that increasingly value WHRS.

Key Takeaways

- Waste Heat Recovery System Market size is expected to be worth around USD 158.1 Billion by 2034, from USD 76.7 Billion in 2024, growing at a CAGR of 7.4%.

- Liquid-liquid Phase System held a dominant market position, capturing more than a 44.2% share of the global waste heat recovery system market.

- Power & Steam Generation held a dominant market position, capturing more than a 51.4% share of the global waste heat recovery system market.

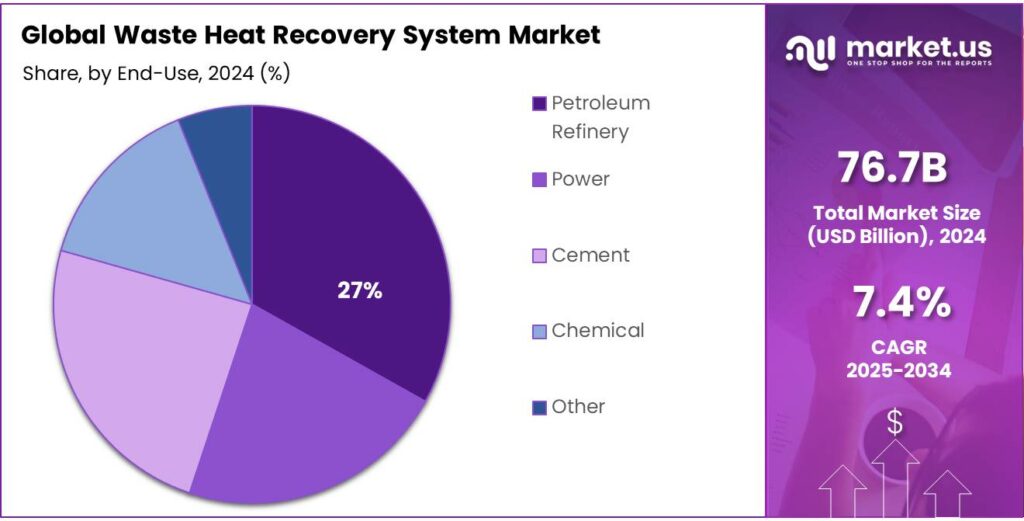

- Petroleum Refinery held a dominant market position, capturing more than a 27.3% share of the global waste heat recovery system market.

- Europe held a dominant position in the global waste heat recovery system market, capturing more than 43.8% of the market share, valued at approximately USD 33.5 billion.

By Phase System Analysis

Liquid-liquid Phase System dominates with 44.2% due to efficiency and versatility in industrial applications

In 2024, the Liquid-liquid Phase System held a dominant market position, capturing more than a 44.2% share of the global waste heat recovery system market. This system is preferred for its high efficiency and ability to recover heat from industrial processes involving liquids, making it a key solution for industries such as chemicals, food processing, and energy generation. The liquid-liquid phase system excels in transferring heat between two liquid mediums, which enhances its heat exchange efficiency.

As industries seek to reduce energy consumption and lower carbon emissions, the demand for liquid-liquid phase systems has increased, particularly in sectors with complex heating requirements. In 2024, the market for liquid-liquid phase systems continued to expand, driven by improvements in system design and materials that allow for better thermal performance and cost-effectiveness.

By Application Analysis

Power & Steam Generation dominates with 51.4% share due to increasing demand for energy efficiency in power plants

In 2024, Power & Steam Generation held a dominant market position, capturing more than a 51.4% share of the global waste heat recovery system market. This segment has been the largest due to the critical need for power plants to improve efficiency and reduce emissions. The recovery of waste heat for power and steam generation allows these facilities to maximize their energy output while minimizing fuel consumption.

In 2024, the focus on reducing carbon footprints and meeting stricter environmental regulations has driven investments in energy-efficient technologies, including waste heat recovery for steam and electricity generation. Looking ahead to 2025, the Power & Steam Generation segment is expected to retain its leadership as global demand for energy increases, and governments continue to push for cleaner, more sustainable energy practices.

