Global Virtual Security Appliance Market Size, Share, Industry Analysis Report By Component (Solutions (Virtual Firewall, Virtual Intrusion Detection & Prevention Systems (IDPS), Virtual Unified Threat Management (UTM), Virtual Content & Email Security, Virtual VPN/SSL Appliances, Virtual Antimalware)), Services (Consulting, Deployment & Integration, Training & Support)), By Deployment Mode (CloudBased, OnPremise), By Organization Size (Small & Medium Enterprises (SMEs), Large Enterprises), By EndUser Industry (IT & Telecom, BFSI (Banking, Financial Services, Insurance), Healthcare & Life Sciences, Government & Defense, Retail & Ecommerce, Manufacturing, Energy & Utilities, Education, Others (Media, Logistics, etc.)), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 160832

- Number of Pages: 289

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

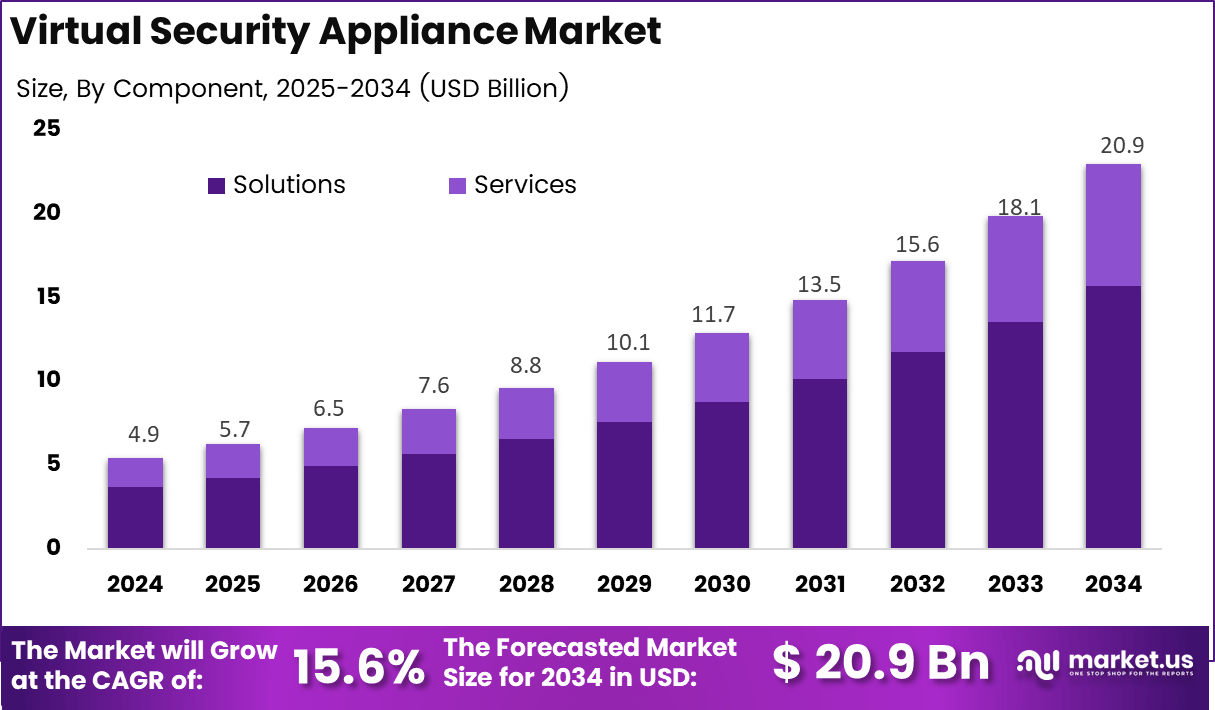

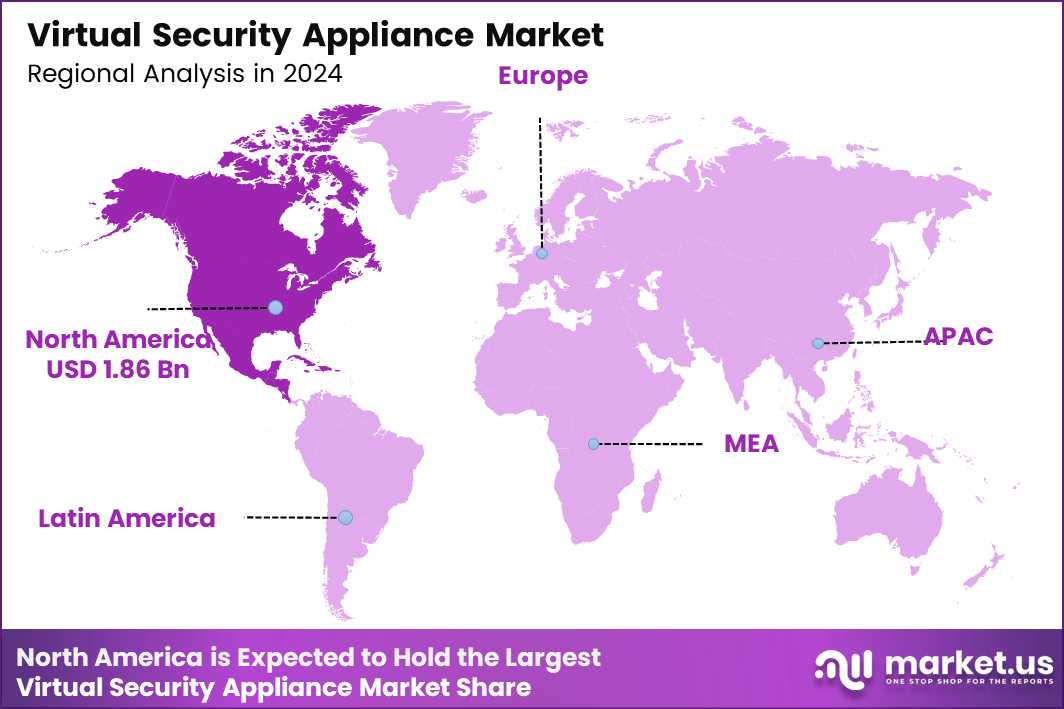

The Global Virtual Security Appliance Market generated USD 4.9 billion in 2024 and is predicted to register growth from USD 5.7 billion in 2025 to about USD 20.9 billion by 2034, recording a CAGR of 15.6% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 38.0% share, holding USD 1.86 Billion revenue.

The virtual security appliance (VSA) market covers software-based security solutions that operate within virtualised or cloud environments instead of relying solely on physical hardware. These appliances provide functions such as firewalls, intrusion detection and prevention systems, virtual private networking (VPN), and content filtering within virtual machines or cloud infrastructure. The market has been growing as organisations shift workloads to cloud and adopt virtual data centres.

Top driving factors include the increasing adoption of cloud computing and virtualization technologies, which create a demand for compatible security solutions. Businesses face growing cyber threats and must protect complex, dynamic networks that span on-premises and cloud platforms. The need for cost-effective, easily deployable security measures also pushes adoption of virtual appliances.

Key Takeaways

- The virtual security appliances market is increasingly favored for its flexibility and scalability, especially as businesses shift towards cloud-based infrastructures.

- The rise in cyber threats, with a notable 30% increase in attacks in the past year, is pushing companies to adopt more adaptive security solutions.

