Global Virtual Sports Market By Component (Solutions, Services), By Game (Football, Racing, Golf, Basketball, Cricket, Skiing, Tennis, MMA, Others), By Age Group (Below 21 Years, 21 to 34 Years, 35 to 54 Years, 55 Years and Above), By Region And Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2024-2033

- Published date: Feb. 2024

- Report ID: 115274

- Number of Pages: 208

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

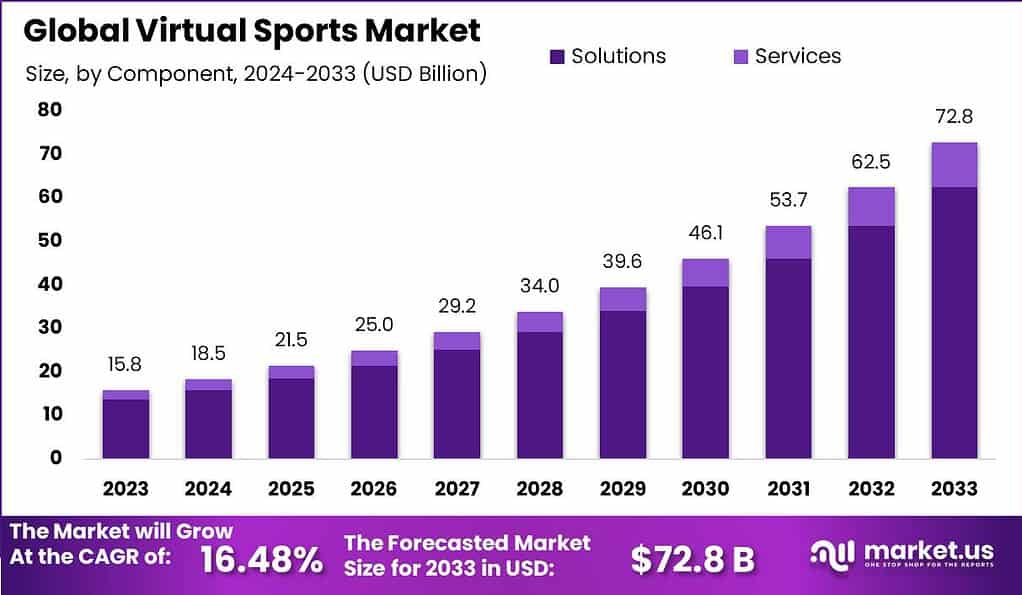

The Global Virtual Sports Market size is expected to be worth around USD 72.8 Billion by 2033, from USD 15.8 Billion in 2023, growing at a CAGR of 16.48% during the forecast period from 2024 to 2033.

Virtual sports, a digital recreation of various sports competitions, have emerged as a significant segment within the digital entertainment and online gaming industries. These simulations are powered by computer algorithms that determine the outcomes of the contests, ensuring fairness and unpredictability similar to real-life sports events.

The virtual sports market encompasses a wide array of sports, including football, horse racing, and motorsports, among others. Participants can engage in these sports through online platforms, betting shops, and casinos, experiencing the thrill of the game without the constraints of real-world schedules and locations.

The growth of the virtual sports market can be attributed to several factors. Advances in technology and graphics have made virtual sports more realistic and engaging, attracting a broader audience. The global increase in internet penetration and the accessibility of online betting platforms have also played crucial roles in expanding the market.

Furthermore, virtual sports offer a consistent and uninterrupted betting opportunity, making them particularly appealing during times when live sports events are scarce or cancelled, as observed during the COVID-19 pandemic.

The advent of 5G technology is set to revolutionize the virtual sports industry by significantly enhancing live streaming capabilities. With predictions indicating a potential increase in live streaming capacity by over 25% compared to 4G, the implications for virtual sports are profound. This technological advancement is expected to improve user experience through faster streaming speeds and reduced latency, thereby fostering greater engagement and potentially increasing the volume of bets placed in real-time.

