Global Vessel Sealing Devices Market by Type (Continuous Positive Airways Pressure Devices, Enteral Feeding Pump, External Heat Pump, and Others), By End-User (Hospitals, Clinics, Trauma Centers, Ambulatory Surgical Centers), and by Region and Companies Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 84261

- Number of Pages: 295

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

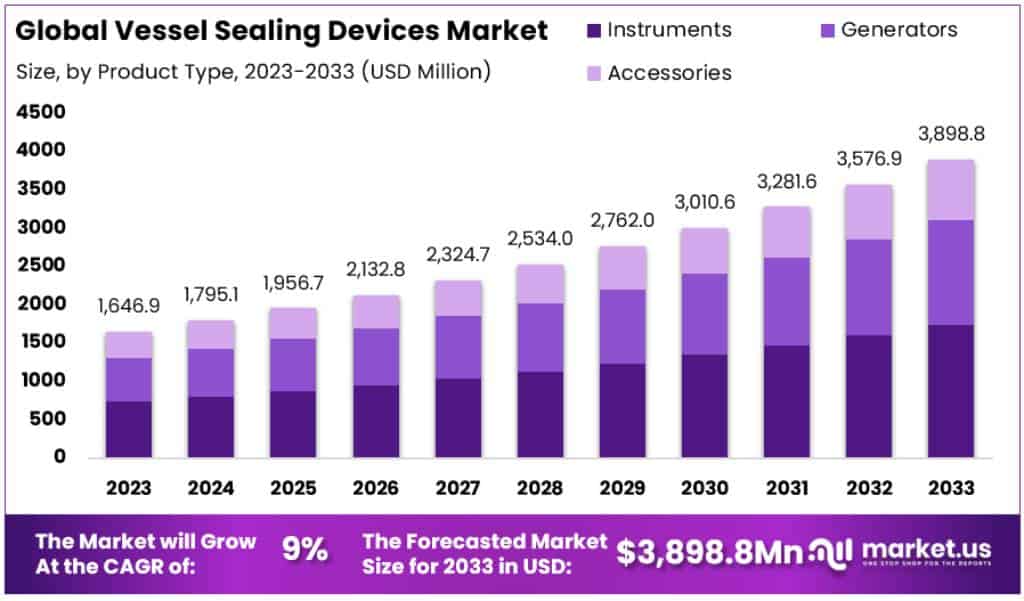

The Global Vessel Sealing Devices Market size is expected to be worth around USD 3898.8 Million by 2033, from USD 1646.9 Million in 2023, growing at a CAGR of 9% during the forecast period from 2023 to 2033.

Vessel sealing devices are surgical instruments used to seal blood vessels during various medical and veterinary procedures. These devices are designed to provide consistent hemostasis and minimize blood loss during operations. There are different kinds of these devices, like mechanical staplers, energy-based staplers, and clips. Each kind works in its own way and has its own pros and cons.

These devices are really helpful in surgeries because they can lower the chances of patients getting infections after the operation. They do this by using heat or energy to seal the blood vessels, which keeps out bacteria and stops bleeding. Research has shown that these devices really help in reducing infections after surgery.

People are using vessel sealing devices more and more because they have lots of benefits. They can help keep a vessel safe and easy to find and fix if there’s an emergency or a leak.

Compared to traditional ways of stitching up wounds, vessel sealing devices are much better in several ways. They’re faster and easier to use, less likely to cause bleeding or bruising, and more precise.

Key Takeaways

- The Vessel Sealing Devices Market is projected to reach approximately USD 3,898.8 million by 2033, up from USD 1,646.9 million in 2023.

- This represents a Compound Annual Growth Rate (CAGR) of 9% from 2023 to 2033.

- In 2023, Instruments dominated the market, capturing over 44.8% market share.

