Global VR Esports Venue Insurance Market Size, Share Report By Coverage Type (Property Insurance, Liability Insurance, Others), By Venue Type (Dedicated VR Esports Arenas, Hybrid LBVR (Location-Based VR) Centers, Others), By End-User (Venue Owners, Event Organizers,Esports Teams, Others), By Distribution Channel(Direct Sales, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec.2025

- Report ID: 169213

- Number of Pages: 357

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Key Risks for VR Esports Venues

- By Coverage Type

- By Venue Type

- By End-User

- By Distribution Channel

- Key Reasons for Adoption

- Benefits

- Usage

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

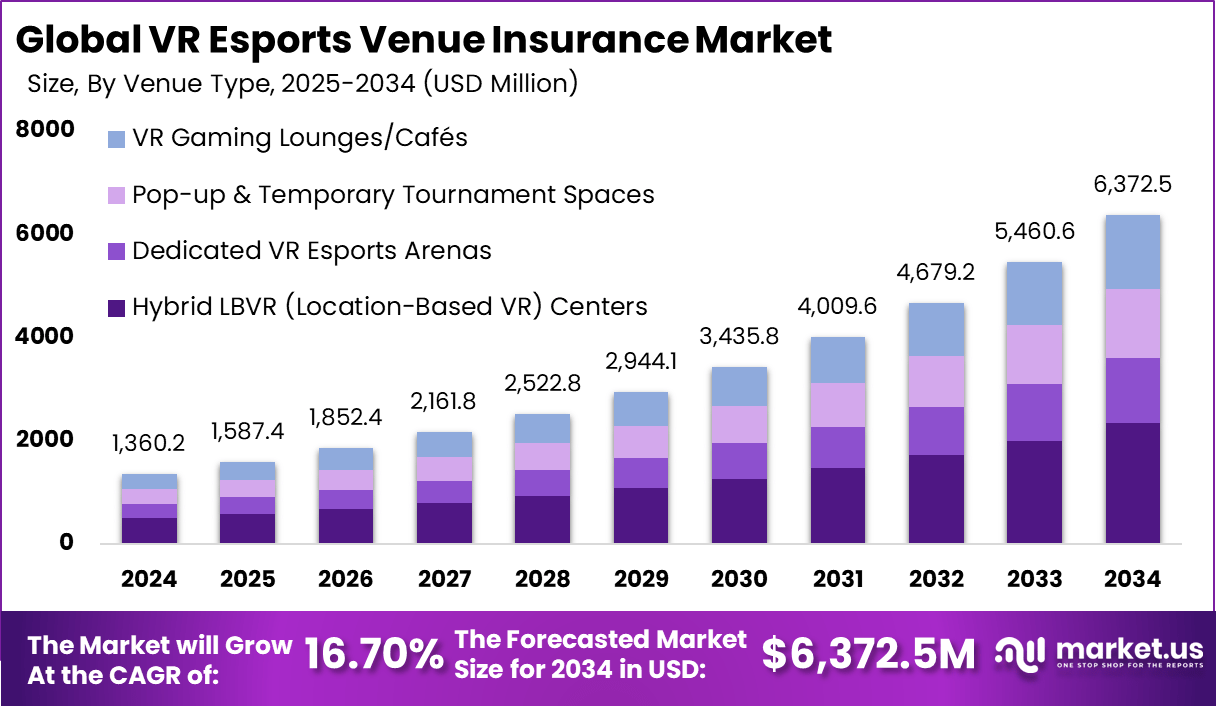

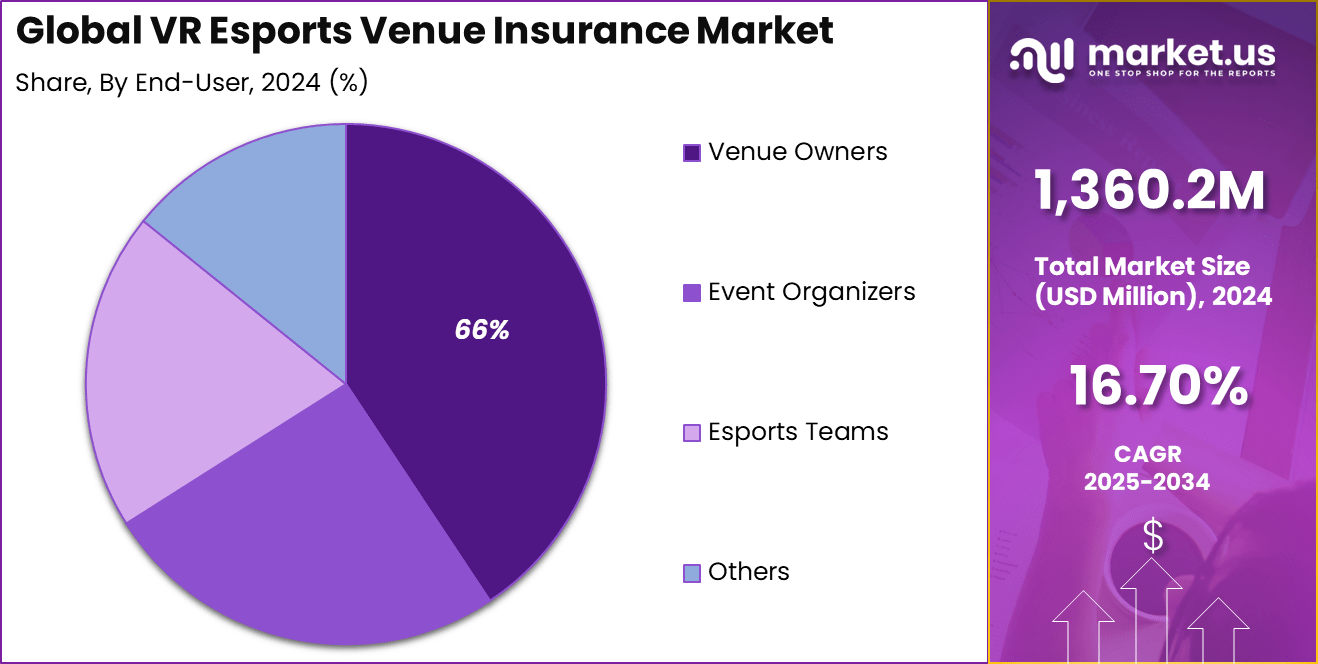

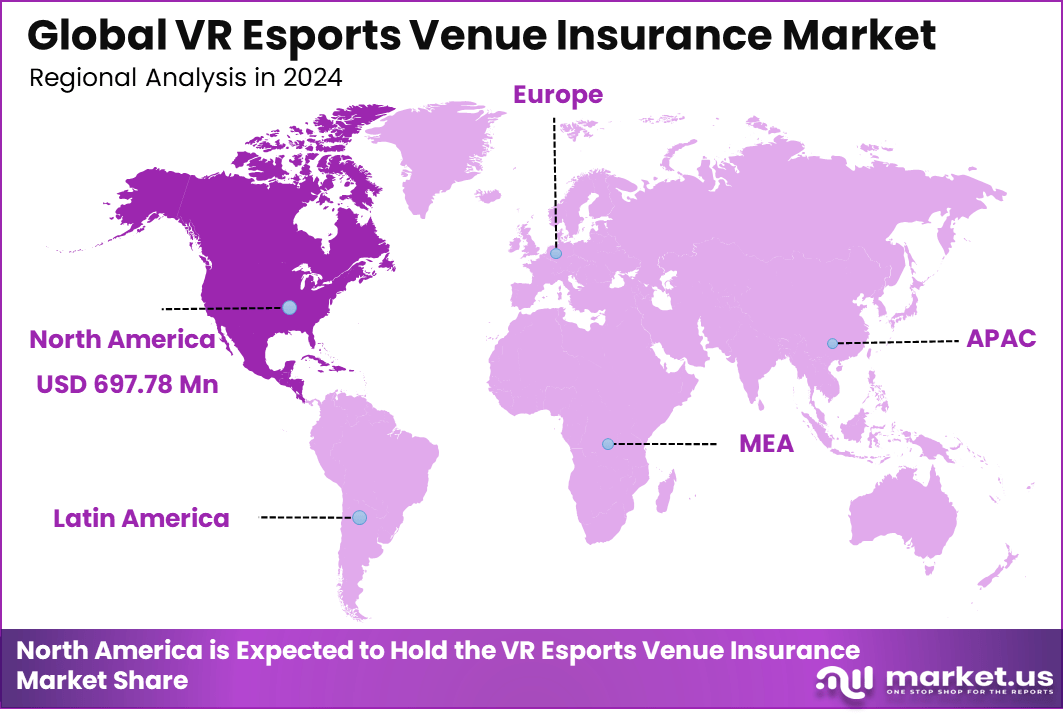

The Global VR Esports Venue Insurance Market generated USD 1,360.2 Million in 2024 and is predicted to register growth from USD 1587.4 Million in 2025 to about USD 6,372.5 Million by 2034, recording a CAGR of 16.70% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 51.3% share, holding USD 697.78 Million revenue.

