Global Virtual Health Service Market By Service Type (Synchronous Virtual Visits, Virtual Urgent Care & On-demand Telehealth, Virtual Specialty Care, Virtual Chronic Care Management, Telebehavioral/Telepsychiatry, Remote Patient Monitoring (RPM), and Asynchronous/Store-and-Forward Consults), By Technology (Video & Voice Communication, Remote Monitoring Devices & Wearables, Mobile Apps & Chat/Messaging, and Integration/Interoperability), By Delivery Model (Provider-to-Patient Platforms, Virtual-first Primary Care, Payer-led Virtual Care, Health System/Hub-and-Spoke Telehealth Networks, and Employer/Workplace Virtual Care Programs), By Payer (Fee-for-Service Telehealth Reimbursement, Value-Based/Capitated Programs, Out-of-pocket/Cash-pay, and Employer-sponsored Direct Contracts/Subscription Models), By End-user (General Acute Care/Adults, Rural/Underserved Populations, Pediatrics & Mental Health, Chronic Disease Patients, and Behavioral Health Patients), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 105794

- Number of Pages: 298

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

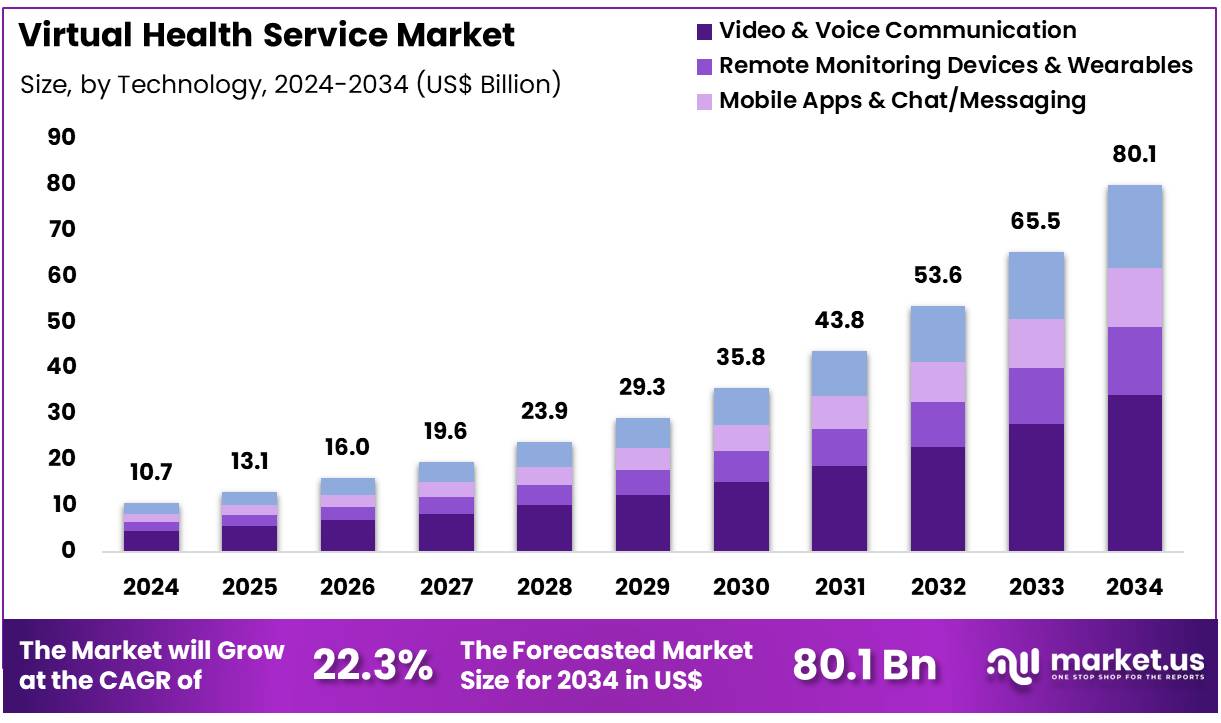

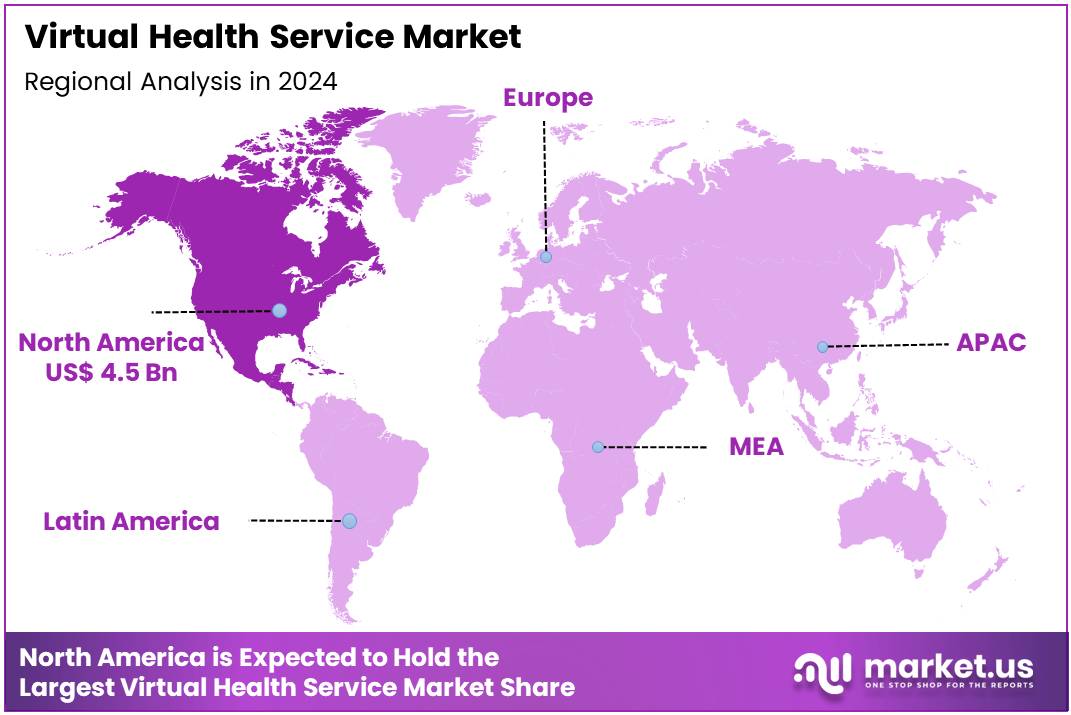

Global Virtual Health Service Market size is expected to be worth around US$ 80.1 Billion by 2034 from US$ 10.7 Billion in 2024, growing at a CAGR of 22.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.5% share with a revenue of US$ 4.5 Billion.

Rising consumer demand for convenient and accessible healthcare services is a primary driver of the virtual health services market. These platforms, which include telehealth, remote patient monitoring, and mHealth apps, enable individuals to consult with healthcare professionals from their homes, saving time and reducing travel costs.

The shift toward virtual care is especially pronounced in the management of long-term conditions. A 2024 report by the National Center for Health Statistics highlighted a stark difference in telemedicine usage, noting that adults with a diagnosed chronic condition like diabetes were more than 50% more likely to utilize virtual health services compared to adults without such a diagnosis.

Growing strategic partnerships and a focus on integrating virtual care into existing healthcare ecosystems are key trends shaping the market. Companies are increasingly acquiring virtual health platforms to broaden their portfolios and offer a more comprehensive range of services to their members.

For example, in February 2024, Elevance Health acquired VirtualHealth Innovations to expand its remote care offerings and improve access to virtual healthcare solutions for its members. This trend is further supported by the high consumer adoption of these technologies; a 2024 Deloitte survey found that 94% of consumers who have had a virtual visit expressed a willingness to have another one, indicating strong patient satisfaction and a permanent shift in care preferences.

