Global Virtual Entertainment Market Size, Share, Statistics Analysis Report By Form (Video, Audio, Games, Internet Radio, Others), By Revenue Model (Subscription, Advertisement, Sponsorship, Others), By Device (Smartphones, Smart TVs, Projectors and Monitors, Laptop, Desktop and Tablets, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 141640

- Number of Pages: 211

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- U.S. Virtual Entertainment Market

- Analysts’ Viewpoint

- Form Analysis

- Revenue Model Analysis

- Device Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

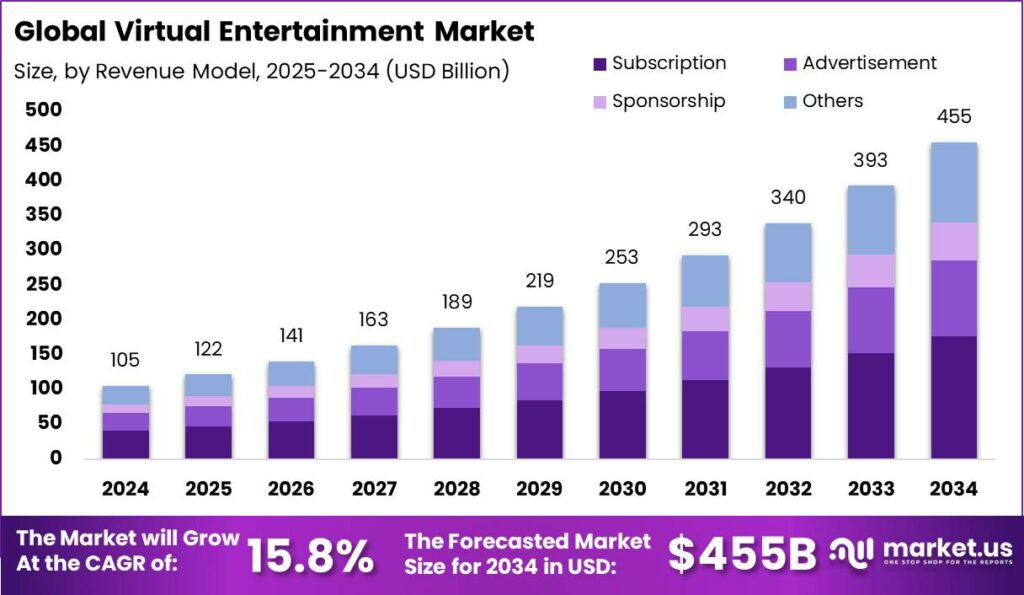

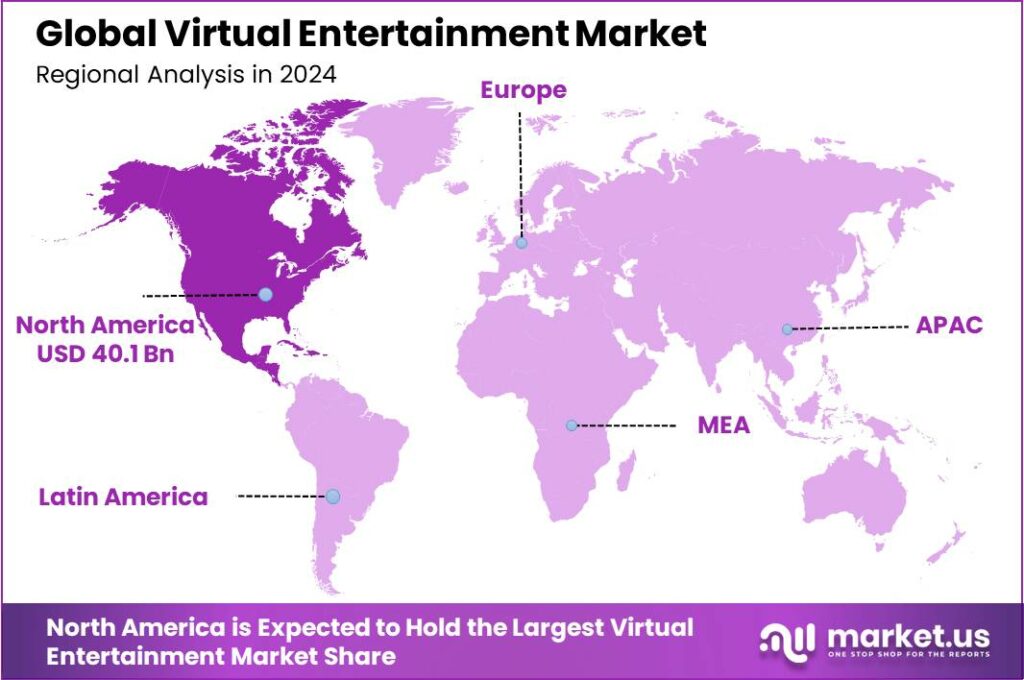

The Global Virtual Entertainment Market size is expected to be worth around USD 455 Billion By 2034, from USD 105 Billion in 2024, growing at a CAGR of 15.80% during the forecast period from 2025 to 2034. North America held a dominant position in the market, capturing over 38.2% share with revenues of USD 40.1 billion. In 2024, the U.S. Virtual Entertainment Market was valued at USD 32.08 billion, with a projected CAGR of 13.2%.

Virtual Entertainment, particularly through Virtual Reality (VR), allows users to engage with a computer-generated environment in a way that simulates reality. This immersive technology leverages devices like VR headsets, gloves, and body suits to create sensory-rich experiences. Users can manipulate objects, move around in a simulated space, and even interact with virtual features, making them active participants rather than passive observers.

