Global Virtual Retinal Display Market Size, Share, Statistics Analysis Report By Technology (Laser-based VRD, MEMS-based VRD, OLED-based VRD), By Product Type (Head-mounted Displays (HMDs), Desktop monitors, Embedded systems, Wearable devices), By End-user Industry (Consumer electronics, Healthcare, Aerospace & defense, Automotive, Retail & advertising, Education & training, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: December 2024

- Report ID: 134169

- Number of Pages: 292

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

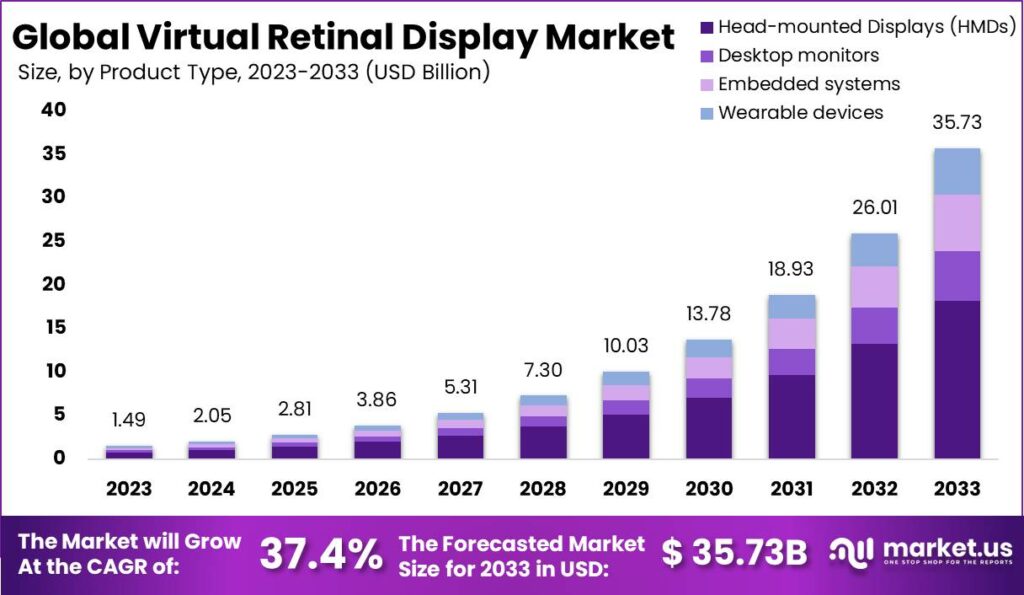

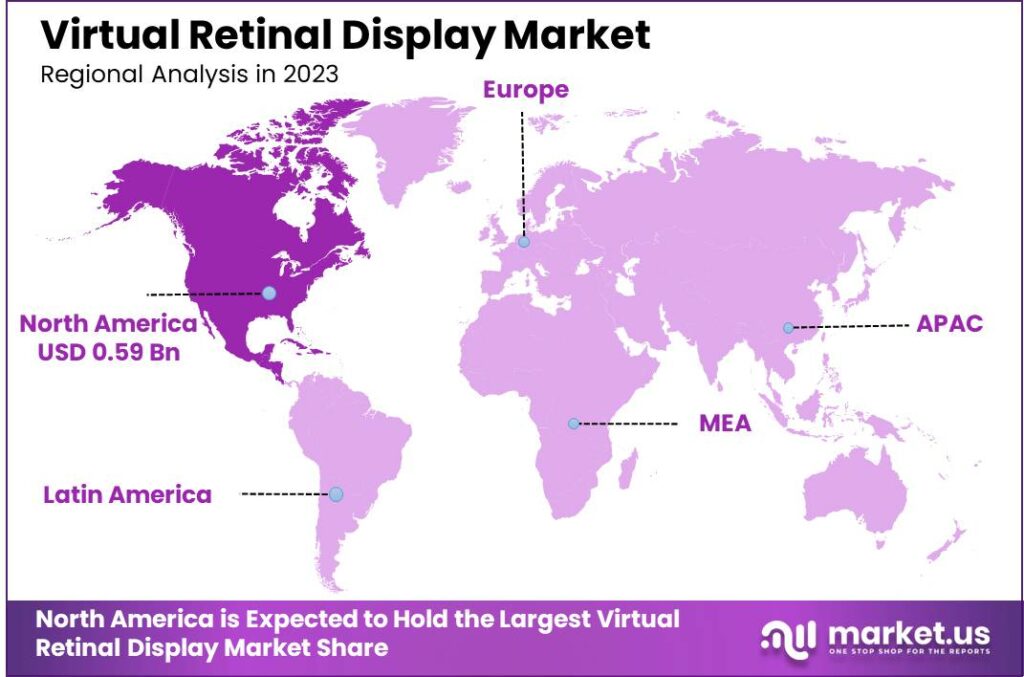

The Global Virtual Retinal Display Market size is expected to be worth around USD 35.73 Billion By 2033, from USD 1.49 Billion in 2023, growing at a CAGR of 37.40% during the forecast period from 2024 to 2033. In 2023, North America dominated the Virtual Retinal Display (VRD) sector, capturing over 40% of the market share, with revenues reaching USD 0.59 billion.