Increasing investment in digital infrastructure and a drive toward data-driven insights are creating significant opportunities for market expansion. The American Hospital Association notes that as of early 2025, more than three-quarters of all U.S. hospitals are connecting with patients through telehealth services, reflecting how integral telemedicine has become in modern care delivery.

The development of AI-powered platforms that can analyze patient data from wearable devices and remote monitors is enabling providers to offer more personalized and proactive care. These advancements are critical for managing complex conditions and reducing the need for emergency visits, ensuring a more efficient and cost-effective healthcare system for all stakeholders.

Key Takeaways

- In 2024, the market generated a revenue of US$ 10.7 Billion, with a CAGR of 22.3%, and is expected to reach US$ 80.1 Billion by the year 2034.

- The service type segment is divided into synchronous virtual visits, virtual urgent care & on-demand telehealth, virtual specialty care, virtual chronic care management, telebehavioral/telepsychiatry, remote patient monitoring (RPM), and asynchronous/store-and-forward consults, with synchronous virtual visits taking the lead in 2023 with a market share of 38.3%.

- Considering technology, the market is divided into video & voice communication, remote monitoring devices & wearables, mobile apps & chat/messaging, and integration/interoperability. Among these, video & voice communication held a significant share of 42.6%.

- Furthermore, concerning the delivery model segment, the market is segregated into provider-to-patient platforms, virtual-first primary care, payer-led virtual care, health system/hub-and-spoke telehealth networks, and employer/workplace virtual care programs. The provider-to-patient platforms sector stands out as the dominant player, holding the largest revenue share of 45.4% in the market.

