Global Virtual Private Branch Exchange (PBX) System Market Size, Share, Industry Analysis Report By Component (Solution (Hosted PBX, Cloud PBX, IP PBX), Services (Professional Services, Managed Services, Integration & Support Services)), By Organization Size (Small & Medium Enterprises (SMEs), Large Enterprises), By Deployment Mode (CloudBased, OnPremise), By EndUser Industry (IT & Telecom, BFSI, Retail & Ecommerce, Healthcare, Education, Government & Public Sector, Manufacturing, Others (Media, Travel, Logistics, etc.)), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 160716

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- Role of Generative AI

- US Market Size

- Emerging Trends

- Growth Factors

- By Component

- By Organization Size

- By Deployment

- By End-User Industry

- Key Market Segment

- Top 5 Use Cases

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- SWOT Analysis

- Key Player Analysis

- Recent Development

- Report Scope

Report Overview

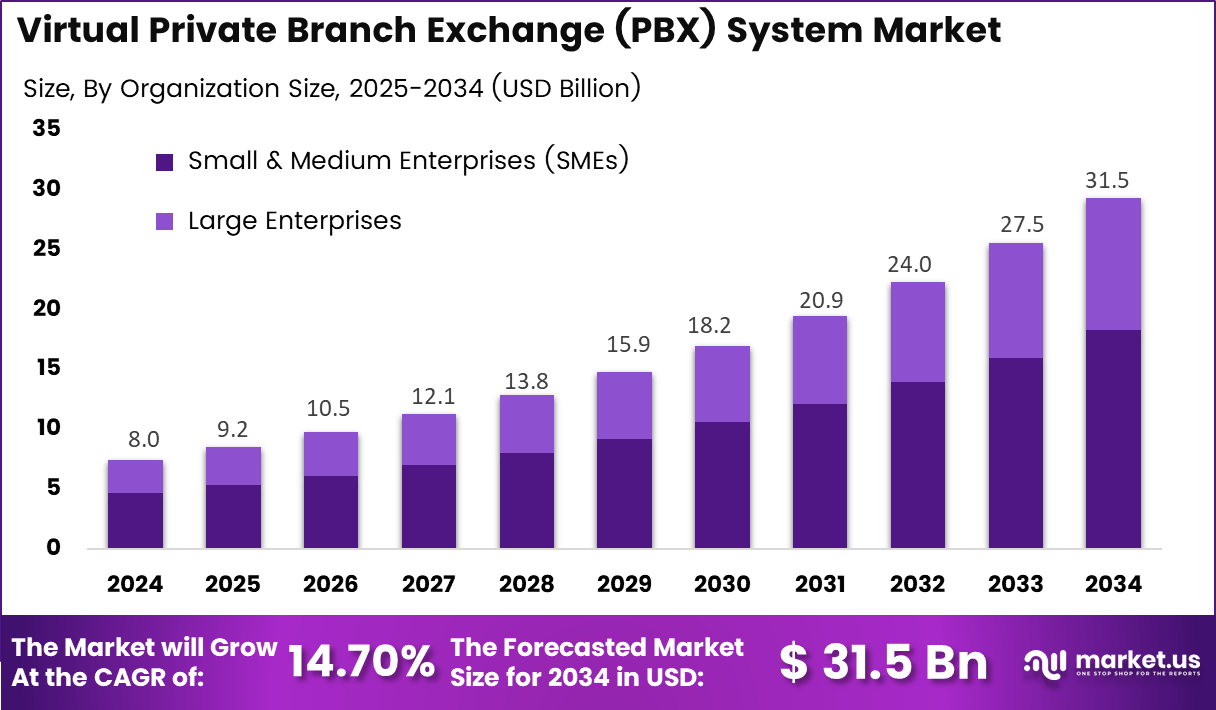

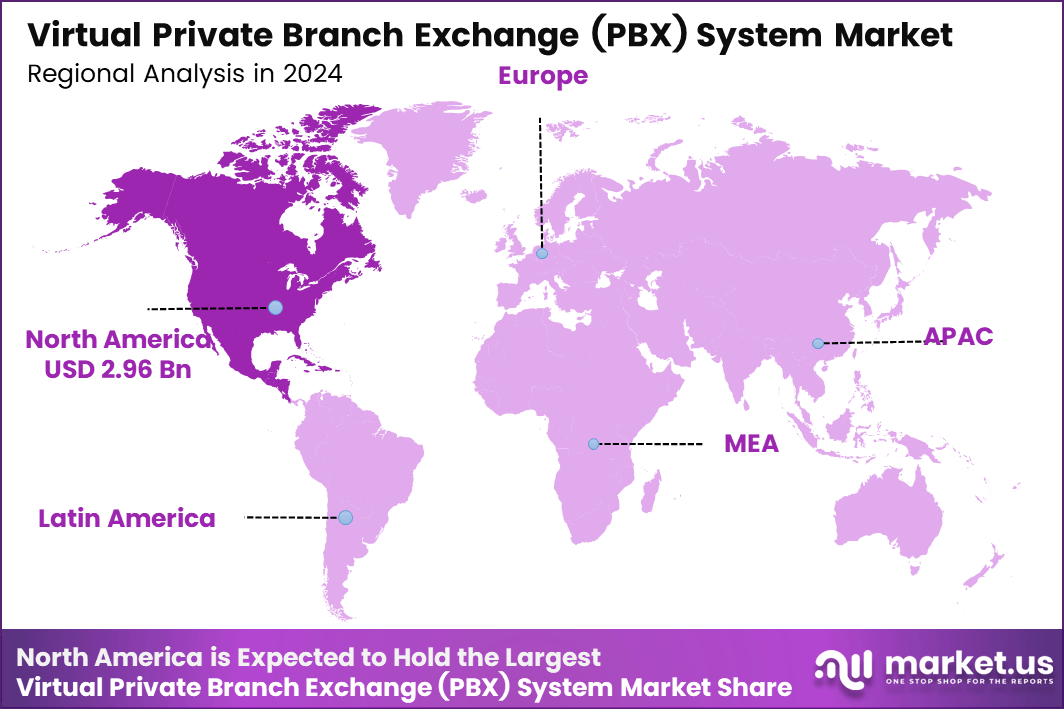

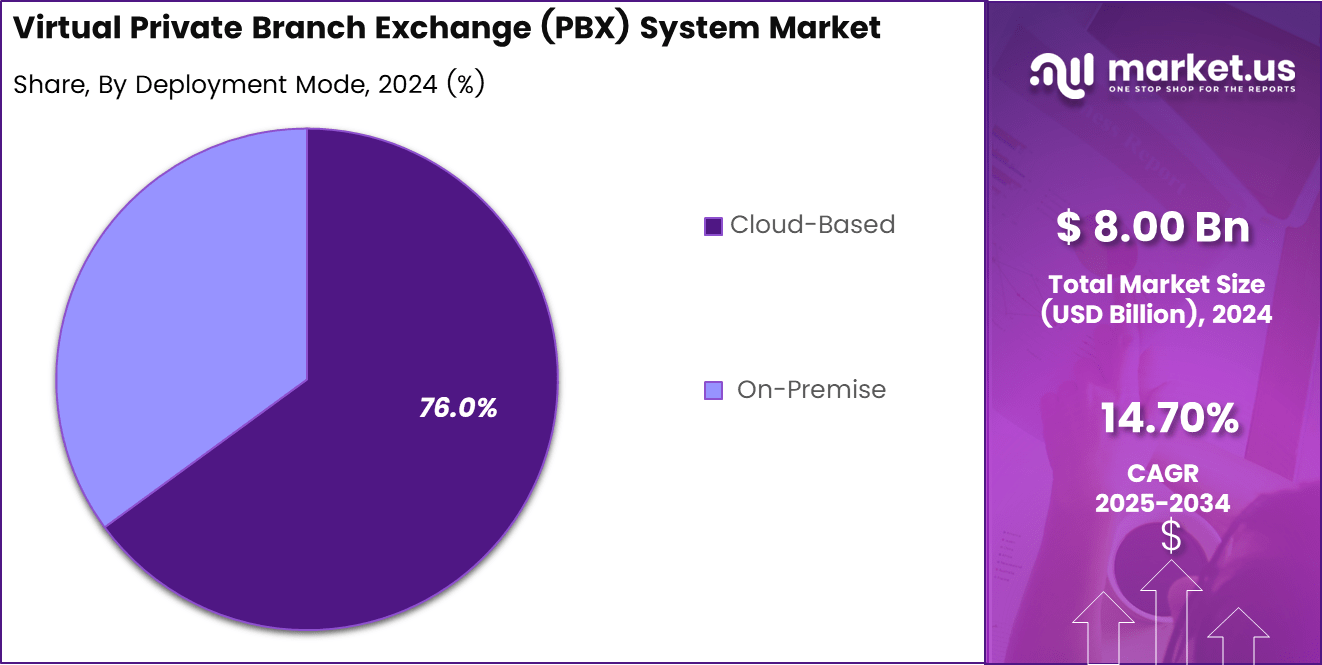

