Global Voice Over IP Market Size, Share, Industry Analysis Report By Access Type (Phone to Phone, Computer to Computer, Computer to Phone), By Type (International VOIP Calls, Domestic VOIP Calls), By Medium (Mobile, Fixed), By User Type (Individual Consumers, SMBS, Large Enterprises), By Industry Vertical (Healthcare, BFSI, Retail, Hospitality, Education, Transportation, Media & Entertainment, Military & Defence, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155758

- Number of Pages: 238

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

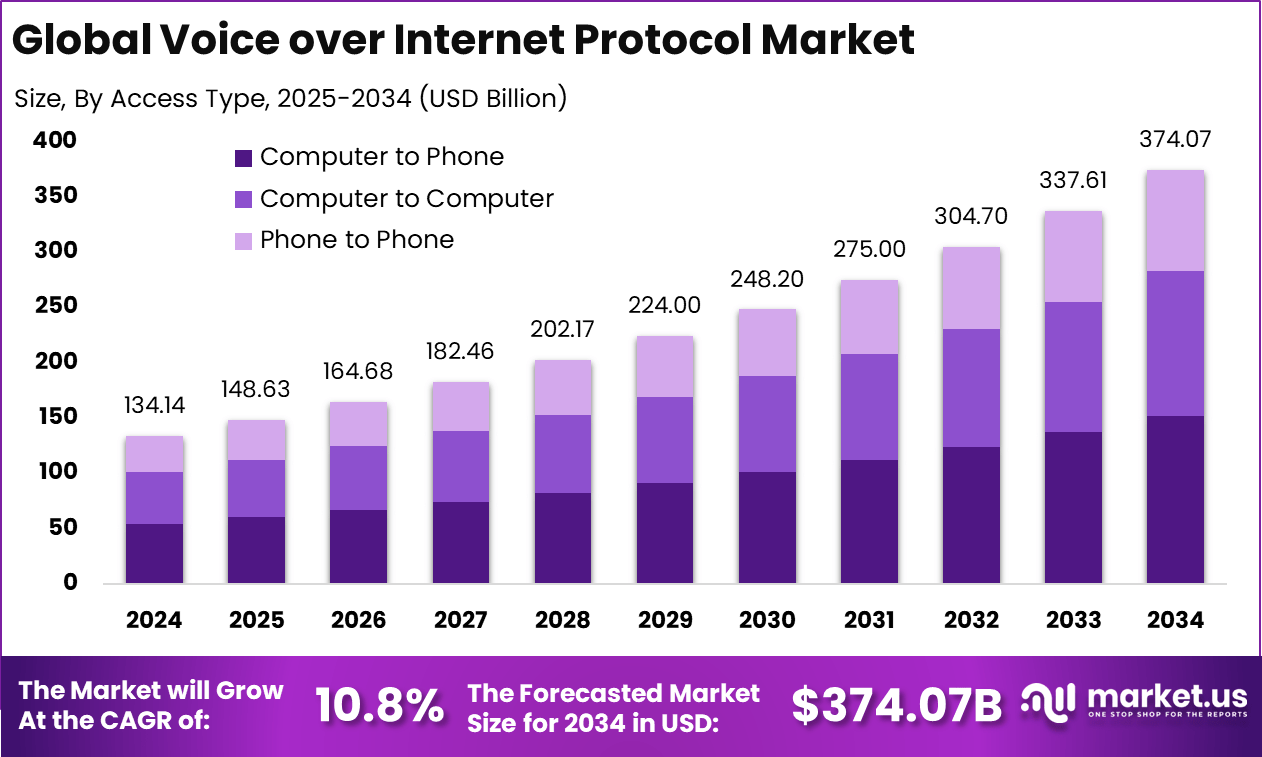

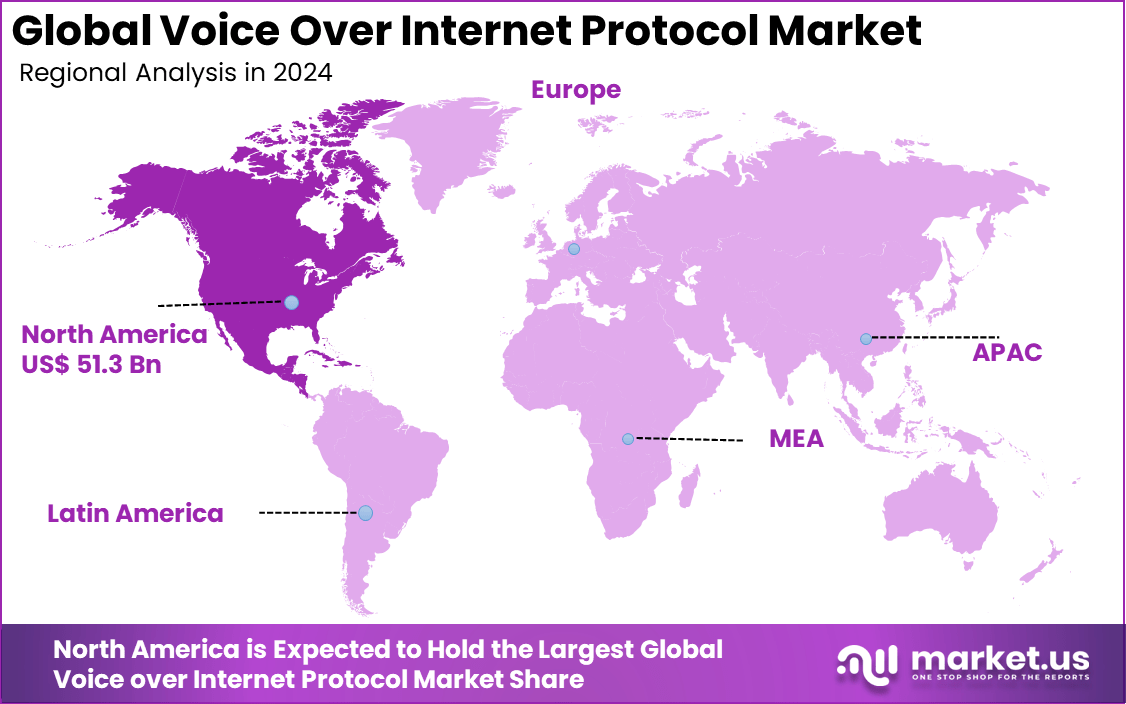

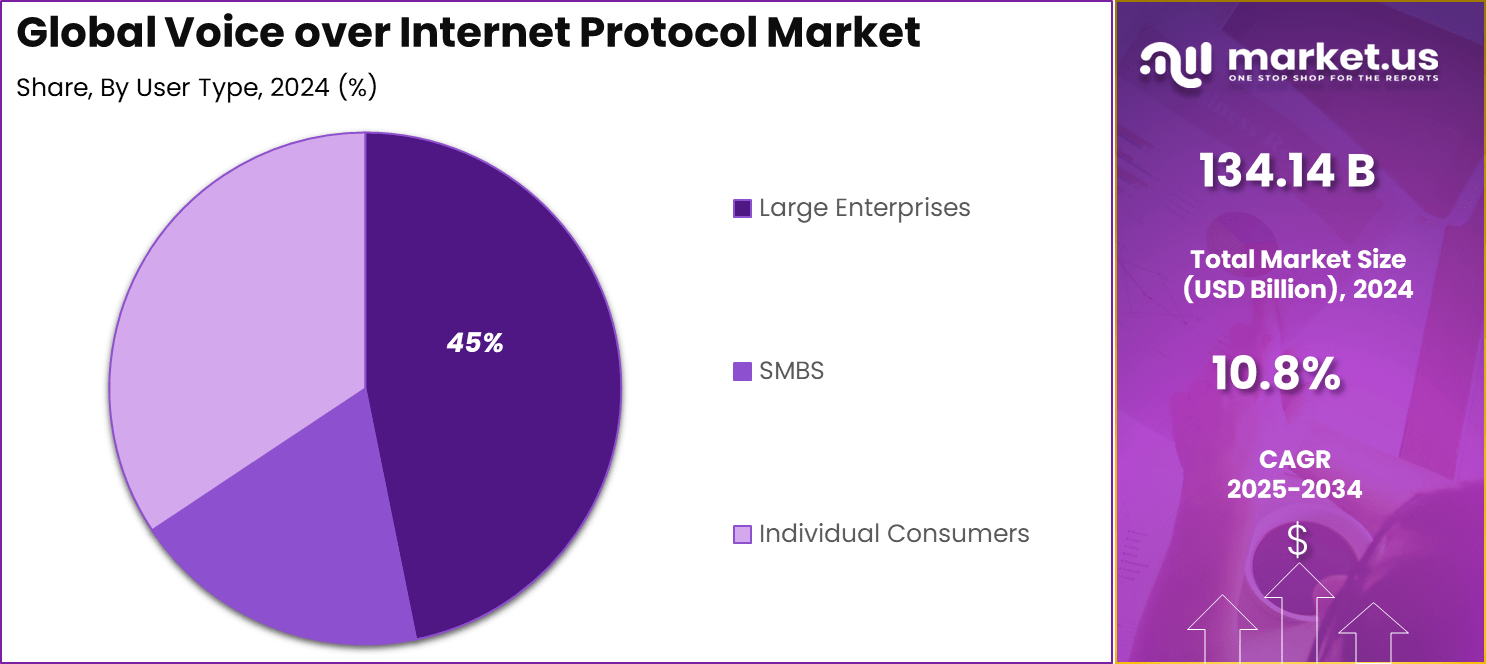

The Global Voice Over IP Market size is expected to be worth around USD 374.07 billion by 2034, from USD 134.14 billion in 2024, growing at a CAGR of 10.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38.3% share, holding USD 51.3 billion in revenue.

The Voice over Internet Protocol (VoIP) market revolves around technologies and solutions that enable voice communications and multimedia sessions over the internet, replacing traditional telephone networks. VoIP converts voice signals into digital packets, allowing calls to be made using internet connections from devices like smartphones, computers, and specialized VoIP phones.

Key Takeaway

- By Access Type, Computer to Phone held the largest share at 40.6%, showing the popularity of low-cost international and domestic calls made via desktop and laptop systems.