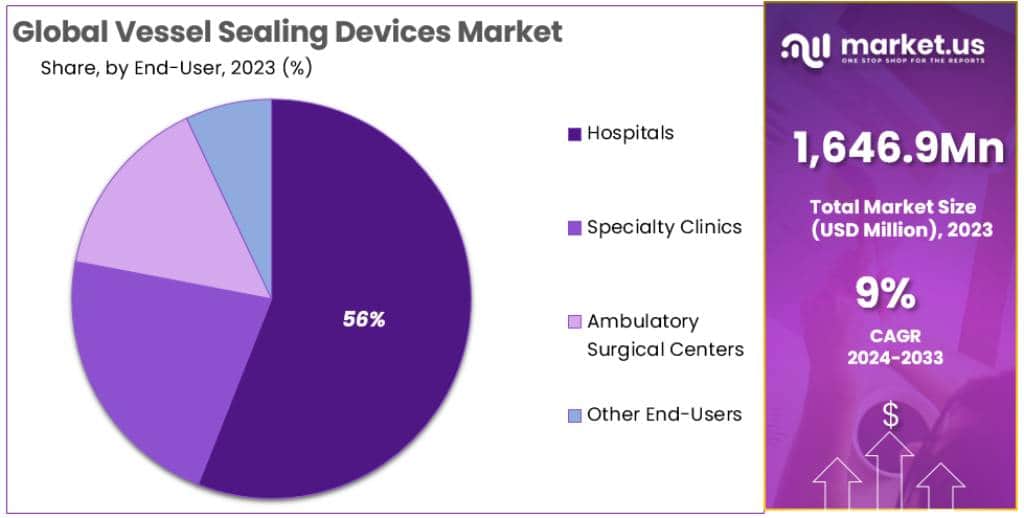

- Hospitals are the primary end-users, accounting for more than 56% market share in 2023.

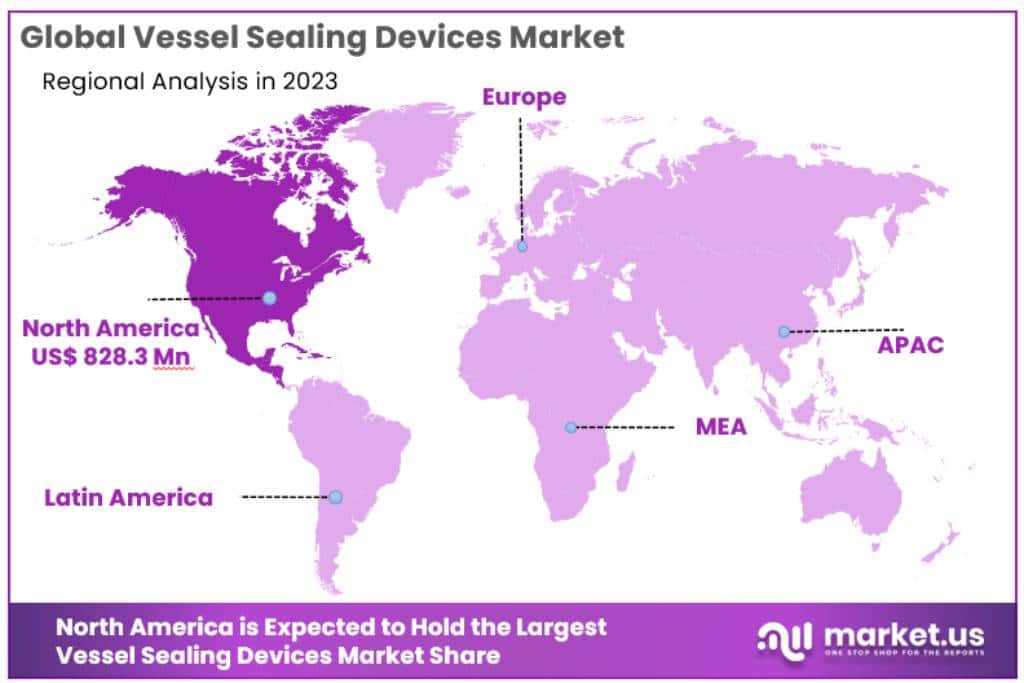

- North America dominates the market with a 50.3% share in 2023, followed by Europe, Asia-Pacific, and other regions.

Product Type Analysis

Under the Product Type segment in 2023, Instruments held a dominant market position, capturing more than a 44.8% share. This segment’s lead can be attributed to several key factors. First, the rising demand for advanced surgical instruments that offer precision and efficiency in complex procedures. These instruments are integral in surgeries, especially those requiring meticulous tissue sealing and cutting.

Generators, as another product type, also play a crucial role in the vessel sealing devices market. They provide the necessary power and control for the instruments, making them indispensable in surgical settings. However, their market share is slightly overshadowed by the instruments, primarily due to the higher unit costs and longer replacement cycles.