The VR esports venue insurance market has expanded as gaming arenas adopt immersive virtual reality experiences that introduce new categories of physical and digital risk. Growth reflects rising participation in competitive VR gaming, increasing commercial investment in dedicated VR arenas and the need for insurance products that address injuries, equipment damage and operational liabilities unique to VR environments.

The growth of the market can be attributed to rising foot traffic in VR venues, increased installation of advanced motion tracking systems and greater operational complexity in competitive events. Venues require specialised insurance to manage risks associated with player movement, headset use and high value hardware. The professionalisation of esports and growing interest in live VR tournaments further accelerate the need for tailored risk coverage.

Demand is rising across VR arcades, competitive esports arenas, gaming theme parks, entertainment centers and mixed reality event organisers. These facilities require coverage for property damage, player injury, device malfunction, cyber incidents and event related liabilities. Markets with strong esports culture and youth engagement show rapid adoption, particularly in regions where VR arcades and competitive gaming hubs are expanding.

Top Market Takeaways

- By coverage type, liability insurance dominates with 42.5% share, protecting against bodily injury, property damage, and legal claims arising from VR esports venue operations.

- By venue type, hybrid location-based VR (LBVR) centers hold 36.7% share, reflecting the rise of venues combining physical space with immersive VR experiences requiring specialized insurance coverage for both real and virtual assets.

- By end-user, venue owners represent 65.8% of the market, as they directly manage liabilities related to infrastructure, equipment, and customer safety in VR esports events and centers.

- By distribution channel, brokers dominate with 72.4% share, leveraging established insurance networks and expertise to tailor policies and manage risks specific to VR esports venues.

- Regionally, North America commands about 51.3% market share.