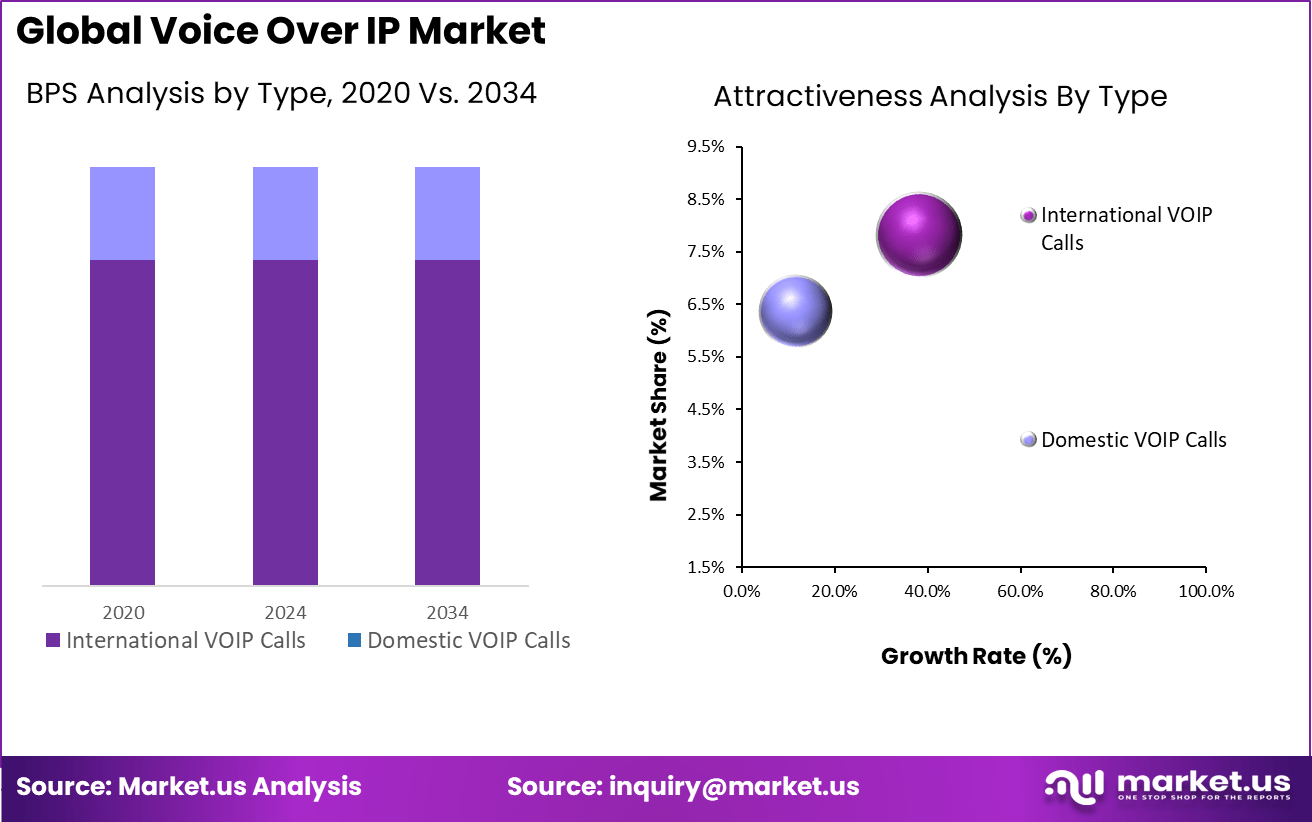

- By Type, International VoIP Calls dominated with 60.1%, reflecting strong demand for affordable cross-border communication in both personal and business use.

- By Medium, Mobile accounted for 55.4%, driven by smartphone penetration and the integration of VoIP services in mobile applications.

- By User Type, Large Enterprises led with 45%, highlighting their preference for VoIP solutions to reduce operational costs and streamline global communications.

- By Industry Vertical, The Banking, Financial Services, and Insurance (BFSI) sector contributed 18.6%, underlining the role of secure, scalable VoIP systems in customer service and financial transactions.

Key drivers fueling the growth of the VoIP market include the increasing demand for affordable and flexible communication solutions. Businesses, especially small and medium enterprises, find VoIP appealing as it reduces the costly infrastructure and maintenance needs associated with traditional phone lines. The rise of mobile VoIP services supports remote work and mobile-first communication strategies, pushing adoption further.

According to research findings, businesses adopting VoIP phone services have been able to cut their telecommunications costs by as much as 50%. This significant reduction in spending provides organizations with greater financial flexibility, enabling them to reallocate resources toward critical areas such as enhancing customer service and improving operational efficiency.

For instance, in May 2025, RingCentral announced the launch of RingCX for Salesforce Service Cloud Voice on Salesforce AppExchange. This integration allows businesses to seamlessly connect their VoIP services with Salesforce’s Service Cloud, enabling more efficient customer support and real-time communication.

