Global Voice First Internet UX Market Size, Share, Industry Analysis Report By Component (Platforms & Solutions, Services), By Application (Smart Speakers & Home Automation, Voice Search & Discovery, Voice Commerce & Shopping, In-Car Infotainment & Control, Enterprise Productivity & CRM, Healthcare & Telemedicine, Others), By Industry Vertical (Consumer Electronics, Automotive & Transportation, Healthcare & Life Sciences, BFSI, Retail & Ecommerce, Government & Defense, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 168569

- Number of Pages: 248

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Key Statistics

- Role of Generative AI

- Investment and Business Benefits

- U.S. Market Size

- Component Analysis

- Application Analysis

- Industry Vertical Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

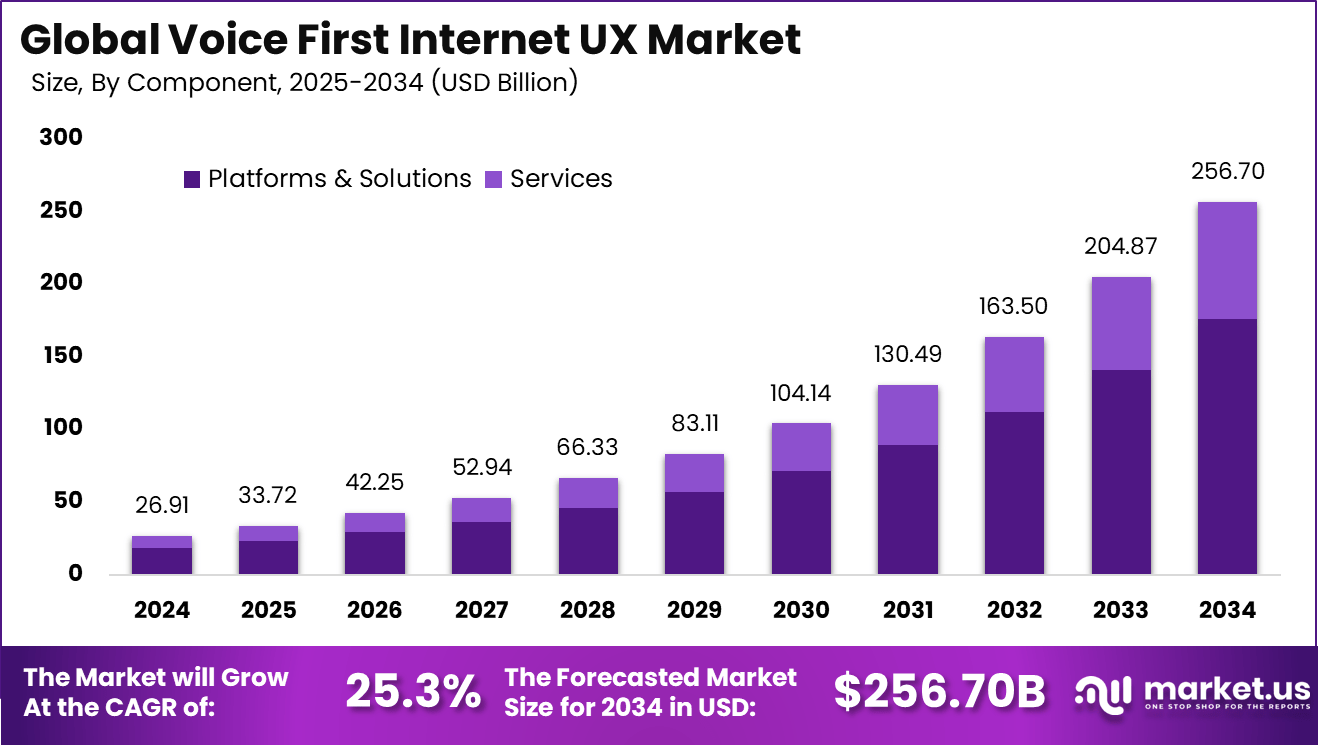

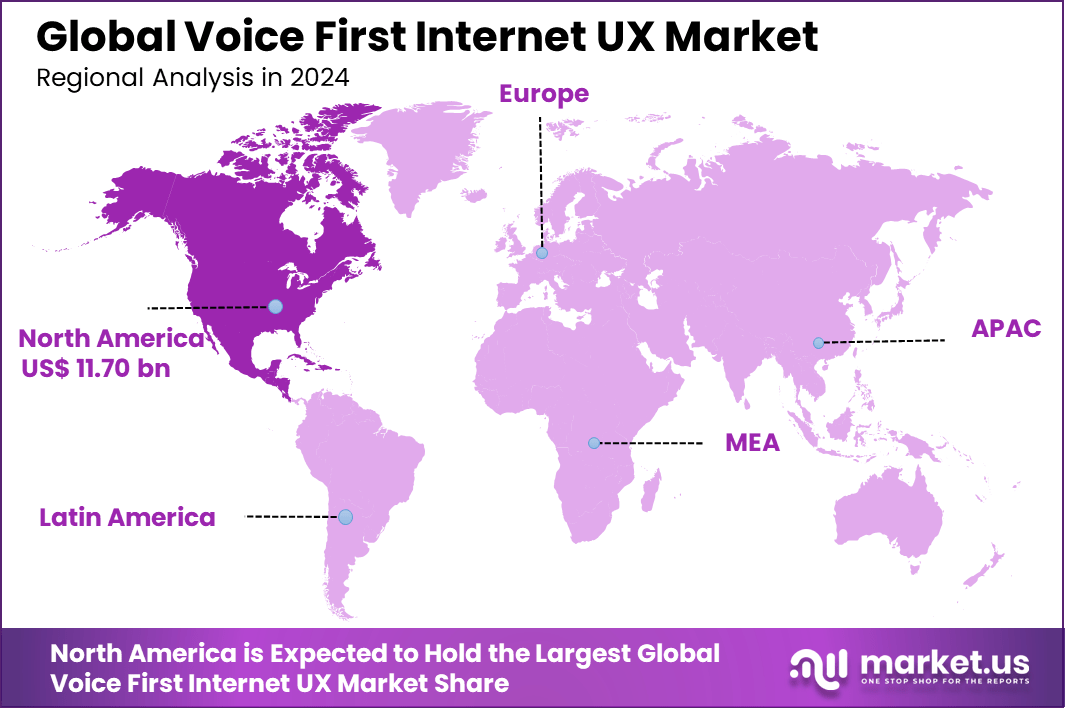

The Global Voice First Internet UX Market size is expected to be worth around USD 256.70 billion by 2034, from USD 26.91 billion in 2024, growing at a CAGR of 25.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 43.5% share, holding USD 11.70 billion in revenue.

Voice First Internet UX is a design approach where voice commands are the primary method for users to interact with digital interfaces, rather than traditional clicking or tapping. This method relies on natural spoken language to navigate, search, and control applications or devices, creating a more intuitive and hands-free experience. It transforms user interaction by making communication feel more like a natural conversation instead of using screens and menus.

Top driving factors for Voice First Internet UX include the rising demand for faster and more accessible interactions. Speaking is, on average, three times faster than typing, which significantly speeds up user tasks. Additionally, voice interfaces promote hands-free convenience, allowing users to multitask during activities like driving or cooking. Advances in natural language processing and AI have improved voice recognition accuracy, making these systems more reliable and user-friendly.

The market for Voice First Internet UX is driven by the growing adoption of voice-activated devices like smart speakers and virtual assistants. Consumers increasingly prefer natural, hands-free interactions for convenience and faster task completion. This trend pushes companies to innovate voice technologies, enhancing user experience and accessibility.

Demand analysis shows expanding interest across personal and enterprise sectors. Users are increasingly using voice commands for activities like shopping, booking services, or controlling smart home devices. Enterprises leverage voice-first strategies to enhance customer experience, reduce response times, and streamline operations.

For instance, in September 2025, Apple showcased bold UI/UX innovations integrating voice with AR/VR and gesture-based controls, emphasizing a multimodal user experience. Apple’s voice-first approach aims to create seamless, conversational interactions that adapt to user context, driving future voice UX trends.

