Global Vitamin C Market Size, Share, And Business Benefits By Grade (Regular, Premium), By End-Use (Food and Beverage, Animal Feed, Personal Care and Cosmetics, Pharmaceuticals, Others), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 161943

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

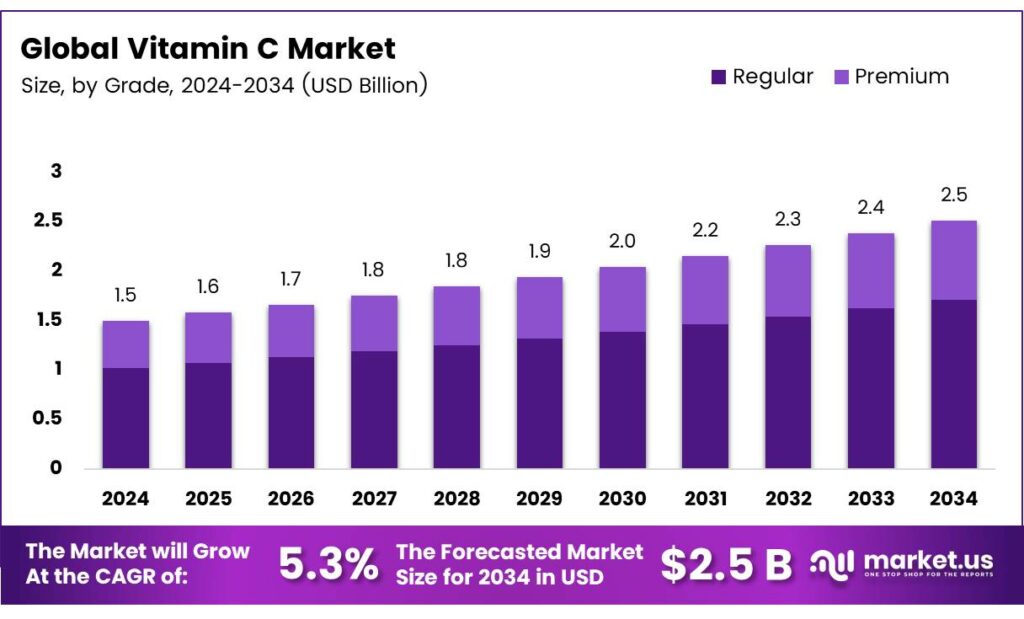

The Global Vitamin C Market size is expected to be worth around USD 2.5 Billion by 2034, from USD 1.5 Billion in 2024, growing at a CAGR of 5.3% during the forecast period from 2025 to 2034.

Vitamin C, or L-ascorbic acid, is a water-soluble vitamin essential for humans, who cannot synthesize it, and is found in foods and supplements. It supports the biosynthesis of collagen, L-carnitine, and neurotransmitters, aiding protein metabolism and wound healing through connective tissue formation. As a key antioxidant, it regenerates other antioxidants like vitamin E and counters free radical damage. This property has spurred research into its potential to prevent oxidative stress-related diseases, such as certain cancers and cardiovascular issues.

Vitamin C also enhances immune function and improves the absorption of nonheme iron from plant-based foods. The absorption of vitamin C in the intestines is regulated by a dose-dependent, active transporter, while a second specific transport protein facilitates its accumulation in cells. In vitro studies indicate that oxidized vitamin C (dehydroascorbic acid) enters cells through facilitated glucose transporters and is then reduced to ascorbic acid internally, though the physiological significance of this process remains unclear.

- The Food and Nutrition Board has set Recommended Dietary Allowances (RDAs) and Adequate Intakes (AIs) for vitamin C to prevent deficiency, ranging from 15 to 120 mg based on age, sex, and life stage, such as pregnancy or lactation. For adults, RDAs are 90 mg for men and 75 mg for women, increasing to 85 mg during pregnancy and 120 mg during lactation, with smokers needing an extra 35 mg daily due to oxidative stress. For infants aged 0–12 months, AIs are set at 40–50 mg, based on the intake of healthy, breastfed infants.