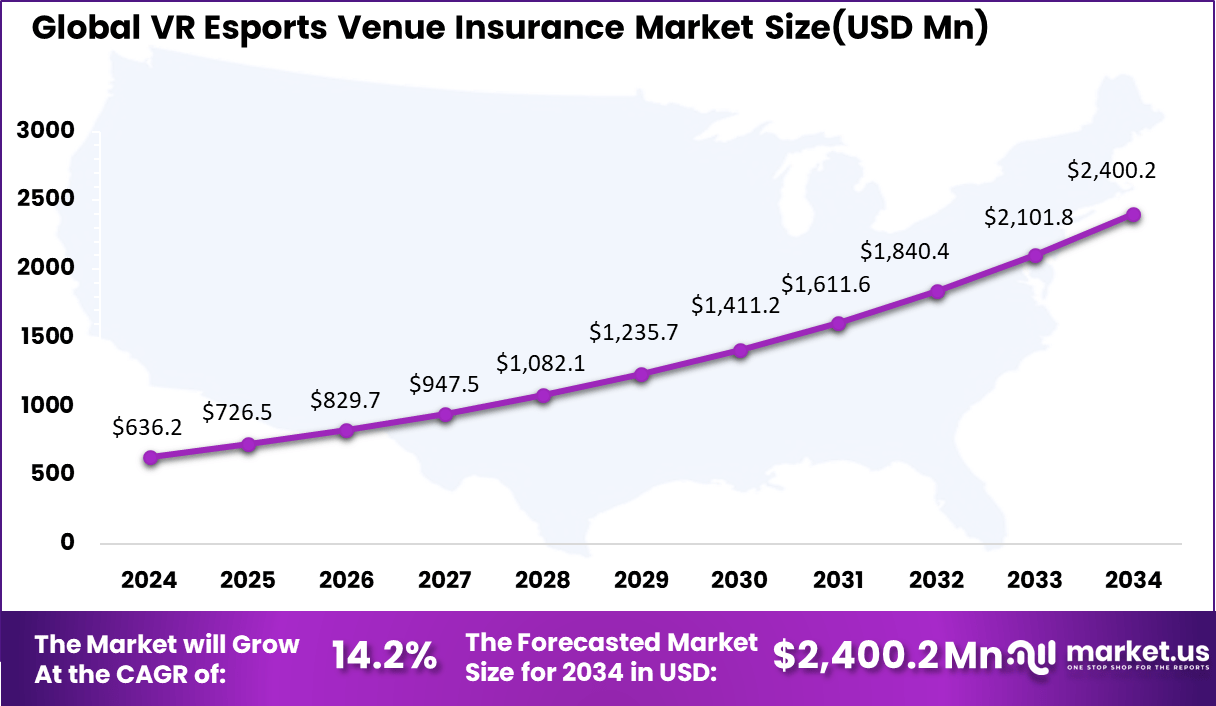

- The U.S. market size is valued at approximately USD 636.2 million in 2025.

- The market grows at a CAGR of 14.2%, driven by the rapid expansion of VR esports venues, increasing consumer participation, regulatory requirements, and emerging risks related to new technologies and event formats.

Key Risks for VR Esports Venues

Risk Category Details General Liability Protects against claims of bodily injury or property damage to customers (e.g., a user getting injured while playing). Property Insurance Covers high-value VR equipment (headsets, computers, sensors, haptic feedback systems) from damage or loss. Cyber Insurance Addresses risks associated with data breaches, ransomware attacks, server downtime, and loss of profit due to operational disruptions. Health Risks Potential issues like motion sickness and eye strain are considerations for customer safety and liability. By Coverage Type

Liability insurance accounts for 42.5% of the VR esports venue insurance market. This large share reflects how venue operators place strong attention on financial protection against injuries and third-party claims. VR activities involve real physical movement, which increases the chance of participants falling or colliding with equipment or other players. As a result, liability protection becomes the first product that venue operators secure when setting up insurance coverage for their facilities.

The segment continues to expand because regulators, landlords, and event partners increasingly expect proper coverage before allowing commercial VR esports operations. The faster adoption of competitive VR events also adds more exposure, as tournaments bring larger crowds and increase the chance of accidental harm. For these reasons, liability insurance remains the most important category in the market and is expected to strengthen its position as more VR venues open worldwide.

By Venue Type

Hybrid LBVR centers hold 36.7% of the market, which shows that mixed physical and virtual environments create a higher need for specialized insurance protection. These centers combine physical play zones with advanced VR systems, which increases the number of assets and the level of movement involved. The presence of expensive headsets, sensors, haptic gear, and large play areas introduces more risk for property damage and operational disruptions.

The demand for insurance in this venue type is rising because LBVR centers attract group activities, tournaments, and commercial events. Each of these brings additional responsibility for safety and equipment reliability. As more entertainment companies expand into hybrid VR formats, insurers observe a steady rise in requests for multi-layered policies that include property, liability, and equipment coverage. This trend supports the strong share held by hybrid LBVR centers.

By End-User

Venue owners represent 65.8% of the market, indicating that the primary buyers of VR esports venue insurance are operators who manage VR facilities on a daily basis. Owners carry the financial responsibility for operational safety, equipment maintenance, and customer experience. This makes insurance a required element of business planning. Most owners purchase multiple coverages at once because VR venues operate in high-traffic environments and depend on costly technology assets.