The Accessories segment, comprising various supplementary items used alongside generators and instruments, holds a significant portion of the market. While individually less expensive, the recurrent need for these accessories in surgical procedures sustains their demand. This segment’s growth is further bolstered by the continuous development of more compatible and user-friendly accessories.

Application Analysis

Under the Application segment in 2023, Laparoscopic Surgery held a dominant market position, capturing more than a 63.7% share. This prominence is primarily due to the increasing preference for minimally invasive surgeries. Laparoscopic procedures, known for their reduced recovery time and minimal post-operative complications, have gained significant traction in recent years.

General Surgery, another key application area, also constitutes a substantial portion of the market. The broad range of procedures falling under this category, from appendectomies to hernia repairs, ensures a consistent demand for vessel sealing devices. However, the shift towards less invasive techniques has slightly moderated its market share compared to Laparoscopic Surgery.

Gynecology Surgery, involving procedures like hysterectomies and ovarian cyst removals, is another significant application area. Vessel sealing devices play a crucial role in these surgeries, offering precision and reduced blood loss. While this segment holds a notable market share, it is somewhat limited by the specialized nature of these procedures.

Urological Surgery, focusing on the urinary tract and male reproductive organs, also utilizes vessel sealing devices. Their adoption in this field is driven by the need for precision in delicate surgeries. Despite its importance, this segment’s market share is smaller compared to Laparoscopic and General Surgeries, owing to the specific and less frequent nature of these procedures.

Other Applications, encompassing various niche surgical areas, collectively form a smaller yet vital part of the market. These diverse applications highlight the versatility of vessel sealing devices across different medical fields.

End-User Analysis

Under the End-User segment in 2023, Hospitals held a dominant market position, capturing more than a 56% share. This significant share is attributed to the comprehensive range of surgical procedures performed in hospitals, combined with their capacity to invest in advanced medical technologies. Hospitals are often the primary settings for both emergency and planned surgeries, necessitating a steady supply of vessel-sealing devices.

Specialty Clinics, focusing on specific types of surgeries or patient groups, also form a crucial part of the market. While their share is smaller compared to hospitals, their specialized nature often means a higher usage rate of vessel sealing devices for targeted procedures. These clinics are typically known for providing focused care, which drives their need for specialized surgical equipment.

Ambulatory Surgical Centers (ASCs) have been gaining ground, offering a convenient and cost-effective alternative for surgeries that don’t require hospital admission. Their market share is reflective of the growing trend towards outpatient surgical procedures, where efficiency and quick turnaround are key. ASCs, with their focus on minimally invasive surgeries, increasingly adopt vessel-sealing devices.

Other end users, including small clinics and outpatient facilities, collectively hold a smaller portion of the market. These settings often deal with less complex surgeries, limiting their usage of advanced vessel sealing devices compared to hospitals and specialized centers.

Key Market Segments

Product Type

- Generators

- Instruments

- Accessories

Application

- General Surgery

- Laparoscopic Surgery

- Gynecology Surgery

- Urological Surgery

- Other Applications

End-User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Other End-Users

Drivers

- Increasing Surgical Procedures: The vessel sealing devices market is thriving due to a rise in surgeries. In 2020 World Journal study reported that, an estimated 5,000 surgeries needed per 100,000 people in low- and middle-income countries. High-income countries see up to 23,000 surgeries per 100,000 people. This surge in surgical needs drives demand for vessel sealing devices.

- Preference for Minimally Invasive Surgeries: Minimally invasive procedures, like laparoscopic surgeries, are becoming more popular due to their reduced recovery times and lower complication rates. The World Health Organization noted that about 354 million people were affected by chronic hepatitis in 2022, often treated with these surgeries, indicating a growing market for vessel sealing devices.

- Technological Advancements: Innovations in medical devices, like Bolder Surgical’s CoolSeal Vessel Sealing platform, enhance surgery safety and effectiveness. These advancements are key market drivers, offering reliable and efficient options for reducing blood loss and infection rates.

Restraints

- Complications and Risks: Issues with vessel sealing devices, such as the risk of lateral thermal energy spread, pose challenges. This can damage critical tissues and organs, limiting device usage. Additionally, the high cost and maintenance of these devices can be a deterrent.