The Virtual Entertainment Market is rapidly expanding, driven by technological advancements and increasing consumer demand for immersive experiences. This market encompasses a variety of segments, including gaming, concerts, and virtual tours of historical sites or museums. Innovations in VR hardware, such as more sophisticated headsets and sensory feedback gloves, continue to enhance the user experience, making virtual environments more realistic and engaging.

Several key factors propel the growth of the Virtual Entertainment Market. The desire for unique and immersive experiences is a major driver, as consumers seek new forms of entertainment beyond traditional media. Technological advancements that improve the quality and accessibility of VR devices also play a crucial role.

The demand for virtual entertainment is influenced by consumer interest in novel and expansive experiences that go beyond the capabilities of traditional media. Younger demographics, particularly those familiar with digital technologies, are the primary market drivers.

Key Takeaways

- The Global Virtual Entertainment Market size is expected to be worth around USD 455 Billion by 2034, up from USD 105 Billion in 2024, growing at a CAGR of 15.80% during the forecast period from 2025 to 2034.

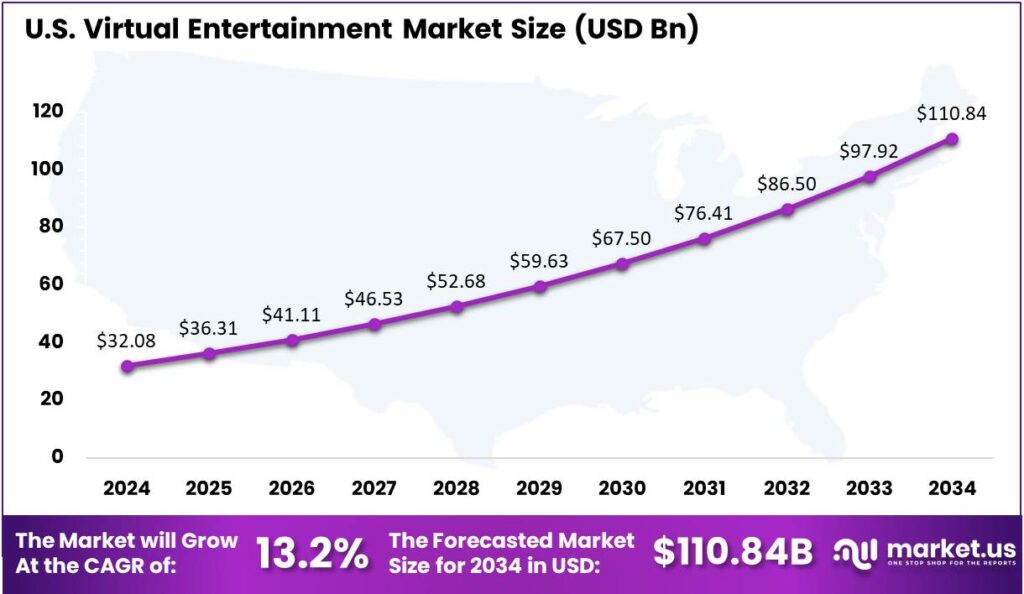

- In 2024, the U.S. Virtual Entertainment Market was estimated to have a valuation of USD 32.08 billion, with a projected expansion at a CAGR of 13.2%.