The strong share also shows that insurance purchasing is closely linked to long-term business stability. Venue owners look for policies that help reduce exposure to lawsuits, accidental injuries, and equipment malfunction. Since most VR esports businesses rely on frequent customer turnover, owners tend to secure insurance early in the business cycle. Their ongoing demand keeps this segment the largest among all end-users.

By Distribution Channel

Brokers hold 72.4% of the market and remain the main channel for purchasing VR esports venue insurance. Venue operators often rely on brokers because the risks involved in VR gaming are complex and not always covered under standard entertainment policies.

Brokers help operators compare different plans, understand policy terms, and secure custom coverage based on the size and nature of the venue. This support is important because many operators are new to insurance requirements for immersive gaming facilities.

The strong dependence on brokers also indicates that insurance products for VR venues are not yet fully standardized. Since each venue has its own layout, equipment mix, and customer volume, brokers play an important role in helping insurers evaluate risks accurately. As the market grows, brokers are expected to keep their central position because operators value personalized guidance for their insurance needs.

Key Reasons for Adoption

- The rapid growth of VR esports events means more venues are hosting tournaments, increasing the need for specialized insurance to cover unique risks.

- VR technology introduces new liability risks like player injuries from physical movement, equipment damage, and data privacy issues, making tailored insurance essential.

- Organizers face higher costs for equipment and venue setup, so insurance helps protect valuable assets and recover from potential losses.

- Regulatory requirements and venue contracts often demand proof of insurance before events can be approved or held.

- Cyber threats and data breaches are more common in digital venues, pushing insurers to offer coverage for online and digital risks.

Benefits

- Insurance reduces financial risk by covering injuries, property damage, and liability claims, helping venues avoid costly lawsuits.

- Tailored policies protect expensive VR hardware and gaming equipment, minimizing out-of-pocket losses from theft or accidents.

- Coverage for cyber incidents helps venues respond to data breaches and maintain customer trust.

- Having insurance makes it easier to secure sponsorships, partnerships, and venue bookings, as stakeholders feel more confident about risk management.

- Insurers offer risk assessment and safety guidance, helping venues improve their operational safety and reduce incidents.

Usage

- Insurance is used for major VR esports tournaments and regular venue operations to cover player injuries and property damage.

- Policies are purchased to protect VR headsets, gaming PCs, and other high-value equipment from theft, damage, or loss.

- Coverage extends to cyber risks, including data breaches and digital fraud, which are common in online and hybrid events.

- Insurance is required for compliance with local regulations and venue contracts, ensuring events can proceed without legal or financial setbacks.

- Risk management support from insurers helps venues implement safety protocols and reduce accidents during events.

Emerging Trends

Key Trends Description Integration of AI and Predictive Analytics Use of AI to assess risk, predict incidents, and dynamically adjust coverage for VR esports venues. Expansion of VR-Specific Policies Development of insurance products tailored to cover unique risks in VR environments, such as technical failures and user injuries. Adoption of Blockchain and Smart Contracts Use of blockchain for secure, transparent claims processing and parametric insurance solutions. Real-Time Monitoring and Risk Assessment Real-time data analytics and monitoring tools to assess venue risks and automate insurance responses. Enhanced Cybersecurity Coverage Growing inclusion of cyber liability and data protection in insurance policies due to digital nature of VR events. Growth Factors

Key Factors Description Rapid Growth of VR Esports Venues Exponential rise in dedicated VR esports arenas and gaming centers increasing demand for specialized insurance. Increasing Regulatory Focus Stricter regulations around safety and liability for immersive gaming experiences driving insurance adoption. Rising Global Investment Growing investments in VR gaming infrastructure and events boosting market expansion. Evolving Risk Landscape Emergence of new risks such as equipment malfunctions, virtual liability, and health concerns requiring new coverage. Strategic Partnerships Collaboration between insurers, venue operators, and tech providers to develop innovative risk management solutions. Key Market Segments