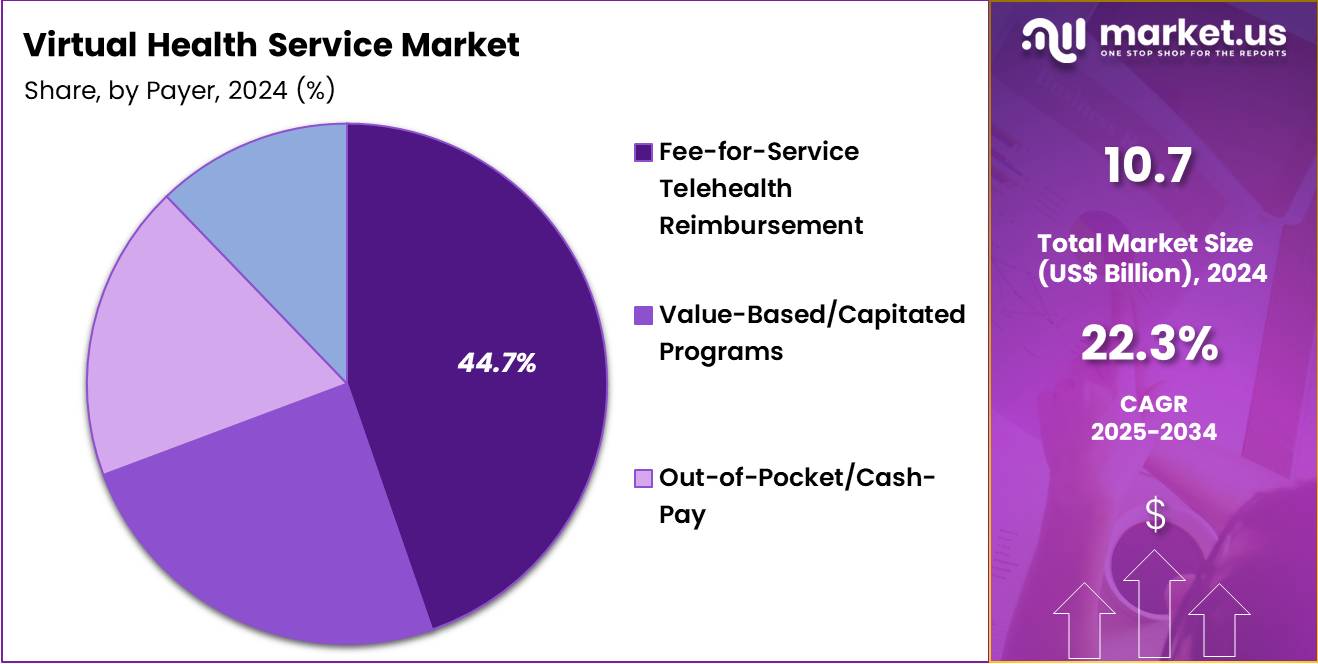

- The payer segment is segregated into fee-for-service telehealth reimbursement, value-based/capitated programs, out-of-pocket/cash-pay, and employer-sponsored direct contracts/subscription models, with the fee-for-service telehealth reimbursement segment leading the market, holding a revenue share of 44.7%.

- Considering end-user, the market is divided into general acute care/adults, rural/underserved populations, pediatrics & mental health, chronic disease patients, and behavioral health patients. Among these, general acute care/adults held a significant share of 45.6%.

- North America led the market by securing a market share of 42.5% in 2023.

Service Type Analysis

Synchronous virtual visits dominate the virtual health service market, accounting for 38.3% of the market share. This segment is expected to grow significantly due to the increasing demand for real-time, face-to-face interactions with healthcare professionals. The ease and convenience of virtual consultations have become increasingly essential, especially following the COVID-19 pandemic, which accelerated the adoption of telehealth services.

Synchronous visits allow patients to receive immediate consultations, making them a preferred option for a variety of healthcare needs, from general medical advice to urgent care. The availability of video and voice communication technologies, along with advancements in mobile and desktop platforms, has further boosted the popularity of synchronous virtual visits. The growing need for cost-effective healthcare solutions and the pressure on healthcare systems to provide more accessible services are expected to continue driving growth in this segment.

Technology Analysis

Video and voice communication technology account for 42.6% of the technology segment in the virtual health service market. This technology is pivotal in enabling synchronous virtual visits, which have become a staple in healthcare delivery. With advancements in video conferencing software and secure communication channels, healthcare providers can offer consultations and treatment recommendations to patients remotely, eliminating the need for physical visits. This shift is expected to expand as more people embrace telemedicine, and healthcare systems continue to prioritize accessibility and convenience.

Additionally, the increased use of smartphones, tablets, and laptops ensures that video and voice communication technology remains integral to the growth of virtual health services. As both patients and providers become more comfortable with digital healthcare, the demand for video and voice communication solutions will likely increase.

Delivery Model Analysis

Provider-to-patient platforms make up 45.4% of the delivery model segment in the virtual health service market. This model allows direct interaction between healthcare providers and patients, facilitating seamless consultations, appointments, and follow-up care. The market for these platforms is expected to grow due to the rising adoption of telehealth and the increasing demand for patient-centered care.

These platforms enable providers to manage patient records, share test results, and conduct virtual consultations without the need for physical office visits. The flexibility and convenience offered by provider-to-patient platforms make them highly attractive to both healthcare professionals and patients. As more healthcare systems invest in digital tools to streamline patient care and enhance service delivery, the provider-to-patient platform segment is anticipated to maintain strong growth in the coming years.

Payer Analysis

Fee-for-service telehealth reimbursement holds 44.7% of the payer segment in the virtual health service market. This reimbursement model is central to the growth of virtual health services, as it ensures that healthcare providers are compensated for remote consultations and services. The expansion of telehealth services has been supported by favorable regulatory changes, including Medicare and Medicaid reimbursement for telehealth consultations. This has encouraged healthcare providers to offer telehealth services more widely, knowing that they will receive reimbursement for their services.

The growing trend toward digital health solutions and the recognition of the effectiveness of telehealth in improving access to care are expected to drive the growth of fee-for-service reimbursement models in the market. With an increasing shift toward value-based care and more insurance plans covering telehealth visits, this segment is expected to see continued growth.

End-User Analysis

General acute care for adults accounts for 45.6% of the end-user segment in the virtual health service market. This segment’s dominance is expected to continue as virtual health services address a wide range of acute care needs, such as urgent consultations, follow-up visits, and post-surgical care. The ability to provide timely consultations, especially in emergency situations or for non-critical health issues, has significantly improved patient care while reducing the burden on physical healthcare facilities.