The virtual sports betting is on an upward trajectory, with forecasts suggesting it could surpass ~$20 billion in value by 2027. This growth is driven by the increasing popularity of virtual sports as a form of entertainment and betting. Companies such as Inspired Entertainment, Betconstruct, and Golden Race are at the forefront of this burgeoning sector, providing cutting-edge technology and content that cater to the growing demand for virtual sports betting.

In a notable development in 2022, Inspired Entertainment received a substantial $35 million investment from Genting Malaysia to bolster its virtual sports business. This move underscores the significant interest and confidence in the virtual sports market. Furthermore, Inspired Entertainment’s agreement with bet365 to supply virtual sports content highlights the strategic partnerships forming within the industry to capitalize on this growing market segment.

Betconstruct’s expansion efforts were further evidenced by a $68 million Series C funding round in 2021, led by Endeavor Catalyst among others. This investment is aimed at enhancing Betconstruct’s virtual sports offerings, illustrating the increasing investor interest in the sector.

Golden Race’s strategic partnership with Logrand Entertainment in 2022 to introduce virtual sports to the Nigerian market represents a significant step towards geographical expansion. With Logrand Entertainment’s planned investment of $14.5 million to initiate operations, this venture indicates the potential for virtual sports betting in emerging markets.

Europe remains a critical market for virtual sports, as demonstrated by Inspired’s 45% year-over-year growth in virtuals wagering in 2021. This growth is reflective of the expanding product offerings by providers and the opening up of new regions to virtual sports betting.

As the industry continues to evolve, the integration of advanced technologies like 5G, along with strategic investments and partnerships, are poised to drive significant growth in the virtual sports betting market. The sector’s future appears promising, with technology and market expansion playing pivotal roles in shaping its trajectory.

Key Takeaways

- The virtual sports market is estimated to reach a staggering USD 72.8 billion by 2033, demonstrating a robust CAGR of 16.48% over the forecast period.

- The advent of 5G technology is poised to revolutionize the virtual sports industry by improving live streaming capabilities. Predictions indicate a potential increase in live streaming capacity by over 25% compared to 4G, enhancing user experience and fostering greater engagement.

- In 2023, the Solutions segment held a dominant market position, capturing over 86% share. This segment’s lead is attributed to the increasing demand for sophisticated virtual sports experiences, driven by advancements in gaming technology and graphics.

- Among virtual sports games, football holds a dominant market position, capturing more than a 27% share in 2023. This leadership is driven by football’s global popularity and the ability of virtual simulations to replicate real-world competitions convincingly.

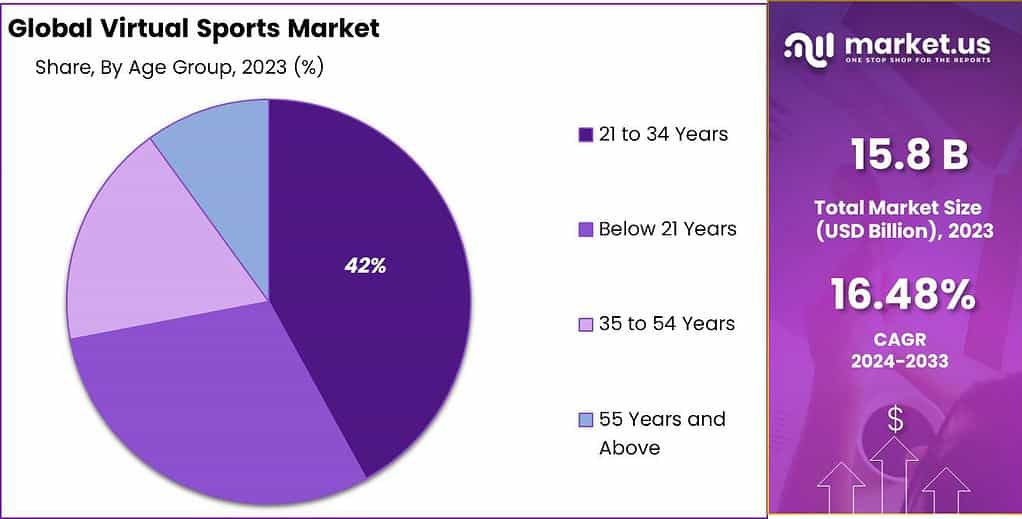

- The 21 to 34 years age group holds a dominant market position, capturing over 42% share in 2023. This demographic’s high digital literacy and enthusiasm for gaming make them prime audiences for virtual sports offerings.