The Global Virtual Private Branch Exchange (PBX) System Market is projected to grow significantly, expanding from USD 8.0 billion in 2024 to USD 31.5 billion by 2034, reflecting a strong CAGR of 14.70% from 2025 to 2034. North America is expected to continue holding the largest share of the market, with USD 2.96 billion in 2024, driven by increasing adoption across industries. Cloud-based deployments dominate, capturing 76% of the market share.

The Virtual Private Branch Exchange (PBX) System market revolves around software-based phone systems that manage internal and external communications for businesses through internet protocols rather than traditional phone lines. Virtual PBX systems offer flexibility, allowing companies to route calls, manage extensions, and integrate communication features like voicemail, conferencing, and messaging from cloud platforms.

Top driving factors include the rising adoption of remote and hybrid work models, which require seamless and scalable communication solutions. Cost savings are a significant motivator, as virtual PBX reduces the need for physical hardware and dedicated maintenance teams. Moreover, growing integration with other business tools such as CRM and collaboration software enhances communication efficiency across departments, further driving adoption.

Demand for virtual PBX systems is strong across organisations that require flexible communications without heavy infrastructure investment. SME sector shows high adoption because of its limited IT resources and desire for simple, cost-effective solutions. Large enterprises are also upgrading existing PBX systems or expanding to support remote branches and mobile workforce. Verticals such as IT & technology, healthcare, retail, education and BFSI (banking, financial services and insurance) are notable users.

Key Takeaways

- The Solutions segment dominated with 70%, reflecting widespread adoption of unified communication and collaboration platforms.

- Small and Medium Enterprises (SMEs) accounted for 58%, driven by cost-effective communication systems and operational flexibility.

- Cloud-Based deployment led with 76%, supported by scalability, remote accessibility, and reduced infrastructure maintenance.

- The IT & Telecom sector contributed 21%, underscoring its reliance on virtual PBX systems for seamless internal and client communication.

- North America captured 37% of the global market, supported by strong cloud adoption and enterprise digital transformation initiatives.