- In 2024, North America held a dominant position in the Virtual Entertainment Market, capturing more than a 38.2% share with revenues amounting to USD 40.1 billion.

- In 2024, the Games segment held a dominant position in the virtual entertainment market, capturing more than a 41.66% share.

- In 2024, the Subscription segment held a dominant position in the virtual entertainment market, capturing more than a 38.8% share.

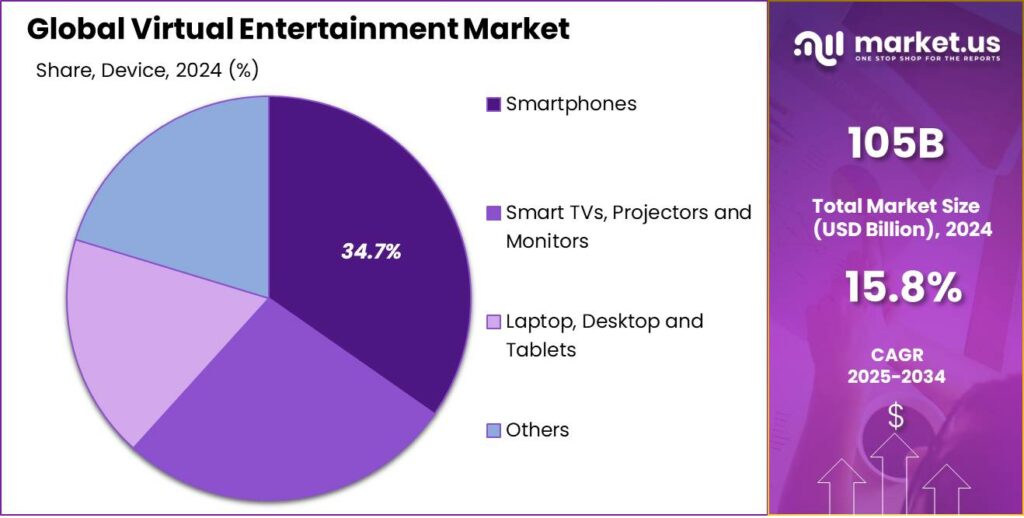

- In 2024, the Smartphones segment held a dominant market position in the Virtual Entertainment Market, capturing more than a 34.7% share.

U.S. Virtual Entertainment Market

In 2024, the U.S. Virtual Entertainment Market was estimated to have a valuation of USD 32.08 billion. The market is projected to expand at a compound annual growth rate (CAGR) of 13.2%.

This significant growth is driven by factors such as technological advancements, rising consumer demand for immersive experiences, and wider access to VR and AR technologies. The expansion of high-speed internet and the increase in connected devices have also contributed to the market’s growth. Additionally, large investments from major tech companies in VR and AR development are expected to accelerate this expansion.

The virtual entertainment sector is becoming increasingly diverse, encompassing a wide range of activities such as virtual concerts, online gaming, VR-based fitness programs, and immersive educational experiences. As these technologies continue to evolve, the market is expected to see new applications emerge, potentially transforming how consumers interact with digital content.

In 2024, North America held a dominant position in the Virtual Entertainment Market, capturing more than a 38.2% share with revenues amounting to USD 40.1 billion. This leadership can be primarily attributed to the region’s robust technological infrastructure and the rapid adoption of new technologies by both consumers and enterprises.

Furthermore, North America benefits from a highly engaged consumer base with a strong propensity for adopting digital entertainment solutions, ranging from streaming services to interactive gaming platforms. The integration of virtual reality into various entertainment verticals, such as video gaming, live events, and even online education, has been swift and extensive.

The region’s advanced economic development coupled with high disposable incomes also allows for greater expenditure on non-essential goods and services, including virtual entertainment. Educational institutions and corporate entities in North America are increasingly utilizing virtual and augmented reality for training and development purposes, further expanding the market’s scope.