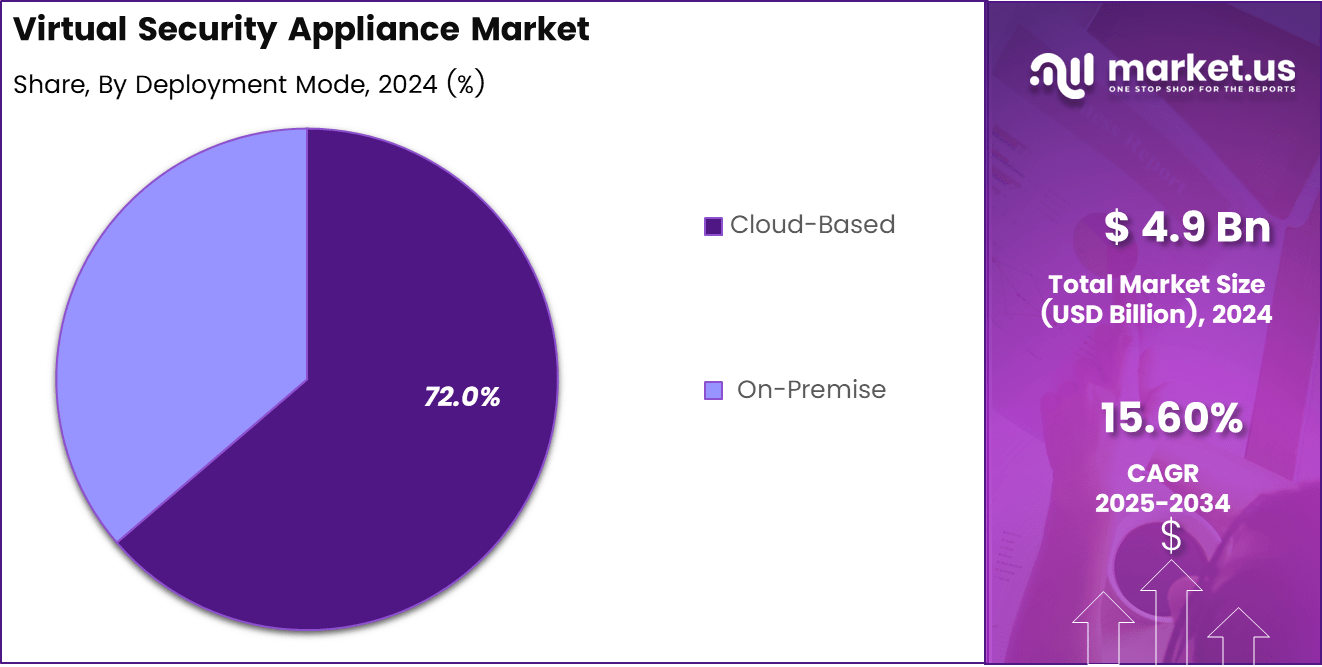

- Cloud-based security solutions are gaining traction, with approximately 72% of businesses now using them.

- Virtualized security appliances enable businesses to integrate advanced protection into their IT systems, with 60% of companies adopting them in their first year of cloud migration.

- The demand for virtual security appliances is expected to continue growing as businesses prioritize cost-effective and scalable security solutions.

Analysts’ Viewpoint

The virtual security appliances market is becoming increasingly essential as businesses move towards more dynamic, cloud-based infrastructures. These solutions offer a level of flexibility that traditional hardware appliances can’t match, allowing organizations to easily scale their security as they grow. As of recent reports, around 72% of businesses are adopting cloud-based security solutions, driven by the need to handle rising cybersecurity threats.

With cyberattacks increasing by over 30% in the last year alone, companies are turning to virtual security appliances to ensure they can quickly adapt to changing security needs. These appliances enable businesses to integrate efficient, software-driven security measures into their existing IT infrastructures, with nearly 60% of businesses adopting virtualized security solutions within their first year of cloud migration.

Role of generative AI

Generative AI plays an emerging role in enhancing the virtual security appliances market by automating threat detection and response. By analyzing vast amounts of data in real time, it can identify patterns that signify potential threats, even before they fully materialize. This proactive approach allows businesses to respond faster, minimizing damage.

Additionally, generative AI helps in creating more adaptive and customized security protocols by continuously learning from new data, ensuring that virtual security appliances remain effective against evolving cyber threats. The technology also supports the automation of security updates, reducing the need for manual intervention and improving overall efficiency. As AI continues to evolve, its role in virtual security appliances is expected to expand, providing even more sophisticated and adaptive protection.