Additionally, the increased focus on patient-centered care, coupled with the need for more accessible healthcare services, is expected to keep driving growth in this segment. With advancements in technology making virtual consultations more effective, adult patients seeking acute care services are anticipated to continue opting for these solutions, driving the demand for virtual health services for general acute care.

Key Market Segments

By Service Type

- Synchronous Virtual Visits

- Virtual Urgent Care & On-demand Telehealth

- Virtual Specialty Care

- Virtual Chronic Care Management

- Telebehavioral/Telepsychiatry

- Remote Patient Monitoring (RPM)

- Asynchronous/Store-and-Forward Consults

By Technology

- Video & Voice Communication

- Remote Monitoring Devices & Wearables

- Mobile Apps & Chat/Messaging

- Integration/Interoperability

By Delivery Model

- Provider-to-Patient Platforms

- Virtual-first Primary Care

- Payer-led Virtual Care

- Health System/Hub-and-Spoke Telehealth Networks

- Employer/Workplace Virtual Care Programs

By Payer

- Fee-for-Service Telehealth Reimbursement

- Value-Based/Capitated Programs

- Out-of-pocket/Cash-pay

- Employer-sponsored Direct Contracts/Subscription Models

By End-user

- General Acute Care/Adults

- Rural/Underserved Populations

- Pediatrics & Mate al Health

- Chronic Disease Patients

- Behavioral Health Patients

Drivers

The rising consumer demand for convenience and accessibility is driving the market.

The market for virtual health services is experiencing significant growth, primarily driven by a fundamental shift in consumer behavior toward convenience and accessibility. The traditional model of in-person medical care, with its associated travel time, wait times, and scheduling inflexibility, has become a major pain point for many patients. The desire for a more streamlined, on-demand healthcare experience has made remote consultations an increasingly attractive option.

Patients are now actively seeking out providers who offer the flexibility to receive care from the comfort of their homes or offices, which is a trend that was accelerated by the global health crisis. According to a study published in the journal BMC Health Services Research in February 2025, a significant percentage of American adults have utilized some form of telehealth. Specifically, 29% of all mental health visits and 21% of substance use disorder care in March 2023 were provided via telemedicine, highlighting its widespread integration and consumer acceptance, especially within behavioral health.

Restraints

The rising cybersecurity risks and data privacy concerns are restraining the virtual health service market.

A significant restraint on the market is the ever-present threat of cybersecurity risks and the associated data privacy concerns. Virtual health platforms transmit highly sensitive personal and medical data, making them a prime target for cybercriminals. A single breach can compromise millions of patient records, leading to severe financial penalties, lawsuits, and a catastrophic loss of patient trust. Healthcare providers and technology developers must invest heavily in robust security infrastructure to meet stringent regulatory requirements, which adds to operational costs.

The scale of the challenge is significant. As of the end of 2024, the U.S. Department of Health and Human Services (HHS) Office for Civil Rights (OCR) breach portal indicated that there were 588 large healthcare data breaches, a notable increase in the total number of individuals affected. These incidents impacted nearly 180 million individuals, underscoring a major vulnerability that restrains the market. Providers are hesitant to fully embrace digital platforms without absolute assurance of data security.

Opportunities

The expansion into chronic disease management and mental health is creating growth opportunities.

A key growth opportunity in the market lies in the expansion of its application into chronic disease management and specialized fields like mental and behavioral health. While initial adoption was focused on simple consultations for acute conditions, platforms are now evolving to provide continuous, long-term care.

For patients with chronic illnesses such as diabetes or hypertension, remote patient monitoring (RPM) allows physicians to track key health metrics in real time, enabling proactive interventions and personalized care plans. This proactive approach improves health outcomes and reduces the need for expensive emergency room visits. This is particularly impactful for mental health services, where access to care has traditionally been a major barrier.