By Coverage Type

- Property Insurance

- Liability Insurance

- Business Interruption Insurance

- Cyber Insurance

- Others

By Venue Type

- Dedicated VR Esports Arenas

- Hybrid LBVR (Location-Based VR) Centers

- Pop-up & Temporary Tournament Spaces

- VR Gaming Lounges/Cafés

By End-User

- Venue Owners

- Event Organizers

- Esports Teams

- Others

By Distribution Channel

- Direct Sales

- Brokers

- Online Platforms

- Others

Regional Analysis

North America held a commanding 51.3% share of the VR esports venue insurance market in 2024, driven by the region’s rapid growth in virtual reality gaming and esports infrastructure. The surge in dedicated VR esports venues, coupled with increasing investments in immersive gaming experiences, has heightened demand for specialized insurance solutions.

The U.S. leads within North America, valued at approximately USD 636.2 million in 2024 and growing at a CAGR of 14.2%. The country’s vibrant esports ecosystem, major VR gaming hubs, and high-profile tournaments drive robust demand for insurance coverage.

U.S. providers are innovating with risk assessment models and coverage options that address the unique challenges of VR venues, positioning the U.S. as the primary growth engine for the North American VR esports venue insurance market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

A key driver in the VR esports venue insurance market is the steady rise of location based VR gaming spaces. These venues rely on advanced headsets, sensors, and large play areas that require careful handling. As more customers participate in immersive games, the chances of equipment damage or accidental injuries increase.

Insurance becomes important because operators need protection against financial loss linked to hardware failure or incidents involving participants. Recent industry insights show that many gaming centres now view structured insurance coverage as part of their core operating costs.

Growth is also supported by the increasing use of VR entertainment for tournaments and group events. These gatherings bring higher foot traffic and greater exposure to safety and property risks. Insurance designed for such venues helps operators maintain stable operations by covering unexpected disruptions. This practical need for smoother risk management continues to strengthen interest in VR esports venue insurance.

Restraint

A major restraint is the cost of adopting these insurance plans. VR venues already spend significant amounts on equipment, software updates, and staffing. Adding specialized insurance raises overall expenses, which can be difficult for smaller businesses or new entrants. Many operators try to limit added costs, which slows adoption in certain regions. Industry commentary suggests that some venues still rely on basic insurance due to financial constraints.

Another restraint comes from limited awareness of risk exposure. Many operators underestimate the range of issues that can affect VR environments, including trip hazards, device breakage, and service interruptions. When owners do not fully understand these risks, they may choose minimal coverage that does not adequately protect their business. This lack of understanding can reduce market demand for detailed insurance plans.

Opportunity

Expansion into New Event Formats

A strong opportunity exists as more VR game arenas open across entertainment districts, malls, and tourist destinations. Operators increasingly prefer insurance coverage that supports long term stability by protecting equipment and customer safety. Providers that offer policies tailored to the layout and scale of VR venues are well positioned to gain new clients.

The growth of social gaming hubs also increases interest in insurance that covers more than standard property risks. There is also opportunity in offering combined policies that address both venue protection and event coverage. Many VR centres host tournaments or private gatherings, which bring short term risks that require separate insurance responses.

Challenge

A major challenge in this market is the wide variation among VR venues. Some operate small rooms with basic setups, while others offer large free movement arenas with advanced tracking systems. These differences make it difficult for insurers to set standard premiums or coverage terms. Each venue requires individual assessment, which increases the time needed for underwriting and limits scalability.

Another challenge is the lack of long term claims data for VR venues. Since this segment is relatively new, insurers have limited real world information about injury rates, equipment failures, or business disruptions. Without strong data, estimating risk becomes difficult, and insurers may charge higher premiums or provide narrow coverage. This uncertainty slows the creation of well balanced insurance products that support broader adoption.

Competitive Analysis

The VR esports venue insurance market is competitive, with leading global insurers such as Allianz, AIG, AXA XL, Chubb, Zurich Insurance Group, Marsh & McLennan, Willis Towers Watson, Arthur J. Gallagher, Liberty Mutual, Tokio Marine HCC, Hiscox, Sompo International, Munich Re, Berkshire Hathaway Specialty Insurance, and Lloyd’s of London offering tailored coverage for virtual reality esports venues.