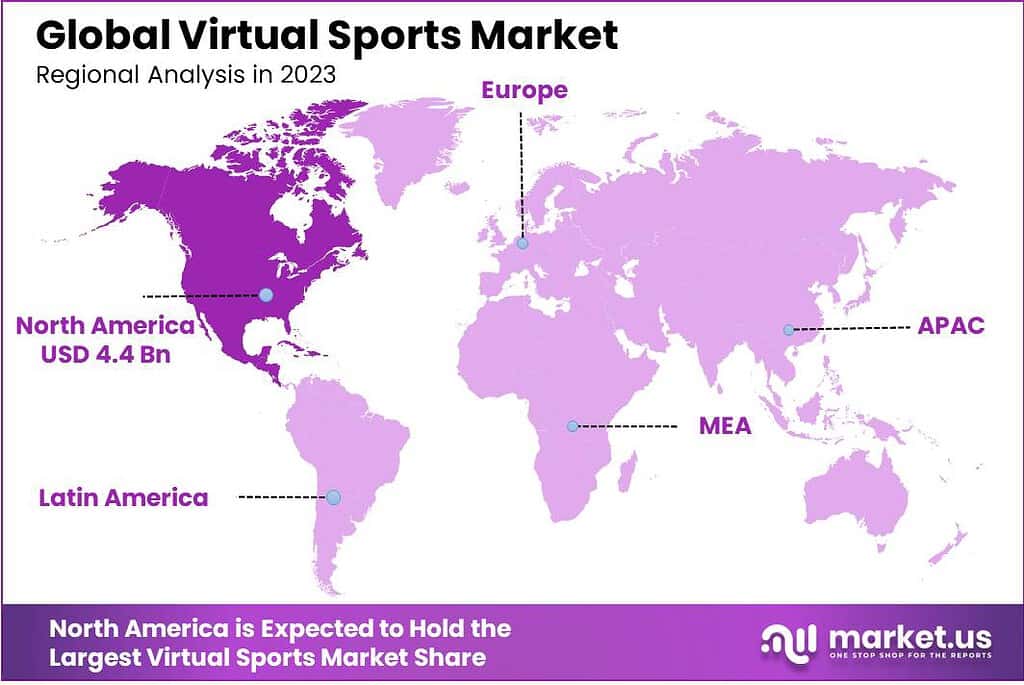

- In 2023, North America held a dominant market position in the virtual sports market, capturing more than a 28% share.

Component Analysis

In 2023, the Solutions segment held a dominant market position within the virtual sports market, capturing more than an 86% share. This significant lead can be attributed to the increasing demand for sophisticated, realistic virtual sports experiences, which are primarily driven by advancements in gaming technology and graphics.

Solutions in this context refer to the software and platforms that simulate virtual sports events, ranging from football and horse racing to motorsports and beyond. The high demand for these solutions stems from their ability to offer immersive, engaging content that appeals to a broad audience, including gamers, sports enthusiasts, and bettors.

The dominance of the Solutions segment is further reinforced by continuous technological innovations, such as the integration of artificial intelligence and machine learning algorithms, which enhance the realism and unpredictability of virtual sports outcomes. These technologies ensure that each event is not only visually captivating but also fair and closely mimics the unpredictability found in real-world sports.

Additionally, the scalability of virtual sports solutions allows operators to offer a wide array of events around the clock, thereby attracting a larger user base and generating higher revenue streams. The substantial investment in R&D by leading companies in the sector to create more engaging and diverse virtual sports offerings has played a crucial role in the growth of the Solutions segment.

Moreover, the Solutions segment’s expansion is supported by the increasing accessibility of digital platforms and the internet globally, enabling users to easily participate in virtual sports betting and gaming. As a result, the Solutions segment not only caters to the entertainment and gaming industry but also significantly impacts the betting industry, where the demand for continuous, engaging, and diverse betting opportunities is on the rise.