Key Takeaway

- In 2024, the Platforms and Solutions segment accounted for 68.7% of the Global Voice First Internet UX Market, highlighting its central role in enabling voice driven digital interactions.

- In 2024, the Smart Speakers and Home Automation segment captured 25.6%, reflecting strong use of voice interfaces in connected home ecosystems.

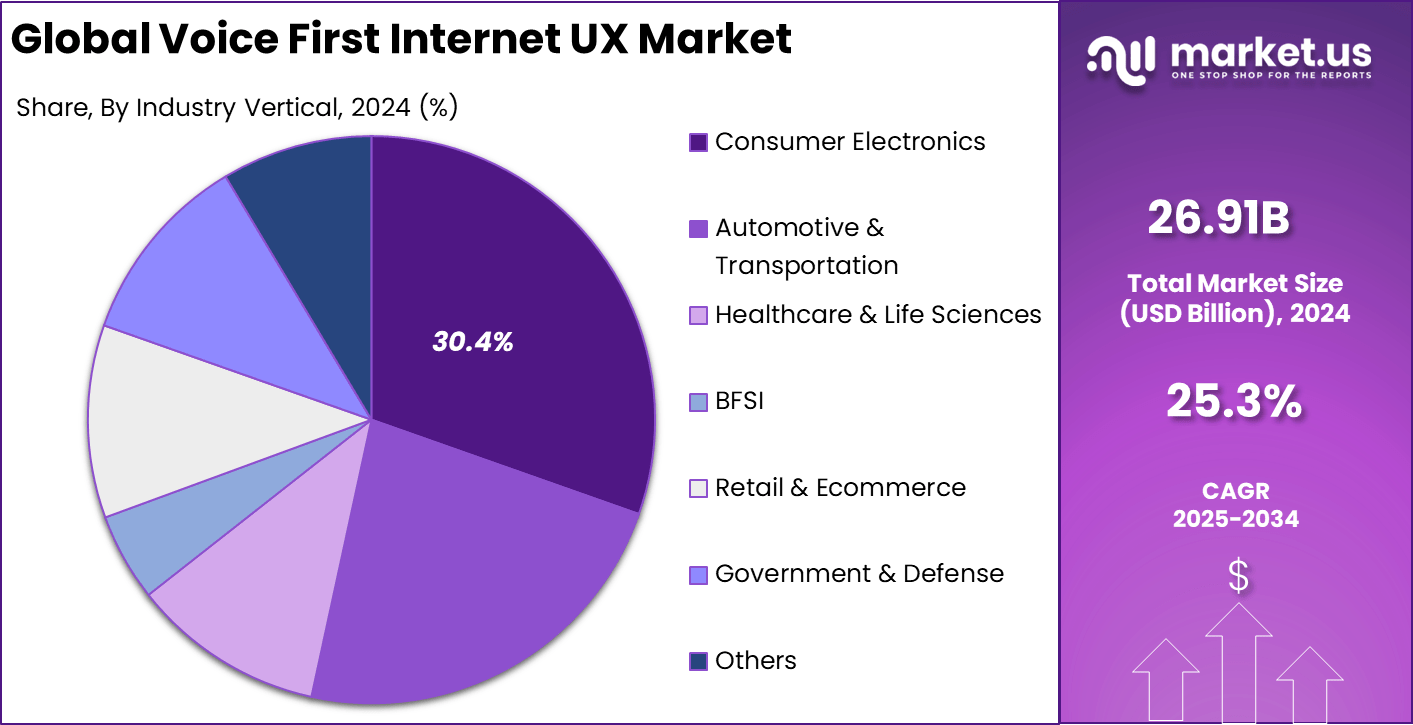

- In 2024, the Consumer Electronics segment reached 30.4%, showing rising integration of voice capabilities across devices such as wearables, TVs, and personal gadgets.