The widespread acceptance of remote mental health sessions has fundamentally changed how patients seek and receive support. As of early 2024, 38% of Americans had used telehealth for medical or mental health needs, with a staggering 60% open to teletherapy for mental health support, highlighting a vast, untapped market eager for these specialized services.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly shape the virtual health service market. On one hand, persistent global inflation drives up the cost of technology hardware like cameras and sensors, forcing companies to increase prices or accept lower margins. The US Bureau of Labor Statistics (BLS) reported that medical care services in the US increased 4.3% for the 12-month period ending in July 2025, which underscores the inflationary pressure on input costs.

Geopolitical tensions, such as trade disputes or regional conflicts, can disrupt intricate supply chains for IT components and impact the security of cloud-based data hosting, which adds operational risk. This volatility exposes the inherent risks of a globally dispersed technology model, compelling companies to rethink their sourcing and data residency strategies. However, these challenges also create a positive ripple effect. They motivate companies to diversify their technology footprint and near-shore data centers to more stable, geographically proximate regions, ultimately building a more resilient and less vulnerable digital infrastructure.

The current landscape of US tariffs on imported goods and components presents a dual-sided challenge and opportunity for the virtual health market. On the negative side, tariffs on key components like computer chips and networking equipment from major manufacturing regions can directly increase the cost of building platforms and providing patient monitoring kits. This price hike can make their services less competitive in the domestic market and make it difficult to scale operations.

A review of US import data from the US International Trade Commission (USITC) shows that in 2023, the US imported US$591.7 billion in electronic products, a significant portion of which includes key components for virtual health technology. However, these same tariffs can also be a positive catalyst. They encourage foreign technology partners to relocate or expand their operations to the US to avoid tariffs, thereby stimulating domestic job growth and innovation. This creates a more robust local supply base, ultimately strengthening the US health technology ecosystem.

Latest Trends

The integration of artificial intelligence for enhanced diagnostics and care is a recent trend.

A defining trend in 2024 is the accelerated integration of artificial intelligence (AI) and machine learning for enhanced diagnostics and personalized care. This innovation is transforming how healthcare is delivered by enabling software to analyze medical images, patient data, and health records to provide rapid, accurate diagnoses and create automated, tailored treatment plans. AI algorithms can triage patients more efficiently, flag potential health risks, and even predict the onset of certain conditions, which makes care more proactive and effective.

The rapid pace of this technological shift is reflected in intellectual property trends. A report analyzing patent filings found that medical-related patents saw a significant increase in 2024, rising to 53,648 from 30,429 in 2023, with AI-driven drug discovery and diagnostic applications leading the surge. This rise in patenting activity demonstrates the strong industry commitment to AI as a core component of future healthcare solutions. This technological advancement is improving clinical outcomes and setting a new standard for patient care.

Regional Analysis

North America is leading the Virtual Health Service Market

The North American virtual health service market held a commanding 42.5% share of the global market in 2024. This leadership is directly attributed to the region’s advanced digital infrastructure, supportive government policies, and a high consumer demand for convenient and accessible healthcare. A key driver of this growth is the sustained adoption of virtual care models by both patients and providers.

According to data from the Centers for Medicare & Medicaid Services (CMS), the utilization of telehealth services by Medicare beneficiaries remained high in 2024, a trend that was accelerated by policy changes during the public health emergency. This widespread adoption is further supported by significant private sector investment in innovative technologies and the integration of these services into mainstream care.

Furthermore, a 2022 report from the American Medical Association found that nearly three-quarters of physicians in the US were utilizing telehealth in their practices, a figure that is a nearly three-fold increase from just four years prior, demonstrating a clear and lasting shift in the delivery of care.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific virtual health service market is anticipated to experience robust growth during the forecast period. This is largely a result of a rapidly expanding healthcare sector, increasing government initiatives to improve access to care in remote and rural areas, and a vast, tech-savvy population. The market’s expansion is further supported by the substantial investment in digital health infrastructure by regional governments.