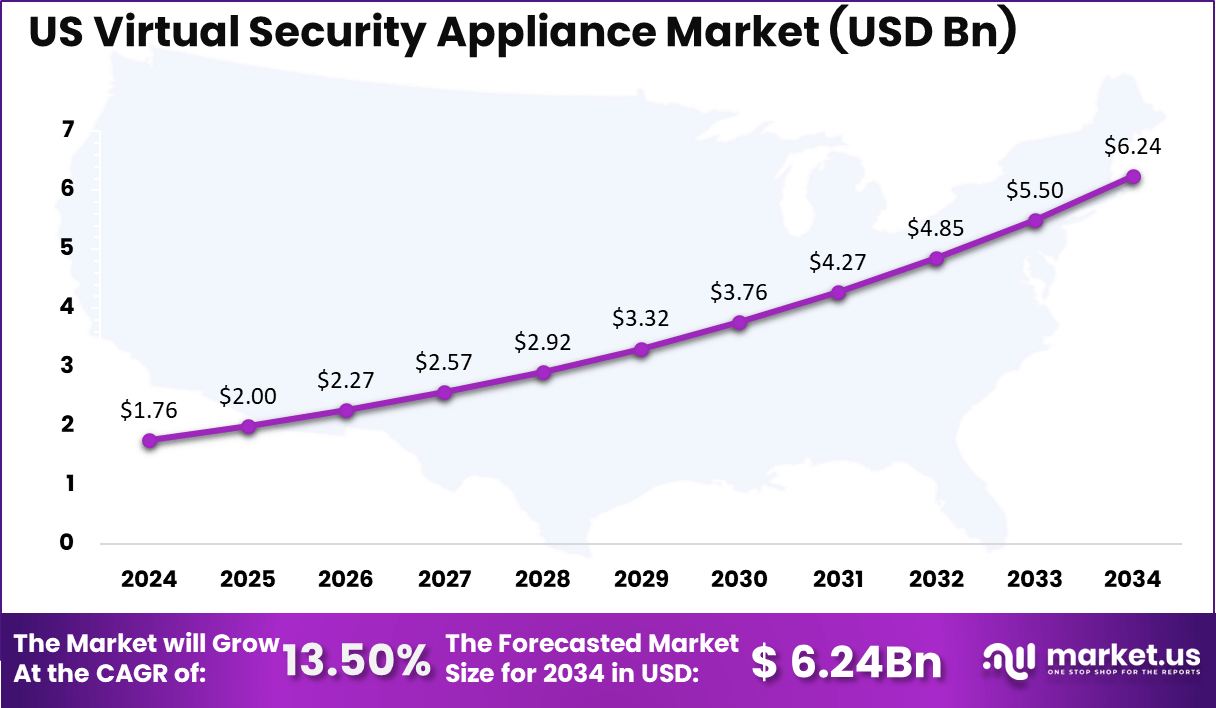

US Market Size

In the United States, the market size stands around USD 1.76 billion with a steady 13.5% CAGR. Growth is driven by increasing investment in cloud security, zero-trust frameworks, and AI-assisted threat management. The U.S. continues to lead innovation in secure virtualization through collaboration between technology developers, enterprises, and public agencies. This momentum positions the region as a key hub for next-generation cybersecurity development.

North America holds about 38% of the virtual security appliance market, reflecting its advanced IT ecosystem and strong focus on data security. The region has high adoption of cloud-based technologies and robust demand for reliable virtual infrastructure. Organizations across industries are integrating virtual security solutions to improve visibility, automate controls, and meet compliance standards.

By Component

In 2024, Solutions account for about 75% of the virtual security appliance market. Their dominance reflects how businesses prefer integrated security tools that combine multiple features like intrusion detection, network monitoring, and firewall protection in one virtual setup.

These solutions help organizations secure digital workloads more efficiently while lowering dependency on physical hardware. The simplified management and consistent protection they offer across hybrid environments make them a practical choice for companies upgrading their network security. The growing shift toward virtualization has encouraged enterprises to replace standalone tools with unified solutions.