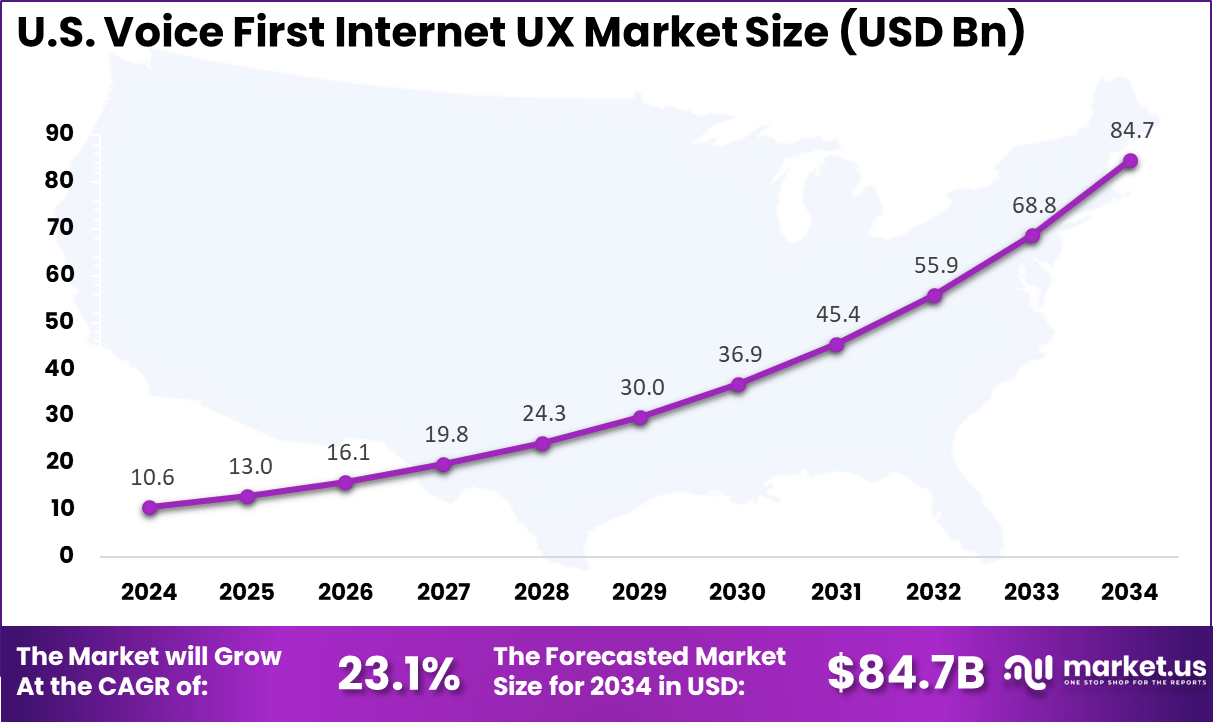

- The US market recorded USD 10.6 Billion in 2024 with a CAGR of 23.1%, indicating steady adoption of voice based user experiences across households and enterprises.

- In 2024, North America held 43.5%, confirming the region’s leading position in deploying voice first technologies across consumer and commercial environments.

Key Statistics

Market Adoption & Usage

- Over 150 million Americans used smart speakers in 2024, with global voice-tech users increasing steadily.

- 72% of smart speaker owners use their devices every day.

- 71% of consumers prefer voice search over typing because it is faster and more convenient.

- Voice recognition technology now reaches about 95% accuracy, making it highly reliable.

- 52% of users have used voice search while driving, with others using it while cooking, working, or multitasking.

Business & Design Impact

- Every dollar invested in UX delivers an average return of $100, showing the strong value of voice-focused design.

- A well-designed user interface can improve conversion rates by up to 200%, and a strong UX strategy can raise them by up to 400%.

- 91% of brands are investing in voice search capabilities, and 71% believe it enhances overall user experience.

- 51% of online consumers use voice search for product research, and 22% have made purchases using voice commands.

Role of Generative AI

Generative AI is playing a crucial role in advancing voice-first internet user experiences by enabling more natural and fluid voice interactions. AI-powered voice assistants like ChatGPT, Gemini, and Copilot transform rigid voice commands into conversations that feel more human and intuitive. This technology allows users to control applications effortlessly without needing to memorize specific commands, boosting accessibility and multitasking capabilities.