Vitamin C absorption decreases significantly at intakes above 1,000 mg, with less than 50% absorbed, and excess amounts are excreted in urine, making megadoses generally non-toxic in healthy individuals. However, doses exceeding 3,000 mg daily may cause diarrhea, nausea, abdominal cramps, and increased risk of kidney stones in those with kidney disease, elevated uric acid levels (linked to gout), or excessive iron absorption in individuals with hemochromatosis. The tolerable upper intake level (UL) ranges from 400 to 2,000 mg, depending on age, indicating the maximum intake unlikely to cause adverse effects.

The RDAs are set higher than the amount needed to prevent deficiency, reflecting vitamin C’s roles in antioxidant activity and physiological functions, particularly in white blood cells. The RDA represents the average daily intake sufficient to meet the needs of 97–98% of healthy individuals, based on scientific evidence. While vitamin C has low toxicity, concerns about kidney stone formation and iron overload are minimal in healthy people but warrant caution in those with specific health conditions.

Key Takeaways

- The Global Vitamin C Market is expected to reach USD 2.5 billion by 2034 from USD 1.5 billion in 2024, with a CAGR of 5.3%.

- Regular grade Vitamin C held a 68.3% market share in 2024, driven by its use in pharmaceuticals, food, and supplements.

- Offline channels dominated with a 73.7% share in 2024, led by pharmacies, supermarkets, and health stores.

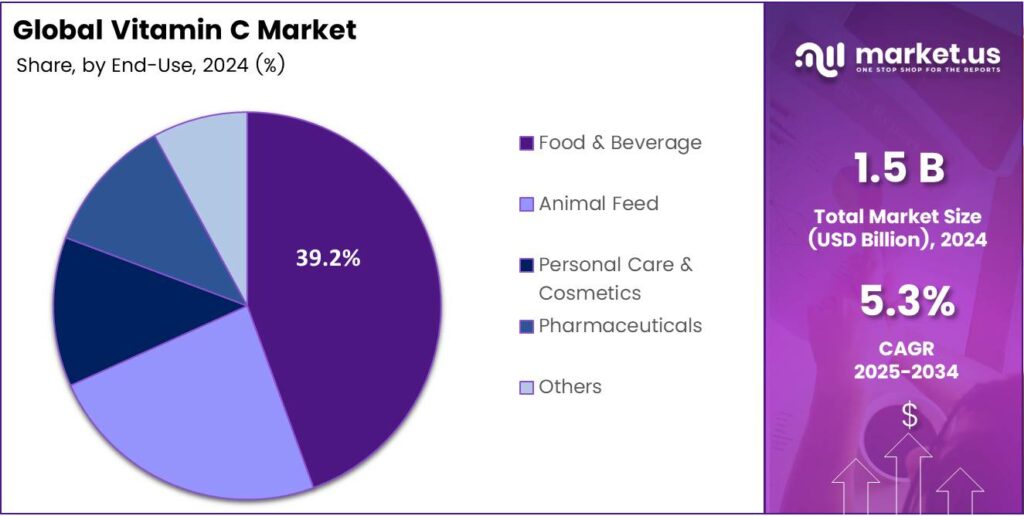

- The Food and Beverage sector led with a 39.2% share in 2024, fueled by demand for fortified and functional products.