By End-use Analysis

Petroleum Refinery dominates with 27.3% share due to high energy consumption and demand for process optimization

In 2024, Petroleum Refinery held a dominant market position, capturing more than a 27.3% share of the global waste heat recovery system market. This dominance is primarily due to the energy-intensive nature of petroleum refining processes, where large amounts of waste heat are generated during distillation, cracking, and other processes. As refineries aim to reduce energy costs and improve overall operational efficiency, waste heat recovery systems have become essential for capturing and reusing this energy.

By recovering waste heat, refineries can lower fuel consumption, reduce carbon emissions, and enhance the efficiency of their operations. In 2024, the petroleum refining sector continued to invest in waste heat recovery technologies as part of broader sustainability efforts and compliance with tightening environmental regulations. Looking ahead to 2025, the Petroleum Refinery segment is expected to maintain its leading position, driven by increasing global energy demand, the push for cleaner technologies, and continued regulatory pressure on emissions.

Key Market Segments

By Phase System

- Liquid-liquid Phase System

- Liquid-gas Phase System

- Thermal Regeneration

By Application

- Pre Heating

- Power & Steam Generation

- Others

By End-use

- Petroleum Refinery

- Power

- Cement

- Chemical

- Other

Emerging Trends

Hygienic industrial heat pumps + heat-to-heat integration in food plants

A clear trend in waste heat recovery systems (WHRS) is the shift from simple economizers to hygienic industrial heat pumps and tightly integrated, closed-loop recovery on pasteurizers, evaporators, ovens, and CIP lines. Two forces anchor this change: most heat in food factories is low to medium temperature, and hygiene rules demand indirect, cleanable designs. Authoritative process data show that process heating takes 69% of steam energy in the U.S. food & beverage sector—a huge base now being targeted with heat-to-heat upgrades that lift 50–90 °C waste streams back into hot-water or low-pressure-steam service.

Industrial heat pumps have matured into this space. The International Energy Agency notes that large industrial heat pumps can already deliver 140–160 °C output, with near-term potential to cover ~30% of the combined heating needs in paper, food and chemicals—precisely the temperature band where many pasteurizers, blanchers, and product heaters operate. In practice, this allows food plants to convert compressor work and low-grade exhaust into usable process heat, trimming gas use and boiler loads without touching product-contact surfaces.

- Scale and economics in the food industry make the trend material. In Europe alone, the food and drink sector generated €1,196 billion in turnover and €249 billion in value added in 2021, so even small percentage cuts in fuel and electricity translate into billions that can be reinvested into line modernization and cold-chain resilience. This financial gravity is why multi-site food groups are standardizing heat-recovery playbooks—heat pumps on pasteurizer outlets, flue-gas condensers on ovens, and refrigerant-to-hot-water loops on compressor racks.

Policy is accelerating adoption and widening outlets for “surplus” food-plant heat. The UK Industrial Energy Transformation Fund sets aside £500 million through 2028 for energy-efficiency and decarbonization technologies, explicitly including heat recovery and heat-pump projects—lowering capex hurdles for bakeries, breweries and dairy sites. Across the EU, the revised Energy Efficiency Directive (2023) strengthens final-energy targets and revises the definition of efficient district heating and cooling to enable the progressive integration of waste heat and cold; this lets food plants monetize low-grade heat by exporting it to networks when on-site demand is saturated.

Drivers

Energy- and carbon-pressure in food And beverage processing

The single biggest push behind waste heat recovery systems (WHRS) today is the mounting energy and carbon pressure inside food and beverage (F&B) factories. Food manufacturing runs on heat—blanchers, pasteurizers, evaporators, CIP loops—and those streams often leave stacks and condensers at high temperatures. That is wasted money and emissions.

Energy is also a material line item in plant P&Ls. Australia’s government notes that energy use accounts for at least 15% of total operational costs in a typical food and beverage manufacturing business—one reason why heat recovery for preheating water, product, or combustion air pays back quickly when fuel prices rise. The financial stakes are large because the industry itself is large: in Europe alone, the sector generated €1,196 billion in turnover and €249 billion in value added in 2021, so even modest efficiency gains scale into billions in avoided costs and reinvestable cash.