About 45% of users in key markets are reported to engage regularly with generative AI-enhanced voice systems, indicating their growing acceptance and usefulness in everyday digital interactions. Beyond facilitating natural conversations, generative AI helps streamline design workflows in voice-first UX, reducing the prototype creation time from days to minutes.

It also supports collaborative iteration through live spoken feedback, making design processes faster and more responsive. The AI continuously learns from user interaction patterns, improving system responsiveness and personalization in real time. This creates a more engaging environment where voice-first experiences adapt dynamically to individual preferences and contexts, substantially improving usability and user satisfaction.

Investment and Business Benefits

Investment opportunities in voice-first UX span platform development, AI-powered voice tools, conversational automation, and accessibility solutions. Businesses entering this space benefit from faster product development cycles and increased customer loyalty through better voice experiences.

Voice UX reduces upfront costs for startups by enabling non-designers to create functional interfaces through spoken commands. Enterprises see improvements in operational efficiency and user engagement, motivating ongoing investments in voice technology ecosystems. The business benefits of Voice First Internet UX include enhanced accessibility, greater user convenience, faster task completion, and improved personalization.

Voice interactions reduce dependency on screens, which is critical for users in motion or with limited dexterity. Companies observe higher customer satisfaction and engagement due to more natural and fluid conversational interfaces. Voice-first design also delivers operational efficiencies by automating routine tasks, freeing staff to focus on strategic activities, and fostering more inclusive user experiences.

U.S. Market Size

The market for Voice First Internet UX within the U.S. is growing tremendously and is currently valued at USD 10.6 billion, the market has a projected CAGR of 23.1%. The market is growing due to the rising consumer adoption of smart devices and increasing demand for hands-free, seamless interactions. Advances in artificial intelligence, natural language processing, and improved speech recognition technologies are enhancing voice interface accuracy and personalization.

Additionally, integration of voice UX in smart home systems, consumer electronics, and enterprise applications is expanding usability and convenience. High investment in voice technology innovation and strong digital infrastructure further support this growth, making the U.S. a key market accelerating voice-first user experience development.

For instance, in February 2025, Amazon announced a major AI overhaul for Alexa, aiming to redefine voice interaction through advanced artificial intelligence capabilities. This initiative is part of Amazon’s strategy to maintain and expand its dominance in the U.S. voice-first Internet UX market by enhancing Alexa’s contextual understanding, natural language processing, and user engagement.

In 2024, North America held a dominant market position in the Global Voice First Internet UX Market, capturing more than a 43.5% share, holding USD 11.70 billion in revenue. This dominance stems from the region’s early adoption of voice technologies and strong digital infrastructure. High consumer awareness and widespread use of smart devices like speakers and home automation systems have fueled demand.

Additionally, substantial investments by leading tech companies in voice platforms, AI advancements, and seamless integration across consumer electronics contribute to North America’s leadership in driving innovative, voice-first user experiences.

For instance, in September 2025, Apple Inc. introduced new Apple Intelligence features that enhance voice-first user experiences across its devices, including iPhone, iPad, Mac, Apple Watch, and Apple Vision. Innovations include real-time voice translation during FaceTime calls and new AirPods gestures to activate live translation, improving seamless voice interactions.

Component Analysis

In 2024, The Platforms & Solutions segment held a dominant market position, capturing a 68.7% share of the Global Voice First Internet UX Market. This segment includes critical elements such as speech recognition, natural language processing, and voice synthesis that enable devices to understand and respond to human speech accurately.

Platforms and solutions empower developers and companies to build and deploy voice-enabled applications efficiently, supporting a wide range of devices and industries. This segment’s size indicates the extensive demand for comprehensive voice UX frameworks that can be integrated into smart home systems, consumer electronics, and enterprise solutions.

With rapid advancements in AI and machine learning, platforms continuously evolve to provide smarter and more personalized interactions. The focus on context-aware capabilities and multimodal interfaces makes voice platforms indispensable for delivering intuitive user experiences in various environments.