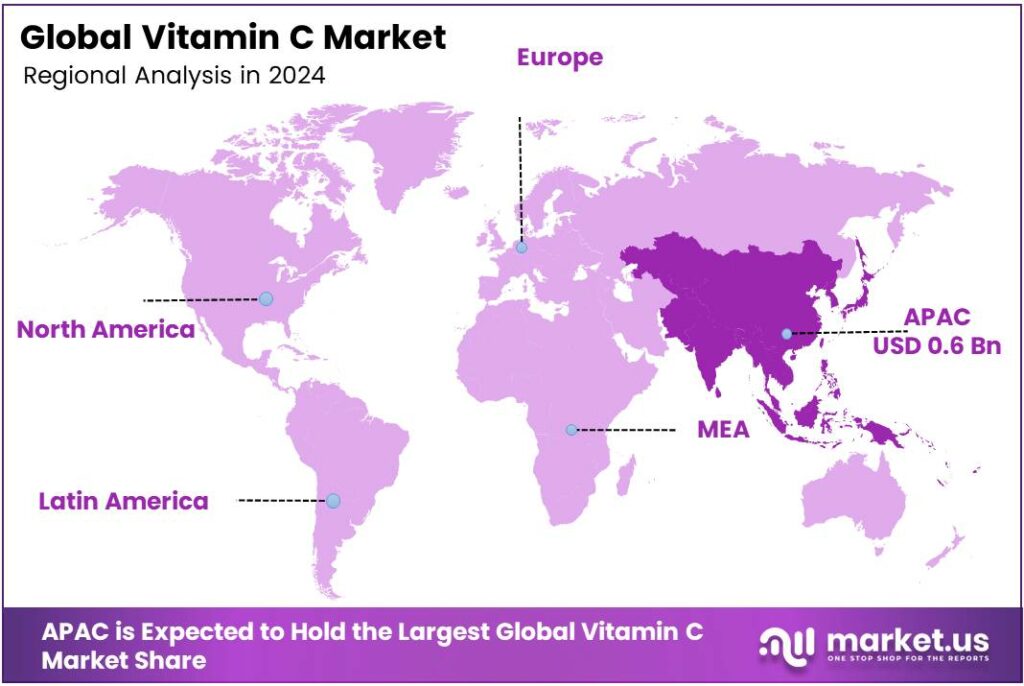

- Asia-Pacific captured a 43.2% market share in 2024, valued at USD 0.6 billion, led by China, Japan, and India.

By Grade

Regular Grade Dominates with 68.3% Market Share

In 2024, Regular grade held a dominant market position, capturing more than a 68.3% share of the global Vitamin C market. This dominance was largely attributed to its extensive use in pharmaceuticals, food and beverages, and dietary supplements, where consistent quality and stability are crucial.

Regular grade Vitamin C continues to be the preferred choice due to its cost efficiency, high solubility, and compatibility with a wide range of formulations. In 2025, demand for regular grade Vitamin C is projected to remain strong, supported by increasing consumption of fortified foods and rising health awareness worldwide.

Its extensive application in processed foods and energy drinks, combined with its role in immune system enhancement, keeps it at the forefront of the market. Additionally, government nutrition programs promoting vitamin intake in developing nations are further fueling the segment’s steady growth momentum.

By Distribution Channel

Offline Channel Leads with 73.7% Market Share

In 2024, Offline held a dominant market position, capturing more than a 73.7% share of the global Vitamin C market. Pharmacies, supermarkets, and health stores remained the primary distribution points, providing consumers with trust, accessibility, and personalized guidance.

The offline channel benefited from strong consumer preference for physical verification of product authenticity, especially in developing regions. In 2025, the offline segment is expected to maintain its leadership as traditional retail chains continue expanding into semi-urban and rural areas.

The availability of a wide range of branded and generic Vitamin C supplements, combined with promotional healthcare campaigns and physician recommendations, further strengthens its dominance. Moreover, the post-pandemic emphasis on immunity and nutrition has kept consumer footfall high in pharmacy outlets, ensuring consistent year-over-year growth for the offline distribution channel.

By End-Use

Food and Beverage Leads with 39.2% Market Share

In 2024, Food and Beverage held a dominant market position, capturing more than a 39.2% share of the global Vitamin C market. This leadership was driven by the growing demand for fortified foods, beverages, and functional products aimed at improving immunity and overall wellness.

Manufacturers increasingly incorporated Vitamin C into juices, dairy products, and snacks to meet consumer preferences for health-oriented products. In 2025, the food and beverage segment is projected to sustain its dominance as more companies focus on clean-label formulations and natural ingredient fortification.

Rising urban lifestyles, coupled with awareness about nutrient deficiencies, continue to fuel this segment’s expansion. Additionally, government programs encouraging nutrient-enriched food production and labeling transparency further support the steady consumption of Vitamin C within the global food and beverage industry.

Key Market Segments

By Grade

- Regular

- Premium

By Distribution Channel

- Offline

- Online

By End-Use

- Food and Beverage

- Animal Feed

- Personal Care and Cosmetics

- Pharmaceuticals

- Others

Emerging Trends

Food-first, clean-label vitamin C

Brands are moving away from mega-dose pills toward food-first, clean-label vitamin C, especially juices, smoothies, shots, and snacks using naturally high-vitamin-C ingredients like acerola. Public guidance keeps steering consumers to get nutrients from whole foods: the WHO recommends consuming fruits and vegetables per day to improve health, which naturally raises vitamin-C intake alongside fiber and polyphenols.