Analysts’ Viewpoint

Investment in the Virtual Entertainment sector is robust, with significant opportunities in content creation, platform development, and hardware innovation. Investors are particularly interested in companies that are pushing the boundaries of VR technology to create more immersive and interactive experiences. Additionally, ventures that integrate AI with VR to produce dynamic and responsive virtual environments are attracting considerable investment attention.

Recent technological advancements have significantly enhanced the quality and immersion of virtual entertainment. Developments in high-definition VR headsets, improved motion tracking, and advanced haptic feedback systems create more lifelike experiences. Software innovations, such as real-time environment rendering and AI-driven interactive elements, are making virtual worlds more detailed and responsive to user actions.

The regulatory landscape for Virtual Entertainment is still evolving, with considerations around user safety, data privacy, and content standards at the forefront. Governments and regulatory bodies are increasingly focusing on setting guidelines that ensure a safe and equitable virtual space, addressing issues such as motion sickness, privacy breaches, and the psychological impacts of long-term VR usage.

Form Analysis

In 2024, the Games segment held a dominant position in the virtual entertainment market, capturing more than a 41.66% share. This prominence can be attributed to the widespread popularity of gaming across various demographic groups globally.

The success of the Games segment is fueled by ongoing technological advancements, such as cloud gaming, improved graphics, and interactive gameplay, enhancing the gaming experience. The integration of AR and VR has further expanded the market, offering more immersive experiences. These innovations attract a broader audience and drive higher spending on gaming content and hardware.

The growth of mobile gaming, fueled by widespread smartphone adoption, has become a major contributor to the gaming industry. It appeals to casual gamers and enhances the segment’s revenue by offering the convenience of playing anytime, anywhere, expanding the consumer base for virtual entertainment.

The Games segment thrives thanks to significant investments from tech companies and developers focused on innovation to attract global gamers. Investments in new games, updates, and expansions strengthen the gamer community. Strategic partnerships create diverse, high-quality content, enhancing market dynamics and solidifying the segment’s dominance in virtual entertainment.

Revenue Model Analysis

In 2024, the Subscription segment held a dominant position in the virtual entertainment market, capturing more than a 38.8% share. This model’s prevalence is primarily due to its consistent revenue stream and consumer preference for uninterrupted, ad-free experiences.

The subscription model fosters customer loyalty through ongoing payments, encouraging regular use and engagement. This consistent interaction gives companies valuable data on user preferences, allowing for personalized content and improved retention rates.

The subscription model is enhanced by AI and machine learning, which personalize content to improve user experiences. This leads to higher satisfaction and increased subscription renewals. Tailored experiences help platforms stand out in a competitive market, where user engagement is key to revenue success.

The global shift to digital platforms has boosted the appeal of subscription services. As consumers prefer on-demand content, the growth of subscriptions continues, supported by wider internet access and mobile devices that enable high-quality virtual entertainment, making subscriptions more accessible and ensuring their dominance in the sector.

Device Analysis

In 2024, the Smartphones segment held a dominant market position in the Virtual Entertainment Market, capturing more than a 34.7% share. This segment’s leadership is primarily driven by the widespread availability and ubiquitous use of smartphones globally.

Smartphones, with enhanced processing power and richer displays, have become the go-to device for virtual entertainment, including gaming, VR, and media streaming. The development of mobile VR apps and AR tools has further established smartphones as a dominant platform in this space.

Another key factor contributing to the dominance of the smartphone segment is the continuous innovation in mobile technology, including faster data connectivity, improved graphics, and larger, more immersive screens. These advancements make smartphones an increasingly effective platform for delivering high-quality virtual entertainment experiences.

Smartphones also benefit from their portability, allowing users to engage with virtual entertainment on the go. This convenience boosts user engagement, enabling easy access to virtual content anytime, anywhere, driving market growth. Advanced sensors and cameras also support augmented reality experiences directly on smartphones.

Key Market Segments

By Form

- Video

- Audio

- Games

- Internet Radio

- Others

By Revenue Model

- Subscription

- Advertisement

- Sponsorship

- Others

By Device

- Smartphones

- Smart TVs, Projectors and Monitors

- Laptop, Desktop and Tablets

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Advancements in Immersive Technologies

The virtual entertainment industry is experiencing significant growth, primarily driven by continuous advancements in immersive technologies such as virtual reality (VR) and augmented reality (AR). These technologies have evolved to offer more realistic and interactive experiences, enhancing user engagement across various entertainment platforms.