A Virtual Retinal Display (VRD), also known as a retinal scan display (RSD) or retinal projector (RP), is an innovative technology that projects images directly onto the retina of the eye, creating a visual experience as if the viewer is seeing a conventional display screen at some distance. This technology bypasses traditional display methods by scanning light directly onto the retina, allowing for high-resolution and potentially less bulky visual devices compared to current VR headsets or AR glasses.

The market for Virtual Retinal Displays is poised for significant growth, driven by its applications in various sectors including augmented reality (AR), medical, and military. The technology’s ability to overlay digital information onto the real world in AR applications makes it incredibly valuable for enhancing user experiences in gaming, training simulations, and professional applications. Moreover, VRDs can provide critical real-time information in medical procedures or military operations, which boosts its adoption in these fields.

The primary factors propelling the growth of the virtual retinal display market include the increasing demand for immersive and realistic visual experiences in AR/VR applications, the rising use in medical imaging and surgical applications, and significant investments in aerospace and defense for enhanced situational awareness and training. The technology’s unique ability to project images that are seen in high resolution and with rich color quality makes it attractive for both consumer and professional markets.

The growing popularity of virtual and augmented reality applications across various sectors, including automotive for advanced driver-assistance systems (ADAS) and in retail for enhanced customer experience, is creating substantial demand for virtual retinal displays. Opportunities also arise from ongoing advancements in micro-display technologies like OLED and MicroLED, which can significantly enhance the visual quality and performance of VRDs.

Significant technological advancements are driving the VRD market, with improvements in OLED and micro-LED technologies enhancing image quality and pixel density. Innovations such as miniaturization, portability, and integration with AI and sensors are making VRDs more practical for everyday use. Additionally, manufacturers are focusing on reducing costs and overcoming technical challenges related to eye tracking and image fidelity, further broadening the potential applications of VRD technology.

Key Takeaways

- The Global Virtual Retinal Display (VRD) Market is projected to reach USD 35.73 billion by 2033, growing from USD 1.49 billion in 2023, at a CAGR of 37.40% from 2024 to 2033.

- In 2023, the Laser-based VRD segment led the market, capturing over 43.7% of the share.

- The Head-mounted Displays (HMDs) segment also held a dominant position in 2023, with more than 51% market share.

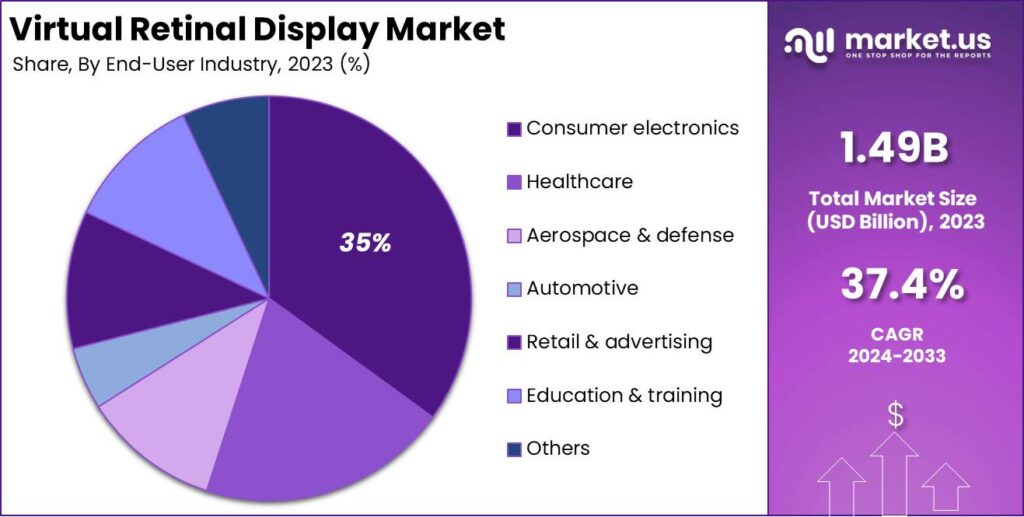

- The Consumer Electronics segment was the leading category in the VRD market in 2023, accounting for more than 35% of the share.