- Lack of Training: Surgeons’ unfamiliarity with these advanced devices can lead to increased risk during surgeries, potentially harming patients and staff.

Opportunities

- Development in Dense Tissue Handling: Companies like Medtronic are innovating in hemostasis methods, like LigaSure’s flat coagulation, to manage dense tissues effectively. This opens new possibilities in surgeries requiring precise vessel sealing.

- Minimally Invasive Internal Patching: NTU’s development of electrically activated glue patches for blood vessel defects offers a less invasive alternative to open surgery, presenting a novel market opportunity.

- Expansion to Pediatric Surgery: Devices like CoolSealTM Vessel-sealing, designed for pediatric patients, show market potential for age-diverse patient care, meeting a broader range of surgical needs.

Challenges

- Economic Impacts of COVID-19: The pandemic led to a decline in surgeries and disrupted supply chains, impacting the market. The British Journal of Surgery in 2020 noted around 28 million canceled or postponed surgeries, affecting device sales.

- Market Accessibility: The high cost and specialized nature of these devices make them less accessible in certain regions, especially in lower-income areas, posing a challenge for market expansion.

Trends

- Laparoscopic Surgery Dominance: With the increasing number of laparoscopic surgeries worldwide and their proven safety and efficiency, this segment is leading the market. Studies like the one in Surgical Innovation (June 2021) validate the superiority of vessel sealing devices in these procedures.

- Rise in Minimally Invasive Procedures: The growing demand for less invasive surgeries is significantly influencing the vessel sealing devices market. This trend aligns with the global increase in chronic diseases, requiring surgeries with minimal recovery time and less post-operative pain.

Regional Analysis

North America’s Market Leadership

In 2023, North America dominates the vessel sealing devices market with a remarkable 50.3% share, amounting to USD 828.3 million. This dominance is primarily due to the presence of leading companies and advanced hospitals in the U.S. and Canada. The region’s market strength is further bolstered by high healthcare spending and a series of product launches by major market players. For instance, in June 2021, Johnson and Johnson’s Ethicon launched ENSEAL X1 Curved Jaw Tissue Sealer, enhancing surgical options in the region. The growing number of surgeries, heightened awareness of advanced surgical technologies, and FDA approvals for new devices further contribute to North America’s leading position.

Europe’s Steady Growth

Europe’s market is projected to grow at a CAGR of 4.26% during the forecast period. Germany stands out due to an aging population and increasing surgical procedures. In 2019, Germany alone performed 17.2 million surgeries, including intestinal and endoscopic surgeries. The rising number of organ transplants and surgical procedures, coupled with a growing geriatric population, is propelling the market forward in Europe.

Asia-Pacific’s Rapid Expansion

Asia-Pacific is anticipated to witness significant growth, with Japan being a notable contributor. The Japanese market is bolstered by a developed healthcare infrastructure and a high number of hospitals. In 2019, Japan reported 231,457 facial surgeries, indicating a well-established market for vessel sealing devices. The expected increase in surgical procedures in the region further adds to the market’s potential.

Middle East’s Emerging Market

The GCC region, comprising Saudi Arabia, Kuwait, Bahrain, Qatar, the UAE, and Oman, is seeing a surge in cosmetic procedures. In 2018, about 5.6 million Arabs sought information on cosmetic surgeries, and Dubai reported approximately 26,000 surgeries. This growing interest in surgical procedures is driving the demand for vessel-sealing devices in the Middle East.

Brazil’s Promising Market

Brazil’s market for vessel sealing devices is set to grow healthily. Known as a destination for medical tourism, Brazil’s increasing number of cosmetic surgeries, including 1,493,673 procedures in 2019, highlights the crucial role of vessel-sealing devices in laparoscopic surgeries.

Key Regions and Countries

North America

- The US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The vessel sealing devices market is characterized by moderate competition, encompassing a diverse array of significant players. These key players are actively engaged in strategic initiatives such as product innovation, distribution network expansion, and enhancing their global presence through subsidiaries and partnerships. Additionally, they focus on diversifying their portfolios and pursuing mergers and acquisitions to strengthen their market positions.

Among these players, Medtronic plc stands out with a dominant share in the advanced energy market, approximately 60%, particularly in the RF segment. This is attributed to their comprehensive product offerings like the LigaSure Vessel Sealing Instruments. Medtronic is also aiming to expand its presence in the ultrasonic market.