The integration of high-definition visuals, spatial audio, and haptic feedback has transformed traditional entertainment mediums, allowing users to immerse themselves fully in virtual environments. For instance, the gaming sector has seen a surge in VR-based games that provide players with lifelike experiences, thereby increasing the demand for VR headsets and related accessories.

Restraint

Privacy and Data Security Concerns

Another significant restraint in the virtual entertainment industry is the growing concern over privacy and data security. Immersive technologies often require the collection of extensive user data to function effectively, including personal preferences and biometric information. Instances of data breaches or misuse of personal information can erode consumer trust in immersive technologies.

High-profile incidents can lead to skepticism and reluctance to adopt this form of entertainment. Violating privacy regulations can lead to legal consequences and damage a company’s reputation. The negative fallout from privacy-related incidents can have lasting effects. High-quality VR headsets, motion sensors, and other peripherals often come with substantial price tags, making them less accessible to average consumers.

Opportunity

Expansion into Emerging Markets

The virtual entertainment industry has a significant opportunity to expand into emerging markets, where increasing internet penetration and smartphone adoption are opening new avenues for growth. Regions such as Southeast Asia, Africa, and Latin America have seen a rapid rise in digital infrastructure development, making them ripe for virtual entertainment offerings.

By tailoring content to local cultures and preferences, virtual entertainment companies can tap into these burgeoning markets, fostering global expansion and diversification. Additionally, embracing regional partnerships and collaborations with local creators can further enhance authenticity, increase engagement, and create a more loyal customer base, ultimately leading to sustained growth in new markets.

Challenge

Regulatory and Standardization Issues

The virtual entertainment industry faces challenges related to regulatory compliance and the lack of standardization across platforms. Different regions have varying regulations concerning content, data privacy, and user safety, making it complex for companies to offer uniform services globally.

For example, the Chinese government has implemented strict regulations to protect minors from excessive gaming, limiting online gaming for minors to only three hours per week. Additionally, the absence of standardized technologies and protocols can lead to compatibility issues, hindering seamless user experiences.

Emerging Trends

Virtual entertainment is undergoing a transformative evolution, integrating advanced technologies to offer immersive and interactive experiences. A notable trend is the rise of virtual influencers and performers. Fans, predominantly in their late teens and 20s, displayed high engagement, dressing in themed apparel and cosplay.

The integration of artificial intelligence (AI) in virtual reality (VR) is another significant development. AI-powered VR experiences analyze user behavior and preferences, adapting virtual environments to individual needs, creating dynamic and responsive virtual worlds.

The concept of the metaverse is also gaining traction, blending virtual and real worlds to create immersive shared experiences. Platforms like Horizon Worlds enable users to create avatars and explore user-generated virtual spaces, facilitating social interactions, entertainment, and collaborative projects.

Additionally, virtual concerts have become a mainstream phenomenon. Artists such as Travis Scott and Ariana Grande have performed in virtual settings within video games like Fortnite, attracting millions of viewers and demonstrating the potential of virtual platforms to host large-scale events.

Business Benefits

One significant benefit is enhanced customer engagement. Virtual reality (VR) and augmented reality (AR) technologies enable businesses to provide immersive experiences, allowing customers to interact with products or services in a simulated environment. This interactive approach can lead to increased customer satisfaction and brand loyalty.

Another advantage is the potential for cost savings. For instance, VR can streamline product design by allowing companies to design, prototype, and test new products without the expense of creating physical models, significantly reducing time to market and enabling a more agile approach.

Virtual entertainment also facilitates improved collaboration among teams, especially in remote work settings. VR platforms can create virtual meeting spaces where employees can interact in real-time, fostering a sense of presence and enhancing teamwork.

Additionally, businesses can leverage virtual entertainment for training and education purposes. Immersive simulations can provide employees with hands-on experience in a controlled environment, improving learning outcomes and reducing the risks associated with real-world training scenarios.

Key Player Analysis

Amazon Web Services (AWS) is a giant in the virtual entertainment space, offering a wide array of cloud computing services that power everything from video streaming platforms to game servers. AWS is a backbone for many businesses in the entertainment industry, providing scalable and reliable infrastructure.