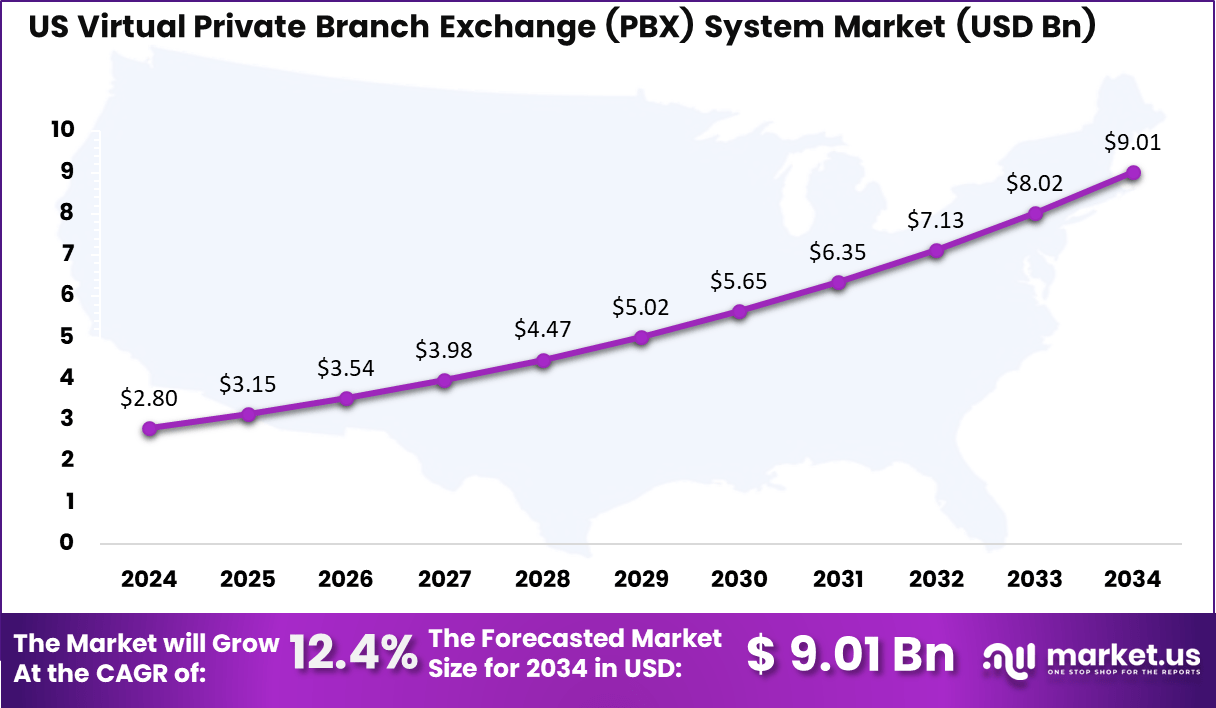

- The US market reached USD 2.8 Billion in 2024, registering a healthy 12.4% CAGR, fueled by growing demand for hosted communication services across businesses.

Analysts’ Viewpoint

Investment opportunities focus on cloud service providers, software developers specializing in unified communications, and firms offering AI-enhanced PBX features such as voice recognition and automated routing. Expansion into emerging markets where adoption of cloud communication is rising presents additional growth avenues. Providers focusing on cybersecurity and data privacy solutions also attract investments as secure communication becomes critical.

Business benefits of virtual PBX systems include reduced communication costs, improved flexibility in managing calls, and enhanced collaboration among teams regardless of location. Faster deployment and centralized control aid IT departments, while improved customer experience drives business growth. The system supports scalability for growing businesses and reduces operational complexity by consolidating communication platforms.

The regulatory environment requires compliance with data protection laws and telecommunications regulations, varying by region. Providers must ensure secure data handling and user privacy, essential for building customer trust. Many countries have introduced telecommunications standards that affect virtual PBX service deployment, requiring providers to stay updated on legal requirements.

Role of Generative AI

Generative AI is reshaping modern Virtual PBX systems by automating call routing, call transcription, and real-time customer sentiment analysis. Around 60% of routine queries in contact centers can now be handled by AI, freeing human operators for complex tasks. This automation enhances customer service quality and operational efficiency significantly.

Generative AI models also analyze call data to predict customer needs and improve interaction strategies, boosting response accuracy and satisfaction rates. The integration of AI in PBX systems leads to smarter, more responsive communication frameworks tailored to business needs.

US Market Size

Within the region, the United States contributes roughly USD 2.8 billion in market value, growing at a robust 12.4% CAGR. Factors like large-scale enterprise mobility initiatives, AI-driven communication tools, and the presence of major technology providers are driving the market.

Growing emphasis on remote and hybrid work infrastructures continues to strengthen cloud PBX adoption. The U.S. is expected to remain a primary center for innovation in virtual communication systems, supported by its mature IT ecosystem and rising use of real-time collaboration tools.

North America leads the market with a 37% share, fueled by digital transformation initiatives and widespread cloud adoption among enterprises. Businesses across the region are moving toward hosted PBX models that reduce capital expense while improving automation and service reach. Strong demand from corporate offices, call centers, and professional services has kept North America at the forefront of adoption.