Ethicon US LLC, a Johnson & Johnson company, also plays a pivotal role in the market. In June 2021, they introduced the ENSEAL X1 Curved Jaw Tissue Sealer, an advanced bipolar energy device designed to enhance procedural efficiency, provide stronger sealing, and allow better access to tissue.

Bolder Surgical made a notable contribution to the market in January 2021 by launching the CoolSeal Vessel Sealing Platform, expanding its range of vessel sealing products. Furthermore, Intuitive Surgical has been instrumental in the market, receiving FDA clearance in November 2019 for its SynchroSeal vessel sealer and E-100 Generator for da Vinci X/Xi surgical platforms.

Key Market Players

- Skanray Technologies Ltd.

- Patten Co. Inc.

- Ewellix

- Life Support Systems

- Medicop

- Becton, Dickinson and Company

- Baxter

- BPL Medical Technologies

- Getinge AB

- Drägerwerk AG & Co. KGaA

- Medtronic plc

- Olympus Corporation

- B. Braun Melsungen AG

- Erbe Elektromedizin GmbH

- OmniGuide Holdings, Inc.

- Intuitive Surgical, Inc.

- KLS Martin Group

- Bolder Surgical, LLC

- Ethicon US LLC.

- Other Key Players

Recent Developments

- October 2023: Medtronic launches LigaSure Advance+ bipolar vessel sealing system: Features improved vessel sealing performance and advanced tissue feedback technology.

- October 2023: Ethicon unveils the Enseal X1+ laparoscopic vessel sealing device: Offers faster sealing times, multi-vessel sealing capabilities, and enhanced ergonomics.

- October 2023: Olympus releases the LigaSure Small Jaw+ vessel sealing device: Designed for minimally invasive surgery and delicate procedures.

- September 2023: Baxter announces FDA approval for its VISTASEAL+ vessel sealing device: Offers improved hemostasis and tissue integrity compared to previous models.

- September 2023: Integra LifeSciences acquires the rights to distribute Erbe’s vessel sealing portfolio in the US: Expands Integra’s product offering and market reach.

- September 2023: Aesculap introduces the LigaSure Vessel Sealing System with advanced bipolar technology: Offers precise sealing and tissue differentiation.

- August 2023: Medtronic reports strong financial performance for its vessel sealing devices business: Attributed to increasing demand for minimally invasive surgical procedures.

- August 2023: Ethicon receives CE Mark for its Enseal X1+ laparoscopic vessel sealing device: Allows for its commercialization in European markets.

- August 2023: AngioDynamics announces positive clinical trial results for its next-generation vessel sealing technology: Demonstrates improved performance and safety compared to existing solutions.

Report Scope

Report Features Description Market Value (2023) USD 1646.9 Million Forecast Revenue (2033) USD 3898.8 Million CAGR (2023-2032) 9% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Generators, Instruments and Accessories) By Application (General Surgery, Laparoscopic Surgery, Gynecology Surgery, Urological Surgery and Other Applications) By End-User (Hospitals, Specialty Clinics, Ambulatory Surgical Centers and Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Skanray Technologies Ltd., Patten Co. Inc., Ewellix, Life Support Systems, Medicop, Becton, Dickinson and Company, Baxter, BPL Medical Technologies, Getinge AB, Drägerwerk AG & Co. KGaA, Medtronic plc, Olympus Corporation, B. Braun Melsungen AG, Erbe Elektromedizin GmbH, OmniGuide Holdings, Inc., Intuitive Surgical, Inc., KLS Martin Group, Bolder Surgical, LLC, Ethicon US LLC. Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Vessel Sealing Devices MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample

Vessel Sealing Devices MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Skanray Technologies Ltd.

- Patten Co. Inc.

- Ewellix

- Life Support Systems

- Medicop

- Becton, Dickinson and Company

- Baxter

- BPL Medical Technologies

- Getinge AB

- Drägerwerk AG & Co. KGaA

- Medtronic plc

- Olympus Corporation

- B. Braun Melsungen AG

- Erbe Elektromedizin GmbH

- OmniGuide Holdings, Inc.

- Intuitive Surgical, Inc.

- KLS Martin Group

- Bolder Surgical, LLC

- Ethicon US LLC.

- Other Key Players