For Instance, in June 2025, Apple enhanced its voice platforms with new AI capabilities across its ecosystem, including iPhone, iPad, Mac, and Apple Vision Pro, empowering developers to build richer, more intelligent voice experiences. The updates introduced refined speech recognition and personalization features, strengthening Apple’s position in the voice UX platform segment. This reflects Apple’s strategic focus on evolving its voice-first technologies to improve how users interact vocally with devices in everyday scenarios.

Application Analysis

In 2024, the Smart Speakers & Home Automation segment held a dominant market position, capturing a 25.6% share of the Global Voice First Internet UX Market. These devices act as central control points where users can effortlessly handle lighting, temperature, security, and entertainment through simple voice commands. The convenience offered by smart speakers has changed everyday living by reducing the need for manual control, thus creating more efficient and accessible home environments.

Growth in this segment is driven by continuous improvements in voice recognition accuracy and integration with diverse smart home ecosystems. Users appreciate the ability to interact naturally with their surroundings, relying on voice commands to perform routine tasks quickly and hands-free. This segment’s expansion reflects a broader trend toward voice-enabled automation technologies that simplify and enhance the user’s lifestyle.

For instance, in June 2025, Google rolled out new updates to its Google Home app, improving presence-based automations and voice broadcasting features, enhancing the smart speakers and home automation experience. These features integrate AI to allow smarter control and communication across devices within the home, showing Google’s commitment to expanding functionality in voice-enabled smart living environments.

Industry Vertical Analysis

In 2024, The Consumer Electronics segment held a dominant market position, capturing a 30.4% share of the Global Voice First Internet UX Market. This dominance is due to the widespread use of voice features in devices like smartphones, smart TVs, wearables, and audio systems. The segment benefits from the increasing integration of voice assistants into everyday gadgets, improving usability and convenience.

Consumers value the ability to control devices, access information, and interact with technology through natural speech, which boosts engagement and satisfaction. This vertical continues to grow as manufacturers focus on embedding sophisticated voice interactions that improve accessibility and personalization.

Advanced voice processing technologies enable devices to recognize diverse accents and contexts, ensuring a smoother user experience. The consumer electronics industry illustrates how voice UX has moved beyond novelty to become a standard feature expected by users.

For Instance, in November 2025, Baidu revealed the ERNIE 5.0 AI foundation model and digital human technologies at Baidu World, showcasing AI applications that improve voice interaction and context understanding in consumer and enterprise electronics. These advancements reflect growing investment in voice-enabled, emotionally intelligent devices that redefine user engagement through natural communication.

Emerging Trends

The voice-first design approach is becoming mainstream, with nearly half of the population in some regions expected to use voice assistants by 2026. This trend highlights the shift from traditional screen-based interfaces to natural voice interactions that prioritize hands-free and seamless communication.

UX designers are focusing more on minimal visual feedback and highly personalized conversations that adapt to user context and behavior. User privacy and contextual understanding have emerged as key design priorities, ensuring trust and relevancy in voice interactions. Another growing trend is the integration of voice interfaces across diverse devices, from smartphones and smart speakers to wearables and home appliances.

This interconnected ecosystem enables users to control multiple platforms via voice commands, creating a unified and convenient experience. Motion design micro-interactions combined with voice inputs are also evolving, enabling richer and more intuitive digital experiences. These developments signal a future where voice user interfaces (VUIs) make digital engagement faster, easier, and more accessible to a broader user base.

Growth Factors

One major growth factor is increasing consumer adoption of smart speakers and voice-activated devices, which has risen by over 30% in recent years. This demand fuels investment in developing more advanced voice recognition and natural language processing technologies, enabling more accurate and context-aware voice interactions.

Faster speech-to-text capabilities and reduced latency in voice engines significantly enhance user satisfaction, encouraging broader use in both consumer and enterprise applications. Enterprise adoption is also accelerating, with companies investing heavily in conversational automation for customer support, internal workflows, and accessibility tools.