Game Analysis

In 2023, the Football segment held a dominant market position within the virtual sports market, capturing more than a 27% share. This leadership can be largely attributed to football’s global popularity, which transcends cultural and national boundaries, making it a universally loved sport.

The widespread fan base of football translates into a high demand for virtual football games, where enthusiasts can engage with the sport in a digital format, enjoying games, tournaments, and leagues that mimic real-world competitions. The appeal of virtual football is further enhanced by the ability to simulate famous tournaments and allow fans to manage their teams, making strategic decisions that influence the outcome of games.

The success of the Football segment is also bolstered by advanced graphics and simulation technologies that offer highly realistic gaming experiences. These technologies enable the vivid depiction of stadiums, players, and match dynamics, closely replicating the atmosphere and intensity of actual football matches. The incorporation of sophisticated algorithms ensures fair play and unpredictability in match outcomes, mirroring the uncertain nature of live football, which is a key factor in maintaining high engagement levels among users.

Moreover, strategic partnerships and licensing agreements with football leagues and clubs have allowed for the use of official team names, badges, and stadiums within virtual games, enhancing the authenticity and appeal of virtual football offerings.

This level of detail and authenticity attracts not only casual gamers but also hardcore football fans seeking an immersive experience. With the ongoing advancements in technology and the continuous growth of the esports and online gaming industries, the Football segment is poised to sustain its leading position in the virtual sports market, driven by its ability to offer engaging, realistic, and accessible football experiences to a global audience.

Age Group Analysis

In 2023, the 21 to 34 Years segment held a dominant market position in the virtual sports market, capturing more than a 42% share. This leading position is primarily attributed to the high digital literacy and technological savviness of individuals within this age group.

Typically, these individuals are at the forefront of adopting new technologies and gaming trends, making them the prime audience for virtual sports. This demographic is known for its enthusiasm for gaming, combined with a disposable income that allows for engagement in online betting and virtual sports platforms.

The preference of the 21 to 34 age group for interactive and immersive forms of entertainment has significantly contributed to the segment’s dominance. Virtual sports provide a unique combination of gaming and sports betting, offering this age group an attractive alternative to traditional forms of entertainment.

The convenience of accessing these platforms through smartphones and other digital devices, coupled with the appeal of engaging in sports betting in a regulated and safe environment, further enhances the attractiveness of virtual sports for this demographic.

Moreover, the social aspect of gaming is particularly relevant to this age group. Virtual sports platforms often include social features, such as leaderboards and multiplayer functionalities, which resonate with the 21 to 34 years demographic’s desire for social interaction and competition.

As virtual sports continue to evolve, incorporating more sophisticated graphics, realistic simulations, and interactive elements, the appeal to this age group is likely to increase further. This demographic’s propensity to engage with digital and online gaming platforms positions the 21 to 34 Years segment as a crucial driver of growth and innovation in the virtual sports market.

Key Market Segments

By Component

- Solutions

- Services

By Game

- Football

- Racing

- Golf

- Basketball

- Cricket

- Skiing

- Tennis

- MMA

- Others

By Age Group

- Below 21 Years

- 21 to 34 Years

- 35 to 54 Years

- 55 Years and Above

Driver

Technological Advancements

Technological advancements in gaming software and hardware represent a significant driver for the virtual sports market. Innovations such as high-definition graphics, realistic animations, and advanced artificial intelligence algorithms have greatly enhanced the realism and appeal of virtual sports, making them nearly indistinguishable from actual sporting events. These improvements have not only captivated a broader audience by offering an immersive gaming experience but have also increased the frequency and engagement levels of existing users.Moreover, the integration of technologies like VR (Virtual Reality) and AR (Augmented Reality) has opened new avenues for interactive and engaging virtual sports experiences. As technology continues to evolve, the virtual sports market is expected to witness substantial growth, driven by the increasing demand for more realistic, accessible, and engaging sports simulation products.