- Second, acerola delivers extraordinary vitamin C density analyses listing roughly 1,600–1,700 mg per 100 g of raw fruit, and scientific reviews report 1,000–4,500 mg/100 g, making it 50–100× richer than oranges or lemons. That potency lets manufacturers hit the source of vitamin C thresholds with very small additions while preserving short ingredient lists.

Third, regulatory nudges shape claims and labels: in the EU, vitamin C health claims such as contribute to normal immune function are pre-approved, giving brands a compliant language toolkit for front-of-pack. In the U.S., vitamin C remains 90 mg Daily Value, but it is no longer mandatory on Nutrition Facts unless added so products that do add it often highlight the percent DV to signal value.

Drivers

Immune-health evidence consumers recognize

A durable driver is the simple consumer memory that vitamin C helps with colds, supported by credible, careful evidence that resonates at the shelf. The well-known Cochrane review pooling 9,745 cold episodes found that regular vitamin-C use shortened cold duration by 8% in adults and 14% in children; in kids taking 1–2 g/day, colds were 18% shorter. This does not mean prevention for most people, but it reliably backs relief-oriented positioning.

Public-health advice to eat ≥400 g/day of fruit and veg also indirectly supports vitamin-C-rich products, because it pushes retailers and foodservice to prioritize fresh produce and fruit-forward formulations. Together, credible clinical outcomes, approved claim wording, and clear labeling numbers explain why consumers keep reaching for vitamin-C-fortified beverages, gummies, and produce-based options when cold season or stress hits.

Restraints

Supply concentration and volatility risk

A practical restraint is the supply concentration for ascorbic acid (AA) and its salts. Global trade data show China exported about USD 802 million (192,000 t) of vitamin C, underlining a heavy reliance on one origin for the world’s bulk AA.

When one geography dominates capacity, prices and availability can swing with plant outages, environmental curbs, freight spikes, or trade actions. Finally, dosage ceilings matter in product design: the Tolerable Upper Intake Level (UL) is 2,000 mg/day for adults.

Exceeding this can cause GI upset in some users, so brands avoid very high per-serving doses and must balance claim-worthy amounts with tolerance. All of this can restrain rapid innovation, especially when costs jump or when companies try to shift from commodity AA to fruit-derived sources that are pricier and season-dependent.

Opportunity

School meals and public nutrition programs

One of the largest near-term opportunities is embedding vitamin-C-rich foods and fortification in school feeding and public meal programs, where volumes are huge and rules are tightening. In the U.S., the National School Lunch Program serves 29.7 million students daily; USDA’s April 2024 final rule begins phasing in added-sugar limits and a sodium reduction, which nudges menus toward fruit, veg, and lower-sugar beverages, natural fits for vitamin C delivery.

- Globally, the WFP/GCNF and partners report 408 million students covered by school feeding across 169 countries. WFP’s latest executive summary notes 139 million children receiving school meals in countries it supports, showing the sheer scale reachable through compliant, child-friendly formats like 150–200 ml fruit juices, fresh fruit portions, or vitamin-C-fortified snacks.

National programs create additional entry points: India’s PM-POSHAN (mid-day meals) continues to expand nutrition initiatives and school kitchen gardens, offering scope for local citrus, guava, or fortified beverages to contribute vitamin C at low cost per serving. For suppliers, aligning products to these standards and tender specs opens stable, multi-year demand while advancing public-health goals.

Regional Analysis

Asia-Pacific leads with a 43.2% share and a USD 0.6 Billion market value.

In 2024, the Asia-Pacific held a dominant position in the global Vitamin C market, capturing over 43.2% share valued at USD 0.6 billion. The region’s leadership stems from its extensive food and beverage manufacturing base, rapidly expanding pharmaceutical sector, and increasing awareness about preventive health. Countries like China, Japan, and India are major producers and consumers of Vitamin C, driven by growing demand for dietary supplements and fortified foods.

China remains the largest producer globally, supported by cost-efficient raw materials and strong export capacity. Rising middle-class income levels and urbanization across Southeast Asia are further propelling the consumption of immunity-boosting products, particularly after the COVID-19 pandemic reinforced the importance of micronutrient intake. Government initiatives promoting nutrition enhancement and public health awareness have also accelerated market growth.