Competition centers on the ability to deliver customized, flexible insurance solutions, rapid claims processing, and deep expertise in both traditional and emerging risks associated with immersive technologies. Insurers differentiate themselves through specialized underwriting, partnerships with technology providers, and risk management services designed for the dynamic esports industry.

Geographic reach, digital innovation, and reputation for reliability are key factors driving market leadership, with North America and Europe leading in adoption and Asia-Pacific showing rapid growth due to increasing VR and esports investments.

Top Key Players in the Market

- Allianz SE

- American International Group, Inc. (AIG)

- AXA XL

- Chubb Limited

- Zurich Insurance Group

- Marsh & McLennan Companies, Inc.

- Willis Towers Watson

- Arthur J. Gallagher & Co.

- Liberty Mutual Insurance

- Tokio Marine HCC

- Hiscox Ltd

- Sompo International

- Munich Re

- Berkshire Hathaway Specialty Insurance

- Lloyd’s of London

- Others

Future Outlook

The VR esports venue insurance market is set to grow as virtual reality gaming venues and esports events become more mainstream and attract larger audiences and investments. With the rise of immersive gaming experiences and the need for specialized coverage, insurers are developing tailored policies that address unique risks such as equipment damage, cyber threats, and liability in VR environments. Regulatory scrutiny and the increasing complexity of VR technology are prompting venues to seek comprehensive insurance solutions to safeguard their operations and patrons.

Opportunities lie in

- Expansion of insurance products tailored for VR-specific risks, including hardware damage and user injury.

- Growth in coverage demand as VR esports venues proliferate in urban and entertainment hubs.

- Partnerships between insurers and technology providers to create bundled risk management solutions for VR operators.

Recent Developments

- October, 2025, Allianz increased its brand value by 20 percent and emphasized the growing importance of insuring large-scale sports and entertainment venues, including VR esports venues. Allianz provides comprehensive coverage for risks including event cancellation, cyberattacks, and infrastructure protection, reflecting heightened awareness of AI-related security threats during events.

- December, 2025, Chubb launched an AI-driven optimization engine for embedded insurance products, aimed at delivering tailored policies at the point of sale for events including esports venues. Chubb’s event insurance offerings cover broad risk factors such as cancellations, liability exposures, and personal accident protection, key for emerging VR esports venues.

Report Scope

Report Features Description Market Value (2024) USD 1,360.2 Mn Forecast Revenue (2034) USD 6,372.5 Mn CAGR(2025-2034) 16.70% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Coverage Type(Property Insurance,Liability Insurance,Others), By Venue Type(Dedicated VR Esports Arenas,Hybrid LBVR (Location-Based VR) Centers,Others), By End-User(Venue Owners,Event Organizers,Esports Teams,Others), By Distribution Channel(Direct Sales,Others), Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Allianz SE, American International Group, Inc., AXA XL, Chubb Limited, Zurich Insurance Group, Marsh & McLennan Companies, Inc., Willis Towers Watson, Arthur J. Gallagher & Co., Liberty Mutual Insurance, Tokio Marine HCC, Hiscox Ltd, Sompo International, Munich Re, Berkshire Hathaway Specialty Insurance, Lloyd’s of London, and others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  VR Esports Venue Insurance MarketPublished date: Dec.2025add_shopping_cartBuy Now get_appDownload Sample

VR Esports Venue Insurance MarketPublished date: Dec.2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Allianz SE

- American International Group, Inc. (AIG)

- AXA XL

- Chubb Limited

- Zurich Insurance Group

- Marsh & McLennan Companies, Inc.

- Willis Towers Watson

- Arthur J. Gallagher & Co.

- Liberty Mutual Insurance

- Tokio Marine HCC

- Hiscox Ltd

- Sompo International

- Munich Re

- Berkshire Hathaway Specialty Insurance

- Lloyd’s of London

- Others