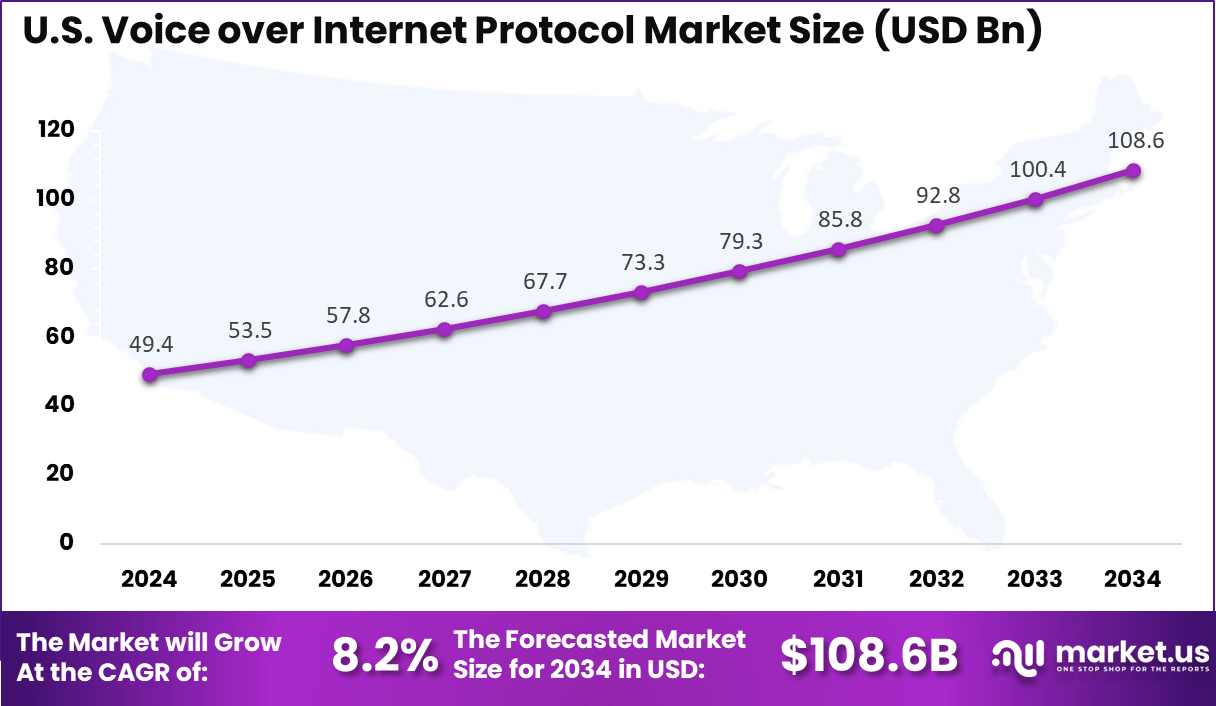

U.S. Market Size

The market for Voice over Internet Protocol within the U.S. is growing tremendously and is currently valued at USD 49.4 billion, the market has a projected CAGR of 8.2%. The market is growing due to the rising need for affordable communication solutions for both businesses and households.

The shift to remote and hybrid work models has increased demand for flexible, cloud-based communication tools. Advances in network infrastructure, including the rollout of 5G and fiber-optic networks, have significantly enhanced VoIP call quality, making it a more dependable option than traditional phone services. Widespread broadband access and strong high-speed internet further support reliable VoIP connectivity.

For instance, in May 2025, the Network Enterprise Center at Fort McCoy completed a significant voice modernization project, transitioning from traditional phone systems to Voice over Internet Protocol (VoIP). This effort is part of the U.S. military’s broader initiative to adopt modern communication technologies, improving reliability, cost-efficiency, and scalability.

In 2024, North America held a dominant market position in the Global Voice over Internet Protocol Market, capturing more than a 38.3% share, holding USD 51.3 billion in revenue. The region benefits from advanced network infrastructure, including widespread 5G and fiber-optic networks, which enhance VoIP call quality and reliability.

Additionally, the strong presence of technology-driven businesses, rapid adoption of cloud-based solutions, and the growing demand for remote work solutions have further fueled market growth. North America’s mature broadband penetration also supports robust VoIP connectivity, driving continued adoption.