Speech-driven automation reduces manual inputs and streamlines complex tasks, contributing to productivity gains. Advances in AI-powered voice engines enabling sub-200 ms audio latency are critical enablers of smooth real-time interactions, making voice-first UX practical and scalable for large user bases.

Key Market Segments

By Component

- Platforms & Solutions

- Voice Assistant Platforms

- Voice Analytics & Intelligence Platforms

- Conversational AI & NLP Engines

- Services

- Voice App Development & Design

- Strategy & Consulting

- Testing & Optimization Services

By Application

- Smart Speakers & Home Automation

- Voice Search & Discovery

- Voice Commerce & Shopping

- In-Car Infotainment & Control

- Enterprise Productivity & CRM

- Healthcare & Telemedicine

- Others

By Industry Vertical

- Consumer Electronics

- Automotive & Transportation

- Healthcare & Life Sciences

- BFSI

- Retail & Ecommerce

- Government & Defense

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Growing Adoption of Voice-Activated Devices

Growing adoption of smart speakers, virtual assistants, and voice-enabled devices is strengthening the Voice First Internet UX market. Rising demand for natural, hands-free interaction improves convenience and accessibility across mobile and home environments. As consumer usage expands, enterprises increase investment in voice-driven applications, supporting steady advancement of voice UX technologies that meet evolving user expectations.

Voice-first interfaces improve digital interaction by replacing manual navigation with natural language communication. This transition streamlines user experiences, enhances speed, and broadens accessibility. Technology providers continue to expand their voice ecosystems, reflecting strong commercial interest in more intuitive and responsive voice-activated designs across multiple device categories.

In June 2025, Apple strengthened its voice UX ecosystem by updating developer tools with advanced AI features, including deeper live-translation capabilities within Messages and FaceTime. These improvements support more natural voice interactions and reinforce broader adoption of voice-first experiences across Apple devices.

Restraint

Privacy and Security Concerns

Data privacy and security concerns are a major restraint on the Voice First Internet UX market. Voice systems process sensitive information, and risks involving unauthorized access, data breaches, and unapproved recordings make users cautious. These issues are particularly challenging in sectors that require strict data protection, such as healthcare and finance.

Limited trust in providers’ ability to secure voice data also slows adoption. Many users remain uncertain about how their data is stored and shared, and companies must work harder to meet regulatory requirements while maintaining transparency. These barriers restrict market growth even as voice technologies improve.

In August 2025, Google faced scrutiny over vulnerabilities in its voice recognition services, including interception risks and account security gaps. Despite stronger encryption and clearer policies, continuing concerns over data misuse and third-party app exposure restrain broader adoption of voice-first platforms.

Opportunities

Enhanced Accessibility and Inclusion

The Voice First Internet UX market presents a strong opportunity to expand digital accessibility for users who face challenges with traditional interfaces. Voice-based interaction supports individuals with visual impairments, motor limitations, or limited technical skills by simplifying navigation through natural conversation. This inclusiveness positions voice UX as a critical tool for widening access to essential digital services.

Growing focus on accessibility standards across public and private sectors further strengthens this opportunity. As organizations work to meet compliance requirements, voice-first designs become valuable for delivering more adaptable and personalized user experiences. Advances in artificial intelligence improve accuracy and responsiveness, increasing the appeal and usefulness of voice-powered systems for diverse populations.

In November 2025, Amazon expanded accessibility features within its Fire OS apps, enhancing voice navigation through Alexa. These upgrades support users with motor or visual impairments and highlight the potential of voice UX to reach underserved groups. The company’s emphasis on inclusive design reflects the broader opportunity for voice-first technologies to achieve global adoption.

Challenges

Linguistic and Technical Limitations

A major challenge for the Voice First Internet UX market is handling linguistic diversity. Voice systems often struggle with varied accents, dialects, and languages, leading to misrecognition and reduced reliability. These issues are especially visible in multilingual regions, where inconsistent speech patterns and background noise limit overall user satisfaction.

Technical hurdles further complicate adoption. Achieving low latency, managing interruptions, and delivering accurate real-time responses requires continuous algorithm refinement and strong backend infrastructure. Developers must address these issues to create dependable voice-first experiences that work consistently across diverse user scenarios.