Emerging Trends

The shift to cloud-based PBX platforms is a major trend, as businesses seek scalable and flexible communication solutions without heavy hardware costs. Cloud PBX adoption supports remote and hybrid workforces by allowing access from anywhere via mobile devices. Additionally, unified communications as a service (UCaaS) is gaining momentum, integrating voice, video, and messaging into seamless platforms.

AI-powered features such as virtual assistants and intelligent call management are increasingly standard, improving user experience and reducing operational expenses. Asia-Pacific, driven by SMB growth and enhanced internet penetration, shows the fastest adoption rates.

Growth Factors

Key growth drivers include the demand for cost reduction in telecommunications through cloud migration, which eliminates upfront hardware and maintenance expenses. The rising need for team collaboration tools amid remote working trends further pushes PBX adoption.

Businesses are also motivated by improved call analytics and CRM integrations that modern PBX systems offer, contributing to better customer engagement. The growing acceptance of mobile-first strategies and BYOD policies, which leverage cloud PBX’s accessibility, also fuel growth. These factors together are accelerating adoption rates globally, particularly in digital-forward industries.

By Component

In 2024, Solutions dominate the virtual private branch exchange system market, accounting for around 70% of total revenue. This segment includes call routing, IVR (interactive voice response), analytics, and unified communication tools that help businesses manage internal and external calls effectively.

As companies adopt hybrid and remote work models, solution-based systems that integrate video, chat, and collaboration functions are seeing steady demand. The ability of these solutions to unify communication without requiring physical infrastructure continues to attract both startups and large enterprises.

Growing emphasis on automation and AI-driven support features further strengthens the solutions segment. Many modern virtual PBX platforms now include intelligent call handling, voice assistants, and advanced reporting capabilities. Businesses are using these technologies to improve customer experience and streamline operations from a single interface.

By Organization Size

Small and medium-sized enterprises (SMEs) hold a market share of around 58%, driven by the need for affordable and flexible communication systems. For small firms, cloud-based PBX solutions offer advanced call management features at a fraction of traditional hardware costs. The ability to set up virtual extensions, manage call centers remotely, and support mobile teams is especially valuable for growing companies.

SMEs see virtual PBX technology as a reliable way to enhance connectivity without investing in complex on-site systems. Many SMEs are also adopting PBX systems to improve customer handling efficiency and internal collaboration. Easy integration with CRM and helpdesk software enables faster response times and supports more professional communication structures.

These systems help businesses maintain continuity even during network disruptions through features like automated rerouting and failover support. The sustained digital shift across smaller enterprises is expected to maintain steady momentum for this segment.

By Deployment

In 2024, Cloud-based systems make up about 76% of the virtual PBX market, highlighting the fundamental shift toward hosted communication services. Companies increasingly prefer cloud deployment due to its lower upfront cost, minimal maintenance, and remote accessibility.

Service providers are offering subscription-based models that include updates, backup management, and security monitoring. As a result, organizations of all sizes are adopting cloud PBX solutions to handle large-scale communication networks without dedicated IT teams.

The scalability of cloud-based systems supports agile business operations and distributed workforces. With easy provisioning and integration, companies can quickly expand or reduce capacity as their workforce and call volume change. Cloud PBX also ensures better disaster recovery and data protection through redundant data centers and automatic backups.

By End-User Industry

The IT and telecom sector accounts for approximately 21% of the market. This industry relies heavily on advanced communication frameworks to manage technical support, customer service, and interdepartmental coordination. High call volumes and the need for 24/7 connectivity make virtual PBX systems a practical choice, especially for firms operating across multiple regions.

Cloud integration allows IT companies to manage global teams while ensuring security and compliance with data regulations. In telecom, PBX systems are increasingly integrated with VoIP and SIP technologies to improve performance and reduce latency.

The rise in managed services and outsourcing across the industry also boosts adoption. Service providers use virtual PBX capabilities to deliver hosted voice services to end clients, reinforcing the segment’s strategic value. The constant upgrade of communication infrastructure within IT and telecom sectors keeps this segment technologically advanced and highly adaptive.