- North America dominated the VRD market in 2023, holding over 40% of the market share, with revenues reaching USD 0.59 billion.

Technology Analysis

In 2023, the Laser-based VRD segment held a dominant market position, capturing more than a 43.7% share of the Virtual Retinal Display market. This segment benefits primarily from the precision and clarity that laser technology provides. Laser-based VRD systems can project images directly onto the retina with exceptional color contrast and resolution.

The leadership of the Laser-based VRD segment can also be attributed to the maturity of laser technology compared to other methods like MEMS-based and OLED-based VRDs. Laser systems have been well-developed over the years, offering reliable performance and durability.

Furthermore, the preference for Laser-based VRDs in professional and industrial applications contributes to its leading position. Industries such as aerospace and defense, where precision is crucial, often opt for laser-based systems due to their ability to deliver clear and accurate visual data in real-time.

The broader acceptance of Laser-based VRDs is reinforced by ongoing improvements in laser safety and energy efficiency. Modern laser systems used in VRDs have evolved to operate at lower power levels while ensuring safety standards that prevent eye damage, making them suitable for everyday use in consumer products.

Product Type Analysis

In 2023, the Head-mounted Displays (HMDs) segment held a dominant market position within the virtual retinal display industry, capturing more than a 51% share. This segment leads primarily due to the growing popularity of immersive technologies in gaming and entertainment, sectors that heavily invest in providing the most engaging user experiences.

HMDs are pivotal in driving consumer and commercial interest because they offer a high degree of immersion that is essential for effective virtual reality (VR) experiences. The increasing demand for VR applications in training and education further bolsters this segment’s growth, as these applications rely on the realism and interactive capabilities that HMDs provide.

Desktop monitors equipped with virtual retinal display technology constitute another segment of the market. Although smaller in market share compared to HMDs, they offer significant advantages for professional and creative work, particularly in fields requiring precise visual detail such as graphic design, video editing, and architectural visualization.The embedded systems segment of the VRD market includes integration of this technology into various devices and machinery, where direct visual interaction is beneficial.

End-user Industry Analysis

In 2023, the Consumer Electronics segment held a dominant position in the Virtual Retinal Display (VRD) market, capturing more than a 35% share. This segment’s leadership can be attributed to the increasing consumer demand for innovative and immersive visual experiences in personal devices such as smartphones, VR headsets, and smart glasses.

As technology enthusiasts and everyday consumers alike seek out the latest advancements, the integration of VRD technology in consumer electronics offers enhanced display resolutions and a more natural viewing experience compared to traditional screens.

Additionally, the ongoing innovation in wearable technology contributes to the growth of this segment. As consumers demand more portable and user-friendly devices, manufacturers are incorporating VRD to create wearables with advanced visual capabilities without the weight and size constraints of conventional displays.

Looking ahead, the Consumer Electronics segment is expected to maintain its lead in the VRD market due to the continuous evolution of consumer technology and the growing integration of VR and AR across various applications.

Key Market Segments

By Technology

- Laser-based VRD

- MEMS-based VRD

- OLED-based VRD

By Product Type

- Head-mounted Displays (HMDs)

- Desktop monitors

- Embedded systems

- Wearable devices

By End-user Industry

- Consumer electronics

- Healthcare

- Aerospace & defense

- Automotive

- Retail & advertising

- Education & training

- Others

Driver

Enhanced User Experience

Virtual Retinal Displays (VRDs) offer a unique and immersive visual experience by projecting images directly onto the retina. This method provides high-resolution, bright, and clear images that appear to float in space, enhancing user engagement.

Unlike traditional screens, VRDs can produce images unaffected by external lighting conditions, ensuring consistent quality in various environments. This capability is particularly beneficial in fields like gaming and entertainment, where immersive visuals are crucial.

Additionally, VRDs can reduce eye strain associated with prolonged screen use, as they require less power and can be adjusted for individual visual needs. This personalized approach not only improves comfort but also broadens accessibility for users with specific visual requirements.

Restraint

High Development and Production Costs

Despite their advantages, VRDs face significant challenges due to high development and production costs. The technology involves complex components like precise light sources and scanning systems, which are expensive to develop and manufacture. This complexity results in higher prices for end products, limiting widespread consumer adoption.

Moreover, the intricate nature of VRDs requires specialized knowledge and equipment for assembly and maintenance, adding to overall costs. These financial barriers can deter investment and slow down technological advancements. Ongoing research and development are essential to simplify VRD designs and reduce production expenses, making the technology more accessible to a broader market.