India’s Food Safety and Standards Authority (FSSAI) continues to encourage fortification programs under the Eat Right India movement, promoting vitamin-enriched food consumption. Similarly, Japan’s aging population and preference for functional foods contribute to steady demand for Vitamin C in health supplements and skincare formulations. The cosmetics industry across South Korea and Japan has witnessed a rise in the use of Vitamin C in antioxidant and anti-aging products.

Additionally, pharmaceutical applications, including Vitamin C injections and effervescent tablets, are expanding with growing healthcare access. Overall, the Asia-Pacific region remains the key growth engine of the global Vitamin C market, benefiting from strong industrial capacity, favorable government support, and increasing consumer awareness toward wellness and nutrition.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Spectrum Chemical is a critical supply chain partner in the Vitamin C market. It does not typically manufacture ascorbic acid but provides high-purity, certified material to diverse industries, including pharmaceuticals, food, and cosmetics. Its strength lies in a vast product portfolio, rigorous quality control, and reliable logistics, serving clients who require guaranteed ingredient specifications and regulatory compliance for their end-products, making it a vital intermediary.

DSM Jiangshan Pharmaceutical (Jiangsu) Co., Ltd. is an entity that represents a powerhouse in the global Vitamin C landscape, born from DSM’s acquisition of a majority stake in Jiangshan Pharmaceutical. It leverages world-class fermentation technology and a significant production scale. The combination of DSM’s extensive international reach, strong R&D capabilities, and Jiangshan’s manufacturing expertise creates a vertically integrated leader focused on serving the pharmaceutical and premium nutraceutical sectors with high-quality.

Fengchen Group Co., Ltd. is a major Chinese manufacturer and supplier of Vitamin C and its derivatives. Competing primarily on cost-efficiency and scale, it is a key player in the bulk ingredient market. The company’s integrated production processes allow it to serve the high-volume demands of the animal feed, food fortification, and industrial sectors globally. Its strategic position within China’s chemical manufacturing ecosystem enables it to be a competitive and influential force in the market’s supply chain.

Top Key Players in the Market

- Spectrum Chemical

- DSM Jiangshan Pharmaceutical (Jiangsu) Co., Ltd

- Fengchen Group Co., Ltd

- Northeast Pharmaceutical Group Co., Ltd (NEPG)

- Botanic Healthcare

- CSPC Pharmaceutical Group Limited

- Foodchem International Corporation

- Global Calcium PVT LTD

- JOSHI AGRO

- M.C. Biotec Inc.

- Pharmavit

Recent Developments

- In 2025, Spectrum Chemical was recognized as a top Workplaces Industry winner by Energage, highlighting its strong workplace culture and operational excellence in supplying high-quality chemicals, including those used in Vitamin C formulations for research and production. This award underscores the company’s reliability as a supplier in the sector.

- In 2024, DSM-Firmenich completed the divestiture of its 100% equity interest in DSM Jiangshan Pharmaceutical to Jingjiang Cosfocus Health Technology Co., Ltd. This followed an announcement exploring options like partnerships or repurposing after halting Vitamin C production. The move aims to reduce costs and refocus on core nutrition assets.

Report Scope

Report Features Description Market Value (2024) USD 1.5 Billion Forecast Revenue (2034) USD 2.5 Billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Regular, Premium), By End-Use (Food and Beverage, Animal Feed, Personal Care and Cosmetics, Pharmaceuticals, Others), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Spectrum Chemical, DSM Jiangshan Pharmaceutical (Jiangsu) Co., Ltd, Fengchen Group Co., Ltd, Northeast Pharmaceutical Group Co., Ltd (NEPG), Botanic Healthcare, CSPC Pharmaceutical Group Limited, Foodchem International Corporation, Global Calcium PVT LTD, JOSHI AGRO, M.C. Biotec Inc., Pharmavit Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Spectrum Chemical

- DSM Jiangshan Pharmaceutical (Jiangsu) Co., Ltd

- Fengchen Group Co., Ltd

- Northeast Pharmaceutical Group Co., Ltd (NEPG)

- Botanic Healthcare

- CSPC Pharmaceutical Group Limited

- Foodchem International Corporation

- Global Calcium PVT LTD

- JOSHI AGRO

- M.C. Biotec Inc.

- Pharmavit