Key Market Segment

By Component

- Solutions

- Hosted PBX

- Cloud PBX

- IP PBX

- Services

- Professional Services

- Managed Services

- Integration & Support Services

By Organization Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By Deployment Mode

- CloudBased

- OnPremise

By EndUser Industry

- IT & Telecom

- BFSI

- Retail & Ecommerce

- Healthcare

- Education

- Government & Public Sector

- Manufacturing

- Others (Media, Travel, Logistics, etc.)

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Top 5 Use Cases

- Personalized Learning Paths: AI analyzes student data to customize curricula, adjusting difficulty in real-time for better outcomes in K-12 and higher education.

- Remote and Hybrid Classrooms: Cloud platforms enable seamless virtual collaboration, with tools like interactive whiteboards supporting global access and reducing geographical barriers.

- Corporate Upskilling Programs: Businesses use adaptive platforms for employee training, integrating VR simulations to build skills cost-effectively and track progress via analytics.

- Automated Assessment and Feedback: Intelligent systems grade assignments and provide instant insights, freeing teachers for mentoring while identifying learning gaps early.

- Inclusive Accessibility Tools: Digital ecosystems offer multilingual content, screen readers, and adaptive interfaces, ensuring equitable education for diverse learners, including those with disabilities.

Driver Analysis

Shift to Cloud-Based PBX Solutions

The Virtual Private Branch Exchange (PBX) market is growing rapidly due to businesses increasingly adopting cloud-based PBX solutions. These cloud systems offer significant advantages in cost, scalability, and flexibility compared to traditional on-premise setups.

Businesses favor the ability to easily scale communications infrastructure according to needs without heavy upfront hardware investments. The cloud also enables remote accessibility, making it suitable for modern hybrid and remote work environments.

This shift supports operational efficiency and reduces maintenance burdens for companies of all sizes. Many providers are integrating advanced features like unified communications, AI-driven call routing, and mobile accessibility. These innovations meet the demand for smarter, more connected workplace communication systems, driving market expansion globally.

Restraint Analysis

Security and Integration Concerns

Despite the drive toward virtual PBX systems, security issues present a significant restraint for market growth. Businesses remain cautious about vulnerabilities relating to data privacy and cyber threats in cloud-based communication platforms. Concerns about secure call transmission and potential breaches slow adoption, especially among industries with strict compliance requirements.

Additionally, integrating virtual PBX systems with existing legacy IT frameworks and other business applications such as customer relationship management (CRM) software can pose technical challenges. Complex integration processes require both time and expertise, and some companies hesitate to transition due to potential disruptions in daily operations. These factors limit faster uptake across certain market segments.

Opportunity Analysis

AI and IoT Integration

A promising opportunity in the PBX market comes from integrating AI and Internet of Things (IoT) technologies. AI-powered features like intelligent call routing, voice recognition, and analytics improve customer service and operational insights. The use of AI helps companies automate routine tasks while optimizing communications workflows.

IoT integration further enhances PBX systems by enabling seamless connectivity across multiple devices and locations. This fosters smarter, more adaptive communication networks that can support distributed workforces and modern business applications. As AI and IoT evolve, they present compelling value-added services that can attract new buyers and drive market differentiation.

Challenge Analysis

Intense Competition and Market Fragmentation

The virtual PBX market faces intense competition from numerous suppliers, leading to pricing pressures and narrowing profit margins. The presence of many established players and new entrants creates a highly fragmented market landscape. Companies compete vigorously by innovating and expanding service offerings, but this also makes it difficult for latecomers to gain traction without major investments.

Furthermore, customer reluctance to adopt newer technologies and preferences for familiar communication setups can slow market growth. Buyers may be hesitant to switch providers or systems due to concerns about service reliability and transition costs. Such hesitation, alongside varying regional regulatory requirements, creates a challenging environment for widespread adoption.

SWOT Analysis

Strengths

- Cloud-based PBX systems offer scalability and cost-efficiency, reducing hardware costs.

- Integration with unified communication platforms enhances collaboration, improving productivity and operational efficiency.

Weaknesses

- Data security concerns persist, with 30% of businesses worried about potential data breaches and unauthorized access

- Integration with legacy systems poses challenges, with 36% of enterprises struggling to integrate cloud-based PBX systems with existing infrastructures.