Opportunity

Growing Demand in Healthcare Applications

The healthcare sector presents a significant opportunity for VRDs, particularly in medical imaging and surgical visualization. VRDs can provide medical professionals with real-time, high-resolution images directly in their line of sight, enhancing precision during procedures.

For instance, surgeons can view critical patient data without looking away from the operative field, improving focus and efficiency. Additionally, VRDs can assist in patient rehabilitation by offering immersive environments for therapy, aiding in faster recovery.

The ability to deliver detailed visuals without external screens makes VRDs a valuable tool in modernizing healthcare practices. As the medical field increasingly adopts advanced technologies, VRDs have the potential to become integral in improving patient outcomes and operational workflows.

Challenge

Addressing Vergence-Accommodation Conflict

A significant challenge for VRDs is the vergence-accommodation conflict, where the eyes’ focus and convergence cues are mismatched, leading to visual discomfort and eye strain. This issue arises because VRDs project images at a fixed focal distance, while the perceived depth of virtual objects varies, causing a disconnect between where the eyes converge and where they focus.

Overcoming this challenge is crucial for prolonged use of VRDs, especially in applications like virtual reality and augmented reality. Researchers are exploring solutions such as adjustable focus mechanisms and advanced display techniques to align vergence and accommodation cues. Addressing this challenge effectively will enhance user comfort and broaden the applicability of VRDs across various industries.

Emerging Trends

One significant trend is the development of compact and lightweight VRD systems. Traditional augmented reality (AR) devices often face challenges like low resolution and limited field of view. VRDs address these issues by using lasers to project images directly onto the retina, resulting in clearer visuals and a wider field of view.

Another advancement is the integration of adaptive optics in VRDs. This feature allows for real-time optical corrections, eliminating the need for prescription glasses and enabling the display to adjust focus dynamically for objects at varying distances.

The medical field is also exploring VRDs for applications like teleophthalmology, where images are projected onto the retina to assist in diagnosing and treating eye conditions.

Business Benefits

For businesses, VRDs offer several advantages. VRDs eliminate the need for bulky monitors and screens, freeing up valuable workspace. This space efficiency is advantageous in environments where desk space is limited, allowing for a more organized and less cluttered work area.

In manufacturing, VRDs can overlay digital information onto physical equipment, aiding in maintenance and training. This hands-free access to data improves efficiency and reduces errors.The entertainment industry benefits from VRDs by providing immersive experiences without the bulk of traditional headsets. This enhances user engagement and opens new avenues for content delivery.

Early adoption of VRD technology can position businesses as innovators in their industry. Offering cutting-edge tools not only attracts top talent but also appeals to clients seeking modern and efficient solutions.

Regional Analysis

In 2023, North America held a dominant market position in the Virtual Retinal Display (VRD) sector, capturing more than a 40% share, with revenues amounting to USD 0.59 billion. This leading stance is largely due to the region’s robust technological infrastructure and the presence of key industry players who are pioneers in VRD technologies.

North America’s commitment to adopting cutting-edge technologies has facilitated the early adoption of VRDs, particularly in sectors such as entertainment, healthcare, and defense, which demand high-performance display solutions.

The concentration of major technology firms and start-ups focused on augmented and virtual reality technologies in North America further fuels the development and expansion of the VRD market. These companies are not only pushing the boundaries of VRD technology but are also securing significant investments for research and development.

Moreover, North America’s regulatory environment supports technological advancements through favorable policies and substantial funding for technology projects. Initiatives by governments and private sectors to boost technological integration in critical sectors such as education and military operations have also propelled the demand for VRDs. This supportive ecosystem encourages continuous research and collaborations that enhance the technological reach and application of VRDs.

The strategic partnerships between academic institutions and tech companies in the region promote further research into overcoming the limitations of current VRD technologies and exploring new applications. These collaborations, coupled with a well-established tech industry, ensure that North America not only maintains but also expands its lead in the global VRD market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the competitive landscape of the Virtual Retinal Display market, several key players stand out due to their innovative contributions and market influence.

Avegant Corporation has carved a niche for itself in the VRD market with its innovative Glyph headset, which uses retinal imaging technology to project images directly into the user’s eyes. Avegant’s focus on delivering a crisp and vivid visual experience positions it as a pioneer in personal entertainment and media consumption devices.

Magic Leap Inc. is another major contender in the VRD space, known for its groundbreaking work in augmented reality (AR) systems. Magic Leap’s technology integrates digital content with the real world, creating uniquely immersive and interactive experiences.