Policy is reinforcing this shift with very tangible support. In the UK, the Industrial Energy Transformation Fund totals £500 million through 2028 to help high-energy-use sites deploy efficiency and low-carbon technologies, including heat recovery and heat-to-power projects—a direct capital lever for bakeries, breweries, and dairy plants. In India, new MSME-focused efficiency programs such as ADEETIE are rolling out across industrial clusters; while cross-sector, they reduce the cost of adopting advanced technologies like WHRS in food hubs too.

Data infrastructure is improving the business case. The U.S. MECS work shows where energy is used and lost in manufacturing; in 2018, total U.S. manufacturing energy consumption was 19,436 trillion Btu, giving corporate engineering teams a solid baseline to size recovery from ovens, dryers, and boilers. Pair that with plant-level heat mapping and you can target the big hitters—spray dryers, peelers, mashing kettles—then route exhaust through economizers, condensing heat exchangers, or organic Rankine cycle units to make low-carbon steam or electricity.

Restraints

Hygiene-critical design and low-grade, variable heat in food processing

In food and beverage plants, the toughest barrier to waste heat recovery systems (WHRS) is not technology—it is hygiene. Food factories are governed by strict rules that make it hard to route exhausts, condensate, or recirculated air through additional equipment without risking contamination or compromising cleanability.

In the EU, the hygiene framework (Regulation (EC) No. 852/2004) requires premises, equipment and processes to support safe food handling “at all stages,” pushing designers to avoid crevices, allow full drainage, and keep clean/dirty zones physically separate—constraints that can force longer pipe runs, extra heat-exchanger surfaces, and frequent disassembly, all of which raise cost and downtime for WHRS.

This hygiene lens matters because most food heat is relatively low temperature, which limits what can be recovered and how efficiently. Authoritative guidance shows low-temperature process needs—20–200 °C—are common across industries, and especially prevalent in food and beverages; at these levels, power generation efficiency is modest and heat-pump lifts are non-trivial. In practice, many food plants sit in the 120–150 °C “medium-grade” band for boiler flue gas and process exhausts. That is recoverable, but the quality, fouling risk, and CIP requirements push designers toward stainless, double-wall or sanitary exchangers, raising capex versus standard industrial WHR.

Regulators and food-safety authorities reinforce this caution. FDA aseptic-processing guidance stresses qualified utilities: steam, compressed air, ventilation and exhaust must be monitored and controlled because they can affect product quality—so any WHR insert must prove it does not introduce contamination or undermine validated thermal regimes. Cleaning validation and access for inspection are mandatory—practical hurdles that lengthen projects and complicate retrofits in tight legacy spaces.

Economics inside the sector also slow payback. Europe’s industry faced 21% annual energy inflation in January 2023, then partial easing; many producers responded by switching contracts and tightening operations rather than committing to complex hygienic retrofits, especially where lines run seasonally. Budget competition with packaging and compliance upgrades is real.

Opportunity

Turning food-plant heat losses into low-carbon steam and power

Food and beverage factories run thousands of thermal steps every day—pasteurizing, sterilizing, blanching, evaporating, baking, and CIP. Those lines throw off large volumes of hot exhaust and hot water that can be captured and reused. In the U.S. alone there were 42,708 food and beverage manufacturing establishments in 2022; even modest heat recovery per site scales into a sizeable national saving for utilities and emissions.

The opportunity is concentrated in process heat. Authoritative sector analysis shows that 69% of the food and beverage sector’s steam energy goes to process heating, with the rest split across HVAC, other process uses, and cooling/refrigeration. These shares point to clear targets for economizers, condensing heat exchangers, and heat-to-heat loops that preheat water, product, or combustion air.

Heat recovery also helps protect margins in a big, competitive industry. In the EU, the food and drink sector generated €1,196 billion in turnover and €249 billion in value added in 2021—so cutting fuel purchases through waste-heat reuse frees meaningful cash for growth and brand investment. In parallel, the U.S. manufacturing energy baseline has been rising again; preliminary federal data show total manufacturing energy use increased 6% between 2018 and 2022—a reminder that avoiding waste is valuable even when plants are already efficient.