These systems are designed for faster deployment, scalability, and easier policy management through centralized consoles. As businesses adopt hybrid and multi-cloud ecosystems, solution-based platforms provide better visibility and flexibility. Their reliability and adaptability make them an essential part of modern cybersecurity strategies.

By Deployment Mode

In 2024, Cloud-based deployment leads the market with 72% share, as more organizations move their workloads to cloud environments. This approach allows faster implementation of virtual security controls without heavy infrastructure investments. Cloud-based setups help reduce maintenance tasks and improve scalability, which makes them attractive for companies of different sizes.

Enterprises value this model for its flexibility and ability to deliver continuous protection across dynamic, distributed networks. The rise of software-defined and virtualized infrastructure has made cloud deployment the preferred mode for managing network security.

Companies gain better resource control and faster updates while keeping costs predictable. The integration of automated monitoring and real-time alerts within cloud platforms strengthens protection against advanced threats. As a result, cloud-based security appliances continue to expand their reach across sectors that rely on remote and hybrid work models.

By Organization Size

In 2024, Large enterprises hold about 64% of the market. They typically operate complex global networks that require strong, flexible, and centralized security management. Virtual appliances meet this need by offering scalable protection that adapts easily to data center or cloud configurations. This allows large organizations to standardize their defenses while avoiding the operational limits of physical hardware.

Many large enterprises are strengthening their cybersecurity through automation and virtualization. The ability to orchestrate multiple security tools under one framework supports better compliance and faster response times. As these businesses expand their digital operations, they are prioritizing flexible, cost-efficient solutions that reduce complexity while maintaining high performance.

By End-User Industry

The IT and telecom sector leads with 22% share of the market. This segment relies heavily on virtualization and cloud computing, which make virtual security appliances critical for protecting data and maintaining network uptime. Telecom operators use these solutions to secure network function virtualization environments, while IT service providers depend on them for managing distributed workloads.

The adoption of 5G and cloud-native networks further drives demand in this sector. Virtual security systems enable real-time protection of multi-tenant environments without slowing network operations. With scalability and flexibility becoming top priorities, IT and telecom businesses continue to invest in these solutions to maintain consistent service availability and regulatory compliance.

Key Market Segment

By Component

- Solutions

- Virtual Firewall

- Virtual Intrusion Detection & Prevention Systems (IDPS)

- Virtual Unified Threat Management (UTM)

- Virtual Content & Email Security

- Virtual VPN/SSL Appliances

- Virtual Antimalware

- Services

- Consulting

- Deployment & Integration

- Training & Support

By Deployment Mode

- CloudBased

- OnPremise

By Organization Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By EndUser Industry

- IT & Telecom

- BFSI (Banking, Financial Services, Insurance)

- Healthcare & Life Sciences

- Government & Defense

- Retail & Ecommerce

- Manufacturing

- Energy & Utilities

- Education

- Others (Media, Logistics, etc.)

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Emerging Trends

The virtual security appliance market is witnessing rapid growth driven by the widespread adoption of cloud computing and remote work models. Cloud-based deployment of virtual security appliances grew by nearly 25% in the last year as organizations seek scalable, flexible security solutions that traditional hardware cannot easily provide.

Companies increasingly prefer virtual firewalls and multi-layered security integrated into virtual environments, allowing them to respond quickly to evolving threats and manage security centrally from anywhere. Further, integration of artificial intelligence and automation in VSAs is a significant trend shaping the market.

AI-powered threat detection and automated response reduce the dependency on scarce cybersecurity talent, with automation adoption increasing by about 20%. There is also a strong shift toward zero-trust security models, pushing VSAs to enforce strict user and device verification continuously. These trends not only improve security effectiveness but also optimize resource usage, helping organizations cut down operational costs related to cyber defense.

Top 5 Use Cases

- Network Protection: Virtual Security Appliances are used to secure network infrastructures by providing real-time monitoring, firewall protection, and intrusion detection to prevent cyber-attacks.

- Cloud Security: As businesses move to the cloud, these appliances protect cloud environments from unauthorized access, data breaches and ensure secure remote access to resources.