Opportunities

- AI integration in PBX systems, such as intelligent call routing and virtual assistants, is gaining traction, with 25% of PBX platforms incorporating AI.

- Expanding into emerging markets like Asia-Pacific and Latin America presents growth opportunities as digital transformation drives demand for cloud-based solutions.

Threats

- Intense competition from established players like RingCentral, Microsoft, and Cisco makes market entry challenging for new players.

- Rapid technological advancements may disrupt traditional PBX systems, requiring continuous innovation and adaptation.

Key Player Analysis

The Virtual Private Branch Exchange (PBX) System Market is dominated by leading unified communication providers such as RingCentral, Inc., 8×8, Inc., Nextiva, and Vonage (Ericsson). These companies deliver cloud-based PBX systems that integrate voice, video, and messaging on a single platform. Their focus on scalability, reliability, and AI-driven analytics enables businesses to streamline communication, reduce infrastructure costs, and support hybrid work environments efficiently.

Prominent participants including Dialpad, Ooma, Inc., Mitel Networks Corp., and Zoom Video Communications, Inc. continue to expand their presence by offering feature-rich PBX solutions tailored for small and medium enterprises (SMEs). These platforms incorporate call routing, virtual extensions, CRM integration, and intelligent voice assistants to enhance customer engagement and collaboration within distributed teams.

Additional contributors such as GoTo, 3CX, and Cisco (Webex Calling), along with other key players, strengthen the market through innovation in SIP trunking, VoIP interoperability, and advanced call security. Their investments in cloud-native architecture, API connectivity, and AI-powered communication tools are transforming enterprise telephony into a more flexible, data-driven, and globally connected communication ecosystem.

Top Key Player

- RingCentral, Inc.

- 8×8, Inc.

- Nextiva

- Vonage (Ericsson)

- Dialpad

- Ooma, Inc.

- Mitel Networks Corp.

- Zoom Video Communications, Inc.

- GoTo

- 3CX

- Cisco (Webex Calling)

- Others

Recent Development

- September 2025, RingCentral, Inc. launched its AI Receptionist (AIR) service in the UK to help SMEs scale faster by automating call handling, inquiries, and appointment booking in multiple languages. The solution has already gained traction in the US with over 3,000 active customers and is expanding globally with new features and country availability in the UK and Australia. This shows strong momentum for AI-powered communications among small and mid-sized businesses.

- October 2025, 8×8, Inc. forged a strategic partnership with UK-based managed services provider Wavenet to deliver unified communications and AI-powered customer experience solutions across Europe. Wavenet was named 8×8’s EMEA Resell Partner of the Year and Contact Centre Partner of the Year 2025, reflecting its strong market position. This collaboration aims to help enterprises upgrade from legacy PBX systems to modern cloud platforms with integrated call center and CPaaS capabilities

Report Scope

Report Features Description Market Value (2024) USD 8.0 Bn Forecast Revenue (2034) USD 31.5 Bn CAGR(2025-2034) 14.70% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Component (Solution [Hosted PBX, Cloud PBX, IP PBX], Services [Professional Services, Managed Services, Integration & Support Services]), By Organization Size (Small & Medium Enterprises (SMEs), Large Enterprises), By Deployment Mode (CloudBased, OnPremise), By EndUser Industry (IT & Telecom, BFSI, Retail & Ecommerce, Healthcare, Education, Government & Public Sector, Manufacturing, Others (Media, Travel, Logistics, etc.)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape RingCentral, Inc., 8×8, Inc., Nextiva, Vonage (Ericsson), Dialpad, Ooma, Inc., Mitel Networks Corp., Zoom Video Communications, Inc., GoTo, 3CX, Cisco (Webex Calling), Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to choose from: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users, Printable PDF)  Virtual Private Branch Exchange System MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Virtual Private Branch Exchange System MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- RingCentral, Inc.

- 8x8, Inc.

- Nextiva

- Vonage (Ericsson)

- Dialpad

- Ooma, Inc.

- Mitel Networks Corp.

- Zoom Video Communications, Inc.

- GoTo

- 3CX

- Cisco (Webex Calling)

- Others