Public policy is now paying for heat recovery in exactly these plants. In the U.K., the Industrial Energy Transformation Fund offers £500 million of support through 2028 for efficiency and low-carbon technologies, explicitly including heat recovery projects that food sites can bid for. In the EU, the revised Energy Efficiency Directive tightens final-energy targets and updates the definition of efficient district heating and cooling to progressively integrate waste heat and cold—expanding off-site offtake options for surplus low-grade heat from dairies, breweries, and bakeries.

Regional Insights

Europe dominates the Waste Heat Recovery System Market with 43.8% share, valued at USD 33.5 billion in 2024

In 2024, Europe held a dominant position in the global waste heat recovery system market, capturing more than 43.8% of the market share, valued at approximately USD 33.5 billion. This dominance is driven by the region’s strong commitment to sustainability, energy efficiency, and reducing greenhouse gas emissions.

Europe has established stringent regulations and policies promoting energy efficiency across industries, particularly in sectors such as manufacturing, petroleum refining, and power generation. In response to these regulations, European countries have adopted advanced waste heat recovery systems to improve energy efficiency and reduce environmental impact.

The European Union (EU) has been at the forefront of supporting energy efficiency projects, with the European Green Deal and the “Fit for 55” package pushing for a 55% reduction in carbon emissions by 2030. As part of these efforts, significant investments have been directed towards waste heat recovery technologies to capture and reuse energy from industrial processes.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Siemens Energy offers its “Heat ReCycle™” power-plant concept that combines a gas turbine with an organic Rankine cycle (ORC) bottoming unit to recover exhaust heat for electricity generation. A pilot project in Alberta, Canada, captures waste heat from a gas-fired turbine and converts it into emissions-free power, reducing CO₂ by ~44,000 tons/year. Siemens focuses on modular, remote-area applications and water-free operation for regions with constrained resources.

General Electric (GE) has developed ORC-based waste heat recovery innovations, including its “ORegen” system which can add up to 25% extra power from a simple-cycle gas turbine while avoiding use of additional water. GE’s HRSG offerings under GE Vernova support combined-cycle plants that recover turbine exhaust heat for steam generation and additional electricity output. Their broad portfolio spans engines, turbines, and heat recovery hardware across power-generation and industrial sectors.

Turboden, an Italian company is a specialist in Organic Rankine Cycle (ORC) systems for waste heat recovery and geothermal/biomass power. Its ORC units can produce up to ~40 MW per single turbine shaft from residual industrial heat. Turboden focuses on converting low- to medium-grade waste heat into electricity and heat, playing a key role in decarbonising energy-intensive industries.

Top Key Players Outlook

- Siemens Energy

- Mitsubishi Power, Ltd.

- General Electric

- ABB

- Turboden S.p.A.

- Bosch Industriekessel GmbH

- Exergy International Srl

- Forbes Marshall

- IHI Corporation

- Terrapin

Recent Industry Developments

In 2024, Siemens Energy reported €34.5 billion revenue and a global workforce of ~99,000, giving scale to finance and execute multi-site WHR programs.

In 2024 Mitsubishi Power, Ltd, announced new GTCC orders such as the 500 MW Sarawak project, reinforcing future HRSG pull-through and long-term service revenues.

Report Scope

Report Features Description Market Value (2024) USD 76.7 Bn Forecast Revenue (2034) USD 158.1 Bn CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Phase System (Liquid-liquid Phase System, Liquid-gas Phase System, Thermal Regeneration), By Application (Pre Heating, Power And Steam Generation, Others), By End-use (Petroleum Refinery, Power, Cement, Chemical, Other) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Siemens Energy, Mitsubishi Power, Ltd., General Electric, ABB, Turboden S.p.A., Bosch Industriekessel GmbH, Exergy International Srl, Forbes Marshall, IHI Corporation, Terrapin Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Waste Heat Recovery System MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Waste Heat Recovery System MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens Energy

- Mitsubishi Power, Ltd.

- General Electric

- ABB

- Turboden S.p.A.

- Bosch Industriekessel GmbH

- Exergy International Srl

- Forbes Marshall

- IHI Corporation

- Terrapin