- Data Loss Prevention: Virtual Security Appliances help in preventing sensitive data leakage through encryption, access controls, and real-time monitoring of data flows.

- Regulatory Compliance: They assist organizations in maintaining compliance with industry regulations like GDPR, HIPAA, and PCI DSS by ensuring secure data handling, auditing, and reporting.

- Threat Intelligence & Incident Response: Virtual Security Appliances provide real-time threat intelligence and help automate responses to security incidents, minimizing the impact of attacks through rapid mitigation strategies.

Driver

Rising Cloud Adoption and Virtualization

The growing enterprise shift toward cloud computing and virtualization is a strong driver for the Virtual Security Appliance market. With more workloads moving to virtual environments, businesses are adopting security appliances that operate within virtual machines rather than relying on physical hardware. These virtual solutions are highly scalable, consume less energy, and simplify deployment and maintenance while offering the same protection capabilities.

Organizations prefer these solutions for their flexibility and ability to integrate easily with software-defined networks and hybrid cloud systems. The need for centralized management and consistent security policies across distributed environments further strengthens adoption. As digital transformation deepens, the move to virtualized infrastructures continues to be a major factor driving the demand for these appliances.

Restraint

Technical Complexity and Skill Shortage

A key restraint for this market is the technical difficulty in configuring and maintaining security within a virtual ecosystem. Unlike traditional hardware-based setups, virtual appliances require specialized expertise to manage hypervisors, network segmentation, and security policy synchronization across multiple virtual instances. This complexity often slows down deployment for organizations that lack advanced IT teams.

Additionally, there is a widespread shortage of cybersecurity professionals skilled in virtualized network management. Many organizations struggle to manage the security lifecycle efficiently, leading to misconfigurations and increased vulnerability risks. As the need for specialized skills outpaces workforce supply, this challenge continues to restrain market growth.

Opportunity

Expansion in Government and Enterprise Use

There is a strong opportunity for virtual security appliances in government and large corporate networks. Governments and regulated industries such as banking and healthcare are steadily adopting these appliances to safeguard sensitive data and ensure compliance. Virtualization enables them to better control network traffic, isolate critical applications, and scale defenses according to need.

This adoption is supported by the growing emphasis on replacing human-assisted security with intelligent, automated systems. Enterprises are now prioritizing security automation tools that can handle growing network loads efficiently. Vendors focusing on modular, AI-enhanced virtual appliances are likely to gain new business opportunities as organizations modernize their IT frameworks.

Challenge

Integration and Deployment Constraints

Integration across diverse IT environments remains a major challenge for the Virtual Security Appliance market. Many companies operate hybrid infrastructures with a mix of physical, virtual, and cloud-based systems. Ensuring that appliances perform effectively across these layers is technically demanding and often leads to interoperability concerns.

Furthermore, legacy systems are not always compatible with advanced virtualization frameworks, creating complications during deployment. These bottlenecks delay full-scale adoption and increase maintenance costs. Overcoming these technical integration barriers will require stronger collaboration between hardware vendors, security developers, and cloud service providers to ensure seamless network security across platforms.

SWOT Analysis

Strengths

- Strong demand driven by increasing cyber threats and data protection needs.

- High scalability and flexibility of cloud-based security solutions.

- Growing integration of AI and machine learning to enhance threat detection.

- Rising adoption of managed services and virtual security solutions by businesses of all sizes.

Weaknesses

- High implementation costs for small and medium-sized enterprises (SMEs).

- Complexity of integrating virtual security appliances with legacy systems.

- Dependency on skilled professionals for effective deployment and management.

Opportunities

- Increasing cloud adoption provides new market opportunities.

- Expansion in AI-driven security solutions for proactive threat mitigation.

- Growth in regulatory compliance demands is driving demand for security appliances.

- Rising demand for remote security solutions due to the remote work trend.

Threats

- Intense competition from emerging cybersecurity technologies like next-gen firewalls.

- Potential vulnerability to new, sophisticated attack vectors bypassing current solutions.

- Rapid technological changes require constant upgrades and innovation.