Restraint

Regulatory and Legal Challenges

One of the primary restraints facing the virtual sports market is the complex regulatory and legal landscape surrounding online betting and gaming. Regulations governing virtual sports betting vary significantly across jurisdictions, with some regions imposing strict restrictions or outright bans. These legal challenges can hinder market entry and expansion, affecting companies that provide virtual sports betting platformsAdditionally, the constantly changing regulatory environment requires businesses to continuously adapt, leading to increased operational costs and complexities. This regulatory uncertainty can also deter potential new entrants, limiting the competition and innovation within the market. As a result, navigating the legal intricacies of different markets remains a significant challenge for stakeholders in the virtual sports industry.

Opportunity

Expansion into Emerging Markets

The expansion into emerging markets presents a significant opportunity for the virtual sports market. Countries in regions such as Asia, Africa, and Latin America are experiencing rapid digital transformation, with growing internet penetration and an increasing number of digital device users. These markets harbor a large, untapped customer base with a keen interest in sports and gaming.Furthermore, the rising middle class in these regions has more disposable income to spend on entertainment, including virtual sports. By tailoring offerings to meet local preferences and leveraging digital platforms for accessibility, companies can capitalize on the opportunity to introduce virtual sports to these new audiences. The expansion into emerging markets not only promises substantial growth prospects but also diversifies revenue streams, mitigating risks associated with market saturation in more developed regions.

Challenge

User Experience and Engagement

Maintaining a high level of user experience and engagement poses a significant challenge in the virtual sports market. As the market becomes increasingly competitive, companies must continuously innovate to captivate users’ attention and foster loyalty. This involves not only improving the realism and variety of the sports simulations but also ensuring the platforms are user-friendly, accessible, and secure.Additionally, with the rise of social gaming, companies face the challenge of integrating social features that enable interaction and competition among users. These demands require substantial investment in research and development, as well as in maintaining and upgrading technological infrastructure. Balancing innovation with cost-effectiveness, while ensuring a seamless and engaging user experience, is a complex challenge that companies in the virtual sports market must navigate to achieve sustained growth.

Regional Analysis

In 2023, North America held a dominant market position in the virtual sports market, capturing more than a 28% share. The demand for Virtual Sports in North America was valued at US$ 4.4 billion in 2023 and is anticipated to grow significantly in the forecast period.

The region’s leading position can be attributed to several factors. Firstly, North America has a well-established sports culture and a large base of sports enthusiasts, making it a receptive market for virtual sports offerings. Additionally, the region is home to several major sports leagues and franchises, which has created a strong fan base and a demand for virtual sports experiences that complement live sporting events.

Furthermore, North America boasts advanced technological infrastructure and a high level of internet penetration, facilitating the widespread adoption of virtual sports platforms and services. The region’s strong presence of gaming and esports industries also contributes to the popularity of virtual sports, as gaming enthusiasts are increasingly engaging with virtual sports simulations.

Moreover, North America has been at the forefront of technological innovation, particularly in the areas of graphics, animation, and virtual reality. This has resulted in highly immersive and realistic virtual sports experiences, attracting a wide audience. The integration of virtual sports with online gambling and betting platforms has further propelled the market growth in the region.

Moving to Europe, the region also holds a significant share in the virtual sports market. Europe has a rich sports heritage and a large population of sports enthusiasts, creating a favorable environment for the adoption of virtual sports. Countries like the United Kingdom, Germany, and Spain have witnessed significant growth in the virtual sports market, driven by the popularity of football and other major sports.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

it’s crucial to assess the landscape where key players like 2K Sports, Activision Blizzard, Big Ant Studios, Codemasters, Cyanide Studio, Dovetail Games, EA Sports, HB Studios, Konami, Milestone S.r.l., Netmarble, Nintendo, Square Enix, SEGA, and other significant entities are making substantial impacts. These companies collectively shape the direction, innovation, and growth patterns of the industry.

2K Sports and EA Sports are at the forefront, renowned for their immersive sports simulations that cover a wide range of sports from basketball to football, appealing to a diverse global audience. Activision Blizzard, while more diversified, contributes with its robust online gaming infrastructure and esports initiatives, enhancing the competitive edge of virtual sports.