For instance, in June 2025, AT&T launched Business Voice, a new VoIP solution designed to replace traditional copper landlines with scalable, internet-based communication services. This move further solidifies North America’s dominance in the Voice over Internet Protocol (VoIP) market.

Access Type Analysis

In 2024, the Computer‑to‑Phone segment held a dominant market position, capturing a 40.6% share of the Global Voice over Internet Protocol Market. This dominance is driven by the rising adoption of cloud-based communication tools and the increasing need for affordable, flexible solutions in both businesses and households.

The seamless integration of VoIP with desktop and mobile applications, coupled with the growth of remote work and international business communications, has led to widespread use of computer-to-phone VoIP services. Both businesses and individuals benefit from easy integration with existing phone systems, advanced features, and cost savings, further solidifying its strong market position.

For instance, In June 2023, advancements in VoIP technology made it possible to place calls between Android phones and tablets using computer-to-phone access. This development reflects the growing integration of VoIP across devices, offering users greater flexibility and seamless communication.

Type Analysis

In 2024, the International VoIP Calls segment held a dominant market position, capturing a 60.1% share of the Global Voice over Internet Protocol Market. This dominance is due to the globalization of businesses, growing cross-border trade, and the increasing number of expatriates and remote workers seeking cost-effective communication solutions.

VoIP provides a more affordable alternative to traditional international calls, making it ideal for long-distance communication. As businesses expand globally and remote work rises, the need for efficient, low-cost international communication has further boosted the adoption of VoIP services for cross-border collaborations and personal connections.

For instance, in November 2024, FriendCaller for Android introduced new features allowing users to make free VoIP calls and group video chats, expanding the accessibility of international VoIP communication. This trend reflects the growing popularity of cost-effective, internet-based communication solutions.

Medium Analysis

In 2024, the Mobile segment held a dominant market position, capturing a 55.4% share of the Global Voice over Internet Protocol Market. This dominance is due to the widespread adoption of smartphones and the growing need for mobile communication in both personal and professional settings.

The rise of mobile-first strategies and VoIP app integration on mobile devices offers users flexibility and convenience in making internet-based calls. Additionally, the rollout of 5G networks and the incorporation of AI-driven features have significantly improved mobile VoIP call quality, enhancing the overall user experience and further solidifying the segment’s strong market position.

For Instance, In June 2025, AT&T introduced AT&T Business Voice, a new VoIP solution aimed at strengthening mobile VoIP for businesses. The service integrates with mobile networks to deliver scalable, cost-effective, and reliable communication. By combining VoIP with mobile-first technologies, it enhances call quality, boosts productivity, and supports remote and hybrid work models.

User Type Analysis

In 2024, The Large Enterprises segment held a dominant market position, capturing a 45% share of the Global Voice over Internet Protocol Market. This dominance is due to the increasing demand for scalable and cost-effective communication solutions to support global workforces.

Large enterprises are turning to VoIP for seamless integration across multiple locations, remote teams, and devices. With its flexibility, advanced features, and capacity to manage high call volumes, VoIP meets enterprise-level communication needs. Furthermore, enterprises are investing in advanced VoIP solutions to enable hybrid work, multi-site connectivity, and real-time collaboration, further boosting market adoption.

For Instance, in April 2023, Microsoft Teams Phone introduced several ways for large enterprises to enhance productivity and reduce communication costs through VoIP integration. The platform allows large businesses to consolidate voice, video, and messaging into one solution, streamlining communications across multiple locations.

Industry Vertical Analysis

In 2024, the BFSI segment held a dominant market position, capturing an 18.6% share of the Global Voice over Internet Protocol Market. This dominance is due to the rising need for secure, reliable, and cost-effective communication solutions to manage customer interactions, global operations, and real-time transactions.

The rise of digital banking and mobile payments has further fueled the demand for scalable VoIP solutions that enhance customer experience and improve operational efficiency. Ongoing security innovations and advanced communication features continue to reinforce the BFSI sector’s leadership in the VoIP market, ensuring its position at the forefront of technology adoption.