QD Laser Co., Ltd. focuses on leveraging its expertise in laser technology to develop retinal displays that offer high precision and safety. The company’s retinal projection technology is particularly noted for its applications in medical and industrial fields, where accuracy and reliability are paramount.

Top Opportunities Awaiting for Players

Virtual Retinal Displays (VRDs) are emerging as a transformative technology with significant potential across various industries.

- Gaming and Entertainment: The gaming industry is a significant driver for VRD adoption. VRDs provide gamers with a wider field of view, reduced motion sickness, and high image quality, enhancing the gaming experience. As demand for immersive gaming experiences grows, VRDs are poised to become a preferred choice for both developers.

- Healthcare Applications: In healthcare, VRDs enable precise medical imaging and enhance surgical visualization, aiding in diagnosis and procedures. This technology offers enhanced situational awareness, real-time data visualization, and heads-up displays (HUDs), contributing to improved decision-making, operational efficiency, and safety in critical missions.

- Aerospace and Defense: VRDs are being used in aerospace and defense applications due to their ability to provide crucial information directly to pilots and soldiers without obstructing their field of view. As defense budgets increase and the need for advanced technology intensifies, the demand for VRDs in this sector continues to expand.

- Consumer Electronics: The integration of VRDs into consumer electronics, such as smart glasses and wearable devices, presents a significant opportunity. Companies like Meta are investing heavily in augmented reality (AR) smart glasses, aiming to integrate their apps more deeply with user experiences. This trend indicates a growing market for VRD-equipped consumer devices.

- Automotive Industry: In the automotive sector, VRDs can power heads-up displays (HUDs) and AR dashboards, providing drivers with real-time information and enhancing safety. The ability to overlay virtual elements onto the real world enables enhanced training simulations, precise navigation aids, and improved spatial understanding in various industries.

Top Key Players in the Market

- Avegant Corporation

- Magic Leap Inc.

- QD Laser Co. Ltd

- Texas Instruments Inc.

- OmniVision Technologies Inc.

- Himax Technologies Inc.

- Movidius Inc. (Intel Corporation)

- Analogix Semiconductor Inc.

- Human Interface Technology Laboratory

- eMagin Corporation

- Vuzix

- Optivent

- Other Key Players

Recent Developments

- In September 2024, Meta introduced the Orion prototype, a pair of augmented reality glasses with holographic capabilities. These glasses integrate hand-tracking, eye-tracking, and a neural interface controlled via a wristband, aiming to replace traditional smartphones by overlaying virtual images onto the real world.

- In February 2024, Apple launched the Vision Pro, a mixed-reality headset that integrates digital content with the physical environment. The device features high-resolution displays and advanced sensors to project images directly into the user’s field of vision, marking Apple’s significant entry into the VRD market.

- In October 2024, Brelyon introduced the Ultra Reality monitor, delivering an immersive 122-inch image with a 110-degree field of view. This desktop monitor simulates virtual reality without the need for goggles, utilizing advanced optics to project images directly into the user’s eyes.

- In 2023, Sony developed a compact camera with an integrated Retissa Neoviewer retinal projection device for the US market, offering a retinal display with a resolution roughly equivalent to 720P. This innovative viewer, aimed at aiding visually impaired users, was heavily subsidized by Sony to enhance accessibility.

Report Scope

Report Features Description Market Value (2023) USD 1.49 Bn Forecast Revenue (2033) USD 35.73 Bn CAGR (2024-2033) 37.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (Laser-based VRD, MEMS-based VRD, OLED-based VRD), By Product Type (Head-mounted Displays (HMDs), Desktop monitors, Embedded systems, Wearable devices), By End-user Industry (Consumer electronics, Healthcare, Aerospace & defense, Automotive, Retail & advertising, Education & training, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Avegant Corporation, Magic Leap Inc., QD Laser Co. Ltd, Texas Instruments Inc., OmniVision Technologies Inc., Himax Technologies Inc., Movidius Inc. (Intel Corporation), Analogix Semiconductor Inc., Human Interface Technology Laboratory, eMagin Corporation, Vuzix, Optivent , Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Virtual Retinal Display MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

Virtual Retinal Display MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Avegant Corporation

- Magic Leap Inc.

- QD Laser Co. Ltd

- Texas Instruments Inc.

- OmniVision Technologies Inc.

- Himax Technologies Inc.

- Movidius Inc. (Intel Corporation)

- Analogix Semiconductor Inc.

- Human Interface Technology Laboratory

- eMagin Corporation

- Vuzix

- Optivent

- Other Key Players