Key Player Analysis

The Virtual Security Appliance Market is dominated by global cybersecurity and networking leaders such as Cisco Systems, Inc., Juniper Networks, Inc., Fortinet, Inc., and Palo Alto Networks, Inc. These companies provide advanced virtualized firewalls, intrusion prevention systems, and secure gateways optimized for cloud and hybrid environments. Their solutions deliver scalable protection, policy automation, and deep visibility for enterprise networks transitioning to software-defined infrastructures.

Key cybersecurity providers including Check Point Software Technologies Ltd., Sophos Ltd., Barracuda Networks, Inc., and Trend Micro, Inc. focus on next-generation virtual security appliances designed for virtualization platforms and multi-cloud environments. Their offerings combine malware detection, data loss prevention, and sandboxing with centralized management capabilities, ensuring consistent protection across distributed workloads.

Additional participants such as VMware (Broadcom), McAfee Corp., Hillstone Networks, and other emerging players contribute by integrating network virtualization, endpoint protection, and AI-driven analytics into unified security frameworks. Their focus on zero-trust architecture, virtual network segmentation, and real-time threat response continues to shape the evolution of security in software-defined data centers and cloud-native ecosystems.

Top Key Player

- Cisco Systems, Inc.

- Juniper Networks, Inc.

- Fortinet, Inc.

- Palo Alto Networks, Inc.

- Check Point Software Technologies Ltd.

- Sophos Ltd.

- Barracuda Networks, Inc.

- Trend Micro, Inc.

- VMware (Broadcom)

- McAfee Corp.

- Hillstone Networks

- Others

Recent Development

- June 2025: Cisco Systems introduced a new generation of secure networking hardware aimed at supporting AI workloads. Key launches included Cisco C9350 and C9610 Smart Switches delivering up to 51.2 Tbps throughput with quantum-resistant security, and a family of Cisco Secure Routers (8100 to 8500 series) integrating native SD-WAN, SASE, next-gen firewall, and post-quantum security offering up to three times the throughput of predecessors.

- July 2025: Hewlett-Packard Enterprise (HPE) completed its $14 billion acquisition of Juniper Networks, enhancing its AI-native networking and hybrid cloud portfolio. This merger doubled HPE’s networking division size, unifying Juniper’s data center, cloud, and service provider routing technologies with HPE’s Aruba platform, promising a stronger AI-driven, secure networking product suite.

Report Scope

Report Features Description Market Value (2024) USD 4.9 Bn Forecast Revenue (2034) USD 20.9 Bn CAGR(2025-2034) 15.60% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Component (Solutions, [Virtual Firewall, Virtual Intrusion Detection & Prevention Systems (IDPS), Virtual Unified Threat Management (UTM), Virtual Content & Email Security, Virtual VPN/SSL Appliances, Virtual Antimalware]), Services, [Consulting, Deployment & Integration, Training & Support]), By Deployment Mode (CloudBased, OnPremise), By Organization Size (Small & Medium Enterprises (SMEs), Large Enterprises), By EndUser Industry (IT & Telecom, BFSI (Banking, Financial Services, Insurance), Healthcare & Life Sciences, Government & Defense, Retail & Ecommerce, Manufacturing, Energy & Utilities, Education, Others (Media, Logistics, etc.)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Cisco Systems, Inc., Juniper Networks, Inc., Fortinet, Inc., Palo Alto Networks, Inc., Check Point Software Technologies Ltd., Sophos Ltd., Barracuda Networks, Inc., Trend Micro, Inc., VMware (Broadcom), McAfee Corp., Hillstone Networks, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to choose from: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users, Printable PDF)  Virtual Security Appliance MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Virtual Security Appliance MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Cisco Systems, Inc.

- Juniper Networks, Inc.

- Fortinet, Inc.

- Palo Alto Networks, Inc.

- Check Point Software Technologies Ltd.

- Sophos Ltd.

- Barracuda Networks, Inc.

- Trend Micro, Inc.

- VMware (Broadcom)

- McAfee Corp.

- Hillstone Networks

- Others