Charter Communications Inc., under its Spectrum brand, is a major force in broadband internet and cable services. In the virtual entertainment industry, Charter is known for offering high-speed internet that is essential for seamless streaming, gaming, and other digital entertainment activities.

Comcast is a global leader in telecommunications and media, with a strong presence in the virtual entertainment market. Through its Xfinity brand, Comcast offers broadband internet, television, and streaming services, including its popular Peacock platform. Comcast’s diverse portfolio and its focus on integrating traditional cable services with modern streaming solutions have made it a key player in the industry.

Top Key Players in the Market

- Amazon Web Services Inc. (Amazon.com Inc.)

- Charter Communications Inc.

- Comcast Corporation

- Google LLC (Alphabet Inc.)

- King.com Limited (Activision Blizzard Inc.)

- Meta Platforms Inc.

- Netflix Inc.

- Rakuten Group Inc.

- Sony Pictures Networks India Pvt. Ltd. (Sony Corporation)

- Spotify AB

- The Walt Disney Company

- Ubisoft Entertainment SA

- Others

Top Opportunities Awaiting for Players

- Expansion of Live Streaming Technologies: The proliferation of live streaming has transformed audience engagement, making it a lucrative area for growth. This technology allows for real-time interaction during events and performances, enhancing viewer participation and satisfaction.

- Growth in Experiential Entertainment: There is increasing demand for immersive and interactive experiences such as virtual concerts and other location-based entertainment. These ventures offer substantial revenue opportunities through ticket sales and food and beverage services. Intellectual property owners can leverage these platforms to expand their brand engagement without significant capital expenditure.

- Rise of the Metaverse and Immersive Platforms: As virtual reality (VR) technology continues to mature, the concept of the metaverse is becoming a reality, providing new ways for socializing, gaming, and professional collaboration. This trend presents opportunities for creating immersive experiences that merge physical and digital realities.

- Increased Adoption of OTT and Streaming Services: Over-the-top (OTT) platforms are reshaping media consumption, offering tailored viewing experiences to a global audience. The shift towards personalized, on-demand content allows for direct consumer engagement and opens up new revenue models through subscription services and targeted advertising.

- Utilization of Artificial Intelligence in Content Creation: AI and machine learning are revolutionizing content creation, making it possible to generate personalized content at scale. These technologies enable more efficient production processes and innovative storytelling techniques, which can attract a broader audience.

Recent Developments

- In June 2024, Sony Pictures acquired Alamo Drafthouse Cinema, marking the first time in over 75 years that a major Hollywood studio owns a theater chain. This acquisition reflects Sony’s strategy to integrate film production with direct exhibition avenues.

- In July 2024, Amazon acquired Bray Film Studios, an award-winning film production company, to strengthen its original content production capabilities for Prime Video.

Report Scope

Report Features Description Market Value (2024) USD 105 Bn Forecast Revenue (2034) USD 455 Bn CAGR (2025-2034) 15.80% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Form (Video, Audio, Games, Internet Radio, Others), By Revenue Model (Subscription, Advertisement, Sponsorship, Others), By Device (Smartphones, Smart TVs, Projectors and Monitors, Laptop, Desktop and Tablets, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amazon Web Services Inc. (Amazon.com Inc.), Charter Communications Inc., Comcast Corporation, Google LLC (Alphabet Inc.), King.com Limited (Activision Blizzard Inc.), Meta Platforms Inc., Netflix Inc., Rakuten Group Inc., Sony Pictures Networks India Pvt. Ltd. (Sony Corporation), Spotify AB, The Walt Disney Company, Ubisoft Entertainment SA, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Virtual Entertainment MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Virtual Entertainment MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amazon Web Services Inc. (Amazon.com Inc.)

- Charter Communications Inc.

- Comcast Corporation

- Google LLC (Alphabet Inc.)

- King.com Limited (Activision Blizzard Inc.)

- Meta Platforms Inc.

- Netflix Inc.

- Rakuten Group Inc.

- Sony Pictures Networks India Pvt. Ltd. (Sony Corporation)

- Spotify AB

- The Walt Disney Company

- Ubisoft Entertainment SA

- Others