Companies like Codemasters and Milestone S.r.l. specialize in racing simulations, offering unparalleled realism and engaging experiences that captivate motorsports enthusiasts. Meanwhile, Big Ant Studios and HB Studios have carved niches in cricket and golf, respectively, demonstrating the market’s diversity.

Top Market Leaders

- 2K Sports

- Activision Blizzard

- Big Ant Studios

- Codemasters

- Cyanide Studio

- Dovetail Games

- EA Sports

- HB Studios

- Konami

- Milestone S.r.l.

- Netmarble

- Nintendo

- Square Enix

- SEGA

- Other key players

Recent Developments

1. Big Ant Studios:

- June 2023: Announced a partnership with Cricket Australia to develop and publish officially licensed cricket video games, including potential virtual cricket titles.

- September 2023: Released “Rugby League Live 4,” a virtual rugby league simulation game, to positive reviews.

2. Codemasters:

- February 2023: Released “F1 22,” a virtual Formula One racing game, with enhanced esports integration and virtual circuit features.

- July 2023: Acquired Slightly Mad Studios, developers of the “Project CARS” virtual racing series, expanding their virtual sports portfolio.

- August 2023: Announced a multi-year partnership with FIA to develop future official Formula One and other FIA-sanctioned virtual racing championships.

Report Scope

Report Features Description Market Value (2023) US$ 15.8 Bn Forecast Revenue (2033) US$ 72.8 Bn CAGR (2024-2033) 16.48% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solutions, Services), By Game (Football, Racing, Golf, Basketball, Cricket, Skiing, Tennis, MMA, Others), By Age Group (Below 21 Years, 21 to 34 Years, 35 to 54 Years, 55 Years and Above) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape 2K Sports, Activision Blizzard, Big Ant Studios, Codemasters, Cyanide Studio, Dovetail Games, EA Sports, HB Studios, Konami, Milestone S.r.l., Netmarble, Nintendo, Square Enix, SEGA, Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are Virtual Sports?Virtual sports are computer-generated simulations of real sports events, where the outcomes are determined by algorithms rather than human players. These simulations are often based on real-life sports, such as football, basketball, horse racing, and more.

What is the Virtual Sports Market?The virtual sports market refers to the industry that develops, markets, and monetizes virtual sports events and related products. This includes software developers, sports betting platforms, broadcasters, and other stakeholders.

How big is the virtual sports market?The Global Virtual Sports Market size is expected to be worth around USD 72.8 Billion by 2033, from USD 15.8 Billion in 2023, growing at a CAGR of 16.48% during the forecast period from 2024 to 2033.

What are the Key Drivers of the Virtual Sports Market?The virtual sports market is driven by several factors, including the growing popularity of esports, advancements in technology (such as virtual reality and augmented reality), and the increasing demand for immersive entertainment experiences.

Who are the key players in virtual sports market?The key players in this industry are 2K Sports, Activision Blizzard, Big Ant Studios, Codemasters, Cyanide Studio, Dovetail Games, EA Sports, HB Studios, Konami, Milestone S.r.l., Netmarble, Nintendo, Square Enix, SEGA, Other key players

What are the Major Trends in the Virtual Sports Market?Some major trends in the virtual sports market include the integration of virtual reality and augmented reality technologies, the rise of mobile gaming, and the increasing adoption of live streaming and online platforms for virtual sports events.

What are the Challenges Facing the Virtual Sports Market?Some challenges facing the virtual sports market include regulatory issues related to sports betting, concerns about the integrity of virtual sports events, and the need for continued innovation to keep pace with evolving consumer preferences.

What are the Opportunities for Investors in the Virtual Sports Market?Investors in the virtual sports market have opportunities to capitalize on the growing demand for virtual sports betting, the development of new technologies for virtual sports simulations, and the expansion of the esports industry.

-

-

- 2K Sports

- Activision Blizzard

- Big Ant Studios

- Codemasters

- Cyanide Studio

- Dovetail Games

- EA Sports

- HB Studios

- Konami

- Milestone S.r.l.

- Netmarble

- Nintendo

- Square Enix

- SEGA

- Other key players