In October 2025, Microsoft launched HD Voices within Dynamics 365 Contact Center to improve natural and context-aware AI interactions. The company noted ongoing challenges in understanding diverse accents, slang, and unclear speech patterns, highlighting the need for more advanced recognition models to enhance global voice UX performance.

Key Players Analysis

Apple, Google, Amazon, and Microsoft lead the Voice-First Internet UX market with advanced voice assistants and ecosystem-wide integrations that support hands-free interaction, search, and smart-home control. Their platforms emphasize natural language understanding, fast response times, and seamless device interoperability. These companies shape the core user experience of voice-driven interfaces across smartphones, speakers, and connected home devices.

Samsung, Nuance Communications, IBM, Baidu, SoundHound, and Speechly strengthen the competitive landscape with specialized speech-recognition technologies and conversational interfaces. Their solutions power voice experiences in cars, appliances, enterprise tools, and consumer electronics. These providers focus on multilingual support, context awareness, and real-time processing.

Alibaba, Facebook, Sony, Huawei, Cisco, Google Nest, Xiaomi, Lenovo, Logitech, and others broaden the market with diverse hardware ecosystems and voice-enabled applications. Their platforms integrate voice controls into smart speakers, TVs, wearables, and IoT devices. These companies prioritize user convenience, cross-device connectivity, and privacy-focused voice processing.

Top Key Players in the Market

- Apple Inc.

- Google LLC

- Microsoft Corporation

- Samsung Electronics

- Nuance Communications

- IBM Corporation

- Baidu, Inc.

- SoundHound Inc.

- Speechly

- Alibaba Group

- Sony Corporation

- Huawei Technologies

- Cisco Systems, Inc.

- Google Nest

- Xiaomi Corporation

- Lenovo Group Limited

- Logitech International S.A.

- Others

Recent Developments

- In November 2025, Google rolled out a major redesign of its voice search interface on Android, delivering a Gemini-inspired, modernized user experience that boosts interaction with real-time dynamic waveforms and a clearer voice prompt. This redesign aims to make voice search feel more natural and responsive, encouraging more frequent use and setting the stage for deeper AI-powered enhancements in voice UX.

- In June 2025, Amazon unveiled AI-powered voice commerce ads that synthesize product highlights into personalized, 60-second audio snippets. Integrated across the Alexa ecosystem and Amazon mobile app, this innovation boosts shopper engagement and conversions by providing hands-free, interactive voice shopping experiences aligned with individual preferences, marking a significant shift in voice-first retail experiences.

Report Scope

Report Features Description Market Value (2024) USD 26.9 Bn Forecast Revenue (2034) USD 256.7 Bn CAGR(2025-2034) 25.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Platforms & Solutions, Services), By Application (Smart Speakers & Home Automation, Voice Search & Discovery, Voice Commerce & Shopping, In-Car Infotainment & Control, Enterprise Productivity & CRM, Healthcare & Telemedicine, Others), By Industry Vertical (Consumer Electronics, Automotive & Transportation, Healthcare & Life Sciences, BFSI, Retail & Ecommerce, Government & Defense, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Apple Inc., Google LLC, Amazon.com, Inc., Microsoft Corporation, Samsung Electronics, Nuance Communications, IBM Corporation, Baidu, Inc., SoundHound Inc., Speechly, Alibaba Group, Facebook, Sony Corporation, Huawei Technologies, Cisco Systems, Inc., Google Nest, Xiaomi Corporation, Lenovo Group Limited, Logitech International S.A., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Voice First Internet UX MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Voice First Internet UX MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Apple Inc.

- Google LLC

- Microsoft Corporation

- Samsung Electronics

- Nuance Communications

- IBM Corporation

- Baidu, Inc.

- SoundHound Inc.

- Speechly

- Alibaba Group

- Sony Corporation

- Huawei Technologies

- Cisco Systems, Inc.

- Google Nest

- Xiaomi Corporation

- Lenovo Group Limited

- Logitech International S.A.

- Others