In India, for instance, the Ayushman Bharat Digital Mission is actively creating a nationwide digital health ecosystem, and as of late 2024, has successfully created over 730 million Ayushman Bharat Health Accounts, which serve as unique identifiers for citizens to access and share health records digitally. This kind of government backing is likely to fuel a rapid expansion of the market by encouraging both domestic and international companies to invest in the region and increase the number of citizens and healthcare providers participating in these sophisticated digital platforms.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the virtual health service market are driving growth by strategically integrating technologies like artificial intelligence and machine learning to improve data analytics and patient care. They are also heavily engaged in mergers and acquisitions and forming strategic partnerships to expand their portfolios and gain access to new therapeutic areas and market segments. Companies are further focusing on developing comprehensive, scalable platforms that can be easily adopted by a wide range of healthcare providers, from large hospital systems to individual clinics. This combination of innovation and business development is crucial for maintaining a competitive edge.

Teladoc Health, a multinational telemedicine company, has solidified its position as a leading innovator in this sector. The company’s business model is centered on a comprehensive virtual care platform that covers a wide spectrum of health needs, from general wellness and prevention to chronic condition management and mental health. Teladoc’s strategy involves leveraging its broad service offering to create an integrated ecosystem that serves individuals, employers, and health systems. The company’s focus on whole-person care and its robust acquisition strategy have solidified its role as a foundational partner for advancing digital health solutions globally.

Top Key Players

- UnitedHealth Group

- Teladoc Health

- MDLive

- McKesson Corp

- Kaiser Permanente

- CVS Health Payor Solution

- Cigna Healthcare

- Cardinal Health

- Babylon Health

- Amwell

Recent Developments

- In June 2024, CVS Health Payor Solution introduced VirtualCare Connect, a new digital platform combining telemedicine, remote patient monitoring, and wellness programs to enhance care coordination and lower costs for patients and providers.

- In May 2024, McKesson Corp expanded its digital health capabilities by acquiring HealthNet Solutions, a telehealth-focused company, strengthening its reach in virtual care services and technology integration.

- In April 2024, Cardinal Health launched the VirtualHealth Suite, a cloud-based system designed to help healthcare providers manage virtual consultations, patient information, and electronic records more efficiently.

- In March 2024, Cigna Healthcare completed a merger with TeleCare Inc., joining resources to deliver advanced virtual care services, including telehealth visits, digital therapeutics, and remote monitoring solutions.

Report Scope

Report Features Description Market Value (2024) US$ 10.7 Billion Forecast Revenue (2034) US$ 80.1 Billion CAGR (2025-2034) 22.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Service Type (Synchronous Virtual Visits, Virtual Urgent Care & On-demand Telehealth, Virtual Specialty Care, Virtual Chronic Care Management, Telebehavioral/Telepsychiatry, Remote Patient Monitoring (RPM), and Asynchronous/Store-and-Forward Consults), By Technology (Video & Voice Communication, Remote Monitoring Devices & Wearables, Mobile Apps & Chat/Messaging, and Integration/Interoperability), By Delivery Model (Provider-to-Patient Platforms, Virtual-first Primary Care, Payer-led Virtual Care, Health System/Hub-and-Spoke Telehealth Networks, and Employer/Workplace Virtual Care Programs), By Payer (Fee-for-Service Telehealth Reimbursement, Value-Based/Capitated Programs, Out-of-pocket/Cash-pay, and Employer-sponsored Direct Contracts/Subscription Models), By End-user (General Acute Care/Adults, Rural/Underserved Populations, Pediatrics & Mental Health, Chronic Disease Patients, and Behavioral Health Patients) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape UnitedHealth Group, Teladoc Health, MDLive, McKesson Corp, Kaiser Permanente, CVS Health Payor Solution, Cigna Healthcare, Cardinal Health, Babylon Health, Amwell. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Virtual Health Service MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Virtual Health Service MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- UnitedHealth Group

- Teladoc Health

- MDLive

- McKesson Corp

- Kaiser Permanente

- CVS Health Payor Solution

- Cigna Healthcare

- Cardinal Health

- Babylon Health

- Amwell