For Instance, in May 2023, Zoom received a unified license to offer VoIP calling services in India, expanding its services to the BFSI (Banking, Financial Services, and Insurance) sector. This move provides the BFSI industry with a cost-effective, secure, and reliable communication platform that integrates voice, video, and messaging for customer support and internal operations.

Key Trends and Innovations

Trend / Innovation Description AI-Enabled VoIP Solutions AI-powered voice assistants, real-time language translation, and call analytics WebRTC and Browser-Based Calling Increasing adoption of browser-native VoIP reducing dependency on apps Voice Biometrics for Security Secure authentication and fraud prevention via voice recognition Unified Communication Platforms Integration of VoIP with messaging, conferencing, and collaboration tools Energy-Efficient VoIP Networks Innovations aiming at reducing power consumption and carbon footprint Enhanced QoS & Network Reliability Advanced protocols and 5G reduce call drops and latency Key Market Segments

By Access Type

- Phone to Phone

- Computer to Computer

- Computer to Phone

By Type

- International VOIP Calls

- Domestic VOIP Calls

By Medium

- Mobile

- Fixed

By User Type

- Individual Consumers

- SMBS

- Large Enterprises

By Industry Vertical

- Healthcare

- BFSI

- Retail

- Hospitality

- Education

- Transportation

- Media & Entertainment

- Military & Defence

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Advancements in Network Infrastructure

The expansion of broadband networks, rapid 5G rollout, and increased fiber optic deployments are significantly enhancing VoIP service quality. These advancements reduce latency, jitter, and packet loss, leading to improved reliability and user experience. As infrastructure strengthens across both developed and emerging markets, VoIP adoption is accelerating.

For instance, In February 2025, Kyocera, Ataya, and Ecrio formed a partnership to create an end-to-end private 5G network solution focused on improving critical communications. The collaboration advances network infrastructure for Voice over Internet Protocol services by delivering ultra-low latency, strong reliability, and enhanced security.

Restraint

Security and Privacy Issues

VoIP systems, operating over IP networks, are inherently vulnerable to cybersecurity threats such as call interception, phishing attacks, and denial-of-service intrusions. These risks are especially concerning in sectors like healthcare, finance, and legal services, where data confidentiality is paramount.

The lack of standardized security protocols and insufficient user awareness further amplifies vulnerabilities. Without robust encryption, authentication, and regulatory compliance mechanisms, these issues can undermine trust and slow VoIP adoption in sensitive or highly regulated environments.

For instance, In June 2022, the Office for Civil Rights (OCR) released new guidance on digital communications that directly addressed security and privacy concerns in Voice over Internet Protocol services. The guidance emphasized compliance with regulations such as HIPAA, particularly in sectors like healthcare.

Opportunities

IoT and Smart Device Compatibility

The growing integration of VoIP technology with IoT and smart devices is unlocking new adoption pathways beyond traditional communication functions. VoIP’s compatibility with smart home systems, voice-activated assistants, and connected security infrastructure enhances user convenience and utility.

This convergence offers service providers opportunities to deliver innovative, bundled offerings that tap into evolving consumer lifestyles. As homes and workplaces become more interconnected, VoIP’s role as a central communications hub positions it to capitalize on the expanding IoT ecosystem.

For instance, in July 2024, D-Link launched a new Wi-Fi 6 modem-router in Australia, incorporating VoIP functionality, which highlights the growing trend of VoIP’s compatibility with smart home and IoT devices. The modem-router not only enhances internet speed and coverage but also integrates voice services, enabling seamless communication alongside other smart devices.

Challenges

Market Saturation and Price Competition

Mature VoIP markets face significant saturation, leading to intense price competition among providers. As basic VoIP services become commoditized, profit margins are under pressure, especially for legacy players unable to differentiate through value-added features.

Low barriers to entry and minimal switching costs further intensify the competitive landscape. To sustain growth, service providers must shift towards innovation, customer experience enhancement, and strategic collaboration to attract and retain customers.

For instance, In March 2025, market saturation and price competition in the Voice over Internet Protocol sector intensified as providers such as Nextiva adopted aggressive pricing strategies to protect market share. With VoIP solutions becoming more commoditized, businesses face growing pressure to move beyond cost competition and focus on differentiation through enhanced customer experience, advanced features, and stronger service support.

Key Players Analysis

The Voice over IP market is shaped by the presence of leading technology companies that continue to define its competitive landscape. Microsoft Corporation and Cisco Systems, Inc. hold strong positions with enterprise-focused communication platforms that integrate seamlessly with business workflows.

Emerging providers such as Nextiva and Dialpad, Inc. are gaining traction through advanced collaboration features and AI-driven functionalities. Mitel Networks Corp. and Zoom Video Communications, Inc. also play a central role, addressing enterprise-grade communication needs and hybrid work models. Companies like 8×8 Inc. and AT&T Intellectual Property have invested in expanding global reach, ensuring network reliability and security.

Specialized providers including OpenPhone, Ooma Office, 3CX, GoTo Connect, and Aircall focus on delivering simple, user-friendly VoIP services that meet the needs of startups and SMEs. CallTower and other niche operators target specific verticals, offering compliance-driven communication tools. These companies enhance competition by differentiating on features, pricing models, and customer support.

Top Key Players in the Market

- Microsoft Corporation

- Cisco Systems, Inc.

- RingCentral, Inc.

- Vonage Holdings Corp.

- Nextiva

- Dialpad, Inc.

- Mitel Networks Corp.

- Zoom Video Communications, Inc.

- 8*8 Inc.

- AT&T Intellectual Property

- OpenPhone

- Ooma Office, 3CX

- GoTo Connect

- Aircall

- CallTower

- Others

Recent Developments

- In October 2024, Zoom launched “Zoom Phone” in India, the country’s first licensed cloud PBX service with native phone numbers. This development was aimed at consolidating business communication and strengthening digital collaboration for enterprises.

- In February 2024, 8×8 enhanced its XCaaS platform by combining voice, video, chat, and contact center services into one unified solution. The upgrade was designed to improve both employee and customer experience across different devices and locations.

- By July 2024, Snom Technology partnered with Cal4Care Group to expand the reach of its VoIP telephones across the Asia Pacific region. With backing from its parent company VTech, the partnership focused on advancing telecom infrastructure in markets such as Japan, India, China, Australia, and South Korea.

Report Scope

Report Features Description Market Value (2024) USD 134.14 Bn Forecast Revenue (2034) USD 374.07 Bn CAGR (2025-2034) 10.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Access Type (Phone to Phone, Computer to Computer, Computer to Phone), By Type (International VOIP Calls, Domestic VOIP Calls), By Medium (Mobile, Fixed), By User Type (Individual Consumers, SMBS, Large Enterprises), By Industry Vertical (Healthcare, BFSI, Retail, Hospitality, Education, Transportation, Media & Entertainment, Military & Defence, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft Corporation, Cisco Systems, Inc., RingCentral, Inc., Vonage Holdings Corp., Nextiva, Dialpad, Inc., Mitel Networks Corp., Zoom Video Communications, Inc., 8*8 Inc., AT&T Intellectual Property, OpenPhone, Ooma Office, 3CX, GoTo Connect, Aircall, CallTower, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Microsoft Corporation

- Cisco Systems, Inc.

- RingCentral, Inc.

- Vonage Holdings Corp.

- Nextiva

- Dialpad, Inc.

- Mitel Networks Corp.

- Zoom Video Communications, Inc.

- 8*8 Inc.

- AT&T Intellectual Property

- OpenPhone

- Ooma Office, 3CX

- GoTo Connect

- Aircall

- CallTower

- Others